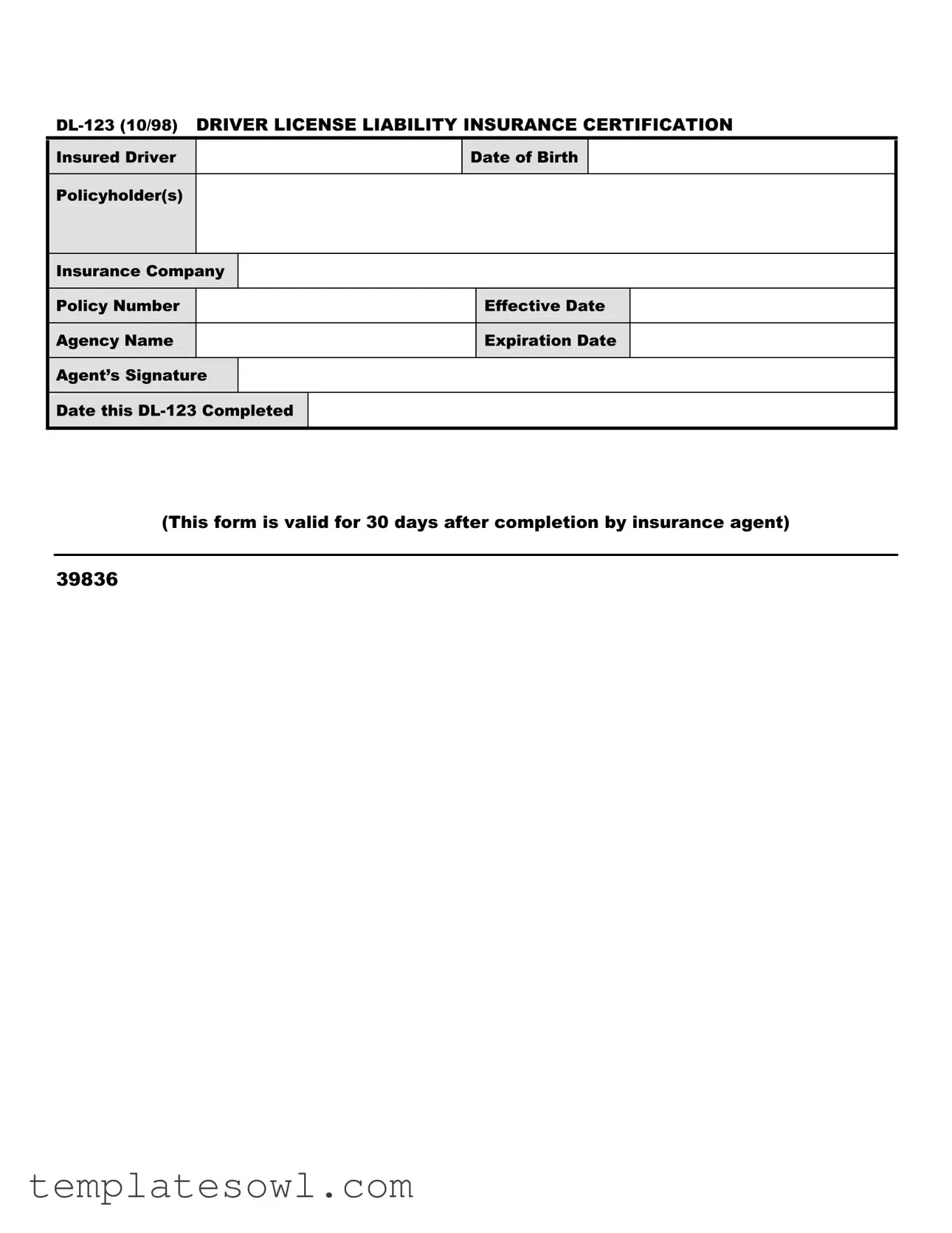

Fill Out Your Dl 123 Form

When navigating the complexities of driver licensing and insurance requirements, the DL-123 form serves a crucial role in ensuring compliance and verifying liability coverage. This form, officially titled the Driver License Liability Insurance Certification, is designed to document essential information for drivers seeking to prove their insurance status. The form includes important details such as the insured driver's name and date of birth, along with particulars about the insurance policyholder or holders. Additionally, it captures the specifics of the insurance company, including the policy number and dates of coverage—both effective and expiration. An insurance agent’s signature verifies the completion of the document, confirming that it is filled out accurately. It is vital to remember that this form remains valid for 30 days following its completion, making timely submission particularly important for those seeking to renew or obtain their driver’s license. Understanding the significance of the DL-123 not only aids in a smoother application process but also reinforces the broader framework of responsible vehicle operation and insurance accountability.

Dl 123 Example

Insured DriverDate of Birth

Policyholder(s)

Insurance Company

|

Policy Number |

|

|

|

Effective Date |

|

|

|

|

|

|

|

|

|

Agency Name |

|

|

|

Expiration Date |

|

|

|

|

|

|

|

|

|

Agent’s Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

Date this |

|

|

|

||

|

|

|

|

|

|

|

(This form is valid for 30 days after completion by insurance agent)

39836

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The DL-123 form certifies that a driver maintains liability insurance, as required by state law. |

| Validity Period | This form is valid for 30 days from the date of completion by the insurance agent. |

| Required Information | Essential details include the insured driver’s name, date of birth, policyholder’s information, insurance company, policy number, effective and expiration dates, and the agent's signature. |

| Governing Law | The use of the DL-123 form is typically governed by vehicle insurance laws in the respective state, ensuring compliance with minimum liability insurance requirements. |

Guidelines on Utilizing Dl 123

Completing the DL-123 form is an essential step in certifying your driver license liability insurance. Make sure to have all necessary information about your insurance policy and personal details ready before starting. This form must be filled out accurately to avoid any delays or issues with your driver license.

- Gather necessary information: Collect your personal details, including your name, date of birth, and the name of your insurance policyholder.

- Enter insured driver information: Fill in your full name and date of birth in the appropriate fields on the form.

- Complete policyholder information: Provide the name of the policyholder(s) if it differs from the insured driver.

- Detail the insurance company: Write down the name of your insurance company correctly.

- Fill out the policy number: Enter your specific policy number as stated on your insurance documents.

- Indicate the effective date: Note the date when your insurance policy became active.

- Provide agency information: Include the name of the insurance agency that issued your policy.

- Enter expiration date: Fill in the expiration date of your insurance policy.

- Obtain agent’s signature: Have your insurance agent sign the form to verify all provided information.

- Fill in the completion date: Write the date when the DL-123 form was completed.

After completing the DL-123 form, ensure that it is submitted within 30 days of being signed by the agent. This will help avoid issues with your license renewal or other related activities. Keep a copy for your records before submitting the original form to the relevant authorities.

What You Should Know About This Form

What is the DL-123 form?

The DL-123 form is a certification document that verifies a driver's liability insurance coverage. It is specifically used for individuals who are applying for, renewing, or reinstating a driver's license. The form provides information about the insured driver, the policyholder, the insurance company, and relevant policy details.

Who needs to complete a DL-123 form?

Any individual seeking to obtain or maintain a driver's license in states that mandate proof of insurance will need to complete the DL-123 form. This includes first-time applicants, individuals renewing their licenses, or those who are reinstating their licenses after a suspension or lapse in coverage.

How long is the DL-123 form valid?

The DL-123 form is valid for 30 days from the date it is completed by the insurance agent. After this period, the form will no longer be accepted as valid proof of insurance. It is important for applicants to be aware of this timeframe when submitting their documentation.

What information is required on the DL-123 form?

The form requires several essential details. This includes information about the insured driver, such as their name and date of birth. Additionally, the policyholder's name, the insurance company's name, and policy number must be filled in. Important dates such as the effective date and expiration date of the insurance policy, along with the agent's signature, are also necessary for the form to be valid.

Where can I obtain a DL-123 form?

The DL-123 form is typically provided by the insurance company or agent during the purchase or renewal of an insurance policy. It may also be available through state Department of Motor Vehicle (DMV) offices or their websites in jurisdictions that require this documentation for driver’s license applications.

What should I do if my DL-123 expires?

If your DL-123 form expires, you will need to obtain a new form from your insurance agent or agency. It is advisable to do this as soon as possible to ensure that you have valid proof of insurance when applying for or renewing your license. This will help to avoid any delays in the licensing process.

Common mistakes

Filling out the DL-123 form may seem straightforward, but there are several common mistakes that can lead to delays or even rejections. One of the biggest errors individuals make is not providing accurate policyholder information. The policyholder's name must match the details on the insurance policy exactly. Any discrepancies, such as misspellings or incorrect initials, can cause issues with processing the form.

Another frequent mistake is failing to include the correct policy number. This number is crucial for the insurance company and must be entered without any errors. Omitting it or providing an outdated number can result in the form being deemed invalid.

There are also issues related to the effective date and expiration date of the insurance policy. It’s essential to ensure that these dates are current and reflect the policy's validity during the time the DL-123 is completed. If the effective date has not yet arrived or if the policy has lapsed, the form will not serve its intended purpose.

Moreover, some individuals neglect to have the insurance agent's signature on the form. The agent must sign and date the DL-123 to confirm that the information provided is accurate and complies with the necessary insurance requirements. Without this signature, the document cannot be processed.

Timing is another critical factor. The DL-123 form is valid for only 30 days after being completed by the insurance agent. Some people forget to submit the form promptly, leading to a situation where it is no longer valid by the time it reaches the Department of Motor Vehicles (DMV).

Another common oversight is not indicating the insurance company's name clearly. This information must be printed legibly to prevent any confusion or miscommunication regarding which agency is handling the insurance.

Checking the insured driver's details is also vital. Mistakes in entering the insured driver's date of birth can lead to complications. This information must match the records on file with the DMV, as any mismatch could raise red flags.

Additionally, some people forget to include their contact information on the form. Providing a phone number or email helps ensure the DMV can easily contact you if there are inquiries regarding your submission.

Lastly, individuals often skip reviewing the completed form for accuracy. It’s crucial to take a moment to double-check all entries before submission. A careful review can catch errors that might otherwise delay the process.

In summary, attention to detail is key when filling out the DL-123 form. By avoiding these common pitfalls, you can ensure a smoother submission process and minimize potential delays with your driver's license certification.

Documents used along the form

The DL-123 form serves as a certification for driver license liability insurance. It is essential for ensuring that drivers are covered in the event of an accident. Completing this form often requires additional documentation to support the insurance coverage. Below is a list of commonly used forms and documents that may be required alongside the DL-123 form, each serving a specific purpose in the driver licensing process.

- DL-1: This is an application for a driver's license or permit. It collects essential information about the applicant, including identification details and residency status.

- DL-2: Also known as a Request for Duplicate License, this form is utilized when an individual needs to replace a lost or stolen driver's license.

- SR-22: This document is an insurance certificate proving that a driver has the required liability coverage. It is often necessary for reinstating a license after certain violations.

- DL-180: The Medical Examination Report form is required for drivers who have specific medical conditions. It ensures that the applicant is fit to operate a vehicle safely.

- DL-123A: This supplemental form provides additional information regarding supplementary insurance coverage or specific vehicle details for insurance policies.

- TC-1: This Traffic Collision Report form is filled out in the event of an accident. It documents important details about the incident for insurance purposes.

- MV-1: This is a vehicle registration application. It is necessary when registering a new vehicle under your name, which may be needed for insurance policies.

- DL-31: A Driver’s License Test Receipt serves as proof that an applicant has paid for and is scheduled to take the driving test, which is required for obtaining a license.

- DMV-30: This is a Reinstatement Application, which is often needed for individuals whose licenses have been suspended due to various infractions.

Each of these documents plays a crucial role in the overall process of obtaining and maintaining a driver's license. Ensure that you gather the necessary forms and complete them accurately to facilitate a smoother experience with your driver licensing needs.

Similar forms

-

DL-44 Form: This is used for applying for a driver's license or identification card in California. Similar to the DL-123, it requires basic personal information and certifies eligibility for licensing.

-

SR-22 Form: Often mandated for high-risk drivers, this document shows proof of insurance and verifies that a driver meets state liability insurance requirements. Like the DL-123, it must be completed by an insurance agent and reflects current policy details.

-

Form FR-44: This form is specific to certain states and is used to show proof of higher insurance limits for drivers with serious violations. Similar to the DL-123, it provides an official certification of insurance coverage and is often required for reinstatement of driving privileges.

-

Certificate of Financial Responsibility: This document serves as proof of a driver’s insurance coverage and compliance with state laws. It shares the same purpose as the DL-123, affirming that the driver is insured and meets minimum requirements.

-

Insurance Policy Declaration Page: This page outlines primary details about an insurance policy including coverage types, limits, and insured individuals. Similar to the DL-123, it provides crucial information regarding liability coverage and must be kept up-to-date.

Dos and Don'ts

When filling out the DL 123 form, there are key practices to follow and some pitfalls to avoid. Here’s a guide that can help ensure your form is completed accurately.

- Do provide complete and accurate information.

- Do use clear handwriting or type the information when possible.

- Do verify that the insurance policy details are current and valid.

- Do ensure the agent’s signature is included at the bottom of the form.

- Do double-check for any misspellings of names or addresses.

- Don't leave any required fields blank.

- Don't submit the form past its validity period of 30 days.

- Don't use abbreviations or shorthand that may confuse the reader.

- Don't forget to keep a copy for your records after completion.

By adhering to these guidelines, you can help facilitate a smoother process in obtaining your driver’s license certification.

Misconceptions

Misconceptions surrounding the DL-123 form can lead to confusion about its purpose and usage. Here are nine common misconceptions that many people believe:

- The DL-123 form is a driver's license application. In reality, the DL-123 is not an application for a driver's license but a certification of liability insurance for a driver.

- This form is only needed for new drivers. Many people think that only new drivers are required to submit the DL-123. However, anyone who wishes to provide proof of insurance for their driver’s license renewal must complete it as well.

- Once submitted, the DL-123 form never expires. Some believe that the DL-123 is a permanent document. In fact, the form is only valid for 30 days after it is completed by an insurance agent.

- The form can be filled out at home. Individuals may assume they can fill out the DL-123 on their own. However, it must be completed and signed by a licensed insurance agent.

- The DL-123 is required for all types of insurance. It’s commonly thought that this form is necessary for every insurance policy. The DL-123 specifically certifies liability insurance—it does not pertain to other types such as comprehensive or collision coverage.

- All states recognize the DL-123 form. There may be an assumption that the DL-123 is uniform across the U.S. However, this form is specific to certain jurisdictions, and it’s essential to check local regulations.

- It is not necessary if you already have car insurance. Some people think that having car insurance means the DL-123 is unnecessary. Yet, this certification is still required to prove that the insurance meets specific state minimum liability standards.

- Submission of the form guarantees insurance compliance. There is a belief that submitting the DL-123 automatically confirms that all insurance conditions are met. Instead, it merely certifies that liability insurance is in place at the time of completion.

- Once the DL-123 is submitted, no further action is needed. Finally, some may think that after submitting the form, everything is settled. However, it remains the driver's responsibility to maintain continuous insurance coverage to avoid penalties or legal issues.

Understanding these misconceptions can help individuals better navigate the requirements associated with the DL-123 form and ensure compliance with state regulations.

Key takeaways

The DL-123 form is essential for driver license liability insurance certification. Below are key takeaways regarding its completion and use.

- This form certifies that a driver has liability insurance coverage.

- It must include the insured driver's name and their date of birth.

- The policyholder's name should also be clearly indicated.

- Insurance company details, including the company name and policy number, are required.

- The effective date of the insurance policy should be accurately recorded.

- The agency name and expiration date must be provided.

- An insurance agent's signature confirms the validity of the form.

- This form is valid for 30 days after it is completed by the insurance agent.

- Keep a copy of the completed form for personal records.

- Submit the DL-123 form when applying for or renewing a driver’s license.

Understanding these elements will help ensure the form is filled out correctly, meeting all necessary requirements.

Browse Other Templates

Best Medicare Supplement Companies - Suspension of coverage is possible for individuals entering Medicaid; specific steps must be followed.

Schedule 6 - Evaluating officers track student performance in a systematic way, facilitating fair assessment.