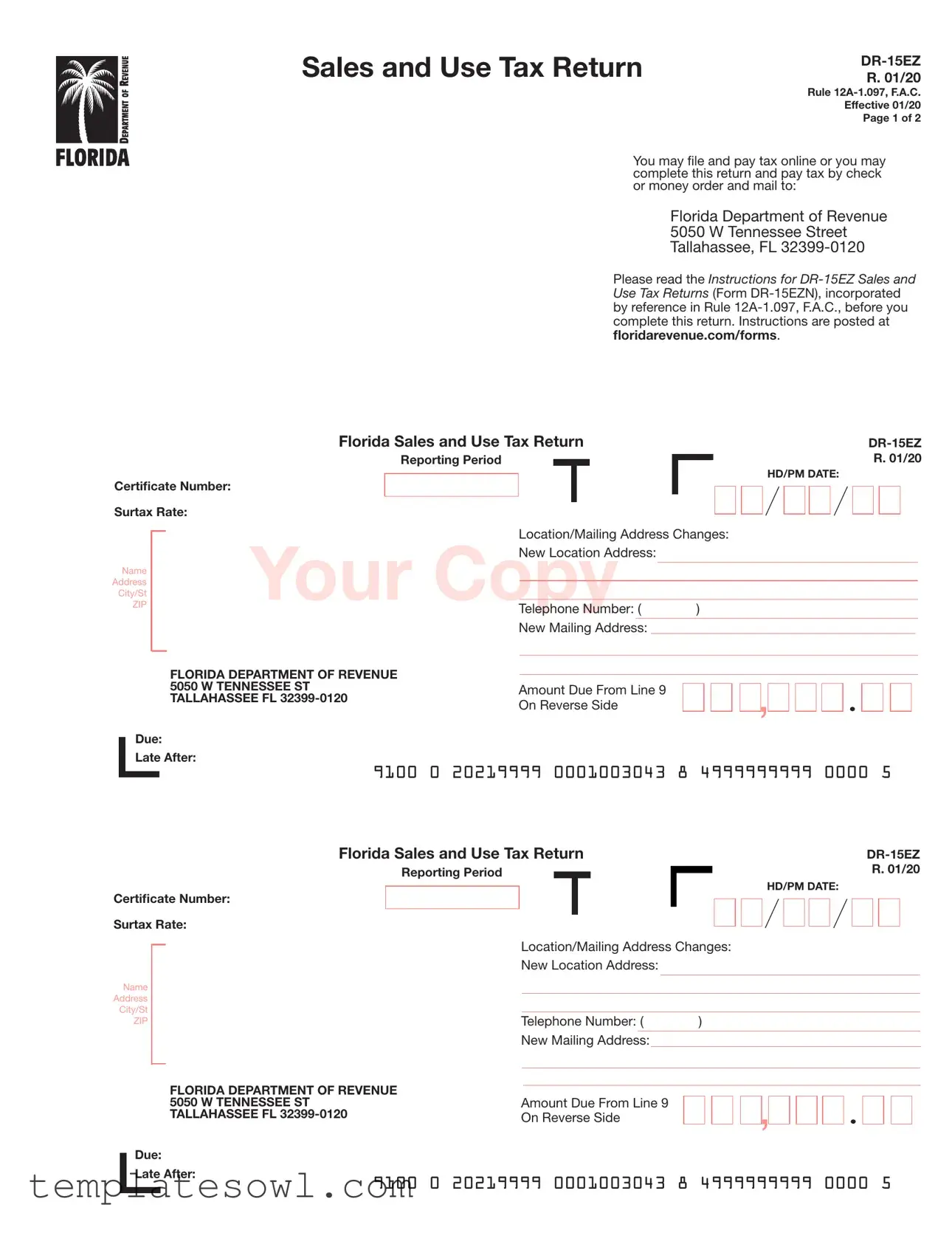

Fill Out Your Dr 15Ez Sales Tax Form

The DR-15EZ Sales and Use Tax Return form is a vital tool for businesses operating in Florida, providing a streamlined process for reporting and remitting sales tax obligations. Designed specifically for simplicity, this form allows businesses to file their returns either online or via traditional mail, accommodating various payment methods, including check or money order. To submit this form correctly, taxpayers must first read the accompanying instructions found on the Florida Department of Revenue’s website, ensuring compliance with the established rules. Each return must reflect the reporting period, capture essential information such as the business name and address, and reveal pertinent financial data, including gross sales, exempt sales, and taxable purchases. The form also requires the taxpayer to declare any lawful deductions and calculate the total tax due, which includes a discretionary sales surtax—an important aspect for those in affected counties. Importantly, timely electronic filing and payment can grant businesses a collection allowance of 2.5% on the initial $1,200 of tax due, making adherence to deadlines crucial. Returns are due on the first of each month and considered late after the 20th day of the preceding month, with penalties imposed for late submissions. As Florida continues to adapt its tax regulations, understanding the elements of the DR-15EZ is essential for managing tax compliance effectively.

Dr 15Ez Sales Tax Example

Sales and Use Tax Return

R. 01/20

Rule

Effective 01/20

Page 1 of 2

You may file and pay tax online or you may complete this return and pay tax by check or money order and mail to:

Florida Department of Revenue

5050 W Tennessee Street

Tallahassee, FL

Please read the Instructions for

Florida Sales and Use Tax Return

Reporting Period

Certificate Number:

Surtax Rate:

R. 01/20

HD/PM DATE:

Name

Address

City/St

ZIP

Location/Mailing Address Changes:

Your CopyNew Location Address:

Telephone Number: ( )

New Mailing Address:_________________________________________

FLORIDA DEPARTMENT OF REVENUE |

|

|

5050 W TENNESSEE ST |

Amount Due From Line 9 |

|

TALLAHASSEE FL |

||

On Reverse Side |

||

|

,

,

Due: |

|

|

|

|

|

|

|

Late After: |

|

|

|

|

|

|

|

9100 |

0 |

20219999 |

0001003043 |

8 |

4999999999 |

0000 |

5 |

Florida Sales and Use Tax Return |

||||

|

Reporting Period |

|

R. 01/20 |

|

|

||||

|

|

|

|

HD/PM DATE: |

|

|

|

|

|

Certificate Number:

Surtax Rate:

Name

Address

City/St

ZIP

Location/Mailing Address Changes:

New Location Address:

Telephone Number: ( |

) |

|

|

|

|

New Mailing Address: |

|

|

FLORIDA DEPARTMENT OF REVENUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5050 W TENNESSEE ST |

Amount Due From Line 9 |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

||

TALLAHASSEE FL |

On Reverse Side |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Due: |

|

|

|

|

|

|

|

|

Late After: |

9100 |

0 |

20219999 |

0001003043 |

8 |

4999999999 |

0000 |

5 |

|

R. 01/20

Page 2 of 2

File and Pay Online to Receive a Collection Allowance. When you electronically file your tax return and pay timely, you are entitled to deduct a collection allowance of 2.5% (.025) of the first $1,200 of tax due, not to exceed $30. To pay timely, you must initiate payment and receive a confirmation number, no later than 5:00 p.m. ET on the business day prior to the 20th. More information on filing and paying electronically, including aFlorida eServices Calendar of Electronic Payment Deadlines (Form

Due Dates. Returns and payments are due on the 1st and late after the 20th day of the month following each reporting period.

A return must be filed for each reporting period, even if no tax is due.If the 20th falls on a Saturday, Sunday, or a state or federal holiday, returns are timely if postmarked or hand delivered on the first business day following the 20th.

Penalty. If you file your return or pay tax late, a late penalty of 10% of the amount of tax owed, but not less than $50, may be charged. The $50 minimum penalty applies even if no tax is due. A floating rate of interest also applies to late payments and underpayments of tax.

|

|

|

|

|

|

|

|

|

|

|

DOLLARS |

|

|

|

|

|

|

|

|

|

CENTS |

Under penalties of perjury, I declare that I have read this return and |

|

|

|

||||||||||||||||||||||||||||

1. |

Gross Sales |

|

|

|

|

|

, |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

the facts stated in it are true. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

(Do not include tax) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Exempt Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

(Include these in |

|

|

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Gross Sales, Line 1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Taxpayer |

|

Date |

|

|

|

|

Telephone # |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

3. |

Taxable Sales/Purchases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

(Include |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Purchases) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Signature of Preparer |

|

Date |

|

|

|

|

Telephone # |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

4. |

Total Tax Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

(Include Discretionary Sales Surtax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

from Line B) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

5. |

Less Lawful Deductions |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discretionary Sales Surtax Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Taxable Sales and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. |

Less DOR Credit Memo |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

Purchases NOT Subject |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to DISCRETIONARY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SALES SURTAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Net Tax Due |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

B. Total Discretionary |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

8. |

|

Less Collection Allowance or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales Surtax Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Plus Penalty and Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Amount Due With Return |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

Please do not fold or staple. |

|

|

|

|

|||||||||||||||||||||||||

|

|

(Enter this amount on front) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOLLARS |

|

|

|

|

|

|

|

|

|

CENTS |

|

Under penalties of perjury, I declare that I have read this return and |

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

, |

, |

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

1. |

Gross Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the facts stated in it are true. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

(Do not include tax) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Exempt Sales |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Include these in |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Gross Sales, Line 1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Taxpayer |

Date |

|

|

|

|

Telephone # |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

3. |

Taxable Sales/Purchases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

(Include |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Purchases) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Signature of Preparer |

Date |

|

|

|

|

Telephone # |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

4. |

Total Tax Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

(Include Discretionary Sales Surtax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

from Line B) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

5. |

Less Lawful Deductions |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discretionary Sales Surtax Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Taxable Sales and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. |

Less DOR Credit Memo |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchases NOT Subject |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to DISCRETIONARY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. |

Net Tax Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SALES SURTAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. Total Discretionary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

8. |

|

Less Collection Allowance or |

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales Surtax Due |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Plus Penalty and Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Collection |

Allowance |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

9. |

Amount Due With Return |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please do not fold or staple. |

|

|

|

||||||||||||||||||||||||||

|

|

(Enter this amount on front) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Form Designation | The Sales and Use Tax Return is designated as DR-15EZ R. 01/20. |

| Governing Law | This form is governed by Rule 12A-1.097, Florida Administrative Code (F.A.C.). |

| Filing Options | Taxpayers can file and pay tax online or submit the form by mail with a check or money order. |

| Payment Due Dates | Returns and payments are due on the 1st of the month and late after the 20th of the following month. |

| Late Penalty | A late penalty of 10% applies to the tax owed with a minimum charge of $50. |

| Collection Allowance | A collection allowance of 2.5% can be claimed on timely electronic payments, not exceeding $30. |

Guidelines on Utilizing Dr 15Ez Sales Tax

Filling out the DR-15EZ Sales Tax form can seem overwhelming at first, but with a clear step-by-step approach, you can complete it accurately and efficiently. After you fill out this form, you'll be ready to submit it either online, by mail, or in person, depending on your preference. Here’s how to do it.

- Gather necessary information: Before starting, collect all required sales and tax data, including your business name, address, certificate number, and relevant sales figures.

- Start with the basic information: At the top of the form, fill in your name, address, city, state, and zip code. Make sure your location and mailing address are correct.

- Report your sales: On Line 1, enter your total gross sales. Remember, do not include tax in this amount.

- Exempt sales: In Line 2, list any exempt sales. These should also be included in your gross sales total from Line 1.

- Taxable sales: Fill in Line 3 with the amount of taxable sales or purchases, including those made online or out of state.

- Calculate tax due: On Line 4, write down the total tax due. Ensure to include any discretionary sales surtax from Line B.

- Subtract lawful deductions: On Line 5, enter any lawful deductions that apply to your sales tax situation.

- Include any DOR credit memo: If applicable, on Line 6, list the amount of any Department of Revenue credit memo that reduces your tax obligation.

- Net tax due: For Line 7, calculate your net tax due by taking the total tax due and subtracting any lawful deductions and credits.

- Calculate discretionary sales surtax: On Line 8, calculate any discretionary sales surtax due, adding any penalties or interest as necessary.

- Final amount due: On Line 9, calculate the amount you need to send with your return. This is the total you will submit.

- Sign and date: Ensure your return is signed and dated by the taxpayer and the preparer, if applicable, as this certifies the accuracy of your returns.

After completing the form, be mindful of submitting it on time. Returns and payments are typically due on the first of the month and considered late after the 20th of the following month. Ensure you file accurately to avoid any late penalties.

What You Should Know About This Form

What is the DR-15EZ Sales Tax form?

The DR-15EZ Sales Tax form is a simplified return for filing and paying Florida's Sales and Use Tax. Designed for businesses with relatively straightforward tax reporting needs, this form allows taxpayers to report their gross sales, exempt sales, and taxable sales, and calculate the total tax due. It's important to submit this form accurately by the due dates outlined by the Florida Department of Revenue to avoid penalties.

How do I file the DR-15EZ Sales Tax form?

You have several options for filing the DR-15EZ form. You can file online through the Florida Department of Revenue's website, which is also the quickest method. Alternatively, you can complete the paper form and mail it in along with your payment by check or money order. If you choose to file online, make sure to do so by 5:00 p.m. ET on the day prior to the 20th of the month following the reporting period for timely processing.

What are the due dates for submitting the DR-15EZ?

Returns and payments for the DR-15EZ are due on the 1st day of each month and considered late after the 20th day of the month following the reporting period. If the 20th falls on a weekend or holiday, you can submit your return on the next business day without incurring a late penalty. It’s essential to keep track of these dates to avoid penalties and ensure compliance.

What happens if I file the form late?

If you file the DR-15EZ Sales Tax form late, you will incur a penalty of 10% of the tax owed, with a minimum penalty of $50, even if no tax is due. Additionally, interest may accrue on any late payments or underpayments. Keeping your filings on time not only avoids these penalties but also ensures accurate record-keeping for your business.

Can I claim a deduction for filing electronically?

Yes, when you file the DR-15EZ electronically and make your payment on time, you are eligible for a collection allowance of 2.5% of the first $1,200 of tax due. However, this allowance cannot exceed $30. To qualify for this deduction, you must initiate your payment and obtain confirmation by the specified deadline.

Where can I find further instructions regarding the DR-15EZ Sales Tax form?

For detailed instructions on how to complete the DR-15EZ, you can visit the Florida Department of Revenue’s website. The document titled "Instructions for DR-15EZ Sales and Use Tax Returns" contains essential information you will need to properly file the form. It’s a good practice to review these instructions before submission to ensure compliance and accuracy in your reporting.

Common mistakes

Filling out the DR-15EZ Sales Tax form can seem straightforward, but many individuals make errors that can lead to delays or problems with the Florida Department of Revenue. One common mistake is incorrectly reporting gross sales. It’s crucial to remember that gross sales should not include tax. Many people mistakenly add taxes to this figure, which skews their total and can lead to penalties.

Another frequent error involves the reporting of exempt sales. Individuals often assume that they do not need to include exempt sales in gross sales. However, the form clearly states that exempt sales must be included in line one. This misinterpretation can result in an inaccurate gross sales figure and may trigger an audit.

When it comes to taxable sales and purchases, omission is a common pitfall. Many filers forget to include internet and out-of-state purchases. Failure to do so can result in underreporting and subsequent penalties. Double-checking these figures before submission is essential to avoid these mistakes.

Additionally, many filers neglect to account for lawful deductions. Deductions are an important part of your tax return and can significantly affect the total tax due. If you forget to apply these deductions, you may end up overpaying. Always ensure that you’ve carefully calculated and documented any lawful deductions before submission.

Missing the collection allowance is another error. When filing electronically, you can deduct a collection allowance of up to $30, but only if you file and pay on time. Forgetting to apply this deduction reduces potential savings. Mark your calendar to ensure you initiate payment by the deadline to take advantage of this benefit.

Understanding the due dates is important. Some filers confuse the due dates and assume they can submit their forms without consequences after the 20th of the month. Remember, returns are due on the 1st and late after the 20th. Missing these dates can lead to penalties of 10% on the amount owed.

Additionally, the penalty for late payments can apply even if you do not owe any tax. A minimum penalty of $50 is charged regardless of the circumstances, leaving some surprised by unexpected fees. Always ensure your return is filed punctually to avoid unnecessary penalties.

Some individuals fail to sign the form, thinking it’s just an administrative step. This can lead to rejection or delays in processing. Always ensure that both the taxpayer and preparer, if applicable, have signed and dated the return to avoid this oversight.

Lastly, filers sometimes do not follow instructions carefully when reviewing how to submit their return. Forms need to be mailed properly and handled with care. For example, folding or stapling the form can lead to processing issues. Paying attention to these small details can streamline the submission process and help avoid complications.

Documents used along the form

The DR-15EZ Sales Tax form, used by businesses in Florida to report and remit sales and use tax, is often accompanied by various other documents to ensure compliance with tax regulations. Each of these forms serves a unique purpose, providing necessary details to the Florida Department of Revenue.

- DR-15EZN: This is the instruction form for the DR-15EZ. It provides detailed guidelines on how to accurately complete the Sales Tax Return. Before filing the DR-15EZ, it's essential to consult the instructions to understand the reporting requirements and avoid errors.

- DR-659: This form outlines the Florida eServices Calendar for Electronic Payment Deadlines. It is an essential resource for businesses that wish to file and pay their sales tax electronically. It includes critical dates that ensure timely compliance and help taxpayers avoid penalties.

- DR-2: The DR-2 form is used for requesting a Certificate of Registered Dealer. Businesses must obtain this certificate to legally collect sales tax from customers. It provides the necessary authorization and ensures the business is in good standing with the state tax authority.

- DR-580: The DR-580 form is a certificate that allows sellers to accept exemption claims from purchasers. When a buyer provides this certificate, it indicates that the sale should not be taxed, helping businesses maintain compliance with tax laws.

- DR-700014: This is the form for the Sales Tax Exemption Request. Businesses may need to fill out this document to formally request exemption from sales tax for certain types of purchases. It outlines the justification for the exemption requested and must be submitted for consideration.

Understanding these forms alongside the DR-15EZ ensures that businesses can effectively navigate Florida's sales tax system. Proper completion and submission of these documents help prevent penalties and enhance overall tax compliance.

Similar forms

The DR-15EZ Sales Tax form has similarities to several other documents used for tax reporting and compliance. Here are five documents that share common features with the DR-15EZ:

- Form 1120: This is the U.S. Corporation Income Tax Return. Both forms require detailed reporting of income, deductions, and tax owed for a specific period. Each form must be filed on time to avoid penalties.

- Form 1040: This is the U.S. Individual Income Tax Return. Like the DR-15EZ, it collects information on gross income and calculates tax liability. Both forms also offer the option for electronic filing.

- Form 941: This form is the Employer's Quarterly Federal Tax Return. Similar to the DR-15EZ, the 941 requires timely reporting of amounts due, including penalties for late submissions. Both forms report taxable activity within a specific timeframe.

- Form ST-3: This is the Sales Tax Resale Certificate for sales tax-exempt purchases in some states. It is similar to the DR-15EZ in its role of facilitating proper tax collection and documentation related to taxable sales.

- Form DR-15: This is the general Sales and Use Tax Return for Florida. The DR-15EZ simplifies the filing process but shares the same basic information and reporting requirements regarding sales taxes due.

Dos and Don'ts

Filling out the DR-15EZ Sales Tax form correctly is crucial for compliance and to avoid penalties. Here are some key do's and don'ts to guide you through the process.

- Do read the instructions thoroughly before beginning the form.

- Do ensure your reporting period and certificate number are accurately entered.

- Do file your return electronically if possible to access the collection allowance.

- Don't ignore the due dates; ensure returns are filed by the 20th of the following month.

- Don't forget to include all taxable sales; this includes internet and out-of-state purchases.

- Don't assume filing is unnecessary if no tax is due; a return is still required for each reporting period.

Misconceptions

Misconceptions about the DR-15EZ Sales Tax form can lead to confusion among taxpayers. Here are nine common misconceptions explained for clarity.

- Filing is optional if no tax is due. Some people believe they do not need to file the form if they owe no taxes. However, a return must be filed for each reporting period regardless of tax owed.

- Late filing penalties only apply if tax is owed. It's a common misconception that penalties do not apply if no tax is due. In fact, a minimum penalty of $50 is charged even if no tax is due.

- Electronic filing is not necessary for small businesses. Many small business owners think they can skip electronic filing. However, filing online allows them to claim a collection allowance, which can be beneficial.

- All sales are taxable under Florida law. Some individuals wrongly assume that everything sold is taxable. Exempt sales can be included in gross sales, but they do not count towards taxable sales.

- Due dates are flexible based on personal circumstances. Some believe they can choose their own deadlines. In reality, returns and payments are due by the 20th of each month following a reporting period, with specific rules regarding weekends and holidays.

- Filing online guarantees no penalties. Just because someone files online does not mean they are free from penalties. Timely payment must be made for online filings to avoid late fees.

- Once filed, no further actions are needed. Taxpayers may think that submitting the form absolves them of any further obligations. However, they must ensure timely payment to avoid penalties and interest.

- All tax amounts are the same across the state. People often don't realize that surtax rates can vary by county. It's crucial to confirm the correct rate based on the location of the sale.

- They can correct an error after submission without issue. Many think that once a form is submitted, corrections can easily be made. In truth, errors may lead to penalties or require a formal amendment process.

Understanding these misconceptions can help ensure compliance and avoid unnecessary penalties. Always review the instructions and stay informed about filing requirements.

Key takeaways

Here are key takeaways for completing and using the DR-15EZ Sales Tax form:

- Filing options include online submission or mail-in payment via check or money order.

- Online filing can earn you a collection allowance of 2.5% on the first $1,200 of tax due, up to a maximum of $30.

- Timely payments must be initiated by 5:00 p.m. ET the business day before the 20th of the month.

- Returns and payments are due on the 1st of the month and late after the 20th of the following month.

- A return is required for each reporting period, even if no tax is owed.

- Late filings incur a penalty of 10% of the tax owed, with a minimum charge of $50.

- Interest may accrue on late payments or underpayments of tax.

- Provide accurate gross, exempt, and taxable sales information to ensure proper reporting.

Browse Other Templates

Sante Prior Auth Form - The form is only for designated recipients and must remain confidential.

Sadlier Vocabulary Workshop Level D - Encouraging creativity allows students to express themselves.