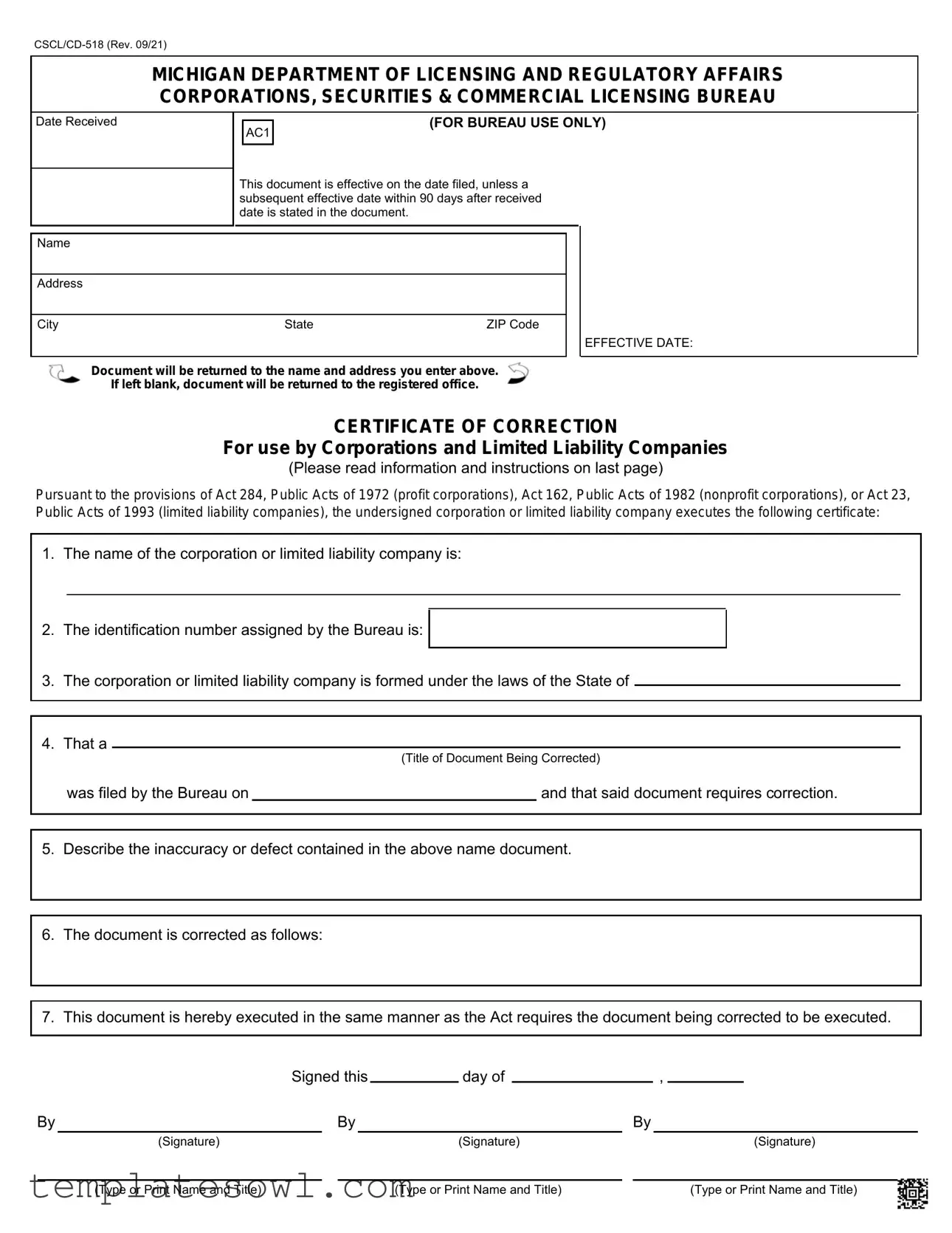

Fill Out Your Cscl Cd 518 Form

The CSCL/CD-518 form, utilized by corporations and limited liability companies in Michigan, serves as a Certificate of Correction. This document is crucial for addressing inaccuracies or defects in previously filed documents. When an error is identified, this form engages a formal process to correct the record while keeping the integrity of the original filing date intact. Essential information required includes the name of the entity, its identification number, and a detailed description of the necessary corrections. Ensuring clarity and legibility is paramount, as any illegible submissions may lead to rejection. This form can be submitted by mail or in person, and fees vary based on the type of entity, reflecting the importance of timely and accurate filings. The Certificate of Correction guarantees that any inaccuracies are rectified, thereby maintaining accurate public records and protecting stakeholder interests. Optional expedited processing is available for those needing immediate corrections, enhancing the form's flexibility for diverse filing needs.

Cscl Cd 518 Example

MICHIGAN DEPARTMENT OF LICENSING AND REGULATORY AFFAIRS CORPORATIONS, SECURITIES & COMMERCIAL LICENSING BUREAU

Date Received

|

(FOR BUREAU USE ONLY) |

|

AC1 |

||

|

||

|

|

This document is effective on the date filed, unless a subsequent effective date within 90 days after received date is stated in the document.

Name

Address

City |

State |

ZIP Code |

EFFECTIVE DATE:

Document will be returned to the name and address you enter above.

If left blank, document will be returned to the registered office.

CERTIFICATE OF CORRECTION

For use by Corporations and Limited Liability Companies

(Please read information and instructions on last page)

Pursuant to the provisions of Act 284, Public Acts of 1972 (profit corporations), Act 162, Public Acts of 1982 (nonprofit corporations), or Act 23, Public Acts of 1993 (limited liability companies), the undersigned corporation or limited liability company executes the following certificate:

1. The name of the corporation or limited liability company is:

2. The identification number assigned by the Bureau is:

3.The corporation or limited liability company is formed under the laws of the State of

4.That a

(Title of Document Being Corrected)

was filed by the Bureau on |

|

and that said document requires correction. |

5.Describe the inaccuracy or defect contained in the above name document.

6.The document is corrected as follows:

7.This document is hereby executed in the same manner as the Act requires the document being corrected to be executed.

|

|

Signed this |

|

day of |

|

|

, |

|

|

|||

By |

|

By |

|

|

|

By |

||||||

|

(Signature) |

|

|

|

|

(Signature) |

|

|

|

(Signature) |

||

|

|

|

|

|

|

|

|

|

(Type or Print Name and Title) |

|||

|

(Type or Print Name and Title) |

|

|

|

|

(Type or Print Name and Title) |

|

|

||||

CSCL/CD518- (Rev. 09/21)

Preparer's Name

Business Telephone Number ( |

) |

|

|

|

|

INFORMATION AND INSTRUCTIONS

1.This form may be used to draft your Certificate of Correction. A document required or permitted to be filed under the act cannot be filed unless it contains the minimum information required by the act. The format provided contains only the minimal information required to make the document fileable and may not meet your needs. This is a legal document and agency staff cannot provide legal advice.

2.Submit one original of this document. Upon filing, the document will be added to the records of the Corporations, Securities & Commercial Licensing Bureau. The original will be returned to your registered office address, unless you enter a different address in the box on the front of this document.

Since this document will be maintained on electronic format, it is important that the filing be legible. Documents with poor black and white contrast, or otherwise illegible, will be rejected.

3.The corrected document is effective in its corrected form as of its original filing date except as to a person who relied upon the inaccurate portion of the document and was, as a result of the inaccurate portion of the document, adversely affected by the correction.

4.Item 2 - Enter the identification number previously assigned by the Bureau. If this number is unknown, leave it blank.

5.This Certificate is to be used pursuant to section 133 of Act 284, P.A. 1972; section 133 of Act 162, P.A. 1982; or section 106 of Act 23, P.A. 1993, for the purpose of correcting a document filed with the Bureau which at the time of filing was an inaccurate record of the action referred to in the document or was defectively or erroneously executed. It may be used by corporations or limited liability companies.

6.Item 6 - State the provision as it should have originally appeared.

7.This Certificate must be signed in the same manner as was required for the document to be corrected.

8.NONREFUNDABLE FEE: Make remittance payable to the State of Michigan. Include corporation name and identification number on check or money order.

CORPORATIONS |

$ 10.00 |

LIMITED LIABILITY COMPANIES |

$ 25.00 |

Submit with check or money order by mail:

Michigan Department of Licensing and Regulatory Affairs

Corporations, Securities & Commercial Licensing Bureau

Corporations Division

P.O. Box 30054

Lansing, MI 48909

To submit in person:

2407 N Grand River Ave

Lansing, MI 48906

Telephone: (517)

Fees may be paid by check, money order, VISA, MasterCard, American Express, or Discover when delivered in person to our office.

Documents that are endorsed filed are available at www.michigan.gov/corpentitysearch. If the submitted document is not fileable, the notice of refusal to file and document will be available at the Rejected Filings Search website at www.michigan.gov/corprejectedsearch.

LARA is an equal opportunity employer/program. Auxiliary aids, services and other reasonable accommodations are available upon request to individuals with disabilities.

Optional expedited service.

Expedited review and filing, if fileable, is available for all documents for profit corporations, limited liability companies, limited partnerships and nonprofit corporations.

The nonrefundable expedited service fee is in addition to the regular fees applicable to the specific document.

Please complete a separate

Same day service

Same day - $100 for formation documents and applications for certificate of authority.

Same day - $200 for any document concerning an existing entity.

Review completed on day of receipt. Document and request for same day expedited service must be received by 1 p.m. EST OR EDT.

Two hour - $500

Review completed within two hours on day of receipt. Document and request for two hour expedited service must be received by 3 p.m. EST OR EDT.

One hour - $1000

Review completed within one hour on day of receipt. Document and request for 1 hour expedited service must be received by 4 p.m. EST OR EDT.

Documents submitted by mail are delivered to a remote location for receipts processing and are then forwarded to the Corporations Division for review. Day of receipt for mailed expedited service requests is the day the Corporations Division receives the request.

Rev. 09/21

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The CSCL/CD-518 form is used to file a Certificate of Correction for corporations and limited liability companies in Michigan. |

| Governing Acts | This form is governed by Act 284 of 1972, Act 162 of 1982, and Act 23 of 1993. |

| Filing Timeframe | The form becomes effective on the date it is filed, unless a different effective date is specified within 90 days of submission. |

| Nonrefundable Fees | The filing fee is $10 for corporations and $25 for limited liability companies. |

| Address for Submission | To file, send the form to the Corporations, Securities & Commercial Licensing Bureau at P.O. Box 30054, Lansing, MI 48909. |

| Required Signatures | The document must be signed in the same manner as the original document being corrected. |

| Expedited Service Options | Expedited review and filing are available for an additional fee, with various processing times and costs based on urgency. |

Guidelines on Utilizing Cscl Cd 518

Filling out the CSCL CD 518 form is an important step when a corporation or limited liability company needs to correct an officially filed document. To ensure that the corrections are made effectively, follow the steps outlined below. Collect all necessary information before starting, as this will facilitate a smoother process.

- Begin by entering the name of the corporation or limited liability company in the designated field.

- Provide the identification number assigned by the Bureau. If you do not have this number, you may leave the space blank.

- Indicate the state under which the corporation or limited liability company is formed.

- Specify the title of the document that requires correction. Also, include the date that the original document was filed by the Bureau.

- Clearly describe the inaccuracy or defect in the original document.

- State the correction that needs to be made, presenting it in the way it should have originally appeared.

- Have the authorized individuals sign the document, ensuring the signature matches how the original document was executed.

- Complete the section for the preparer’s name and business telephone number.

- Prepare the appropriate nonrefundable fee: $10 for corporations or $25 for limited liability companies, making the check payable to the State of Michigan. Include the corporation name and identification number on the check or money order.

- Submit the original form with payment by mail or in person to the appropriate office.

What You Should Know About This Form

What is the CSCL CD-518 form used for?

The CSCL CD-518 form is a Certificate of Correction used by corporations and limited liability companies in Michigan. It corrects inaccuracies or defects in previously filed documents. This form allows entities to formally rectify errors to ensure accurate legal records.

Who needs to file the CSCL CD-518 form?

Any corporation or limited liability company that has filed a document with the Michigan Department of Licensing and Regulatory Affairs that contains an error or defect may need to file this form. This applies to both profit and nonprofit corporations, as well as limited liability companies.

What information do I need to provide on the form?

You will need to provide the name of your corporation or limited liability company, its identification number, the type of document being corrected, the date that document was filed, a description of the inaccuracy, and the correct information. Signatures of individuals authorized to execute the original document are also required.

How long does it take for the CSCL CD-518 form to be processed?

Processing times can vary. Regular processing typically occurs within a few weeks. However, expedited service options are available for those who require quicker processing. Expedited services can significantly reduce the wait time, with options for same-day or even two-hour reviews.

What is the cost associated with filing the CSCL CD-518 form?

The nonrefundable fee for filing this form is $10.00 for corporations and $25.00 for limited liability companies. Payment must be made by check or money order payable to the State of Michigan. Fees may be higher if expedited services are requested.

What should I do if I don’t know the identification number assigned by the Bureau?

If you do not know your identification number, you may leave that section of the form blank. However, it is beneficial to locate this number prior to submission, as it helps ensure accurate processing.

Will the corrected document be effective immediately?

The corrected document becomes effective on the date it was originally filed, unless the correction adversely affects a person who relied on the inaccurate information, in which case, the correction may not benefit them.

Where do I submit the CSCL CD-518 form?

You can submit the form by mail to the Michigan Department of Licensing and Regulatory Affairs, Corporations, Securities & Commercial Licensing Bureau, or in person at their Lansing office. Ensure that you send the appropriate payment along with your submission.

What happens if my document is not fileable?

If the CSCL CD-518 form is not acceptable for filing, you will receive a notice of refusal, along with your document. This notice will indicate the reasons for rejection, and you can check the status through the Rejected Filings Search website.

Are there accommodations available for individuals with disabilities?

Yes, the agency provides auxiliary aids, services, and other reasonable accommodations upon request to ensure accessibility for individuals with disabilities. It is advisable to reach out prior to submission to discuss specific needs.

Common mistakes

Filling out the CSCL CD 518 form can be a straightforward process, but common mistakes often lead to unnecessary delays. One significant error is neglecting to fill in the effective date field. Many individuals mistakenly believe that the form becomes effective upon submission, but unless an effective date is specified, it defaults to the date it’s filed. Without this clarity, the form may be subject to greater scrutiny or even rejected.

Another frequent mistake occurs in the identification number section. Some people are unsure of their corporation or LLC’s assigned number and leave the space blank. While it’s okay to leave it empty if unknown, not being diligent about finding this number can slow down processing. This number is crucial for the Bureau's records and for maintaining organization.

Additionally, errors in describing the inaccuracy or defect in the original document can lead to problems. When completing item five, it’s important to be clear and concise. Vague or unclear descriptions can result in the correction being incomplete or misinterpreted, prompting potential rejections or further amendments.

In the same vein, item six must reflect how the document should have read originally. Individuals sometimes struggle with specifics here. A common error is providing an incorrect or incomplete correction, which does not fully resolve the earlier inaccuracies. Double-checking the original document ensures that the correct revisions are made.

Signature issues are another area of concern. The form requires signatures in a specific manner according to the original document's execution. Some may forget to include all necessary signatures, which can lead to the document being returned. It’s crucial to ensure that every required party signs where indicated to avoid unnecessary delays.

People also often overlook the payment details. Whether it’s a check or money order, failing to include the corporation name and identification number can lead to processing issues. A simple mistake like this might leave the form in limbo, causing a ripple effect that can impact business operations.

Lastly, the legibility of the document cannot be overstated. Submissions that are poorly formatted or hard to read are likely to be rejected. It’s beneficial to use high-contrast colors and clear fonts, ensuring that all information is easily visible. An effort placed here can save considerable time and hassle during the filing process.

Documents used along the form

The CSCL/CD-518 form serves as a Certificate of Correction for corporations and limited liability companies in Michigan. When correcting errors in previously filed documents, several other forms and documents may also need to be completed. Each serves a specific purpose in ensuring compliance with state requirements.

- CSCL/CD-700 Application for Certificate of Good Standing: This document confirms that a corporation is compliant with state requirements and has paid necessary fees. It is often required for business transactions or when applying for loans.

- CSCL/CD-720 Articles of Incorporation: This form formally establishes a corporation in Michigan. It outlines essential details about the corporation, including its name, purpose, and structure.

- CSCL/CD-543 LLC Articles of Organization: Similar to the Articles of Incorporation, this form is used to legally create a limited liability company. It specifies the LLC's name, duration, and purpose.

- CSCL/CD-540 Annual Report: Required for corporations and LLCs, this document provides updated information about the business, confirming that it is still active and in line with state regulations.

- CSCL/CD-225 Consent to Serve as Resident Agent: This form designates a resident agent for the business. The resident agent is responsible for receiving legal documents and notices on behalf of the company.

- CSCL/CD-221 Change of Registered Office: If a corporation or LLC changes its registered office address, this form is used to notify the bureau. Timely updates are vital to maintain effective communication with the state.

- CSCL/CD-223 Statement of Information: This document provides ongoing information about the business and must be updated periodically. It may include details on management changes or new business activities.

- CSCL/CD-536 Certificate of Merger: This form is filed when two or more corporations merge. It details the merger process and ensures that both entities' information is accurately combined.

- CSCL/CD-272 Expedited Service Form: If faster processing is needed for any filings, this form allows for expedited handling of documents, including a required fee. It is crucial for urgent business needs.

In summary, understanding these forms and their functions can streamline the process of maintaining compliance and managing business documentation in Michigan. Properly addressing and correcting errors is essential for legal adherence and operational efficiency.

Similar forms

The CSCL CD-518 form, known as the Certificate of Correction, is designed for corporations and limited liability companies to correct inaccuracies in filed documents. Similar documents serve various purposes under corporate law, helping businesses to manage their records and legal obligations. Here are five documents similar to the CSCL CD-518:

- Certificate of Amendment: This form is used to make changes to a corporation’s articles of incorporation, such as changing the company name or amending the purpose of the company. Like the CSCL CD-518, it provides a formal method for correcting or altering records held by the state.

- Certificate of Dissolution: This document is submitted when a corporation seeks to officially end its existence. It is similar to the CSCL CD-518 in that it ensures proper notification to the state and can rectify any outstanding issues prior to dissolution.

- Certificate of Good Standing: This certificate verifies that a business entity is up to date with its filings and fees. Employees within the state rely on this document for accurate representation, much like the corrections made with the CSCL CD-518.

- Application for Certificate of Authority: This form is needed by foreign corporations that wish to operate in Michigan. Similar to the CSCL CD-518, it establishes compliance requirements and provides a formal route to correct or clarify information as needed.

- Certificate of Conversion: This document is used when a company changes its business structure, such as converting from a corporation to an LLC. It parallels the CSCL CD-518 by requiring formal filings to ensure accuracy and compliance with state laws.

Dos and Don'ts

When filling out the CSCL CD 518 form, it is important to follow specific guidelines to ensure the application is processed smoothly. Here are some recommendations on what to do and what to avoid:

- Do include the name and address accurately to ensure the document is sent back to the correct location.

- Do describe the inaccuracy or defect clearly to prevent confusion during processing.

- Do sign the document in the same manner as required for the original document being corrected.

- Do provide a legible version of the form, as poor contrast may lead to rejection.

- Don't leave the identification number blank unless it is absolutely unknown.

- Don't forget to pay the required nonrefundable fee; failing to do so will prevent processing.

- Don't use illegible handwriting, as submissions must be clear and easy to read.

- Don't disregard deadlines for submitting expedited service requests if you require faster processing.

Misconceptions

Misconceptions can often lead to confusion and missteps, especially when dealing with legal documents like the CSCL CD 518 form. Below are some common misconceptions about this certificate of correction, along with explanations to clarify the truth.

- Misconception 1: The CSCL CD 518 form only applies to corporations.

- Misconception 2: This form can correct any document, regardless of the issue.

- Misconception 3: Filing the CSCL CD 518 guarantees that all errors will be corrected.

- Misconception 4: You can file the certificate without any fees.

- Misconception 5: The document is effective immediately upon submission.

- Misconception 6: You can leave the identification number blank on the form.

- Misconception 7: You can submit the form online.

- Misconception 8: All submissions will be processed without review for legibility.

- Misconception 9: The same signatories from the original document must sign the correction.

- Misconception 10: Expedited service isn't available for this form.

In reality, both corporations and limited liability companies can utilize this form. It serves as a means to correct inaccuracies in documents filed with the Bureau.

This form is specifically designed to correct documents that are defectively executed or inaccurately record an action. It cannot be used for all types of errors.

While the form addresses certain inaccuracies, it does not automatically rectify all issues. The correction must be appropriate and relevant to the initial filing.

A fee is required for submitting the CSCL CD 518 form. These fees vary based on whether you are representing a corporation or a limited liability company.

The adjustments made through this form are effective as of the original filing date. However, the impact of the correction can vary for those affected by the error.

If the identification number is unknown, it may be left blank. However, providing this number ensures smoother processing of your request.

Currently, the CSCL CD 518 form must be submitted by mail or in person. Online submission is not available for this certificate of correction.

Legibility is crucial. Documents with poor contrast or clarity may be rejected, emphasizing the need for clear and readable submissions.

The correction must be signed as the initial document required but does not necessarily have to be signed by the same individuals.

Contrary to this belief, you can opt for expedited service to have your form reviewed and processed more quickly. A separate form must be completed for such requests.

Understanding these misconceptions can help ensure that you correctly file your CSCL CD 518 form and effectively address any inaccuracies in your documents.

Key takeaways

The CSCL/CD-518 form is utilized for submitting a Certificate of Correction for corporations and limited liability companies in Michigan. Filling out this form accurately is crucial. Here are five key takeaways to keep in mind when using the CSCL/CD-518 form:

- Provide Complete Information: Ensure that all required fields are filled out completely. Missing information can lead to delays or rejections. The details about the corporation name, ID number, and reasons for the corrections must be included.

- Review Legibility: The form must be clear and legible. Poor contrast or illegibility will result in rejection by the Bureau, so take care to ensure good quality when filling out the document.

- Understand Effective Dates: The corrections become effective as of the original filing date, unless the correction adversely affects individuals who relied on the inaccurate portion. It’s essential to be aware of how this may impact those involved.

- Payment Processing: A nonrefundable fee is required when submitting the form, with different amounts for corporations and limited liability companies. Make sure to include the appropriate payment method as instructed.

- Seek Assistance Wisely: While instructions are provided, remember that agency staff cannot offer legal advice. If needed, consider consulting a legal professional for guidance specific to your situation.

Browse Other Templates

Af Form 63 - There’s an option to convert this form into a digital format.

Virginia S Corporation - This form must outline the corporation's name and include required designations like "Corporation" or "Inc." at the end.

T&lc - Reapplying after a ban requires time and a corrected application to be considered.