Fill Out Your Ct 5 4 Form

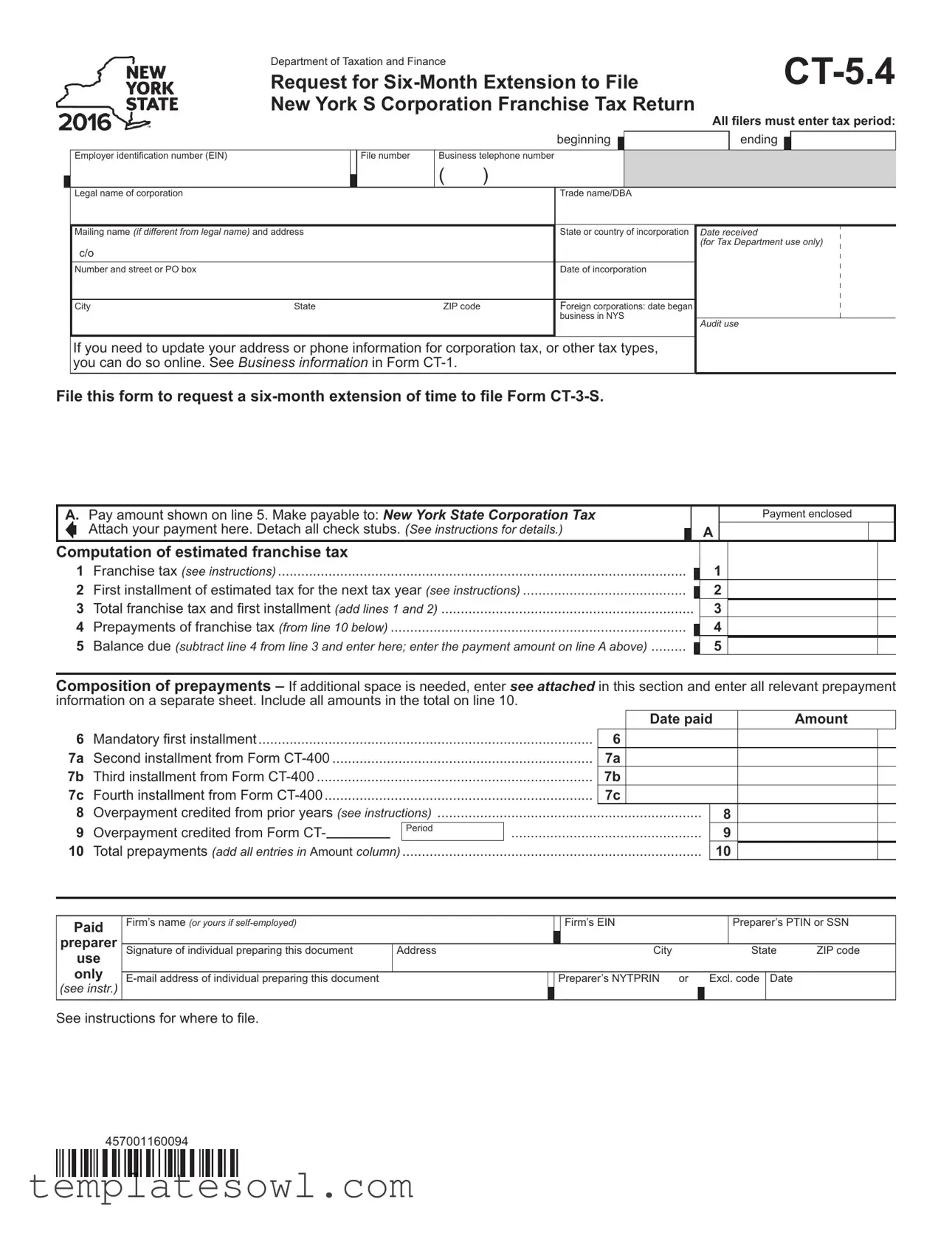

The CT-5.4 form, known as the Request for Six-Month Extension to File New York S Corporation Franchise Tax Return, plays a crucial role for S corporations operating in New York State. Businesses seeking a timely extension for their tax filings utilize this form to request an additional six months. Essential information must be completed on the form, including the tax period, employer identification number (EIN), business details such as the legal name and trade name, as well as mailing information. Pay particular attention to the computation of estimated franchise tax, as it guides users through calculating their total tax obligations. This includes entering amounts for franchise tax, estimated tax installments, and any prepayments made. Additional fields allow corporations to clarify any changes in their contact information and report when they began business in New York for foreign entities. Proper submission of this form not only ensures compliance but also offers peace of mind as businesses manage their tax responsibilities efficiently.

Ct 5 4 Example

|

|

Department of Taxation and Finance |

|

|

|

|

|

|

|||||

|

|

Request for |

|

||||||||||

|

|

New York S Corporation Franchise Tax Return |

All ilers must enter tax period: |

||||||||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

beginning |

|

|

|

|

ending |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Employer identiication number (EIN) |

|

File number |

Business telephone number |

|

|

|

|

|

|

|

|||

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Legal name of corporation |

|

|

|

|

Trade name/DBA |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

Mailing name (if different from legal name) and address |

|

|

|

State or country of incorporation |

Date received |

|||||||

|

|

|

|

|

|

|

|

|

|

(for Tax Department use only) |

|||

|

c/o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number and street or PO box |

|

|

|

|

Date of incorporation |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

|

ZIP code |

|

Foreign corporations: date began |

|

|

|

|

|||

|

|

|

|

|

|

business in NYS |

|

|

|

|

|

||

|

|

|

|

|

|

|

Audit use |

||||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you need to update your address or phone information for corporation tax, or other tax types, you can do so online. See Business information in Form

File this form to request a

A.Pay amount shown on line 5. Make payable to: New York State Corporation Tax

Attach your payment here. Detach all check stubs. (See instructions for details.)

A

Payment enclosed

Computation of estimated franchise tax

1 Franchise tax (see instructions).........................................................................................................

2First installment of estimated tax for the next tax year (see instructions) ..........................................

3 Total franchise tax and irst installment (add lines 1 and 2) .................................................................

4 Prepayments of franchise tax (from line 10 below) ............................................................................

5 Balance due (subtract line 4 from line 3 and enter here; enter the payment amount on line A above) .........

1

2

3

4

5

Composition of prepayments – If additional space is needed, enter see attached in this section and enter all relevant prepayment information on a separate sheet. Include all amounts in the total on line 10.

|

|

|

|

|

|

|

Date paid |

|

Amount |

||

|

Mandatory irst installment |

|

|

|

|

|

|

|

|

||

6 |

|

|

6 |

|

|

|

|

|

|||

7a |

Second installment from Form |

|

|

7a |

|

|

|

|

|

||

7b |

Third installment from Form |

|

|

7b |

|

|

|

|

|

||

7c |

Fourth installment from Form |

|

|

7c |

|

|

|

|

|

||

8 |

....................................................................Overpayment credited from prior years (see instructions) |

|

|

|

8 |

|

|

||||

9 |

Overpayment credited from Form CT- |

|

|

Period |

|

|

|

|

9 |

|

|

|

................................................. |

|

|

|

|

|

|||||

10 |

Total prepayments (add all entries in Amount column) |

|

|

|

|

|

|

|

|

||

............................................................................. |

|

|

|

|

10 |

|

|

||||

Paid

preparer

use

only

(see instr.)

Firm’s name (or yours if |

|

|

|

Firm’s EIN |

|

|

Preparer’s PTIN or SSN |

||

|

|

|

|

|

|

|

|

|

|

Signature of individual preparing this document |

Address |

|

City |

|

|

State |

ZIP code |

||

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s NYTPRIN |

or |

Excl. code |

Date |

|

|||

|

|

|

|

|

|

|

|

|

|

See instructions for where to ile.

457001160094

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The CT-5.4 form is used to request a six-month extension to file the New York S Corporation franchise tax return, officially known as Form CT-3-S. |

| Eligibility | This form can be filed by any S corporation that meets the criteria for filing a franchise tax return in New York State, as outlined in the relevant tax laws. |

| Filing Requirements | All taxpayers must provide key information, including the tax period, Employer Identification Number (EIN), and business contact information. Payment for estimated taxes may also be required. |

| Governing Laws | The CT-5.4 form is governed by New York State Tax Law, specifically under Article 9-A relating to corporation franchise taxes. |

Guidelines on Utilizing Ct 5 4

Filling out the CT-5.4 form is a necessary step if you need an extension to file your New York S Corporation Franchise Tax Return. Once you complete the form, submit it to the appropriate tax department with any required payment. Here are the steps to follow when filling out the CT-5.4 form:

- At the top of the form, enter the tax period, including the beginning and ending dates.

- Provide your Employer Identification Number (EIN) and file number.

- Fill in your business telephone number.

- Write the legal name of the corporation and the trade name or “Doing Business As” (DBA) name.

- If the mailing name is different from the legal name, provide that as well as the mailing address.

- For corporations incorporated in another state or country, provide the state or country of incorporation.

- Indicate the date of incorporation.

- If applicable, provide the date your foreign corporation began business in New York State.

- On line A, enter the payment amount as shown on line 5 and make the check payable to New York State Corporation Tax. Attach your payment to the form and detach all check stubs.

- Complete the computation of estimated franchise tax by filling in the amounts for franchise tax, first installment of estimated tax for the next tax year, and related lines.

- For any prepayments, list mandatory first installment and amounts from Form CT-400 as needed.

- Add all entries to calculate the total prepayments and enter this amount on line 10.

- If you used a paid preparer, fill in the preparer's firm name, EIN, PTIN or SSN, signature, address, city, state, ZIP code, email address, and NYTPRIN or exclusion code.

- Finally, review the form for accuracy before submitting it according to the instructions provided.

What You Should Know About This Form

What is the purpose of the CT-5.4 form?

The CT-5.4 form is used to request a six-month extension to file the New York S Corporation Franchise Tax Return, also known as Form CT-3-S. This extension allows corporations additional time to prepare their tax returns while ensuring they comply with deadlines.

Who needs to file the CT-5.4 form?

Any corporation that needs an extension on filing their New York S Corporation Franchise Tax Return should submit the CT-5.4 form. This includes S Corporations looking for more time to complete their tax documents or those who may require extra time to address complex tax situations.

What information is required when filling out the CT-5.4 form?

When completing the CT-5.4 form, individuals must provide details such as the tax period, Employer Identification Number (EIN), business phone number, legal name of the corporation, trade name or DBA, and the mailing address if different from the legal name. Additionally, foreign corporations must include the date they began conducting business in New York State.

Is there a payment required with the CT-5.4 form?

Yes, if there is a balance due on the computed franchise tax, that amount must be paid when submitting the CT-5.4 form. The payment should be made payable to New York State Corporation Tax, and individuals should attach payment documents and detach any check stubs as instructed.

What is the deadline for filing the CT-5.4 form?

The CT-5.4 form must be filed by the original due date of the S Corporation Franchise Tax Return (Form CT-3-S). This ensures that the request for the extension is considered valid and allows the corporation to benefit from the additional time to file their taxes.

Can I update my address or phone number on the CT-5.4 form?

Yes, if you need to update your address or phone number with the Department of Taxation and Finance, you can do so online. Additionally, ensure any new information is accurately reflected on your CT-5.4 form to maintain correct records.

What happens if I do not file the CT-5.4 form?

If the CT-5.4 form is not filed to request an extension, the corporation will be expected to file their S Corporation Franchise Tax Return by the original due date. Failure to file on time may result in penalties and interest on any taxes owed.

Common mistakes

Filling out the CT-5.4 form to request an extension for filing your New York S Corporation franchise tax return can be straightforward, but it’s easy to make mistakes. One common error is not providing the correct Employer Identification Number (EIN). This number is essential for identifying your corporation in the tax system. If you leave it out or enter it incorrectly, your request may be denied or delayed.

Another frequent mistake is failing to enter the correct tax period. You must specify the dates marking the beginning and ending of the tax period. Even a small error in the dates can create complications and could lead to misunderstandings with tax authorities.

Many people also neglect to list all necessary payments accurately. Line four should reflect prepayments made toward your franchise tax. If you fail to carry over the correct amount from prior calculations, it could lead to an underpayment and more significant issues down the line.

Not including a total for franchise tax and first installment is a common oversight. Ensure that you add the totals on lines one and two, as this figure is vital for determining the balance due. Double-check these calculations to avoid any mistakes that might impact your final payment.

Some filers forget to attach their payment, which must be included with the form. If you are sending a check, be sure to detach all check stubs. Leaving this out can result in your extension request not being processed.

Another mistake involves not providing updated contact information. If your mailing address or business telephone number has changed, make sure this information reflects the current data. This detail ensures that you receive timely communications from tax authorities.

Consideration of foreign corporations is also crucial. If you operate outside of New York State, you must provide specific details, including the date when your business began operations in New York. Ignoring this information could lead to unnecessary complications.

Lastly, it's important to ensure that you have all required signatures on the form. If someone else prepares your documents, they must include their information along with a signature. Missing a signature can cause considerable delays in processing your extension request.

Documents used along the form

When filing for an extension using the CT-5.4, several other forms and documents may be necessary. These complementary forms help ensure that the extension process, along with tax obligations, is handled correctly. Here are some key documents frequently used alongside the CT-5.4 form:

- Form CT-3-S: This is the New York S Corporation franchise tax return that the corporation will eventually file. It details the corporation's income, deductions, and tax obligations.

- Form CT-400: This form is used to make estimated tax payments for S Corporations. It outlines the corporation's estimated tax liability and payment schedule for the year.

- Form CT-1: This form is utilized by corporations to report and update their business information, including changes to addresses and phone numbers. It is important for maintaining accurate records with the Tax Department.

- Form DTF-95: This form can be submitted to request a refund of any overpaid corporate taxes. Corporations must ensure they have overpayments verified before proceeding with this request.

- Form ST-119.1: This is the exemption certificate for sales tax. If a corporation claims an exemption for taxes associated with purchases, this form may be required.

- Form CT-5: This form is used to request a general extension of time to file the corporation's tax return. While CT-5.4 is specific to S Corporations, CT-5 has broader applicability.

- Form IT-203: This is the New York State Nonresident and Part-Year Resident Income Tax Return. If shareholders earn income in New York but reside elsewhere, this form is essential for compliance.

Utilizing these forms effectively helps ensure that your corporation remains compliant with New York tax obligations and can mitigate potential issues with the Tax Department. Always review your specific circumstances to determine which forms apply to your situation.

Similar forms

- CT-3-S: This is the New York S Corporation Franchise Tax Return. It is similar to the CT-5.4 form because both are used by S corporations for tax purposes. The CT-3-S details the corporation’s income, deductions, and credits, while the CT-5.4 is specifically for requesting an extension to file this return.

- CT-400: This form is the Estimated Tax for Corporations. Like the CT-5.4, it involves estimating taxes owed for a tax year. The CT-400 is used to report estimated tax payments, while the CT-5.4 addresses the extension for filing respective returns.

- CT-1: This form provides the Business information necessary for tax filings. While the CT-5.4 requests an extension, the CT-1 collects essential details about the corporation, such as contact information and EIN, which are also needed for tax returns.

- CT-3: The CT-3 is the General Business Corporation Franchise Tax Return. Similar to the CT-5.4, this form deals with filings for business taxes. The CT-5.4 is specifically for S corporations seeking an extension on their CT-3-S return.

- Form 1120: The U.S. Corporation Income Tax Return resembles the CT-5.4 in the sense that both forms are used for corporate tax compliance. The 1120 is used to report income for C corporations, while the CT-5.4 is strictly for S corporations requesting an extension.

- CT-5: This is the New York Request for Extension of Time to File Corporation Tax Return. It shares the same purpose as the CT-5.4, which is to provide a formal request for additional time to submit necessary tax documentation.

Dos and Don'ts

When filling out the CT-5.4 form, it’s important to follow specific guidelines to ensure accuracy and compliance. Here are six recommendations on what to do and what to avoid during the process.

- Check Accuracy: Ensure that all information entered, including dates, names, and identification numbers, is correct and corresponds with official documents.

- Use Clear Descriptions: When completing the form, clearly describe your business if using a trade name or DBA. This helps avoid confusion.

- Attach Required Payments: Include any necessary payments with the form. It is crucial to detach all check stubs before submission.

- Print Legibly: If completing the form by hand, ensure that all writing is legible. Use block letters to prevent misinterpretation.

- Submit on Time: File the form before the deadline to avoid late fees and complications with your tax filing.

- Review Instructions: Always refer to the complete instructions provided with the form for any updates or additional requirements.

- Do not leave any section blank: Ensure every section of the form is filled out completely, as missing information can delay processing.

- Do not use pencil or unclear ink: Submitting the form in pencil or using ink that is hard to read could render it invalid.

- Do not ignore mailing instructions: Follow the outlined mailing instructions carefully, including the appropriate address for submission.

- Do not forget to keep copies: Always make a copy of the completed form and any attachments for your records before sending.

- Do not try to guess amounts: Read the instructions carefully to calculate your franchise tax accurately; guessing could lead to mistakes.

- Do not hesitate to seek help: If unsure about completing the form, consider consulting a tax professional to ensure compliance.

Misconceptions

Misconceptions about the CT-5.4 form can lead to confusion and mistakes in filing. Here are nine common misunderstandings:

- Only New York corporations need to file it: While the CT-5.4 is specific to New York corporations, foreign corporations doing business in New York must also file this form.

- Filing the CT-5.4 extends the due date for tax payments: It's important to note that the extension only applies to filing the return, not to paying any taxes owed; these must still be submitted on time to avoid penalties.

- Anyone can file it without restrictions: Only S corporations that can prove they meet specific requirements are eligible to use this form for an extension.

- You don't need to pay anything with the form: Companies must include any payment due along with the CT-5.4 if they owe taxes, as indicated on the form.

- The form can be submitted anytime before the deadline: The CT-5.4 must be submitted prior to the original filing deadline of the S corporation return. Late submissions will not be accepted to secure an extension.

- Form CT-5.4 is only for first-time filers: Any S corporation seeking an extension can utilize the CT-5.4, regardless of whether they’ve filed before.

- Address and contact changes aren't necessary on this form: Filing this form is a good opportunity to update the business's address and contact information if it has changed.

- All payments need to be made electronically: Though electronic payments are encouraged, corporations can still submit checks when filing the CT-5.4.

- There is no penalty for late filing if the CT-5.4 is submitted: Even with a submitted CT-5.4 for an extension, penalties may apply if the corporation fails to file the return within the extended timeframe.

Understanding these misconceptions can help businesses navigate the complexities of tax filing more effectively. Accurate completion of the CT-5.4 is crucial for compliance and to avoid unnecessary complications.

Key takeaways

When dealing with the CT-5.4 form, which is a request for a six-month extension to file the New York S Corporation Franchise Tax Return, there are several important points to remember.

- Ensure Accuracy: Fill in the tax period, employer identification number (EIN), and other basic information precisely to avoid processing delays.

- Payment Section: If applicable, attach your payment for the estimated franchise tax directly to the form and make sure to detach check stubs as per the instructions.

- Prepayments of Franchise Tax: Be aware of how to calculate your total franchise tax and any necessary installments accurately. There are separate lines for listed installments; use them correctly.

- Foreign Corporations: If your business operates as a foreign corporation in New York, note the specific date you began business in the state—this may be relevant for compliance.

- Contact Updates: If you're changing your address or phone number for corporation tax, update it online to ensure you receive all communications.

- Attach Supporting Documents: If you have more prepayment details than space allows, indicate on the form that additional information is attached.

- Filing Instructions: Pay close attention to the instructions on where to submit the form to ensure it reaches the appropriate tax department without issues.

Following these guidelines will help in completing and using the CT-5.4 form efficiently.

Browse Other Templates

Prudential 401k Loan - Your submission may be delayed if you fail to include the 401(k) Loan Request form.

Ca Dept of Consumer Affairs - The applicant must disclose any past legal issues that could affect their eligibility.