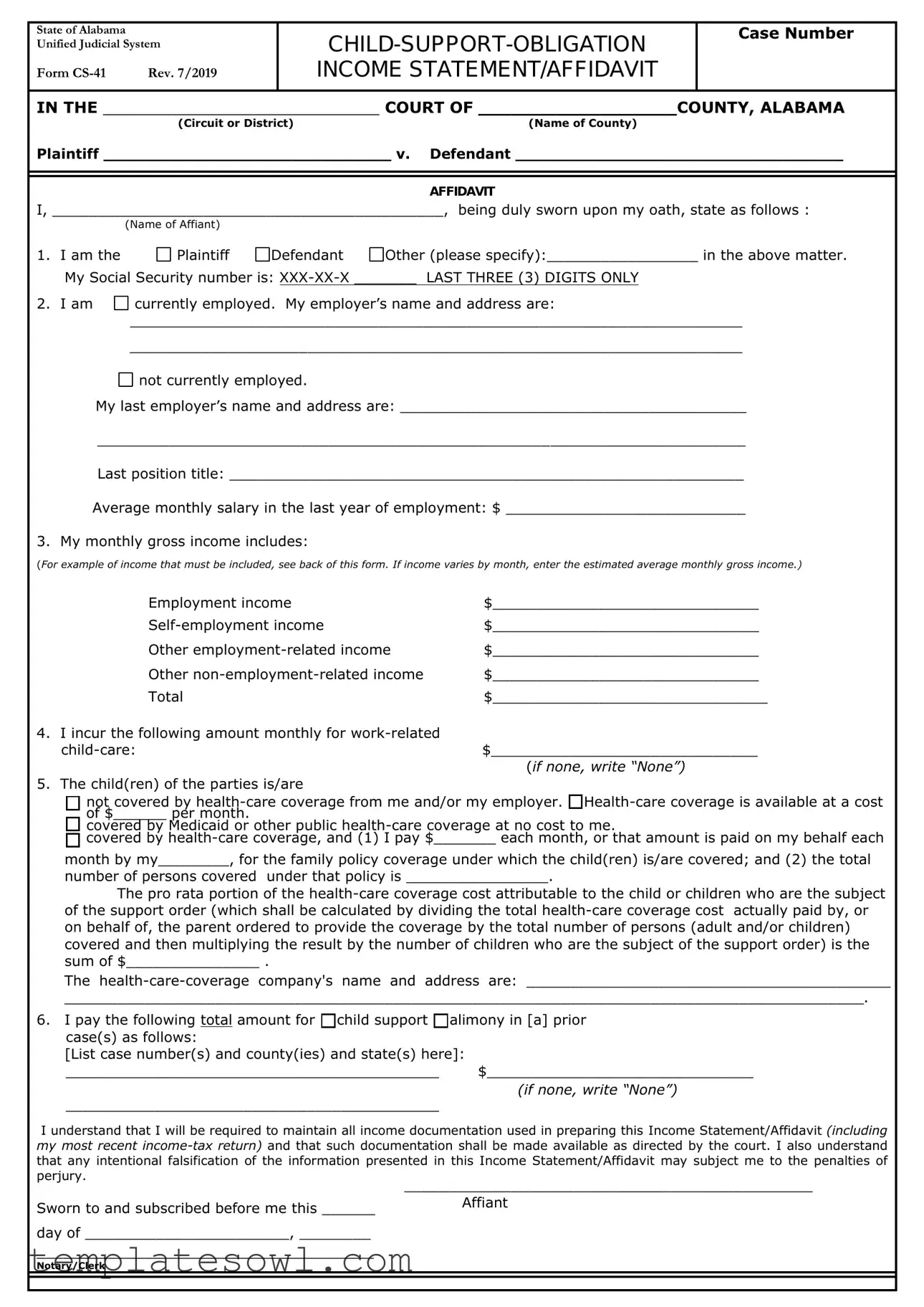

Fill Out Your Cs 41 Form

The CS-41 form, known as the Income Statement/Affidavit, is an essential document used in Alabama's family law cases, particularly in matters related to child support obligations. This form serves a pivotal role in accurately representing an individual's financial situation to the court. It requires detailed disclosure of the affiant's income sources, which may include employment wages, self-employment earnings, and any other relevant income streams. The form also addresses the affiant's child-care expenses and health-care coverage for children, providing a comprehensive view of financial responsibilities. Furthermore, it mandates the disclosure of any existing child support or alimony obligations related to previous cases. By compiling this information, the CS-41 form facilitates an equitable determination of child support payments, ensuring all parties are compliant with legal expectations. The integrity of the data presented is crucial, as any falsification may lead to severe legal repercussions, including penalties for perjury. Completing the CS-41 form meticulously not only aids the court but also assists individuals in clearly understanding their financial obligations.

Cs 41 Example

State of Alabama |

|

|

|

Case Number |

|||

Unified Judicial System |

|

|

|

||||

Form |

Rev. 7/2019 |

|

|

INCOME STATEMENT/AFFIDAVIT |

|

||

|

|

|

|||||

IN THE ____________________________ COURT OF __________________COUNTY, ALABAMA |

|||||||

|

(Circuit or District) |

|

|

(Name of County) |

|

||

Plaintiff _____________________________ v. |

Defendant _________________________________ |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AFFIDAVIT |

|

I, ____________________________________________, being duly sworn upon my oath, state as follows : |

|||||||

(Name of Affiant) |

|

|

|

|

|

|

|

1. I am the |

Plaintiff |

Defendant |

Other (please specify):_________________ in the above matter. |

||||

My Social Security number is: |

LAST THREE (3) DIGITS ONLY |

|

|||||

2. I am |

currently employed. My employer’s name and address are: |

|

|||||

|

_____________________________________________________________________ |

||||||

_____________________________________________________________________

not currently employed.

not currently employed.

My last employer’s name and address are: _______________________________________

_________________________________________________________________________

Last position title: __________________________________________________________

Average monthly salary in the last year of employment: $ ___________________________

3. My monthly gross income includes:

(For example of income that must be included, see back of this form. If income varies by month, enter the estimated average monthly gross income.)

|

Employment income |

$______________________________ |

|

$______________________________ |

|

|

Other |

$______________________________ |

|

Other |

$______________________________ |

|

Total |

$_______________________________ |

4. |

I incur the following amount monthly for |

|

|

$______________________________ |

|

|

|

(if none, write “None”) |

5. |

The child(ren) of the parties is/are |

|

not covered by

covered by Medicaid or other public

covered by

month by my________, for the family policy coverage under which the child(ren) is/are covered; and (2) the total

number of persons covered under that policy is ________________.

The pro rata portion of the

The

__________________________________________________________________________________________.

6. I pay the following total amount for child support alimony in [a] prior case(s) as follows:

[List case number(s) and county(ies) and state(s) here]:

__________________________________________ $______________________________

(if none, write “None”)

__________________________________________

I understand that I will be required to maintain all income documentation used in preparing this Income Statement/Affidavit (including my most recent

Sworn to and subscribed before me this ______

day of _______________________, ________

______________________________________

Notary/Clerk

Form

EXAMPLES OF INCOME THAT MUST BE INCLUDED IN YOUR GROSS MONTHLY INCOME

1.Employment Income – shall include, but not be limited to, salary, wages, bonuses, commissions, severance pay, worker’s compensation, pension income, unemployment insurance, disability insurance, and Social Security benefits.

2.

3.Other

4.Other

RULE 32, ALABAMA RULES OF JUDICIAL ADMINISTRATION, PROVIDES THE FOLLOWING DEFINITIONS:

Income. For purposes of the guidelines specified in this Rule, “income” means the actual gross income of a parent, if the parent is employed to full capacity, or if the parent is unemployed or underemployed, then it means the actual gross income the parent has the ability to earn.

Gross Income.

“Gross income” includes income from any source, and includes, but is not limited to, income from salaries, wages, commissions, bonuses, dividends, severance pay, pensions, interest, trust income, annuities, capital gains, Social Security benefits, Veteran's benefits, workers’ compensation benefits,

“Gross income” does not include child support received for other children or benefits received from means- tested

For income from

Under those exceptions, “ordinary and necessary expenses” does not include amounts allowable by the Internal Revenue Service for the accelerated component of depreciation expenses, investment tax credits, or any other business expenses determined by the court to be inappropriate for determining gross income for purposes of calculating child support.

Other Income. Expense reimbursements or

Form Characteristics

| Fact Name | Details |

|---|---|

| Form ID | CS-41 |

| Governing State | Alabama |

| Purpose of Form | This form is used to provide an affidavit detailing an individual's income and expenses for child support obligations. |

| Revision Date | Rev. 7/2019 |

| Required Information | The form requires disclosure of gross income, work-related childcare costs, and health-care coverage details. |

| Child Support Considerations | Income from various sources, such as employment wages, self-employment, and other incomes, should be included. |

| Legal Reference | Defined under Rule 32, Alabama Rules of Judicial Administration, which outlines income definitions and calculations. |

Guidelines on Utilizing Cs 41

Completing the CS-41 form is a structured process that involves gathering specific financial information. Once you have all the necessary details, you can accurately report your income and expenses, which will help the court make informed decisions regarding child support obligations.

- Begin by identifying yourself as the plaintiff or defendant. Write your name clearly in the designated space.

- Provide your Social Security number, entering only the last three digits.

- Indicate your employment status. If you are currently employed, fill in your employer's name and address. If not, provide the name and address of your last employer, and include your last job title and average monthly salary from that position.

- Detail your monthly gross income. This includes various sources like employment income, self-employment income, and any other relevant income. Make sure to total this amount for clarity.

- If applicable, note your monthly work-related child-care expenses. If you have none, simply write "None."

- Explain the health-care coverage status for your child(ren). Be specific about whether they’re covered by your plan, another plan, Medicaid, or if you have no coverage at all. Include costs when necessary.

- If you pay child support or alimony in previous cases, list those obligations, including case numbers and amounts. If there are none, indicate "None."

- Before signing, ensure all documentation supporting the information provided is maintained and available as required by the court.

- Finally, sign the affidavit in front of a notary or clerk, and include the date and place of signing.

What You Should Know About This Form

What is the purpose of the CS-41 form?

The CS-41 form, also known as the Income Statement/Affidavit, is used in Alabama court proceedings related to child support obligations. It serves as a declaration of a parent's income, employment status, and any financial liabilities. This information helps the court determine appropriate child support amounts based on accurate financial data.

Who needs to complete the CS-41 form?

The form must be completed by the party involved in a child support action—either the plaintiff or the defendant. This ensures that the court has a clear understanding of each parent's financial circumstances. Accurate completion of the form is crucial for fair support calculations.

What types of income must be reported on the CS-41 form?

The CS-41 requires disclosure of all sources of gross income. This includes salary, wages, bonuses, self-employment earnings, unemployment benefits, and other employment-related income. Additionally, include non-employment-related income such as dividends, gifts, and any other recurring financial assistance. Providing comprehensive information helps ensure that child support calculations are based on a complete financial picture.

What if I am currently unemployed or underemployed?

If you are not currently employed, you must provide information about your last employer, including your last job title and average monthly earnings. If you are underemployed, the CS-41 form requires you to report what you believe you could earn based on your qualifications. The court will assess your financial responsibilities based on your actual and potential income.

Are there penalties for providing false information on the CS-41 form?

Yes, submitting false information is a serious issue and can result in legal consequences. The form includes a statement that knowingly providing false information may lead to penalties for perjury. It is crucial to provide accurate and truthful information to avoid potential legal ramifications.

How is health care coverage accounted for on the CS-41 form?

The form requires detailed information regarding health care coverage for the child or children in question. You must disclose whether the children are covered under your insurance or public assistance programs. If there is specific health insurance available at a cost, you must report the monthly premium and indicate who pays for that coverage. This information is essential for considering child support obligations.

Common mistakes

Filling out the CS-41 form is an important step for individuals dealing with child support matters in Alabama. However, many make common mistakes that can lead to complications. Here are seven frequent errors to avoid.

First, some individuals fail to provide complete information about their income. This includes not listing all sources of income, such as self-employment earnings or bonuses. It’s crucial to include every form of income, as omitting any can lead to incorrect assessments. Ensure all income sources are documented.

Second, mistakes in reporting monthly income can create confusion. People often average their income incorrectly or use inconsistent figures. It is vital to take the time to compute the average accurately and use monthly amounts that reflect financial realities. Discrepancies can result in court questions later on.

Another common oversight is failing to indicate employment status properly. Individuals sometimes state they are employed, yet provide no employer information. This can raise red flags and delay proceedings. Clearly state if you are currently employed or not, and provide complete details as required.

Inaccurate child-care expenses can also cause issues. Many forget to report these costs or write “None” without thinking it through. If child-related expenses do exist, listing them is necessary as they can affect support calculations. Ensure all relevant costs are documented.

Fourth, individuals often misrepresent health insurance coverage. It is easy to misstate whether a child is covered or to provide incorrect figures for health-care costs. Review your documentation carefully and provide accurate information about how children are insured and any expenses incurred.

Another important aspect is reporting prior child support or alimony obligations. Many individuals neglect this section or provide incomplete data. It’s essential to fully disclose these obligations to ensure accurate evaluations by the court.

Lastly, failure to sign and date the affidavit can invalidate the entire form. A signature confirms that the information is believed to be true, and without it, the court cannot process your case. Always double-check that the form is signed appropriately before submission.

By being aware of these common mistakes, individuals can complete the CS-41 form more accurately. Taking time and care with this form can help ensure a smoother child support process.

Documents used along the form

In addition to the CS-41 form, several other documents and forms may be required or useful in child support cases. These documents help ensure that all relevant information is considered, and they support the process of determining child support obligations. Below is a list of common forms.

- CS-42: Child Support Guidelines Worksheet—This worksheet helps calculate the appropriate amount of child support based on the income of both parents and other relevant factors.

- CS-43: Income Statement for Immediate Support—This form is used to report income when urgent child support needs arise, ensuring immediate action can be taken.

- CS-44: Affidavit of Child Support Payments—This affidavit is used to confirm payments made for child support, establishing a record of compliance.

- CS-45: Request for Modification of Child Support—Parents can use this form to ask the court to change their child support obligation due to changed circumstances.

- CS-46: Health Insurance Information Form—This form collects details about health insurance coverage for the child, which is important for establishing medical support.

- CS-47: Notice of Intent to Enforce Child Support Order—With this notice, one parent informs the other about intentions to pursue enforcement of child support obligations through legal channels.

- CS-48: Response to Petition for Child Support—This form allows the receiving parent to respond adequately when they are served a petition for child support.

- CS-49: Motion to Enforce Child Support Order—If there is a failure to pay child support, this motion is submitted to seek the court's assistance in enforcing the order.

Utilizing these forms alongside the CS-41 can facilitate smoother proceedings and assist in making informed decisions regarding child support. Each document addresses specific aspects of family law and helps ensure that the needs of the children are prioritized and adequately supported during the legal process.

Similar forms

- CS-42: Child Support Guidelines Worksheet - This document helps calculate the child support obligations of parents. It assesses both parents' incomes and takes into account expenses related to health care and child care, similar to the income assessment provided in the CS-41 form.

- CS-43: Child Custody Arrangement - This form provides details on custody arrangements and parental responsibilities. While the CS-41 focuses on income, the CS-43 addresses the needs and living situations of children, ensuring that all relevant financial obligations can be evaluated.

- CS-40: Child Support Order - This order specifies the amount of child support to be paid, based on the financial information submitted through the CS-41. Both documents are essential in ensuring that financial contributions are fair and clear.

- CS-44: Affidavit of Financial Disclosure - Similar to the CS-41, this affidavit collects comprehensive financial information from parties involved. It is important for providing a more holistic view of the financial circumstances of all parties.

- CS-45: Health Care Coverage Affidavit - This form specifically details the health care coverage available to children. Like the CS-41, it requires disclosure of income and expense information, focusing particularly on health care costs.

- CS-48: Parenting Plan - While primarily focused on custody and visitation arrangements, this document can incorporate relevant financial information related to child support, ensuring that the child’s welfare is fully considered.

- CS-46: Notice of Child Support Hearing - This notice informs parties about upcoming hearings related to child support. It may reference information from the CS-41 for context, outlining how financial situations influence decisions regarding child support.

- CS-47: Request for Modification of Child Support - This form is used when either parent wishes to change the existing child support arrangement. It typically requires updated income data, similar to what is found in the CS-41, facilitating fair modifications.

Dos and Don'ts

When filling out the CS 41 form, attention to detail and accuracy are crucial. The following list highlights key actions to take and avoid for a smooth process.

- DO double-check all personal information, including your name and case number, for accuracy.

- DO include all relevant income sources, such as employment wages, self-employment revenue, and any other earnings.

- DO provide exact monthly amounts wherever possible to ensure clarity and reduce confusion.

- DO keep copies of all documentation used to complete the form, such as pay stubs or tax returns, for your records.

- DON'T exaggerate or understate your income; honesty is vital, as discrepancies can lead to serious penalties.

- DON'T leave fields blank; if a question does not apply, write “None” or indicate that it's not applicable.

- DON'T forget to sign the form under oath; neglecting this step may invalidate your affidavit.

- DON'T submit without reviewing the entire document for typographical errors or incomplete sections.

By adhering to these guidelines, you can confidently navigate the process of completing the CS 41 form, ensuring that all information is conveyed accurately and completely.

Misconceptions

Misunderstandings about the CS-41 form, which is essential for accurately assessing child support obligations, can lead to confusion and errors in the process. Below are seven common misconceptions:

- The CS-41 form is only for custodial parents. Many believe this form is exclusive to custodial parents for asserting their rights. In reality, both custodial and non-custodial parents may need to complete it, as it details income and expenses relevant to child support calculations.

- Only current income matters. Some individuals think that only current employment income is considered. However, the form requires a comprehensive disclosure of all income sources, including previous jobs and self-employment income, to accurately assess overall financial contributions.

- Child support is determined solely by income. It is a common belief that child support is based only on the income reported on the form. In fact, factors like child-related expenses, such as childcare and healthcare costs, also significantly influence the final calculation.

- I don't need to attach supporting documents. Many assume that providing the CS-41 form alone suffices. This is misleading; relevant documentation such as pay stubs, tax returns, and proof of other income types are typically required to substantiate the claims made on the form.

- Income includes everything, with no exceptions. Some people think all forms of compensation must be reported. Nonetheless, specific types of income, such as child support received for other children or certain public assistance benefits, are indeed excluded from gross income calculations.

- Falsifying information is not a serious issue. Some individuals may underestimate the consequences of presenting incorrect information. In truth, intentionally providing false information on the CS-41 form can lead to severe penalties, including charges of perjury.

- Filling out the form is straightforward and requires no help. While the form may appear simple, many people benefit from assistance when completing it. Consulting with a legal professional or knowledgeable advisor can ensure accuracy and compliance with the law.

Understanding these misconceptions is crucial for those involved in child support proceedings. Accurate completion of the CS-41 form helps foster fairness in child support determinations.

Key takeaways

Filling out and using the CS-41 form can be straightforward when you keep these important points in mind:

- Accurate Information is Essential: Ensure that all details regarding your employment and income sources are filled out accurately. This includes listing your current employer, previous employer, and types of income received.

- Include All Income Sources: Remember to account for all forms of income. Employment income, self-employment income, and non-employment-related income must all be included to provide a complete picture of your financial situation.

- Health-Care Coverage Details Matter: Clearly specify any health-care coverage related to the children involved. Detail the costs and ensure you calculate the pro rata portion correctly, as this will impact child support considerations.

- Maintain Documentation: Keep all income documentation readily available, such as tax returns and pay stubs. The court may request this information, and having it organized will make the process smoother.

- Understand the Consequences: Be aware that providing false information on the form can lead to serious penalties, including charges of perjury. It’s crucial to be truthful and diligent when completing the CS-41.

Staying organized and truthful will not only help you manage the form but also ensure that the child support process is handled properly.

Browse Other Templates

Farbar Contract - Buyers must be provided the Homeowners Association information before executing the contract.

Grandparent Medical Consent Form Without Notary - This form allows parents to give consent for emergency medical treatment for their child.

Exhibit 5-2b - For boxholder information, the name and Post Office box address are essential.