Fill Out Your Dd Form

The DD Form 2058, known as the State of Legal Residence Certificate, serves multiple vital purposes for military personnel, particularly regarding income tax withholding. This form gathers essential information about a service member's legal residence, which is crucial for determining the appropriate state for withholding state income taxes from military pay. Comprised of various fields, the form requests personal details such as the individual’s name, Department of Defense ID number, and current mailing address. Moreover, it seeks clarification on the legal residence or domicile, which is pivotal in establishing where income taxes should be directed. The form intertwines with federal regulations, including the Soldiers’ and Sailors’ Civil Relief Act, which safeguards military pay from state income taxes based on military orders, provided the service member's legal residence remains unchanged. This certificate emphasizes the distinction between an individual's home of record and legal residence, as each can bear different tax implications and legal responsibilities. While the provision of this information is voluntary, failure to submit the form may result in state taxes being withheld according to the laws of the individual's former legal residence. Therefore, understanding the DD Form 2058 is vital for ensuring compliance with tax obligations and safeguarding benefits related to residency status.

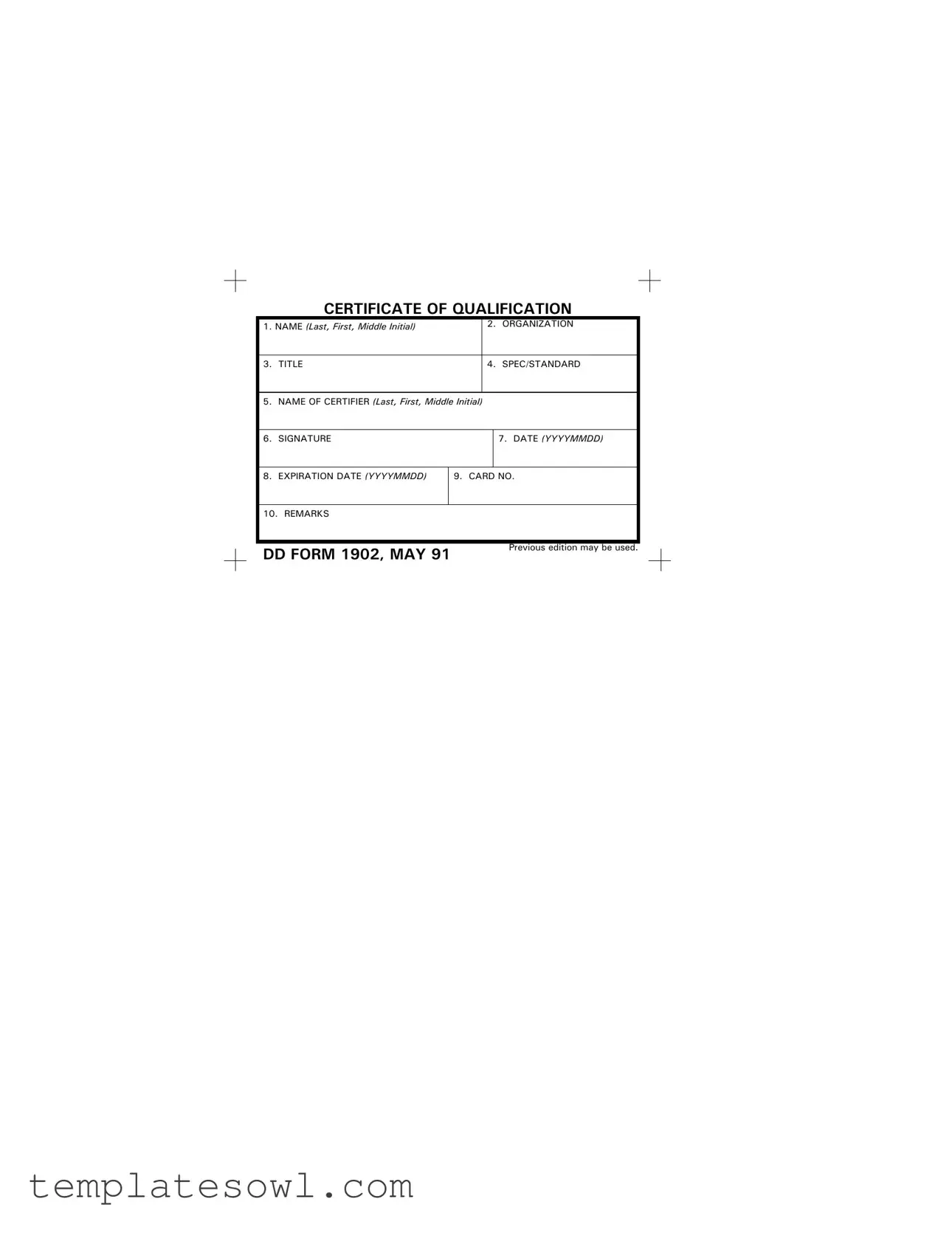

Dd Example

STATE OF LEGAL RESIDENCE CERTIFICATE

PRIVACY ACT STATEMENT

AUTHORITY: 50 U.S.C 571, Residence for tax purposes and 37 U.S.C., Pay and Allowances of the Uniformed Services.

PURPOSE: Information is required for determining the correct State of legal residence for purposes of withholding State income taxes from military pay.

ROUTINE USES: Additional routine uses are listed in the applicable system of records notices, T7340, Defense Joint Military Pay

Component, and T7344, Defense Joint Military Pay

DISCLOSURE: Voluntary, however, if not provided, State income taxes will be withheld based on the tax laws of the applicable State, based on your home of record.

1.NAME (Last, First, Middle Initial)

2. DOD ID NUMBER

3. LEGAL RESIDENCE/DOMICILE (City or county and State)

INSTRUCTIONS FOR CERTIFICATION OF STATE OF LEGAL RESIDENCE

The purpose of this certificate is to obtain information with respect to your legal residence/domicile for the purpose of determining the State for which income taxes are to be withheld from your "wages" as defined by Section 3401(a) of the Internal Revenue Code of 1954. PLEASE READ INSTRUCTIONS CAREFULLY BEFORE SIGNING.

The terms "legal residence" and "domicile" are essentially interchangeable. In brief, they are used to denote that place where you have your permanent home and to which, whenever you are absent, you have the intention of returning. The Soldiers’ and Sailors’ Civil Relief Act protects your military pay from the income taxes of the State in which you reside by reason of military orders unless that is also your legal residence/domicile. The Act further provides that no change in your State of legal residence/domicile will occur solely as a result of your being ordered to a new duty station.

You should not confuse the State which is your "home of record" with your State of legal residence/domicile. Your "home of record" is used for fixing travel and transportation allowances. A "home of record" must be changed if it was erroneously or fraudulently recorded initially.

Enlisted members may change their "home of record" at the time they sign a new enlistment contract. Officers may not change their "home of record" except to correct an error, or after a break in service. The State which is your "home of record" may be your State of legal residence/domicile only if it meets certain criteria.

The formula for changing your State of legal residence/domicile is simply stated as follows: physical presence in the new State with the simultaneous intent of making it your permanent home and abandonment of the old State of legal residence/domicile. In most cases, you must actually reside in the new State at the time you form the intent to make it your permanent home. Such intent must be clearly indicated. Your intent to make the new State your permanent home may be indicated by certain actions such as: (1) registering to vote; (2) purchasing residential property or an unimproved residential lot; (3) titling and registering your automobile(s); (4) notifying the State of your previous legal residence/domicile of the change in your State of legal residence/domicile; and (5) preparing a new last will and testament which indicates your new State of legal residence/domicile. Finally, you must comply with the applicable tax laws of the State which is your new legal residence/domicile.

Generally, unless these steps have been taken, it is doubtful that your State of legal residence/domicile has changed. Failure to resolve any doubts as to your State of legal residence/domicile may adversely impact on certain legal privileges which depend on legal residence/domicile including among others, eligibility for resident tuition rates at State universities, eligibility to vote or be a candidate for public office, and eligibility for various welfare benefits. If you have any doubt with regard to your State of legal residence/domicile, you are advised to see your Legal Assistance Officer (JAG Representative) for advice prior to completing this form.

I certify that to the best of my knowledge and belief, I have met all the requirements for legal residence/domicile in the State claimed above and that the information provided is correct.

I understand that the tax authorities of my former State of legal residence/domicile will be notified of this certificate.

4. SIGNATURE OF APPLICANT

5.CURRENT MAILING ADDRESS (Include Zip Code)

6.DATE (YYMMDD)

DD FORM 2058, JAN 2018 |

PREVIOUS EDITION IS OBSOLETE. |

AEM Designer |

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Authority | The DD Form is governed by Title 50 U.S.C. 571 and 37 U.S.C., which relate to residence for tax purposes and military pay, respectively. |

| Purpose of the Form | This form is essential for determining the correct state of legal residence, primarily to withhold state income taxes from military pay. |

| Voluntary Disclosure | While providing information on the form is voluntary, failure to do so results in tax withholding based on the state of record. |

| Legal Residence Definition | Legal residence and domicile are interchangeable terms, indicating where a person has their permanent home and intends to return. |

| Impact of Military Orders | The Soldiers’ and Sailors’ Civil Relief Act protects military pay from state income taxes, unless the state is also the legal residence. |

| Home of Record vs. Legal Residence | Your home of record is used for travel allowances and may differ from your state of legal residence or domicile. |

| Changing Legal Residence | To change your legal residence, you must demonstrate physical presence and the intention to make the new state your permanent home. |

| Evidencing Intent | Intent to establish a new legal residence can be shown through actions like registering to vote or purchasing property. |

| Legal Assistance | If uncertain about your legal residence status, consulting with a Legal Assistance Officer (JAG Representative) is highly advised. |

Guidelines on Utilizing Dd

Filling out the DD Form is essential for establishing your state of legal residence for tax purposes. This process ensures that your military pay is taxed accurately based on your actual legal residence. Careful attention to the instructions will help streamline the process.

- Gather necessary information. Ensure you have your full name, DOD ID number, current mailing address, and date.

- Fill in your name. Write your last name, followed by your first and middle initial in the designated spaces.

- Enter your DOD ID number. This number is important for identifying your military records.

- Provide your legal residence/domicile. List the city or county and state where you have established your legal residence.

- Sign the form. Your signature certifies that you have provided accurate information regarding your legal residence/domicile.

- Include your current mailing address. This should be the address where you can receive correspondence.

- Fill in the date. Use the format YYMMDD to indicate when you completed the form.

After completing these steps, submit the form as required by your military branch. Maintain a copy for your records, as it is useful for future reference or verification.

What You Should Know About This Form

What is the purpose of the DD Form 2058?

The primary purpose of the DD Form 2058, also known as the State of Legal Residence Certificate, is to determine the correct state from which to withhold state income taxes for military personnel. This form is crucial in establishing an individual’s legal residence or domicile, which directly affects tax obligations. By submitting this form, service members can clarify their legal residence, helping to ensure that they are taxed according to the rules of their actual state of residence rather than their home of record.

How does one establish legal residence or domicile using the DD Form 2058?

Establishing legal residence or domicile essentially requires the individual to demonstrate physical presence in a new state along with a clear intent to make it their permanent home. This can involve registering to vote in the new state, purchasing property, or updating vehicle registrations. Additionally, it is important to notify the previous state of residence about the change. Documenting these actions can substantiate one's claim of having established a new legal residence. However, unless specific criteria are met, the previous state may continue to be considered the legal residence.

Is it mandatory to fill out the DD Form 2058?

Completing the DD Form 2058 is voluntary, but choosing not to submit the form could have financial implications. If the form is not provided, the individual's state income taxes will be withheld based on their home of record rather than their actual state of residence. This may lead to higher tax liabilities than if the individual had properly declared their legal residence. Therefore, submitting the form can be beneficial for most service members seeking to ensure they are taxed in line with their actual living situation.

What should someone do if they have doubts regarding their legal residence?

If uncertainties arise about which state serves as one’s legal residence or domicile, it is advisable to consult with a Legal Assistance Officer or a JAG Representative. These professionals can provide guidance tailored to one’s specific situation. Clarifying these details is essential, as legal residence impacts various rights and benefits, including eligibility for in-state tuition rates at public universities, ability to vote, and access to state-specific welfare benefits. Taking proactive steps can help resolve any potential issues before they affect one’s legal status.

Common mistakes

Completing the DD Form can be daunting, and many individuals encounter pitfalls along the way. One of the most common mistakes is not providing the full, legal name in the designated fields. It's essential to include your last name, first name, and middle initial, as this ensures the accuracy of your records. Omitting part of your name can lead to confusion when processing your information.

Another frequent error is misunderstanding the concept of legal residence versus home of record. People often confuse these terms, leading to inaccurate information. Your legal residence is where you plan to return, while your home of record relates to military pay and travel allowances. Misidentifying these can have financial repercussions, impacting your state income tax obligations.

Failure to provide a current mailing address is also a common oversight. This information is crucial as it ensures that any correspondence from military and tax authorities reaches you without delay. Leaving this section blank may leave you in the dark about important notifications or updates relevant to your status.

Many individuals neglect to review the instructions carefully before signing the form. Each section has specific mandates that help clarify your intent and residence. Skipping this step can result in misinformation, which in turn, complicates your tax situation.

Some individuals forget to double-check their signatures. A signature that does not match the name provided may raise red flags during processing. It is crucial to be consistent to avoid unnecessary complications.

Submitting the form without the date is yet another error. The date validates your submission and helps establish timelines for processing your information. Neglecting this simple step can delay your application.

People also sometimes fail to demonstrate the intent to change their legal residence adequately. Actions such as registering to vote or purchasing property in the new state should be clearly noted. Without this evidence, it may be challenging to establish your claim, creating issues when tax obligations arise.

Another issue arises when individuals attempt to change their legal residence without truly abandoning their old one. The law requires that you physically reside in the new state and show intent to make it your permanent home. Failure to do so can lead to complications with tax liabilities.

Lastly, many individuals do not seek advice if they are unsure about their legal residence status. Consulting with a Legal Assistance Officer or JAG representative can provide clarity and prevent costly mistakes. It's always better to seek guidance than to risk financial consequences later.

Documents used along the form

The DD Form, specifically the State of Legal Residence Certificate, is an essential document for military personnel, as it determines state income tax withholding from military pay. Alongside this form, several other documents often accompany it to provide further clarity on the individual’s legal status, benefits, and financial obligations. Below is a list of commonly associated forms and documents.

- DD Form 214: This document serves as a certificate of release or discharge from active duty. It provides vital discharge information and is important for veterans seeking benefits and services after service completion.

- W-4 Form: Used by employees to indicate their tax withholding preferences, this form helps ensure the correct amount of federal income tax is deducted from an individual's paycheck, aligning with their tax situation.

- SGLI Election and Certificate (SGLV 8286): This document enables military members to select and adjust life insurance coverage. It ensures that beneficiaries are clearly identified and that the service member's preferences are documented.

- VA Form 21-526EZ: This application for disability compensation is essential for veterans seeking benefits due to service-related injuries or conditions. It collects valuable information necessary for processing claims.

- State Tax Withholding Form: Each state may have its own form for employees to indicate their state tax withholding preferences. This document ensures that the appropriate state taxes are withheld from military pay based on the individual’s state of legal residence.

Utilizing these forms and documents helps ensure that service members are aware of their responsibilities and rights regarding tax obligations, benefits, and protections. Proper documentation fosters transparency and eases the navigation of legal and financial matters for military personnel.

Similar forms

-

DD Form 214 - Certificate of Release or Discharge from Active Duty: Like the DD Form, this document is pivotal for military personnel, providing proof of service and discharge status. Both forms serve essential functions that relate to legal benefits and entitlements.

-

DA Form 31 - Request and Authority for Leave: Similar to the DD Form, the DA Form 31 is a key document used in the military context, requiring personal information for leave authorization. Both forms emphasize the importance of accurate personal data for official processing.

-

SF-86 - Questionnaire for National Security Positions: This document collects extensive personal information, akin to the DD Form's purpose in verifying legal residence. Both are required to determine eligibility for various benefits and duties.

-

VA Form 22-1990 - Application for VA Education Benefits: Similar in function to the DD Form, this form requires specific personal and residency details. Both documents play roles in ensuring individuals can access appropriate benefits and services.

-

DD Form 256 - Honorable Discharge Certificate: This document also indicates the status and history of military service, much like the DD Form does for tax residence. Both confirm important information regarding a service member’s legal situation.

-

Form W-4 - Employee’s Withholding Certificate: The W-4 is used to collect personal and tax residency information for withholding purposes, akin to the DD Form's focus on state tax implications for military personnel.

-

IRS Form 8832 - Entity Classification Election: Similar in its formal requirements, this IRS form addresses tax classifications that can affect residency status. Like the DD Form, it necessitates attention to residency issues for legal purposes.

-

DD Form 2656 - Data for Payment of Retired Personnel: This form captures essential information regarding a retiree's status and residency for payment purposes. Both documents require careful attention to detail to ensure accurate legal and financial outcomes.

Dos and Don'ts

When filling out the DD Form 2058, it is essential to adhere to guidelines to ensure accurate and effective completion. The following list outlines what to do and what to avoid.

- Do read the instructions carefully before signing the form.

- Do provide your full legal name, including last, first, and middle initial.

- Do confirm that your stated legal residence aligns with your intent to make it your permanent home.

- Do seek advice from a Legal Assistance Officer if you have doubts regarding your legal residence.

- Don't confuse your "home of record" with your state of legal residence/domicile.

- Don't leave out critical details such as your DOD ID number or current mailing address.

Accuracy and clarity in completing this form contribute significantly to ensuring appropriate withholding of state income taxes. Your diligence will help mitigate potential complications in the future.

Misconceptions

There are many misunderstandings surrounding the DD Form, also known as the State of Legal Residence Certificate. Here are some common misconceptions and clarifications regarding this vital form:

- Only military personnel need to use the DD Form. This form is primarily for military members, but their dependents may also need to complete it under certain circumstances.

- Filling out the form is mandatory. While it’s voluntary to provide this information, not submitting the form means taxes will be withheld based on your home of record.

- Legal residence and home of record are the same. They are different. Your home of record is established for travel allowances, while legal residence determines tax withholding.

- Changing duty stations changes your legal residence. Moving for orders does not automatically change your legal residence. Intent and actions are needed to make that change.

- Once legal residence is set, it can't be changed. It can be changed, but you must show physical presence and the intention to remain in the new location.

- A verbal statement is enough to establish legal residence. Actions, like registering to vote or buying property, solidify your claim more effectively than just a verbal assertion.

- Tax benefits are guaranteed regardless of the form. Completing the form correctly is essential for any tax benefits related to your legal residence to be properly recognized.

- All states have the same criteria for legal residence. Each state has specific laws that govern residency. It’s crucial to check the rules of the state you are claiming.

- Your signature on the form is merely a formality. Your signature certifies that all information is correct and that you understand the implications of your legal residence status.

Key takeaways

Filling out the DD Form 2058, known as the State of Legal Residence Certificate, is an important process for military personnel. Here are some key takeaways to help you navigate the form effectively:

- Determine Your Legal Residence: The form helps establish your state of legal residence for tax purposes. This is different from your home of record. Your legal residence is where you intend to return, while the home of record is used for travel allowances.

- Understand the Purpose: The information collected is necessary for withholding state income taxes from your military pay. Ensure you provide accurate details to avoid unnecessary tax withholdings.

- Intent Matters: To change your state of legal residence, you must show clear intention. Actions like registering to vote or purchasing property can indicate that you plan to make the new state your permanent home.

- Legal Protections: The Soldiers’ and Sailors’ Civil Relief Act protects your military pay from income taxes based on military orders. Be aware that moving to a new duty station doesn’t automatically change your legal residence.

- Seek Guidance if Unsure: If you have any doubts about your legal residence or how to fill out the form, consult with your Legal Assistance Officer (JAG Representative) before submitting it.

Completing the DD Form 2058 accurately is vital for your tax status and legal rights. Be thoughtful and thorough when filling it out.

Browse Other Templates

Clinical Forms - Patient birthdate and sex are necessary demographic details on the form.

Wells Fargo Check Styles - Coastal Views Leather captures the serene beauty of seaside landscapes.