Fill Out Your Dc 4212 1211 Form

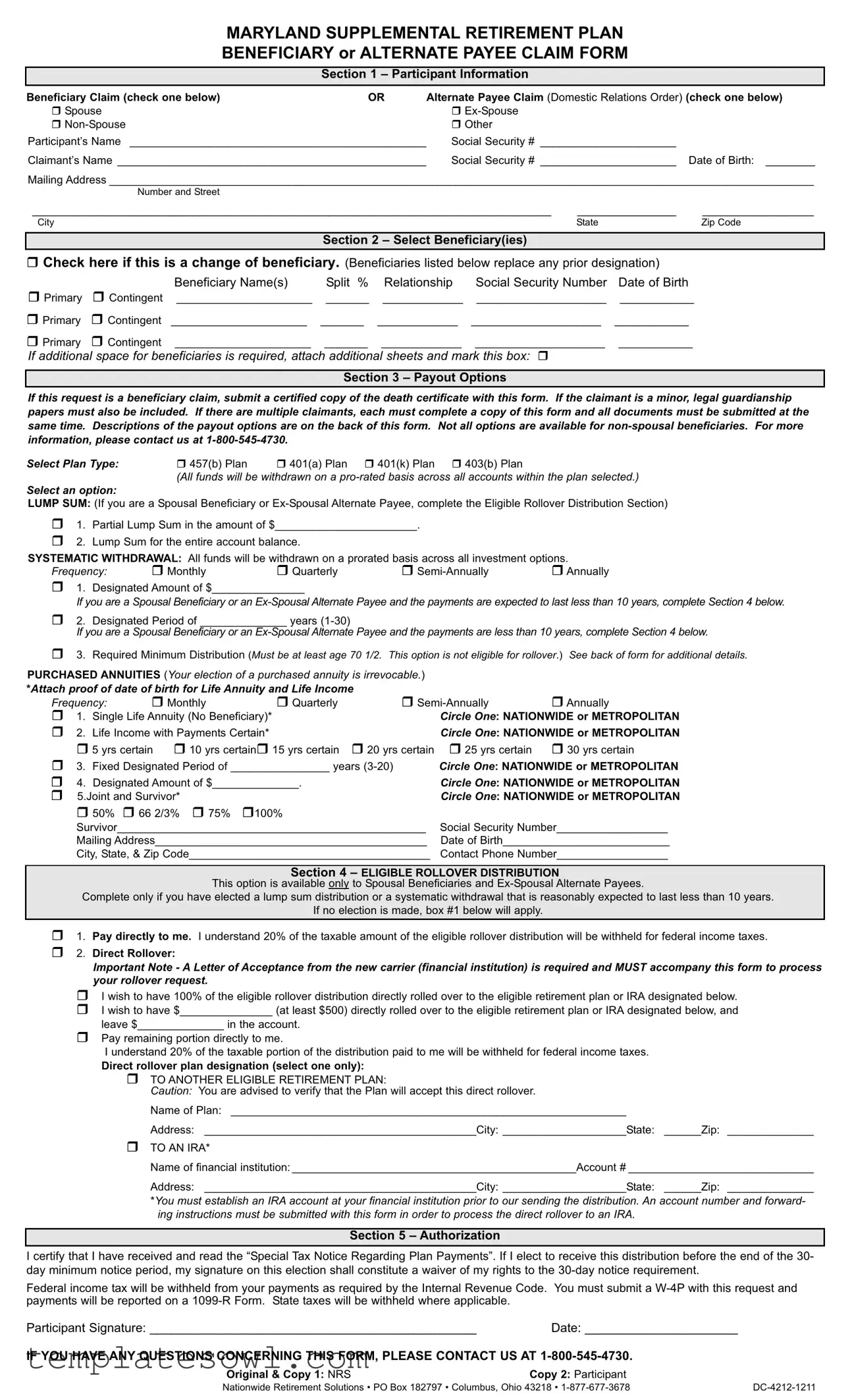

The DC 4212 1211 form is essential for individuals involved in the Maryland Supplemental Retirement Plan. This form allows participants to designate beneficiaries or alternate payees, which is crucial when an account holder passes away or in the event of a divorce. It consists of several key sections. First, it requires participant and claimant information, including names and social security numbers. The form offers a selection between filing a beneficiary claim or an alternate payee claim. Participants can list multiple beneficiaries, indicating their relationships and identifying information. Additionally, there are options regarding payout types, enabling beneficiaries to choose between lump sum payments, systematic withdrawals, or annuities. The choices available can significantly impact the financial future of those receiving the benefits, and each option has its own advantages and considerations. Along with the completed form, claimants must attach necessary documentation, such as a certified death certificate or guardianship papers if applicable. As this form plays a critical role in managing retirement funds efficiently, understanding its components and providing accurate information is necessary for ensuring that distributions are handled smoothly and in accordance with each individual’s wishes.

Dc 4212 1211 Example

MARYLAND SUPPLEMENTAL RETIREMENT PLAN

BENEFICIARY or ALTERNATE PAYEE CLAIM FORM

Section 1 – Participant Information

Beneficiary Claim (check one below) |

OR |

Alternate Payee Claim (Domestic Relations Order) (check one below) |

r Spouse |

|

r |

r |

|

r Other |

Participant’s Name ________________________________________________ |

Social Security # ______________________ |

|

Claimant’s Name __________________________________________________ |

Social Security # ______________________ Date of Birth: ________ |

|

Mailing Address __________________________________________________________________________________________________________________

Number and Street

____________________________________________________________________________________ |

________________ |

__________________ |

City |

State |

Zip Code |

|

|

|

Section 2 – Select Beneficiary(ies) |

|

|

|

|

|

r Check here if this is a change of beneficiary. (Beneficiaries listed below replace any prior designation)

|

|

Beneficiary Name(s) |

Split % |

Relationship |

Social Security Number |

Date of Birth |

r Primary |

r Contingent |

______________________ |

_______ |

_____________ |

_____________________ |

____________ |

r Primary |

r Contingent |

______________________ |

_______ |

_____________ |

_____________________ |

____________ |

r Primary |

r Contingent |

______________________ |

_______ |

_____________ |

_____________________ |

____________ |

If additional space for beneficiaries is required, attach additional sheets and mark this box: r

Section 3 – Payout Options

If this request is a beneficiary claim, submit a certified copy of the death certificate with this form. If the claimant is a minor, legal guardianship papers must also be included. If there are multiple claimants, each must complete a copy of this form and all documents must be submitted at the same time. Descriptions of the payout options are on the back of this form. Not all options are available for

Select Plan Type: r 457(b) Plan r 401(a) Plan r 401(k) Plan r 403(b) Plan

(All funds will be withdrawn on a

Select an option:

LUMP SUM: (If you are a Spousal Beneficiary or

r1. Partial Lump Sum in the amount of $_______________________.

r2. Lump Sum for the entire account balance.

SYSTEMATIC WITHDRAWAL: All funds will be withdrawn on a prorated basis across all investment options.

Frequency: |

r Monthly |

r Quarterly |

r |

r Annually |

r1. Designated Amount of $_______________

If you are a Spousal Beneficiary or an

r2. Designated Period of ______________ years

If you are a Spousal Beneficiary or an

r3. Required Minimum Distribution (Must be at least age 70 1/2. This option is not eligible for rollover.) See back of form for additional details.

PURCHASED ANNUITIES (Your election of a purchased annuity is irrevocable.)

*Attach proof of date of birth for Life Annuity and Life Income |

|

|

||||

Frequency: |

r Monthly |

r Quarterly |

r |

r Annually |

||

r 1. |

Single Life Annuity (No Beneficiary)* |

|

Circle One: NATIONWIDE or METROPOLITAN |

|||

r 2. |

Life Income with Payments Certain* |

|

Circle One: NATIONWIDE or METROPOLITAN |

|||

r 5 yrs certain r 10 yrs certainr 15 yrs certain |

r 20 yrs certain |

r 25 yrs certain |

r 30 yrs certain |

|||

r 3. |

Fixed Designated Period of ________________ years |

Circle One: NATIONWIDE or METROPOLITAN |

||||

r 4. |

Designated Amount of $______________. |

|

Circle One: NATIONWIDE or METROPOLITAN |

|||

r 5.Joint and Survivor* |

|

|

Circle One: NATIONWIDE or METROPOLITAN |

|||

r 50% |

r 66 2/3% r 75% |

r100% |

|

|

|

|

Survivor__________________________________________________ |

Social Security Number__________________ |

|||||

Mailing Address____________________________________________ |

Date of Birth___________________________ |

|||||

City, State, & Zip Code_______________________________________ |

Contact Phone Number__________________ |

|||||

Section 4 – ELIGIBLE ROLLOVER DISTRIBUTION

This option is available only to Spousal Beneficiaries and

Complete only if you have elected a lump sum distribution or a systematic withdrawal that is reasonably expected to last less than 10 years.

If no election is made, box #1 below will apply.

r1. Pay directly to me. I understand 20% of the taxable amount of the eligible rollover distribution will be withheld for federal income taxes.

r2. Direct Rollover:

Important Note - A Letter of Acceptance from the new carrier (financial institution) is required and MUST accompany this form to process your rollover request.

rI wish to have 100% of the eligible rollover distribution directly rolled over to the eligible retirement plan or IRA designated below.

rI wish to have $_______________ (at least $500) directly rolled over to the eligible retirement plan or IRA designated below, and leave $______________ in the account.

rPay remaining portion directly to me.

I understand 20% of the taxable portion of the distribution paid to me will be withheld for federal income taxes.

Direct rollover plan designation (select one only):

rTO ANOTHER ELIGIBLE RETIREMENT PLAN:

Caution: You are advised to verify that the Plan will accept this direct rollover.

Name of Plan: ________________________________________________________________

Address: ____________________________________________City: ____________________State: ______Zip: ______________

rTO AN IRA*

Name of financial institution: ______________________________________________Account # ______________________________

Address: ____________________________________________City: ____________________State: ______Zip: ______________

*You must establish an IRA account at your financial institution prior to our sending the distribution. An account number and forward- ing instructions must be submitted with this form in order to process the direct rollover to an IRA.

Section 5 – Authorization

I certify that I have received and read the “Special Tax Notice Regarding Plan Payments”. If I elect to receive this distribution before the end of the 30- day minimum notice period, my signature on this election shall constitute a waiver of my rights to the

Federal income tax will be withheld from your payments as required by the Internal Revenue Code. You must submit a

Participant Signature: _______________________________________________ |

Date: ______________________ |

IF YOU HAVE ANY QUESTIONS CONCERNING THIS FORM, PLEASE CONTACT US AT |

|

Original & Copy 1: NRS |

Copy 2: Participant |

Nationwide Retirement Solutions • PO Box 182797 • Columbus, Ohio 43218 • |

PAYOUT OPTION DESCRIPTIONS

PARTIAL LUMP SUM PAYMENT: This option provides for a single payment in the amount requested (minimum of $25.00) from the value of your account.

LUMP SUM PAYMENT: This option provides for the payment of the full value of your account in a single payment.

SYSTEMATIC WITHDRAWAL OPTIONS: Your account is maintained on the Administrator’s Accumulation System and continues to earn either recurrent interest in the fixed return or fund investment performance if in the variable return option, throughout the payout period. You will continue to receive quarterly statements. In the event of your death prior to the exhaustion of your account, upon the claim, the beneficiary will receive payments until the account is exhausted or a lump sum payment of the remaining account balance. All funds are withdrawn on a prorated basis.

DESIGNATED AMOUNT: This option provides for payments of the designated amount (minimum of $25.00) until your account is exhausted. The final payment will be the balance of your account. Please indicate the amount to be paid, your beneficiaries, their rela- tionships to you, their Social Security numbers, and their birth dates.

Exchanges are permitted, subject to annual exchange limitations.

For example:

Participant dies prior to the exhaustion of the account.

––Upon their claim, the beneficiary receives payments until the account is exhausted or a lump sum payment of the remaining account balance.

DESIGNATED PERIOD: This option allows you to choose the number of years you will receive payments. Your payment may fluctuate if some or all of your money is invested in Mutual Fund Options. Please indicate the amount to be paid, your beneficiaries, their relationships to you, their Social Security numbers, and their birth dates.

Exchanges are permitted, subject to annual exchange limitations.

For example:

Participant dies prior to the exhaustion of the account.

––Upon their claim, the beneficiary receives payments until the account is exhausted or a lump sum payment of the remaining account balance.

REQUIRED MINIMUM DISTRIBUTION: A minimum distribution of your account is required to begin when you attain age 70 1/2. This payment option will only pay the minimum that is required to be paid to you each year. The amount that is required to be distributed will be calculated for each distribution year in accordance with regulations under Section 401(a)(9) of the Internal Revenue Code. The Required Minimum Distribution (RMD) will usually be different for each year because of the changes in your account balance and the change in your life expectan- cy. This payment option is not available unless you have attained age 70 1/2 and your account cannot be rolled over to another

eligible retirement plan or IRA. Please indicate the amount to be paid, your beneficiaries, their relationships to you, their Social Security numbers, and their birth dates

For example:

Participant dies prior to the exhaustion of the account.

PURCHASED ANNUITY OPTIONS: Your account is removed from the Administrator’s Accumulation System and your account balance is used to purchase an annuity contract that you select. Purchase rates are subject to change monthly. However, once you have purchased an annuity, the benefit amount will remain the same for the life of the annuity. You will receive an annuity certificate stating the terms of the con- tract. You will no longer receive quarterly statements.

SINGLE LIFE ANNUITY: This option provides equal payments over your lifetime. At the participant’s death, payments will stop. There is no named beneficiary. Attach proof of date of birth.

For example:

Annuitant dies after two payments are made - no death benefit payable.

LIFE INCOME WITH PAYMENTS CERTAIN: This option provides payments for your lifetime. If you die before the selected number of guaranteed payments has been made, payments will continue to your named beneficiary until the total number of guaranteed payments (5, 10, 15, 20, 25, or 30 years) has been made to you and your beneficiary. If you die after the guaranteed number of payments has been made, no death benefit is payable. Please select a guaranteed period and indicate your beneficiaries, their relationships to you, their Social Security numbers and their birth date and attach proof of your date of birth.

For example:

20 Years Certain – Annuitant dies in the 5th year.

JOINT & SURVIVOR: This option provides payments for you and your survivor for your lifetimes. Upon your death, payments will contin- ue to survivor, if he or she is living. No other beneficiaries are permitted under this option. Payments to the survivor may be a percentage (50%, 66 2/3%, 75% 100%) of the original amount. Please name your survivor, the survivor’s relationship to you, the survivor’s Social Security number, and the survivor’s birth date.

For example:

Annuitant dies and survivor is still living.

––Survivor receives the monthly benefit for as long as they live at 50%, 66 2/3%, 75%, or 100% of the original amount. Annuitant dies and survivor is also deceased.

––No death benefit, once the annuitant and the survivor are deceased the annuity is over.

FIXED DESIGNATED PERIOD: This option provides for payments for the number of years chosen. You may select any whole number of years between 3 and 20, inclusive. If you should die before the end of the period, payments will continue to the beneficiary. Please indi- cate the number of years to be paid, your beneficiaries, their relationships to you, their Social Security numbers, and their birth dates.

For example:

Annuitant dies prior to the end of the designated number of years.

DESIGNATED AMOUNT: This option provides for payments of a specified dollar amount. The length of the payout is determined by the account value and a set purchase rate. If you should die before the annuity is exhausted, your beneficiary could either continue the pay- out or receive the remaining lump sum.

For example:

Annuitant dies before all annuity payments are received.

Nationwide Retirement Solutions • PO Box 182797 • Columbus, Ohio 43218 • |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The DC 4212 1211 form serves to claim benefits as a beneficiary or alternate payee from the Maryland Supplemental Retirement Plan. |

| Eligibility Criteria | Only eligible beneficiaries such as spouses, ex-spouses, non-spouses, or other designated parties can file the claim using this form. |

| Required Documentation | When claiming as a beneficiary, a certified copy of the death certificate is required to process the claim. For minor claimants, legal guardianship papers must also be included. |

| Governing Law | This form is governed by Maryland state law surrounding retirement benefits and domestic relations orders. |

Guidelines on Utilizing Dc 4212 1211

Filling out the DC 4212 1211 form is a straightforward process, but it’s essential to pay attention to each section to ensure accuracy. After completing the form, you’ll need to submit it along with any required documents, such as a death certificate or guardianship papers if applicable. This submission will initiate the claims process.

- Begin with Section 1 - Participant Information: Indicate whether you are filing a Beneficiary Claim or an Alternate Payee Claim by checking the appropriate box.

- Fill in the Participant’s Name: Write the name of the participant whose retirement account you are claiming.

- Provide Social Security Number: Enter the participant’s Social Security number.

- Claimant’s Information: Write down your name, Social Security number, and date of birth.

- Mailing Address: Fill in your complete mailing address, including street, city, state, and zip code.

- Section 2 - Select Beneficiary(ies): Check the box if this is a change of beneficiary and list the names, relationships, Social Security numbers, and birth dates of all beneficiaries you wish to designate.

- If needed, attach additional sheets: Check the appropriate box if you require more space for beneficiaries.

- Section 3 - Payout Options: If applicable, submit a certified copy of the death certificate and, if the claimant is a minor, include legal guardianship papers.

- Select the Plan Type: Choose from the 457(b) Plan, 401(a) Plan, 401(k) Plan, or 403(b) Plan.

- Choose a Payout Option: Decide whether to receive a lump sum, systematic withdrawal, or purchased annuity. Fill in required amounts and select frequencies for systematic withdrawals.

- If applicable, complete Section 4: Indicate your choice regarding eligible rollover distribution options. Note that this only applies to Spousal Beneficiaries and Ex-Spousal Alternate Payees.

- Section 5 - Authorization: Read the “Special Tax Notice Regarding Plan Payments” and sign and date the form.

- Make Copies: Keep a copy of the completed form for your records and prepare the original for submission.

Once you've completed all these steps, submit the form and any required documents to the designated address. For any uncertainties or questions, consider reaching out to the appropriate contact numbers provided on the form for assistance.

What You Should Know About This Form

What is the DC 4212 1211 form used for?

The DC 4212 1211 form is designed for individuals involved in the Maryland Supplemental Retirement Plan. This form allows participants to claim benefits as either a beneficiary or alternate payee under a Domestic Relations Order. It facilitates the process of designating recipients for retirement plan payouts after the death or divorce of the participant.

Who can file a claim using this form?

Claims can be filed by beneficiaries such as spouses, ex-spouses, non-spouses, or other designated individuals. Additionally, alternate payees who may have received benefits through a Domestic Relations Order can also utilize this form. Each claimant must provide their personal details and the necessary documents.

What information is required on the form?

The form requests personal information about both the participant and the claimant. Details such as full names, Social Security numbers, dates of birth, and mailing addresses are mandatory. Furthermore, the form requires the claimant to identify their relationship to the participant and to complete beneficiary designations, if applicable.

Do I need to submit any additional documents with the claim?

Yes, for a beneficiary claim, a certified copy of the participant's death certificate must be submitted along with the form. If the claimant is a minor, legal guardianship papers must also be included. In cases where there are multiple claimants, each must complete a separate form and the documents must be submitted simultaneously.

What payout options are available on the DC 4212 1211 form?

The form provides several payout options including lump sum payments, systematic withdrawals, and purchased annuities. Claimants can choose from partial lump sums, complete account balances, or specify a recurring withdrawal amount over designated time periods. Note that not all options are available for non-spousal beneficiaries. Detailed descriptions of each option are included on the form.

What is a Direct Rollover option, and who can elect it?

The Direct Rollover option allows spousal beneficiaries and ex-spousal alternate payees to transfer retirement funds directly to another eligible retirement plan or an IRA without incurring immediate tax liabilities. To process this rollover, a Letter of Acceptance from the new financial institution is required, along with the appropriate details filled out on the form.

How is the tax withholding managed for distributions?

The form indicates that for eligible rollover distributions, 20% of the taxable amount will be withheld for federal income taxes. Claimants have the option to receive payments directly, in which case taxes will still apply under federal regulations. It is beneficial to review the tax implications associated with each payout option prior to making a selection.

What if I want to change my beneficiary designation?

If there is a desire to change the beneficiary designation, the current form provides an option to indicate this change. New beneficiaries listed will replace any previously designated beneficiaries. It is important to keep such designations updated to reflect your current wishes.

Where can I get help if I have questions about the form?

If there are any uncertainties or questions regarding the form or the claims process, assistance is available by contacting the customer service center of Nationwide Retirement Solutions at 1-800-545-4730. They can provide further clarification and guidance on how to properly complete the form and navigate the claims process.

How do I submit the DC 4212 1211 form?

After completing the DC 4212 1211 form, it should be submitted along with any required documentation to the address specified on the form. It is advisable to keep a copy of the completed form and any supporting materials for your personal records.

Common mistakes

Completing the DC 4212 1211 form can be a straightforward process, but there are common pitfalls that can complicate your submission. One frequent mistake is not providing the required supporting documents. For instance, if this is a beneficiary claim, it is crucial to include a certified copy of the death certificate. Without this document, your claim cannot be processed, delaying access to the funds.

Another common error is failing to update beneficiary information. If you are checking the box to change beneficiaries, make sure all new names and details are accurately filled out. If the form is submitted with incorrect or outdated information, it can result in your intended beneficiaries not receiving their rightful distributions.

Many people also overlook the importance of providing accurate Social Security numbers for both the participant and beneficiaries. Incorrect numbers will lead to complications during processing. Double-check each entry. Errors in this section can lead to delays or even rejections of your claim.

Additionally, selecting the wrong payout option is a frequent mistake. It’s essential to carefully read through the choices available for your specific situation. For example, make sure you understand which payout options are available to non-spousal beneficiaries if you are claiming as one. Wrong selections could lead to unintended tax consequences or issues in receiving the correct amounts.

People sometimes forget the impact of tax withholding on their distributions. Be aware that certain choices, especially those involving direct rollovers or lump sums, may have tax implications. If you opt to receive payments directly, a portion may be withheld for federal taxes. Understanding these details is essential to avoiding surprises later on.

Finally, a major mistake is neglecting to sign and date the form. This may seem trivial, but failing to provide your signature means your claim will not be considered valid. Always ensure that every required section is completed, including your signature and the date, before submitting your claim. Taking the time to review your form can save you from common headaches and secure your benefits without unnecessary delays.

Documents used along the form

The DC 4212 1211 form is crucial for beneficiaries and alternate payees who wish to claim their rights under the Maryland Supplemental Retirement Plan. Along with this form, several other documents are commonly needed to ensure a complete and thorough application process. Each document serves its purpose in facilitating the claimant's request.

- Death Certificate: This document provides proof of the participant's death and is typically required when submitting a beneficiary claim. A certified copy should be included with the claim form to validate the request.

- Legal Guardianship Papers: If the claimant is a minor, these papers establish the claimant's legal guardian and their authority to manage the minor's benefits. They must accompany the DC 4212 1211 form.

- W-4P Form: This form is used to indicate federal income tax withholding for pension payments. It needs to be submitted alongside the DC 4212 1211 form to ensure compliance with tax regulations.

- Domestic Relations Order (DRO): Required in cases where the alternate payee is an ex-spouse. This official court document outlines the rights of the alternate payee to the participant's retirement benefits and must be included to validate the claim.

- Letter of Acceptance from New Carrier: If the claimant opts for a direct rollover of funds, they must obtain this letter from the financial institution where the funds will be rolled over. It ensures that the receiving institution acknowledges the incoming funds.

Gathering these documents helps streamline the claims process and ensures that all necessary information is presented. A complete submission significantly increases the chances of a successful claim, allowing beneficiaries and alternate payees to access their rightful benefits without unnecessary delays.

Similar forms

The DC-4212-1211 form is used in the context of beneficiary and alternate payee claims regarding retirement benefits in Maryland. It shares similarities with several other documents commonly used in retirement and benefits management. Below is a list of seven such documents, along with how they relate to the DC-4212-1211 form.

- Beneficiary Designation Form: Like the DC-4212-1211, this form is used to designate who will receive benefits upon a participant’s death. It allows individuals to update their beneficiaries and often requires identifying details of both the participant and the beneficiaries.

- Domestic Relations Order (DRO): This document specifies how retirement benefits should be divided in the event of a divorce. Similar to the DC-4212-1211, it involves claims from alternate payees, ensuring that the designated parties receive their entitled shares.

- Request for Distribution Form: Used to initiate the payout process from retirement accounts, this form serves a purpose akin to that of the DC-4212-1211. It outlines various distribution options, including lump sums and systematic withdrawals.

- IRA Beneficiary Designation Form: This form allows individuals to specify beneficiaries for their Individual Retirement Accounts (IRAs). It shares the same objective as the DC-4212-1211 in clearly outlining intended recipients for retirement assets.

- Withdrawal Request Form: Similar to the DC-4212-1211, this form is used to request a withdrawal from a retirement plan. It also requires the claimant to specify the type of withdrawal and details about recipients if applicable.

- Qualified Domestic Relations Order (QDRO): This court order recognizes the right of an alternate payee to receive a portion of a retirement plan. Like the DC-4212-1211, it is vital for ensuring that divorced individuals receive their fair share of retirement assets.

- Pension Benefit Claim Form: This document is necessary for initiating a claim for pension benefits after an individual’s retirement or death. It is similar to the DC-4212-1211 as both require claimant information and details about beneficiaries.

Dos and Don'ts

When filling out the DC 4212 1211 form, it’s essential to ensure accuracy and completeness. Here are five key points to keep in mind:

- Do: Carefully read all instructions before starting. Understanding the requirements can help prevent errors.

- Don’t: Rush through the form. Take your time to ensure all information is accurate and complete.

- Do: Double-check Social Security numbers for both the participant and beneficiaries. Mistakes can lead to processing delays.

- Don’t: Leave any sections blank, especially those related to payout options. Missing information can result in rejection of your claim.

- Do: Contact customer support for any questions. They can provide guidance and clarification when needed.

Filling out forms can sometimes feel overwhelming. By following these tips, you can increase the likelihood of a smooth process, ensuring that your claims are handled promptly and accurately.

Misconceptions

Understanding the DC 4212 1211 form can require careful attention, especially considering the many misconceptions surrounding it. Here are five common myths and the facts that clarify them:

- Myth 1: This form is only for spousal beneficiaries.

- Myth 2: You can submit the form without supporting documents.

- Myth 3: All payout options are available for every beneficiary type.

- Myth 4: Only one form needs to be submitted, regardless of the number of claimants.

- Myth 5: You cannot make changes to beneficiaries once designated.

This is not accurate. The form is designed for various types of claimants, including ex-spouses, non-spouses, and other designated beneficiaries. Individuals should assess their eligibility based on their relationship to the participant.

Submitting the form without necessary documents is not advisable. Claimants must include a certified copy of the death certificate when applicable, and minors need to submit legal guardianship papers. Incomplete submissions may delay processing.

This is a misconception. Not all payout options are permissible for non-spousal beneficiaries. It's important to review the specific options available and choose accordingly.

This is incorrect. If there are multiple claimants, each must complete their own form. All documents should be submitted at the same time for efficient processing.

This statement is not true. The form allows individuals to change their beneficiaries by checking the designated box, effectively replacing any prior designations. It's crucial to keep this updated to reflect your current wishes.

Key takeaways

Understanding the DC 4212 1211 form can help ensure smooth processing of your beneficiary claims or alternate payee claims within Maryland's retirement plan. Here are some key takeaways:

- The form has different sections to fill out depending on whether you are applying as a beneficiary or an alternate payee.

- Accurate participant and claimant information is critical. Make sure to provide correct names, social security numbers, and mailing addresses.

- You may need to submit additional documents, such as a certified death certificate and legal guardianship papers if applicable.

- Choose your payout option carefully. You can select a lump sum, systematic withdrawal, or various annuity options, each with its own implications.

- If you are eligible for rollover distributions, be prepared to provide a Letter of Acceptance from the receiving financial institution.

Filling out this form correctly will help ensure that your request is processed without unnecessary delays. For further assistance, don’t hesitate to reach out to the contact number provided on the form.

Browse Other Templates

OHR Leave Application - The form must be submitted to the Office of Human Resources for official processing.

Employee Profiling Template - We value the diversity of our workforce as reflected in this form.

Nc Divorce Papers - Understand the implications of marital property and debt before filing.