Fill Out Your Dos 1523 F L Form

The DOS-1523 F L form serves as a vital document for professionals looking to establish a professional service corporation in New York State. Administered by the New York State Department of State, it outlines key information necessary for the incorporation process. This form requires the designation of a name for the corporation, specifies the professional services to be offered, and identifies the county where the corporate office will be located. Additionally, the corporation is permitted to issue up to 200 shares of common stock without par value. The Secretary of State is designated as the agent for service of process, ensuring that legal notifications reach the corporation. It is crucial to include the names and addresses of the initial shareholders, directors, and officers as part of the filing. Furthermore, incorporating individuals must attach the proper certificates from the relevant licensing authorities to ensure compliance with professional regulations. While the form simplifies the incorporation process, it must be accompanied by a filing fee of $125. A certified copy of the filed certificate must also be submitted to the licensing authority within 30 days, with a fee of $10 for the certification. It should be noted that the DOS-1523 F L form is not the only option available; individuals may opt for their own forms or those from other sources, although legal guidance is strongly recommended for navigating these requirements.

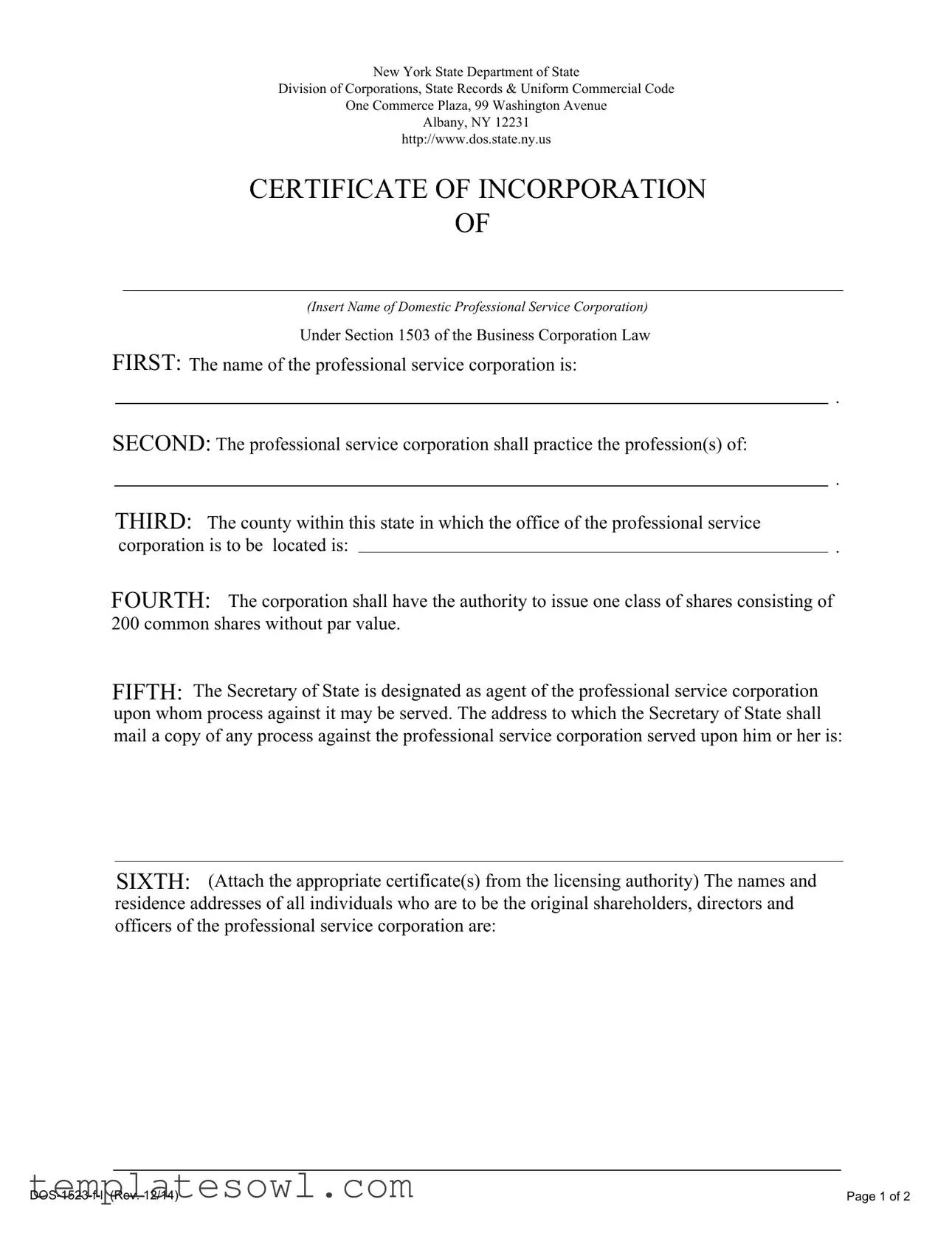

Dos 1523 F L Example

New York State Department of State

Division of Corporations, State Records & Uniform Commercial Code

One Commerce Plaza, 99 Washington Avenue

Albany, NY 12231

http://www.dos.state.ny.us

CERTIFICATE OF INCORPORATION

OF

(Insert Name of Domestic Professional Service Corporation)

Under Section 1503 of the Business Corporation Law

FIRST: The name of the professional service corporation is:

|

|

|

|

|

. |

SECOND: The professional service corporation shall practice the profession(s) of: |

|

|

|||

|

|

|

|

. |

|

|

THIRD: The county within this state in which the office of the professional service |

|

|

||

|

|

corporation is to be located is: |

|

. |

|

|

|||||

FOURTH: The corporation shall have the authority to issue one class of shares consisting of 200 common shares without par value.

FIFTH: The Secretary of State is designated as agent of the professional service corporation upon whom process against it may be served. The address to which the Secretary of State shall mail a copy of any process against the professional service corporation served upon him or her is:

SIXTH: (Attach the appropriate certificate(s) from the licensing authority) The names and residence addresses of all individuals who are to be the original shareholders, directors and officers of the professional service corporation are:

Page 1 of 2 |

(Typed or Printed Name of Incorporator)

(Address)

(City, State and Zip Code)

(Signature of Incorporator)

CERTIFICATE OF INCORPORATION

OF

(Insert Name of Domestic Professional Service Corporation)

Under Section 1503 of the Business Corporation Law

Filed by:

(Name)

(Mailing Address)

(City, State and Zip Code)

NOTE: This form was prepared by the New York State Department of State for filing a certificate of incorporation for a professional service corporation. It does not contain all option provisions under the law. You are not required to use this form. You may draft your own form or use forms available at legal stationery stores. The Department of State recommends that legal documents be prepared under the guidance of an attorney. The certificate must be submitted with the filing fee, made payable to the Department of State, of $125. §1503(c) of the Business Corporation Law requires that a certified copy of the certificate of incorporation be filed with the licensing authority within 30 days after the date of the filing of the certificate of incorporation with the Department of State. The fee for a certified copy is $10.

For DOS Use Only

Page 2 of 2 |

Form Characteristics

| Fact Title | Description |

|---|---|

| Purpose | This form is used to file a certificate of incorporation for a Domestic Professional Service Corporation in New York State. |

| Governing Law | The form operates under Section 1503 of the New York Business Corporation Law. |

| Filing Fee | A filing fee of $125 must accompany the completed form when submitted to the Department of State. |

| Share Structure | The corporation is allowed to issue 200 common shares without par value. |

| Secretary of State | The Secretary of State is designated as the agent for service of process against the professional service corporation. |

| Licensing Authority | A certified copy of the certificate must be filed with the licensing authority within 30 days of filing with the Department of State. |

| Additional Documentation | It is necessary to attach certificates from the relevant licensing authority when filing the form. |

| Preparation Recommendation | While the form can be used, the Department of State advises seeking the help of an attorney for legal document preparation. |

| Certified Copy Fee | The fee for obtaining a certified copy of the certificate is $10. |

| Form Availability | Applicants are not required to use this specific form and may create their own or use forms from legal stationery stores. |

Guidelines on Utilizing Dos 1523 F L

Filling out the DOS-1523 F L form is an important step in establishing your domestic professional service corporation in New York. Make sure you have all necessary information and documents ready before starting. Below are step-by-step instructions to guide you through the completion of this form.

- Section One: Enter the name of your professional service corporation in the space provided.

- Section Two: Specify the profession or professions that your corporation will practice.

- Section Three: Indicate the county in New York State where the corporation's office will be located.

- Section Four: Write the details regarding the shares. Note that you are allowed to issue one class of shares, consisting of 200 common shares without par value.

- Section Five: Designate the Secretary of State as the agent for service of process. Include the address where the Secretary of State should mail a copy of any process served against your corporation.

- Section Six: Attach the necessary certificates from the appropriate licensing authority. List the names and residence addresses of all original shareholders, directors, and officers of the corporation.

- Incorporator Information: Fill in the typed or printed name of the incorporator, along with their address, city, state, and zip code.

- Signature: Sign the form to validate it as the incorporator.

- Filing Information: Provide your name, mailing address, city, state, and zip code in the filed-by section.

- Payment: Prepare the filing fee of $125, made payable to the Department of State, and include it with your completed form.

After filling out the form, make sure to send it to the New York State Department of State along with the filing fee. Do not forget that a certified copy of this certificate must be filed with the licensing authority within 30 days. A small additional fee applies to obtain this certified copy. Make sure to follow all steps carefully to ensure smooth processing of your application.

What You Should Know About This Form

What is the DOS 1523 F L form?

The DOS 1523 F L form is a certificate of incorporation specifically designed for professional service corporations in New York State. It enables professionals to formally establish a corporation that offers services in fields like law, medicine, or engineering. This form must be filed with the New York State Department of State, Division of Corporations.

What information is required to fill out the form?

To complete the DOS 1523 F L form, you need to provide several critical pieces of information: the name of the professional service corporation, the specific profession(s) it will practice, the county where it will be located, the number of shares to be issued, and the designated agent for service of process. Additionally, you must list the names and addresses of the original shareholders, directors, and officers. It's essential to attach verification from the relevant licensing authority if required.

How much does it cost to file the DOS 1523 F L?

Filing the DOS 1523 F L form incurs a fee of $125, payable to the New York State Department of State. If you require a certified copy of the certificate of incorporation later, this will cost an additional $10. Keep in mind that these fees are subject to change, so it’s advisable to check for the most current costs before proceeding.

Who can serve as the designated agent for the corporation?

For the DOS 1523 F L form, the Secretary of State is designated as the agent upon whom legal processes can be served. This means that if your corporation is involved in a legal matter, documents can be sent to the Secretary of State, who will then notify you. A physical address needs to be provided for any notifications to be sent to you accordingly.

What happens after the form is filed?

Once you submit the completed DOS 1523 F L form with the required fee, it will be processed by the Department of State. After approval, your corporation is officially recognized. However, under §1503(c) of the Business Corporation Law, you must file a certified copy of your certificate of incorporation with the appropriate licensing authority within 30 days of your initial filing. Failing to do so may result in penalties or delays in your ability to operate legally.

Can I create my own version of the DOS 1523 F L form?

Yes, you are allowed to draft your own version of the DOS 1523 F L form. While the form provided by the New York State Department of State serves as a guideline, legal stationery stores or attorneys can also provide templates. However, it’s advisable to seek assistance from a legal professional to ensure that all legal requirements are accurately addressed in your custom form. This can help prevent issues down the line.

Common mistakes

Filling out the DOS 1523 F L form is an important step in establishing a professional service corporation in New York. However, individuals can easily make mistakes during this process. One common error is leaving out the name of the corporation. The first section of the form specifically requests the name of the professional service corporation. Omitting this vital information can lead to delays or denials of the application.

Another mistake involves not providing the correct professional practice areas in the second section. The form asks for the profession(s) in which the corporation will engage. Failing to accurately list these professions can result in complications down the line, as it is crucial for legal and regulatory compliance.

People often overlook the requirement to specify the location of the corporation's office. The third section necessitates the county in which the office will be based. Providing vague or incorrect information can be problematic and may lead to additional requests for clarification from state authorities.

In addition, a common error is in the issuance of shares. The fourth section specifies that the corporation can issue shares; however, some applicants may forget to include this section or misinterpret its requirements. Understanding that a professional service corporation is allowed one class of shares is essential for an accurate filing.

Designating the Secretary of State as the legal agent is another area where errors can arise. While this is a straightforward requirement in the fifth section, people sometimes fail to provide an accurate address for the Secretary of State to send legal correspondence. This address must be complete and current.

Furthermore, individuals may neglect to attach the necessary licensing certificates in the sixth section. Attachments are crucial for the processing of the application. If the appropriate certificates are not included, the application will be considered incomplete.

Lastly, failing to sign and date the application is a frequent oversight. The signature of the incorporator is required to validate the filing. Without this, the form cannot be processed, potentially delaying the establishment of the corporation.

Documents used along the form

When incorporating a professional service corporation in New York, various additional forms and documents are often required alongside the DOS 1523 F L form. Each of these documents serves a specific purpose in the formation and operation of the corporation. Below is a list of common documents that may be needed.

- Certificate of Good Standing: This document proves that the corporation is compliant with state regulations and has met necessary obligations, such as filing annual reports and paying fees.

- Licensing Certificates: These are required to show that the owners or shareholders possess the necessary licenses to practice their profession, such as medical or legal licenses.

- Bylaws: Bylaws act as the internal rules governing the corporation's operations, detailing how meetings are conducted, how directors are elected, and other essential governing procedures.

- Organizational Meeting Minutes: This record documents the initial meeting of the corporation's directors, outlining decisions like the appointment of officers and other significant actions taken to start the business.

- Statement of Information (if applicable): Some states require periodic filings with updated information about the corporation, including its address and officer details.

- Application for Employer Identification Number (EIN): An EIN is necessary for tax purposes. It identifies the corporation as a separate legal entity for the IRS and is often required to open a business bank account.

- Filing Fee Payment Receipt: When submitting the DOS 1523 F L form and other documents, a receipt confirming the payment of filing fees is typically required as proof of submission.

- Certified Copies of Key Documents: Many licensing authorities ask for certified copies of the Certificate of Incorporation and other essential documents as part of their review process.

It’s important to understand the role of each document in the incorporation process. Being prepared with the right paperwork can streamline the establishment of your professional service corporation and help ensure compliance with state laws.

Similar forms

The DOS 1523 F L form serves as a certificate of incorporation for professional service corporations in New York. This form is similar to several other documents commonly used in business formation and regulation. Here are six similar documents and how they relate:

- Articles of Incorporation: This document also officially establishes a corporation, outlining its name, purpose, and structure. Like the DOS 1523 F L form, it functions as a foundational legal document that must be filed with the state.

- Certificate of Formation: Similar to the DOS 1523 F L form, the certificate of formation is required for various types of business entities. It declares the creation of the entity and includes essential information about the business.

- Operating Agreement: This document governs the operations of a limited liability company (LLC) and outlines rights and responsibilities of its members. While focused on LLCs, it serves a purpose akin to that of the DOS 1523 F L form in setting rules for business operations.

- Bylaws: Bylaws provide the internal rules of governance for a corporation, detailing how the corporation operates. They complement the DOS 1523 F L form by clarifying how the corporation will function post-incorporation.

- Business License/Application: Similar to the DOS 1523 F L, a business license is required to legally operate within a jurisdiction. It often necessitates proof of incorporation or legal formation.

- Certificate of Good Standing: This document confirms that a business is legally registered and compliant with state regulations. Like the DOS form, it can be necessary for various transactions, including banking and contracting.

Dos and Don'ts

Here are 8 dos and don'ts to keep in mind when filling out the DOS 1523 F L form:

- Do enter the full legal name of the professional service corporation accurately.

- Do specify the profession(s) the corporation will practice.

- Do ensure the address for the Secretary of State is complete and correct.

- Do include all required certificates from your licensing authority.

- Don't leave any required fields blank; it can delay processing.

- Don't forget to include the filing fee of $125 with your submission.

- Don't submit the form without verifying all information is accurate.

- Don't overlook the requirement to file a certified copy with your licensing authority within 30 days.

Misconceptions

Misconceptions about the DOS 1523 F L Form

- This form is mandatory for all businesses in New York. This is incorrect. The DOS 1523 F L form is specifically for professional service corporations, not for all types of businesses.

- Once filed, the professional service corporation is exempt from all future filings. This misconception can be costly. Professional service corporations must adhere to ongoing filing requirements beyond the initial submission.

- The Secretary of State automatically handles all legal processes for the corporation. While the Secretary of State acts as a registered agent, the corporation must still manage its legal obligations and responses independently.

- The form provides complete legal protection for my business. Filing the form does not confer immunity from liability. Proper business practices and adequate insurance are still essential.

- I can submit the form without requiring any supporting documents. This is untrue. The form requires certification from the relevant licensing authority to be valid.

- The filing fee is refundable if my application is rejected. This is a common misunderstanding. The filing fee is not refundable under any circumstances.

- All shareholders must reside in New York. This is incorrect. There are no residency requirements for shareholders of a professional service corporation.

- That's it once my form is filed; my corporation is official. The corporation is not legally established until all necessary documents, including certification, are submitted properly.

- Only attorneys can incorporate a professional service corporation. While it's recommended to consult an attorney, individuals can file the form themselves if they understand the requirements.

Key takeaways

Here are some key takeaways regarding the DOS-1523 F L form for incorporating a professional service corporation in New York:

- Essential Details: You must accurately fill out the name of the professional service corporation, the profession(s) it will practice, and the county where the office will be located.

- Share Structure: The corporation can issue one class of shares, specifically 200 common shares without par value.

- Agent for Service: The Secretary of State acts as the corporation's agent for process. You need to provide a mailing address for any legal documents served.

- Licensing Authority Certification: Attach the required certification(s) from the relevant licensing authority when submitting the form.

- Incorporators’ Information: Include the names and residence addresses of all original shareholders, directors, and officers of the corporation.

- Filing Fee: A fee of $125 is required for submitting the certificate, made payable to the Department of State.

- Certified Copy Requirement: After submitting the certificate, you must file a certified copy with the relevant licensing authority within 30 days. The fee for this copy is $10.

It's advisable to consult an attorney when preparing these legal documents to ensure all requirements are met accurately.

Browse Other Templates

Integrated Brand Promotion - This resource outlines the foundational principles of creating memorable brand experiences.

Midway University Transcript Request - Students may provide additional notes or instructions if needed on the request form.

Sweet Frog Application - This form serves as a vital part of your eligibility verification process.