Fill Out Your Dr 700030 Form

The DR-700030 form serves as the Application for Self-Accrual Authority or Direct Pay Permit, specifically related to Florida's Communications Services Tax. This application is crucial for businesses looking to manage their tax responsibilities effectively. By completing this form, entities can request permission to self-accrue taxes on communication services they utilize, which can offer significant financial benefits under certain circumstances. The form requires essential business information, including the name, address, and Federal Employer Identification Number (FEIN) of the applicant. Additionally, it mandates the selection of one of two specific categories for which the direct pay permit is sought, tailored for businesses that predominantly use interstate communication services or those that incur taxes based on the determination of use. A declaration section at the end seeks affirmation from the applicant regarding their eligibility and understanding of the rules surrounding the permit. Understanding the intricacies of the DR-700030 form will aid businesses in taking advantage of potential savings while ensuring compliance with Florida's tax regulations.

Dr 700030 Example

|

|

|

|

Application for |

|

|

R. 01/16 |

|

|

Communications Services Tax |

TC |

|

|

Rule |

|

|

|

|

|

|

|

|

Florida Administrative Code |

MAIL TO: |

Effective 01/16 |

|

ACCOUNT MANAGEMENT |

|

|

FLORIDA DEPARTMENT OF REVENUE |

THIS AREA FOR DOR USE ONLY |

|

PO BOX 6480 |

PERMIT NO.________________________________ |

|

TALLAHASSEE FL |

||

EFF DATE___________________________________ |

||

|

||

|

EXP DATE___________________________________ |

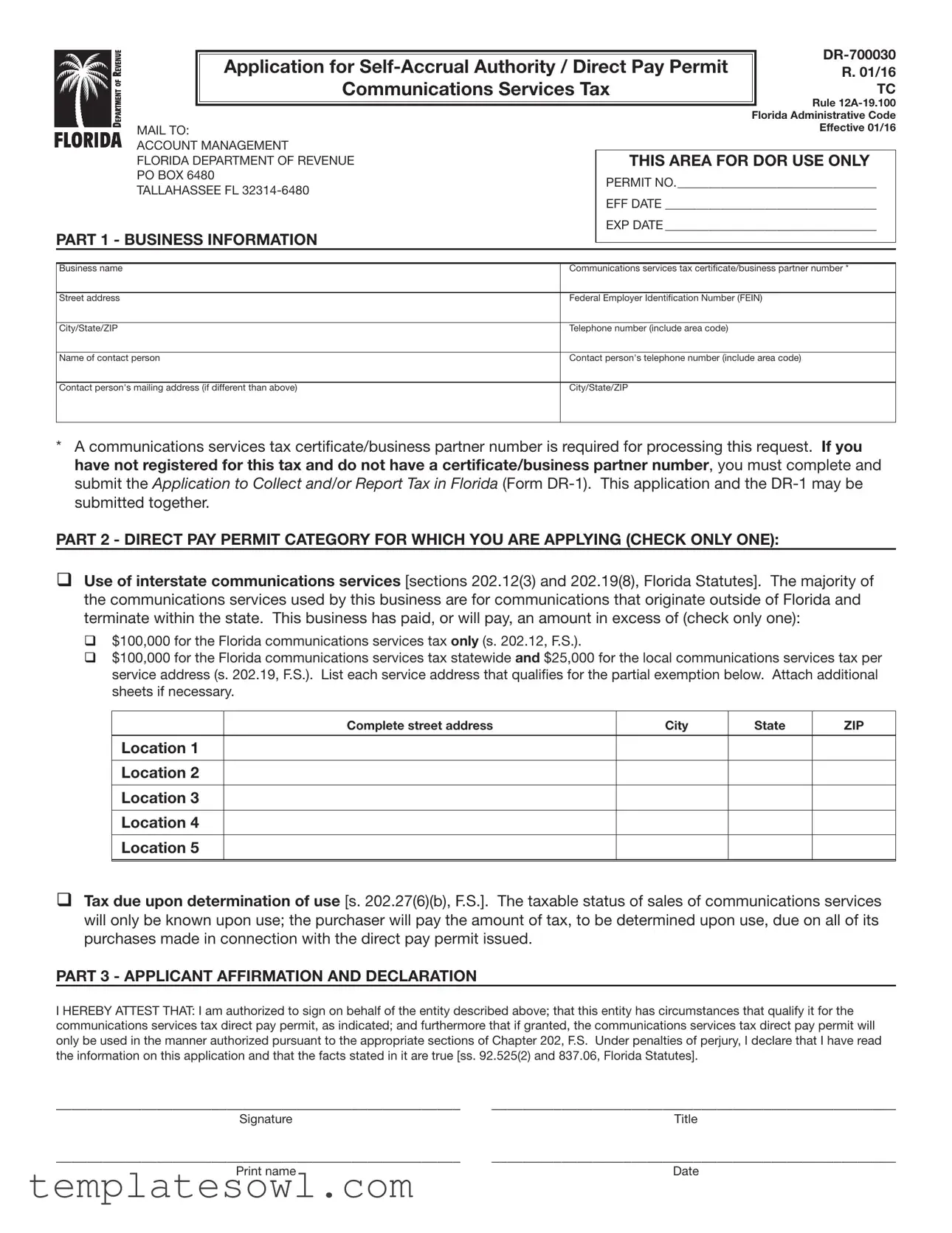

PART 1 - BUSINESS INFORMATION

Business name |

Communications services tax certificate/business partner number * |

Street address |

Federal Employer Identification Number (FEIN) |

City/State/ZIP |

Telephone number (include area code) |

Name of contact person |

Contact person's telephone number (include area code) |

Contact person's mailing address (if different than above) |

City/State/ZIP |

*A communications services tax certificate/business partner number is required for processing this request. If you have not registered for this tax and do not have a certificate/business partner number, you must complete and submit the Application to Collect and/or Report Tax in Florida (Form

PART 2 - DIRECT PAY PERMIT CATEGORY FOR WHICH YOU ARE APPLYING (CHECK ONLY ONE):

qUse of interstate communications services [sections 202.12(3) and 202.19(8), Florida Statutes]. The majority of the communications services used by this business are for communications that originate outside of Florida and terminate within the state. This business has paid, or will pay, an amount in excess of (check only one):

q $100,000 for the Florida communications services tax only (s. 202.12, F.S.).

q $100,000 for the Florida communications services tax statewide and $25,000 for the local communications services tax per service address (s. 202.19, F.S.). List each service address that qualifies for the partial exemption below. Attach additional sheets if necessary.

Complete street address |

City |

State |

ZIP |

Location 1

Location 2

Location 3

Location 4

Location 5

qTax due upon determination of use [s. 202.27(6)(b), F.S.]. The taxable status of sales of communications services will only be known upon use; the purchaser will pay the amount of tax, to be determined upon use, due on all of its purchases made in connection with the direct pay permit issued.

PART 3 - APPLICANT AFFIRMATION AND DECLARATION

I HEREBY ATTEST THAT: I am authorized to sign on behalf of the entity described above; that this entity has circumstances that qualify it for the communications services tax direct pay permit, as indicated; and furthermore that if granted, the communications services tax direct pay permit will only be used in the manner authorized pursuant to the appropriate sections of Chapter 202, F.S. Under penalties of perjury, I declare that I have read the information on this application and that the facts stated in it are true [ss. 92.525(2) and 837.06, Florida Statutes].

____________________________________________________ |

_____________________________________________________ |

Signature |

Title |

____________________________________________________ |

_____________________________________________________ |

Print name |

Date |

Information and Instructions for Completing Application

for

Communications Services Tax

R.01/16 Page 2

Sections 202.12 and 202.19, Florida Statutes, provide that

Purposes and Use of Permits

1.Direct Pay Permit for Interstate Communications Services [ss. 202.12(3) and 202.19(8), F.S.]

Who qualifies? Purchasers of communications services where the majority of the communications services used by the entity are for communications that originate outside of Florida and terminate within the state. Qualified businesses will receive a Communications Services Tax Direct Pay Permit (Form

What can the direct pay permit be used for? This direct pay permit allows the purchaser a partial exemption either from the state communications services tax only, or from both the state and the local communications services taxes on interstate communications services. The amount of state communications services tax to be paid shall

not exceed $100,000. The amount of the local communications services tax to be paid shall not exceed $25,000 per service address. Note: Entities qualifying for this permit category will be required to report and remit the tax to the Department electronically.

2.Direct Pay Permit for Tax Due Upon Determination of Use [s. 202.27(6)(b), F.S.]

Who qualifies? Purchasers of communications services where the taxable status of sales of communications services will only be known upon use. Qualified businesses will receive a Communications Services Tax Direct Pay Permit (Form

What can the direct pay permit be used for? The permit allows purchasers of communications services to accrue and remit taxes upon determination of the use of the services, rather than paying tax at the time of the purchase.

Instructions for Completing the Application

üReview the purposes stated above and identify the category under which your business qualifies.

üNote the specific uses of the direct pay permit, if granted.

üComplete Parts 1 and 2.

üRead and sign Part 3.

Note: Incomplete or unsigned applications will be returned, thus delaying the issuance of the direct pay permit.

Mail or deliver your completed application to:

Account Management

Florida Department of Revenue

PO Box 6480

Tallahassee FL

Information and forms are available on our Internet site at

floridarevenue.com

For general information about communications services tax or assistance with this application, call Taxpayer Services at

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Title | Application for Self-Accrual Authority / Direct Pay Permit |

| Applicable Tax | Communications Services Tax |

| Governing Law | Florida Statutes, Chapter 202 |

| Submission Address | Florida Department of Revenue, PO Box 6480, Tallahassee, FL 32314-6480 |

| Effective Date | January 1, 2016 |

| FEIN Requirement | A Federal Employer Identification Number (FEIN) is needed for processing. |

| Direct Pay Permit Categories | 1. Interstate Communications Services 2. Tax Due Upon Determination of Use |

| Partial Exemption Limits | State tax up to $100,000; local tax limited to $25,000 per service address. |

| Authorization | Applicant must be authorized to sign on behalf of the business. |

| Contact for Assistance | Taxpayer Services, 850-488-6800, Monday to Friday. |

Guidelines on Utilizing Dr 700030

After completing the DR 700030 form, it is important to review all information for accuracy before submission. Once submitted, the Florida Department of Revenue will process your application and determine if the permit can be granted. Ensure that your business qualifies under the appropriate category, as this will affect the outcome.

- Gather necessary information: Collect your business name, address, federal employer identification number (FEIN), and contact details.

- Complete Part 1: Fill in the business information section, ensuring to include your communications services tax certificate/business partner number.

- Choose a category in Part 2: Indicate which direct pay permit category applies:

- Use of interstate communications services

- Tax due upon determination of use

- If applicable, list service addresses: For the first category, provide qualifying street addresses and necessary details.

- Sign and date Part 3: An authorized person must sign the affirmation and declaration. Ensure the name and title are printed clearly.

- Double-check your application: Verify that all sections are completed and signed. Incomplete forms will be returned, causing delays.

- Mail your application: Send the completed form to the Florida Department of Revenue at the designated address provided.

What You Should Know About This Form

What is the DR-700030 form and whom does it apply to?

The DR-700030 form is an application for a Direct Pay Permit specifically related to the Communications Services Tax in Florida. This form is intended for businesses that either predominantly use interstate communication services or wish to defer tax payments until the services are utilized. Businesses must possess a communications services tax certificate or a business partner number to process this application. Additionally, the form is applicable only to qualifying entities as outlined in Florida Statutes, particularly for those with significant communications expenses.

What are the purposes of the Direct Pay Permit?

The Direct Pay Permit is issued for two main purposes. First, it applies to businesses purchasing interstate communications services where the majority of use originates outside Florida. These businesses may receive a partial exemption from both state and local taxes, provided their total state tax due does not exceed $100,000, and local taxes do not exceed $25,000 per service address. Second, the permit allows businesses to accrue tax payments based on actual service usage rather than at the time of purchase, which is beneficial when the taxable status of the services isn't immediately known.

How should I complete the DR-700030 form?

To complete the DR-700030 form, first review the qualifications for the Direct Pay Permit to determine under which category your business qualifies. Then, fill out Part 1 with necessary business information, such as the business name, address, and contact details. Next, specify the category you're applying for in Part 2. Incomplete submissions may delay processing, so it's crucial to ensure all sections are filled out correctly. Finally, sign and date Part 3 to affirm the accuracy of the information provided. Mail the completed application to the Florida Department of Revenue at the designated address.

What happens after I submit the DR-700030 form?

Once submitted, the Florida Department of Revenue will review your application. If approved, you will receive a Communications Services Tax Direct Pay Permit (Form DR-700031). The permit allows you to extend your tax payment obligations, granting you the authority to report and remit taxes required based on actual service usage electronically. If your application is incomplete or lacks the necessary signatures, it will be returned, causing delays in processing. For further assistance, you can contact Taxpayer Services at the Department of Revenue.

Common mistakes

Filling out the Dr 700030 form can be a straightforward process, but several common mistakes might cause delays or issues. One frequent error is neglecting to provide the required communications services tax certificate or business partner number. This number is essential for processing the application; without it, the form may be returned. It's advisable to ensure you have completed Form DR-1 if you haven't registered yet for the communications services tax.

Another common mistake occurs when applicants fail to check the appropriate category under which they are applying for the direct pay permit. The form requires you to select only one category, and misidentifying it can lead to complications. Be sure to clearly understand which category corresponds to your business circumstances before submitting the application.

Additionally, incomplete or missing information can lead to rejections. Applicants often overlook critical fields, such as the street address or telephone number for the contact person. All sections should be fully completed, with careful attention to detail to avoid unnecessary delays.

Some individuals might also provide outdated or incorrect business information. It is important to ensure that all contact details are accurate and current. Incorrect information can make it difficult for the Florida Department of Revenue to reach you if they need clarification or further information during the processing of your application.

Another frequent error is failing to sign and date the affirmation section of the form. This section verifies that the individual submitting the application has the authority to do so and that the information provided is correct. An unsigned application will be returned, which can prolong the wait for the required permit.

Lastly, applicants sometimes overlook the submission instructions provided at the end of the form. These instructions detail where and how to send the completed application. It is crucial to follow these guidelines carefully to ensure prompt processing. Mailing the application to the incorrect address or not including necessary attachments could significantly delay the acquisition of the direct pay permit.

Documents used along the form

The DR-700030 form is essential for businesses seeking Self-Accrual Authority and a Direct Pay Permit regarding the communications services tax in Florida. Along with the DR-700030, several other forms and documents may be necessary or beneficial during the application and compliance process. Here’s a list of related documents you might encounter.

- Form DR-1: This is the Application to Collect and/or Report Tax in Florida. It is used by businesses that have not yet registered for the communications services tax and need to obtain a tax certificate/business partner number to proceed with the DR-700030 application.

- Form DR-700031: This form is the Communications Services Tax Direct Pay Permit itself. Once approved, this grant allows businesses to pay taxes directly to the state rather than to their service provider, streamlining tax management.

- Form DR-7020: Known as the Communications Services Tax Return, this document is used for reporting and remitting taxes owed. Businesses must submit this return regularly to remain compliant after receiving their direct pay permit.

- Form DR-7060: This form is the Communications Services Tax Exemption Certificate. It’s for businesses that qualify for an exemption or reduction and allows them to document their tax-exempt purchases when applicable.

- Form DR-70004: This is the Application for a Consumer's Certificate of Exemption. It allows specific entities to apply for exemption from paying communication taxes based on certain criteria.

- Form DR-7400: This Document helps businesses claim a refund for overpaid communications services taxes. If a business believes they have paid more tax than required, this form must be filled out and submitted for review.

- Form DR-8000: The Annual Report for Exempt Organizations. Any out-of-state businesses claiming an exemption must report on this form to maintain their tax status.

While the DR-700030 form is a stepping stone for many businesses in the communications sector, understanding and preparing these associated documents can make the entire process smoother. Each form serves a specific purpose and contributes to maintaining compliance with tax regulations in Florida.

Similar forms

The DR-700030 form, which is the Application for Self-Accrual Authority / Direct Pay Permit related to the Communications Services Tax, bears similarities to several other documents used in tax applications and exemptions. Here are seven documents that share key elements with the DR-700030 form:

- Form DR-1: Application to Collect and/or Report Tax in Florida - This form is used for registering to collect taxes in Florida. Like the DR-700030, it requires business information and is necessary for tax compliance.

- Form DR-700031: Communications Services Tax Direct Pay Permit - This form is directly related, as it is issued to businesses qualifying for the direct pay permit after submitting the DR-700030. Both forms deal with tax exemptions in similar contexts.

- Form DR-15: Sales and Use Tax Return - Businesses use this form to report sales and use taxes collected. Similar to the DR-700030, it involves tax remittance under specific regulations.

- Form DR-2: Application for Florida Consumer’s Certificate of Exemption - This form enables businesses to claim an exemption from sales tax. It requires businesses to provide proof of eligibility, akin to the requirements on the DR-700030.

- Form DR-26S: Sales Tax Exempt Use Certificate - Similar to the DR-700030, this form allows purchasers to claim exemption from sales tax on specific items. It involves details about the purchaser and the nature of the exemption.

- Form DR-301: Report of Unverified Distributors - This form is used by businesses to report unverified distributors. It requires similar business information and tax-related reporting as seen in the DR-700030.

- Form DR-487: Application for Industrial Machinery and Equipment Exemption - This form applies to qualifying businesses seeking exemptions for industrial machinery. Like the DR-700030, it necessitates supporting documentation to justify the exemption request.

Dos and Don'ts

When filling out the DR 700030 form, proper attention to detail is crucial. The following list outlines key actions to take and common mistakes to avoid to ensure your application is processed smoothly.

- Do: Review the instructions carefully before you begin filling out the form.

- Do: Ensure that all required fields are completed fully and accurately.

- Do: Include your Communications Services Tax certificate or business partner number if you have one.

- Do: Double-check the contact information provided for accuracy.

- Do: Sign and date the declaration section of the form.

- Don't: Leave any sections blank, as incomplete forms can cause delays.

- Don't: Forget to mail your application to the correct address.

- Don't: Submit the application without reviewing it for errors.

- Don't: Use a pencil or follow up after sending without keeping a copy for your records.

- Don't: Assume you qualify without verifying the eligibility criteria laid out in the instructions.

Misconceptions

Several misconceptions surround the DR-700030 form, which can create confusion for businesses applying for self-accrual authority or a direct pay permit. Understanding these misunderstandings is vital for a smooth application process.

- Misconception 1: The DR-700030 form can be used by any business for any kind of tax exemption.

- Misconception 2: Once a direct pay permit is obtained, no taxes need to be paid.

- Misconception 3: Completing the application is straightforward and won't require much detail.

- Misconception 4: The DR-700030 form can be submitted without a communications services tax certificate or business partner number.

This is incorrect. The form is specifically designed for certain categories of communications services. Only businesses that meet the qualifications for interstate communications services or that can determine their tax liability upon service use can apply using this form.

This statement is misleading. A direct pay permit allows businesses to defer paying sales tax at the time of purchase. However, taxes must still be reported and remitted to the Department of Revenue based on actual usage or specified limits.

This is not the case. Incomplete or improperly signed applications often get returned, causing delays. Detailed and accurate completion of all required parts is essential for processing.

This is incorrect. Having a communications services tax certificate or business partner number is a prerequisite for processing the DR-700030 form. Businesses lacking this must submit the Application to Collect and/or Report Tax in Florida (Form DR-1) before applying.

Understanding these points can help ensure a smoother and more efficient application process for businesses seeking a direct pay permit.

Key takeaways

Filling out the DR-700030 form for a Direct Pay Permit is an important process for businesses dealing with communications services in Florida. Here are key takeaways to help guide you through it:

- Understand the Purpose: The DR-700030 form is designed to apply for self-accrual authority related to communications services tax. It allows qualifying entities to pay taxes directly instead of through their service providers.

- Identify Your Category: There are two specific categories for which you can apply: interstate communications services and tax due upon determination of use. Carefully determine which one applies to your business to ensure correct processing.

- Complete Required Information: Fill out all sections, including business name, contact details, and the tax certificate or business partner number. This last point is crucial; without it, your application cannot be processed.

- Be Prepared for Verification: Submit any additional sheets listing service addresses if applying for a partial exemption. Make sure all information is accurate and aligns with your business activities.

- Sign and Date the Application: An incomplete or unsigned application will be returned, leading to delays. Ensure your declaration in Part 3 of the form is complete.

- Keep Copies and Submit Promptly: Retain copies of your application for your records and mail or deliver it promptly to the Florida Department of Revenue to avoid delays in processing.

By following these key points, you can navigate the process more smoothly and ensure compliance with Florida's communications services tax regulations.

Browse Other Templates

How Much Is Child Support in Sc - Submitting all necessary documents prevents delays in processing the application.

Excusable Neglect Examples - By filing the Motion Set Aside, defendants can prevent irreparable harm caused by a default judgment.

Ca $800 Llc Fee Due Date - Faster service options are available but require an additional fee.