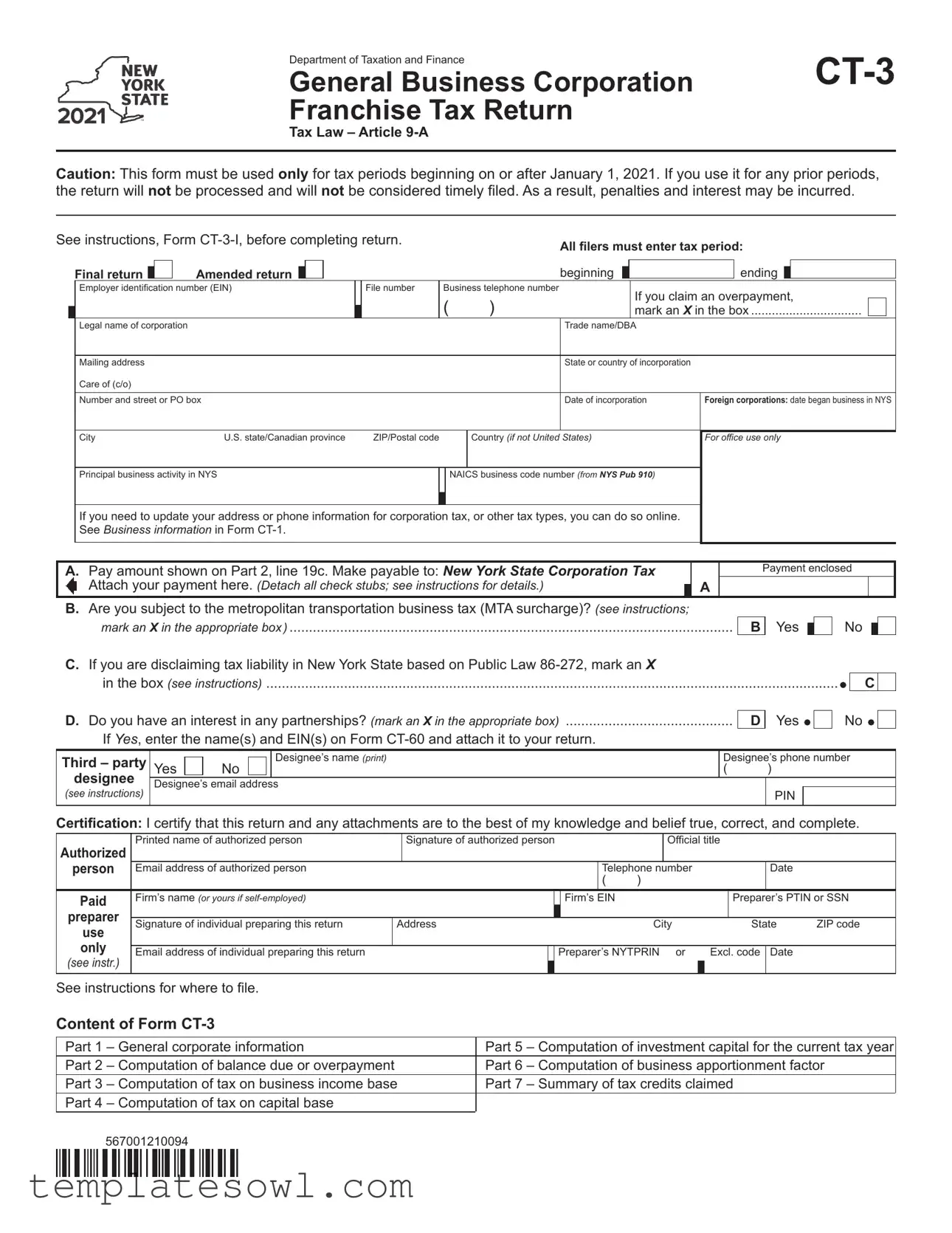

Fill Out Your Ct3 Form

The CT-3 form is an essential document required for corporations operating within New York State as part of their franchise tax return. It specifically caters to general business corporations under Article 9-A of the New York State tax law. This form has undergone significant updates, with particular caution given to the fact that it should only be used for tax periods commencing on or after January 1, 2021. Utilizing the form for previous tax periods will result in the return being unprocessed and considered late, potentially incurring penalties and interest. The form requires various pieces of information, such as the employer identification number (EIN), legal name, trade name, mailing address, and incorporation details. Corporations must also indicate whether they are filing a final or amended return and provide specifics related to tax credits, business activities, and liabilities. Each section of the CT-3 form is structured to capture vital financial data, including computations for business income, capital, and potential overpayments. Additionally, identifying factors that may qualify for preferential tax rates is crucial in fully leveraging the tax benefits provided by the state. As a pivotal element in New York's tax landscape, the CT-3 form demands careful attention to ensure compliance and accuracy in reporting financial obligations. Detailed instructions are included within the form to aid filers in navigating its requirements effectively.

Ct3 Example

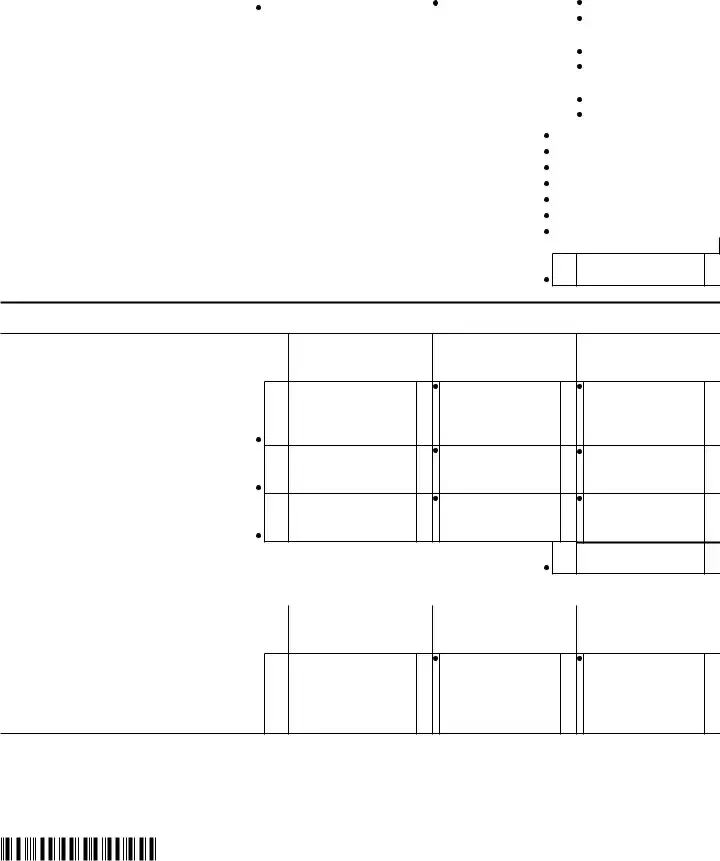

Department of Taxation and Finance

General Business Corporation Franchise Tax Return

Tax Law – Article

Caution: This form must be used only for tax periods beginning on or after January 1, 2021. If you use it for any prior periods, the return will not be processed and will not be considered timely filed. As a result, penalties and interest may be incurred.

See instructions, Form |

|

|

|

All filers must enter tax period: |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Final return |

|

|

|

Amended return |

|

|

|

|

|

|

|

beginning |

|

|

|

|

|

|

ending |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Employer identification number (EIN) |

File number |

Business telephone number |

|

|

If you claim an overpayment, |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

mark an X in the box |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal name of corporation |

|

|

|

|

|

|

|

|

Trade name/DBA |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Mailing address |

|

|

|

|

|

|

|

|

State or country of incorporation |

|

|

|

|

|

|

|

|

||||||

|

|

Care of (c/o) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Number and street or PO box |

|

|

|

|

Date of incorporation |

|

Foreign corporations: date began business in NYS |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

City |

U.S. state/Canadian province |

ZIP/Postal code |

|

|

Country (if not United States) |

|

For office use only |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Principal business activity in NYS |

|

|

NAICS business code number (from NYS Pub 910) |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

If you need to update your address or phone information for corporation tax, or other tax types, you can do so online. |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

See Business information in Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Pay amount shown on Part 2, line 19c. Make payable to: New York State Corporation Tax |

|

|

|

Payment enclosed |

|||||||||||||||||||||

|

|

Attach your payment here. (Detach all check stubs; see instructions for details.) |

|

|

|

|

|

A |

|

|

|

||||||||||||||

|

|

|

|

||||||||||||||||||||||

B. Are you subject to the metropolitan transportation business tax (MTA surcharge)? (see instructions;

mark an X in the appropriate box ) ..................................................................................................................

B

Yes

No

C.If you are disclaiming tax liability in New York State based on Public Law

in the box (see instructions) |

C |

|

D.Do you have an interest in any partnerships? (mark an X in the appropriate box) ............................................

If Yes, enter the name(s) and EIN(s) on Form

D

Yes

No

Third – party |

Yes |

No |

Designee’s name (print) |

Designee’s phone number |

||

|

( |

) |

|

|||

designee |

|

|

|

|

|

|

Designee’s email address |

|

|

|

|||

(see instructions) |

|

PIN |

|

|||

Certification: I certify that this return and any attachments are to the best of my knowledge and belief true, correct, and complete.

Authorized |

Printed name of authorized person |

|

Signature of authorized person |

|

Official title |

|

||||||

person |

Email address of authorized person |

|

|

|

Telephone number |

|

|

Date |

|

|||

|

|

|

|

( |

) |

|

|

|

|

|

|

|

Paid |

Firm’s name (or yours if |

|

|

Firm’s |

EIN |

|

|

|

|

Preparer’s PTIN or SSN |

||

preparer |

|

|

|

|

|

|

|

|

|

|

|

|

use |

Signature of individual preparing this return |

Address |

City |

|

State |

ZIP code |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

only |

|

|

|

|

|

|

|

|

||||

Email address of individual preparing this return |

|

|

Preparer’s NYTPRIN or |

Excl. code |

Date |

|

||||||

(see instr.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See instructions for where to file.

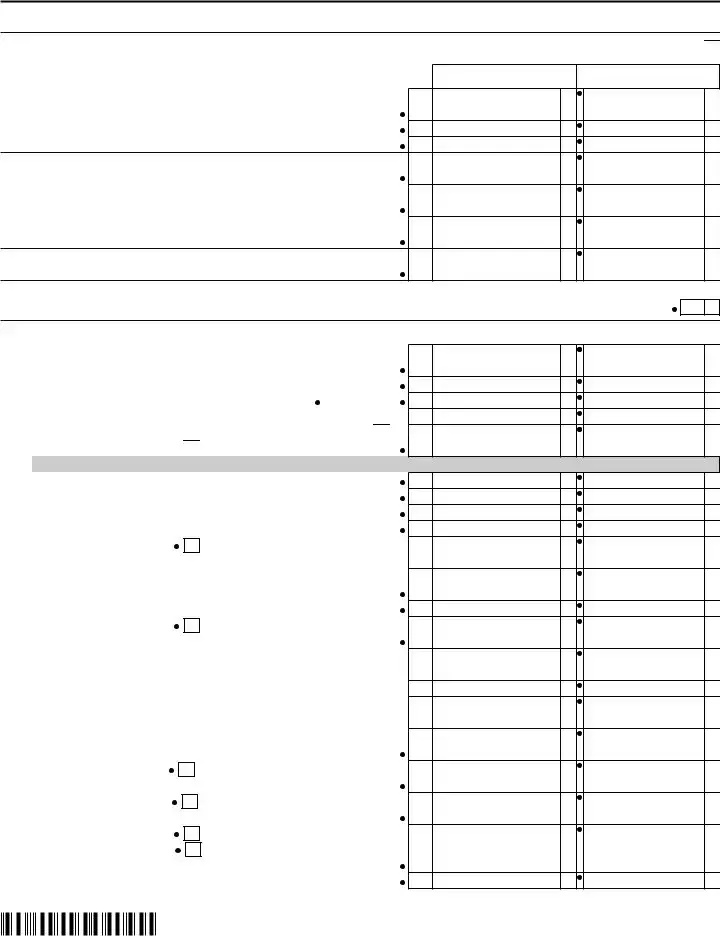

Content of Form

Part 1 |

– General corporate information |

Part 5 |

– Computation of investment capital for the current tax year |

Part 2 |

– Computation of balance due or overpayment |

Part 6 |

– Computation of business apportionment factor |

Part 3 |

– Computation of tax on business income base |

Part 7 |

– Summary of tax credits claimed |

Part 4 |

– Computation of tax on capital base |

|

|

567001210094

Page 2 of 8

Part 1 – General corporate information

Section A – Qualification for preferential tax rates – If you are a corporation as identified in this section and qualify for preferential tax rates, mark an X in the boxes that apply to you (see instructions).

1A qualified emerging technology company (QETC) eligible for the lower business income base tax rate, 0% capital

base tax rate, and lower fixed dollar minimum tax amounts |

1 |

2A qualified New York manufacturer based on the principally engaged test eligible for the 0% business income

base tax rate and lower fixed dollar minimum tax amounts |

2 |

3A qualified New York manufacturer based on the principally engaged test eligible for the 0% capital base

tax rate |

3 |

4A qualified New York manufacturer based on the significant employment and property test eligible for the 0% business

|

|

income base tax rate, 0% capital base tax rate, and lower fixed dollar minimum tax amounts |

4 |

5 |

A cooperative housing corporation eligible for the 0% capital base tax rate |

5 |

|

6 |

A small business taxpayer eligible for the 0% capital base tax rate |

6 |

|

|

|

If you marked this box, complete line 6a below and Section B, line 1. |

|

..........................................................................................................6a Total capital contributions |

6a |

7A qualified entity of a New York State innovation hot spot that operates solely within such New York State innovation

|

hot spot, and you have elected to be subject only to the fixed dollar minimum tax base |

7 |

Section B – New York State information (see instructions) |

|

|

1 |

Number of New York State employees |

1 |

2 |

Wages paid to New York State employees |

2 |

3 |

Number of business establishments in New York State |

3 |

4 |

If you have an interest in, or have rented, real property in New York State, mark an X in the box |

4 |

5If you are claiming an exception to the related member expense addback under Tax Law §208.9(o)(2)(B),

mark an X in the box |

5 |

|

5a If you marked the line 5 box, use line 5a to report the applicable exception |

Number |

Amount |

number |

5a |

|

6If you are not protected by Public Law

New York State, mark an X in the box |

6 |

Section C – Filing information

1Federal return filed – you must mark an X in one box and attach a complete copy of your federal return

|

|

|

|

|

|

|

1120 |

1120 consolidated |

or |

|

|

1120S |

1120F |

|

2Amended return – If you marked the amended return box on page 1, then for any item(s) that apply, mark an X in the box

and attach documentation:

Final federal |

Date of determination |

NOL |

Capital loss |

|

|

|

determination |

|

|

carryback |

carryback.... |

1139 |

1120X |

2a Enter the tax due amount from your most recently filed New York State return for this tax period .

2a

2a

3Required attachments – For all forms, other than tax credit claim forms, that are attached to this return, mark an X in the applicable box(es)

Other (identify):

4If you are claiming tax credits, enter the number of tax credit forms attached to this return. Where multiple forms

are filed for the same credit, count each form filed. |

4 |

5 If you filed federal Form 1120F and you have effectively connected income (ECI), mark an X in the box |

5 |

6Were you required to report any nonqualified deferred compensation, as required by Internal Revenue

Code (IRC) §457A, on your 2021 federal return? (see instructions) |

Yes |

No |

7If you are a foreign corporation computing your tax taking into account only your distributive shares from multiple limited

partnerships, mark an X in the box and file Form

567002210094

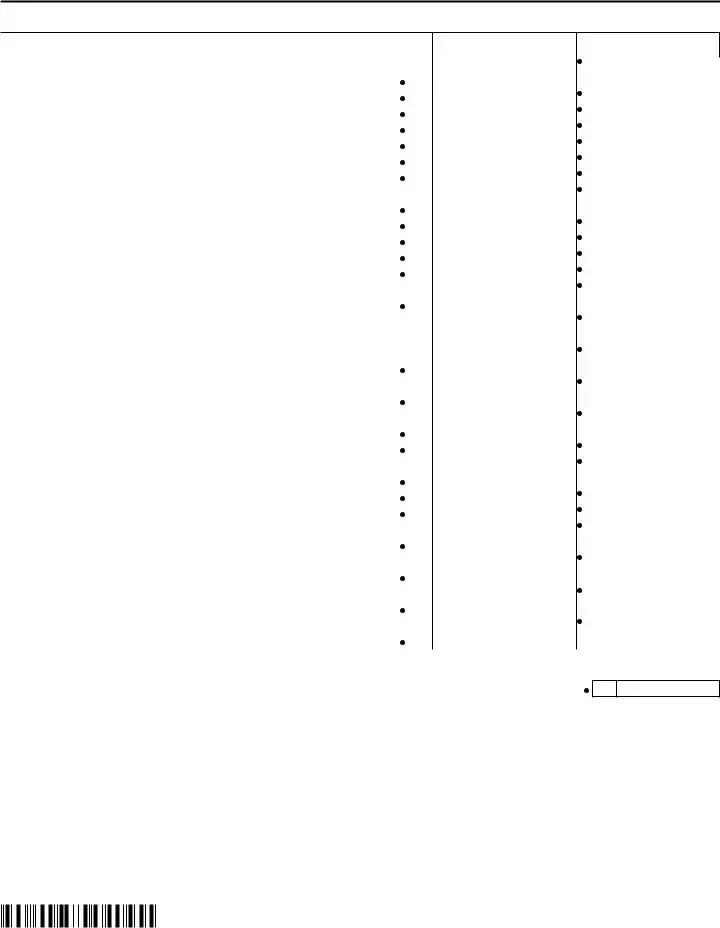

Part 2 – Computation of balance due or overpayment |

|

||

Largest of three tax bases, minus credits |

|

|

|

1a |

Business income base tax (from Part 3, line 20) |

1a |

|

1b |

Capital base tax (from Part 4, line 15; see instructions) |

1b |

|

|

New York receipts |

|

|

1c |

Fixed dollar minimum tax (see instr) |

..... 1c |

|

2 |

Tax due (enter the amount from line 1a, 1b, or 1c, whichever is largest; see instructions) |

2 |

|

3 |

Tax credits used (from Part 7, line 2; see instructions) |

3 |

|

4 |

Tax due after credits (subtract line 3 from line 2; if line 3 is more than line 2, enter 0) |

4 |

|

Penalties and interest |

|

|

|

5Estimated tax penalty (see instructions; if Form

|

attached, mark an X in the box) |

5 |

6 |

Interest on late payment (see instructions) |

6 |

7 |

Late filing and late payment penalties (see instructions) |

7 |

8 |

Total penalties and interest (add lines 5, 6, and 7) |

8 |

Voluntary gifts/contributions |

|

|

9 |

Total voluntary gifts/contributions (from Form |

9 |

10 |

Total amount due (add lines 4, 8, and 9) |

10 |

Prepayments |

|

|

11 |

Mandatory first installment from Form |

11 |

12 |

Second installment (from Form |

12 |

13 |

Third installment (from Form |

13 |

14 |

Fourth installment (from Form |

14 |

15 |

Payment with extension request (from Form |

15 |

16 |

Overpayment credited from prior years (see instr.) Period |

16 |

17 |

Overpayment credited from |

17 |

18 |

Total prepayments (add lines 11 through 17; see instructions) |

18 |

Payment due or overpayment to be credited/refunded (see instructions) |

|

|

19a |

Underpayment |

19a |

19b |

Additional amount for 2022 MFI |

19b |

19c |

Balance due |

19c |

20a |

Excess prepayments |

20a |

20b |

Amount previously credited to 2022 MFI |

20b |

20c |

Overpayment |

20c |

21 |

Amount of overpayment to be credited to next period |

21 |

22 |

Balance of overpayment available (subtract line 21 from line 20c) |

22 |

23 |

Amount of overpayment to be credited to Form |

23 |

24 |

Balance of overpayment to be refunded (subtract line 23 from line 22) |

24 |

25 |

Unused tax credits to be refunded |

25 |

26 |

Unused tax credits applied to next period |

26 |

567003210094

Page 4 of 8 |

|

|

Part 3 – Computation of tax on business income base |

|

|

1 |

Federal taxable income (FTI) before net operating loss (NOL) and special deductions (see instructions). |

1 |

2 |

Additions to FTI (from Form |

2 |

3 |

Add lines 1 and 2 |

3 |

4 |

Subtractions from FTI (from Form |

4 |

5 |

Subtract line 4 from line 3 |

5 |

6 |

Subtraction modification for qualified banks (from Form |

6 |

7 |

Entire net income (ENI) (subtract line 6 from line 5) |

7 |

8 |

Investment and other exempt income (from Form |

8 |

9 |

Subtract line 8 from line 7 |

9 |

10Excess interest deductions attributable to investment income, investment capital, and other

exempt income (from Form |

10 |

11 Business income (add lines 9 and 10) |

11 |

12Addback of income previously reported as investment income (from Form

|

line 6; if zero, enter 0; see instructions) |

12 |

13 |

Business income after addback (add lines 11 and 12) |

13 |

14 |

Business apportionment factor (from Part 6, line 56) |

14 |

15 |

Apportioned business income after addback (multiply line 13 by line 14) |

15 |

16 |

Prior net operating loss conversion subtraction (from Form |

16 |

17 |

Subtract line 16 from line 15 |

17 |

18 |

NOL deduction (from Form |

18 |

19 |

Business income base (subtract line 18 from line 17) |

19 |

20Business income base tax (multiply line 19 by the appropriate business income tax rate from the tax

rates schedule in Form |

20 |

Note: If you make any entry on line 2, 4, 6, 8, 10, 12, 16, or 18, you must complete and file the appropriate attachment form, or any tax benefit claimed may be disallowed, or there may be a delay in receiving such benefit. In addition, all amounts entered on these lines must be entered as positive numbers.

567004210094

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||||||

Part 4 – Computation of tax on capital base (see instructions) |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

B |

|

|

C |

||||

|

|

|

Beginning of year |

|

|

End of year |

|

|

Average value |

||||

1 |

Total assets from federal return |

1 |

|

|

|

|

|

|

|

|

|

|

|

2 |

Real property and marketable securities |

|

|

|

|

|

|

|

|

|

|

|

|

3 |

included on line 1 |

2 |

|

|

|

|

|

|

|

|

|

|

|

.........................Subtract line 2 from line 1 |

3 |

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Real property and marketable securities |

4 |

|

|

|

|

|

|

|

|

|

|

|

5 |

at fair market value |

|

|

|

|

|

|

|

|

|

|

|

|

.......Adjusted total assets (add lines 3 and 4) |

5 |

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Total liabilities |

6 |

|

|

|

|

|

|

|

|

|

|

|

7 |

.........................................................Total net assets (subtract line 6, column C, from line 5, column C) |

|

7 |

|

|

|

|

||||||

8 |

............................................................Investment capital (from Part 5, line 19; if zero or less, enter 0) |

|

8 |

|

|

|

|

||||||

9 |

.......................................................................................Business capital (subtract line 8 from line 7) |

|

|

|

|

|

|

|

9 |

|

|

|

|

10 |

Addback of capital previously reported as investment capital (from Part 5, line 20, column C; if zero or less, enter 0) . |

|

10 |

|

|

|

|

||||||

11 |

.........................................................................................Total business capital (add lines 9 and 10) |

|

|

|

|

|

|

|

11 |

|

|

|

|

12 |

.........................................................................Business apportionment factor (from Part 6, line 56) |

|

12 |

|

|

|

|

||||||

13 |

...................................................................Apportioned business capital (multiply line 11 by line 12) |

|

13 |

|

|

|

|

||||||

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

15Capital base tax (multiply line 13 by the appropriate capital base tax rate from the tax rates schedule in

Form |

15 |

|

Part 5 – Computation of investment capital for the current tax year (see instructions) |

||

A |

B |

C |

Average fair |

Liabilities attributable to |

Net average value |

market value |

column A amount |

(column A - column B) |

16 Total capital that generates income

claimed to not be taxable by New York

under the U.S. Constitution

(from Form |

16 |

17 Total of stocks actually held for more than |

|

one year (from Form

line 2) |

17 |

18 Total of stocks presumed held for more |

|

than one year (from Form

Schedule E, line 3) |

18 |

19Total investment capital for the current year (Add column C lines 16, 17, and 18; enter the result here

and on Part 4, line 8. If zero or less, enter 0.) |

19 |

Addback of capital previously reported as investment capital

20Total of stocks previously presumed held

for more than one year, but did not meet

the holding period (from Form

Schedule F, line 1; enter here and on

Part 4, line 10)...........................................

A |

B |

C |

Average fair market |

Liabilities attributable |

Net average value as |

value as previously reported |

to column A amount as |

previously reported |

|

previously reported |

(column A - column B) |

20

567005210094

Page 6 of 8

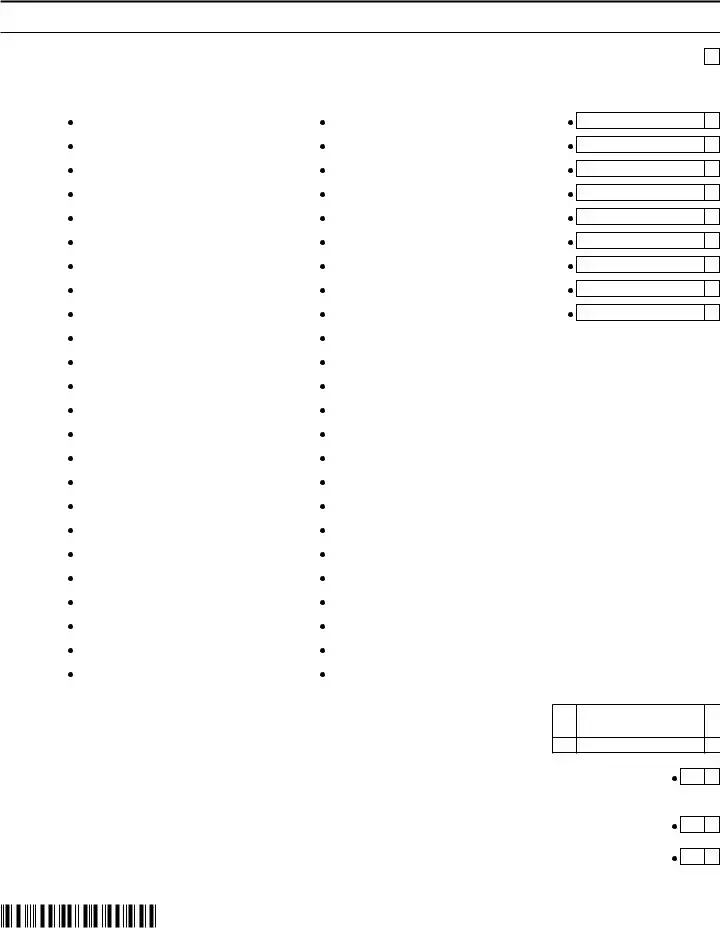

Part 6 – Computation of business apportionment factor (see instructions)

Mark an X in this box only if you have no receipts required to be included in the denominator of the apportionment factor (see instr.) ...

A – New York State |

B – Everywhere |

Section |

|

|

1 |

Sales of tangible personal property |

1 |

2 |

Sales of electricity |

2 |

3 |

Net gains from sales of real property |

3 |

Section |

|

|

4 |

Rentals of real and tangible personal property |

4 |

5 |

Royalties from patents, copyrights, trademarks, and similar intangible |

|

|

personal property |

5 |

6 |

Sales of rights for certain |

|

|

of an event |

6 |

Section |

|

|

7 |

Sale, licensing, or granting access to digital products |

7 |

Section

8 To make this irrevocable election, mark an X in the box (see instructions) |

8 |

Section

Section |

|

|

|

9 |

Interest from loans secured by real property |

|

|

10 |

Net gains from sales of loans secured by real property |

|

|

11 |

Interest from loans not secured by real property (QFI |

|

.............. ) |

12Net gains from sales of loans not secured by real property (QFI

).

).

Section

)

)

13 |

Interest from federal debt |

|

14 |

|

|

15 |

Interest from NYS and its political subdivisions debt |

|

16 |

Net gains from federal, NYS, and NYS political subdivisions debt |

|

17 |

Interest from other states and their political subdivisions debt |

|

18 |

Net gains from other states and their political subdivisions debt |

|

Section |

) |

|

19Interest from

20Net gains from government agency debt or

21 |

sold through an exchange |

|

Net gains from all other |

||

Section |

) |

|

22 |

Interest from corporate bonds |

|

23Net gains from corporate bonds sold through broker/dealer or

licensed exchange ............................................................................

24 Net gains from other corporate bonds .................................................

Section

25Net interest from reverse repurchase and securities borrowing agreements.

Section

26 |

Net interest from federal funds |

|

Section |

) |

|

27 |

Net income from sales of physical commodities |

|

Section |

) |

|

28 |

Marked to market net gains |

|

Section |

) |

|

29 |

) |

|

Interest from other financial instruments |

||

30 |

Net gains and other income from other financial instruments |

|

9

10

11

12

13

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

567006210094

Part 6 – Computation of business apportionment factor (continued)

A – New York State |

B – Everywhere |

Section |

|

|

|

|

|

|

31 |

Brokerage commissions |

31 |

|

|

|

|

32 |

Margin interest earned on behalf of brokerage accounts |

32 |

|

|

|

|

33 |

Fees for advisory services for underwriting or management of underwriting . |

33 |

|

|

|

|

34 |

Receipts from primary spread of selling concessions |

34 |

|

|

|

|

35 |

Receipts from account maintenance fees |

35 |

|

|

|

|

36 |

Fees for management or advisory services |

36 |

|

|

|

|

37 |

...................................................Interest from an affiliated corporation |

37 |

|

|

|

|

Section |

|

|

|

|

|

|

38 |

Interest, fees, and penalties from credit cards |

38 |

|

|

|

|

39 |

Service charges and fees from credit cards |

39 |

|

|

|

|

40 |

Receipts from merchant discounts |

40 |

|

|

|

|

41 |

Receipts from credit card authorizations and settlement processing ... |

41 |

|

|

|

|

42 |

..................................................Other credit card processing receipts |

42 |

|

|

|

|

Section |

|

|

|

|

|

|

43 |

Receipts from certain services to investment companies |

43 |

|

|

|

|

Section |

|

|

|

|

|

|

44 |

Global intangible |

44 |

0 |

00 |

|

|

Section |

|

|

|

|

|

|

45 |

Receipts from railroad and trucking business |

45 |

|

|

|

|

Section |

|

|

|

|

|

|

46 |

Receipts from the operation of vessels |

46 |

|

|

|

|

Section |

|

|

|

|

|

|

47 |

Receipts from air freight forwarding |

47 |

|

|

|

|

48 |

..................................................Receipts from other aviation services |

48 |

|

|

|

|

Section |

|

|

|

|

|

|

49 |

Advertising in newspapers or periodicals |

49 |

|

|

|

|

50 |

.........................................................Advertising on television or radio |

50 |

|

|

|

|

51 |

.................................................................Advertising via other means |

51 |

|

|

|

|

Section |

|

|

|

|

|

|

52 |

Transportation or transmission of gas through pipes |

52 |

|

|

|

|

Section |

|

|

|

|

|

|

53 |

Receipts from other services/activities not specified |

53 |

|

|

|

|

Section |

|

|

|

|

|

|

54 |

Discretionary adjustments |

54 |

|

|

|

|

Total receipts |

|

|

|

|

|

|

55 |

Add lines 1 through 54 in columns A and B |

55 |

|

|

|

|

Calculation of business apportionment factor |

|

|

|

|

|

|

56New York State business apportionment factor (divide line 55, column A by line 55, column B and enter the

resulting decimal here; round to the sixth decimal place after the decimal point; see instructions) |

56 |

Enter line 56 on Part 3, Computation of tax on business income base, line 14; and on Part 4, Computation of tax on capital base, line 12.

567007210094

Page 8 of 8

Part 7 – Summary of tax credits claimed

1Have you been convicted of an offense, or are you an owner of an entity convicted of an offense, defined in New York State

Penal Law, Article 200 or 496, or section 195.20? (see Form |

1 |

Yes |

|

|

No |

|

|

||||

|

|

|

|

|

|

Enter in the appropriate box below the amount of each tax credit used to reduce the tax due shown on Part 2, line 2, and attach the corresponding properly completed claim form. The amount of credit to enter is computed on each credit form and carried to this section.

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

Other credits |

||

|

|

|

|

|||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

2Total tax credits claimed above (enter here and on Part 2, line 3; attach appropriate form for each credit

claimed) .........................................................................................................................................

3Total tax credits claimed that are refund eligible (see instructions) ....................................................

2

3

4a If you claimed the QEZE tax reduction credit and you had a 100% zone allocation factor, mark an X in the box ................

4b If you claimed the

in the box ...........................................................................................................................................................................

4c If you claimed the

factor, mark an X in the box ...............................................................................................................................................

4a

4b

4c

567008210094

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Governing Law | The CT-3 form is governed by New York Tax Law, specifically Article 9-A. |

| Effective Date | This form is only for tax periods that begin on or after January 1, 2021. |

| Processing Note | Filing for periods prior to January 1, 2021, will not be accepted and may incur penalties. |

| Identification Requirements | All filers must provide their Employer Identification Number (EIN) and file number. |

| Payment Instructions | All payments should be payable to New York State and attached to the return. |

Guidelines on Utilizing Ct3

Completing the CT-3 form is essential for corporations in New York State, ensuring compliance with tax requirements. Following the proper steps will help you fill it out accurately, minimizing the risk of penalties or interest. Below are the instructions to guide you through the process.

- Start by entering the tax period for your corporation at the top of the form.

- Mark whether this is a final return or amended return.

- Fill in your Employer Identification Number (EIN) and File Number.

- Provide your business telephone number.

- If claiming an overpayment, mark an X in the appropriate box.

- Enter the legal name and trade name of the corporation.

- Complete the mailing address, including care of (c/o), street or PO box, city, state, ZIP code, and country, if applicable.

- Indicate the date of incorporation and for foreign corporations, the date the business commenced in New York State.

- Provide the principal business activity and the NAICS business code number.

- For payment, write the amount from Part 2, line 19c, and attach your payment where indicated.

- Answer questions regarding the metropolitan transportation business tax and whether you have an interest in partnerships.

- Complete the certification section, including the authorized person’s printed name, signature, title, and contact information.

- If using a preparer, complete their details, including signature and contact information.

- Finally, ensure you know where to file the form by reviewing the provided instructions.

What You Should Know About This Form

What is the CT-3 form and who needs to file it?

The CT-3 form is the General Business Corporation Franchise Tax Return. It is specifically designed for corporations operating in New York State that are subject to the franchise tax. Corporations must use this form for tax periods beginning on or after January 1, 2021. If a corporation was in operation prior to this date, it is crucial to use the correct form for prior periods to avoid any issues with processing or potential penalties.

What should I do if my tax period and filing status have changed?

When filing the CT-3 form, be sure to indicate the appropriate tax period start and end dates. Additionally, if you need to file an amended return, there is a specific box on the form for this purpose. Mark this box and provide the necessary documentation required for changes. This ensures that your filing status reflects the most current information and helps avoid complications with your tax obligations.

What information is required on the CT-3 form?

The CT-3 form requires various pieces of information, including the business’s legal name, trade name, Employer Identification Number (EIN), and mailing address. It's also important to provide details on the corporation’s principal business activity and any partnerships. Complete information ensures that your return is processed without delays. Corporations should prepare to include financial details, such as total assets and investment capital. Each section of the form has specific instructions that must be followed to accurately report your information.

What happens if I file the CT-3 form late?

Filing the CT-3 form late can result in penalties and interest. If the form is not submitted within the required time frame, it will not be processed, and you may incur additional charges. It’s advisable to refer to Form CT-3-I for guidance on penalties associated with late filing. If you anticipate being late, consider filing for an extension and ensure all documentation is submitted promptly to minimize any potential consequences.

Can I make changes to my corporation's address or contact information on this form?

Yes, the CT-3 form includes options for updating your corporation's address or business contact information. It is essential to ensure that this information is current, as any discrepancies may hinder processing or lead to missed communications from the tax authorities. For more straightforward updates, you can also visit the New York State Department of Taxation and Finance website to find additional resources on making these changes online.

Common mistakes

Filling out the CT-3 form can be daunting, and mistakes may lead to delays or penalties. One common error is using an outdated version of the form. The CT-3 form must be used for tax periods that begin on or after January 1, 2021. Using an older version will result in the return being rejected as untimely. Always ensure you have the correct and current form before starting.

Another frequent mistake involves skipping essential sections. Each part of the form serves a specific purpose, and omitting information can raise red flags with the tax authorities. For instance, failing to enter the tax period or your Employer Identification Number (EIN) can cause your return to be treated as incomplete. It's crucial to carefully check each section to ensure all necessary details are included.

Forgetting to mark the appropriate boxes is a third common pitfall. The form has specific prompts where you need to indicate if you're eligible for preferential tax rates, claiming tax credits, or reporting certain liabilities. Marking these boxes correctly is vital because otherwise, you might miss out on potential tax savings or inadvertently misrepresent your corporation’s activities.

One of the more complex issues arises in Part 2—computation of balance due or overpayment. Many tend to miscalculate their tax due amounts by failing to consider the highest owed tax base. To avoid complications, double-check your calculations to ensure they are accurate and align with the corresponding sections of the form.

It's also critical to complete the certification section accurately. Many time-consuming errors occur because the signature or printed name of the authorized person is missing or incorrectly filled out. This area is your guarantee that all information provided is true and correct, so take the time to verify that everything is properly entered.

Moreover, some filers neglect to double-check their payment information. It's essential to attach any payment due and ensure it’s in the correct format. Detaching check stubs as indicated in the instructions is a small step that can prevent larger issues, such as misapplied payments that could lead to penalties.

Finally, failing to consult the instructions can lead to misunderstandings about particular sections. The CT-3 form comes with an instruction document that offers guidance on how to fill out each portion correctly. Ignoring the accompanying instructions can lead to costly mistakes. Be proactive: read through them thoroughly before submission.

Documents used along the form

When preparing your CT3 form for New York's General Business Corporation Franchise Tax Return, it's essential to understand that several other documents may be required or beneficial to include. These documents can support your tax return, provide necessary financial details, or claim deductions and credits. Below are some key forms that are often used in conjunction with CT3, along with a brief description of each.

- Form CT-3.1: This form is used to compute adjustments for investment capital and is necessary if you are claiming any deductions related to investment income. It helps in detailing the assets held by your corporation.

- Form CT-3.2: This schedule assists in calculating any tax modifications related to life insurance company deductions, ensuring that the return reflects accurate financial standing for tax purposes.

- Form CT-3.3: Specifically for corporations with net operating losses, this form helps compute the eligible NOL subtraction, allowing businesses to offset income with prior losses to lower their tax burden.

- Form CT-3.4: If your corporation is claiming a specific tax credit, Form CT-3.4 aids in detailing the claimed credits. Documentation on the nature of these credits is vital to receive due benefits.

- Form CT-60: Required for corporations with interests in partnerships or other pass-through entities, this form reports those interests, providing a clearer picture of your business's overall financial activity.

- Form CT-225: This is used to claim certain business tax credits that can significantly reduce tax liabilities. Accurate information here can ensure that you receive the full benefit of available tax relief options.

The combination of these forms will help ensure that your CT3 submission is comprehensive. Providing detailed and accurate information will not only facilitate a smoother filing process but also safeguard against potential penalties or audits. It is crucial to review these requirements carefully and consider consulting a tax professional to ensure compliance with all applicable regulations.

Similar forms

The CT-3 form, which is the General Business Corporation Franchise Tax Return for New York, shares similarities with several other tax-related documents. The structure, purpose, and requirements of these forms can provide valuable insights into corporate taxation practices. Below is a list of eight documents that the CT-3 form is similar to, along with explanations of their similarities.

- Form CT-3.1 - This form, used for computing investment income, complements the CT-3 by gathering information about investment capital. Both forms require detailed financial information and calculations related to corporate taxes.

- Form CT-3.2 - This document addresses banks and provides modifications to the income. Similar to the CT-3, it calculates different elements of tax liability and requires specific financial data from corporations to determine tax owed.

- Form CT-3.3 - Businesses that have net operating losses must use this form to calculate modifications. Like the CT-3, it is part of the corporate tax filing process and requires comprehensive financial disclosures.

- Form CT-3.4 - This form is utilized for computing various credits and adjustments to business income. The CT-3 and CT-3.4 both work together to assess total corporate tax obligations and potential credits or deductions.

- Form 1120 - As a federal income tax return for corporations, Form 1120 collects similar financial information. It serves to determine federal tax obligations, paralleling the CT-3’s role in state taxation.

- Form 1120S - This is the tax return for S corporations. Both forms focus on different types of corporate entities and their respective tax calculations, emphasizing how closely intertwined state and federal tax systems are.

- IRS Schedule C - While primarily for sole proprietorships, it deals with business income and expenses. Like the CT-3, it allows for the identification of taxable income, underscoring the importance of accurate financial reporting for tax obligations.

- Form CT-400 - This form is used for estimated corporation tax payments. Like the CT-3, it calculates tax obligations, but focuses on advance payments based on expected income, demonstrating further connections within corporate taxation.

Dos and Don'ts

When filling out the CT-3 form, accuracy and attention to detail are paramount. Common mistakes can lead to delays in processing and potential penalties. Here’s a guide on what you should and shouldn’t do:

- Do: Use the correct form for the appropriate tax period. Ensure you are using the CT-3 form for tax periods starting on or after January 1, 2021.

- Do: Double-check your corporation's legal name and trade name/DBA against official documents. This ensures consistency and avoids confusion.

- Do: Clearly mark any boxes that apply to your situation. Whether claiming an overpayment or stating if you are subject to certain taxes, clarity is key.

- Do: Attach any payment stubs correctly. Detach your check stubs if payments are being submitted, as instructed.

- Do: Review your entries in sections related to income and capital. Accurate reporting on income bases impacts your tax calculation significantly.

- Do: Ensure that all required attachments are included. Missing forms can lead to delays or the return being rejected.

- Don’t: Use this form for tax periods prior to January 1, 2021. It will not be processed and will lead to penalties.

- Don’t: Ignore instructions in Form CT-3-I. Following these will help prevent common errors in your return.

- Don’t: Leave any required fields blank. All sections must be completed thoroughly to avoid processing issues.

- Don’t: Submit multiple filings for the same tax year without indicating that they are amended. This can create confusion for the tax office.

- Don’t: Forget to sign and date your return. An unsigned form can be treated as unfiled.

- Don’t: Delay in filing; submitting your return late can incur penalties and interest that can increase the amount owed.

Misconceptions

- Misconception 1: The CT-3 form can be used for tax periods before January 1, 2021.

- Misconception 2: Filing the CT-3 form late incurs no penalties if the payment is made afterward.

- Misconception 3: Completing the form is straightforward, and no additional documentation is needed.

- Misconception 4: If overpayment is claimed, no further action is required from the taxpayer.

- Misconception 5: Only domestic corporations need to file the CT-3 form.

- Misconception 6: The CT-3 form is only for large businesses.

- Misconception 7: Once filed, the CT-3 form cannot be amended.

- Misconception 8: All tax credits from the CT-3 form are automatically applied in the next tax year.

- Misconception 9: Assistance with the CT-3 form is not available for small business owners.

- Misconception 10: No interest is charged if there is an overpayment.

This is incorrect. The CT-3 form is specifically designed for tax years that begin on or after January 1, 2021. Using it for prior periods will result in penalties.

Late filings do incur penalties and interest regardless of payment status. Timely filing is crucial to avoid additional fees.

In many cases, the CT-3 may require attachments or supporting documents. Reviewing the instructions thoroughly is essential.

Taxpayers must ensure they mark the overpayment box and complete any additional steps outlined in the instructions.

This is false. Foreign corporations doing business in New York must also file this form if they meet certain criteria.

In reality, all qualifying entities, regardless of size, that conduct business in New York must file this form if applicable.

This is misleading. Taxpayers can file an amended return using the CT-3 form if there are changes or corrections needed.

Taxpayers must specifically indicate their intent to carry credits over to the next year on the form to ensure they are applied appropriately.

Many resources, including online guides and support from tax professionals, are available to assist all business owners with this form.

Even if a business claims an overpayment, understanding the timeline for refunds is critical, as delays can sometimes lead to interest accrual.

Key takeaways

Filling out and using the CT-3 form requires careful attention to detail. Below are key takeaways to help ensure accurate completion and understanding of the process.

- Use the correct form version: The CT-3 form must only be used for tax periods beginning on or after January 1, 2021. Using it for prior periods will result in non-processing of your return.

- Complete mandatory fields: All filers need to provide essential information, including the tax period, Employer Identification Number (EIN), business name, and contact details.

- Understand filing options: Indicate whether it is a final or amended return, as this affects processing requirements and potential penalties.

- Review credits and payments: Carefully compute tax due or overpayment. Ensure to attach any required payment and understand the implications of underpayment or overpayment.

- Claim business types: Certain corporations may qualify for preferential tax rates. Make sure to indicate if your corporation fits under the designated categories.

- Document all attachments: If claiming tax credit or amending, attach supporting documentation as specified in the filing instructions.

- Filing deadlines matter: Observe specific deadlines for submission to avoid late penalties. This includes ensuring that all documents and payments are sent promptly.

- Consult available resources: Leverage instructions in Form CT-3-I and additional guidance provided by the Department of Taxation and Finance for complex situations or specific queries.

Taking these steps will help to facilitate a smoother filing process and minimize the risk of complications. Always keep a copy of the completed return for your records.

Browse Other Templates

Pub Sub Delivery - Indicate if you prefer a combo meal that includes a drink and chips.

Death Claims - The VA 29 4125 form is a claim application for one sum payment related to government life insurance.