Fill Out Your D 400V Form

The D 400V form plays a crucial role in the payment process for North Carolina taxpayers who have a balance due on their 2012 Form D-400. As a payment voucher, it facilitates accurate and efficient processing by the North Carolina Department of Revenue. By using the D 400V, individuals can ensure their payments are correctly attributed to their tax obligations. The form must be accompanied by a check or money order made payable to the NC Department of Revenue, adhering to specific guidelines regarding acceptable payment methods and formats. It is vital for taxpayers to clearly include their name, address, and relevant return information on the payment method to avoid processing delays. Additionally, electronic filers are advised to follow their preparer’s instructions for payments if opting for electronic submission. Awareness of important reminders, such as not folding the voucher or allowing it to be stapled to the payment, is essential for compliance. Overall, utilizing the D 400V form fosters a smoother transaction process and supports the timely settlement of tax obligations.

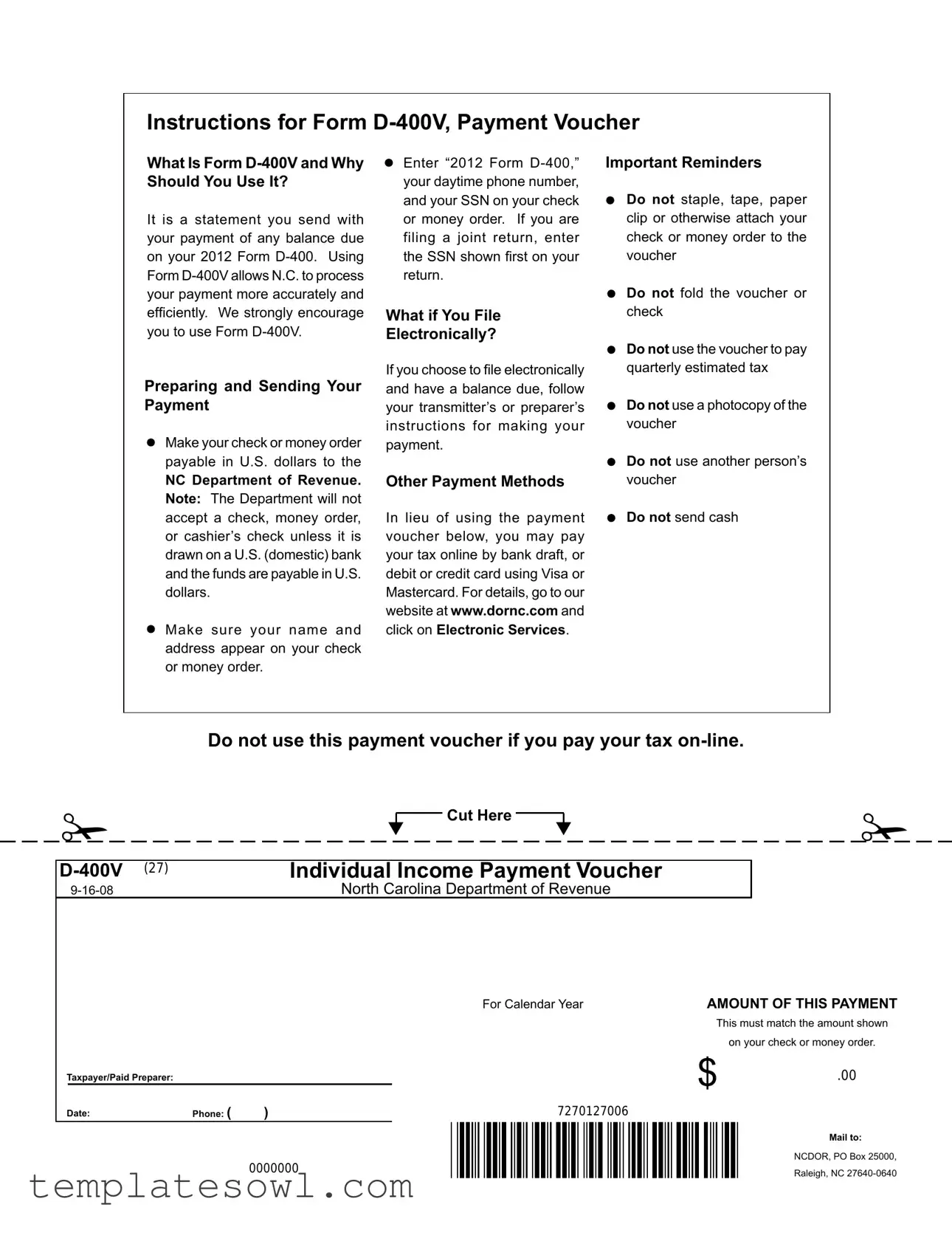

D 400V Example

Instructions for Form

What Is Form

It is a statement you send with your payment of any balance due on your 2012 Form

your payment more accurately and eficiently. We strongly encourage

you to use Form

Preparing and Sending Your Payment

Make your check or money order payable in U.S. dollars to the

NC Department of Revenue.

Note: The Department will not accept a check, money order, or cashier’s check unless it is drawn on a U.S. (domestic) bank and the funds are payable in U.S. dollars.

Make sure your name and address appear on your check or money order.

Enter “2012 Form

filing a joint return, enter the SSN shown irst on your

return.

What if You File

Electronically?

If you choose to ile electronically

and have a balance due, follow your transmitter’s or preparer’s instructions for making your payment.

Other Payment Methods

In lieu of using the payment voucher below, you may pay your tax online by bank draft, or debit or credit card using Visa or Mastercard. For details, go to our website at www.dornc.com and click on Electronic Services.

Important Reminders

Do not staple, tape, paper clip or otherwise attach your check or money order to the voucher

Do not fold the voucher or check

Do not use the voucher to pay quarterly estimated tax

Do not use a photocopy of the voucher

Do not use another person’s voucher

Do not send cash

Do not use this payment voucher if you pay your tax

|

Cut Here |

|

|

|

Individual Income Payment Voucher

North Carolina Department of Revenue |

For Calendar Year |

AMOUNT OF THIS PAYMENT |

|

This must match the amount shown |

|

on your check or money order. |

Taxpayer/Paid Preparer:

Date: |

Phone: ( |

) |

0000000

$ .00

7270127006

Mail to:

NCDOR, PO Box 25000,

Raleigh, NC

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | Form D-400V is used to submit a payment of any balance due on your 2012 Form D-400. |

| Processing Efficiency | Using Form D-400V allows the North Carolina Department of Revenue to process payments more accurately and efficiently. |

| Payment Instructions | Make checks or money orders payable to the NC Department of Revenue and ensure they are drawn on a U.S. bank in U.S. dollars. |

| Filing Joint Returns | If filing jointly, use the SSN that appears first on your return when completing the payment information. |

| Electronic Payments | For electronic filers with a balance due, follow your preparer’s instructions for making the payment. |

| Important Reminders | Do not staple, tape, or otherwise attach your check to the voucher. Also, avoid using a photocopy or another person’s voucher. |

| Governing Law | This form is governed by the laws of North Carolina, specifically under the North Carolina Department of Revenue regulations. |

Guidelines on Utilizing D 400V

Once you have your D-400V form ready, the next step is to ensure that all information is accurately filled out. This ensures that your payment is processed without delays. Follow the steps carefully to avoid any mistakes that could complicate your payment. Be mindful of the specific requirements for your payment method to ensure smooth processing.

- Obtain the D-400V form from the North Carolina Department of Revenue website or an authorized source.

- Enter the calendar year for which you are making the payment at the top of the form.

- In the section labelled AMOUNT OF THIS PAYMENT, write the total amount that matches your check or money order.

- Indicate the Taxpayer/Paid Preparer name.

- Fill in the Date when you are submitting the payment.

- Provide your Phone Number in the designated box.

- Make your check or money order payable in U.S. dollars to NC Department of Revenue.

- Ensure your name and address are clearly printed on the check or money order.

- Include “2012 Form D-400,” your daytime phone number, and your Social Security Number (SSN) on your payment instrument.

- If filing jointly, use the SSN that appears first on your return.

- Do not staple, tape, or paper clip your payment to the voucher.

- Mail the completed D-400V form and your payment to: NCDOR, PO Box 25000, Raleigh, NC 27640-0640.

What You Should Know About This Form

What is Form D-400V and why should I use it?

Form D-400V is a payment voucher used when you send a payment for any balance due on your 2012 Form D-400 tax return. Using this form helps the North Carolina Department of Revenue process your payment more accurately and efficiently. It’s strongly recommended to use Form D-400V to avoid any issues with your payment.

How do I prepare and send my payment with Form D-400V?

Start by making your check or money order payable in U.S. dollars to the NC Department of Revenue. It’s important that the payment is drawn on a U.S. bank. Write your name and address on the check or money order. Additionally, include “2012 Form D-400,” your daytime phone number, and your Social Security Number. If you filed jointly, use the Social Security Number listed first on your tax return.

What should I do if I file electronically?

If you file electronically and have a balance due, it's important to follow the instructions provided by your tax preparer or software. These instructions will guide you on how to make your payment properly without needing to use the D-400V voucher.

Are there other payment methods available aside from Form D-400V?

Yes! In addition to using Form D-400V, you can pay your taxes online. This can be done through bank draft or by using a debit or credit card, specifically Visa or Mastercard. For more information on electronic payments, visit the North Carolina Department of Revenue website at www.dornc.com and click on Electronic Services.

What should I avoid when submitting Form D-400V?

When submitting Form D-400V, do not staple, tape, or paper clip your check or money order to the voucher. Keep both the voucher and the payment flat and do not fold them. Never use the voucher for paying quarterly estimated taxes, and do not send a photocopy or someone else’s voucher. Also, avoid sending cash, and don’t use this form if you are paying your tax online.

Where do I mail my completed Form D-400V?

Your completed Form D-400V should be mailed to the North Carolina Department of Revenue at this address: NCDOR, PO Box 25000, Raleigh, NC 27640-0640. Make sure the payment matches the amount due as stated in the instructions to ensure accurate processing.

Common mistakes

When filling out Form D-400V, many individuals make common mistakes that can lead to processing delays. One common error is not including the correct payment amount. Ensure the amount on the voucher matches the amount on your check or money order. Any discrepancies could cause unnecessary frustration.

Another mistake people make is failing to provide their name and address on the check or money order. This information is crucial for proper identification and ensures that your payment is processed without complication. Always double-check that these details are clearly printed.

Incorrectly entering your Social Security Number (SSN) is also a frequent issue. For joint returns, remember to use the SSN of the person listed first on the return. Misidentifying your SSN can result in delays in processing your payment.

Some individuals choose to file electronically but forget to follow the specific instructions provided by their transmitter or preparer. Always adhere to the guidelines given to avoid mistakes that can lead to confusion about the payment process.

Avoid attaching your payment to the voucher with staples, tape, or paper clips. This is a strict instruction that should be followed to prevent any issues with your submission. Seemingly small actions can have big repercussions in official processes.

Be cautious not to use a photocopy of the voucher. Each voucher must be an original to ensure valid processing. Submitting a copy can lead to rejection of your payment.

Do not send cash with your submission. The Department will not accept cash payments, so ensure you use a check or money order instead. Sending cash is a surefire way to create complications.

Finally, remember that the payment voucher should not be used to pay quarterly estimated taxes. Using it for the wrong purpose can lead to erroneous processing and significant delays. Stick to using it for the right payments only.

By paying attention to these details and avoiding these mistakes, you can ensure that your payment is processed smoothly and accurately. A little diligence goes a long way in making the process easier for yourself and the North Carolina Department of Revenue.

Documents used along the form

When dealing with tax returns and payments, several documents and forms are often used alongside the D-400V form to ensure everything is processed smoothly. Understanding these forms can help simplify the tax filing process and avoid any potential issues. Here’s a brief overview of some key documents you may encounter.

- Form D-400: This is the individual income tax return form for North Carolina residents. It outlines your income, deductions, and credits, allowing you to determine your tax liability for the year.

- Form D-400TC: Known as the “Tax Credits” form, this document is used to claim various tax credits available in North Carolina, helping reduce your overall tax bill.

- Form D-404: This form is the “North Carolina Individual Income Tax Return for Nonresident and Part-Year Resident.” It is specifically designed for individuals who reside outside of North Carolina for part of the year.

- Form D-410: The “North Carolina Tax Refund Application” is submitted by individuals seeking a refund of taxes previously overpaid or paid in error.

- Form D-430: This form is used to report any “North Carolina Withholding Tax” from your wages. Employers utilize this document to ensure tax withholding is managed properly throughout the year.

- Form D-485: This is the “Individual Income Tax Extension Request” form. If you need more time to file your D-400, this form will allow you an extension but does not extend the time to pay taxes owed.

- Form D-400V EZ: A simplified version of the D-400V, this is utilized specifically for making electronic payments to the NC Department of Revenue, streamlining the payment process for those who file electronically.

- Form D-429: This form is used for claiming a “Request for Refund of Nonresident Tax.” It's used by nonresidents who may have had tax withheld incorrectly or have a claim for a refund.

Each of these forms serves a unique purpose, making the overall tax process more organized and manageable. Familiarizing yourself with these documents can significantly aid in ensuring your tax filings are correct and timely.

Similar forms

- Form 1040-V: Similar to Form D-400V, Form 1040-V is a payment voucher that taxpayers must send with their payment for individual income tax returns. Just like D-400V, it ensures accurate processing of payments due to the IRS.

- Form 4868: This is an application for an automatic extension of time to file your U.S. Individual Income Tax Return. The payment voucher helps ensure that any balance due at the time of the extension is processed accurately, resembling the function of D-400V.

- Form 1120-W: Used by corporations, this form is a quarterly estimated tax payment voucher. It shares the purpose of D-400V in providing clear payment instructions for proper processing.

- Form 8862: This document is used by taxpayers who are reapplying for the Earned Income Credit after it was disallowed. Submitting it alongside payment resembles D-400V’s role in clarifying payments due on a return.

- Form 9465: This is an Installment Agreement Request form. Although primarily for setting up a payment plan, it also includes a payment voucher component, which is similar to the D-400V in ensuring payments are accurately processed.

- Form 1040-ES: Used for making estimated tax payments throughout the year, this form includes a payment voucher similar to D-400V, facilitating timely and organized payment submissions.

- Form IT-150: This is the New York State income tax return payment voucher. Like the D-400V form, it helps provide a clear method for remitting any tax balances due.

- Form 7203: This form is used to report shareholder stock basis and includes a payment voucher for taxes owed, echoing the role of D-400V in easing the payment process.

Dos and Don'ts

When filling out the D-400V form, it’s crucial to follow the guidelines carefully to ensure your payment is processed accurately. Below are important dos and don'ts to keep in mind.

- Do make your check or money order payable in U.S. dollars to the NC Department of Revenue.

- Do ensure your name and address are clearly printed on the check or money order.

- Do include “2012 Form D-400,” your daytime phone number, and your SSN on the check or money order.

- Do enter the SSN of the first person listed on a joint return if applicable.

- Do follow any specific instructions if filing electronically.

- Do utilize online payment options if preferred, through bank draft or credit/debit card.

- Don't staple, tape, or paperclip your check or money order to the voucher.

- Don't fold the voucher or your check.

- Don't use the voucher for quarterly estimated taxes.

- Don't send cash or a photocopy of the payment voucher.

Keeping these points in mind will help streamline the submission process and minimize any potential issues with the North Carolina Department of Revenue.

Misconceptions

Here are six common misconceptions about the D-400V form:

- The D-400V form is optional for all taxpayers. Some taxpayers believe that using the D-400V is not necessary when sending a payment. However, it is strongly encouraged as it helps ensure that payments are processed accurately and efficiently.

- Any payment method is acceptable. Many individuals think they can use any check or money order for their payment. In reality, the payment must be payable in U.S. dollars and drawn on a U.S. bank.

- Filing electronically eliminates the need for the D-400V. There is a misconception that once a taxpayer files their return electronically, they do not need to use the D-400V. While electronic filing is an option, a payment voucher is still required if a balance is owed.

- It’s fine to attach the payment check to the voucher. Some taxpayers mistakenly believe that stapling or attaching their check to the voucher is acceptable. The instructions specifically state not to attach anything to the voucher.

- Photocopying the voucher is sufficient. There is a common belief that using a photocopy of the voucher will work for payments. This is incorrect; taxpayers must use the original, unaltered voucher.

- Cash can be sent with the voucher. Many people think they can send cash along with the payment voucher. This is not permitted; only checks, money orders, or electronic payments are accepted.

Key takeaways

When using the D-400V form, keep the following points in mind:

- Purpose of the Form: Form D-400V is designed for submitting payments related to any outstanding balance on your 2012 Form D-400.

- Payment Methods: You can pay by check or money order, ensuring it is drawn on a U.S. bank and in U.S. dollars.

- Payment Details: Clearly write your name, address, the payment amount, “2012 Form D-400,” your daytime phone number, and the appropriate Social Security Number (SSN) on your payment.

- Electronic Filing: If you file electronically and owe a balance, follow your preparer's instructions for payment.

- Avoid Common Mistakes: Do not staple, tape, or fold the voucher or payment method, and never use a photocopy or someone else's voucher.

- Payment Options: Besides using the voucher, you can pay online via bank draft or with a debit/credit card on the N.C. Department of Revenue website.

These key takeaways will help ensure that your use of the D-400V form is smooth and efficient. Make sure to follow these guidelines for accurate processing of your payments.

Browse Other Templates

Ontario Secondary School Transcript - The document allows schools to plan appropriately for the academic and emotional well-being of the student.

What Is a Verified Complaint in California - Defendant names must be spelled correctly on the form to avoid unnecessary complications.

Who Owns Mr Cooper - Contributors must outline their income, expenses, and assets clearly.