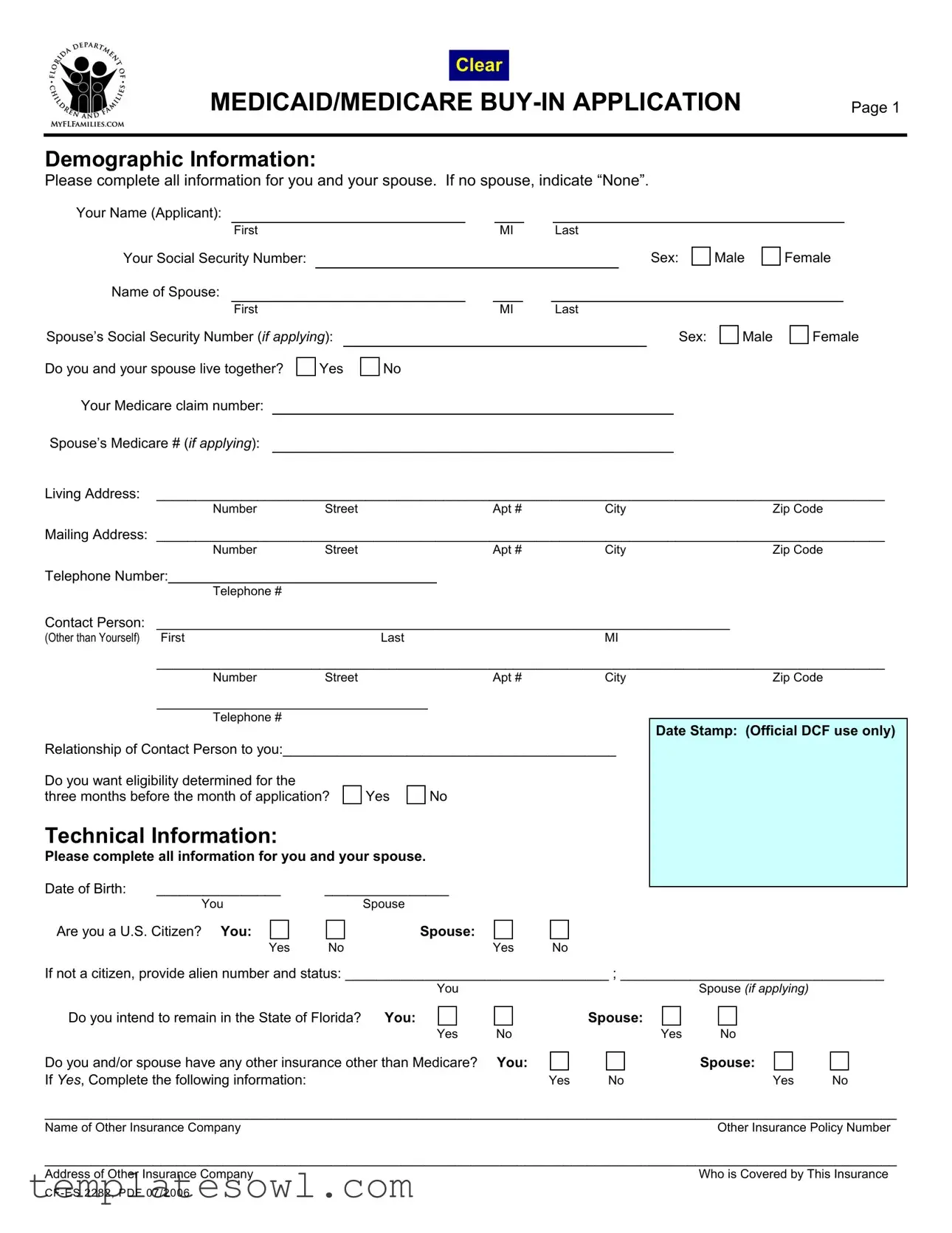

Fill Out Your Des 202 Form

The DES 202 form is a vital document used for applying for the Medicaid and Medicare Buy-In program in Florida. This application seeks to gather comprehensive demographic information about both the applicant and their spouse, if applicable, ensuring that details such as names, social security numbers, and living addresses are accurately recorded. Additionally, it delves into technical aspects like citizenship status and insurance coverage, which aid in determining eligibility for Medicaid assistance. Prospective applicants need to provide information about their financial assets, including bank accounts, property holdings, and other investments. Income details also play a crucial role in evaluating eligibility; thus, the form collects data on any wages or benefits received. Throughout the application process, individuals are informed of their rights and responsibilities, highlighting the importance of providing truthful and complete information. This form not only facilitates access to essential healthcare resources but also educates applicants about the implications of misrepresentation within the application process, ensuring that they understand the significance of their submissions.

Des 202 Example

|

Clear |

|

|

MEDICAID/MEDICARE |

Page 1 |

||

|

|

|

|

Demographic Information: |

|

||

Please complete all information for you and your spouse. If no spouse, indicate “None”. |

|

||

Your Name (Applicant):

First |

|

MI |

|

Last |

Your Social Security Number: |

|

Sex: |

Name of Spouse: |

|

|

Male

Female

|

First |

|

|

|

|

MI |

|

Last |

|

|

|

|||

Spouse’s Social Security Number (if applying): |

|

|

|

|

|

|

|

Sex: |

Male |

Female |

||||

Do you and your spouse live together? |

Yes |

No |

|

|

|

|

|

|

|

|||||

Your Medicare claim number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s Medicare # (if applying): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Living Address: ______________________________________________________________________________________________

Number |

Street |

Apt # |

City |

Zip Code |

Mailing Address: ______________________________________________________________________________________________

NumberStreetApt #CityZip Code

Telephone Number:

Telephone #

Contact Person: |

__________________________________________________________________________ |

|

|||

(Other than Yourself) |

First |

Last |

|

MI |

|

|

______________________________________________________________________________________________ |

||||

|

Number |

Street |

Apt # |

City |

Zip Code |

___________________________________

Telephone #

Relationship of Contact Person to you:___________________________________________

Do you want eligibility determined for the |

|

|

three months before the month of application? |

Yes |

No |

Technical Information:

Please complete all information for you and your spouse.

Date of Birth: |

________________ |

________________ |

|

|

|

You |

Spouse |

|

|

Are you a U.S. Citizen? You: |

Spouse: |

|

|

|

|

Yes |

No |

Yes |

No |

Date Stamp: (Official DCF use only)

If not a citizen, provide alien number and status: __________________________________ ; __________________________________

You |

Spouse (if applying) |

Do you intend to remain in the State of Florida? You:

Yes

Do you and/or spouse have any other insurance other than Medicare? If Yes, Complete the following information:

Spouse:

NoYes No

You: |

|

Spouse: |

|

Yes |

No |

Yes |

No |

______________________________________________________________________________________________________________

Name of Other Insurance CompanyOther Insurance Policy Number

______________________________________________________________________________________________________________

Address of Other Insurance Company |

Who is Covered by This Insurance |

|

|

|

|

|

|

Page 2 |

Asset Information: Please list all assets owned by you and/or spouse (even if your spouse is not applying). |

|||||

TYPE |

NAME OF BANK/ |

ADDRESS |

ACCOUNT NUMBER |

VALUE OF |

IN WHOSE NAME |

|

FINANCIAL INSTITUTION |

|

|

ASSET |

IS IT HELD |

CASH |

|

|

|

|

|

|

|

|

|

|

|

SAVINGS ACCOUNT |

|

|

|

|

|

|

|

|

|

|

|

CHECKING ACCOUNT |

|

|

|

|

|

|

|

|

|

|

|

CAR |

|

|

|

|

|

Make/Model/Year: |

|

|

|

|

|

|

|

|

|

|

|

HOMESTEAD |

|

|

|

|

|

|

|

|

|

|

|

OTHER PROPERTY |

|

|

|

|

|

|

|

|

|

|

|

TRUST FUND |

|

|

|

|

|

|

|

|

|

|

|

STOCKS/BONDS |

|

|

|

|

|

|

|

|

|

|

|

TAX SHELTERED |

|

|

|

|

|

ACCOUNTS |

|

|

|

|

|

LIFE INSURANCE |

|

|

|

|

|

|

|

|

|

|

|

KEOGH PLAN |

|

|

|

|

|

|

|

|

|

|

|

Other: Please Specify |

|

|

|

|

|

|

|

|

|

|

|

Income Information: Please complete all information for you and your spouse (even if spouse is not applying).

Are you or your spouse

Applicant

Yes |

No |

Gross Amount |

|

|

Earned Monthly |

Spouse

Yes |

No |

Gross Amount |

|

|

Earned Monthly |

Do you or your spouse work for someone else?

Applicant

Yes |

No |

Gross Amount |

|

|

Earned Monthly |

Spouse

Yes |

No |

Gross Amount |

|

|

Earned Monthly |

Do you or your spouse receive income from any of the following? |

|

|

|

Gross Amount Received Each Month |

|||

|

|

(Before Any Deductions) |

|

Type |

Benefit No. |

Applicant |

Spouse |

Veterans Benefits |

|

|

|

Pension |

|

|

|

Interest/Dividends |

|

|

|

Civil Service Annuity |

|

|

|

Income from another person |

|

|

|

Black Lung |

|

|

|

Social Security |

|

|

|

Other (e.g. SSI, Annuities): (specify) |

|

|

|

|

|

|

|

Page 3

YOUR RIGHTS AND RESPONSIBILITIES: Read this sheet before you sign your name.

YOU HAVE THE RIGHT TO:

•Apply for assistance and have a determination of your eligibility made without regard to race, color, sex, age, handicap, religion, national origin, marital status or political belief.

•Have a representative help you fill out the eligibility forms.

•Have action taken on your application promptly and be notified of such action.

•Be informed of other available services of the Department of Children and Families.

•Request a fair hearing when you disagree with a decision of the Department of Children and Families.

•Have the information about you and/or your spouse that is collected by the department treated confidentially in accordance with federal and state laws.

YOU HAVE THE RESPONSIBILITY TO (things you must do):

•Assist in determining your eligibility by giving complete and correct information and provide written proof of information, as requested, within the time limits given.

•Declare the citizenship or alien status for you and your spouse by signing the Medicaid/Medicare

•File for any payments or benefits from other sources if this application, or other information, indicates that you or your spouse may be eligible for such payments or benefits.

•Assign your rights to third party benefits and cooperate in reporting any insurance or other health plan that covers medical costs for you (and/or your spouse, if applying) unless good cause can be shown not to do so.

•Report changes in your situation (e.g., income, assets) within 10 days of the change.

•Report your (and your spouse’s, if applying) Social Security numbers. Without accurate numbers, we will be unable to provide Medicaid/Medicare

IMPORTANT INFORMATION ABOUT MEDICAID:

Any person (including the designated representative) who knowingly withholds information or knowingly misrepresents the truth may be punished under federal or state law or both. If you get medical assistance for which you do not qualify, you may have to repay the cash value of that assistance.

Certification of Citizenship/Alien Status: I certify, under the penalty of perjury, by signing my name on this application, that I and my spouse (if applicable) are U.S. citizens or nationals of the United States or qualified aliens.

Certification: In signing this application, I swear and affirm, under penalty of perjury, that the information I have given on this application is correct and complete to the best of my knowledge. I have read and understand the above rights and responsibilities and important information about Medicaid.

Applicant |

Go Back To Page 1 |

|

|||||

|

|

|

|

||||

Signature: |

|

|

Date: |

|

|||

Spouse |

|

|

|

|

|

||

Signature: |

|

|

Date: |

|

|||

|

|

|

|

|

|

|

|

Designated |

|

|

|

|

|||

Representative Signature: |

|

|

Date: |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

HELPING PERSON: (Official use only) |

|

|

|

|

|||

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

Signature of Individual Who Assisted Applicant in Completing

In accordance with Federal law and our policy, the Department of Children and Families is prohibited from discriminating on the basis of race, color, national origin, sex, age, disability, religion, political belief, or marital status.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Title | Medicaid/Medicare Buy-In Application |

| Purpose | This form is used to apply for assistance under Medicaid and Medicare programs. |

| Eligibility | Eligibility is determined based on income, assets, and citizenship status. |

| U.S. Citizenship Requirement | Applicants must declare their U.S. citizenship or qualified alien status. |

| Living Arrangement | Applicants must indicate if they live with a spouse or alone. |

| Asset Disclosure | All assets must be reported, including bank accounts and property. |

| Income Reporting | Income from various sources must be disclosed for both the applicant and spouse. |

| Rights and Responsibilities | Applicants have rights regarding assistance and obligations to provide accurate information. |

Guidelines on Utilizing Des 202

Filling out the DES 202 form is a straightforward process, but it does require attention to detail and accuracy. This form collects important information about you and your spouse (if applicable), which will be used to determine your eligibility for benefits. Follow these steps carefully to complete the application.

- Gather Required Information: Make sure you have your personal details ready, including name, Social Security number, and Medicare claim number, as well as this information for your spouse, if applicable.

- Fill Out Demographic Information: Start with your name, Social Security number, sex, and that of your spouse if you have one. Indicate whether you live together.

- Provide Contact Information: Enter your living address and mailing address. Include a telephone number and a contact person’s details, such as their name, address, and relationship to you.

- Indicate Eligibility Period: Answer whether you want your eligibility determined for the three months before your application month.

- Enter Technical Information: Supply the date of birth and citizenship status for both you and your spouse. If you’re not a citizen, provide your alien number and status.

- Disclose Other Insurance: If you or your spouse have insurance other than Medicare, list the insurance company's name and policy number, along with the address and who is covered.

- List Assets: Document all your and your spouse’s assets such as bank accounts, properties, vehicles, stocks, and any others, including the account number and the name of the financial institution.

- Complete Income Information: Indicate if you or your spouse are self-employed or work for someone else. List all types of income received and the gross monthly amounts for both of you.

- Read Your Rights and Responsibilities: It is crucial to understand your rights and responsibilities outlined in the form. Take a moment to read this section carefully.

- Certification: Sign and date the application, confirming that the information provided is accurate and complete, and that you understand your rights.

What You Should Know About This Form

What is the DES 202 form used for?

The DES 202 form is primarily the Medicaid and Medicare Buy-In Application. It enables eligible individuals, particularly those who are low-income seniors or people with disabilities, to apply for assistance with healthcare costs associated with Medicare. By filling out this form, applicants can seek financial help to cover premiums and other related expenses, thereby making healthcare more accessible.

Who needs to fill out the DES 202 form?

Any individual who wishes to apply for the Medicaid Buy-In for Medicare must complete the DES 202 form. If the applicant is married, the spouse's information is also required, even if the spouse is not applying for benefits. It's essential to provide complete details about both personal and financial circumstances.

What information is required on the form?

The form requests demographic information such as names, Social Security numbers, and Medicare claim numbers for both the applicant and their spouse, if applicable. It also asks for residence and mailing addresses, income details, and asset information, including bank accounts and properties. Lastly, applicants must disclose any additional health insurance coverage they might have.

Do I need to provide proof of citizenship or alien status?

Yes, the form requires applicants to declare their U.S. citizenship or alien status. If not a U.S. citizen, the applicant must provide their alien number and explain their status. This declaration is crucial for eligibility determination and is a legal requirement.

What happens if I do not report my changes in financial situation?

It's vital to report any changes in your financial situation, such as income or asset modifications, within 10 days of the change. Failure to do so could lead to delays in benefits or even require repayment of assistance received if it is later discovered that you were not eligible based on your actual circumstances.

Is there assistance available for completing the form?

Absolutely! Applicants have the right to receive help while filling out the DES 202 form. A representative can assist you, whether it’s a family member or a care advocate, ensuring that you provide accurate information and understand the process.

What should I do after completing the form?

Once you have filled out the DES 202 form, make sure to review all the information for accuracy. After affirming that all details are correct and complete, you can sign the form and submit it to the appropriate agency for evaluation. Stay informed about the timeline for notifications regarding eligibility decisions, as the application will be processed promptly.

Common mistakes

Filling out the DES 202 form is a critical step in applying for Medicaid or Medicare buy-in benefits. However, many applicants make common mistakes that can lead to delays or denials of their applications. Understanding these pitfalls can save time and ensure that your application is processed smoothly.

One frequent error is leaving out required personal information. Always ensure that you fill in all sections for both yourself and your spouse, including names, Social Security numbers, and contact details. Missing even a few pieces of information can stall your application.

Inaccurate reporting of income and assets is another common mistake. Be sure to include all sources of income and list assets accurately to avoid complications down the line. For example, underreporting income or failing to declare assets may result in a denial of benefits.

Additionally, many people overlook the question about whether they have insurance besides Medicare. If the answer is "yes," be prepared to provide details about the other insurance policies. This information is crucial for determining eligibility and is often a point of confusion.

Another mistake involves not signing the application correctly. It is essential to provide your signature and the date on the form, as well as your spouse's signature if applicable. A missing signature can delay the process significantly.

Applicants sometimes fail to report changes in their circumstances, such as changes in income or residency. This oversight can lead to complications and affect eligibility. The form requires filing such updates within ten days, so it is vital to stay vigilant.

Misunderstanding residency requirements can also be a problem. Applicants must indicate whether they intend to remain in Florida. Answering "No" without understanding the implications can affect the outcome of the application.

Some individuals do not provide a contact person or fail to include the correct information for them. This contact person should be someone other than yourself and will assist in communication about your application. Omitting this detail can delay communication from the Department of Children and Families.

Failure to read and understand the rights and responsibilities section of the application is another issue. It's imperative to know what is expected of you in the application process and ensure compliance with all requests for information.

Lastly, many applicants make the mistake of not keeping a copy of their completed application. Retaining a copy ensures you have a record of what you submitted and allows for easier follow-up in case additional information is requested.

By being vigilant and attentive to these common errors while filling out the DES 202 form, you can increase the likelihood of a successful application. Take the time to review the form thoroughly, and consider seeking assistance if needed to ensure all areas are completed accurately.

Documents used along the form

The DES 202 form is a critical component in applying for Medicaid and Medicare buy-in programs. However, several other documents often accompany this application to ensure a complete submission. Below is a list of related documents that may be necessary or beneficial in the application process.

- Proof of Citizenship: This document verifies your citizenship status. Acceptable forms include a birth certificate, passport, or naturalization certificate.

- Health Insurance Information: This provides details about any existing health insurance policies you or your spouse hold, including policy numbers and coverage specifics.

- Income Verification Documents: Documentation such as pay stubs, tax returns, or social security benefit statements helps establish income levels for both you and your spouse.

- Asset Information Letters: Bank statements or asset valuations outline all owned properties, savings, and financial interests that contribute to your overall financial picture.

- Disability Verification: For applicants with disabilities, medical records or disability benefits letters help confirm the status and extent of a disability.

- Power of Attorney Document: If someone is assisting you with the application, this document authorizes that individual to act on your behalf in the process.

- Representative Payee Information: If applicable, this document identifies who receives Social Security benefits on your behalf, crucial for determining financial eligibility.

- Application Checklist: This serves as a guide to ensure all necessary documents are included with the submission and helps avoid delays in processing.

Compiling these documents and ensuring they are accurate and up-to-date enhances the likelihood of a smooth application process. Being thorough and organized is key to navigating the Medicaid and Medicare buy-in system successfully.

Similar forms

Medicaid Application Form: Similar to the DES 202, this form collects personal and financial information to determine eligibility for Medicaid services.

Medicare Enrollment Form: Both documents require applicants to provide demographic details and information about any other health insurance, ensuring proper enrollment in Medicare.

Financial Assistance Application: Just like the DES 202, this application includes sections for income and asset reporting, essential for assessing financial need.

Social Security Disability Benefits Application: This form involves providing personal details and financial resources, mirroring the thoroughness of the DES 202 for eligibility evaluation.

Health Insurance Marketplace Application: Both require individuals to disclose financial and demographic information to assess eligibility for health insurance coverage.

Supplemental Nutrition Assistance Program (SNAP) Application: The SNAP application similarly gathers information on income and household composition to determine eligibility for food assistance.

Veterans Affairs Benefits Application: Both documents necessitate personal and financial disclosures to assess the applicant's eligibility for various VA benefits.

Dos and Don'ts

- Ensure all information is accurate: Double-check names, Social Security numbers, and addresses for any errors.

- Provide complete financial data: List all assets and income sources without leaving anything out to avoid delays.

- Report changes promptly: Notify the Department within 10 days of any significant changes in income or assets.

- Include the right signatures: Ensure both the applicant and spouse (if applicable) sign the form where indicated.

- Read all instructions carefully: Understanding the requirements can prevent mistakes and speed up the application process.

- Avoid guessing answers: If unsure about a question, seek assistance rather than providing incorrect information.

- Do not leave sections blank: Fill in every section, even if the information does not apply. Mark "N/A" where necessary.

- Refrain from submitting without supporting documents: Include required proof of citizenship, income, and assets along with the form.

- Do not ignore deadlines: Submit the application and any requested documentation on time to prevent delays in eligibility.

- Stay vague or general: Provide specific details and exact figures to help ensure a smooth processing of the application.

Misconceptions

Understanding the DES 202 form is essential, but many misconceptions can lead to confusion. Let’s clarify seven common misunderstandings about this important application.

- Myth 1: Only individuals currently on Medicaid need to fill out this form.

- Myth 2: You don't need to include your spouse's information if they aren't applying.

- Myth 3: The form is only for U.S. citizens.

- Myth 4: You can submit the form without supporting documents.

- Myth 5: The application process is the same for everyone.

- Myth 6: Once submitted, the application will be processed immediately.

- Myth 7: It's unnecessary to report changes after submitting the application.

In reality, anyone seeking to qualify for Medicaid or Medicare buy-in benefits must complete the DES 202 form, regardless of their current status.

This is incorrect. The form requires information about your spouse to accurately assess household income and assets, even if they do not intend to apply.

This misconception overlooks that qualified aliens can also apply. However, applicants must declare their citizenship status on the form.

While you may submit the application form, you must provide supporting documents when requested to verify the information you've declared.

The process may vary depending on individual circumstances, such as income or asset levels. It’s important to follow the specific instructions that apply to your situation.

It may take some time to process applications, and you will receive a notification regarding the status. Patience is key as they review your information.

On the contrary, you must report any changes in your or your spouse's situation, such as income, within ten days to ensure continued eligibility.

By addressing these misconceptions, applicants can better understand the DES 202 form and navigate the application process more effectively.

Key takeaways

Filling out the DES 202 form can be a crucial step in securing Medicaid and Medicare benefits. Here are some key takeaways to keep in mind during the process:

- Accurate Demographics Matter: Ensure all demographic information is complete for both you and your spouse, including Social Security numbers and addresses.

- Joint or Separate Applications: If you're applying with a spouse, make sure to include their details. If single, indicate "None" for the spouse's information.

- Confirming Citizenship: Be prepared to declare your citizenship status. This is essential for receiving benefits and must be signed on the application.

- Timely Communication: You must report any changes in income or assets within 10 days to maintain eligibility.

- Income Disclosure: List all sources of income accurately, including benefits, employment, and any self-employment earnings.

- Responsibilities on You: Understand that you have a duty to provide correct information and assist in determining eligibility. Failure to do so may impact benefits.

- Confidentiality Matters: Your information is protected under state and federal laws, and you have the right to keep personal details private.

These takeaways highlight the importance of diligence and accuracy when filling out the DES 202 form. Each piece of information you provide plays a role in determining your eligibility for essential benefits.

Browse Other Templates

Ct-3 - The CT-3-S form also allows for the reporting of interest income derived from various sources.

Ppd Hours - Entities must regularly review their registration status to avoid unnecessary complications.

Medical Authorized Representative Form - This form grants United HealthCare permission to share your health information with an authorized person.