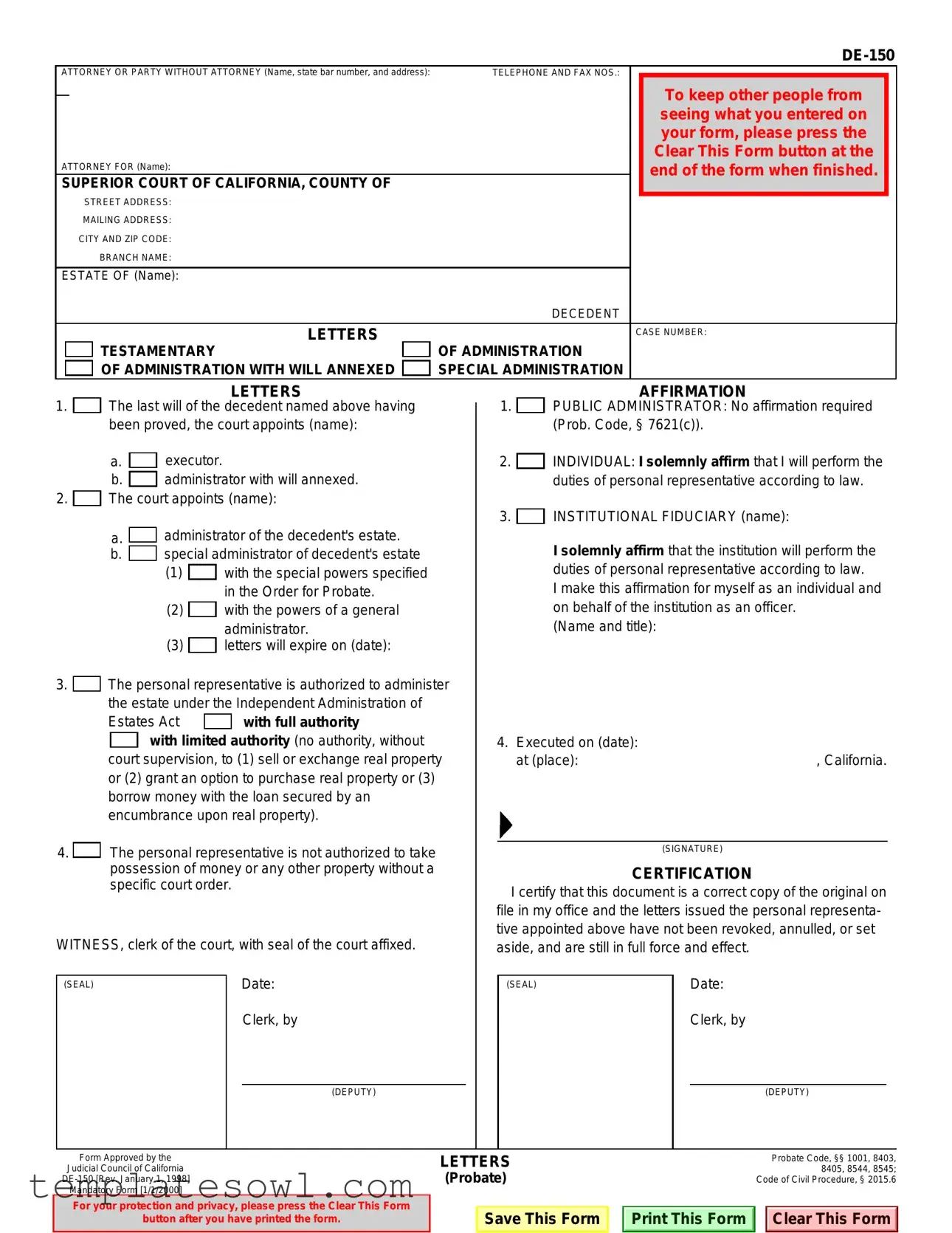

Fill Out Your De 150 Form

When navigating the aftermath of a loved one’s passing, understanding the legal processes involved can significantly ease the burden on family members and heirs. The DE-150 form serves as a crucial document in the administration of a decedent's estate in California. This form facilitates the appointment of a personal representative—either an executor or an administrator—to oversee the estate's distribution according to the decedent's wishes or state law when there is no will. The DE-150 outlines essential details such as the names and addresses of the parties involved, including the attorney if applicable, and provides the necessary court information. It distinguishes between different types of administration, such as administration with will annexed or special administration, detailing the specific powers granted to the appointed individual. The form also includes sections for affirmations from both individual and institutional fiduciaries, assuring that they will carry out their responsibilities as per legal obligations. Additionally, it highlights the importance of keeping the information private, advising users to clear the form after completion. Understanding the DE-150 is paramount for any individual involved in estate matters, as it helps streamline the legal process during a challenging period.

De 150 Example

ATTORNEY OR PARTY WITHOUT ATTORNEY (Name, state bar number, and address): |

TELEPHONE AND FAX NOS.: |

FOR COURT USE ONLY |

|

|

|

|

|

|

|

To keep other people from |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

seeing what you entered on |

|

|

|

|

|

|

|

|

your form, please press the |

|

|

|

|

|

|

|

|

Clear This Form button at the |

|

ATTORNEY FOR (Name): |

|

|

|

end of the form when finished. |

||||

SUPERIOR COURT OF CALIFORNIA, COUNTY OF |

|

|

|

|||||

|

|

|

|

|

||||

|

|

STREET ADDRESS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

MAILING ADDRESS: |

|

|

|

|

|

|

|

|

CITY AND ZIP CODE: |

|

|

|

|

|

|

|

|

|

BRANCH NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESTATE OF (Name): |

|

|

|

|

|

|||

|

|

|

|

|

DECEDENT |

|||

|

|

|

LETTERS |

|

|

CASE NUMBER: |

||

|

|

|

|

|

|

|||

|

|

|

TESTAMENTARY |

|

OF ADMINISTRATION |

|||

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

OF ADMINISTRATION WITH WILL ANNEXED |

|

SPECIAL ADMINISTRATION |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LETTERS |

1. |

|

The last will of the decedent named above having |

||||||||||

|

|

been proved, the court appoints (name): |

||||||||||

|

|

|

a. |

|

|

executor. |

|

|

||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. |

|

|

administrator with will annexed. |

||||||

2. |

|

The court appoints (name): |

||||||||||

|

||||||||||||

|

|

|

a. |

|

|

|

administrator of the decedent's estate. |

|||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

||||||||

|

|

|

b. |

|

|

|

special administrator of decedent's estate |

|||||

|

|

|

|

|

(1) |

|

|

|

with the special powers specified |

|||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

in the Order for Probate. |

|

|

|

|

|

|

(2) |

|

|

|

with the powers of a general |

|||

|

|

|

|

|

|

|

|

|

|

|

administrator. |

|

3. |

|

|

|

|

(3) |

|

|

|

letters will expire on (date): |

|||

|

The personal representative is authorized to administer |

|||||||||||

|

||||||||||||

|

|

the estate under the Independent Administration of |

||||||||||

|

|

Estates Act |

|

|

with full authority |

|||||||

|

|

|

|

|

||||||||

|

|

|

|

|

|

with limited authority (no authority, without |

||||||

|

|

|

|

|

|

|||||||

court supervision, to (1) sell or exchange real property or (2) grant an option to purchase real property or (3) borrow money with the loan secured by an encumbrance upon real property).

4.

The personal representative is not authorized to take possession of money or any other property without a specific court order.

The personal representative is not authorized to take possession of money or any other property without a specific court order.

WITNESS, clerk of the court, with seal of the court affixed.

(SEAL) |

Date: |

|

Clerk, by |

(DEPUTY)

|

|

AFFIRMATION |

1. |

|

PUBLIC ADMINISTRATOR: No affirmation required |

|

|

(Prob. Code, § 7621(c)). |

2. |

|

INDIVIDUAL: I solemnly affirm that I will perform the |

|

||

|

|

duties of personal representative according to law. |

3. |

|

INSTITUTIONAL FIDUCIARY (name): |

|

||

|

|

I solemnly affirm that the institution will perform the |

|

|

duties of personal representative according to law. |

|

|

I make this affirmation for myself as an individual and |

on behalf of the institution as an officer. (Name and title):

4. Executed on (date): |

|

at (place): |

, California. |

(SIGNATURE)

CERTIFICATION

I certify that this document is a correct copy of the original on file in my office and the letters issued the personal representa- tive appointed above have not been revoked, annulled, or set aside, and are still in full force and effect.

(SEAL) |

Date: |

|

Clerk, by |

(DEPUTY)

Form Approved by the

Judicial Council of California

Mandatory Form [1/1/2000]

For your protection and privacy, please press the Clear This Form

button after you have printed the form.

LETTERS

(Probate)

Save This Form

Probate Code, §§ 1001, 8403, 8405, 8544, 8545; Code of Civil Procedure, § 2015.6

Print This Form

Clear This Form

Clear This Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The form is officially titled "DE-150: Attorney or Party Without Attorney." It is primarily used in California probate cases. |

| Governing Laws | This form operates under various sections of the California Probate Code, specifically §§ 1001, 8403, 8405, 8544, and 8545, as well as the California Code of Civil Procedure § 2015.6. |

| Purpose | The DE-150 serves to appoint a personal representative of the decedent's estate, whether as an executor, administrator, or special administrator. |

| Required Signatures | Signatures from the appointed personal representative and the court clerk are mandatory for the form to be considered valid. |

| Types of Letters | The form allows for the issuance of letters testamentary or letters of administration with a will annexed, specifying the authority granted to the personal representative. |

| Expiration of Letters | Specific provisions regarding the expiration date of the letters issued can be filled in by the court, highlighting the time frame for which the appointed representative is authorized to act. |

| Independent Administration | The DE-150 can authorize the personal representative to act under the Independent Administration of Estates Act, offering either full or limited authority. |

| AFFIRMATION Section | The form includes an affirmation clause where administrators must affirm their commitment to perform their duties according to the law. |

| Confidentiality Notice | A notice prompts users to press the 'Clear This Form' button after completion to maintain privacy and protect personal information entered on the form. |

Guidelines on Utilizing De 150

The DE-150 form is essential for individuals involved in the probate process. Properly completing this form ensures that all necessary information is accurately provided, facilitating the administration of an estate. Here are the steps to fill out the DE-150 form efficiently.

- Begin by filling in the **Attorney or Party Without Attorney** section. Include the name, state bar number, and address. If applicable, also provide the telephone and fax numbers.

- Leave the **FOR COURT USE ONLY** section blank, as this section will be completed by court staff.

- Enter the **Attorney For** (Name) if an attorney is representing the party.

- Fill in the **SUPERIOR COURT OF CALIFORNIA, COUNTY OF** section with the appropriate details, including the street address, mailing address, city, and zip code.

- Provide the **Branch Name** of the court.

- In the **Estate of (Name)** section, insert the name of the decedent.

- Write the case number under the **CASE NUMBER** box.

- Indicate whether the letters requested are for **TESTAMENTARY ADMINISTRATION**, **ADMINISTRATION WITH WILL ANNEXED**, or **SPECIAL ADMINISTRATION**. Then, specify the appointed individuals for those roles.

- Detail which specific powers the personal representative will have. Indicate if they have full authority or limited authority.

- State when the letters will expire by filling in the expiration date.

- Indicate whether the personal representative is authorized to take money or property without a court order.

- Sign and date the **WITNESS** section, ensuring the Clerk and Deputy fields are appropriately filled out.

- If applicable, complete the **AFFIRMATION** section based on whether you are a public administrator, an individual, or an institutional fiduciary. Provide the name and title of an institutional fiduciary if relevant.

- Finish by dating and signing the form, underlining the significance of the document with your name and place of execution.

After completing the form, review all sections to ensure accuracy before submission. It is crucial to keep personal information secure. Press the "Clear This Form" button after printing to protect your data.

What You Should Know About This Form

What is the purpose of the DE-150 form?

The DE-150 form primarily serves as a request for letters of administration or testamentary in the probate process within California. It enables a court to officially appoint an executor or administrator to manage a deceased person's estate, ensuring that the estate is handled according to the law and the decedent's wishes.

Who needs to fill out the DE-150 form?

Any individual or institution looking to administer the estate of a deceased person in California must complete this form. This could include personal representatives or executors named in the will or individuals seeking to become administrators if there isn't a will.

What information is required to complete the DE-150 form?

The form requires several pieces of information, such as the names and addresses of the attorney or party involved, the name of the decedent, details of the estate, and the case number. You’ll also need to specify whether you are applying for letters of administration or testamentary, among other details about the powers granted to the personal representative.

What does “letters of administration” mean?

Letters of administration are a legal document issued by the court that grants an appointed individual or entity the authority to manage a deceased person's estate. This includes settling debts, distributing assets to beneficiaries, and handling any other necessary responsibilities related to the estate.

What does the term “executor” refer to?

An executor is a person or institution that is named in a will to carry out the wishes of the deceased. This role includes managing the estate, as well as ensuring that the stipulations in the will are followed. If there is no will, the court may appoint an administrator instead.

Can someone apply for the DE-150 form without a lawyer?

Yes, individuals can fill out and submit the DE-150 form without the assistance of an attorney. However, because probate laws can be complex, it may be beneficial to seek legal advice to ensure all aspects of the process are properly addressed.

What happens after submitting the DE-150 form?

Once the DE-150 form is submitted, the court will review the application. If everything is in order, the court will issue the letters of administration or testamentary, officially appointing the executor or administrator to manage the estate.

How long does the DE-150 process take?

The length of the process can vary depending on several factors, including court schedules and the completeness of the submitted information. Generally, it may take several weeks to a few months before the court issues the letters.

What should I do once I have received the letters of administration?

After receiving the letters, the personal representative should begin the process of managing the estate. This may involve gathering assets, paying debts, notifying beneficiaries, and potentially filing tax returns for the estate. Keeping accurate records throughout this process is essential.

Common mistakes

Filling out the DE-150 form can be straightforward, but there are common mistakes that individuals often make. One prevalent error is neglecting to complete all necessary fields. Each section of the form serves a specific purpose, and incomplete information can delay the processing of the estate. It's crucial to ensure that all relevant details, such as names and addresses, are filled in accurately.

Another mistake involves the signature section. Some people forget to sign the form or do not include the required dates and places. This step is essential, as a missing signature may render the document invalid. Reviewers must ensure all required signatures are present before submitting the form to prevent additional complications.

Additionally, failing to specify the type of administration can lead to confusion. The form offers options for either executor or administrator, depending on the circumstances surrounding the estate. Selecting the incorrect option may affect the authority granted and could complicate the probate process. Understanding these distinctions is key for proper document completion.

Lastly, overlooking instructions regarding the affirmation can be a critical error. Individuals may mistakenly believe their affirmation is unnecessary when it is indeed a required step, especially for institutional fiduciaries. Affirmation reinforces the responsibility that the personal representative will uphold their legal duties. It’s important to carefully read all instructions to avoid missing this vital component.

Documents used along the form

The DE-150 form is a crucial document in the probate process, specifically related to the appointment of a personal representative for a decedent's estate. While it serves a specific purpose, several other forms and documents often accompany it to ensure comprehensive estate administration. Here are five important forms that work alongside the DE-150.

- DE-140: Petition for Probate - This document requests that the court officially recognize a will and appoint a personal representative. The petitioner must provide details about the decedent's assets, debts, and beneficiaries.

- DE-147: Notice of Hearing - After filing the Petition for Probate, the petitioner prepares this notice to inform interested parties of the court hearing. It ensures transparency in the legal process and allows heirs and beneficiaries to be heard.

- DE-221: Duties of Personal Representative - This form outlines the legal responsibilities of the appointed personal representative. It is a guide to ensure compliance with probate laws, covering aspects like asset management and distribution to beneficiaries.

- DE-252: Final Inventory and Appraisal - Once the personal representative has gathered the estate's assets, this document lists them for the court. An appraisal may be required to determine the fair market value, providing a complete accounting of the estate.

- DE-295: Account Current - As the personal representative manages the decedent's estate, this form documents all income, expenses, and distributions made. It ensures accountability and is submitted to the court for approval at various stages of the probate process.

Coordinating these forms with the DE-150 ensures an orderly probate process. Each document contributes to a transparent and structured administration of an estate, safeguarding the interests of the decedent's beneficiaries and complying with legal requirements.

Similar forms

- Form DE-111 (Petition for Probate): Similar in purpose, this form initiates the probate process. It provides the details of the decedent's estate and the appointment of a personal representative.

- Form DE-140 (Order for Probate): This document formally establishes the validity of the will and appoints the executor or administrator of the estate, paralleling the authority granted in Form DE-150.

- Form DE-146 (Letters Testamentary): Issued to executors, this form grants them the legal authority to act on behalf of the estate, akin to the powers conferred by the DE-150.

- Form DE-147 (Letters of Administration): This document is used for appointing administrators when there is no will. It serves a similar function to the DE-150 in terms of granting authority over the estate.

- Form DE-151 (Order for Special Administration): It allows the court to grant temporary powers to an administrator, similar to the special administration provisions in the DE-150.

- Form DE-160 (Notice of Hearing on Petition for Probate): While primarily a notification document, it is related in that it ensures all interested parties are aware of proceedings related to estate administration, like those established through the DE-150.

- Form DE-145 (Notice of Proposed Action): This form informs interested parties about actions the personal representative intends to take. Like the DE-150, it protects the interests of the estate beneficiaries.

- Form DE-111D (Probate Status Report): This document provides updates on the progress of the probate case, ensuring transparency and accountability similar to the affirmations in the DE-150.

- Form DE-120 (Request for Special Notice): Similar in that it alerts parties to important developments in the probate process. It enhances communication regarding estate administration matters outlined in the DE-150.

- Form DE-175 (Notice of Administration to Creditors): This form notifies creditors of the probate proceedings, ensuring their rights are protected, much like the provisions within the DE-150 that seek to uphold estate obligations.

Dos and Don'ts

When filling out the DE-150 form, there are several important guidelines to keep in mind to ensure accuracy and compliance. Here’s a helpful list of dos and don’ts:

- Do read the entire form carefully before starting to fill it out. Familiarity with all sections will help prevent errors.

- Don't leave any required fields blank. Incomplete information can lead to delays in the process.

- Do provide clear and legible handwriting if filling out the form by hand. If possible, type the information to enhance readability.

- Don't use correction fluid or tape to modify the form. If you make a mistake, it’s best to start with a fresh form.

- Do double-check all names, dates, and addresses for accuracy. Small mistakes can have significant consequences.

- Don't forget to sign and date the form. A missing signature can invalidate your submission.

Following these guidelines will help ensure that your DE-150 form is completed correctly and processed efficiently.

Misconceptions

Here are some misconceptions about the DE-150 form, commonly used in probate matters:

- The DE-150 form is only for lawyers. Many believe that only attorneys can use this form, but anyone representing themselves can fill it out.

- You cannot file the DE-150 without an attorney. While having legal representation can be helpful, it isn’t necessary to submit the form.

- The DE-150 is only needed if there’s a will. This form is applicable both with and without a will, as it addresses the appointment of personal representatives.

- The information submitted is public. Though some details become part of the public record, you have options to maintain privacy on sensitive information.

- You need to update the DE-150 every time there’s a court hearing. You only need to submit the form once, unless changes occur that necessitate a new filing.

- The form has to be filled out in a specific ink color. There’s no required ink color; black or blue ink is typically acceptable.

- If you make a mistake, you have to start over. Mistakes can often be corrected with simple cross-outs or corrections, depending on the filing guidelines.

- Filing the DE-150 guarantees your appointment as a personal representative. Filling out the form is just one step; the court must approve the appointment.

Understanding these misconceptions can help navigate the probate process with more confidence and clarity.

Key takeaways

When you fill out the DE-150 form, be aware of several important considerations.

- The form is vital for initiating the probate process in California.

- Complete the attorney or party information at the top, including the name and state bar number.

- Provide accurate information about the decedent, including their full name and case number.

- Clearly indicate whether you are applying for testamentary letters of administration with or without a will.

- Understand that the personal representative has significant powers regarding the estate, which vary based on the type of letters issued.

- Check if the personal representative needs court approval for transactions involving money or property.

- Use the affirmation section to confirm the intentions of individuals or institutional fiduciaries.

- Do not forget to date and sign the form, as an unsigned document may be considered invalid.

- Press the "Clear This Form" button after printing it to protect your private information.

Making sure that each section is carefully filled out can help smooth the probate process. Missteps may lead to delays or complications, so it's essential to be thorough and deliberate in your approach.

Browse Other Templates

Transcript Submission Form,Academic Record Request,Student Transcript Application,Official Transcript Order,Transcript Retrieval Request,Course History Request Form,Educational Record Release Form,Transcript Delivery Request,Student Transcript Author - Provide your student ID number to help the registrar locate your records.

Vics Bol - Overall, careful preparation can lead to more efficient logistics.