Fill Out Your Dos 1625 F L Form

The DOS 1625 F L form plays an essential role for businesses operating under assumed names in New York State. This form facilitates the official discontinuation of a previously registered fictitious name, enabling entities to clarify their legal identity in public records. It requires specific information, including the entity's real name and any assumed names previously used. Additionally, foreign entities must declare their fictitious name, if applicable. Key dates are also necessary, such as when the original Certificate of Assumed Name was filed and the date when the assumed name was discontinued. The signing process is straightforward but must be executed by an authorized individual, such as an officer of a corporation or a general partner in a partnership. While the Department of State provides a standard template for this form, businesses are not mandated to use it and can create their own, though legal guidance is recommended to ensure compliance with state regulations. A submission fee of $25 accompanies the form, making it accessible for businesses to update their records efficiently and accurately.

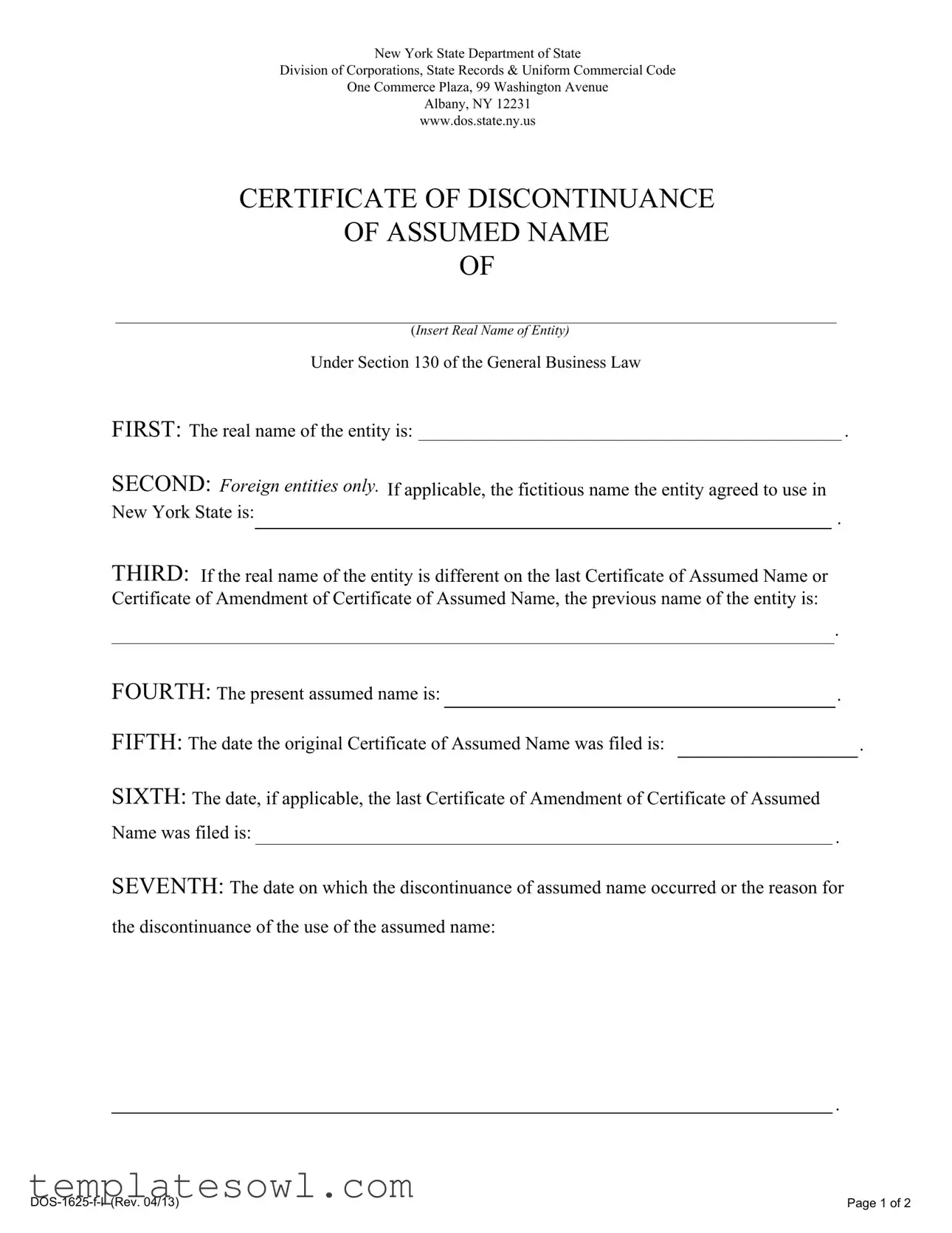

Dos 1625 F L Example

New York State Department of State

Division of Corporations, State Records & Uniform Commercial Code

One Commerce Plaza, 99 Washington Avenue

Albany, NY 12231 www.dos.state.ny.us

CERTIFICATE OF DISCONTINUANCE

OF ASSUMED NAME

OF

(Insert Real Name of Entity)

Under Section 130 of the General Business Law

FIRST: The real name of the entity is:

SECOND: Foreign entities only. If applicable, the fictitious name the entity agreed to use in New York State is:

THIRD: If the real name of the entity is different on the last Certificate of Assumed Name or Certificate of Amendment of Certificate of Assumed Name, the previous name of the entity is:

.

.

.

FOURTH: The present assumed name is: |

|

|

. |

|

||

FIFTH: The date the original Certificate of Assumed Name was filed is: |

. |

|||||

|

|

|

|

|

|

|

SIXTH: The date, if applicable, the last Certificate of Amendment of Certificate of Assumed |

|

|

|

|||

Name was filed is: |

|

. |

|

|||

SEVENTH: The date on which the discontinuance of assumed name occurred or the reason for

the discontinuance of the use of the assumed name:

.

Page 1 of 2 |

INSTRUCTIONS FOR SIGNING: If a corporation, by an officer; if a limited partnership, by a general partner; if a limited liability company, by a member or manager; or by an authorized person or

(Name of Signer) |

(Signature) |

(Title of Signer)

CERTIFICATE OF DISCONTINUANCE

OF ASSUMED NAME

OF

(Insert Real Name of Entity)

Under Section 130 of the General Business Law

Filer’s Name:

Address:

City, State and Zip Code:

Note: This form was prepared by the New York State Department of State. You are not required to use this form. You may draft your own form or use forms available at legal stationery stores. The Department of State recommends that all documents be prepared under the guidance of an attorney. The certificate must be submitted with a $25 fee.

For Office Use Only

Page 2 of 2 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The DOS 1625 F L form is governed by Section 130 of the New York General Business Law. |

| Purpose | This form is used to officially discontinue the use of an assumed name for a business entity in New York State. |

| Filing Fee | There is a filing fee of $25 associated with submitting the DOS 1625 F L form. |

| Entity Types | The form can be filed by corporations, limited partnerships, and limited liability companies operating in New York. |

| Signature Requirements | The form must be signed by an authorized person, such as an officer or member, or by an attorney-in-fact. |

| Filer's Information | The filer must provide their name and address on the form, ensuring accurate identification. |

| Previous Names | If the entity has changed its name, the discontinued name must be stated on the form. |

| Document Preparation Advice | The New York State Department of State recommends that individuals consider seeking legal advice when preparing this form. |

Guidelines on Utilizing Dos 1625 F L

Filling out the DOS 1625 F L form is an important task that requires careful attention to detail. This form is to formally document the discontinuation of an assumed name for a business entity in New York State. Following the correct procedure ensures that all necessary information is conveyed clearly. Here are the steps to fill out the form:

- Identify the entity: Write the real name of the entity in the space provided under "FIRST."

- Foreign entities only: If applicable, enter the fictitious name the entity previously used in New York State in the space under "SECOND."

- Previous name: If the real name of the entity differs from the last submitted Certificate of Assumed Name, indicate that previous name in the "THIRD" section.

- Current assumed name: Write the present assumed name in the space provided under "FOURTH."

- Filing date: Provide the date when the original Certificate of Assumed Name was filed in the "FIFTH" section.

- Last amendment date: If there was a last Certificate of Amendment, indicate the date it was filed under "SIXTH."

- Reason for discontinuance: In "SEVENTH," document the date the discontinuance of the assumed name occurred or explain the reason for discontinuance.

- Filer's information: Fill in your name, address, city, state, and zip code.

- Signature: Sign the form in the designated area, including your title and, if applicable, the name and title of the person you are acting for.

- Fee submission: Ensure that you include the required $25 fee when submitting the certificate.

Once the form is filled out thoroughly, review it for accuracy before submission. This careful verification helps ensure that the information is correct, which can help avoid delays in processing your request.

What You Should Know About This Form

What is the DOS 1625 FL form used for?

The DOS 1625 FL form is a Certificate of Discontinuance of Assumed Name. It is required under Section 130 of the General Business Law in New York State. This form is utilized when a business wishes to formally discontinue the use of an assumed name, which is a name different from its registered legal name. Filing this document ensures that the business is compliant with state regulations, formally documenting the discontinuance in public records.

Who needs to file this form?

What information is needed to complete the form?

Filing the DOS 1625 FL form requires several pieces of information, including the real name of the entity, the assumed name being discontinued, the dates of any previous filings related to the assumed name, and the reason for discontinuance. Additionally, it requires the name and title of the person authorized to sign the form. Each of these details must be accurate to ensure that the filing is processed smoothly.

Is there a filing fee associated with the DOS 1625 FL form?

Yes, there is a $25 filing fee that must accompany the submission of the DOS 1625 FL form. This fee is required by the New York State Department of State and is payable at the time of filing. It's important to include this fee to avoid delays in processing your application.

Can I draft my own version of the DOS 1625 FL form?

Yes, you are allowed to draft your own version of the DOS 1625 FL form. The New York State Department of State does not mandate the use of their specific form. However, it is highly recommended to prepare legal documents, including this certificate, under the guidance of an attorney to ensure compliance with all necessary legal standards.

How is the form filed?

The completed DOS 1625 FL form must be submitted to the New York State Department of State, specifically to the Division of Corporations, State Records, and Uniform Commercial Code. You can file it in person or by mail. In either case, ensure that all required information is correctly filled out and that the filing fee is included to facilitate processing.

What happens after I file the DOS 1625 FL form?

Once the DOS 1625 FL form is filed and processed, the discontinuance of the assumed name is recorded in the official records of the New York State Department of State. This action provides public notice that the business entity no longer operates under that specific assumed name. Additionally, you should maintain a copy of the filed form for your records as it may be required for future legal or business-related matters.

Common mistakes

Filing the DOS 1625 F L form can be a straightforward process, but several common mistakes can create complications. One prevalent error is providing incomplete information. Every section of the form must be filled out entirely. Omitting details such as the entity's real name or the date the original certificate was filed can lead to delays or rejections.

Another mistake involves not aligning the assumed name with the official documents. If the assumed name listed differs from previous filings, the form must reflect that change. Failing to include the prior name, when applicable, can result in confusion and impede the discontinuance process.

Signature issues often arise as well. The form requires the signature of an authorized individual, which may include an officer or manager, depending on the entity type. A common mistake is having someone who is not authorized sign the document. This specific oversight can invalidate the submission, causing additional hassle.

Moreover, many filers overlook the fee requirement. The $25 fee for processing the certificate must accompany the form. If omitted, even a correctly filled-out form may not be accepted, leading to unnecessary delays.

Another frequent misstep relates to the dates provided. Incorrect or missing dates—such as the date of original filing or the date of discontinuance—can raise questions about the timeline and legitimacy of the filing. Attention to these details is crucial.

Lastly, filers sometimes neglect the importance of reviewing the final document for accuracy. Simple typos or incorrect sequences of numbers can lead to confusion down the line. A thorough review can save time and avoid potential rejection of the form.

Being aware of these common mistakes can significantly improve the filing process for the DOS 1625 F L form. By ensuring that all information is complete and accurate, and by complying with all submission requirements, the chances of filing success increase tremendously.

Documents used along the form

When discontinuing the use of an assumed name, there are several forms and documents that may be needed alongside the DOS 1625 F L form. Each document serves a specific purpose in ensuring compliance with state regulations and accurately updating business records. Here’s a list of relevant documents that can facilitate this process.

- Application for Certificate of Assumed Name: This document is filed when a business wants to operate under a name different from its legal name. It establishes the fictitious name in use.

- Certificate of Amendment: If a business needs to change its assumed name, this certificate is filed to amend the previously recorded assumed name. It updates legal records accordingly.

- Operating Agreement: This internal document outlines the management structure and operational procedures for Limited Liability Companies (LLCs). It may need to reflect any changes related to the use of an assumed name.

- Bylaws: Corporations maintain this document to govern their day-to-day operations. If the assumed name affects corporate governance, the bylaws may need to be amended.

- Business License or Permit: Depending on the nature of business, a license or permit may need updating if it reflects the name of the entity. This ensures compliance with local regulations.

- Tax Registration Documents: These are necessary for reporting and tax purposes. When changing an assumed name, the business must ensure that its tax records are up-to-date.

- Promotional Materials: Brochures, business cards, and websites may all display the assumed name. These materials should be updated to avoid confusion for clients and customers.

- Notification to Creditors and Clients: It’s prudent to inform all stakeholders about the change. A formal notification can be beneficial for transparency and maintaining trust.

- State UCC Filings: If the business has filed Uniform Commercial Code documents under the assumed name, those will need to be amended or terminated to reflect the discontinuance.

- Final Tax Returns: If the business discontinues operating under an assumed name, it may also need to file final tax returns that indicate the change and confirm closure.

Ensuring all necessary forms and documents are handled properly can help avoid legal complications and promote smooth business operations in New York State. Consider consulting with an attorney for guidance tailored to your specific situation.

Similar forms

-

Certificate of Assumed Name: This document is filed to establish a fictitious name that a business intends to use. Similar to the DOS 1625 F L form, it involves identifying the entity and potentially discontinuing that name in the future.

-

Certificate of Amendment: This form allows for changes to be made to the details of an existing assumed name. Like the DOS 1625 F L, it requires information about previously filed names and dates.

-

Certificate of Incorporation: When starting a business, this document formalizes its existence. It similarly includes essential information about the entity, but it focuses on the creation rather than discontinuation.

-

Certificate of Good Standing: This is a document that proves a business is authorized to conduct operations. While it serves a different purpose, it affirms a business's legal status similar to how the DOS 1625 discontinues a previous name.

-

Withdrawal of Fictitious Name Registration: This document is used to formally withdraw an assumed name, similar in function to the DOS 1625 F L. Both provide legal notice of ending the use of a name.

-

Change of Registered Agent: This document updates the person or entity serving as the business's registered agent. It parallels the discontinuance process by updating essential business information.

-

Revocation of a Certificate of Authority: This expresses the intent to cancel a business’s authority to operate within a state. Like the DOS 1625 F L, it signifies a cessation of certain activities.

-

Foreign Entity Registration: Required for foreign businesses wishing to operate in New York, this document ensures compliance. It, too, relates to the authenticity of business names.

-

Amendment to Bylaws: Changes to a company's operational rules can be formally documented. This is akin to the amendment aspect of the DOS 1625 F L, which updates business information.

-

Certificate of Merger: This document is filed when two or more companies merge. It may relate to the identity changes of entities, much like how the DOS 1625 F L addresses changes in assumed names.

Dos and Don'ts

When filling out the DOS 1625 F L form, keep the following do's and don'ts in mind:

- Do ensure all required fields are completed accurately.

- Do use the real name of the entity, as stated in the formation documents.

- Do check for any name changes in previous documents and provide them if applicable.

- Do submit the form with the $25 fee included.

- Don't leave any sections blank; every section that applies should be filled out.

- Don't forget to sign the form where indicated, as it is required for processing.

- Don't use an outdated version of the form; confirm it's the latest revision.

- Don't submit the form without reviewing it for errors or omissions first.

Misconceptions

Misconceptions often arise regarding the DOS 1625 F L form, leading to confusion among users. Below are six common misunderstandings:

- The form is only for corporations. This is incorrect. While corporations often use this form, limited partnerships and limited liability companies can also submit it. The instructions specify who may sign the form based on the entity type.

- Anyone can sign the form. This is not true. The form must be signed by an authorized representative. For a corporation, this means an officer must sign. Limited liability companies require a member or manager to sign.

- It is not necessary to file the form if the business stops using the assumed name. This misconception can lead to legal issues. Once a business discontinues the use of an assumed name, filing the DOS 1625 F L form is essential to formally document that discontinuation.

- The reason for discontinuance is optional information. This is misleading. While the form allows for a date or reason for the discontinuance, providing this information helps clarify the business's actions for any future inquiries.

- Filing this form requires no fee. This is false. A fee of $25 is required when submitting the DOS 1625 F L form, as specified by the New York State Department of State.

- Only one copy of the form needs to be filed. This belief is incorrect. While the Department of State requires only one copy for processing, it's advisable for businesses to keep a copy of their filed form for their records.

Understanding these misconceptions can help ensure compliance with New York State requirements and avoid potential pitfalls.

Key takeaways

The DOS 1625 F L form is essential for any entity wishing to discontinue its use of an assumed name in New York State. Understanding its components will help streamline the process. Here are key takeaways:

- Purpose of the Form: This form serves to officially declare the discontinuation of an assumed name for an entity, ensuring compliance with New York State laws.

- Who Should File: Corporations, limited partnerships, and limited liability companies can file this form. It is critical to ensure the right person signs it.

- Required Information: The form requires several pieces of information, including the real name of the entity and the assumed name being discontinued.

- Previous Names: If the entity has changed its assumed name, the previous name must be included on the form for clarity.

- Date of Filing: Record the date of the original assumed name filing and, if applicable, the last amendment date.

- Discontinuance Date: Make sure to specify when the assumed name discontinuance takes effect or provide the reason for ceasing its use.

- Signature Requirements: The form must be signed by an authorized individual, such as an officer or general partner. An attorney-in-fact can also sign, but must include their designation.

- Submitting the Form: The completed form must be submitted to the New York State Department of State, accompanied by a $25 filing fee.

- Alternative Options: While the DOS 1625 F L form is recommended, entities are free to create their own version or purchase forms from legal stationery stores.

These steps are pivotal in ensuring a smooth process for discontinuing an assumed name in New York State. Proper adherence to these guidelines can prevent future legal complications.

Browse Other Templates

St 5 Form - This form can be reproduced as approved by the Commissioner of Revenue.

Az Nursing Board - Standards for unprofessional conduct in nursing are included in the form.

Declaration of Non Ownership - Incorrectly filled forms might prevent the timely update of the DMV's records, leaving the seller liable.