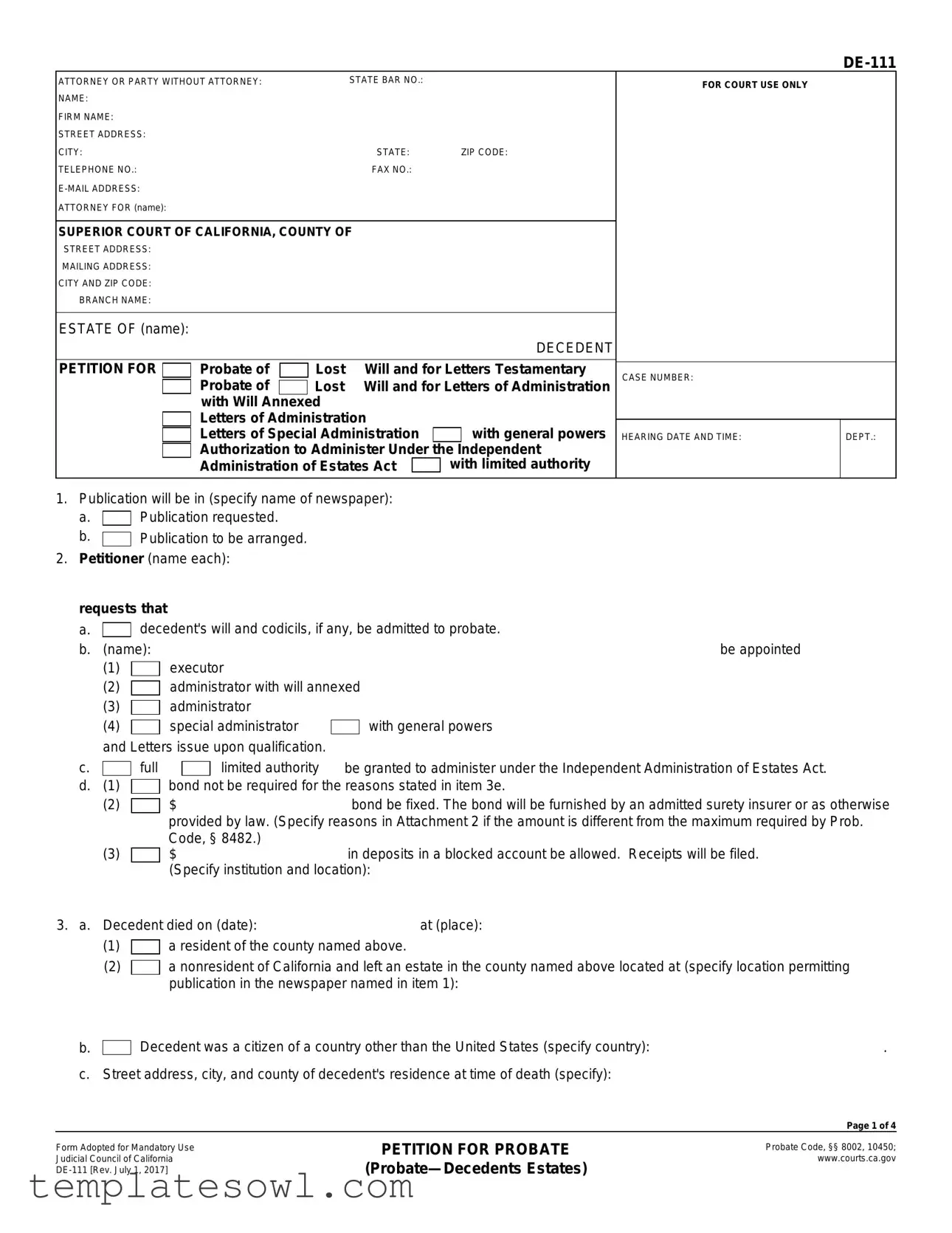

Fill Out Your De 111 Form

The De 111 form is a critical document within California's probate process, utilized primarily for the probate of lost wills and the appointment of personal representatives. This form allows individuals to petition the court for the admission of a decedent's will, if applicable, or to obtain Letters Testamentary or Letters of Administration. It includes essential information such as the decedent's name, date of death, and details regarding their estate. Petitioner details, including contact information and the nature of their relationship to the decedent, must also be provided. The form outlines requests for administration powers, bond requirements, and publication of notices in a designated newspaper, ensuring all legal obligations are met. Furthermore, the De 111 form facilitates the declaration of the decedent’s heirs and beneficiaries, detailing their relationships and whether they survived the decedent. The completion of this form is crucial for moving forward in the probate process and for ensuring that the decedent’s wishes are honored while complying with state laws.

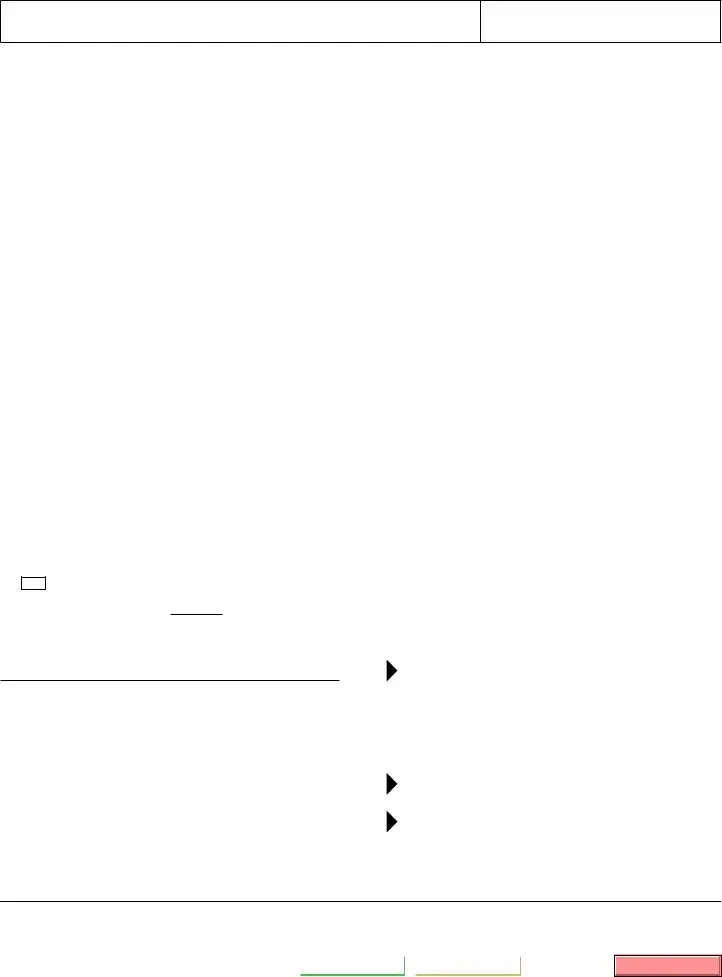

De 111 Example

ATTORNEY OR PARTY WITHOUT ATTORNEY: |

STATE BAR NO.: |

FOR COURT USE ONLY |

|

|

|

NAME: |

|

|

FIRM NAME: |

|

|

STREET ADDRESS: |

|

|

CITY: |

STATE: |

ZIP CODE: |

TELEPHONE NO.: |

FAX NO.: |

|

|

|

|

ATTORNEY FOR (name): |

|

|

SUPERIOR COURT OF CALIFORNIA, COUNTY OF |

|

|

|

|

|

|

|

|

|||||

STREET ADDRESS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY AND ZIP CODE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

BRANCH NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESTATE OF (name): |

|

|

|

|

|

|

|

|

DECEDENT |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PETITION FOR |

|

Probate of |

|

Lost |

Will and for Letters Testamentary |

|

|

|

|||||

|

CASE NUMBER: |

|

|||||||||||

|

|

|

|

||||||||||

|

|

Probate of |

|

|

Lost |

Will and for Letters of Administration |

|

||||||

|

|

|

|

|

|||||||||

|

|

with Will Annexed |

|

|

|

|

|

|

|

|

|

||

|

|

Letters of Administration |

|

|

|

|

|

|

|||||

|

|

Letters of Special Administration |

|

|

with general powers |

HEARING DATE AND TIME: |

DEPT.: |

||||||

|

|

Authorization to Administer Under |

the |

Independent |

|

|

|||||||

|

|

|

|

||||||||||

|

|

Administration of Estates Act |

|

|

with limited authority |

|

|

||||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.Publication will be in (specify name of newspaper):

a. Publication requested.

Publication requested.

b.

Publication to be arranged.

Publication to be arranged.

2.Petitioner (name each): requests that

a.

decedent's will and codicils, if any, be admitted to probate.

decedent's will and codicils, if any, be admitted to probate.

b. (name): |

be appointed |

(1)

executor

executor

(2)

administrator with will annexed

administrator with will annexed

(3)

administrator

administrator

|

(4) |

|

|

special administrator |

|

with general powers |

||

|

|

|

|

|||||

|

and Letters issue upon qualification. |

|

|

|||||

c. |

|

|

full |

|

|

limited authority |

be granted to administer under the Independent Administration of Estates Act. |

|

|

|

|

||||||

d. |

(1) |

|

|

bond not be required for the reasons stated in item 3e. |

||||

|

|

|||||||

|

(2) |

|

|

$ |

|

|

bond be fixed. The bond will be furnished by an admitted surety insurer or as otherwise |

|

|

|

|

|

|

||||

|

|

|

|

provided by law. (Specify reasons in Attachment 2 if the amount is different from the maximum required by Prob. |

||||

|

|

|

|

Code, § 8482.) |

|

|

||

|

(3) |

|

|

$ |

|

|

in deposits in a blocked account be allowed. Receipts will be filed. |

|

|

|

|

|

(Specify institution and location): |

||||

3. a. |

Decedent died on (date): |

|

at (place): |

|||||

(1) a resident of the county named above.

a resident of the county named above.

(2) a nonresident of California and left an estate in the county named above located at (specify location permitting publication in the newspaper named in item 1):

a nonresident of California and left an estate in the county named above located at (specify location permitting publication in the newspaper named in item 1):

b.

Decedent was a citizen of a country other than the United States (specify country): |

. |

c. Street address, city, and county of decedent's residence at time of death (specify):

Page 1 of 4

Form Adopted for Mandatory Use Judicial Council of California

PETITION FOR PROBATE

Probate Code, §§ 8002, 10450; www.courts.ca.gov

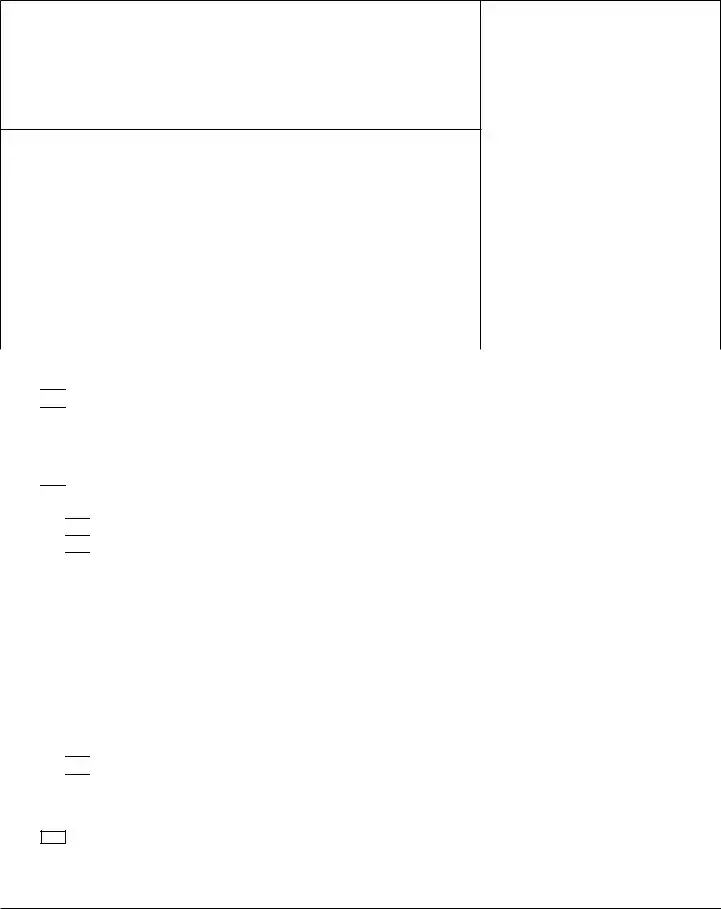

ESTATE OF (name):

DECEDENT

CASE NUMBER:

3.d. Character and estimated value of the property of the estate (complete in all cases):

(1) |

Personal property: |

|

|

$ |

|

|

|

|

||

(2) |

Annual gross income from |

|

|

|

|

|

|

|

||

|

(a) |

real property: |

|

|

$ |

|

|

|

|

|

|

(b) |

personal property: |

|

|

$ |

|

|

|

|

|

(3) |

Subtotal (add (1) and (2)): |

|

|

$ |

|

|

|

|

||

(4) |

Gross fair market value of real property: |

$ |

|

|

|

|

||||

(5) |

(Less) Encumbrances: |

|

|

($ |

) |

|

||||

(6) |

Net value of real property: |

|

|

$ |

|

|

|

|

||

(7) |

Total (add (3) and (6)): |

|

|

|

$ |

|

||||

e. (1) |

|

|

Will waives bond. |

|

Special administrator is the named executor, and the will waives bond. |

|||||

|

|

|

||||||||

(2) All beneficiaries are adults and have waived bond, and the will does not require a bond. (Affix waiver as Attachment 3e(2).)

All beneficiaries are adults and have waived bond, and the will does not require a bond. (Affix waiver as Attachment 3e(2).)

(3) All heirs at law are adults and have waived bond. (Affix waiver as Attachment 3e(3).)

All heirs at law are adults and have waived bond. (Affix waiver as Attachment 3e(3).)

(4) Sole personal representative is a corporate fiduciary or an exempt government agency.

Sole personal representative is a corporate fiduciary or an exempt government agency.

f. (1)  Decedent died intestate.

Decedent died intestate.

(2) |

|

Copy of decedent's will dated: |

|

codicil dated |

(specify for each): |

||

|

|

||||||

|

|

are affixed as Attachment 3f(2). (Include typed copies of handwritten documents and English translations of foreign- |

|||||

|

|

language documents.) |

|

|

|

||

|

|

|

|

The will and all codicils are |

|

||

|

|

|

|

|

|||

(3) |

|

The original of the will and/or codicil identified above has been lost. (Affix a copy of the lost will or codicil or a written |

|||||

|

|||||||

|

|

|

statement of the testamentary words or their substance in Attachment 3f(3), and state reasons in that attachment |

||||

|

|

|

why the presumption in Prob. Code, § 6124 does not apply.) |

|

|||

g.Appointment of personal representative (check all applicable boxes):

(1)Appointment of executor or administrator with will annexed:

(a) Proposed executor is named as executor in the will and consents to act.

Proposed executor is named as executor in the will and consents to act.

(b) No executor is named in the will.

No executor is named in the will.

(c) Proposed personal representative is a nominee of a person entitled to Letters. (Affix nomination as Attachment 3g(1)(c).)

Proposed personal representative is a nominee of a person entitled to Letters. (Affix nomination as Attachment 3g(1)(c).)

(d) |

|

Other named executors will not act because of |

|

death |

|

declination |

||

|

|

|

||||||

|

|

|

|

other reasons (specify): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Continued in Attachment 3g(1)(d).

(2)Appointment of administrator:

(a) Petitioner is a person entitled to Letters. (If necessary, explain priority in Attachment 3g(2)(a).)

Petitioner is a person entitled to Letters. (If necessary, explain priority in Attachment 3g(2)(a).)

(b) Petitioner is a nominee of a person entitled to Letters. (Affix nomination as Attachment 3g(2)(b).)

Petitioner is a nominee of a person entitled to Letters. (Affix nomination as Attachment 3g(2)(b).)

(c) Petitioner is related to the decedent as (specify):

Petitioner is related to the decedent as (specify):

(3) Appointment of special administrator requested. (Specify grounds and requested powers in Attachment 3g(3).)

Appointment of special administrator requested. (Specify grounds and requested powers in Attachment 3g(3).)

(4) Proposed personal representative would be a successor personal representative. h. Proposed personal representative is a

Proposed personal representative would be a successor personal representative. h. Proposed personal representative is a

(1) resident of California.

resident of California.

(2)

nonresident of California (specify permanent address):

nonresident of California (specify permanent address):

(3)

(4)

resident of the United States. nonresident of the United States.

PETITION FOR PROBATE

Page 2 of 4

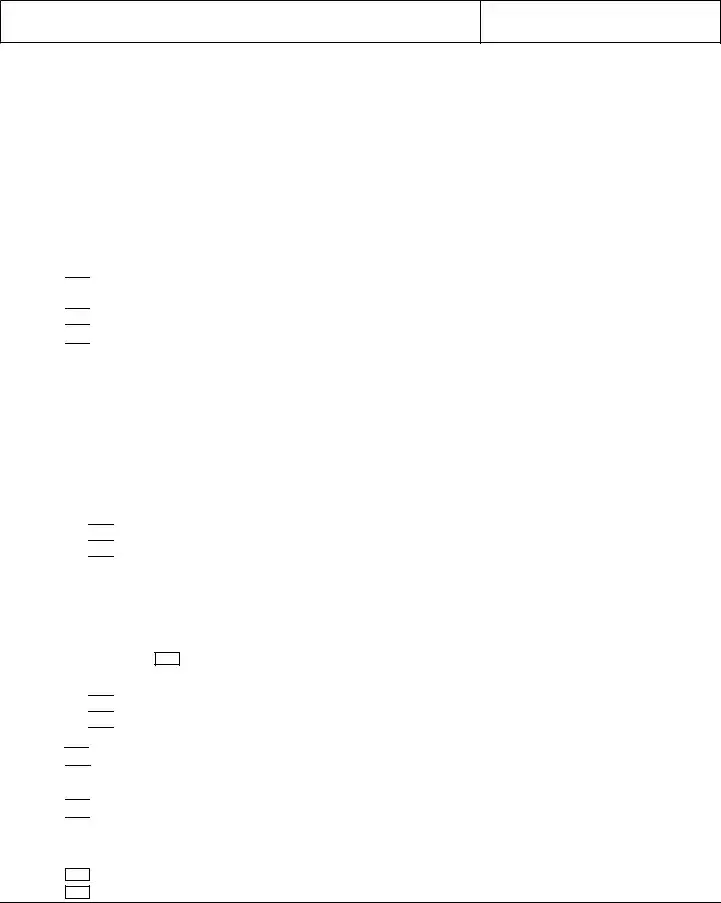

ESTATE OF (name):

DECEDENT

CASE NUMBER:

4.

Decedent's will does not preclude administration of this estate under the Independent Administration of Estates Act.

5. a. Decedent was survived by (check items (1) or (2), and (3) or (4), and (5) or (6), and (7) or (8))

(1)

(2)

(a)

(b)

(3)

(4)

(5)

(a)

(b)

(6)

(7)

(8)

spouse.

no spouse as follows:

divorced or never married. spouse deceased.

registered domestic partner.

no registered domestic partner. (See Fam. Code, § 297.5(c); Prob. Code, §§ 37(b), 6401(c), and 6402.)

child as follows: natural or adopted.

natural adopted by a third party.

no child.

issue of a predeceased child. no issue of a predeceased child.

b. Decedent |

|

was |

|

was not survived by a stepchild or foster child or children who would have been adopted by |

|

|

|||

decedent but for a legal barrier. (See Prob. Code, § 6454.) |

||||

6.(Complete if decedent was survived by (1) a spouse or registered domestic partner but no issue (only a or b apply), or (2) no spouse, registered domestic partner, or issue. (Check the first box that applies):

a.

b.

c.

d.

e.

f.

g.

h.

Decedent was survived by a parent or parents who are listed in item 8.

Decedent was survived by issue of deceased parents, all of whom are listed in item 8. Decedent was survived by a grandparent or grandparents who are listed in item 8. Decedent was survived by issue of grandparents, all of whom are listed in item 8.

Decedent was survived by issue of a predeceased spouse, all of whom are listed in item 8. Decedent was survived by next of kin, all of whom are listed in item 8.

Decedent was survived by parents of a predeceased spouse or issue of those parents, if both are predeceased, all of whom are listed in item 8.

Decedent was survived by no known next of kin.

7.(Complete only if no spouse or issue survived decedent.)

a.

b.

Decedent had no predeceased spouse.

Decedent had a predeceased spouse who

(1)

died not more than 15 years before decedent and who owned an interest in real property that passed to decedent,

died not more than 15 years before decedent and who owned an interest in real property that passed to decedent,

(2)

died not more than five years before decedent and who owned personal property valued at $10,000 or more that passed to decedent, (If you checked (1) or (2), check only the first box that applies):

died not more than five years before decedent and who owned personal property valued at $10,000 or more that passed to decedent, (If you checked (1) or (2), check only the first box that applies):

(a)

Decedent was survived by issue of a predeceased spouse, all of whom are listed in item 8.

Decedent was survived by issue of a predeceased spouse, all of whom are listed in item 8.

(b)

Decedent was survived by a parent or parents of the predeceased spouse who are listed in item 8.

Decedent was survived by a parent or parents of the predeceased spouse who are listed in item 8.

(c)

Decedent was survived by issue of a parent of the predeceased spouse, all of whom are listed in item 8.

Decedent was survived by issue of a parent of the predeceased spouse, all of whom are listed in item 8.

(d)

Decedent was survived by next of kin of the decedent, all of whom are listed in item 8.

Decedent was survived by next of kin of the decedent, all of whom are listed in item 8.

(e)

Decedent was survived by next of kin of the predeceased spouse, all of whom are listed in item 8.

Decedent was survived by next of kin of the predeceased spouse, all of whom are listed in item 8.

(3)

neither (1) nor (2) apply.

neither (1) nor (2) apply.

8.Listed on the next page are the names, relationships to decedent, ages, and addresses, so far as known to or reasonably ascertainable by petitioner, of (1) all persons mentioned in decedent's will or any codicil, whether living or deceased; (2) all persons named or checked in items 2, 5, 6, and 7; and (3) all beneficiaries of a trust named in decedent's will or any codicil in which the trustee and personal representative are the same person.

PETITION FOR PROBATE

Page 3 of 4

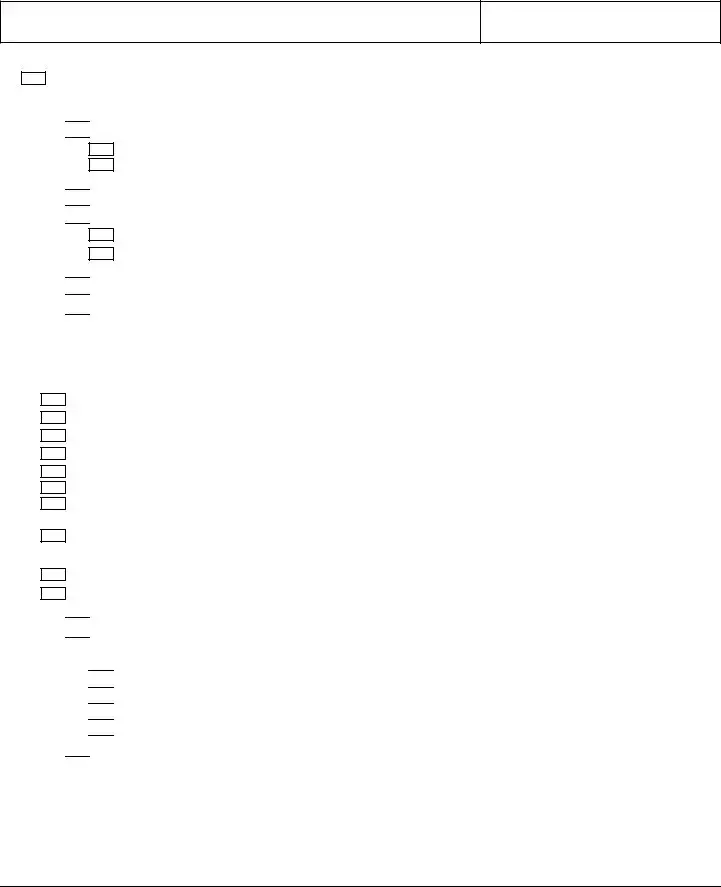

ESTATE OF (name):

DECEDENT

CASE NUMBER:

8. |

Name and relationship to decedent |

Age |

Address |

Continued on Attachment 8.

9.Number of pages attached: Date:

(TYPE OR PRINT NAME OF ATTORNEY ) |

(SIGNATURE OF ATTORNEY ) * |

* (Signatures of all petitioners are also required. All petitioners must sign, but the petition may be verified by any one of them (Prob. Code, §§ 1020, 1021; Cal. Rules of Court, rule 7.103).)

I declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

Date:

(TYPE OR PRINT NAME OF PETITIONER) |

|

(SIGNATURE OF PETITIONER) |

|

|

|

||

|

|

|

|

(TYPE OR PRINT NAME OF PETITIONER) |

|

||

(SIGNATURE OF PETITIONER) |

|||

|

|

||

Signatures of additional petitioners follow last attachment.

PETITION FOR PROBATE |

|||||

|

|||||

|

|

|

|

|

|

For your protection and privacy, please press the Clear |

|

|

|||

This Form button after you have printed the form. |

|

|

Print this form |

|

Save this form |

|

|

|

|

|

|

Page 4 of 4

Clear this form

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The DE-111 form is governed by the California Probate Code, specifically sections 8002 and 10450. |

| Purpose | This form is used for the petition for probate of a lost will and for letters testamentary in California. |

| Filing Requirement | Petitioners must file the DE-111 in the Superior Court of California for the county where the decedent resided. |

| Publication | The petitioner is required to specify a newspaper for publication concerning the probate proceedings. |

| Bond Requirement | Petitioners may request that a bond not be required, but must provide reasons if it differs from the Probate Code maximum. |

| Decedent's Information | Details about the decedent, including date and place of death, must be clearly stated in the form. |

| Executor Appointment | The form allows for the appointment of an executor or administrator with will annexed, among other options. |

| Survivorship Information | Petitioners must detail the survivors of the decedent, including spouses, children, and other potential heirs. |

| Signatures Required | All petitioners are required to sign the form, but any one of them may verify the petition. |

Guidelines on Utilizing De 111

Filling out the DE-111 form can seem daunting at first. However, with a systematic approach, it becomes manageable. Follow these simple steps to complete the form accurately.

- Start by entering your information at the top of the form. This includes your name, firm name (if applicable), address, city, state, zip code, telephone number, fax number, email address, and state bar number if you are an attorney.

- Next, provide the name of the decedent (the person who has passed away) in the designated area. Include the estate name and the case number, if you have it.

- Fill in the street address and mailing address for the court where you will be submitting the form. Ensure the city and zip code are accurate.

- Detail the type of petition you are submitting: Probate of Lost Will, Letters Testamentary, Letters of Administration, or another option as indicated on the form.

- Indicate the hearing date and time, along with the department number where the case will be heard.

- In the next section, specify the publication arrangements for notifying the public about your petition. You can choose to have it published in a newspaper and select whether you will arrange it or request publication.

- List the names of the petitioners who are making this request. Include necessary details such as whether the decedent's will is to be admitted to probate, and who should be appointed as executor or administrator.

- Provide information about the decedent. This includes the date and place of death, as well as their residence at that time. Specify if they were a nonresident of California and where their estate is located within the state.

- Complete the section that asks for the estimated value of the decedent’s estate, including any personal property and real estate details.

- Indicate whether bond requirements are waived or if a specific bond amount is necessary, with reasons provided where required.

- Answer questions regarding the surviving members of the decedent's family. State whether they left behind a spouse, children, or other relatives.

- Finally, list all individuals mentioned in the will or any codicil, along with their relationships to the decedent, ages, and addresses. Try to capture this information as accurately as possible.

- After you have completed filling out the form, sign and date it at the bottom. Make sure all petitioners also sign the document as required.

Once you have filled out the DE-111 form, review it for accuracy. It's important that all information is complete and correct before you submit it. This step will help avoid any delays in the probate process.

What You Should Know About This Form

What is the DE-111 form used for?

The DE-111 form is a petition used in California to initiate the probate process for a decedent's estate. Specifically, it serves multiple purposes, such as admitting a lost will to probate, requesting letters testamentary to appoint an executor, or seeking letters of administration if no will exists. It is crucial for individuals looking to manage the estate of someone who has passed away, ensuring their assets are distributed according to the law or the decedent's wishes.

Who can file a DE-111 form?

Any interested party can file the DE-111 form, such as a family member, heir, or someone named in the will. The petitioner should have a legitimate interest in the estate, typically having a close relationship with the decedent. If you haven’t been named, but you’re an heir or have a claim to the estate, you may still petition for probate. However, it is highly recommended to seek legal advice to navigate this sometimes complex process.

What information is required on the DE-111 form?

The DE-111 requires various details about the decedent and the estate. This includes the decedent's name, date of death, and information about any wills, including their existence and status. You will also need to provide the estimated value of the estate, including both personal and real property. In addition, information regarding the beneficiaries and any claims against the estate must be disclosed. It’s essential to be thorough and accurate, as missing or incorrect information can delay the probate process.

What happens after filing the DE-111 form?

After submitting the DE-111 form, the court will schedule a hearing date. All interested parties and beneficiaries will need to be notified of this hearing. At the hearing, the court will review the petition and any objections that may arise. If everything is in order, the court will grant the petition, appoint the requested executor or administrator, and issue the necessary letters. This allows the personal representative to legally manage and distribute the estate’s assets. Staying organized and attending the hearing is vital, as these steps move the process forward.

Common mistakes

Filling out the DE-111 form can be a complex task, and there are several common mistakes that individuals often make. One frequent error is not providing complete contact information. It is essential to include the correct name, firm name, address, and telephone number. Missing or incorrect details can delay the processing of the petition.

Another mistake involves the failure to specify the type of authority being requested. Applicants must clearly indicate whether they seek full or limited authority under the Independent Administration of Estates Act. This detail is crucial, as it affects how the estate can be managed.

People often overlook the requirement to include the decedent's date and place of death. Inaccuracies in this section can lead to complications. It's important to double-check this information to ensure accuracy.

Inaccurately estimating the value of the estate is another common issue. It is beneficial to provide a full account of both personal property and real property. This includes giving a complete breakdown of income, total value, and encumbrances associated with the estate.

Some petitioners neglect to include necessary attachments. For example, if a will has been lost, it is required to state the details and reasons why. Failure to attach these documents can result in processing delays. Always ensure that all relevant documents accompany the form.

Additionally, people frequently skip checking all applicable boxes related to the appointment of personal representatives. Clear communication of who is being nominated for the role is vital. This can help avoid confusion and expedite the process.

Another mistake is failing to sign and date the form correctly. All required signatures must be collected from petitioners. Missing signatures can result in the rejection of the application.

Providing outdated information is a common error. It is advisable to ensure that all details reflect the current situation of the estate. Changes in circumstances should be updated promptly.

Lastly, some individuals fail to follow submission guidelines. Instructions regarding the filing process must be adhered to, including understanding where and how to submit the completed forms. Neglect of these details may result in unnecessary complications and delays.

Documents used along the form

When dealing with the DE-111 form, a variety of other forms and documents often accompany it. These additional documents provide necessary context, information, and legal support for the probate process. Below are some commonly used forms that may be required alongside the DE-111.

- DE-140 - This document is a proposed order for probate, which the court uses to grant permission to proceed with the probate process. It outlines the terms of the appointment and the authority being granted to the personal representative.

- DE-121 - This notice of hearing informs interested parties about the upcoming hearings regarding the estate. It ensures that all relevant individuals are aware and have the opportunity to participate in the proceedings.

- DE-147 - This form serves as a proof of publication, demonstrating that notice of the probate hearings has been published in a newspaper, as required by law. It is crucial for ensuring transparency and providing notice to potential claimants.

- DE-150 - This attachment contains a list of heirs and beneficiaries. It is an important document that helps establish who is entitled to inherit from the decedent's estate, and their respective shares.

- DE-114 - This form requests that the court appoint a personal representative, and it details their qualifications. It ensures that a suitable individual is chosen to manage the estate properly.

- DE-130 - If the deceased had a will, this form serves to formally admit the will to probate. It includes information about the will's provisions and authenticates its validity in accordance with legal standards.

- DE-161 - This is a request for bond waiver. In certain cases, the court may not require the personal representative to post bond, which creates a financial safeguard for estate assets. This form outlines reasons for the waiver request.

Each of these documents plays a vital role in the probate process, ensuring that the decedent's wishes are honored and that all relevant parties are informed and protected. Collectively, they contribute to a transparent and orderly administration of the estate, providing much-needed clarity during a challenging time.

Similar forms

The DE-111 form, used for filing a petition for probate, has similarities to several other legal documents encountered in estate planning and administration. Below are eight documents that share functionality or purpose with the DE-111 form:

- Probate Petition (Form DE-140): This document is typically filed when there is a need to administer a decedent’s estate and specifically requests that a will be probated or that letters testamentary be issued. Like the DE-111, it outlines the authority and duties of the personal representative.

- Letters Testamentary: This document is issued by a court to an executor named in a will, authorizing them to administer the estate. Similar to DE-111, letters testamentary formalize authority over the estate's affairs.

- Letters of Administration (Form DE-147): When a person dies intestate (without a will), an application for letters of administration is necessary. This form, like the DE-111, is designed to appoint a personal representative to manage the estate.

- Will: A will provides instructions for the distribution of a deceased individual’s assets. Although it acts as an instrument for directives, it complements the DE-111 by detailing what should be probated.

- Affidavit for Collection of Personal Property (Form DE-305): This document allows heirs with minimal assets to bypass full probate. It serves a purpose akin to the DE-111 in that both facilitate the settlement of estates but differ in their complexity based on estate value.

- Trust Certification (Form DE-205): This document verifies the existence of a trust and identifies its trustee. While primarily concerned with trusts, it parallels the DE-111, as both involve the management of a decedent's assets.

- Notice of Hearing (Form DE-121): This form is required to notify involved parties of a hearing regarding any probate matter. It works in conjunction with the DE-111, emphasizing the importance of informing all interested individuals about the proceedings.

- Inventory and Appraisal (Form DE-160): This form details the value of all property within the probate estate. Like the DE-111, it ensures that all estate assets are cataloged and assessed, providing crucial information for administration and distribution.

Dos and Don'ts

Filling out the De 111 form requires careful attention to detail. Mistakes can lead to delays or complications in the probate process. Here are four key dos and don'ts to consider.

- Do: Provide accurate information.

- Do: Double-check the spelling of names and addresses.

- Do: Include all required attachments, such as the decedent's will and any relevant waivers.

- Do: Ensure signatures are provided by all petitioners.

- Don't: Leave any sections blank; incomplete forms may be rejected.

- Don't: Forget to specify details regarding the decedent's estate.

- Don't: Use unclear language or abbreviations; clarity is crucial.

- Don't: Submit the form without reviewing it for errors.

Misconceptions

Understanding the DE-111 form is essential for anyone navigating the probate process in California. However, several misconceptions exist that can lead to confusion. Here are nine common misunderstandings about the DE-111 form and clarifications for each:

- It is only for cases involving a will. The DE-111 can be used in proceedings for both testate (with a will) and intestate (without a will) estates. It accommodates different scenarios, not just those involving a formal last testament.

- Filing the form guarantees probate will be granted. Submission of the DE-111 form initiates the process, but it does not guarantee approval. The court will assess the evidence and may require further information or hearings.

- The DE-111 form is the only document needed in probate proceedings. It is a critical document, but it often requires supporting attachments and other forms. A complete set of documents is necessary for the court to consider the petition.

- All types of property must be disclosed on the form. While it is important to provide information about the estate’s assets, not all personal possessions need to be detailed if they do not contribute significantly to the estate’s value.

- Decedent's debts need not be reported. Reporting debts is essential. The court needs to understand the decedent's financial obligations to accurately evaluate and administer the estate.

- Non-resident decedents cannot use the DE-111 form. Non-residents can utilize the DE-111 if they have property in California. It is tailored to accommodate various residency situations.

- A personal representative must be an attorney. Although many choose to hire legal representation, individuals who are not attorneys can serve as personal representatives, provided they meet certain qualifications.

- The DE-111 form must be submitted within a specific time frame after death. While there are general guidelines to follow, there is no fixed deadline for when the DE-111 must be filed. However, expediency is highly recommended to minimize potential issues.

- Once submitted, the DE-111 cannot be amended. Changes can be made to the form before the hearing date. If new information arises or errors are found, updates are permissible to ensure accuracy in the probate process.

By recognizing and addressing these misconceptions, individuals can approach the probate process with more clarity and confidence. An understanding of the DE-111 form, its requirements, and implications is vital for a smoother transition through this challenging period.

Key takeaways

Filling out the DE-111 form is an important step in the probate process in California. Here are some key takeaways to keep in mind:

- Accurate Information is Essential: Ensure that all names, addresses, and details about the decedent's estate are filled out correctly. Errors can delay the probate process.

- Attachments Matter: Include all necessary attachments, such as copies of the will, any codicils, and waivers related to bond requirements. These documents support your petition.

- Petitioner Identification: Clearly identify each petitioner’s role and relationship to the decedent. This clarity helps the court understand who is involved in the process.

- Follow Submission Guidelines: Make sure to submit the form to the correct branch of the Superior Court. Check requirements for filing fees and publication notices regarding the hearing.

Browse Other Templates

Registrar Nu - A signature line reinforces the importance of student authorization in the transcript release process.

Fl 421 - The FL-420 specifically addresses government agency involvement in family law matters.

What Is a Wdir Inspection - Conditions contributing to wood-destroying insect infestations should be routinely assessed by homeowners.