Fill Out Your Da 3072 2 Form

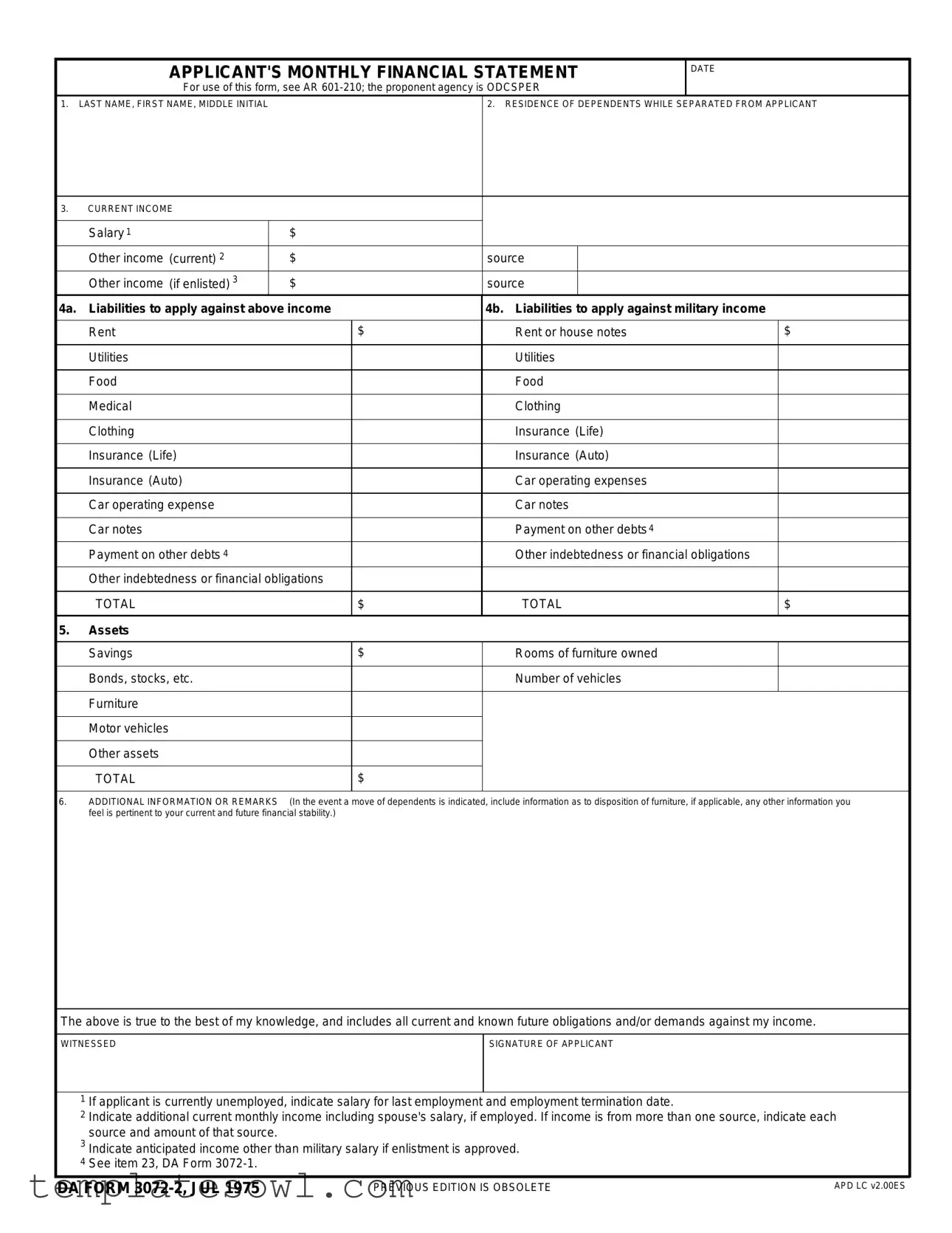

The DA 3072 2 form plays a crucial role in assessing an applicant's financial situation, particularly for those seeking enlistment or other military-related considerations. It facilitates a thorough evaluation of monthly income, current liabilities, and available assets, helping the military to understand the financial readiness of its personnel. Applicants must provide their full name as well as details about their dependents’ residence while separated. Additionally, they are required to disclose their current income streams, which include salary and other earnings, alongside an itemized list of liabilities that could impact their financial stability. This includes essential expenses such as rent, utilities, food, and medical costs, allowing the form to gather a comprehensive view of the applicant's monthly obligations. Assets are also documented, providing information about savings, vehicles, and any significant investments. This financial assessment isn't just about numbers; it also invites applicants to offer any additional remarks that may assist in portraying their overall financial landscape—especially if a move for dependents is expected. The significance of the form lies in its ability to depict a clear picture of an applicant's financial situation, which helps services make informed decisions about enlistment and support. Moreover, signing the form constitutes an agreement to the presented information being true and comprehensive, underscoring its importance in the recruitment process.

Da 3072 2 Example

|

APPLICANT'S MONTHLY FINANCIAL STATEMENT |

DATE |

|

|||||

|

|

|

||||||

|

For use of this form, see AR |

|

|

|||||

1. LAST NAME, FIRST NAME, MIDDLE INITIAL |

|

|

2. RESIDENCE OF DEPENDENTS WHILE SEPARATED FROM APPLICANT |

|||||

|

|

|

|

|

|

|

|

|

3. |

CURRENT INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salary 1 |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (current) 2 |

|

$ |

|

source |

|

|

|

|

Other income (if enlisted) 3 |

|

$ |

|

source |

|

|

|

4a. |

Liabilities to apply against above income |

4b. Liabilities to apply against military income |

|

|||||

|

|

|

|

|

|

|

||

|

Rent |

|

$ |

Rent or house notes |

|

$ |

||

|

|

|

|

|

|

|

|

|

|

Utilities |

|

|

Utilities |

|

|

||

|

|

|

|

|

|

|

|

|

|

Food |

|

|

Food |

|

|

||

|

|

|

|

|

|

|

|

|

|

Medical |

|

|

Clothing |

|

|

||

|

|

|

|

|

|

|

|

|

|

Clothing |

|

|

Insurance (Life) |

|

|

||

|

|

|

|

|

|

|

|

|

|

Insurance (Life) |

|

|

Insurance (Auto) |

|

|

||

|

|

|

|

|

|

|

|

|

|

Insurance (Auto) |

|

|

Car operating expenses |

|

|

||

|

|

|

|

|

|

|

|

|

|

Car operating expense |

|

|

Car notes |

|

|

||

|

|

|

|

|

|

|

|

|

|

Car notes |

|

|

Payment on other debts4 |

|

|

||

|

|

|

|

|

|

|

|

|

|

Payment on other debts 4 |

|

|

Other indebtedness or financial obligations |

|

|||

|

|

|

|

|

|

|

|

|

|

Other indebtedness or financial obligations |

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

TOTAL |

|

$ |

TOTAL |

|

$ |

||

|

|

|

|

|

|

|

|

|

5. |

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Savings |

|

$ |

Rooms of furniture owned |

|

|

||

|

|

|

|

|

|

|

|

|

|

Bonds, stocks, etc. |

|

|

Number of vehicles |

|

|

||

|

|

|

|

|

|

|

|

|

|

Furniture |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Motor vehicles |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

ADDITIONAL INFORMATION OR REMARKS |

(In the event a move of dependents is indicated, include information as to disposition of furniture, if applicable, any other information you |

||||||

feel is pertinent to your current and future financial stability.)

The above is true to the best of my knowledge, and includes all current and known future obligations and/or demands against my income.

WITNESSED |

SIGNATURE OF APPLICANT |

|

|

1 If applicant is currently unemployed, indicate salary for last employment and employment termination date.

2 Indicate additional current monthly income including spouse's salary, if employed. If income is from more than one source, indicate each source and amount of that source.

3 Indicate anticipated income other than military salary if enlistment is approved.

4 See item 23, DA Form

DA FORM |

PREVIOUS EDITION IS OBSOLETE |

APD LC v2.00ES |

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The form is known as the DA 3072-2, titled the Monthly Financial Statement. |

| Governing Law | This form is governed by Army Regulation 601-210. |

| Applicant Information | It requires the applicant's last name, first name, and middle initial. |

| Income Reporting | Applicants must report their current income, including salary and other sources. |

| Liabilities Section | There's a section for listing liabilities that the applicant needs to apply against their income. |

| Asset Declaration | Applicants are required to provide a summary of their assets, including savings and property. |

| Additional Remarks | Space is provided for any additional comments that may relate to the applicant's financial situation. |

| Signature Requirement | The applicant must provide a signature to attest to the truthfulness of the information submitted. |

Guidelines on Utilizing Da 3072 2

Completing the DA 3072-2 form requires careful attention to detail to ensure all financial information is accurately represented. After the form is filled out, it should be submitted as directed, typically to serve specific military administrative processes. The information provided will generally be used to assess the applicant's financial status.

- Date: Write the current date at the top of the form.

- Applicant's Information: Enter your last name, first name, and middle initial in the designated fields.

- Residence of Dependents: Indicate the address where your dependents will reside while you are separated.

- Current Income:

- List your salary:

- Provide details for other current income (include the source):

- If enlisted, list additional income sources and amounts.

- Liabilities:

- Document liabilities against your income such as rent, utilities, food, and clothing. Include amounts for each category.

- Calculate the total liabilities and write it down.

- Assets:

- List your assets, including savings, furniture, bonds, and vehicles.

- Calculate the total value of your assets and record it.

- Additional Information: Provide any pertinent remarks that might affect your financial stability, including details regarding the disposition of furniture if a move is indicated.

- Signature: Sign the form where indicated, confirming the information is accurate to the best of your knowledge.

What You Should Know About This Form

What is the purpose of the DA 3072-2 form?

The DA 3072-2 form is designed to provide a comprehensive overview of an applicant's financial situation. It is primarily used by military personnel including those seeking enlistment or reclassification. This form requires applicants to detail their monthly income, liabilities, assets, and any relevant additional information that might impact their financial stability. It serves as a tool for assessing the financial obligations of individuals in relation to their military service.

What information is required on the DA 3072-2 form?

The form necessitates several pieces of information. Applicants must provide their name and the residence of their dependents if they are separated. Additionally, the form requires a breakdown of current income sources, which includes salaries and other income. Applicants also need to list their financial liabilities, detailing expenses such as rent, utilities, food, insurance, and any car operating costs. Furthermore, it requires a declaration of assets like savings, vehicles, and furniture. This structured information helps in creating a clear financial picture of the applicant.

How should an applicant report their income on the DA 3072-2 form?

Income should be reported in a detailed manner. Applicants are encouraged to indicate their salary, including any additional current income from various sources. If the applicant is currently unemployed, they should list their last salary and the date they stopped working. It’s important to specify each income source and the respective amounts. This thoroughness provides clarity and transparency in the financial assessment process.

What happens if an applicant has additional financial obligations?

If an applicant has additional financial obligations not explicitly listed on the form, they can include this information in the section reserved for additional remarks. It is vital to provide as much information as possible about any other debts or obligations as this can impact their financial assessment. Honesty and thoroughness in this section can help create a more accurate evaluation of their financial situation.

Is there any specific instruction for dependent information?

Yes, when filling out the DA 3072-2 form, the applicant must specify the residence of their dependents while they are separated. This ensures that the military can understand the living situation of the applicant's family members, which may influence their overall financial stability. This information will be considered carefully during the assessment process.

What should an applicant ensure before signing the DA 3072-2 form?

Before signing the DA 3072-2 form, applicants must ensure that all provided information is accurate and truthful to the best of their knowledge. They should review the form to verify that it includes all current and known future obligations against their income. The signature confirms that the applicant has understood and completed the form truthfully, which is crucial for maintaining the integrity of the application process.

Common mistakes

When completing the DA 3072-2 form, many applicants make common mistakes that can lead to unnecessary delays or complications. Being aware of these pitfalls can help ensure that your application is processed smoothly.

One major mistake is failing to provide complete and accurate information in the income section. Applicants often leave out sources of income or provide vague details. It's crucial to list all forms of income, such as spouse's salary or any other contributions. Ensure that each source is clearly identified and the amounts are accurate. Missing this can cast doubt on the legitimacy of your financial situation.

Another frequent error occurs when individuals estimate their liabilities. Some applicants rush through this section, not fully accounting for monthly expenses like rent, utilities, and insurance. A precise breakdown of liabilities is essential. Inaccuracies here could misrepresent your financial obligations.

Additionally, many people do not include all of their assets. Applicants might overlook items such as savings accounts, bonds, or additional vehicles. This omission can significantly affect the overall picture of financial health presented in the application. Listing all assets accurately helps paint a complete snapshot of your financial situation.

Individuals often misinterpret the 'Additional Information or Remarks' section. This area is not just for extra details; it's an opportunity to clarify any aspects of your application that may require further explanation. Failing to utilize this section properly can leave reviewers with unanswered questions.

Another mistake is not signing the document properly. The application needs a witnessed signature, and skipping this step can lead to immediate rejection. Always ensure that your signature is legible and that it is witnessed as required.

Sometimes, applicants provide outdated information. It's essential to use the most current financial details when filling out the form. If there have been recent changes in income, liabilities, or assets, those should be reflected accurately.

Miscommunication regarding dependents can also cause issues. It's important to clearly indicate the residence of dependents while separated. Ambiguity can lead to confusion, so providing specific details is critical.

Lastly, neglecting to review the entire form before submission is a common error. A rushed review can result in overlooked mistakes or inconsistencies. Take the time to double-check each section and ensure everything aligns correctly.

By being mindful of these common mistakes, applicants can improve the quality of their application and increase the chances of a successful outcome. Careful preparation and attention to detail are vital when filling out the DA 3072-2 form.

Documents used along the form

When applying for certain benefits or services through the military, you might encounter several forms and documents in addition to the DA 3072-2 form. Each of these documents serves a unique purpose and helps provide a fuller picture of an applicant's financial situation or eligibility. Here’s a brief overview of some commonly used forms that you might need alongside the DA 3072-2.

- DA Form 3072-1: This form is a statement focusing on enlistment verification. It asks for information related to previous military service and assists in confirming eligibility for enlistment.

- DD Form 214: Often referred to as the Certificate of Release or Discharge from Active Duty, this document summarizes a service member's military career. It includes details about the length of service, discharge status, and any awards received.

- SF 86: This is the Standard Form 86, which is part of the background investigation process for obtaining security clearance. It gathers extensive personal information and requires detailed disclosure of all aspects of the individual’s life relevant to national security.

- W-2 Forms: These are Wage and Tax Statements from employers that outline the yearly income a service member received, along with the taxes withheld. They help provide proof of income for financial assessments.

- Pay Stubs: Recent pay stubs serve as evidence of current income and help verify the applicant's financial landscape for the purposes of loans, housing assistance, or other support.

- VA Form 21-526EZ: This form is used to apply for disability compensation from the Department of Veterans Affairs. It asks for information regarding the applicant's service-related injuries and assists in determining eligibility for benefits.

- Financial Aid Application: Depending on the specific program one is applying for, this document may be necessary to assess financial needs. It outlines income, assets, and expenses to help determine assistance qualification.

Understanding these documents and their purposes can make the application process smoother. Gathering the necessary paperwork ahead of time allows for a more thorough and efficient submission, ultimately leading to better chances of securing the benefits you are seeking.

Similar forms

The DA Form 3072-2 is primarily a financial document used by applicants to provide their monthly financial information while separated from dependents. Several other documents share similar characteristics, focusing on financial disclosures for various purposes. Below is a list of nine forms that are similar to the DA Form 3072-2, detailing their relationship:

- VA Form 21-526EZ: This is used to apply for disability compensation and keeps track of current income and expenses, similar to how the DA 3072-2 collects financial information for military purposes.

- IRS Form 1040: The standard individual income tax return form, which collects detailed financial information. Like the DA 3072-2, it assesses income and liabilities to determine obligations.

- HUD Form 92006: This is a supplemental questionnaire for Housing Choice Voucher applicants. It captures income and asset information, echoing the financial assessment approach of the DA form.

- USDA Rural Development Form RD 410-1: Used for loan applications in rural areas, it also requests monthly income and liabilities, akin to the DA 3072-2's requirement for financial details.

- Social Security Administration Form SSA-8000: This form is for the application for Supplemental Security Income, looking for extensive financial disclosures similar to those noted in the DA form.

- Department of Education FAFSA: The Free Application for Federal Student Aid considers the financial status of applicants, collecting information about income, expenses, and assets much like the DA 3072-2 does.

- Form 4506-T: A request for transcript of tax return form frequently used by loan applicants to verify income, paralleling the DA form’s needed verification of financial matters.

- VA Form 21-534EZ: Used to apply for survivor benefits, it similarly requires current financial information that affects eligibility and benefits, similar to the DA 3072-2.

- FHA Loan Application: This application requires detailed financial statements from borrowers to assess eligibility for home buying, much like the financial overview required by the DA 3072-2.

Gathering financial information is crucial in many contexts, ensuring that all parties have a clear understanding of an applicant's financial situation. Each of these forms utilizes a structured approach to collect necessary details about income, expenses, and liabilities, similar to the framework of the DA 3072-2.

Dos and Don'ts

When filling out the DA 3072-2 form, adhere to the following guidelines to ensure accuracy and completeness.

- Do read the form instructions carefully to understand each requirement.

- Do provide accurate and up-to-date information regarding your financial status.

- Do include all sources of income, not just your military salary.

- Do list all liabilities, ensuring each figure is correctly calculated.

- Do review your entries to confirm they are error-free before submission.

- Don’t leave any required sections blank; fill in all applicable areas.

- Don’t report estimates; only include actual figures in your statement.

- Don’t use abbreviations that could lead to misunderstandings.

- Don’t forget to sign the form; an unsigned form may be rejected.

- Don’t submit the form without keeping a copy for your records.

Following these do's and don'ts will help ensure that your form is processed smoothly and without delays.

Misconceptions

- Misconception 1: The DA 3072-2 form is only necessary for enlisted personnel.

- Misconception 2: Completing the form is optional if the applicant has no debts.

- Misconception 3: The DA 3072-2 form is not relevant for those in different states or regions.

- Misconception 4: The information provided on the form is not verified.

- Misconception 5: Assets listed on the form do not need to be detailed.

This form is used by both enlisted personnel and officers. It helps assess the financial situation of the applicant, regardless of their rank.

Even if an applicant has no debts, this form must still be completed. It provides a comprehensive overview of financial standards, assets, and other obligations that could impact the approval of enlistment.

The form is applicable across all states. Financial documentation is standardized to ensure consistency in evaluating applicants, independent of geographical location.

While there may not be immediate verification, the authorities may cross-check the provided information during future assessments. Accuracy is essential to avoid complications later on.

It’s important to provide as much detail as possible regarding assets. This includes their value and type, as it helps in evaluating the financial capabilities and responsibilities of the applicant.

Key takeaways

When filling out the DA 3072-2 form, it's important to ensure accuracy and completeness. Here are four key takeaways to consider:

- Be Thorough with Income Reporting: List all current income sources, including salary and other forms of income. If married, remember to include your spouse's earnings, ensuring a full picture of your household finances.

- Carefully Detail Liabilities: Provide a comprehensive breakdown of all liabilities. This includes expenses like rent, utilities, food, insurance, and any other debts. A clear financial obligation overview is crucial.

- Accurate Asset Valuation: Itemize your assets honestly, such as savings and property. This is essential for assessing your financial standing and future obligations.

- Include Additional Remarks: Use the additional information section to provide context that could affect your financial situation, like planned moves or changes in dependent care. This information can be vital for understanding your overall financial health.

Completing the form accurately makes a significant difference in the review process. Take your time, gather the necessary information, and ensure that everything is clearly stated. Doing so can facilitate better outcomes related to your enlistment or benefits applications.

Browse Other Templates

Aig Beneficiary Change Form - Each AIG branch has its dedicated section within the form.

Delta Usa Dental - Patients should stay informed about their rights and responsibilities regarding referrals.