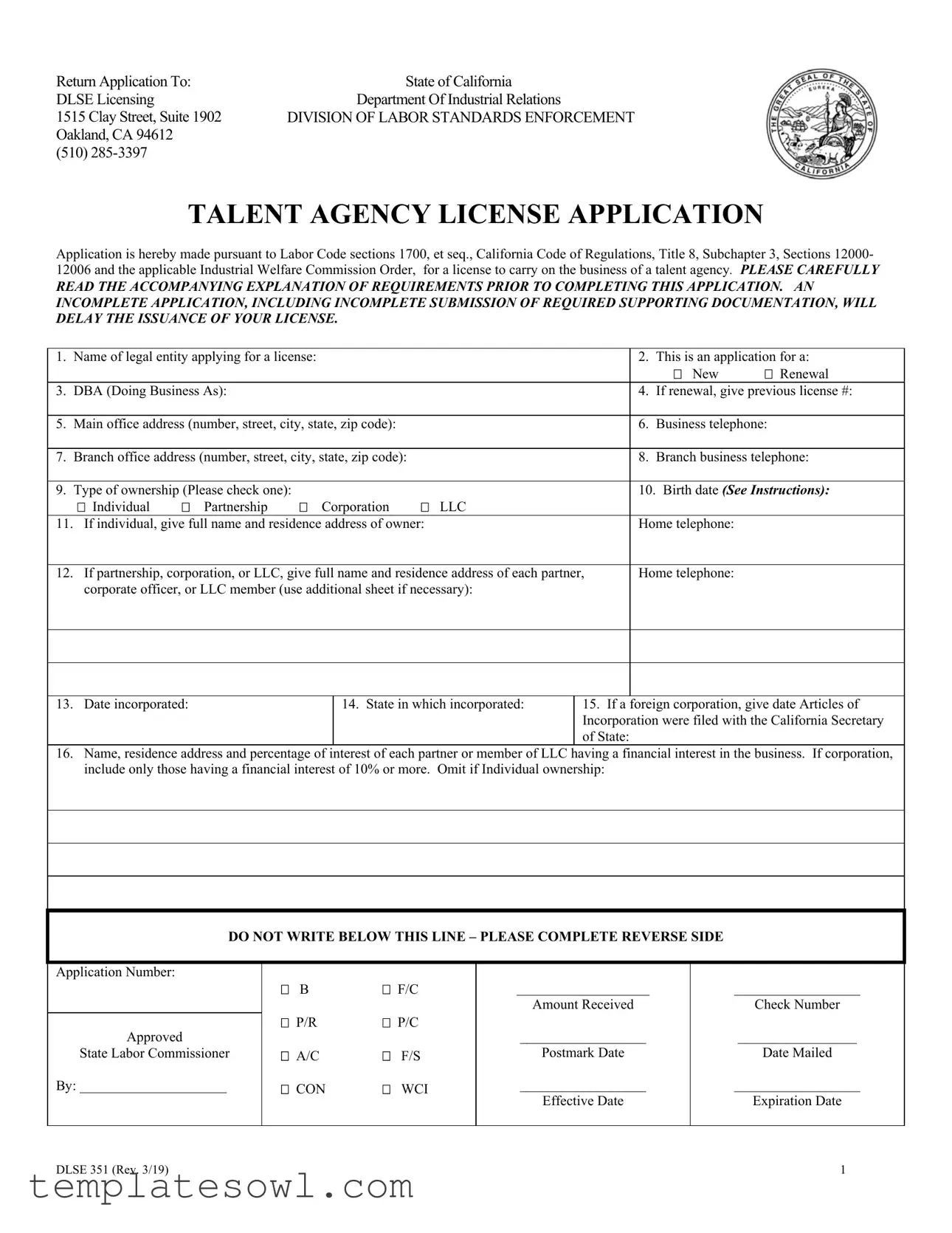

Fill Out Your Dlse 351 Form

The DLSE 351 form is a crucial document for individuals and entities seeking to operate a talent agency in California. This application is governed by specific Labor Code sections and regulations, ensuring compliance with state laws. Applicants must provide comprehensive details about their business structure, whether it is a new application or a renewal of an existing license. Key pieces of information include the legal entity’s name, the main and branch office addresses, and the type of ownership—ranging from individuals to corporations. Additionally, the form requests disclosures about financial interests, management responsibilities, and any potential legal issues associated with the business or its principals. It is essential for applicants to carefully fill out the form to prevent delays; an incomplete submission may hinder the license issuance process. The signed certification at the end of the form emphasizes the importance of truthful representation and the legal consequences of any misstatements made during the application process. Adhering to these guidelines is vital for establishing a compliant and legitimate talent agency in California.

Dlse 351 Example

Return Application To: |

State of California |

DLSE Licensing |

Department Of Industrial Relations |

1515 Clay Street, Suite 1902 |

DIVISION OF LABOR STANDARDS ENFORCEMENT |

Oakland, CA 94612 |

|

(510) |

|

TALENT AGENCY LICENSE APPLICATION

Application is hereby made pursuant to Labor Code sections 1700, et seq., California Code of Regulations, Title 8, Subchapter 3, Sections 12000- 12006 and the applicable Industrial Welfare Commission Order, for a license to carry on the business of a talent agency. PLEASE CAREFULLY

READ THE ACCOMPANYING EXPLANATION OF REQUIREMENTS PRIOR TO COMPLETING THIS APPLICATION. AN INCOMPLETE APPLICATION, INCLUDING INCOMPLETE SUBMISSION OF REQUIRED SUPPORTING DOCUMENTATION, WILL DELAY THE ISSUANCE OF YOUR LICENSE.

1. |

Name of legal entity applying for a license: |

|

|

|

|

|

2. |

This is an application for a: |

||

|

|

|

|

|

|

|

|

|

New |

Renewal |

3. |

DBA (Doing Business As): |

|

|

|

|

|

4. |

If renewal, give previous license #: |

||

|

|

|

|

|

|

|

|

|

||

5. |

Main office address (number, street, city, state, zip code): |

|

|

|

6. |

Business telephone: |

|

|||

|

|

|

|

|

|

|

|

|||

7. |

Branch office address (number, street, city, state, zip code): |

|

|

|

8. |

Branch business telephone: |

||||

|

|

|

|

|

|

|

|

|

||

9. |

Type of ownership (Please check one): |

|

|

|

|

|

10. |

Birth date (See Instructions): |

||

|

Individual |

Partnership |

Corporation |

LLC |

|

|

|

|

|

|

11. |

If individual, give full name and residence address of owner: |

|

|

|

Home telephone: |

|

||||

|

|

|

|

|

|

|

||||

12. |

If partnership, corporation, or LLC, give full name and residence address of each partner, |

|

Home telephone: |

|

||||||

|

corporate officer, or LLC member (use additional sheet if necessary): |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

13. |

Date incorporated: |

|

|

14. State in which incorporated: |

15. |

If a |

foreign corporation, give date Articles of |

|||

|

|

|

|

|

|

Incorporation were filed with the California Secretary |

||||

|

|

|

|

|

|

of State: |

|

|

||

16. Name, residence address and percentage of interest of each partner or member of LLC having a financial interest in the business. If corporation, include only those having a financial interest of 10% or more. Omit if Individual ownership:

DO NOT WRITE BELOW THIS LINE – PLEASE COMPLETE REVERSE SIDE

Application Number:

Approved

State Labor Commissioner

By: _____________________

BF/C

P/RP/C

A/CF/S

CON WCI

___________________

Amount Received

__________________

Postmark Date

__________________

Effective Date

__________________

Check Number

_________________

Date Mailed

__________________

Expiration Date

DLSE 351 (Rev. 3/19) |

1 |

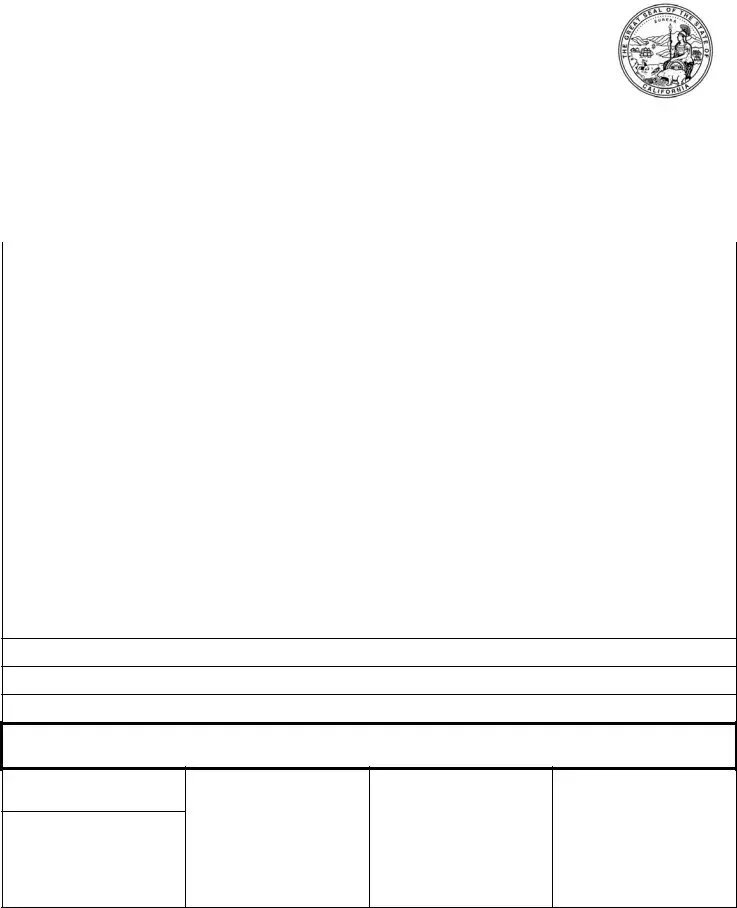

State of California |

TALENT AGENCY LICENSE |

|

Department of Industrial Relations |

APPLICATION |

Division of Labor Standards Enforcement |

17.Name, residence address and position of each person with responsibility and authority to manage the business:

18.Name, residence address and percentage of profit sharing of each person with profit sharing interest in the business (exclude bona fide employees on stated salaries:

19. Will the business of this talent agency be conducted in connection with any other business? |

Yes |

No |

If yes, indicate the kind of business and circumstances (use separate sheet if necessary): |

|

|

20. Does the talent agency or any of the persons names in Items 11, 12 or 16 presently:

(a) Owe any unpaid wages? |

Yes |

No |

|

(b) Have any unpaid outstanding judgments? |

Yes |

No |

|

If yes to either, indicate the kind of business and explain the circumstances (use separate sheet if necessary):

21. Have any of the persons listed in items 11, 12 or 16 ever been convicted1 of a crime, either misdemeanor or felony?

Yes No

If yes, indicate the name of the person, the date, the place and explain the circumstances for each crime (use separate sheet if necessary). Attach

documentation to indicate disposition.

22. Will the talent agency have

If yes, complete Items 23, 24 and 25 below and attach a copy of the Workers Compensation Certificate of Insurance

23. Name of Workers’ Compensation Insurance carrier:

24. Policy Number: |

25. Period covered: |

|

|

From: |

To: |

CERTIFICATION

I am/We are aware of and agree to comply with the provisions of Section 3700 of the Labor Code which requires every employer to be insured against liability for workers’ compensation.

I/We, under penalty of perjury, confirm that I/We will comply with Section 1700.53 of the Labor Code not later than June 30, 2019, and understand that the Labor Commissioner may at any time conduct an inspection to ensure compliance with Sections 1700.50 and 1700.51.

I/We agree to operate as a talent agency in compliance with the provisions of the California Labor Code and with the Rules and Regulations issued by the Labor Commissioner of the State of California.

I/We hereby certify, under penalty of perjury, that the foregoing statements are true and correct and that I am/we are aware of the fact that ANY

MATERIAL MISREPRESENTATION IS GROUNDS FOR DENIAL OR SUBSEQUENT REVOCATION OF A LICENSE.

Executed at 2 ______________________________________ California, this ______ day of _________________________, 20 _____

Signatures: (Individual owner, each partner or each LLC member must sign; if corporation, any authorized corporate officer may sign. He/She must show his/her title and submit a copy of Articles of Incorporation and Statement by Domestic Stock Corporation)

Printed name and title |

Signature |

Printed name and title |

Signature |

1The term “convicted” includes instances in which suspension of sentence was had and probation granted, and where expungement proceedings under Penal Code section 1203.4 and the following were undertaken.

2If place of execution is outside California, the foregoing statements must be sworn to before a notary public or other officer authorized to take oaths and affirmations.

DLSE 351 (Rev. 3/19) |

2 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The DLSE 351 form is governed by California Labor Code sections 1700, et seq., and California Code of Regulations, Title 8, Subchapter 3, Sections 12000-12006. |

| Application Purpose | This form is used to apply for a talent agency license in California. |

| Submission | Incomplete applications can delay the issuance of the license. It's crucial to provide all required documentation. |

| Management Responsibility | Applicants must include details about each person responsible for managing the talent agency. |

| Workers Compensation Requirement | Evidence of workers' compensation insurance is required if the agency has employees or sub-agents. |

Guidelines on Utilizing Dlse 351

Completing the DLSE 351 form requires careful attention to detail. Ensure all information is accurate and complete. An incomplete application may lead to delays in obtaining your talent agency license, so it is crucial to follow each step closely.

- Start with the name of the legal entity applying for the license.

- Indicate whether this application is for a new license or a renewal.

- If applicable, provide the “Doing Business As” (DBA) name.

- If this is a renewal, enter the previous license number.

- Fill in the main office address, including the street, city, state, and zip code.

- Provide your business telephone number.

- If applicable, fill in the branch office address.

- Enter the branch's business telephone number.

- Select the type of ownership: Individual, Partnership, Corporation, or LLC.

- If you are an individual, provide your full name and residence address. Include your home telephone number.

- If part of a partnership, corporation, or LLC, list the full name and residence address of each partner or member, along with their home telephone numbers.

- Indicate the date of incorporation.

- Specify the state where the business is incorporated.

- If you are a foreign corporation, provide the date your Articles of Incorporation were filed with the California Secretary of State.

- List the name, residence address, and percentage of interest for each partner or member of the LLC with a financial interest in the business. If it's a corporation, include those with a 10% or more interest.

- Fill out the name, residence address, and position of each person responsible for managing the business.

- Provide the name, residence address, and profit-sharing percentage of each person sharing in the business's profits (noting that bona fide employees on stated salaries are excluded).

- Answer whether the talent agency will conduct business with any other entity.

- Indicate if the talent agency or individuals listed owe any unpaid wages or have outstanding judgments.

- State whether any individuals listed have ever been convicted of a crime and provide the details if applicable.

- Indicate if the talent agency will have sub-agents or employees, and complete the required items if so.

- Provide the name of your Workers’ Compensation Insurance carrier.

- Enter your Workers’ Compensation policy number.

- Specify the period your Workers’ Compensation insurance covers.

- Sign and date the certification section, ensuring that every required person signs.

After submitting the form, your application will be reviewed. If approved, you will receive your talent agency license. Ensure all documents are included to avoid unnecessary delays. Keeping track of your application status is advisable.

What You Should Know About This Form

What is the DLSE 351 form?

The DLSE 351 form is an application used to obtain a Talent Agency License in California. It is required for anyone wanting to operate a talent agency within the state. The form must be filled out completely, including all necessary supporting documentation, to avoid delays in the application process.

Who needs to submit the DLSE 351 form?

Individuals or entities intending to run a talent agency in California need to submit the DLSE 351 form. This applies to new applicants seeking a license and those looking to renew an existing license. Each person involved in the agency must be disclosed on the application, including any partners or members.

What happens if my application is incomplete?

Submitting an incomplete application will delay the processing of your Talent Agency License. This includes not only missing signatures or information but also any required documentation. It is crucial to carefully review the application to ensure all parts are filled out properly before submission.

What supporting documents are required with the DLSE 351 form?

The application may require various supporting documents, such as identification for owners and officers, certification of workers’ compensation insurance, and possibly documentation related to any prior convictions or business affiliations. It's recommended to check the instructions accompanying the form for specific requirements.

How long does it take to process the DLSE 351 form?

The processing time for the DLSE 351 form can vary. Once a complete application is submitted, it may take several weeks for approval. Factors affecting the timeline include the volume of applications currently being processed and any necessary background checks or additional documentation that may be required.

Where do I send my completed DLSE 351 form?

You should send your completed DLSE 351 form to the State of California DLSE Licensing Department of Industrial Relations. The address is 1515 Clay Street, Suite 1902, Oakland, CA 94612. Be sure to double-check the address and consider using a mailing method with tracking to ensure it arrives safely.

Common mistakes

Filling out the DLSE 351 form for a talent agency license can be complicated. Many applicants make mistakes that can delay the approval process. One common error is not thoroughly reading the instructions that accompany the form. These instructions provide important details about what is required, and skipping them can lead to missing critical information.

Another frequent issue is failing to include all necessary supporting documentation. An incomplete application may hold up the issuance of your license. Be sure to check the list of required documents and include everything. It’s easy to overlook items like proof of ownership or financial interests, which are essential for your application to be complete.

Error in the selection of the type of ownership is also common. Applicants sometimes misidentify their business structure, whether it’s an individual, partnership, corporation, or LLC. This mistake can affect the rest of the application, as different requirements apply depending on the type of ownership.

Providing incorrect or outdated contact information can lead to significant communication issues. Make sure that both your business and residential addresses, as well as phone numbers, are accurate and current. Incomplete or incorrect information may result in delays or rejection of your application.

Omitting details about financial interests can cause problems in the review process. Be sure to include the names, addresses, and percentage of interest for those involved in the business. If your ownership is structured as a corporation, report only those with a financial stake of 10% or more. Neglecting this step may raise red flags during the evaluation of your application.

Another mistake involves not disclosing past criminal convictions. Applicants might feel that certain offenses are insignificant or forgettable. However, even minor convictions need to be reported. Be honest and thorough in this section to avoid potential denial of your license.

Additionally, applicants often forget to mention whether the talent agency will operate alongside another business. If your agency has ties to other operations, make sure to clearly state this information. This ensures compliance with all regulations and avoids possible fines or issues later.

Finally, failing to sign the form correctly is an easily overlooked mistake. Ensure that the form is signed by all required individuals and that titles are included where necessary. Incomplete signatures can lead to delays or rejection, so take this step seriously.

Documents used along the form

The DLSE 351 form, which is the Talent Agency License Application, is a key document for those looking to establish or renew a talent agency in California. Along with this form, several other documents are often required to ensure a smooth application process. Here is a list of additional forms and documents you may encounter:

- Articles of Incorporation: This document establishes the existence of a corporation. It includes essential details such as the corporation's name, purpose, and structure, and must be filed with the Secretary of State.

- Statement of Information: Required for corporations and LLCs, this form provides updated information about business addresses, officers, and more to maintain transparency with the state.

- Workers' Compensation Certificate of Insurance: This certificate proves that a business has purchased workers' compensation insurance to cover potential injuries that employees might incur on the job.

- Employer Identification Number (EIN): Issued by the IRS, this number is vital for tax purposes. Individuals or businesses must obtain it to report taxes and hire employees legally.

- Business License: A local government-issued document that allows an individual or company to legally operate a business within a specific jurisdiction.

- Tax Registration Certificate: This certificate proves that a business has registered with local and state tax authorities, ensuring compliance with tax regulations.

- Partnership Agreement: If the business is a partnership, this document outlines the roles, responsibilities, and obligations of each partner in the venture.

- Proof of Liability Insurance: This document provides evidence that a business has liability coverage to protect against claims of negligence or harm.

- Financial Statements: These documents provide a snapshot of the business's financial health, including balance sheets, income statements, and cash flow statements, and may be required to show financial stability.

Gathering these documents in advance can facilitate a smoother application process and help avoid any delays. Always double-check specifications and requirements before submission to ensure compliance and completeness.

Similar forms

- Business License Application: Similar to the DLSE 351 form, a business license application requires information about the business structure, ownership, and location. Both documents are essential for legal operation within the state.

- Employer Identification Number (EIN) Application: This form captures identifying details about the business, including ownership and business type. Like the DLSE 351, it’s a foundational step in legally establishing a business in California.

- Secretary of State Registration: Both forms require the disclosure of the legal entity’s name and address. The Secretary of State registration also necessitates details about the business structure and principals, similar to the ownership disclosure in the DLSE 351.

- Workers’ Compensation Insurance Certificate: While the DLSE 351 requires acknowledgment of compliance, the Workers' Compensation Insurance Certificate shows proof of coverage. Both documents are essential to ensure businesses meet state labor regulations.

- Fictitious Business Name Statement: This document must be filed when a business operates under a name different from its legal name. It also reflects ownership details, mirroring the requirements seen in the DLSE 351 application.

- Sales Tax Permit Application: This application requires information about the business structure and ownership. Both involve regulatory oversight and ensure the business can operate legally in California.

- Non-Profit Corporation Application: If applicable, similar to DLSE, the non-profit application demands detailed information about management and ownership, ensuring compliance with state regulations governing organizational structures.

- Business Personal Property Statement: This document collects data about the property used in business operations. Like the DLSE 351, it assists in regulatory compliance and tax assessment processes.

Dos and Don'ts

When filling out the DLSE 351 form, there are important dos and don'ts to keep in mind to ensure a smooth application process. Here's a concise guide:

- Do read the accompanying explanation of requirements carefully before starting the application.

- Do provide complete and accurate information. An incomplete application will delay your license.

- Do sign the form and provide your printed name and title where required.

- Do check the form for errors or omissions before submitting it.

- Don't leave any required fields blank. Fill out all sections as instructed.

- Don't misrepresent any information, as this can lead to denial or revocation of your license.

- Don't forget to attach any necessary supporting documentation.

- Don't submit the application without ensuring that all signatures are included.

Misconceptions

Misconceptions about the DLSE 351 form can lead to confusion and potential delays in obtaining a talent agency license. Here are eight common misunderstandings:

- All information can be provided later. Some applicants think they can submit the form without complete details. However, an incomplete application will delay your license.

- The license is automatically renewed. Many individuals believe renewing a license is a simple formality. In reality, renewal requires specific documentation and timely submission.

- Only individual owners need to provide personal details. It is a mistake to think that only sole proprietors must disclose personal information. Partnerships and corporations must also list key individuals involved in the business.

- Submitting extra documents is unnecessary. Some applicants argue that additional documents, such as proof of financial interest or workers' compensation, are optional. In fact, failure to provide necessary documents can lead to denial.

- Having a prior violation or conviction disqualifies you from licensing. Many believe that any past issues automatically lead to a rejection. While they must be disclosed, each case is evaluated based on context.

- All applicant business structures are treated the same. Not true. Different ownership structures—like corporations versus LLCs—have unique requirements and implications that affect the application process.

- The state conducts a review after approval. Some assume oversight occurs only after the license is granted. However, the state may conduct inspections and check compliance any time during the application process.

- Late applications can be submitted without consequences. Believing that a late application has no penalties is dangerous. Officers should understand that delays can result in fines or complications in obtaining a license.

To ensure a smooth application process, it is essential to approach the DLSE 351 form with a thorough understanding of these points. By doing so, individuals can enhance their chances of approval and operate within compliance.

Key takeaways

Filling out and using the DLSE 351 form correctly is crucial for obtaining a talent agency license in California. Here are key takeaways to consider:

- Read Instructions Carefully: Always read the accompanying explanation of requirements before completing the application to avoid errors.

- Complete All Sections: An incomplete application can delay the licensing process.

- Application Type: Clearly indicate whether you are applying for a new license or a renewal.

- Provide Accurate Information: Check that the business name, address, contact details, and ownership type are correct.

- Financial Interest Disclosure: Disclose the names and interests of individuals with financial stakes in the business.

- Criminal History: Be prepared to disclose any criminal convictions related to the individuals named on the application.

- Workers’ Compensation Insurance: Attach a copy of your Workers’ Compensation Certificate of Insurance if applicable.

- Signatures Required: Ensure that all required parties sign the form; each partner or LLC member must provide their signature.

- Submit Payment: Include the required fee for processing the application. Ensure you keep records of the payment made.

These takeaways serve to guide applicants in successfully navigating the form and the licensing process, ensuring compliance with California's labor codes.

Browse Other Templates

Proof of Self Employment - This document can be requested at any time by the DHS for verification purposes.

Land Contract Indiana - The seller can accelerate the entire balance due if a purchaser is in default for more than 30 days.