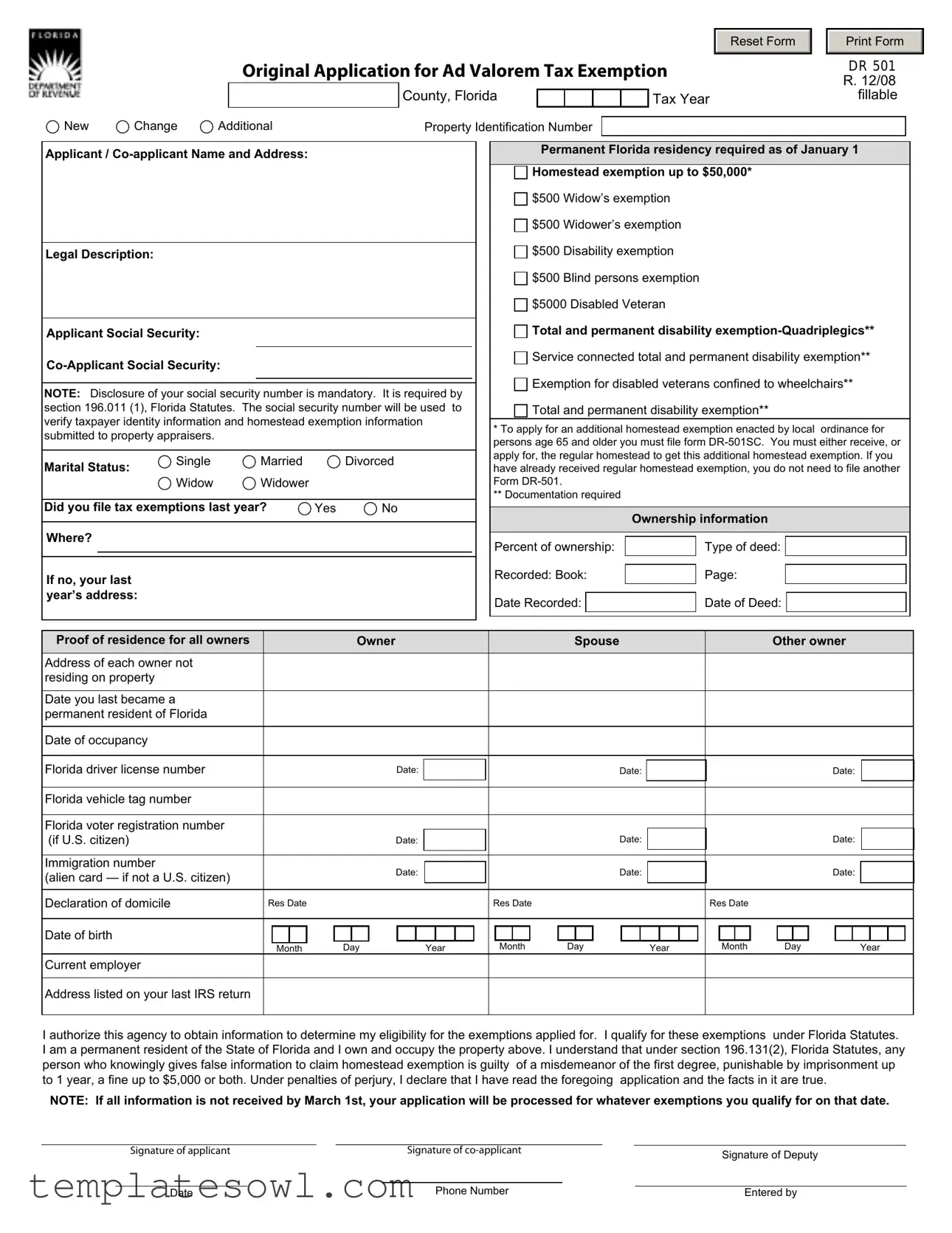

Fill Out Your Dr 501 Form

The DR 501 form serves as a crucial application for individuals seeking ad valorem tax exemptions in Florida. Designed for use by property owners, this form must be submitted to the county property appraiser annually by March 1st to qualify for various exemptions, including the homestead exemption, which can provide savings of up to $50,000 on property taxes. Applicants must provide essential personal details, such as name, address, and Social Security number. This information allows authorities to verify identity and residency status. The form also accommodates co-applicants and requires documentation related to property ownership and residency. Furthermore, specific exemptions cater to seniors, disabled veterans, and individuals with disabilities, each with distinct qualifications and requirements. It is essential for applicants to note that failure to complete the form accurately or submit necessary documentation by the deadline may result in a loss of tax benefits. This example illustrates the intersection of homeowner responsibility and government processes in Florida's property tax system, emphasizing the importance of timely and accurate submissions.

Dr 501 Example

Reset Form

Original Application for Ad Valorem Tax Exemption

|

|

|

|

County, Florida |

|

|

|

|

|

Tax Year |

|

|

|

|

|

|

|

|

|

||

New |

Change |

Additional |

Property Identification Number |

|

|

|

||||

|

|

|

||||||||

Print Form

DR 501

R.12/08 fillable

Applicant /

Legal Description:

Applicant Social Security:

NOTE: Disclosure of your social security number is mandatory. It is required by section 196.011 (1), Florida Statutes. The social security number will be used to verify taxpayer identity information and homestead exemption information submitted to property appraisers.

Marital Status: |

Single |

Married |

|

Divorced |

Widow |

Widower |

|

|

|

|

|

|

||

Did you file tax exemptions last year? |

Yes |

No |

||

Where? |

|

|

|

|

If no, your last year’s address:

Permanent Florida residency required as of January 1  Homestead exemption up to $50,000*

Homestead exemption up to $50,000*

$500 Widow’s exemption

$500 Widow’s exemption

$500 Widower’s exemption

$500 Widower’s exemption

$500 Disability exemption

$500 Disability exemption

$500 Blind persons exemption

$500 Blind persons exemption  $5000 Disabled Veteran

$5000 Disabled Veteran

Total and permanent disability

Total and permanent disability

Service connected total and permanent disability exemption**

Service connected total and permanent disability exemption**  Exemption for disabled veterans confined to wheelchairs**

Exemption for disabled veterans confined to wheelchairs**

Total and permanent disability exemption**

Total and permanent disability exemption**

*To apply for an additional homestead exemption enacted by local ordinance for persons age 65 and older you must file form

**Documentation required

|

|

Ownership information |

|||||

|

|

|

|

|

|

|

|

Percent of ownership: |

|

Type of deed: |

|

|

|

|

|

|

|

|

|

|

|||

Recorded: Book: |

|

Page: |

|

|

|

||

|

|

|

|

||||

|

|

|

|

|

|

|

|

Date Recorded: |

|

|

Date of Deed: |

|

|

||

Proof of residence for all owners |

|

|

|

|

|

Owner |

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

Other owner |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of each owner not |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

residing on property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date you last became a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

permanent resident of Florida |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of occupancy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida driver license number |

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida vehicle tag number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida voter registration number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(if U.S. citizen) |

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Immigration number |

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

(alien card — if not a U.S. citizen) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Declaration of domicile |

Res Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

Res Date |

|

|

|

|

|

|

|

|

|

|

Res Date |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

|

Day |

|

|

|

|

|

Year |

|

|

|

Month |

|

Day |

|

|

|

|

Year |

|

|

Month |

|

|

Day |

|

|

|

Year |

|

||||||||||||

Current employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address listed on your last IRS return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

I authorize this agency to obtain information to determine my eligibility for the exemptions applied for. I qualify for these exemptions |

under Florida Statutes. |

|||||||||||||||||||||||||||||||||||||||||||

I am a permanent resident of the State of Florida and I own and occupy the property above. I understand that under section 196.131(2), Florida Statutes, any person who knowingly gives false information to claim homestead exemption is guilty of a misdemeanor of the first degree, punishable by imprisonment up to 1 year, a fine up to $5,000 or both. Under penalties of perjury, I declare that I have read the foregoing application and the facts in it are true.

NOTE: If all information is not received by March 1st, your application will be processed for whatever exemptions you qualify for on that date.

|

Signature of applicant |

|

Signature of |

|

Signature of Deputy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

|

Date |

|

Entered by |

|||

This application must be filed with the property appraiser by March 1st

The information contained in this application will be provided to the Department of Revenue and the Department and/or property appraisers are authorized to provide this information to any state in which the applicant has previously resided, pursuant to Section 196.121, Florida Statutes. Social security numbers will remain confidential pursuant to sections 193.114(5), and 193.074, Florida Statutes.

Notice: A tax lien can be imposed on your property.

Section 196.161 (1) provides:

(1)(a) “When the estate of any person is being probated or administered in another state under an allegation that such person was a resident of that state and the estate of such person contains real property situate in this state upon which homestead exemption has been allowed pursuant to s. 196.031 for any year or years within 10 years immediately prior to the death of the deceased, then within 3 years after the death of such person the property appraiser of the county where the real property is located shall, upon knowledge of such fact, record a notice of tax lien against the property among the public records of that county, and the property shall be subject to the payment of all taxes exempt thereunder, a penalty of 50 percent of the unpaid taxes for each year, plus 15 percent interest per year, unless the circuit court having jurisdiction over the ancillary administration in this state, determines that the decedent was a permanent resident of this state during the year or years an exemption was allowed, whereupon the lien shall not be filed or, if filed, shall be canceled of record by the property appraiser of the county where the real estate is located. (b) In addition, upon determination by the property appraiser that for any year or years within the prior 10 years a person who was not entitled to a homestead exemption was granted a homestead exemption from ad valorem taxes, it shall be the duty of the property appraiser making such determination to serve upon the owner a notice of intent to record in the public records of the county a notice of tax lien against any property owned by that person in the county, and such property shall be identified in the notice of tax lien. Such property which is situated in this state shall be subject to the taxes exempted thereby, plus a penalty of 50 percent of the unpaid taxes for each year and 15 percent interest per annum. However, if a homestead exemption

is improperly granted as a result of a clerical mistake or omission by the property appraiser, the person improperly receiving the exemption shall not be assessed penalty and interest. Before any such lien may be filed, the owner so notified must be given 30 days to pay the taxes, penalties, and interest.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The DR 501 form is titled "Original Application for Ad Valorem Tax Exemption" and is specific to Florida. |

| Filing Deadline | Applicants must submit the DR 501 form by March 1st of the tax year in which they seek exemptions. |

| Mandatory Disclosure | Disclosure of social security numbers is mandatory, as required by section 196.011(1), Florida Statutes. |

| Residency Requirement | Permanent residency in Florida is required as of January 1st of the tax year for qualification. |

| Exemption Amounts | Exemptions vary such as homestead exemption of up to $50,000, and various $500 exemptions related to disability and widow status. |

| Additional Exemptions | To apply for additional exemptions, older adults must file form DR-501SC along with the regular homestead application. |

| Legal Consequences | Providing false information on the application is classified as a misdemeanor, punishable under section 196.131(2), Florida Statutes. |

| Tax Liens | Section 196.161(1) outlines conditions under which tax liens may be imposed on property due to improperly granted exemptions. |

| Application Processing | Failure to include all required information by the March 1st deadline limits the exemptions available for processing. |

Guidelines on Utilizing Dr 501

Once you have gathered all necessary information, you are ready to fill out the DR 501 form. Completing this form accurately is essential, as any missing details could affect the process of your application. By following the steps outlined below, you can ensure that you provide all required information clearly and correctly.

- Start by printing the form DR 501. Make sure you have the latest version, as forms may be updated from time to time.

- Fill in the County and Tax Year in the designated fields at the top of the form.

- Indicate if this is an Original Application, Change, or Additional Property application.

- Provide the Property Identification Number if applicable.

- Enter your Applicant / Co-applicant Name and Address. Both names should be clearly written.

- Fill out the Legal Description of the property in the appropriate field.

- Input your and your co-applicant’s Social Security Numbers in the required sections. Remember, disclosure of this information is mandatory.

- Select your Marital Status from the options provided: Single, Married, Divorced, Widow, or Widower.

- Indicate whether you filed tax exemptions last year by answering Yes or No.

- If applicable, provide your last year’s address if you answered No.

- Mark your Permanent Florida residency date as of January 1.

- Fill in any exemptions you are applying for, such as Homestead exemption, Widow or Widower’s exemption, Disability exemption, etc. Make sure to indicate if you are eligible for additional exemptions.

- Provide necessary ownership information, including the percent of ownership, type of deed, recorded book and page, and applicable dates.

- Document proof of residence for all owners in the sections provided.

- If you or your co-applicant has a Florida driver license or vehicle tag number, include them as required.

- Complete other required sections including Declaration of Domicile, Date of Birth, and Current Employer information.

- Review your application for accuracy and completeness.

- Sign and date the form. Ensure both the applicant and co-applicant have signed it. A Deputy also needs to sign.

- Finally, submit the completed form to the property appraiser by the deadline of March 1st.

Ensure that all sections are filled out correctly to avoid any potential issues with your application. Keep a copy of your completed form for personal records. This will help you track your application and have important information on hand for future reference.

What You Should Know About This Form

What is the purpose of the DR 501 form?

The DR 501 form is used to apply for various ad valorem tax exemptions for property in Florida. These exemptions can reduce the amount of property taxes owed. The form is primarily for individuals seeking a homestead exemption, but it also covers other exemptions such as those for disabled veterans, the blind, and surviving spouses.

Who is eligible to apply for the DR 501 form?

Eligibility for the DR 501 form generally includes Florida residents who own and occupy the property they are applying to exempt. You must be a permanent resident of Florida as of January 1 of the tax year for which you are applying. Additionally, there are specific requirements for certain exemptions, such as those for disabled veterans or individuals with disabilities.

What information is required on the DR 501 form?

The form requires several pieces of personal information, including your name, address, Social Security number, and marital status. You must also provide details about your property, such as its legal description and ownership information. Additional documentation may be needed to support your eligibility, depending on the type of exemption for which you are applying.

When should the DR 501 form be submitted?

The completed DR 501 form must be filed with the property appraiser by March 1 of the tax year to ensure that your application is processed in time for that year's exemptions. Late submissions may only be eligible for partial exemptions, if any.

What happens if I miss the March 1 deadline?

If you miss the March 1 deadline, your application may still be processed, but typically only for the exemptions you qualify for on the date your application is received. You may not be able to claim exemptions for the whole year, which could result in higher property taxes.

What penalties may I face for providing false information on the DR 501 form?

Providing false information on the DR 501 form can lead to severe penalties, including charges of a first-degree misdemeanor. This can result in imprisonment for up to one year, fines of up to $5,000, or both. Accurate information is critical to avoid these legal consequences.

Can I appeal if my application for exemption is denied?

If your application for an exemption is denied, you have the right to appeal the decision. Typically, you must file your appeal with the Value Adjustment Board in your county. The process and timeline for appeals can vary, so it's advisable to review your local property appraiser's guidelines for specific instructions.

Is my Social Security number confidential when submitting the DR 501 form?

Yes, your Social Security number will be kept confidential. Florida statutes protect this information, ensuring it is not publicly disclosed. However, disclosure is mandatory for the purpose of verifying your identity and eligibility for the exemptions you are applying for.

Common mistakes

Completing the DR 501 form can feel overwhelming for many applicants, and mistakes are common. One significant error is failing to provide complete and accurate personal information. Applicants often overlook filling in all sections or mistakenly offer incorrect details, like their Social Security numbers. This information is crucial as it verifies your identity and tax exemption eligibility. Missing or wrong details can lead to delays or even rejection of your application.

Another frequent mistake involves misunderstanding the residency requirements. Many people check the wrong box or forget to declare their permanent residency status in Florida accurately. The form asks for clear indications of your residency since January 1, which is critical in determining eligibility for exemptions. If you're unsure about your residency date, finding the exact date can save time and headaches later in the process.

Many applicants skip the section about previous tax exemptions, which can be misleading. The form asks if you filed for tax exemptions the previous year. If you answer inaccurately, there could be complications when processing your current application. Such discrepancies prompt additional questions from property appraisers, causing delays.

Documentation is another area where mistakes often happen. The DR 501 form requires supporting documents to establish ownership and residency. Failing to attach necessary documents or providing incomplete proof can be a dealbreaker. Make sure to gather all required evidence and double-check that it matches what you’ve indicated on your application.

People also tend to ignore the deadlines. The application must be submitted by March 1 to be considered for the current tax year. Some may not realize that applications received after this date will only be processed for the exemptions available as of that day. This oversight can lead to regrettable outcomes for those expecting to benefit from exemptions.

Lastly, many applicants forget to sign the form. A missing signature can turn a carefully completed application into a void document. Both applicant and co-applicant must provide their signatures. This small yet essential step can make all the difference in ensuring your application is valid and complete.

Documents used along the form

The DR-501 form is a crucial document for individuals seeking a homestead exemption in Florida. However, several other forms and documents often accompany this application to provide necessary information and support. Below are some commonly used forms that may also be relevant in this process.

- DR-501SC: This form is used to apply for an additional homestead exemption for individuals aged 65 and older. To qualify for this extra exemption, applicants must have already applied for the regular homestead exemption.

- DR-402: The Property Appraisal Data Disclosure form allows property owners to access information regarding their property’s assessed value. This transparency helps in understanding how the property appraisal process works and prepares applicants for any potential disputes.

- DR-501T: If an applicant is applying for a temporary homestead exemption, this form captures the details needed for temporary residency exemptions. This documentation is vital for those who may not meet the year-round residency criteria.

- DR-1220: This is the application for the Disabled Veteran’s Homestead Exemption. Veterans with service-connected disabilities can benefit from this exemption, which provides significant property tax relief.

- DR-417: Used for the Blind Person’s Homestead Exemption, this form allows blind individuals to apply for property tax exemptions, which can alleviate some financial burdens.

- Declaration of Domicile: This document is essential to establish a legal residency claim in Florida. By declaring domicile, individuals affirm their intent to make Florida their permanent home, which is a key requirement for many exemptions.

Each of these forms plays a critical role in ensuring that property owners understand their eligibility and the overall exemption process. Properly completing and submitting the required documentation is essential to obtaining the benefits available under Florida law.

Similar forms

The DR 501 form plays a crucial role in claiming tax exemptions in Florida, specifically for homeowners seeking a homestead exemption. Several other documents share similar purposes or functions, helping individuals manage property tax exemptions effectively. Here are nine documents that are akin to the DR 501 form:

- DR-501SC: This form is for individuals age 65 and older to apply for an additional homestead exemption. Like the DR 501, it requires proof of previous exemptions but focuses on seniors.

- DR-420: This form is utilized for the annual certification of the governmental entities receiving property tax exemptions. It is similar in that it addresses tax-exempt properties and necessitates verification.

- DR-2940: Used to claim a disability exemption, this form provides benefits to those who qualify under the conditions similar to those listed in the DR 501 regarding specific disabilities.

- DR-501A: This form serves as an application for the additional homestead exemption for veterans who have a total and permanent disability. Like the DR 501, it’s critical for ensuring proper exemption status.

- DR-302: This application is used to claim the widow's or widower's exemption. It follows a similar process to DR 501, requiring social security information and proof of eligibility.

- DR-405: This form allows property owners to apply for an agricultural exemption. While focused on agriculture, it involves similar eligibility verification and documentation requirements.

- DR-843: This form is used to apply for a homestead exemption for special assessment properties. It has a like function, ensuring tax benefits for unique property circumstances.

- DR-150: The form is used to declare and apply for property tax exemptions for nonprofit organizations. It shares an essential purpose of securing exemption rights based on specific criteria.

- Petition for Administrative Hearing: If a claim is denied, this form allows an individual to appeal the decision regarding their tax exemptions. Like the DR 501, it engages with the tax exemption process but from a different angle.

Each of these forms stands out in its specific context regarding property tax exemptions, yet all share the foundational purpose of allowing qualified individuals to navigate Florida’s property tax systems more effectively. Understanding these forms can greatly assist in ensuring adherence to regulations while optimizing tax benefits.

Dos and Don'ts

When filling out the DR 501 form for ad valorem tax exemption, there are some important dos and don'ts to keep in mind:

- Do read the entire form carefully before starting. Understanding what’s required helps avoid mistakes.

- Do provide accurate information, especially your social security number. It verifies your identity.

- Do submit the form before the March 1st deadline. Missing this date can affect your exemptions.

- Do include supporting documentation. This may include proof of residency and ownership.

- Don't leave any fields blank. Completeness is key for successful processing.

- Don't submit false information. Providing incorrect details can lead to penalties.

Being thorough and accurate can make the process smoother. Take your time and ensure everything is correct before submission.

Misconceptions

Understanding the DR-501 form is essential for anyone applying for property tax exemptions in Florida. However, several misconceptions often arise regarding this form. Here are five common misunderstandings:

- The DR-501 is only for new applicants. Many believe that this form is only necessary for first-time applicants seeking exemptions. In reality, it is also required for those making changes to their existing exemptions or for those whose circumstances have shifted, such as changes in marital status.

- You do not need to file again if you received an exemption last year. This is misleading. While returning applicants do not need to refile for the same exemption in subsequent years, they must submit the DR-501 if they wish to make any changes or add new exemptions.

- Providing social security numbers is optional. Some people may think that they can skip the section requiring a social security number. However, it's mandatory as stated in Florida law, and the information will be used for identity verification and exemption purposes.

- Filing late will not affect the exemptions. There is a common belief that submitting the application after the March 1 deadline won’t impact eligibility. Unfortunately, if applications are not received by this date, they will only be processed for whatever exemptions the applicant qualifies for on that date, which may result in loss of important benefits.

- Only the primary homeowner needs to provide documentation. It is a misconception that only the owner needs to submit documents. All owners who reside on the property must provide proof of residency, ownership details, and relevant documentation for the exemptions applied for.

Becoming informed about these misconceptions can aid in the accurate completion of the DR-501 form, ensuring that applicants are well-prepared and understand the process clearly. Navigating these requirements can feel daunting, but with the right information, you can move forward confidently.

Key takeaways

Completing and utilizing the DR 501 form for ad valorem tax exemption in Florida comes with specific guidelines and important considerations. Here are some key takeaways:

- Required Information: Applicants must provide personal details, including Social Security numbers. This information is critical for verifying identity and eligibility. It is important to note that providing false information can lead to serious legal consequences.

- Eligibility Criteria: Individuals must meet permanent residency requirements as of January 1 of the tax year for which they are applying. Various exemptions are available, such as the homestead exemption and those for disabled veterans.

- Submission Deadline: The application must be filed with the property appraiser by March 1. Late submissions may result in receiving only partial exemptions.

- Documentation Required: To qualify for specific exemptions, include supporting documentation, such as proof of residence and ownership. Documentation must be comprehensive to ensure proper processing of the application.

- Tax Liens and Penalties: Be aware that tax liens can be imposed if the exemption is granted improperly or if the applicant fails to meet residency requirements after exemptions were granted. This can lead to significant financial penalties.

Understanding these aspects of the DR 501 form can greatly enhance the application process and ensure compliance with Florida statutes.

Browse Other Templates

New York Sales Tax Exemption Certificate,Official Government Occupancy Tax Exemption Form,ST-129 Tax Exemption Application,Hotel Occupancy Exemption Certificate,State and Local Sales Tax Waiver Form,Government Employee Hotel Tax Exemption,Tax Exempti - Each entry on the ST-129 must be carefully checked to avoid any inaccuracies.

Mold Inspection Checklist - Health complaints from occupants may indicate potential mold exposure issues.