Fill Out Your Dr 123 Form

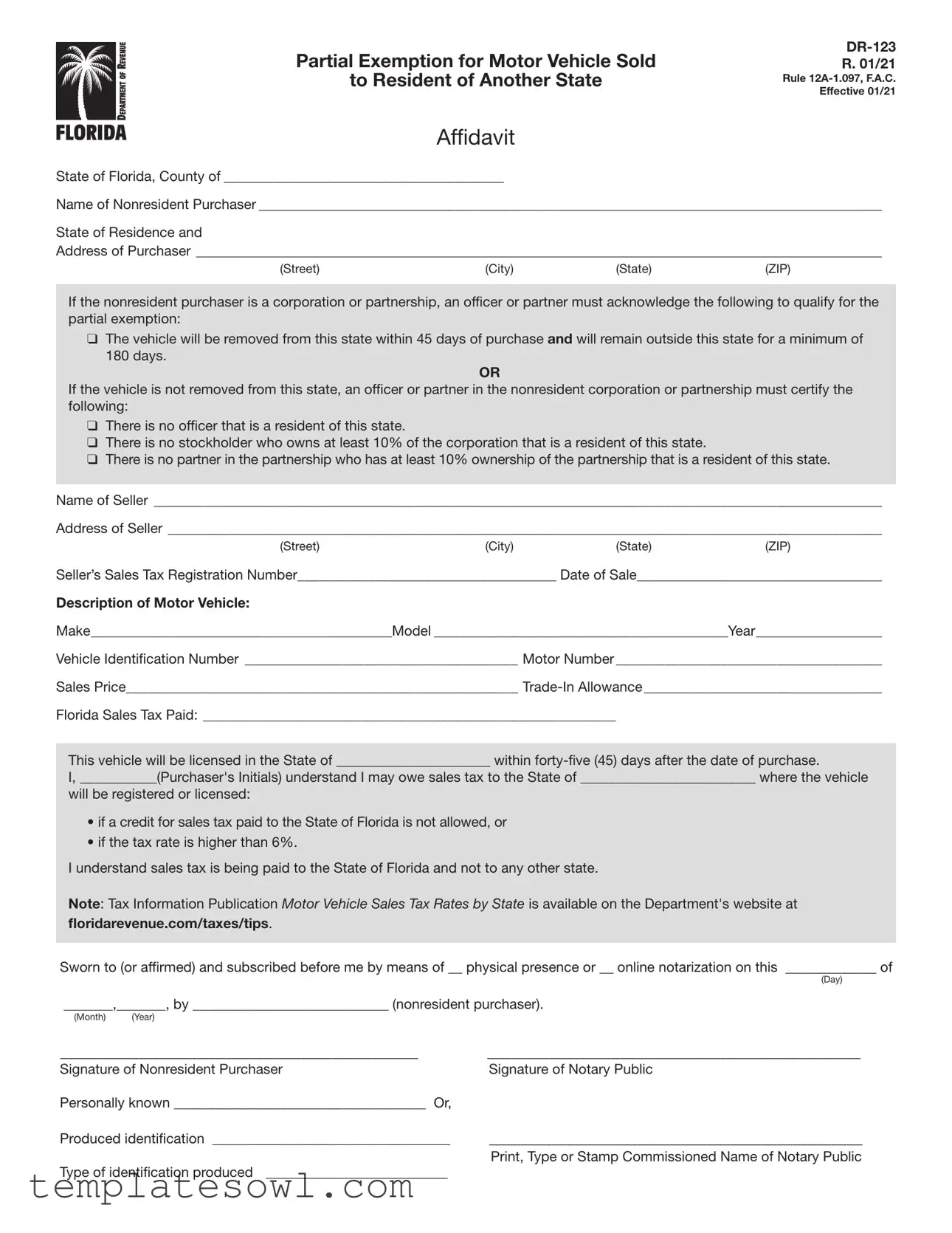

The DR-123 form is an important document for nonresidents who purchase motor vehicles in Florida. It serves as an affidavit for claiming a partial exemption from Florida sales tax when the vehicle is sold to a resident of another state. This form requires detailed information about both the purchaser and the seller, such as their names, addresses, and sales tax registration numbers. Notably, if the buyer is a corporation or partnership, certain conditions must be acknowledged to qualify for the exemption. For instance, the vehicle must be removed from Florida within 45 days of purchase and must remain outside the state for at least 180 days. Additionally, the form asks for the motor vehicle’s description, including its make, model, year, and Vehicle Identification Number (VIN). The implications of this form extend beyond just tax exemption; it informs the purchaser of their potential tax liabilities in their home state. This includes the responsibility to pay any additional sales tax if the rates in their state exceed those in Florida. Further, it must be notarized to validate the information provided. Understanding the key elements of the DR-123 form is essential for making informed decisions about vehicle purchases and compliance with state regulations.

Dr 123 Example

Partial Exemption for Motor Vehicle Sold

to Resident of Another State

Affidavit

R. 01/21

Rule

State of Florida, County of ________________________________________

Name of Nonresident Purchaser _________________________________________________________________________________________

State of Residence and

Address of Purchaser __________________________________________________________________________________________________

(Street) |

(City) |

(State) |

(ZIP) |

If the nonresident purchaser is a corporation or partnership, an officer or partner |

must acknowledge the following to qualify for the |

||

partial exemption: |

|

|

|

qThe vehicle will be removed from this state within 45 days of purchase and will remain outside this state for a minimum of 180 days.

OR

If the vehicle is not removed from this state, an officer or partner in the nonresident corporation or partnership must certify the following:

qThere is no officer that is a resident of this state.

qThere is no stockholder who owns at least 10% of the corporation that is a resident of this state.

qThere is no partner in the partnership who has at least 10% ownership of the partnership that is a resident of this state.

Name of Seller ________________________________________________________________________________________________________

Address of Seller ______________________________________________________________________________________________________

(Street)(City)(State)(ZIP)

Seller’s Sales Tax Registration Number_____________________________________ Date of Sale___________________________________

Description of Motor Vehicle:

Make___________________________________________Model __________________________________________Year__________________

Vehicle Identification Number _______________________________________ Motor Number ______________________________________

Sales Price________________________________________________________

Florida Sales Tax Paid: ___________________________________________________________

This vehicle will be licensed in the State of ______________________ within

I, ___________(Purchaser's Initials) understand I may owe sales tax to the State of _________________________ where the vehicle

will be registered or licensed:

•if a credit for sales tax paid to the State of Florida is not allowed, or

•if the tax rate is higher than 6%.

I understand sales tax is being paid to the State of Florida and not to any other state.

Note: Tax Information Publication Motor Vehicle Sales Tax Rates by State is available on the Department's website at

floridarevenue.com/taxes/tips .

Sworn to (or affirmed) and subscribed before me by means of __ physical presence or __ online notarization on this _____________ of

(Day)

_______,_______, by ____________________________ (nonresident purchaser).

(Month) (Year)

______________________________________________ |

________________________________________________ |

Signature of Nonresident Purchaser |

Signature of Notary Public |

Personally known ____________________________________ Or, |

|

Produced identification __________________________________ |

________________________________________________ |

|

Print, Type or Stamp Commissioned Name of Notary Public |

Type of identification produced __________________________ |

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The DR-123 form is used for claiming a partial exemption from Florida sales tax for motor vehicle purchases by nonresidents. |

| Effective Date | This form became effective in January 2021. |

| Governing Rule | The form is governed by Rule 12A-1.097, Florida Administrative Code (F.A.C). |

| Qualification Criteria | The buyer must ensure that the vehicle is removed from Florida within 45 days and remains outside the state for at least 180 days. |

| Tax Implications | Sales tax is due to Florida. If not allowed a credit, the buyer may owe additional sales tax to their residence state. |

| Notarization Requirement | The purchaser must sign the form in the presence of a notary public, who certifies their identity. |

Guidelines on Utilizing Dr 123

Completing the DR 123 form requires attention to detail and accurate information regarding the motor vehicle purchase. It's essential to ensure all sections are filled out correctly to qualify for the partial exemption for taxes. Follow these steps to fill out the form efficiently.

- Obtain the DR 123 form, ensuring it is the latest version.

- At the top of the form, fill in the County where the transaction takes place.

- Under "Name of Nonresident Purchaser," write the full name of the person or entity buying the vehicle.

- Complete the section for the State of Residence and Address of the purchaser. Include the street, city, state, and ZIP code.

- If the purchaser is a corporation or partnership, check the appropriate box indicating that the vehicle will be removed from Florida within 45 days and will remain out of state for at least 180 days.

- If the vehicle will remain in Florida, certify by checking the box that confirms no officer, stockholder, or partner is a Florida resident as indicated.

- In the next section, provide the Name of Seller and the Address of the seller, including street, city, state, and ZIP code.

- Enter the seller's sales tax registration number, followed by the Date of Sale.

- Describe the motor vehicle by filling out the Make, Model, Year, Vehicle Identification Number, and Motor Number.

- Indicate the Sales Price and any Trade-In Allowance if applicable.

- Document the Florida Sales Tax Paid.

- Specify that the vehicle will be licensed in the identified State within 45 days after purchase.

- Initial in the provided space confirming your understanding of potential sales tax liabilities in the state where the vehicle will be registered.

- Proceed to the notarization section. Sign and date the form where indicated for the nonresident purchaser.

- Have the form notarized by a licensed notary public, ensuring they complete their section, including identifying information.

After completing the form, ensure that all information is accurate and legible. Once everything is filled out and notarized, the form should be submitted as directed. Keeping a copy of the completed form for your records is advisable, as it may be needed for future reference or tax purposes.

What You Should Know About This Form

What is the purpose of the DR-123 form?

The DR-123 form serves as an affidavit that allows non-residents of Florida to claim a partial exemption from sales tax when purchasing a motor vehicle. Specifically, it applies to individuals or entities from another state who plan to take their vehicle out of Florida within 45 days after the purchase and keep it registered in their home state for at least 180 days. This form ensures compliance with Florida's tax regulations while supporting non-resident purchasers in minimizing their tax burden.

Who qualifies to use the DR-123 form?

Non-resident purchasers can qualify to use the DR-123 form if they satisfy certain conditions outlined in the affidavit. If the buyer is an individual, they must intend to remove the vehicle from Florida within 45 days and keep it out for a minimum of 180 days. In cases where the purchaser is a corporation or partnership, an authorized officer or partner must confirm that no resident of Florida holds a significant stake—10% ownership or more—in the company. Meeting these requirements is crucial for securing the partial exemption.

What information is required on the DR-123 form?

The DR-123 form collects essential details about both the purchaser and the seller, as well as information concerning the vehicle itself. Purchasers must provide their name, state of residence, and address. The seller's name, address, and sales tax registration number must also be included. Additionally, the form requires detailed information about the motor vehicle, including the make, model, year, vehicle identification number (VIN), motor number, and sales price. All of these details help ensure the correct application of the partial exemption for sales tax purposes.

What are the potential tax implications after using the DR-123 form?

Even after utilizing the DR-123 form to claim a partial exemption from Florida sales tax, purchasers may still owe taxes to their home state when registering the vehicle. This obligation arises if their home state does not credit sales tax paid to Florida or if the state’s sales tax rate exceeds the 6% rate in Florida. Therefore, it's advisable for non-resident purchasers to familiarize themselves with their own state's tax regulations to avoid any surprises when registering their vehicle.

Common mistakes

Filling out the DR 123 form can be straightforward, but many people still make common mistakes that can delay processing or complicate the exemption claim. Understanding these mistakes can help ensure a smoother experience.

One frequent issue arises with the nonresident purchaser's address. It’s important to provide a complete address, including street, city, state, and ZIP code. Omitting any part can cause confusion and result in a delay in processing the form. Always double-check to confirm that the information is accurate and fully filled out.

Another mistake often encountered is related to the vehicle removal criteria. The form states that the vehicle must be removed from Florida within 45 days and must remain outside the state for at least 180 days. Many people fail to acknowledge this requirement or mistakenly believe it is optional. It is crucial to fully understand and comply with these conditions to qualify for the partial exemption.

Many purchasers also overlook the sellers’ information. The address and sales tax registration number of the seller must be included accurately. Errors in this section can lead to misconceptions about the transaction, leading to delays. It’s best to obtain this information directly from the seller to avoid mistakes.

Another key area is the signature section. It’s vital that the nonresident purchaser signs the form in the correct spot. In some instances, people neglect to sign or fail to include the date when signing. Each of these elements is necessary for the validity of the affidavit. A missing signature can mean the difference between approval and rejection of the tax exemption.

Lastly, individuals should pay careful attention to the notary requirements. The form needs to be notarized correctly. Failing to ensure that the notary signs and indicates the method of notarization can lead to complications. It’s important to choose a notary who is familiar with this type of documentation to help ensure that everything is completed correctly.

By understanding these common mistakes, individuals can complete the DR 123 form more effectively, helping to facilitate a smoother process and avoid unnecessary delays.

Documents used along the form

The DR-123 form is essential when a nonresident purchases a motor vehicle in Florida, allowing them to claim a partial sales tax exemption. To ensure a smooth transaction, several other documents are commonly used alongside the DR-123 form. Below are those documents, each described for your understanding.

- Bill of Sale: This document serves as proof of the vehicle sale, detailing the transaction between the buyer and seller. It includes essential information such as the vehicle's description, sale price, and both parties' signatures.

- Title Transfer Application: To officially transfer ownership of the vehicle, this application must be completed. It provides necessary details about the new owner and ensures that the title is updated in the state's records.

- Notarized Affidavit: In some cases, an affidavit may be needed to confirm that the vehicle will be taken out of state. This document requires a signature and a notary public's acknowledgment, providing an additional layer of verification.

- Sales Tax Exemption Certificate: If applicable, this certificate supports the claim for exemption from sales tax. It demonstrates that the buyer is eligible for the tax relief due to their residency status.

- Proof of Identity: Identification, such as a state-issued driver's license or passport, is often required to confirm the identity of the buyer. It ensures that the information on all documents is accurate and trustworthy.

- Vehicle Registration Application: Once the sale is complete, this application is needed to register the vehicle in the buyer's home state. It includes the necessary details about the vehicle and owner for state records.

- Trade-In Documentation: If the purchase involves a vehicle trade-in, this documentation is crucial. It details the traded vehicle's value and sales conditions, affecting the final sales price and tax calculations.

- State-Specific Tax Information: Buyers may need to familiarize themselves with their home state’s tax regulations. This information helps in understanding potential sales tax obligations upon registering the vehicle in their state.

Utilizing these forms and documents effectively can streamline the process of purchasing a vehicle as a nonresident in Florida. Being prepared with the necessary information not only helps in compliance but also facilitates a smoother transition into ownership.

Similar forms

The DR-123 form, which is used for claiming a partial exemption for motor vehicle sales tax in Florida for nonresident purchasers, shares similarities with several other important documents used in various administrative and legal processes. Here are eight documents that are comparable and how they relate to the DR-123 form:

- Form 5405: First-Time Homebuyer Credit: Like the DR-123 form, this document is used to claim a tax exemption based on specific eligibility criteria. Both forms require the individual to provide detailed information about their residency and the item in question—whether it's a vehicle or a property.

- Form W-4: Employee's Withholding Certificate: This form and the DR-123 both require the individual to attest under penalties of perjury to certain facts regarding residency. Both help determine how tax obligations are calculated based on residency status.

- Form 8843: Statement for Exempt Individuals: Similar to the DR-123 form, which addresses residency status for vehicle tax purposes, the Form 8843 is used to determine the tax status of certain nonresident aliens in the U.S. Both forms involve affirmations by the signer about their residence and status.

- IRS Form 1065: U.S. Return of Partnership Income: This form requires partnership entities to declare information about partners and their residency, akin to the DR-123's requirement for nonresident corporations or partnerships to affirm that there are no resident partners.

- Form 1099: Miscellaneous Income: Both the 1099 and the DR-123 form require disclosure of significant financial transactions, whether sales for a vehicle or miscellaneous income. Transparency in transactions is a key aspect of both forms.

- Form I-9: Employment Eligibility Verification: The I-9 form, like the DR-123, requires verification of residency status. Individuals must provide supporting information and may face residency-related obligations in both scenarios.

- Form 990: Return of Organization Exempt from Income Tax: Nonprofit organizations use this form to provide information regarding their operations, which can include residency of key individuals. The focus on residency and tax implications links it to the DR-123.

- State Vehicle Title Application: Similar to the DR-123, this application requires the applicant to provide residency information to establish ownership of a vehicle. Both forms ensure the appropriate state receives tax revenue based on proper residency claims.

Understanding these documents can help clarify the regulatory landscape surrounding vehicle purchases and tax liabilities based on residency. They serve to protect both individuals and governmental interests by ensuring accurate tax collection based on state residency laws.

Dos and Don'ts

When filling out the Dr 123 form, it's important to follow certain guidelines. Here’s a list of what to do and what to avoid:

- Do provide accurate and complete information.

- Do ensure that the vehicle description matches the vehicle's registration.

- Do include the seller’s sales tax registration number.

- Do submit the form within the required time frame.

- Do have a notary public witness your signature.

- Don't leave any empty spaces unless instructed.

- Don't sign the form before it is notarized.

- Don't provide false information, as it may lead to penalties.

- Don't ignore the requirement for the vehicle to be removed from Florida within 45 days.

Misconceptions

- Misconception 1: The DR-123 form eliminates all sales tax obligations.

- Misconception 2: Non-residents can ignore the 180-day rule.

- Misconception 3: Only individual buyers can use the DR-123 form.

- Misconception 4: Completing the DR-123 form guarantees tax exemption.

This form allows for a partial exemption from Florida sales tax for vehicles sold to non-residents, but it does not eliminate the obligation to pay sales tax entirely. Purchasers may still need to pay sales tax in their home state if Florida does not provide a credit for taxes paid.

The affidavit requires that the vehicle must be removed from Florida within 45 days and must remain outside the state for at least 180 days. This condition is crucial to qualify for the tax exemption, and failure to comply can result in additional tax liabilities.

In fact, the form is also applicable to corporations and partnerships. However, certain conditions, such as no officers being residents of Florida, must be met for these entities to qualify.

While the form is a necessary document for claiming the exemption, it does not automatically secure it. The purchaser must still adhere to the regulations and provide accurate information regarding their residency and the use of the vehicle.

Key takeaways

When filling out the DR-123 form, it is essential to be thorough and precise. This form is used for claiming a partial sales tax exemption on a motor vehicle purchased by a non-resident in Florida. Here are some key takeaways to help you navigate the process:

- Understand the Purpose: The DR-123 form allows non-residents to potentially exempt their motor vehicle purchases from Florida sales tax if they meet specific criteria.

- Complete the Buyer Information: Accurate details of the non-resident purchaser must be filled out, including their name, address, and state of residence. This information establishes their qualification.

- Certification Requirement: If the purchaser is a corporation or partnership, an officer or partner must confirm the vehicle will be removed from Florida within 45 days of purchase.

- Residency Considerations: The form mandates that there should be no resident officers or stakeholders in the purchasing partnership or corporation if the vehicle remains in Florida longer than specified.

- Seller Details: Information about the seller must also be entered. The seller’s sales tax registration number and address play a significant role in the transaction.

- Vehicle Information: Clearly fill out the description of the vehicle, including its make, model, year, vehicle identification number, and motor number.

- Tax Obligations: The form emphasizes that the purchaser may still owe sales tax to their state of registration if required, particularly if they do not receive a credit for tax paid in Florida.

- Notarization Requirement: The form must be sworn to or affirmed before a notary public, which validates the authenticity of the information provided.

- Filing Timeline: Completing and submitting the DR-123 form in a timely manner is crucial. The motor vehicle should be licensed in the purchaser's home state within 45 days of purchase.

By following these guidelines, non-residents can effectively navigate the DR-123 form, ensuring compliance with Florida regulations while taking advantage of potential sales tax exemptions.

Browse Other Templates

Lic 9282 - Confirmed signatures complete the form, ensuring accountability and accuracy.

How Long Can You Be Flagged in the Army - Proper completion ensures compliance with Army regulations and protocols.