Fill Out Your Dd 2762 Form

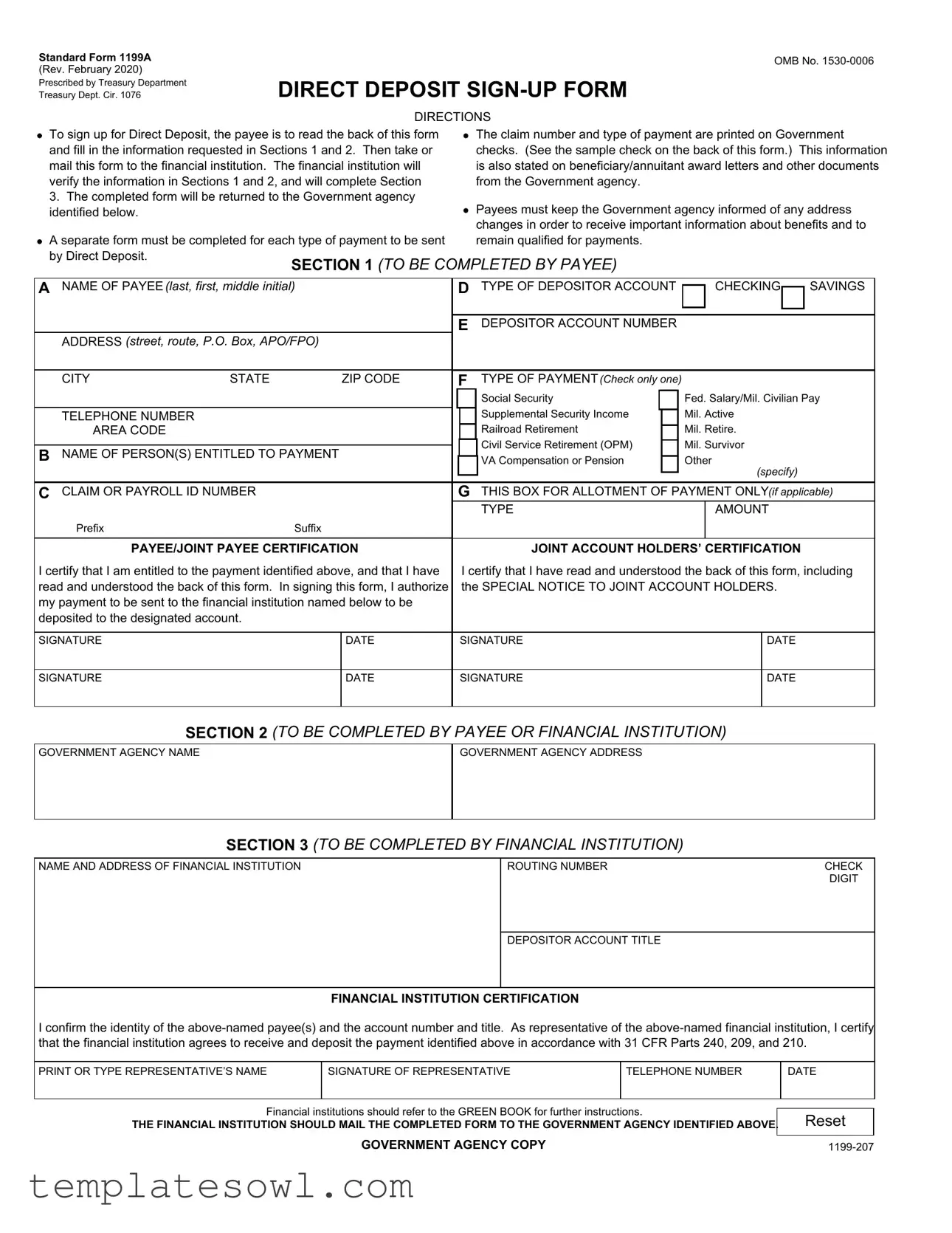

The DD 2762 form, officially known as the Standard Form 1199A, plays a crucial role in the Direct Deposit Sign-Up process for individuals receiving federal payments. Understanding this form is essential for ensuring that your funds are deposited directly into your bank account without delay. The form is divided into three sections, with the first two completed by the payee and the financial institution, respectively. Payees must provide personal details such as their name, address, and account information, while the financial institution verifies this information before returning the completed form to the specified government agency. It's important to note that a separate DD 2762 form must be filled out for each type of payment, whether it be Social Security, military benefits, or civilian pay. Keeping the government informed of any address changes is critical to continue receiving benefits and to ensure compliance with eligibility requirements. Additionally, specific areas of the form cater to joint account holders and allotments, emphasizing the importance of open communication among all parties involved. Failing to adhere to the instructions may delay the processing of payments, so thorough completion and submission of the DD 2762 form is a vital step in maintaining financial stability while receiving federal benefits.

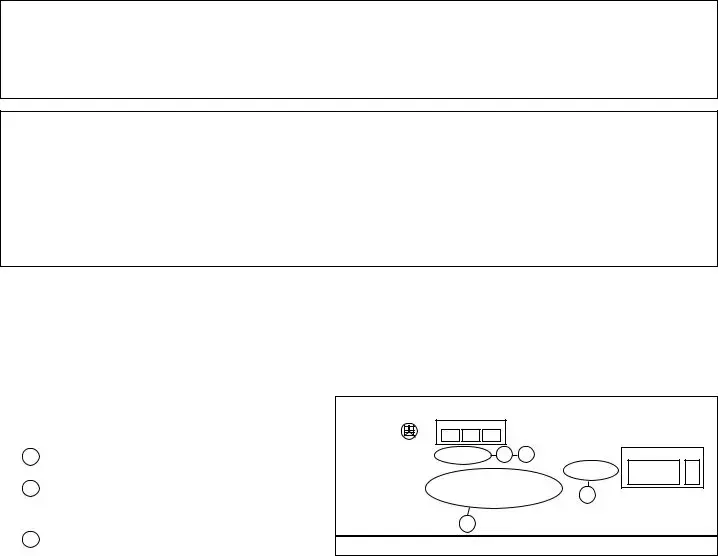

Dd 2762 Example

Standard Form 1199A |

OMB No. |

(Rev. February 2020) |

|

Treasury Dept. Cir. 1076 |

DIRECT DEPOSIT |

Prescribed by Treasury Department |

|

|

DIRECTIONS |

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

3.The completed form will be returned to the Government agency identified below.

A separate form must be completed for each type of payment to be sent by Direct Deposit.

A separate form must be completed for each type of payment to be sent by Direct Deposit.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

A NAME OF PAYEE (last, first, middle initial) |

|

D TYPE OF DEPOSITOR ACCOUNT |

|

CHECKING |

|

SAVINGS |

|||||||

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

DEPOSITOR ACCOUNT NUMBER |

|

|

|

|

|

||

ADDRESS (street, route, P.O. Box, APO/FPO) |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

STATE |

|

ZIP CODE |

|

F |

TYPE OF PAYMENT (Check only one) |

|

|

|

|

|

||

|

|

|

|

|

|

Social Security |

|

|

Fed. Salary/Mil. Civilian Pay |

||||

TELEPHONE NUMBER |

|

|

|

|

|

Supplemental Security Income |

|

|

Mil. Active |

|

|||

AREA CODE |

|

|

|

|

|

Railroad Retirement |

|

|

Mil. Retire. |

|

|||

|

|

|

|

|

|

Civil Service Retirement (OPM) |

|

|

Mil. Survivor |

|

|||

B NAME OF PERSON(S) ENTITLED TO PAYMENT |

|

|

|

||||||||||

|

|

VA Compensation or Pension |

|

|

Other |

|

|||||||

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

(specify) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C CLAIM OR PAYROLL ID NUMBER |

|

|

|

G THIS BOX FOR ALLOTMENT OF PAYMENT ONLY(if applicable) |

|||||||||

|

|

|

|

|

|

TYPE |

|

AMOUNT |

|

||||

Prefix |

|

Suffix |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

PAYEE/JOINT PAYEE CERTIFICATION |

|

|

JOINT ACCOUNT HOLDERS’ CERTIFICATION |

|

|||||||||

I certify that I am entitled to the payment identified above, and that I have |

|

I certify that I have read and understood the back of this form, including |

|||||||||||

read and understood the back of this form. In signing this form, I authorize |

|

the SPECIAL NOTICE TO JOINT ACCOUNT HOLDERS. |

|

||||||||||

my payment to be sent to the financial institution named below to be |

|

|

|

|

|

|

|

|

|

|

|||

deposited to the designated account. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

DATE |

|

SIGNATURE |

|

|

DATE |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

DATE |

|

SIGNATURE |

|

|

DATE |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 2 (TO BE COMPLETED BY PAYEE OR FINANCIAL INSTITUTION)

GOVERNMENT AGENCY NAME

GOVERNMENT AGENCY ADDRESS

SECTION 3 (TO BE COMPLETED BY FINANCIAL INSTITUTION)

NAME AND ADDRESS OF FINANCIAL INSTITUTION |

ROUTING NUMBER |

CHECK |

|

|

DIGIT |

|

|

|

|

DEPOSITOR ACCOUNT TITLE |

|

|

|

|

FINANCIAL INSTITUTION CERTIFICATION

I confirm the identity of the

PRINT OR TYPE REPRESENTATIVE’S NAME |

SIGNATURE OF REPRESENTATIVE |

TELEPHONE NUMBER |

DATE |

|

|

|

|

|

|

Financial institutions should refer to the GREEN BOOK for further instructions. |

|

|

||

|

Reset |

|||

THE FINANCIAL INSTITUTION SHOULD MAIL THE COMPLETED FORM TO THE GOVERNMENT AGENCY IDENTIFIED ABOVE. |

|

|||

|

GOVERNMENT AGENCY COPY |

|

|

|

|

|

|

||

Standard Form 1199A |

OMB No. |

(Rev. February 2020) |

|

Treasury Dept. Cir. 1076 |

DIRECT DEPOSIT |

Prescribed by Treasury Department |

|

|

DIRECTIONS |

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

3.The completed form will be returned to the Government agency identified below.

A separate form must be completed for each type of payment to be sent by Direct Deposit.

A separate form must be completed for each type of payment to be sent by Direct Deposit.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

A NAME OF PAYEE (last, first, middle initial) |

D TYPE OF DEPOSITOR ACCOUNT |

|

CHECKING |

|

SAVINGS |

|||||||||

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

DEPOSITOR ACCOUNT NUMBER |

|

|

|

|

|

||||

ADDRESS (street, route, P.O. Box, APO/FPO) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

STATE |

|

ZIP CODE |

|

F |

TYPE OF PAYMENT (Check only |

one) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security |

|

|

|

Fed. Salary/Mil. Civilian Pay |

||||

TELEPHONE NUMBER |

|

|

|

|

|

Supplemental Security Income |

|

|

|

Mil. Active |

|

|||

AREA CODE |

|

|

|

|

|

Railroad Retirement |

|

|

|

Mil. Retire. |

|

|||

B NAME OF PERSON(S) ENTITLED TO PAYMENT |

|

|

Civil Service Retirement (OPM) |

|

|

Mil. Survivor |

|

|||||||

|

|

VA Compensation or Pension |

|

|

Other |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

(specify) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C CLAIM OR PAYROLL ID NUMBER |

|

|

G THIS BOX FOR ALLOTMENT OF PAYMENT ONLY(if applicable) |

|||||||||||

|

|

|

|

|

|

TYPE |

|

AMOUNT |

|

|||||

Prefix |

|

Suffix |

|

|

|

|

|

|

|

|

|

|

|

|

PAYEE/JOINT PAYEE CERTIFICATION |

|

|

JOINT ACCOUNT HOLDERS’ CERTIFICATION |

|

||||||||||

I certify that I am entitled to the payment identified above, and that I have |

|

I certify that I have read and understood the back of this form, including |

||||||||||||

read and understood the back of this form. In signing this form, I authorize |

|

the SPECIAL NOTICE TO JOINT ACCOUNT HOLDERS. |

|

|||||||||||

my payment to be sent to the financial institution named below to be |

|

|

|

|

|

|

|

|

|

|

|

|||

deposited to the designated account. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

DATE |

|

SIGNATURE |

|

|

DATE |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

DATE |

|

SIGNATURE |

|

|

DATE |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 2 (TO BE COMPLETED BY PAYEE OR FINANCIAL INSTITUTION)

GOVERNMENT AGENCY NAME

GOVERNMENT AGENCY ADDRESS

SECTION 3 (TO BE COMPLETED BY FINANCIAL INSTITUTION)

NAME AND ADDRESS OF FINANCIAL INSTITUTION |

ROUTING NUMBER |

CHECK |

|

|

DIGIT |

|

|

|

|

DEPOSITOR ACCOUNT TITLE |

|

|

|

|

FINANCIAL INSTITUTION CERTIFICATION

I confirm the identity of the

PRINT OR TYPE REPRESENTATIVE’S NAME |

SIGNATURE OF REPRESENTATIVE |

TELEPHONE NUMBER |

DATE |

|

|

|

|

|

|

Financial institutions should refer to the GREEN BOOK for further instructions. |

|

|

||

|

Reset |

|||

THE FINANCIAL INSTITUTION SHOULD MAIL THE COMPLETED FORM TO THE GOVERNMENT AGENCY IDENTIFIED ABOVE. |

|

|||

|

FINANCIAL INSTITUTION COPY |

|

|

|

Standard Form 1199A |

OMB No. |

(Rev. February 2020) |

|

Treasury Dept. Cir. 1076 |

DIRECT DEPOSIT |

Prescribed by Treasury Department |

|

|

DIRECTIONS |

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

3.The completed form will be returned to the Government agency identified below.

A separate form must be completed for each type of payment to be sent by Direct Deposit.

A separate form must be completed for each type of payment to be sent by Direct Deposit.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

A NAME OF PAYEE (last, first, middle initial) |

D TYPE OF DEPOSITOR ACCOUNT |

|

|

CHECKING |

|

SAVINGS |

|||||||||

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

DEPOSITOR ACCOUNT NUMBER |

|

|

|

|

|

|

||||

ADDRESS (street, route, P.O. Box, APO/FPO) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

STATE |

|

ZIP CODE |

|

F |

TYPE OF PAYMENT (Check only |

one) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security |

|

|

Fed. Salary/Mil. Civilian Pay |

|||||

|

|

|

|

|

|

|

Supplemental Security Income |

|

|

Mil. Active |

|

||||

TELEPHONE NUMBER |

|

|

|

|

|

|

|

||||||||

AREA CODE |

|

|

|

|

|

|

Railroad Retirement |

|

|

Mil. Retire. |

|

||||

|

|

|

|

|

|

|

Civil Service Retirement (OPM) |

|

|

Mil. Survivor |

|

||||

B NAME OF PERSON(S) ENTITLED TO PAYMENT |

|

|

|

|

|||||||||||

|

|

|

VA Compensation or Pension |

|

|

Other |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

(specify) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C CLAIM OR PAYROLL ID NUMBER |

|

|

G THIS BOX FOR ALLOTMENT OF PAYMENT ONLY(if applicable) |

||||||||||||

|

|

|

|

|

|

|

TYPE |

|

|

AMOUNT |

|

||||

Prefix |

|

Suffix |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

PAYEE/JOINT PAYEE CERTIFICATION |

|

|

|

JOINT ACCOUNT HOLDERS’ CERTIFICATION |

|

||||||||||

I certify that I am entitled to the payment identified above, and that I have |

|

I certify that I have read and understood the back of this form, including |

|||||||||||||

read and understood the back of this form. In signing this form, I authorize |

|

the SPECIAL NOTICE TO JOINT ACCOUNT HOLDERS. |

|

||||||||||||

my payment to be sent to the financial institution named below to be |

|

|

|

|

|

|

|

|

|

|

|

|

|||

deposited to the designated account. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

DATE |

|

SIGNATURE |

|

|

|

DATE |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

DATE |

|

SIGNATURE |

|

|

|

DATE |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 2 (TO BE COMPLETED BY PAYEE OR FINANCIAL INSTITUTION)

GOVERNMENT AGENCY NAME

GOVERNMENT AGENCY ADDRESS

SECTION 3 (TO BE COMPLETED BY FINANCIAL INSTITUTION)

NAME AND ADDRESS OF FINANCIAL INSTITUTION |

ROUTING NUMBER |

CHECK |

|

|

DIGIT |

|

|

|

|

DEPOSITOR ACCOUNT TITLE |

|

|

|

|

FINANCIAL INSTITUTION CERTIFICATION

I confirm the identity of the

PRINT OR TYPE REPRESENTATIVE’S NAME |

SIGNATURE OF REPRESENTATIVE |

TELEPHONE NUMBER |

DATE |

|

|

|

|

|

|

|

|

|||

Financial institutions should refer to the GREEN BOOK for further instructions. |

Reset |

|||

THE FINANCIAL INSTITUTION SHOULD MAIL THE COMPLETED FORM TO THE GOVERNMENT AGENCY IDENTIFIED ABOVE. |

||||

|

||||

|

PAYEE COPY |

|

||

SF 1199A (Back)

BURDEN ESTIMATE STATEMENT

The estimated average burden associated with this collection of information is 10 minutes per respondent or recordkeeper, depending on individual circumstances. Comments concerning the accuracy of this burden estimates and suggestions for reducing this burden should be directed to the Bureau of the Fiscal Service, Forms Management Officer, Parkersburg, WV

PRIVACY ACT NOTICE

Collection of the information in this Direct Deposit

or another government agency as authorized or required to verify your receipt of federal payments. Although providing the requested information is voluntary, your direct deposit cannot be processed without it.

PLEASE READ THIS CAREFULLY

All information on this form, including the individual claim number, is required under 31 USC 3322, 31 CFR 209 and/ or 210. The information is confidential and is needed to prove entitlement to payments. The information will be used to process payment data from the Federal agency to the financial institution and/or its agent. Failure to provide the requested information may affect the processing of this form and may delay or prevent the receipt of payments through the Direct Deposit/Electronic Funds Transfer Program.

INFORMATION FOUND ON CHECKS

Most of the information needed to complete boxes A, C, and F in Section 1 is printed on your government check:

ABe sure that payee’s name is written exactly as it appears on the check. Be sure current address is shown.

CClaim numbers and suffixes are printed here on checks beneath the date for the type of payment shown here. Check the Green Book for the location of prefixes and suffixes for other types of payments.

FType of payment is printed to the left of the amount.

|

|

|

|

|

|||

Month Day Year |

000 |

|

Check No. |

||||

PHILADELPHIA, PA |

|||||||

08 |

31 |

84 |

0000 415785 |

||||

|

|

|

|||||

|

|

00 |

|

C |

28 28 DOLLARS CTS |

||

Pay to |

|

|

|

|

|

|

|

the order of |

|

|

|

|

F |

|

|

|

|

|

|

|

|

||

|

A |

|

|

|

NOT NEGOTIABLE |

||

|

:00000518’: |

0415771926” |

|

||||

SPECIAL NOTICE TO JOINT ACCOUNT HOLDERS

Joint account holders should immediately advise both the Government agency and the financial institution of the death of a beneficiary. Funds deposited after the date of death or ineligibility, except for salary payments, are to be returned to the Government agency. The Government agency will then make a determination regarding survivor rights, calculate survivor benefit payments, if any, and begin payments.

CANCELLATION

The agreement represented by this authorization remains in effect until cancelled by the recipient by notice to the Federal agency or by the death or legal incapacity of the recipient. Upon cancellation by the recipient, the recipient should notify the receiving financial institution that he/she is doing so.

The agreement represented by this authorization may be cancelled by the financial institution by providing the recipient a written notice 30 days in advance of the cancellation date. The recipient must immediately advise the Federal agency if the authorization is cancelled by the financial institution. The financial institution cannot cancel the authorization by advice to the Government agency.

CHANGING RECEIVING FINANCIAL INSTITUTIONS

The payee’s Direct Deposit will continue to be received by the selected financial institution until the Government agency is notified by the payee that the payee wishes to change the financial institution receiving the Direct Deposit. To effect this change, the payee will contact the paying agency with updated financial information. It is recommended that the payee maintain accounts at both financial institutions until the transaction is complete, i.e. after the new financial institution receives the payee’s Direct Deposit payment.

FALSE STATEMENTS OR FRAUDULENT CLAIMS

Federal law provides a fine of not more than $10,000 or imprisonment for not more than five (5) years or both for presenting a false statement or making a fraudulent claim.

Form Characteristics

| Fact Title | Details |

|---|---|

| Form Purpose | The Dd 2762 form, also known as Standard Form 1199A, is used to set up direct deposit for various government payments. |

| Required Sections | Payees must complete Sections 1 and 2 of the form. The financial institution fills out Section 3. |

| Multiple Payments | A separate Dd 2762 form is needed for each type of payment that needs to be deposited directly. |

| Address Updates | It is crucial for payees to inform the government agency of any address changes to ensure uninterrupted payments. |

| Governing Law | The processing of the form is governed by 31 CFR Parts 240, 209, and 210, as well as privacy provisions under 5 U.S.C. § 552a. |

Guidelines on Utilizing Dd 2762

Filling out the DD 2762 form is crucial for setting up Direct Deposit for various government payments. Following these carefully outlined steps will assist in submitting the form correctly, ensuring that payments are deposited safely into the intended account.

- Provide your name: Fill in the payee's full name (last, first, middle initial) in Section 1, Box A.

- Select the account type: Indicate whether the account is a checking or savings account in Section 1, Box D.

- Enter the account number: Input the depositor account number in Section 1, Box E. Ensure the number is accurate.

- Provide your address: Write the full address, including street, city, state, and zip code, in Section 1, Box E.

- Specify the type of payment: In Section 1, Box F, check only one option that reflects the nature of the payment you are enrolling for.

- List the beneficiary's name: If there are others entitled to payment, include their names in Section 1, Box B.

- Note the claim or payroll ID number: Record this information in Section 1, Box C, as it is necessary for identification.

- Phone number: Enter your telephone number, including the area code, in Section 1, Box F.

- Joint account holder certification: If applicable, joint account holders must read, understand, and sign the certification in the designated area.

- Complete Section 2: The payee or financial institution must fill in the government agency's name and address.

- Financial institution details: The financial institution will complete Section 3, filling out their information along with the routing number.

- Institution certification: A representative of the financial institution needs to print their name, sign, and provide their contact information in Section 3.

- Submission: After completing all sections, either take or mail the form to the designated financial institution for processing.

Each of these steps is important to ensure accurate and timely processing of your Direct Deposit setup. It is essential to double-check all entries for correctness to avoid potential delays in payment. After submission, the financial institution will verify the information and send the completed form to the appropriate government agency for final processing.

What You Should Know About This Form

What is the DD 2762 form used for?

The DD 2762, also known as the Direct Deposit Sign-Up Form, is utilized by payees to establish direct deposit for various types of federal payments. This form allows the government to make payments directly into the payee's bank account, ensuring timely and secure delivery of funds. It is important to complete this form accurately to prevent any delays in payment processing.

Who should complete the DD 2762 form?

The payee, or the individual entitled to receive government payments, is responsible for completing the DD 2762 form. If the payee has a joint account, all account holders must also sign the form. Each type of payment requires a separate form, so ensure that you fill out one for each payment type you expect to receive.

How do I fill out the DD 2762 form?

To complete the DD 2762 form, begin by filling out Sections 1 and 2 with your personal information including your name, address, and type of payment. You will also need to specify your bank details, such as your account number and the type of account (checking or savings). After you finish filling out your portion, submit the form to your financial institution for verification. They will complete Section 3 before returning the form to the appropriate government agency.

What types of payments can I receive through direct deposit with the DD 2762 form?

Through the DD 2762 form, various federal payments can be deposited directly into your bank account. These include Social Security payments, Supplemental Security Income, Military pay, Civil Service Retirement, Railroad Retirement, and VA Compensation or Pension, among others. Be sure to choose one payment type per form.

Can I change my financial institution after submitting the DD 2762 form?

Yes, you can change your financial institution. To do so, inform the government agency that processes your payments of your new banking details. It is advisable to maintain your accounts at both the old and new financial institutions until the transaction is fully processed and confirmed by the new institution to avoid any disruption in payments.

What should I do if my address changes after submitting the DD 2762 form?

If your address changes, it is crucial to update the government agency that administers your payments. Keeping your address current ensures that you receive important correspondence regarding your benefits and will help you maintain your eligibility for payments. Prompt notification is essential to avoid any potential disruptions in your payment processing.

What happens if false information is provided on the DD 2762 form?

Providing false information on the DD 2762 form can have serious consequences. Under federal law, individuals may face fines up to $10,000 or imprisonment for up to five years, or both, for presenting false statements or making fraudulent claims. It is essential to provide accurate information to avoid potential penalties.

Common mistakes

Filling out the DD 2762 form can be straightforward, yet many make common errors that can lead to delays. One significant mistake is failing to provide the correct name of the payee. The name must match exactly as it appears on the government check. Any discrepancies could result in a rejection, making it essential to double-check this critical detail.

Another frequent error is not including the complete account number. It is easy to overlook the account number, especially if it's written down elsewhere. Missing digits can disrupt direct deposits and necessitate the re-filing of the form. Ensure that every digit is accurate and complete when filling out this section.

Some individuals neglect to select the appropriate type of payment. The form includes multiple options, such as Social Security or Civil Service Retirement. Selecting more than one option can cause confusion for the financial institution and may delay processing. Choosing only the relevant payment type is crucial.

Addressing the current address section is another area where mistakes commonly occur. Payees must ensure their listed address matches their official records. An outdated or incorrect address can lead to important communications being missed, hindering the receipt of benefits.

People also often forget to sign and date the form. The payee’s signature is legally required, and any missing signature will invalidate the application. In joint accounts, all required signatures must be present, providing another layer of complexity.

Lastly, people sometimes overlook the necessary submission steps after completing the form. The completed DD 2762 must be submitted to the financial institution, which then verifies the information before sending it to the government agency. Failing to follow these instructions can lead to significant delays in processing.

Documents used along the form

The DD Form 2762 is often used in conjunction with various other forms and documents to ensure that beneficiaries can efficiently receive government payments. Each document has a specific purpose and is important to complete for accurate processing. Below is a list of forms that are commonly linked with the DD Form 2762.

- Standard Form 1199A: This is the Direct Deposit Sign-Up Form that individuals fill out to authorize their payments to be directly deposited into their bank accounts. It requires payee information, account details, and must be verified by the financial institution.

- IRS Form W-9: This form is used for tax purposes and involves providing the correct taxpayer identification information. It's essential for confirming the payee's identity to the IRS when payments are made, especially for taxable events.

- SF 50 – Notification of Personnel Action: This document typically records changes to a federal employee's job status, which can also affect their eligibility for certain payments. It is important to keep it updated in case of changes in employment status.

- Form SSA-11: This form is used to apply for Social Security Benefits. Individuals may need to complete this form if they are claiming dependency or survivor benefits, which would also be part of the payment system.

Completing the required forms accurately helps ensure a smooth process for receiving payments. It is beneficial for beneficiaries to be familiar with these documents and maintain current information with the government agencies involved.

Similar forms

- Form W-4: This form allows employees to inform their employer about their tax withholding preferences. Like the DD 2762, it requires submission to a financial institution or agency and helps in directly managing financial transactions.

- Direct Deposit Authorization Form: Similar to the DD 2762, this document permits an organization to deposit funds directly into a bank account. Both forms necessitate details about the payee and the financial institution.

- Form 1040: Taxpayers use this form to report their income to the IRS. It involves sharing personal information and bank details for possible refunds, similar to how the DD 2762 collects information for direct deposits.

- Form I-9: This form verifies employment eligibility in the U.S. Although focused on identity and work status, both forms require personal information and verification from a financial institution or agency.

- Standard Form 330: Used for architect-engineer qualifications, it collects firm and project details. Both forms gather comprehensive information for processing payments or qualifications.

- Form SSA-1: This application for Social Security benefits requires detailed personal information. Like the DD 2762, it supports the collection of necessary details for processing payment benefits.

- Form SF-86: This form is used for Security Clearance. It requires extensive personal history. Both necessitate accurate information to proceed with government-related processes.

- Form 8850: This is a Pre-Screening Notice and Certification Request for the Work Opportunity Tax Credit. Similar to the DD 2762, both forms involve submitting personal information for eligibility assessments.

- IRS Form 4506-T: This form permits obtaining a transcript of tax return data. Much like the DD 2762, it necessitates inputting specific details and is processed by a government agency.

- Financial Aid Application (FAFSA): This application collects financial information for securing student aid. It parallels the DD 2762 in requiring detailed financial data for payment purposes.

Dos and Don'ts

When completing the DD 2762 form, there are several important guidelines to consider. Following these tips can help ensure that the process goes smoothly.

- Do ensure accuracy. Double-check all information entered in Sections 1 and 2.

- Do provide complete information. Fill in every required field, as incomplete forms may delay processing.

- Do notify of address changes. Keep the government agency informed of any updates to your contact information.

- Do use a separate form for different payments. A separate DD 2762 must be completed for each type of payment.

- Don't submit an incomplete form. Leaving sections blank, especially your account details, might result in rejection.

- Don't forget to sign. Ensure that the form is signed and dated in the designated areas before submission.

Misconceptions

Below are some common misconceptions about the DD 2762 form, which is often confused with the Direct Deposit Sign-Up Form:

- It is only for Social Security payments. Many individuals believe that the DD 2762 form is exclusively for Social Security payments, but this form can be used for several types of payments, including military salaries, pensions, and other federal benefits.

- One form suffices for all payments. Some assume that a single DD 2762 form can cover multiple payment types. However, a separate form must be completed for each type of payment to be deposited directly.

- Once submitted, updates are unnecessary. A common belief is that after submitting the form, the information remains relevant indefinitely. It is crucial to inform the government agency of any address changes to continue receiving payments and other pertinent information.

- The financial institution automatically knows how to process it. Many people think that financial institutions automatically understand how to process the DD 2762 form. In reality, the completed form needs to be verified by the institution to ensure accuracy.

- Joint accounts do not need any special consideration. Some believe that joint account holders can disregard certain instructions. All joint account holders must be aware of the form's requirements and submit their signatures, ensuring that everyone understands and agrees to the payment arrangement.

- The agency can identify you without your Social Security number. There is a misconception that a Social Security number isn't necessary for processing. The number helps verify identity and ensures that payments reach the correct person. Omitting it could delay transactions.

- It isn't legal to cancel the payment authorization. Some individuals fear that once they authorize direct deposit, they cannot cancel. In fact, recipients have the right to cancel the authorization through written notice to the federal agency.

- Changes to financial institutions will not affect payments. Many think that they can switch banks without consequence. Changing the financial institution requires notifying both the paying agency and the new bank, and it's advised to maintain accounts at both until the switch is confirmed.

Key takeaways

- The DD 2762 form is essential for setting up direct deposits for federal payments.

- Payees must complete Sections 1 and 2 of the form before submitting it to their financial institution.

- Each payment type requires a separate form; it cannot be used for multiple payment types.

- Provide accurate account information, including the account type and account number.

- It's important for payees to inform the government agency of any address changes.

- Joint account holders need to notify both the financial institution and the government agency if a beneficiary passes away.

- Keep a copy of the completed form for personal records, and ensure the financial institution submits it to the appropriate government agency.

Browse Other Templates

Ut Forms - Complete the form to initiate your transcript request.

Client Registration Form,Account Information Sheet,Investor Profile Document,Customer Profile Form,Account Setup Questionnaire,Financial Information Form,Client Details Form,Account Holder Data Form,Customer Data Collection Form,Personal Information - Account holders must provide their tax identification and identification numbers.

How Long Does a Father Have to Be Absent to Lose His Rights in California - It features a table for entering holiday schedules for each parent or party involved.