Fill Out Your Cs 22 Alabama Form

The CS-22 form, a vital instrument within Alabama's child support enforcement system, encapsulates important directives meant to ensure that financial responsibilities to children are met. It is specifically designed to instruct employers regarding the withholding of child support payments directly from an employee's wages or benefits. Within its clear framework, the form details the amount to be withheld for both current child support obligations and any arrears. Employers are required to comply with these withholdings, which must be promptly remitted to the Alabama Child Support Payment Center. This form not only serves to protect the financial well-being of children but also outlines specific procedures that safeguard the rights of both the obligor, often the non-custodial parent, and the employer. Additionally, provisions regarding employment status changes and the potential penalties for non-compliance reflect the seriousness of maintaining these obligations. By addressing these components, the CS-22 form plays a critical role in the state’s efforts to ensure that child support is consistently enforced and that children receive the financial support they deserve.

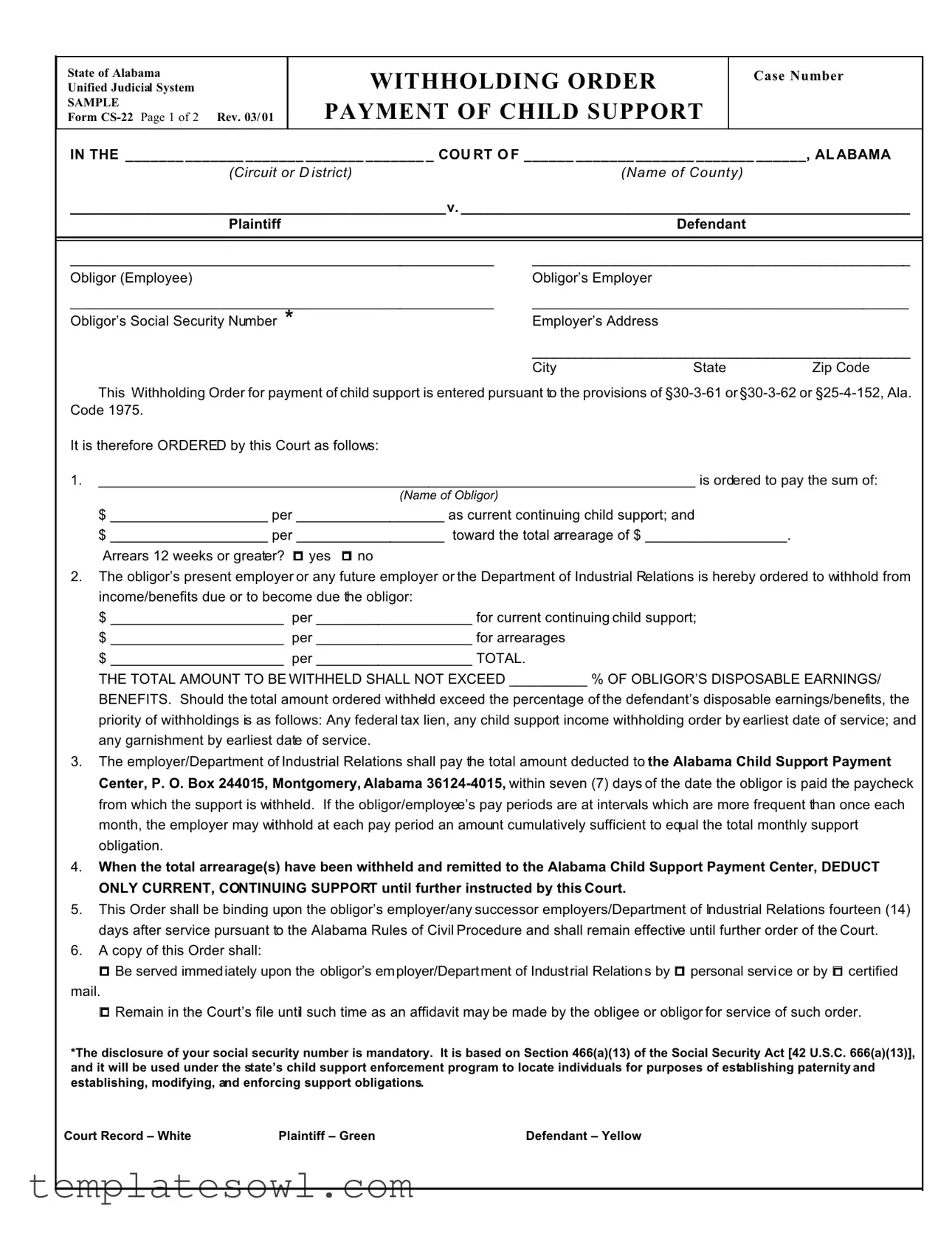

Cs 22 Alabama Example

State of Alabama

Unified Judicial System

SAMPLE

Form

WITHHOLDING ORDER

PAYMENT OF CHILD SUPPORT

Case Number

IN THE _______ _______ _______ _______ _______ _ COU RT O F ______ _______ _______ _______ ______, AL ABAMA

(Circuit or D istrict)(Name of County)

________________________________________________v. __________________________________________________________

Plaintiff |

|

Defendant |

|

|

|

||

|

|

||

______________________________________________________ |

___________________________________________________ |

||

Obligor (Employee) |

Obligor’s Employer |

|

|

______________________________________________________ |

________________________________________________ |

||

Obligor’s Social Security Number * |

Employer’s Address |

|

|

|

____________________________________________________ |

||

|

City |

State |

Zip Code |

This Withholding Order for payment of child support is entered pursuant to the provisions of

It is therefore ORDERED by this Court as follows:

1.____________________________________________________________________________ is ordered to pay the sum of:

(Name of Obligor)

$ ____________________ per ___________________ as current continuing child support; and

$ ____________________ per ___________________ toward the total arrearage of $ __________________.

Arrears 12 weeks or greater? G yes G no

2.The obligor’s present employer or any future employer or the Department of Industrial Relations is hereby ordered to withhold from income/benefits due or to become due the obligor:

$ ______________________ per ____________________ for current continuing child support; $ ______________________ per ____________________ for arrearages

$ ______________________ per ____________________ TOTAL.

THE TOTAL AMOUNT TO BE WITHHELD SHALL NOT EXCEED __________ % OF OBLIGOR’S DISPOSABLE EARNINGS/ BENEFITS. Should the total amount ordered withheld exceed the percentage of the defendant’s disposable earnings/benefits, the priority of withholdings is as follows: Any federal tax lien, any child support income withholding order by earliest date of service; and any garnishment by earliest date of service.

3.The employer/Department of Industrial Relations shall pay the total amount deducted to the Alabama Child Support Payment Center, P. O. Box 244015, Montgomery, Alabama

4.When the total arrearage(s) have been withheld and remitted to the Alabama Child Support Payment Center, DEDUCT ONLY CURRENT, CONTINUING SUPPORT until further instructed by this Court.

5.This Order shall be binding upon the obligor’s employer/any successor employers/Department of Industrial Relations fourteen (14) days after service pursuant to the Alabama Rules of Civil Procedure and shall remain effective until further order of the Court.

6.A copy of this Order shall:

G Be served immed iately upon the obligor’s em ployer/Depart ment of Indust rial Relation s by G personal servi ce or by G certified

mail.

GRemain in the Court’s file until such time as an affidavit may be made by the obligee or obligor for service of such order.

*The disclosure of your social security number is mandatory. It is based on Section 466(a)(13) of the Social Security Act [42 U.S.C. 666(a)(13)], and it will be used under the state’s child support enforcement program to locate individuals for purposes of establishing paternity and establishing, modifying, and enforcing support obligations.

Court Record – White |

Plaintiff – Green |

Defendant – Yellow |

SAMPLE |

Form |

WITHHOLDING ORDER PAYMENT OF CHILD SUPPORT (Continued)

7.Costs of entering this order for income withholding are: G taxed against plaintiff G taxed against defendant G waived G not applicable.

Additional costs may be incurred and the Clerk is authorized to tax same if this order is served at a later date.

8.The obligor, the obligor’s employer/any future employer/or the Department of Industrial Relations as required by law, must notify the clerk of the court of any changes in employment or termination of income/benefits.

9.The employer shall not use this order as a basis for the discharge of the obligor/employee.

10.This order shall not under any circumstances be waived by mutual agreement of the parties to the case.

11.An employer/successor employer/Department of Industrial Relations who willfully fails or refuses to withhold or pay the amounts as ordered may be found to be personally liable to the obligee for failure to answer or withhold and in such cases conditional and final judgment for the amounts ordered to be withheld may be entered by the Court against the employer.

12.Other: __________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

G The Clerk is hereby directed to mail a copy of this order to the clerk of the court which entered the original order of support, and to

further notify the clerk when this Withholding Order is served upon an employer/Department of Industrial Relations and withholdings are to commence in accordance with

G If checked, the employer is required to enroll the child(ren) identified above in any health insurance coverage available through the

employee’s/obligor’s employment.

DONE this the __________ day of __________________________, 20 ______.

___________________________________________________

Judge

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | This form serves as a Withholding Order for the payment of child support in Alabama. |

| Governing Laws | The form is governed by §30-3-61, §30-3-62, and §25-4-152 of the Alabama Code 1975. |

| Employer Responsibilities | The employer must withhold specified amounts from the obligor’s earnings as ordered by the court. |

| Filing Costs | Costs associated with entering this order can be taxed against the plaintiff or defendant, or may be waived. |

| Notification Requirement | The obligor and their employer must notify the court of any changes in employment or income status. |

| Enforcement | An employer that fails to comply with the withholding order may face personal liability for unpaid amounts. |

Guidelines on Utilizing Cs 22 Alabama

Filling out the CS-22 Alabama form requires careful attention to every detail. This form facilitates the process of income withholding for child support payments. After thoroughly completing the form, it should be submitted to the appropriate court and served on the obligor's employer to ensure compliance. Below is a step-by-step guide to assist in filling out the form accurately.

- At the top of the form, fill in the case number for your child support case.

- Indicate the court type (Circuit or District) and the name of the county where the case is filed.

- List the names of the plaintiff and the defendant.

- In the next section, provide the name of the obligor (the individual paying support) and their employer’s name.

- Write down the obligor’s Social Security Number and the employer’s address, including city, state, and zip code.

- In the section pertaining to payments, specify the amount the obligor is ordered to pay for current continuing child support and for arrearages.

- Answer the question regarding whether the arrears are twelve weeks or greater by checking yes or no.

- Indicate the amount to be withheld from income for both current support and arrearages. Ensure the total does not exceed the allowed percentage of the obligor’s disposable earnings/benefits.

- Write the payment instructions for the employer, ensuring they understand where to send the deducted amounts.

- Record the date of when this order is being established and include any additional instructions or notes, if necessary.

- Final details will include the judge's signature and the date, allowing the order to become officially binding.

What You Should Know About This Form

What is the purpose of the CS-22 Alabama form?

The CS-22 Alabama form is a Withholding Order for the payment of child support. It directs an employer to deduct a specified amount from an employee’s earnings to fulfill child support obligations. This ensures that payments are made consistently and in accordance with a court order, supporting the well-being of the child involved.

Who completes the CS-22 form?

The CS-22 form is typically completed by the court. The judge will fill in relevant details such as case numbers, parties involved, and amounts owed before issuing it. While the judge oversees the completion, specific information regarding the obligor and their employer may be provided by either the plaintiff or the obligor's legal representative.

What information is required on the CS-22 form?

The form requires various details including the names of the plaintiff and defendant, the case number, the amount to be withheld for current child support, and the amount for any arrears. Additionally, it needs the employer’s details and the obligor’s Social Security Number, which is mandatory for identification purposes within the state’s child support enforcement system.

How does an employer comply with the CS-22 order?

An employer must comply with the CS-22 order by withholding the specified amounts from the obligor's paychecks as outlined in the order. These withheld amounts must then be forwarded to the Alabama Child Support Payment Center within seven days of the obligor receiving their paycheck. Compliance ensures that the child support obligations are met without delay.

What happens if the employer does not comply with the CS-22 order?

If an employer fails or refuses to withhold or pay the amounts ordered on the CS-22 form, they may be held personally liable for the unpaid child support. The court can impose conditional and final judgments against the employer, which emphasizes the seriousness of complying with the withholding order.

Is the amount withheld from the obligor's earnings limited?

Yes, the total amount withheld cannot exceed a certain percentage of the obligor's disposable earnings or benefits. This percentage is determined by Alabama law and is intended to ensure that obligors can maintain a reasonable standard of living while fulfilling their child support responsibilities.

What are the consequences if the obligor’s employment changes?

The obligor, their employer, or the Department of Industrial Relations must notify the court clerk of any changes in employment or termination of income. This is critical, as keeping the court informed helps to ensure continuous compliance with the support obligations despite any changes in the obligor’s work situation.

Can the child support order be waived?

No, the order cannot be waived by mutual agreement between the involved parties. The court’s order is binding, and any modifications must go through the legal system. This provision protects the rights of the child and reinforces the obligation of the obligor to support their child consistently.

How is the CS-22 order served?

The CS-22 order is typically served to the obligor’s employer either through personal service or by certified mail. Its timely service ensures that the withholding process can begin promptly, thus aiding in the execution of child support payments without unnecessary delays.

What should one do if they have questions about the CS-22 form?

If there are any questions or concerns regarding the CS-22 form, it is advisable to contact a legal representative or consult the clerk of the court. They can provide guidance specific to individual circumstances and help clarify obligations or processes associated with the withholding order.

Common mistakes

Filling out the CS-22 form in Alabama is a crucial step for managing child support payments, but it can be prone to errors. One common mistake is neglecting to include accurate information about the obligor’s employer. This section is vital because the order mandates the employer to withhold payments. If the employer's name or address is wrong or incomplete, it could result in delays or even non-compliance with the order.

Another frequent error involves miscalculating the amounts owed for child support or arrears. It’s essential to ensure that the numbers are not only accurate but also clearly stated. Any discrepancies in the amounts can lead to confusion and disputes later on. Double-checking the amounts before submission can prevent unnecessary complications down the line.

Many individuals also fail to specify the frequency of payments clearly. The form requires you to indicate how often the payments should be made—weekly, biweekly, monthly, etc. An ambiguous or incorrect frequency can cause issues for both the obligor and the recipient. Clarity in this area helps ensure that all parties understand the expectations.

Individuals often overlook the required signatures. Whether it’s the obligor, their employer, or any other involved party, missing signatures can render the form ineffective. This oversight can delay the processing of the order, which can be frustrating for everyone involved in the child support arrangement.

Lastly, it's crucial to remember that social security numbers must be provided. This piece of information is not just a formality; it serves to enforce child support obligations efficiently. Failure to provide the social security number will lead to complications, as it is a necessary detail for the court’s child support enforcement program.

Documents used along the form

The CS-22 Alabama form is typically accompanied by several other documents and forms that help ensure the proper processing of child support matters. Below is a list of commonly used forms and documents that may be relevant in conjunction with the CS-22 form.

- CS-41 - Child Support Order: This form outlines the specific terms and conditions of child support, including the amount to be paid and the frequency of payments. It establishes the legal obligation to provide support.

- CS-43 - Income Withholding for Child Support: This document is used to formally notify an employer about the obligation to withhold a portion of the obligor’s income for child support payments.

- CS-40 - Application for Child Support Services: Parents can use this application form to request child support enforcement services from the state, which helps in establishing and collecting child support.

- CS-25 - Affidavit of Arrears: This affidavit provides a detailed account of any overdue child support payments. It helps establish the amount owed and can be used in court proceedings.

- CS-30 - Child Support Modification Request: If circumstances change, such as income alterations or changes in custody arrangements, either parent can use this form to request a modification of the existing child support order.

- CS-45 - Notice of Default: This notice informs the parties that the obligor has failed to comply with the child support order. It may initiate enforcement actions by the court or other authorities.

- CS-70 - Health Insurance Verification Form: This document is used to verify and ensure that the child is covered under health insurance, as stipulated in the child support agreement.

- CS-50 - Notice to Employer: The employer receives this notice to clarify the obligations under the child support order and the changes that may occur in payment requirements.

- CS-10 - Registration of Out-of-State Support Order: This form allows parties to register a child support order from another state in Alabama, ensuring enforcement under Alabama law.

These forms create a comprehensive framework to ensure that child support obligations are clearly established, communicated, and enforced. Using these documents correctly facilitates smoother processes for both parents and the court system.

Similar forms

The CS-22 form in Alabama serves as an order for the withholding of child support payments, but it is similar to several other legal documents. Below are seven documents that share key elements with the CS-22 form:

- Income Withholding Order for Child Support (IWO): This federal form is used across multiple states to collect child support from an obligor's wages, similar in purpose to the CS-22, demanding a specific amount withheld for child support.

- Child Support Judgment: A court-issued document outlining the child support amount a non-custodial parent must pay. Much like the CS-22, this judgment includes details about current payments and arrears.

- Garnishment Order: Often issued for various debts, including child support, this document instructs an employer to withhold earnings. The connection to CS-22 lies in its directive to withhold funds from an employee's paycheck.

- Modification of Child Support Order: When circumstances change, a court may modify how much child support is due. Like the CS-22, it outlines the obligations of the obligor, reflecting adjustments in payment terms.

- Notice of Liens: This document may be filed against an obligor’s assets to secure child support obligations. Similar to CS-22, it pertains to the enforcement of child support obligations when payments are not made.

- Child Support Payment Agreement: This is an agreement between the parents regarding how child support will be paid. Like the CS-22, it often spells out amounts due and the duration of payments.

- Order for Health Insurance Coverage: Sometimes included with child support orders, this document requires the obligor to provide health insurance for the child. It parallels the CS-22 in ensuring the welfare of the child, showcasing the obligor’s responsibilities beyond just financial support.

Dos and Don'ts

When filling out the CS-22 Alabama form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Below is a list of important practices to adopt and avoid.

- Do read all instructions carefully before beginning to fill out the form.

- Do provide accurate and complete information, particularly regarding the obligor’s social security number and employer details.

- Do ensure that all monetary amounts are clearly stated, including specifics on payment frequency.

- Do sign and date the form in the appropriate section.

- Don't leave any sections blank; fill in all applicable fields to prevent delays.

- Don't provide misleading information, as this can lead to legal complications.

Misconceptions

- It is only for current support. Many people think the CS-22 form is solely for ongoing child support payments. However, it also includes provisions for past due amounts, called arrears.

- Employers have discretion in withholding amounts. Some believe that employers can choose how much to withhold. The form clearly states the specific amounts that must be deducted, leaving little room for discretion.

- The obligor can stop payments at any time. This form creates a legally binding order. Obligor cannot stop payments without a court order, even if both parties agree.

- Arrears do not need to be paid until current support is settled. It is a misconception that arrears can wait. The CS-22 specifies that both current support and arrearages must be addressed as directed.

- The CS-22 form is optional. Some believe they can skip filing this form. It is critical for enforcement of child support and must be filed to ensure compliance.

- All employers understand their obligation under this order. Not all employers are familiar with this process. Clear communication and documentation of this order are essential to ensure compliance.

- Failure to comply has no real consequences. In reality, if an employer fails to comply with the withholding order, they could face legal consequences, including being held personally liable for the amounts owed.

Key takeaways

Understanding the CS-22 Alabama form is crucial for anyone involved in child support cases. Here are six key takeaways about the form and its use:

- Purpose and Authority: The CS-22 form serves as a Withholding Order for child support payments. It is issued under specific legal provisions, ensuring the enforcement of child support obligations.

- Payment Details: The form requires clear information regarding the amounts to be withheld for both current support and any overdue payments (arrears). Accuracy in completing this section is essential.

- Employer Responsibilities: The employer is obligated to withhold the specified amounts from the obligor's earnings and remit these funds to the Alabama Child Support Payment Center within seven days of payment to the employee.

- Percentage Limits: The total amount deducted from the obligor’s earnings cannot exceed a certain percentage of their disposable earnings. This provision ensures that the obligor has enough to cover their living expenses.

- Notification Requirements: It is mandatory for employers and the Department of Industrial Relations to notify the court of any changes in the obligor’s employment status or income. This keeps the system updated and ensures compliance.

- Legal Consequences: Employers who fail to comply with the withholding order may face legal liability. Courts can hold them accountable for failing to withhold or pay the ordered amounts.

By understanding these key points, individuals can effectively navigate the requirements of the CS-22 form, ensuring that child support payments are processed correctly and within the legal framework.

Browse Other Templates

Florida Oversize Permit Login - The form encompasses a structured format to streamline application processing.

Connecticut Sales Tax Login - This form plays a key role in the state’s revenue collection process for sales taxes.