Fill Out Your Dr14 Form

The DR-14 form, known formally as the Florida Certificate of Exemption, plays a critical role for institutions like Indiana University when it comes to managing sales tax. Under Florida law, specifically section 212.08(7) of the Florida Statutes, Indiana University is permitted to make various purchases and leases without incurring sales tax. To take advantage of this exemption, the university must supply the DR-14 form to vendors as proof of eligibility. It is important that Indiana University is identified as the direct purchaser and payer on all transactions. Purchases must be charged directly to the university, whether through check or credit card, ensuring that all items acquired through the form directly support the institution's mission. The exemption is strictly limited to university use, prohibiting any benefits that could extend to individual officers, members, or employees of Indiana University. Consequently, purchases must relate closely to the university's operations and nonprofit objectives, confirming that only those transactions aligned with the institution’s exempt purpose qualify for the exemption. This process underlines the importance of accurate form submission and compliance with state regulations in order to maintain eligibility for tax exemption.

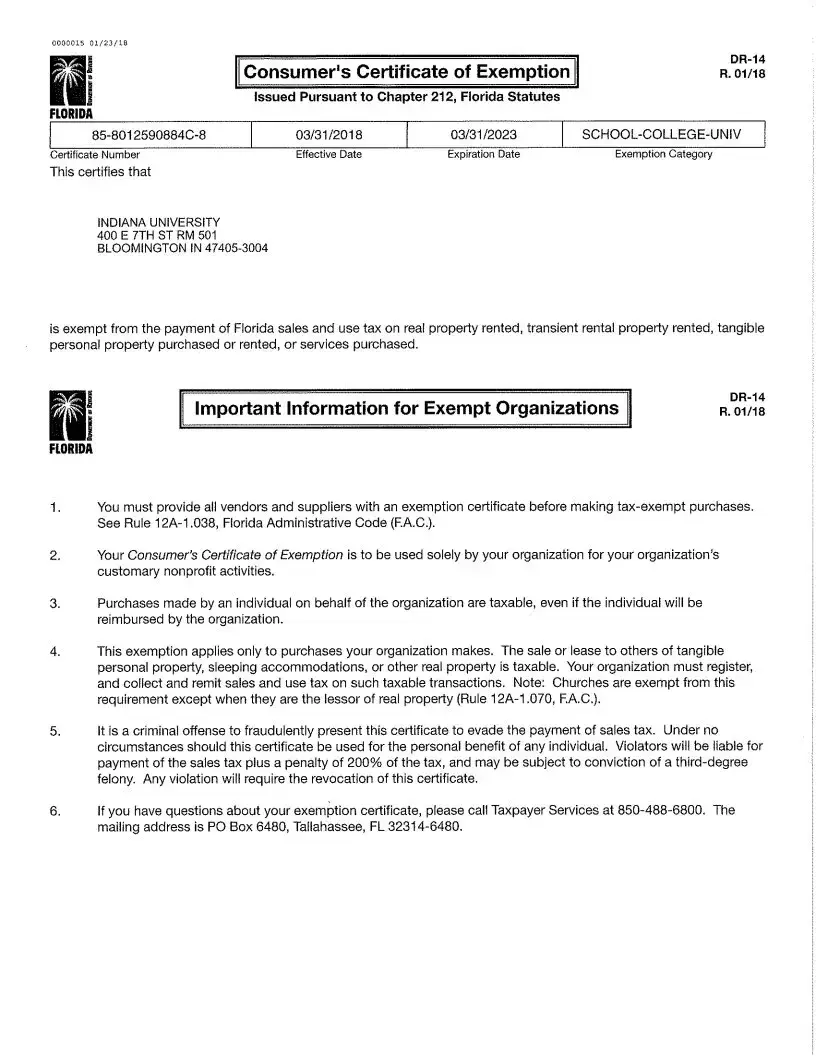

Dr14 Example

FLORIDA CERTIFICATE OF EXEMPTION (DR‐ 14)

***For internal Indiana University use only***

NOTE: According to Florida section 212.08(7), Florida Statutes (F.S.), Indiana University is authorized to make purchases and leases for its exclusive use without paying sales tax. The University must issue the attached certificate to vendors when purchasing tangible personal property or taxable services to qualify for the exemption.

Indiana University must be the direct purchaser and payer of record. Purchases must be made in the following manner:

o Are directly invoiced and charged to Indiana University, and o Are directly paid by Indiana University via

check,

credit card

All purchases made using Form DR‐14 must benefit the University only. The form may not be used for the benefit of any officer, member, or employee of Indiana University.

The purchases must be made for use in carrying on the work of the organization and directly related to the University’s exempt purpose.

INSTRUCTIONS:

Provide a copy of the Florida Consumer's Certificate of Exemption to vendors

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of DR-14 | The DR-14 form serves as a Certificate of Exemption for Indiana University, allowing it to make purchases without paying sales tax in Florida. |

| Applicable Law | This form is governed under Florida Statutes, specifically section 212.08(7). This law outlines the conditions under which the exemption is applicable. |

| Authorized Use | The purchases authenticated by the DR-14 must exclusively benefit Indiana University, not individuals associated with the institution. |

| Method of Purchase | Purchases should be directly invoiced and charged to Indiana University, ensuring the university is the payer of record. |

| Acceptable Payment Methods | Payments made via check or credit card from Indiana University can validate the use of DR-14. |

| Restricted Benefits | The form is strictly for the university’s purposes and cannot be used for the personal benefit of any officer, member, or employee of Indiana University. |

| Exempt Purpose | All purchases using the DR-14 must be related to the organization’s work and must align with the university’s exempt purposes. |

| Vendor Requirement | A copy of the Florida Consumer's Certificate of Exemption must be provided to vendors when using this form to verify the exemption status. |

Guidelines on Utilizing Dr14

After completing the DR14 form, you are ready to provide it to vendors for applicable purchases. This form will assist in qualifying for a sales tax exemption when purchasing tangible personal property or taxable services on behalf of Indiana University. Follow the steps below to ensure accurate completion of the form.

- Begin with the header section. Clearly write "Florida Certificate of Exemption (DR-14)" at the top of the form.

- Enter the name of the institution: Indiana University.

- In the next field, provide the address for Indiana University, ensuring all details are accurate.

- Fill in the Tax Identification Number for Indiana University. This is necessary for tax exemption.

- In the space designated for the vendor’s name, write the full name of the vendor from whom you are making the purchase.

- Next, provide the address of the vendor, including the city, state, and ZIP code.

- Now, describe the nature of the purchase in detail, specifying if it is tangible personal property or a service.

- Confirm that the purchases will be directly invoiced and charged to Indiana University. Indicate if the payment will be made via check or credit card.

- After completing all required fields, review the form for any inaccuracies or missing information.

- Lastly, sign and date the form to certify its authenticity before providing it to the vendor.

What You Should Know About This Form

What is the purpose of the DR-14 form?

The DR-14 form, or Florida Certificate of Exemption, allows Indiana University to make purchases tax-free for items that directly benefit the institution. This exemption is specifically granted under Florida law, allowing the university to avoid paying sales tax on tangible personal property and taxable services as long as they are for exclusive use by the university. It’s a valuable tool for educational institutions to allocate funds more efficiently.

Who can use the DR-14 form?

The DR-14 form is exclusively for Indiana University. The university must be the direct purchaser and responsible party for payment. This means that purchases made through this form must be invoiced directly to Indiana University, and payments must come from the university's funds, whether via check or credit card. It's important to note that the benefit of the purchase must go solely to the university and not to any individual officer, member, or employee.

What types of purchases qualify for the DR-14 exemption?

How should vendors be provided with the DR-14 form?

To ensure tax exemption is granted, a copy of the Florida Consumer's Certificate of Exemption must be given to vendors when making a purchase. This certificate confirms the university's tax-exempt status and is necessary for vendors to exclude sales tax on their invoices. Always ensure that your vendor is aware of this form and its implications to avoid any complications during the transaction.

Are there consequences if the DR-14 form is misused?

Yes, misuse of the DR-14 form can have serious consequences. If the form is used to benefit individuals rather than the university, it could lead to the university being liable for sales taxes that should have been paid. Additionally, improper use could jeopardize the institution's tax-exempt status in the future and could even result in penalties for the individuals involved. So, it's crucial to adhere strictly to the guidelines provided by Florida law regarding the use of this form.

Common mistakes

Filling out the Florida Certificate of Exemption (DR-14) form can seem straightforward, but several common mistakes often lead to complications. Understanding these errors can ensure a smoother process for both the purchaser and the vendor.

One frequent mistake is failing to ensure that Indiana University is identified as the direct purchaser. The form must clearly reflect that purchases are made for the exclusive use of the university. If someone incorrectly lists an individual, such as a university employee, as the purchaser, this could invalidate the exemption.

Another common error involves incomplete or incorrect payment information. The form specifies that Indiana University must be the payer of record. Any discrepancies, such as a payment not made through university channels (e.g., personal credit cards), can result in challenges during audits or transactions.

Some individuals overlook the requirement that all purchases must directly benefit Indiana University. This means that items purchased cannot be for personal use or benefit any university employee. A misunderstanding of this rule can lead to unnecessary tax liabilities.

Further complicating matters, individuals often neglect to ensure that the purchases align with the university's exempt purpose. Items or services that do not support the university's operations can disrupt the exemption process. Purchases must be clearly tied to the university's mission to maintain compliance.

Finally, one significant error occurs when individuals forget to provide a copy of the Florida Consumer's Certificate of Exemption to vendors. This step is essential for ensuring that the seller recognizes the validity of the exemption. Without this documentation, vendors may be unaware of the tax exemption status, leading to incorrect tax charges.

Documents used along the form

The Florida Certificate of Exemption (DR-14) form is essential for Indiana University to make tax-exempt purchases in Florida. It ensures that the university can buy tangible personal property or taxable services without incurring sales tax. Along with this form, there are several other documents often needed to facilitate this process. Below is a list of these additional forms and documents that may be useful.

- Florida Consumer's Certificate of Exemption (Form DR-13): This certificate allows the purchaser to exempt themself from sales tax for qualifying purchases. Vendors may require this document to verify the buyer’s exemption status.

- Vendor Purchase Order: A purchase order details the items or services being acquired, the agreed prices, and terms. It serves as a contract between the university and the vendor and helps track orders and payments.

- Invoice: This document provides a detailed billing statement from the vendor after goods or services have been delivered. It includes information about the purchase, such as quantities, prices, and payment terms.

- Payment Confirmation: This acknowledgment may come from a bank or payment service. It proves that the transaction was processed and can help maintain records of expenditures made with the DR-14 exemption.

- Internal Purchase Requisition Form: This form is used within the university to request the purchase of goods or services. It outlines what is needed and justifies the request, ensuring that purchases align with university policies.

These documents play a supportive role in ensuring that Indiana University maintains compliance while benefiting from tax exemptions. Proper use and organization of these forms can streamline the purchasing process significantly.

Similar forms

The Florida Certificate of Exemption (DR-14) has similarities with other documents that facilitate tax exemption or proof of tax-exempt status. Here are six documents that share a purpose or function with the DR-14 form:

- IRS Form 990: Organizations exempt from federal income tax must file this form annually to provide the IRS with financial information. Like the DR-14, it illustrates compliance with tax regulations.

- Florida Annual Resale Certificate: This form allows purchases for resale without paying sales tax. Both documents enable organizations to make tax-exempt purchases for legitimate business purposes.

- IRS Form 1023: This is the application for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. Similar to the DR-14, it demonstrates an organization’s tax-exempt status to appropriate authorities.

- State Sales Tax Exemption Certificate: Like the DR-14, this document is used to make tax-exempt transactions at the state level, validating that the purchaser meets specific criteria to qualify for the exemption.

- Nonprofit Organization Certificate: Issued by various states, this certificate verifies an organization’s status as a nonprofit. It functions similarly to the DR-14 in establishing eligibility for tax exemptions.

- Florida Nonprofit Corporation Registration: This registration indicates an organization is recognized as a nonprofit. While it does not specifically pertain to tax exemption, it supports the legitimacy of tax-exempt claims associated with the DR-14.

Understanding these documents can provide insight into the broader context of tax exemptions and compliance for organizations. Each document supports the organization's ability to operate while fulfilling tax obligations appropriately.

Dos and Don'ts

Filling out the Florida Certificate of Exemption (DR-14) requires attention to detail. Here are nine essential dos and don'ts to keep in mind:

- Do confirm that Indiana University is the direct purchaser and payer of record.

- Do ensure that all purchases are invoiced and charged directly to Indiana University.

- Do make payments using Indiana University's funds, either by check or credit card.

- Do provide a copy of the Florida Consumer's Certificate of Exemption to vendors.

- Do use the form only for purchases that benefit the University and its exempt purpose.

- Don't use the form for personal benefit or for any employee or officer of Indiana University.

- Don't make purchases unrelated to the University's work or exempt purpose.

- Don't forget to keep accurate records of all transactions made under the exemption.

- Don't submit the form without verifying that all information is correct and complete.

Misconceptions

When discussing the Florida Certificate of Exemption (DR-14), several misconceptions often arise. It is important to clarify these points to ensure compliance and proper understanding of use.

- Misconception 1: The DR-14 form can be used for personal purchases.

- Misconception 2: Any vendor can accept the DR-14 form without verification.

- Misconception 3: All purchases qualify for the exemption with the DR-14 form.

- Misconception 4: Once the DR-14 is filled out, it does not need to be renewed or referenced again.

This is incorrect. The DR-14 form is specifically for purchases made by Indiana University for its exclusive use. It cannot be used for personal items or purchases that benefit individual employees, officers, or members.

Not true. Vendors must verify that the form is applicable to their goods or services. It is the responsibility of the university to ensure that the vendors understand the limitation of the exemption.

This is misleading. Only tangible personal property or taxable services directly related to the work of Indiana University qualify for the exemption. Other types of purchases may still incur sales tax.

This is not correct. While the DR-14 can be used multiple times, each transaction must adhere to the guidelines outlined, ensuring that purchases are directly invoiced and paid by Indiana University.

Key takeaways

Understanding the Florida Certificate of Exemption (DR-14) is essential for ensuring that Indiana University can make purchases without incurring sales tax. The following key takeaways can help simplify the process:

- Direct Purchaser Requirement: Indiana University must be the direct purchaser and must have its name on the invoice. This means that purchases must be directly billed to the University.

- Method of Payment: All purchases must be paid directly by Indiana University. Acceptable methods of payment include checks and credit cards.

- University Benefit Only: Form DR-14 should solely be used for purchases that benefit Indiana University. It cannot be utilized for personal benefit by any individual associated with the University.

- Purpose of Purchases: Items or services purchased must support the work of Indiana University and align with its exempt purposes as defined by Florida Statutes.

By adhering to these guidelines, Indiana University can effectively leverage the DR-14 form for its tax-exempt purchasing needs.

Browse Other Templates

Abandoned Vehicle Title Va - This form is necessary for auctions conducted under court supervision.

Vision Test at Dmv - Understanding color vision and contrast sensitivity can be crucial for safe driving.

How Old Do You Have to Be to Get a Driver's License in California - By defining roles clearly, the form helps streamline the hiring process for commercial drivers.