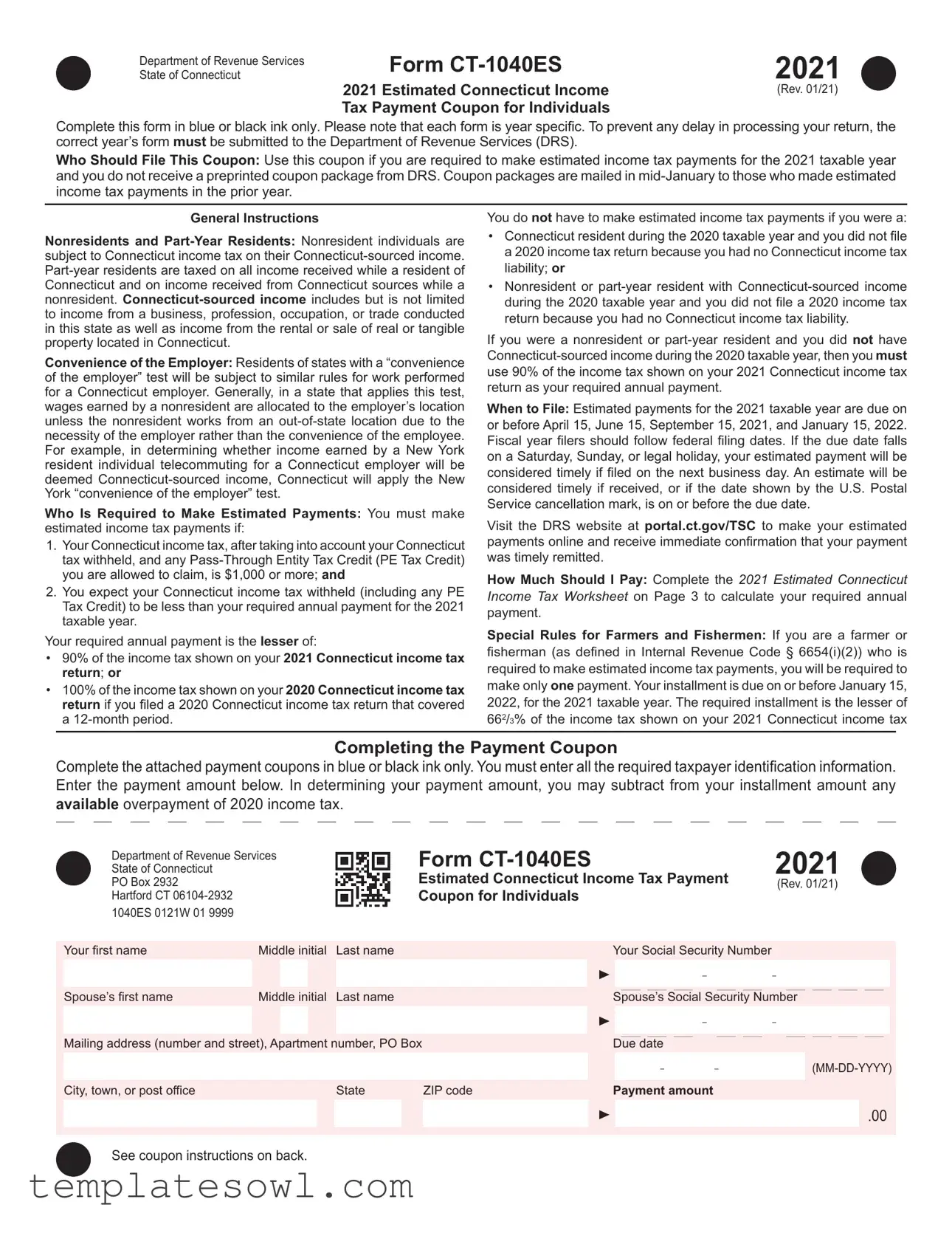

Fill Out Your Ct 1040Es Form

The CT-1040ES form is a crucial document for individuals in Connecticut who need to make estimated income tax payments. This form serves as the payment coupon specifically for the tax year 2021. If you are required to make these payments and haven't received a preprinted coupon package, you'll need to complete the CT-1040ES. It's essential to submit the correct year’s form to ensure your tax payments are processed without delay. Taxpayers who owe $1,000 or more after accounting for withholding and credits are generally required to file. Nonresidents and part-year residents have specific rules regarding Connecticut-sourced income that must be followed. Deadlines for payments fall on April 15, June 15, September 15, 2021, and January 15, 2022. Notably, farmers and fishermen have their own set of guidelines and can fulfill their tax obligations with a single payment. The proper completion of this form is a key aspect of maintaining compliance with state tax regulations. Failure to adhere may result in penalties, so attention to detail is critical when handling your estimated tax payments.

Ct 1040Es Example

Department of Revenue Services State of Connecticut

Form |

2021 |

2021 Estimated Connecticut Income |

(Rev. 01/21) |

Tax Payment Coupon for Individuals |

|

Complete this form in blue or black ink only. Please note that each form is year specific. To prevent any delay in processing your return, the correct year’s form must be submitted to the Department of Revenue Services (DRS).

Who Should File This Coupon: Use this coupon if you are required to make estimated income tax payments for the 2021 taxable year and you do not receive a preprinted coupon package from DRS. Coupon packages are mailed in

General Instructions

Nonresidents and Part‑Year Residents: Nonresident individuals are subject to Connecticut income tax on their Connecticut‑sourced income. Part‑year residents are taxed on all income received while a resident of Connecticut and on income received from Connecticut sources while a nonresident. Connecticut‑sourced income includes but is not limited to income from a business, profession, occupation, or trade conducted in this state as well as income from the rental or sale of real or tangible property located in Connecticut.

Convenience of the Employer: Residents of states with a “convenience of the employer” test will be subject to similar rules for work performed for a Connecticut employer. Generally, in a state that applies this test, wages earned by a nonresident are allocated to the employer’s location unless the nonresident works from an out‑of‑state location due to the necessity of the employer rather than the convenience of the employee. For example, in determining whether income earned by a New York resident individual telecommuting for a Connecticut employer will be deemed Connecticut‑sourced income, Connecticut will apply the New York “convenience of the employer” test.

Who Is Required to Make Estimated Payments: You must make estimated income tax payments if:

1.Your Connecticut income tax, after taking into account your Connecticut tax withheld, and any

2.You expect your Connecticut income tax withheld (including any PE Tax Credit) to be less than your required annual payment for the 2021 taxable year.

Your required annual payment is the lesser of:

•90% of the income tax shown on your 2021 Connecticut income tax return; or

•100% of the income tax shown on your 2020 Connecticut income tax return if you filed a 2020 Connecticut income tax return that covered a 12‑month period.

You do not have to make estimated income tax payments if you were a:

•Connecticut resident during the 2020 taxable year and you did not file a 2020 income tax return because you had no Connecticut income tax liability; or

•Nonresident or part‑year resident with

If you were a nonresident or part‑year resident and you did not have Connecticut‑sourced income during the 2020 taxable year, then you must use 90% of the income tax shown on your 2021 Connecticut income tax

return as your required annual payment.

When to File: Estimated payments for the 2021 taxable year are due on or before April 15, June 15, September 15, 2021, and January 15, 2022. Fiscal year filers should follow federal filing dates. If the due date falls on a Saturday, Sunday, or legal holiday, your estimated payment will be considered timely if filed on the next business day. An estimate will be considered timely if received, or if the date shown by the U.S. Postal Service cancellation mark, is on or before the due date.

Visit the DRS website at portal.ct.gov/TSC to make your estimated payments online and receive immediate confirmation that your payment

was timely remitted.

How Much Should I Pay: Complete the 2021 Estimated Connecticut

Income Tax Worksheet on Page 3 to calculate your required annual

payment.

Special Rules for Farmers and Fishermen: If you are a farmer or

fisherman (as defined in Internal Revenue Code § 6654(i)(2)) who is

required to make estimated income tax payments, you will be required to

make only one payment. Your installment is due on or before January 15, 2022, for the 2021 taxable year. The required installment is the lesser of 662/3% of the income tax shown on your 2021 Connecticut income tax

Completing the Payment Coupon

Complete the attached payment coupons in blue or black ink only. You must enter all the required taxpayer identification information. Enter the payment amount below. In determining your payment amount, you may subtract from your installment amount any available overpayment of 2020 income tax.

Department of Revenue Services

State of Connecticut

PO Box 2932

Hartford CT

1040ES 0121W 01 9999

Your first name |

Middle initial |

Last name |

||

|

|

|

|

|

Spouse’s first name |

Middle initial |

Last name |

||

|

|

|

|

|

Form |

2021 |

Estimated Connecticut Income Tax Payment |

(Rev. 01/21) |

Coupon for Individuals |

|

Your Social Security Number

Spouse’s Social Security Number

Mailing address (number and street), Apartment number, PO Box |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Due |

date |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, town, or post office |

State |

ZIP code |

Payment amount |

||||||||||||||||||

.00

.00

See coupon instructions on back.

return or 100% of the income tax shown on your 2020 Connecticut income tax return. See Informational Publication 2018(19), Farmer’s Guide to Sales and Use Taxes, Motor Vehicle Fuels Tax, Estimated Income Tax, and Withholding Tax.

Members of Partnerships and Shareholders of S corporations: If you are a partner in a partnership or shareholder of an S corporation, you must continue to include your distributive or

In general, you are required to make estimated payments based upon 100% of your prior year tax or 90% of your current year tax. Because of the potential variability in your income and credits, you may prefer to pay 100% of the tax shown on your 2020 return to avoid underpayment interest (2210 interest). You are required to pay the full amount of your 2021 tax liability by April 15, 2022, either with a timely filed return or with an extension request. Otherwise, you may incur late payment penalties.

Annualized Income Installment Method: If your income varies throughout the year, you may be able to reduce or eliminate the amount of your estimated tax payment for one or more periods by using the annualized income installment method. See Informational Publication 2018(11), A Guide to Calculating Your Annualized Estimated Income Tax Installments and Worksheet CT‑1040 AES.

Interest: You may be charged interest if you did not pay enough tax through withholding, estimated payments, or both, by the installment due date, or if any PE Tax Credit reported to you on Schedule CT K‑1, Part III, Line 1, or Schedule CT‑1041 K‑1, Part IV, Line 1, is not sufficient to cover your tax liability by the installment due date. This is true even if you are due a refund when you file your tax return. Interest is calculated separately for each installment. Therefore, you may owe interest for an earlier installment even if you paid enough tax later to make up for the underpayment. Interest at 1% per month or fraction of a month will be added to the tax due until the earlier of April 15, 2022, or the date on which the underpayment is paid.

If you file your income tax return for the 2021 taxable year on or before January 31, 2022, and pay in full the amount computed on the return as payable on or before that date, you will not be charged interest for failing to make the estimated payment due January 15, 2022.

A farmer or fisherman who files a 2021 Connecticut income tax return on or before March 1, 2022, and pays in full the amount computed on the return as payable on or before that date, will not be charged interest for underpayment of estimated tax. See Payment Options, on Page 8.

Form CT‑1040ES (Rev. 01/21)

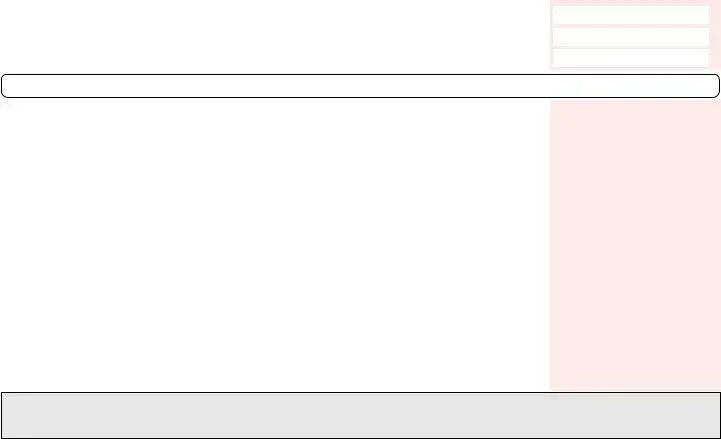

Worksheet Instructions

Line 2: Enter the total of your estimated allowable Connecticut modifications. See instructions for Schedule 1 - Modifications to Federal Adjusted Gross Income (AGI) of Form CT‑1040 or Form CT‑1040NR/PY for information about allowable modifications.

Social Security Benefit Adjustment: If your required Connecticut income tax return filing status is single or married filing separately, and you expect your 2021 federal adjusted gross income will be less than $75,000, enter as a subtraction the amount of federally taxable Social Security benefits you expect to report on your 2021 federal Form 1040, Line 6b, or federal Form 1040‑SR, Line 6b.

If your required Connecticut income tax return filing status is married filing jointly, qualifying widow(er), or head of household, and you expect your federal adjusted gross income will be less than $100,000, enter as a subtraction the amount of federally taxable Social Security benefits you expect to report on your 2021 federal Form 1040, Line 6b, or federal Form 1040‑SR, Line 6b.

If you expect your federal adjusted gross income will be above the threshold for your filing status, complete the Social Security Benefit Adjustment Worksheet on Page 4 and include the amount from Line F on Line 2.

Line 3: Nonresidents and

Line 5: Apportionment Factor: Nonresidents and part‑year residents, if your Connecticut‑sourced income is greater than or equal to your Connecticut adjusted gross income, enter 1.0000. If your Connecticut‑sourced income is less than your Connecticut adjusted gross income, complete the following calculation and enter the result on Line 5.

= Line 5 |

|

Connecticut Adjusted Gross Income (Line 3) |

Do not enter a number that is less than zero or greater than 1. If the result is less than zero, enter “0”; if greater than 1 enter 1.0000. Round to four decimal places.

Line 7: Residents and

Line 9: If you expect to owe federal alternative minimum tax for the 2021 taxable year, you may also owe Connecticut alternative minimum tax. Enter your estimated Connecticut alternative minimum tax liability. See instructions for Form CT‑6251, Connecticut Alternative Minimum Tax Return - Individuals.

Instructions continue on Page 8 |

Page 2 of 8 |

|

Form

•See Payment Options, on Page 8.

•Print all information. Include your spouse’s SSN, if married filing jointly.

•Cut along dotted line and mail coupon and payment to the address below.

•Make your check payable to Commissioner of Revenue Services.

•Do not use staples.

•DRS may submit your check to your bank electronically.

•To ensure proper posting, write your SSN(s) (optional) and “2021 Form CT‑1040ES” on your check.

Send completed coupon and payment to:

Department of Revenue Services

PO Box 2932

Hartford CT

2021 Estimated Connecticut Income Tax Worksheet

1. |

Federal adjusted gross income you expect in the 2021 taxable year |

|

|

(from 2021 federal Form 1040ES, 2021 Estimated Tax Worksheet, Line 1) |

1. |

2. |

Allowable Connecticut modifications: Additions or subtractions (to your AGI). See instructions |

2. |

3. |

Connecticut adjusted gross income: Combine Line 1 and Line 2 |

3. |

Nonresidents and

4. |

Connecticut income tax: Complete the Tax Calculation Schedule below |

4. |

|

|

5. |

Apportionment factor: Connecticut residents enter 1.0000. Nonresidents and part‑year residents, |

|

|

|

|

. |

|

||

|

see Page 2 |

5. |

|

|

6. |

Multiply Line 5 by Line 4 |

6. |

|

|

7. |

Credit for income taxes paid to qualifying jurisdictions: See instructions |

7. |

|

|

|

|

|||

8. |

Subtract Line 7 from Line 6 |

8. |

|

|

|

|

|||

9. |

Estimated Connecticut alternative minimum tax: See instructions |

9. |

|

|

|

|

|||

10. |

Add Line 8 and Line 9 |

10. |

|

|

|

|

|||

11. |

Estimated allowable credit(s) from Schedule CT‑IT Credit: See instructions |

11. |

|

|

|

|

|||

12. |

Total estimated income tax: Subtract Line 11 from Line 10 |

12. |

|

|

|

|

|||

13. |

Multiply Line 12 by 90% (662/3% for farmers and fishermen) |

13. |

|

|

|

|

|||

14. |

Enter 100% of the income tax shown on your 2020 Connecticut income tax return. See instructions |

14. |

|

|

|

|

|||

15. |

Enter the lesser of Line 13 or Line 14. If Line 14 is blank, enter the amount from Line 13. |

|

|

|

|

|

|

||

|

This is your required annual payment. See caution below |

15. |

|

|

Caution: Generally, you may owe interest if you do not prepay (through timely estimates, withholding,

16. |

. ................Connecticut income tax withheld or expected to be withheld during the 2021 taxable year |

|

|

|

|

|

||

16a. Estimated PE Tax Credit for taxable year 2021 |

16a. |

|

|

|

|

|||

|

|

|

|

|||||

17. |

Subtract Lines 16 and 16a from Line 15. If zero (“0”) or less, no estimated payment is required. Or, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

. .................Subtract Lines 16 and 16a from Line 12. If less than $1,000, no estimated payment is required |

|

|

|

|

|

||

18. |

Installment amount |

18. |

|

|

|

|

|

|

|

25 |

|

||||||

19. |

. .......................................................Multiply Line 17 by Line 18. Pay this amount for each installment |

|

|

|

|

|

||

|

Tax Calculation Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Enter Connecticut AGI from 2021 Estimated Connecticut Income Tax Worksheet, Line 3 |

1. |

|

|

|

|

||

|

|

|

|

.00 |

||||

2. |

Enter the exemption amount from Table A, Personal Exemptions. If zero, enter “0.” |

2. |

|

|

|

|

.00 |

|

3. |

Connecticut Taxable Income: Subtract Line 2 from Line 1. If less than zero, enter “0.” |

3. |

|

|

|

|

.00 |

|

4. |

Enter amount from Table B, Initial Tax Calculation |

4. |

|

|

|

|

.00 |

|

5. |

Enter the |

5. |

|

|

|

|

.00 |

|

6. |

Enter the recapture amount from Table D, Tax Recapture. If zero, enter “0.” |

6. |

|

|

|

|

.00 |

|

7. |

Add Lines 4, 5, and 6 |

7. |

|

|

|

|

.00 |

|

8. |

Enter the decimal amount from Table E, Personal Tax Credits. If zero, enter “0.” |

8. |

|

|

. |

|

|

|

9. |

Multiply the amount on Line 7 by the decimal amount on Line 8 |

9. |

|

|

|

|

.00 |

|

10. |

Connecticut Income Tax: Subtract Line 9 from Line 7. Enter here and on 2021 Estimated |

|

|

|

|

|

.00 |

|

|

|

|

|

|

||||

|

Connecticut Income Tax Worksheet, Line 4 |

10. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Form |

Page 3 of 8 |

Social Security Benefit Adjustment Worksheet

Enter the amount you expect to enter on Form CT‑1040 or Form CT‑1040NR/PY, Line 1 |

|

.00 |

If your filing status is single or married filing separately, is the amount on Line 1 $75,000 or more?

Yes: Complete this worksheet.

No: Do not complete this worksheet. *

If your filing status is married filing jointly, qualifying widow(er), or head of household, is the amount on Line 1 $100,000 or more?

Yes: Complete this worksheet.

No: Do not complete this worksheet. *

*If you answered No to either question, enter as a subtraction modification on the 2021 Estimated Connecticut Income Tax Worksheet, Line 2, the amount of federally taxable Social Security benefits you expect to report on federal Form 1040, Line 6b, or federal Form

A.Enter the amount you reported on federal Publication 505 **, Tax Withholding and Estimated

Tax, Worksheet 2‑2, Line 1. If Line A is zero or less, stop here. Otherwise, go to Line B |

A. |

B.Enter the amount you reported on federal Publication 505 **, Tax Withholding and Estimated

|

Tax, Worksheet 2‑2, Line 10. If Line B is zero or less, stop here. Otherwise, go to Line C |

B. |

C. |

Enter the lesser of Line A or Line B |

C. |

D. |

Multiply Line C by 25% (.25) |

D. |

E. |

Expected taxable amount of Social Security benefits you reported on federal |

|

|

Publication 505 **, Tax Withholding and Estimated Tax, Worksheet 2‑2, Line 19 |

E. |

F.Social Security benefit adjustment: Subtract Line D from Line E. Enter the amount here and as a subtraction on the 2021 Estimated Connecticut Income Tax Worksheet, Line 2. If

Line D is greater than or equal to Line E, enter “0.” |

F. |

**To obtain federal Publication 505, visit the IRS website at www.irs.gov or call the IRS at 800‑829‑3676.

Form |

Page 4 of 8 |

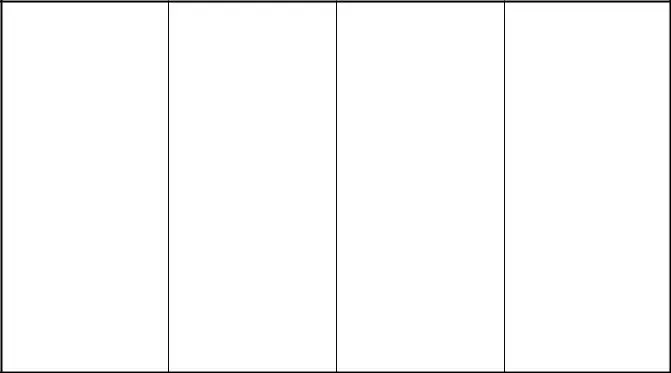

Table A - Personal Exemptions for 2021 Taxable Year

Enter the exemption amount on the Tax Calculation Schedule, Line 2.

Use the filing status you expect to report on your 2021 Connecticut income tax return and your Connecticut AGI* (from Tax Calculation Schedule, Line 1) to determine your exemption.

|

|

Single |

|

|

|

Married Filing Jointly or |

|

Married Filing Separately |

|

Head of Household |

|||||||||

|

|

|

|

|

Qualifying Widow(er) |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Connecticut AGI * |

Exemption |

Connecticut AGI * |

Exemption |

Connecticut AGI * |

Exemption |

Connecticut AGI * |

Exemption |

||||||||||||

More Than |

Less Than |

|

|

More Than |

Less Than |

|

|

More Than |

Less Than |

|

|

More Than |

Less Than |

|

|

||||

|

|

or Equal To |

|

|

|

|

or Equal To |

|

|

|

|

or Equal To |

|

|

|

|

or Equal To |

|

|

$ |

0 |

$30,000 |

$ |

15,000 |

$ |

0 |

$48,000 |

$ |

24,000 |

$ |

0 |

$24,000 |

$ |

12,000 |

$ |

0 |

$38,000 |

$ |

19,000 |

$ |

30,000 |

$31,000 |

$ |

14,000 |

$ |

48,000 |

$49,000 |

$ |

23,000 |

$ |

24,000 |

$25,000 |

$ |

11,000 |

$ |

38,000 |

$39,000 |

$ |

18,000 |

$ |

31,000 |

$32,000 |

$ |

13,000 |

$ |

49,000 |

$50,000 |

$ |

22,000 |

$ |

25,000 |

$26,000 |

$ |

10,000 |

$ |

39,000 |

$40,000 |

$ |

17,000 |

$ |

32,000 |

$33,000 |

$ |

12,000 |

$ |

50,000 |

$51,000 |

$ |

21,000 |

$ |

26,000 |

$27,000 |

$ |

9,000 |

$ |

40,000 |

$41,000 |

$ |

16,000 |

$ |

33,000 |

$34,000 |

$11,000 |

$ |

51,000 |

$52,000 |

$ |

20,000 |

$ |

27,000 |

$28,000 |

$ |

8,000 |

$ |

41,000 |

$42,000 |

$ |

15,000 |

|

$ |

34,000 |

$35,000 |

$ |

10,000 |

$ |

52,000 |

$53,000 |

$ |

19,000 |

$ |

28,000 |

$29,000 |

$ |

7,000 |

$ |

42,000 |

$43,000 |

$ |

14,000 |

$ |

35,000 |

$36,000 |

$ |

9,000 |

$ |

53,000 |

$54,000 |

$ |

18,000 |

$ |

29,000 |

$30,000 |

$ |

6,000 |

$ |

43,000 |

$44,000 |

$ |

13,000 |

$ |

36,000 |

$37,000 |

$ |

8,000 |

$ |

54,000 |

$55,000 |

$ |

17,000 |

$ |

30,000 |

$31,000 |

$ |

5,000 |

$ |

44,000 |

$45,000 |

$ |

12,000 |

$ |

37,000 |

$38,000 |

$ |

7,000 |

$ |

55,000 |

$56,000 |

$ |

16,000 |

$ |

31,000 |

$32,000 |

$ |

4,000 |

$ |

45,000 |

$46,000 |

$ |

11,000 |

$ |

38,000 |

$39,000 |

$ |

6,000 |

$ |

56,000 |

$57,000 |

$ |

15,000 |

$ |

32,000 |

$33,000 |

$ |

3,000 |

$ |

46,000 |

$47,000 |

$ |

10,000 |

$ |

39,000 |

$40,000 |

$ |

5,000 |

$ |

57,000 |

$58,000 |

$ |

14,000 |

$ |

33,000 |

$34,000 |

$ |

2,000 |

$ |

47,000 |

$48,000 |

$ |

9,000 |

$ |

40,000 |

$41,000 |

$ |

4,000 |

$ |

58,000 |

$59,000 |

$ |

13,000 |

$ |

34,000 |

$35,000 |

$ |

1,000 |

$ |

48,000 |

$49,000 |

$ |

8,000 |

$ |

41,000 |

$42,000 |

$ |

3,000 |

$ |

59,000 |

$60,000 |

$ |

12,000 |

$ |

35,000 |

and up |

$ |

0 |

$ |

49,000 |

$50,000 |

$ |

7,000 |

$ |

42,000 |

$43,000 |

$ |

2,000 |

$ |

60,000 |

$61,000 |

$ |

11,000 |

|

|

|

|

|

$ |

50,000 |

$51,000 |

$ |

6,000 |

$ |

43,000 |

$44,000 |

$ |

1,000 |

$ |

61,000 |

$62,000 |

$ |

10,000 |

|

|

|

|

|

$ |

51,000 |

$52,000 |

$ |

5,000 |

$ |

44,000 |

and up |

$ |

0 |

$ |

62,000 |

$63,000 |

$ |

9,000 |

|

|

|

|

|

$ |

52,000 |

$53,000 |

$ |

4,000 |

|

|

|

|

|

$ |

63,000 |

$64,000 |

$ |

8,000 |

|

|

|

|

|

$ |

53,000 |

$54,000 |

$ |

3,000 |

|

|

|

|

|

$ |

64,000 |

$65,000 |

$ |

7,000 |

|

|

|

|

|

$ |

54,000 |

$55,000 |

$ |

2,000 |

|

|

|

|

|

$ |

65,000 |

$66,000 |

$ |

6,000 |

|

|

|

|

|

$ |

55,000 |

$56,000 |

$ |

1,000 |

|

|

|

|

|

$ |

66,000 |

$67,000 |

$ |

5,000 |

|

|

|

|

|

$ |

56,000 |

and up |

$ |

0 |

|

|

|

|

|

$ |

67,000 |

$68,000 |

$ |

4,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

68,000 |

$69,000 |

$ |

3,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

69,000 |

$70,000 |

$ |

2,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

70,000 |

$71,000 |

$ |

1,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

71,000 |

and up |

$ |

0 |

|

|

|

|

|

|

|

|

|

|

*Form

Form |

Page 5 of 8 |

Table B - Initial Tax Calculation for 2021 Taxable Year

Enter the tax calculation amount on the Tax Calculation Schedule, Line 4 and continue to Line 5.

Use the filing status you expect to report on your 2021 Connecticut income tax return. This is the initial tax calculation of your tax liability. It does not include personal tax credits, the 3%

Single or Married Filing Separately

If the amount on Line 3 of the Tax Calculation Schedule is:

Less than or equal to: |

$ 10,000 |

3.00% |

More than $10,000, but less than or equal to |

$ 50,000 |

$300 plus 5.0% of the excess over $10,000 |

More than $50,000, but less than or equal to |

$100,000 |

$2,300 plus 5.5% of the excess over $50,000 |

More than $100,000, but less than or equal to |

$200,000 |

$5,050 plus 6.0% of the excess over $100,000 |

More than $200,000, but less than or equal to |

$250,000 |

$11,050 plus 6.5% of the excess over $200,000 |

More than $250,000, but less than or equal to |

$500,000 |

$14,300 plus 6.9% of the excess over $250,000 |

More than $500,000 |

$31,550 plus 6.99% of the excess over $500,000 |

|

Single or Married Filing Separately Examples:

Line 3 is $13,000, Line 4 is $450

$13,000 - $10,000 |

= |

$3,000 |

$3,000 X .05 |

= |

$150 |

$300 + $150 |

= |

$450 |

Line 3 is $525,000, Line 4 is $33,298

$525,000 - $500,000 |

= |

$25,000 |

$25,000 x .0699 |

= |

$1,748 |

$31,550 + $1,748 |

= |

$33,298 |

Married Filing Jointly/Qualifying Widow(er)

If the amount on Line 3 of the Tax Calculation Schedule is:

Less than or equal to: |

$ 20,000 |

3.00% |

More than $20,000, but less than or equal to |

$100,000 |

$600 plus 5.0% of the excess over $20,000 |

More than $100,000, but less than or equal to |

$200,000 |

$4,600 plus 5.5% of the excess over $100,000 |

More than $200,000, but less than or equal to |

$400,000 |

$10,100 plus 6.0% of the excess over $200,000 |

More than $400,000, but less than or equal to |

$500,000 |

$22,100 plus 6.5% of the excess over $400,000 |

More than $500,000, but less than or equal to |

$1,000,000 |

$28,600 plus 6.9% of the excess over $500,000 |

More than $1,000,000 |

$63,100 plus 6.99% of the excess over $1,000,000 |

|

Married Filing Jointly/Qualifying Widow(er) Examples:

Line 3 is $22,500, Line 4 is $725

$22,500 - $20,000 |

= |

$2,500 |

$2,500 x .05 |

= |

$125 |

$600 + $125 |

= |

$725 |

Line 3 is $1,100,000, Line 4 is $70,090

$1,100,000 |

- $1,000,000 |

= $100,000 |

|

$100,000 x |

.0699 |

= |

$6,990 |

$63,100 + $6,990 |

= |

$70,090 |

|

Head of Household

If the amount on Line 3 of the Tax Calculation Schedule is:

Less than or equal to: |

$ 16,000 |

3.00% |

More than $16,000, but less than or equal to |

$ 80,000 |

$480 plus 5.0% of the excess over $16,000 |

More than $80,000, but less than or equal to |

$160,000 |

$3,680 plus 5.5% of the excess over $80,000 |

More than $160,000, but less than or equal to |

$320,000 |

$8,080 plus 6.0% of the excess over $160,000 |

More than $320,000, but less than or equal to |

$400,000 |

$17,680 plus 6.5% of the excess over $320,000 |

More than $400,000, but less than or equal to |

$800,000 |

$22,880 plus 6.9% of the excess over $400,000 |

More than $800,000 |

$50,480 plus 6.99% of the excess over $800,000 |

|

Head of Household Examples:

Line 3 is $20,000, Line 4 is $680

$20,000 - $16,000 |

= |

$4,000 |

$4,000 x .05 |

= |

$200 |

$480 + $200 |

= |

$680 |

Line 3 is $825,000, Line 4 is $52,228

$825,000 - $800,000 |

= |

$25,000 |

$25,000 x .0699 |

= |

$1,748 |

$50,480 + $1,748 |

= |

$52,228 |

Table C - 3%

Enter the

Use the filing status you expect to report on your 2021 Connecticut income tax return and your Connecticut AGI * (Tax Calculation Schedule, Line 1) to determine your

|

|

Single |

|

|

|

Married Filing Jointly or |

|

Married Filing Separately |

|

Head of Household |

||||||||||||

|

|

|

|

|

Qualifying Widow(er) |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Connecticut AGI* |

|

3% |

Connecticut AGI* |

|

3% |

Connecticut AGI* |

3% |

Connecticut AGI* |

|

3% |

||||||||||||

More Than |

Less Than |

|

More Than |

Less Than |

|

More Than |

Less Than |

More Than |

Less Than |

|

||||||||||||

|

|

or Equal To |

|

|

|

or Equal To |

|

|

|

or Equal To |

|

|

or Equal To |

|

||||||||

$ |

0 |

$ 56,500 |

|

$ |

0 |

$ |

0 |

$100,500 |

$ |

0 |

$ |

0 |

$50,250 |

$ |

0 |

$ |

0 |

$ 78,500 |

|

$ |

0 |

|

$ |

56,500 |

$ 61,500 |

|

$ |

20 |

$100,500 |

$105,500 |

$ |

40 |

$ |

50,250 |

$52,750 |

$ |

20 |

$ |

78,500 |

$ 82,500 |

|

$ |

32 |

||

$ |

61,500 |

$ 66,500 |

|

$ |

40 |

$105,500 |

$110,500 |

$ |

80 |

$ |

52,750 |

$55,250 |

$ |

40 |

$ |

82,500 |

$ 86,500 |

|

$ |

64 |

||

$ |

66,500 |

$ 71,500 |

|

$ |

60 |

$110,500 |

$115,500 |

$ |

120 |

$ |

55,250 |

$57,750 |

$ |

60 |

$ |

86,500 |

$ 90,500 |

|

$ |

96 |

||

$ |

71,500 |

$ 76,500 |

|

$ |

80 |

$115,500 |

$120,500 |

$ |

160 |

$ |

57,750 |

$60,250 |

$ |

80 |

$ |

90,500 |

$ 94,500 |

|

$ |

128 |

||

$ |

76,500 |

$ 81,500 |

|

$ |

100 |

$120,500 |

$125,500 |

$ |

200 |

$ |

60,250 |

$62,750 |

$ |

100 |

$ |

94,500 |

$ 98,500 |

|

$ |

160 |

||

$ |

81,500 |

$ 86,500 |

|

$ |

120 |

$125,500 |

$130,500 |

$ |

240 |

$ |

62,750 |

$65,250 |

$ |

120 |

$ |

98,500 |

$102,500 |

$ |

192 |

|||

$ |

86,500 |

$ 91,500 |

|

$ |

140 |

$130,500 |

$135,500 |

$ |

280 |

$ |

65,250 |

$67,750 |

$ |

140 |

$102,500 |

$106,500 |

$ |

224 |

||||

$ |

91,500 |

$ 96,500 |

|

$ |

160 |

$135,500 |

$140,500 |

$ |

320 |

$ |

67,750 |

$70,250 |

$ |

160 |

$106,500 |

$110,500 |

$ |

256 |

||||

$ |

96,500 |

$101,500 |

$ |

180 |

$140,500 |

$145,500 |

$ |

360 |

$ |

70,250 |

$72,750 |

$ |

180 |

$110,500 |

$114,500 |

$ |

288 |

|||||

$101,500 |

and up |

$ |

200 |

$145,500 |

and up |

$ |

400 |

$ |

72,750 |

and up |

$ |

200 |

$114,500 |

and up |

$ |

320 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Form

Form |

Page 6 of 8 |

Table D - Tax Recapture

Enter the recapture amount on the Tax Calculation Schedule, Line 6.

Use the filing status you expect to report on your 2021 Connecticut income tax return and your Connecticut AGI * (Tax Calculation Schedule, Line 1) to determine your recapture amount.

|

Single or Married Filing Separately |

|

Married Filing Jointly or |

|

|

|

Head of Household |

|

|

|||||||||

|

|

|

|

|

|

|

Qualifying Widow(er) |

|

|

|

|

|

|

|

|

|

||

|

|

Connecticut AGI * |

|

|

|

Connecticut AGI * |

|

|

|

|

|

Connecticut AGI * |

|

|

|

|||

|

More Than |

Less Than |

Recapture |

More Than |

Less Than |

|

Recapture |

More Than |

Less Than |

|

Recapture |

|||||||

|

|

|

or |

Amount |

|

|

or |

|

Amount |

|

|

or |

|

Amount |

||||

|

|

|

Equal To |

|

|

|

|

Equal To |

|

|

|

|

|

|

Equal To |

|

|

|

$ |

0 |

$200,000 |

$ |

0 |

$ |

0 |

$400,000 |

|

$ |

0 |

|

$ |

0 |

$320,000 |

|

$ |

0 |

|

$ |

200,000 |

$205,000 |

$ |

90 |

$400,000 |

$410,000 |

|

$ |

180 |

|

$ |

320,000 |

$328,000 |

|

$ |

140 |

||

$ |

205,000 |

$210,000 |

$ |

180 |

$410,000 |

$420,000 |

|

$ |

360 |

|

$ |

328,000 |

$336,000 |

|

$ |

280 |

||

$ |

210,000 |

$215,000 |

$ |

270 |

$420,000 |

$430,000 |

|

$ |

540 |

|

$ |

336,000 |

$344,000 |

|

$ |

420 |

||

$ |

215,000 |

$220,000 |

$ |

360 |

$430,000 |

$440,000 |

|

$ |

720 |

|

$ |

344,000 |

$352,000 |

|

$ |

560 |

||

$ |

220,000 |

$225,000 |

$ |

450 |

$440,000 |

$450,000 |

|

$ |

900 |

|

$ |

352,000 |

$360,000 |

|

$ |

700 |

||

$ |

225,000 |

$230,000 |

$ |

540 |

$450,000 |

$460,000 |

|

$ |

1,080 |

|

$ |

360,000 |

$368,000 |

|

$ |

840 |

||

$ |

230,000 |

$235,000 |

$ |

630 |

$460,000 |

$470,000 |

|

$ |

1,260 |

|

$ |

368,000 |

$376,000 |

|

$ |

980 |

||

$ |

235,000 |

$240,000 |

$ |

720 |

$470,000 |

$480,000 |

|

$ |

1,440 |

|

$ |

376,000 |

$384,000 |

|

$ |

1,120 |

||

$ |

240,000 |

$245,000 |

$ |

810 |

$480,000 |

$490,000 |

|

$ |

1,620 |

|

$ |

384,000 |

$392,000 |

|

$ |

1,260 |

||

$ |

245,000 |

$250,000 |

$ |

900 |

$490,000 |

$500,000 |

|

$ |

1,800 |

|

$ |

392,000 |

$400,000 |

|

$ |

1,400 |

||

$ |

250,000 |

$255,000 |

$ |

990 |

$500,000 |

$510,000 |

|

$ |

1,980 |

|

$ |

400,000 |

$408,000 |

|

$ |

1,540 |

||

$ |

255,000 |

$260,000 |

$ |

1,080 |

$510,000 |

$520,000 |

|

$ |

2,160 |

|

$ |

408,000 |

$416,000 |

|

$ |

1,680 |

||

$ |

260,000 |

$265,000 |

$ |

1,170 |

$520,000 |

$530,000 |

|

$ |

2,340 |

|

$ |

416,000 |

$424,000 |

|

$ |

1,820 |

||

$ |

265,000 |

$270,000 |

$ |

1,260 |

$530,000 |

$540,000 |

|

$ |

2,520 |

|

$ |

424,000 |

$432,000 |

|

$ |

1,960 |

||

$ |

270,000 |

$275,000 |

$ |

1,350 |

$540,000 |

$550,000 |

|

$ |

2,700 |

|

$ |

432,000 |

$440,000 |

|

$ |

2,100 |

||

$ |

275,000 |

$280,000 |

$ |

1,440 |

$550,000 |

$560,000 |

|

$ |

2,880 |

|

$ |

440,000 |

$448,000 |

|

$ |

2,240 |

||

$ |

280,000 |

$285,000 |

$ |

1,530 |

$560,000 |

$570,000 |

|

$ |

3,060 |

|

$ |

448,000 |

$456,000 |

|

$ |

2,380 |

||

$ |

285,000 |

$290,000 |

$ |

1,620 |

$570,000 |

$580,000 |

|

$ |

3,240 |

|

$ |

456,000 |

$464,000 |

|

$ |

2,520 |

||

$ |

290,000 |

$295,000 |

$ |

1,710 |

$580,000 |

$590,000 |

|

$ |

3,420 |

|

$ |

464,000 |

$472,000 |

|

$ |

2,660 |

||

$ |

295,000 |

$300,000 |

$ |

1,800 |

$590,000 |

$600,000 |

|

$ |

3,600 |

|

$ |

472,000 |

$480,000 |

|

$ |

2,800 |

||

$ |

300,000 |

$305,000 |

$ |

1,890 |

$600,000 |

$610,000 |

|

$ |

3,780 |

|

$ |

480,000 |

$488,000 |

|

$ |

2,940 |

||

$ |

305,000 |

$310,000 |

$ |

1,980 |

$610,000 |

$620,000 |

|

$ |

3,960 |

|

$ |

488,000 |

$496,000 |

|

$ |

3,080 |

||

$ |

310,000 |

$315,000 |

$ |

2,070 |

$620,000 |

$630,000 |

|

$ |

4,140 |

|

$ |

496,000 |

$504,000 |

|

$ |

3,220 |

||

$ |

315,000 |

$320,000 |

$ |

2,160 |

$630,000 |

$640,000 |

|

$ |

4,320 |

|

$ |

504,000 |

$512,000 |

|

$ |

3,360 |

||

$ |

320,000 |

$325,000 |

$ |

2,250 |

$640,000 |

$650,000 |

|

$ |

4,500 |

|

$ |

512,000 |

$520,000 |

|

$ |

3,500 |

||

$ |

325,000 |

$330,000 |

$ |

2,340 |

$650,000 |

$660,000 |

|

$ |

4,680 |

|

$ |

520,000 |

$528,000 |

|

$ |

3,640 |

||

$ |

330,000 |

$335,000 |

$ |

2,430 |

$660,000 |

$670,000 |

|

$ |

4,860 |

|

$ |

528,000 |

$536,000 |

|

$ |

3,780 |

||

$ |

335,000 |

$340,000 |

$ |

2,520 |

$670,000 |

$680,000 |

|

$ |

5,040 |

|

$ |

536,000 |

$544,000 |

|

$ |

3,920 |

||

$ |

340,000 |

$345,000 |

$ |

2,610 |

$680,000 |

$690,000 |

|

$ |

5,220 |

|

$ |

544,000 |

$552,000 |

|

$ |

4,060 |

||

$ |

345,000 |

$500,000 |

$ |

2,700 |

$690,000 |

$1,000,000 |

|

$ |

5,400 |

|

$ |

552,000 |

$800,000 |

|

$ |

4,200 |

||

$ |

500,000 |

$505,000 |

$ |

2,750 |

$1,000,000 |

$1,010,000 |

|

$ |

5,500 |

|

$ |

800,000 |

$808,000 |

|

$ |

4,280 |

||

$ |

505,000 |

$510,000 |

$ |

2,800 |

$1,010,000 |

$1,020,000 |

|

$ |

5,600 |

|

$ |

808,000 |

$816,000 |

|

$ |

4,360 |

||

$ |

510,000 |

$515,000 |

$ |

2,850 |

$1,020,000 |

$1,030,000 |

|

$ |

5,700 |

|

$ |

816,000 |

$824,000 |

|

$ |

4,440 |

||

$ |

515,000 |

$520,000 |

$ |

2,900 |

$1,030,000 |

$1,040,000 |

|

$ |

5,800 |

|

$ |

824,000 |

$832,000 |

|

$ |

4,520 |

||

$ |

520,000 |

$525,000 |

$ |

2,950 |

$1,040,000 |

$1,050,000 |

|

$ |

5,900 |

|

$ |

832,000 |

$840,000 |

|

$ |

4,600 |

||

$ |

525,000 |

$530,000 |

$ |

3,000 |

$1,050,000 |

$1,060,000 |

|

$ |

6,000 |

|

$ |

840,000 |

$848,000 |

|

$ |

4,680 |

||

$ |

530,000 |

$535,000 |

$ |

3,050 |

$1,060,000 |

$1,070,000 |

|

$ |

6,100 |

|

$ |

848,000 |

$856,000 |

|

$ |

4,760 |

||

$ |

535,000 |

$540,000 |

$ |

3,100 |

$1,070,000 |

$1,080,000 |

|

$ |

6,200 |

|

$ |

856,000 |

$864,000 |

|

$ |

4,840 |

||

$ |

540,000 |

and up |

$ |

3,150 |

$1,080,000 |

and up |

$ |

6,300 |

|

$ |

864,000 |

and up |

$ |

4,920 |

||||

* Form

Form |

Page 7 of 8 |

Table E - Personal Tax Credits for 2021 Taxable Year

Enter the decimal amount on the Tax Calculation Schedule, Line 8.

Use the filing status you expect to report on your 2021 Connecticut income tax return and your Connecticut AGI * (Tax Calculation Schedule, Line 1) to determine your decimal amount.

|

|

Single |

|

Married Filing Jointly or |

Married Filing Separately |

Head of Household |

||||||

|

|

|

Qualifying Widow(er) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|||

|

Connecticut AGI* |

Decimal |

Connecticut AGI* |

Decimal |

Connecticut AGI* |

Decimal |

Connecticut AGI* |

Decimal |

||||

|

More Than |

Less Than |

Amount |

More Than |

Less Than |

Amount |

More Than |

Less Than |

Amount |

More Than |

Less Than |

Amount |

|

|

or Equal To |

|

|

or Equal To |

|

|

or Equal To |

|

|

or Equal To |

|

$15,000 |

$18,800 |

.75 |

$24,000 |

$30,000 |

.75 |

$12,000 |

$15,000 |

.75 |

$19,000 |

$24,000 |

.75 |

|

$18,800 |

$19,300 |

.70 |

$30,000 |

$30,500 |

.70 |

$15,000 |

$15,500 |

.70 |

$24,000 |

$24,500 |

.70 |

|

$19,300 |

$19,800 |

.65 |

$30,500 |

$31,000 |

.65 |

$15,500 |

$16,000 |

.65 |

$24,500 |

$25,000 |

.65 |

|

$19,800 |

$20,300 |

.60 |

$31,000 |

$31,500 |

.60 |

$16,000 |

$16,500 |

.60 |

$25,000 |

$25,500 |

.60 |

|

$20,300 |

$20,800 |

.55 |

$31,500 |

$32,000 |

.55 |

$16,500 |

$17,000 |

.55 |

$25,500 |

$26,000 |

.55 |

|

$20,800 |

$21,300 |

.50 |

$32,000 |

$32,500 |

.50 |

$17,000 |

$17,500 |

.50 |

$26,000 |

$26,500 |

.50 |

|

$21,300 |

$21,800 |

.45 |

$32,500 |

$33,000 |

.45 |

$17,500 |

$18,000 |

.45 |

$26,500 |

$27,000 |

.45 |

|

$21,800 |

$22,300 |

.40 |

$33,000 |

$33,500 |

.40 |

$18,000 |

$18,500 |

.40 |

$27,000 |

$27,500 |

.40 |

|

$22,300 |

$25,000 |

.35 |

$33,500 |

$40,000 |

.35 |

$18,500 |

$20,000 |

.35 |

$27,500 |

$34,000 |

.35 |

|

$25,000 |

$25,500 |

.30 |

$40,000 |

$40,500 |

.30 |

$20,000 |

$20,500 |

.30 |

$34,000 |

$34,500 |

.30 |

|

$25,500 |

$26,000 |

.25 |

$40,500 |

$41,000 |

.25 |

$20,500 |

$21,000 |

.25 |

$34,500 |

$35,000 |

.25 |

|

$26,000 |

$26,500 |

.20 |

$41,000 |

$41,500 |

.20 |

$21,000 |

$21,500 |

.20 |

$35,000 |

$35,500 |

.20 |

|

$26,500 |

$31,300 |

.15 |

$41,500 |

$50,000 |

.15 |

$21,500 |

$25,000 |

.15 |

$35,500 |

$44,000 |

.15 |

|

$31,300 |

$31,800 |

.14 |

$50,000 |

$50,500 |

.14 |

$25,000 |

$25,500 |

.14 |

$44,000 |

$44,500 |

.14 |

|

$31,800 |

$32,300 |

.13 |

$50,500 |

$51,000 |

.13 |

$25,500 |

$26,000 |

.13 |

$44,500 |

$45,000 |

.13 |

|

$32,300 |

$32,800 |

.12 |

$51,000 |

$51,500 |

.12 |

$26,000 |

$26,500 |

.12 |

$45,000 |

$45,500 |

.12 |

|

$32,800 |

$33,300 |

.11 |

$51,500 |

$52,000 |

.11 |

$26,500 |

$27,000 |

.11 |

$45,500 |

$46,000 |

.11 |

|

$33,300 |

$60,000 |

.10 |

$52,000 |

$96,000 |

.10 |

$27,000 |

$48,000 |

.10 |

$46,000 |

$74,000 |

.10 |

|

$60,000 |

$60,500 |

.09 |

$96,000 |

$96,500 |

.09 |

$48,000 |

$48,500 |

.09 |

$74,000 |

$74,500 |

.09 |

|

$60,500 |

$61,000 |

.08 |

$96,500 |

$97,000 |

.08 |

$48,500 |

$49,000 |

.08 |

$74,500 |

$75,000 |

.08 |

|

$61,000 |

$61,500 |

.07 |

$97,000 |

$97,500 |

.07 |

$49,000 |

$49,500 |

.07 |

$75,000 |

$75,500 |

.07 |

|

$61,500 |

$62,000 |

.06 |

$97,500 |

$98,000 |

.06 |

$49,500 |

$50,000 |

.06 |

$75,500 |

$76,000 |

.06 |

|

$62,000 |

$62,500 |

.05 |

$98,000 |

$98,500 |

.05 |

$50,000 |

$50,500 |

.05 |

$76,000 |

$76,500 |

.05 |

|

$62,500 |

$63,000 |

.04 |

$98,500 |

$99,000 |

.04 |

$50,500 |

$51,000 |

.04 |

$76,500 |

$77,000 |

.04 |

|

$63,000 |

$63,500 |

.03 |

$99,000 |

$99,500 |

.03 |

$51,000 |

$51,500 |

.03 |

$77,000 |

$77,500 |

.03 |

|

$63,500 |

$64,000 |

.02 |

$99,500 |

$100,000 |

.02 |

$51,500 |

$52,000 |

.02 |

$77,500 |

$78,000 |

.02 |

|

$64,000 |

$64,500 |

.01 |

$100,000 |

$100 ,500 |

.01 |

$52,000 |

$52,500 |

.01 |

$78,000 |

$78,500 |

.01 |

|

$64,500 |

and up |

.00 |

$100,500 |

and up |

.00 |

$52,500 |

and up |

.00 |

$78,500 |

and up |

.00 |

|

*Form

Line 11: Enter estimated allowable Connecticut income tax credit(s). Enter “0” if you are not entitled to a credit. (Credit for a prior year alternative minimum tax is not allowed if you entered an amount on Line 9.) See instructions for

Schedule CT‑IT Credit, Income Tax Credit Summary. Do not include any

PE Tax Credit on this line.

Line 14: If your 2020 Connecticut income tax return covered a 12‑month period, enter 100% of the income tax shown on your return (from Form CT‑1040, Line 14, or Form CT‑1040NR/PY, Line 16). If you were a resident during the 2020 taxable year and you did not file a 2020 Connecticut income tax return because you had no Connecticut income tax liability, enter “0.” If you were a nonresident or part‑year resident during the 2020 taxable year with Connecticut‑sourced income and you did not file a 2020 Connecticut

income tax return because you had no Connecticut income tax liability,

enter “0.” All other taxpayers must leave Line 14 blank.

Line 16a: Enter the estimated PE Tax Credit. You may receive a PE Tax Credit if you are a member or a shareholder of a pass‑through entity subject to the Connecticut Pass‑Through Entity Tax, or if you are a beneficiary of a trust or estate that is a member or a shareholder of a pass‑through entity subject to the Connecticut Pass‑Through Entity Tax. The PE Tax Credit will be reported to you on Schedule CT K‑1 or on Schedule CT‑1041 K‑1.

Payment Options

Visit the DRS website at portal.ct.gov/TSC to pay your Connecticut estimated taxes electronically using the TSC.

Pay by Credit Card or Debit Card

You may elect to pay your estimated 2021 Connecticut income tax liability using your credit card (American Express®, Discover®, MasterCard®, VISA®) or comparable debit card. A convenience fee will be charged by the service provider. You will be informed of the amount of the fee and you may elect to cancel the transaction. At the end of the transaction you will be given a confirmation number for your records. Visit www.officialpayments.com and select State Payments.

Do not mail Form CT‑1040ES if you make your payment by credit card or debit card. Your payment will be effective on the date you make the charge.

Pay by Mail

Make your check payable to Commissioner of Revenue Services.

To ensure your payment is applied to your account, write “2021 Form CT‑1040ES” and your Social Security Number (SSN), optional, on the front of your check. Be sure to sign your check and paper clip it to the front of the coupon. Do not send cash. DRS may submit your check to your bank electronically.

Completing the Payment Coupon: Complete all required taxpayer identification information in blue or black ink only.

Enter the payment amount where indicated on the coupon. In determining your payment amount, you may subtract from your installment amount any available overpayment of 2020 income tax.

If you file this coupon, DRS will mail you personalized, preprinted coupons for the remaining quarters of the 2021 taxable year.

Form |

Page 8 of 8 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | Form CT-1040ES is used for individuals required to make estimated income tax payments for the 2021 taxable year. |

| Who Must File | Individuals must file if their expected Connecticut income tax after credits is $1,000 or more. |

| Filing Deadlines | Estimated payments for 2021 are due on April 15, June 15, September 15, 2021, and January 15, 2022. |

| Payment Calculation | Calculate payments based on 90% of the current year’s tax or 100% of the prior year’s tax, whichever is lower. |

| Governing Law | This form is governed by the Connecticut General Statutes, Sections 12-701 through 12-749. |

Guidelines on Utilizing Ct 1040Es

Filling out the CT 1040ES form is essential for individuals required to make estimated income tax payments in Connecticut. This form allows taxpayers to calculate and submit their expected tax liability for the year. To ensure accuracy and timely filing, follow the steps outlined below carefully.

- Obtain the correct form: Make sure you are using the CT 1040ES form for the correct tax year.

- Use blue or black ink: Fill out the form using only blue or black ink.

- Provide your personal information: Enter your first name, middle initial, last name, and your spouse’s information if applicable. Include Social Security Numbers for both.

- Complete the payment amount: Determine your expected payment amount based on the calculations in the Estimated Connecticut Income Tax Worksheet and enter it in the designated space.

- Fill out your mailing address: Include your street address, apartment number (if applicable), PO Box, city or town, state, and ZIP code.

- Indicate the due date: Write the payment due date in the specified format (MM-DD-YYYY).

- Calculate your required annual payment: Use the provided worksheet to compute your total estimated income tax and arrive at the required payment amount.

- Make a payment: Include a check for your payment made out to the Commissioner of Revenue Services. Do not use staples on the form or check.

- Cut along the dotted line: Detach the coupon from the form and ensure it's correctly filled out before mailing.

- Mail your form: Send the completed coupon and payment to the correct address: Department of Revenue Services, PO Box 2932, Hartford CT 06104-2932.

What You Should Know About This Form

What is the purpose of the CT-1040ES form?

The CT-1040ES form is used by individuals to make estimated income tax payments for the state of Connecticut. If you expect to owe $1,000 or more in Connecticut income tax, you will need to file this form. It helps ensure that you pay your state tax obligations throughout the year rather than in a lump sum when filing your tax return.

Who needs to file the CT-1040ES form?

You need to file the CT-1040ES if you are required to make estimated income tax payments for the 2021 taxable year and did not receive a preprinted coupon package from the Department of Revenue Services (DRS). This includes nonresidents and part-year residents who have Connecticut-sourced income.

When are the estimated payments due?

For the 2021 taxable year, the estimated payments are due on April 15, June 15, September 15, 2021, and January 15, 2022. If any due date falls on a weekend or holiday, you can submit your payment on the next business day without penalty.

How do I calculate my estimated payment?

Start by completing the 2021 Estimated Connecticut Income Tax Worksheet included with the CT-1040ES. Calculate your required annual payment by determining the lesser of 90% of your expected 2021 tax or 100% of your previous year’s tax if you filed a full-year 2020 return. Take into account any Connecticut tax withheld and credits from pass-through entities to adjust the payment due.

What if my income varies throughout the year?

If your income fluctuates, consider using the annualized income installment method to potentially reduce your required estimated payments. This method allows you to make lower payments when your income is lower and helps avoid overpayment during lower income periods.

What are the penalties for late or insufficient payments?

Where do I send the completed CT-1040ES form?

Mail your completed CT-1040ES form and payment to the Department of Revenue Services at P.O. Box 2932, Hartford, CT 06104-2932. Make your payment check payable to the Commissioner of Revenue Services and include your Social Security Number to ensure proper posting.

Common mistakes

When filling out the CT 1040ES form, one common mistake is using the wrong year’s form. Each form is specific to the year, and submitting a form meant for a different year can lead to delays in processing. Always ensure you are using the form designated for the current taxable year.

Another frequent error involves not entering all required taxpayer identification information. Incomplete forms can result in processing issues. Be sure to fill in your name, Social Security number, and your spouse’s information if filing jointly. Double-checking this information helps avoid unnecessary complications.

People often forget to calculate their estimated payment correctly. It is crucial to complete the 2021 Estimated Connecticut Income Tax Worksheet accurately to determine the amount owed. Failing to perform this calculation can lead to either underpayment or overpayment, which can cause penalties or a delay in refunds.

Using the wrong ink color is yet another mistake. The instructions specifically state that forms should be completed using blue or black ink only. Using any other color can hinder the clarity of your entries and may complicate the processing of your form.

Some filers neglect to account for available overpayments from the previous year. There is an option to subtract any overpayment from your installment payment. This oversight may result in paying more than necessary.

Another common pitfall is misunderstanding who is required to make estimated payments. Not every taxpayer must make these payments, and some may believe they do when they do not. Make sure to review the eligibility criteria carefully to determine if you fall under this requirement.

Many individuals submit their forms late or fail to pay on time. To avoid interest charges, be mindful of the due dates: April 15, June 15, September 15, 2021, and January 15, 2022. Filing and making payments late can lead to penalties that are easily avoidable by staying organized.

Many people overlook the special rules that apply to farmers and fishermen. They are often required to make only one estimated payment, which is different from the standard payment schedule. Understanding these nuances can help in effective planning for those who qualify.

Lastly, individuals sometimes fail to review their estimates thoroughly before submission. It's important to double-check all figures and ensure everything is filled out correctly. Mistakes in calculations can lead to unnecessary fees, delays, or unwanted interest charges. Taking the time to carefully review the form before sending it can prevent many issues.

Documents used along the form

The CT-1040ES form is essential for individuals required to make estimated income tax payments in Connecticut. Accompanying this form are several other documents that help taxpayers accurately prepare and file their estimated tax obligations. The following list includes four important forms often used alongside the CT-1040ES.

- Form CT-1040: This is the standard Connecticut income tax return for residents. Taxpayers file it to report their annual income and calculate their tax liability. Information from the CT-1040 will help determine if more estimated payments are required.

- Form CT-1040NR/PY: This form is for nonresidents and part-year residents. It enables them to report their Connecticut-sourced income and calculate their tax responsibility for the time they were in Connecticut.

- Form CT-6251: This form helps individuals calculate their Connecticut Alternative Minimum Tax (AMT). It is essential for those whose income triggers AMT, ensuring they meet their minimum tax obligations.

- Worksheet for Form CT-1040ES: This worksheet assists taxpayers in estimating their tax payments. It helps calculate their required annual payment based on income projections and previous tax liabilities.

Filing the correct forms ensures compliance and helps avoid potential penalties. Taxpayers should verify that all documents are accurate and submitted on time to maintain a good standing with the Connecticut Department of Revenue Services.

Similar forms

- Form 1040: The federal tax return similar to the CT-1040ES is the Form 1040. Both forms require taxpayers to report their income and calculate their tax liability. The 1040 focuses on annual income reporting, while the CT-1040ES is for estimated tax payments for the year.

- Form 1040-ES: This federal form is used for making estimated tax payments to the IRS. Like the CT-1040ES, it allows individuals to pay federal income tax based on their expected tax liability for the year.

- CT-1040: The CT-1040 is the full annual tax return for Connecticut residents. While it’s used for reporting actual income at year-end, the CT-1040ES is for estimating and fulfilling tax obligations throughout the year.

- Form W-4: Employees use this form to indicate their tax situation to employers. Like the CT-1040ES, it helps determine withholdings, ensuring taxpayers pay enough throughout the year, thus avoiding estimated payments.

- Schedule C: This is used by sole proprietors to report profit or loss from a business. For those who have business income, both the Schedule C and CT-1040ES address income that could require estimated payments if taxes owed meet certain thresholds.

- Form 4868: This form is used to request an extension to file a federal return. It offers short-term relief similar to the CT-1040ES, allowing time to pay taxes owed, though payments may still be required at estimated amounts.

- Form 1065: Partnerships file this return, and members often must make estimated payments. Similar to the CT-1040ES, it requires partners to plan for tax liabilities arising from the business income they report.

- Form 1120: Corporations use this form for the corporate income tax return. Just like individual estimated payments with CT-1040ES, corporations must also estimate taxes and can make quarterly payments based on projected income.

- CT-8809: This form is used for requesting an extension of time to file certain business forms. Similar to the CT-1040ES, it allows for an extra period for compliance, but proper estimated payments are still necessary.

Dos and Don'ts

When filling out the CT 1040ES form, there are certain best practices to follow and pitfalls to avoid. Below is a list of what you should and shouldn't do:

- Do use blue or black ink to fill out the form.

- Don’t submit a form from a different tax year.

- Do ensure all required taxpayer identification information is included.

- Don’t leave any sections blank if they are applicable to your situation.

- Do calculate your estimated tax payments accurately using the provided worksheet.

- Don’t forget to include your spouse’s Social Security Number if filing jointly.

- Do mail your completed coupon and payment to the correct address.

- Don’t use staples when sending your payment; it can delay processing.

- Do keep copies of your completed forms and payments for your records.

Misconceptions

- Misconception 1: Nonresidents do not need to file the CT-1040ES form.

- Misconception 2: You must have received a preprinted coupon to use the CT-1040ES form.

- Misconception 3: All income tax payments can be made later without penalty.

- Misconception 4: Previous year’s tax return is irrelevant to current year estimated payments.

- Misconception 5: Any payment amount can be submitted at any time.

- Misconception 6: Only individuals with significant income need to file the CT-1040ES form.

- Misconception 7: Submitting the CT-1040ES form is optional for Connecticut residents.

In reality, nonresident individuals are required to file if they have Connecticut-sourced income and meet other payment thresholds. This form helps manage estimated tax payments that may be owed on that income.

While preprinted coupons are sent to those who made payments in the previous year, anyone required to make estimated payments must complete the CT-1040ES form if they did not receive one.

This is misleading. Estimated payments are due on specific dates during the year. Missing these deadlines may result in interest charges or penalties. It is essential to pay on time to avoid potential complications.

Actually, the prior year's tax return plays a critical role in determining your estimated payments. You can choose to pay either 90% of your current year's tax or 100% of the previous year's tax, depending on which amount is lower.

This is not quite right. Payments must be made in specific installments and by set due dates. Adhering to these requirements is vital to ensure that you remain in compliance and avoid any unnecessary interest or penalties.

Many individuals, including part-year residents and those with varying incomes, might still have tax obligations. If you expect to owe at least $1,000 in state tax after withholding, you need to file.

On the contrary, for residents who meet certain income thresholds, filing this form is not merely optional but a necessary requirement to avoid penalties and ensure proper compliance with Connecticut tax laws.

Key takeaways

Use blue or black ink only when completing the CT-1040ES form. This ensures clarity and prevents delays in processing your payments.

The CT-1040ES is specifically designed for individuals who expect to owe $1,000 or more in Connecticut income tax after accounting for withholdings and available credits.

Estimated payments must be submitted on or before designated due dates: April 15, June 15, September 15, 2021, and January 15, 2022. Late submissions may incur penalties.

To avoid interest charges, ensure that your estimated payment accurately reflects the lesser of 90% of your current year’s tax or 100% of your previous year’s tax return.

Browse Other Templates

Dd Form 282 - Provide details if a digital version or modifications are required.

Motor Vehicle Administration Maryland - Contact information is provided for lienholders needing assistance with the process.