Fill Out Your Ds 5026 Form

The DS-5026 form, officially known as the FSPS Annuity Supplement Earnings Report, is a critical document for retirees participating in the Federal Employees Retirement System (FERS). This form is designed to help determine eligibility for the annuity supplement, which is an additional benefit for those who have retired but still have some earnings. Notably, the earnings test applies once retirees reach their Minimum Retirement Age (MRA). As outlined in federal regulations, if a retiree's earnings exceed a set annual exempt amount, their annuity supplement may be reduced. This reduction occurs at a specified rate—one dollar for every two dollars earned over the exempt amount. The exempt amount varies annually, and retirees must report all qualifying income, excluding pre-retirement salary or post-retirement payments, to ensure compliance. Timeliness is essential, as submitting this form after the deadline can result in the termination of the annuity supplement. Clarity in the reported information is vital since inaccuracies could lead to verification issues and potential penalties. Retirees must keep thorough records of their earnings as documentation may be requested.

Ds 5026 Example

FSPS ANNUITY SUPPLEMENT EARNINGS REPORT

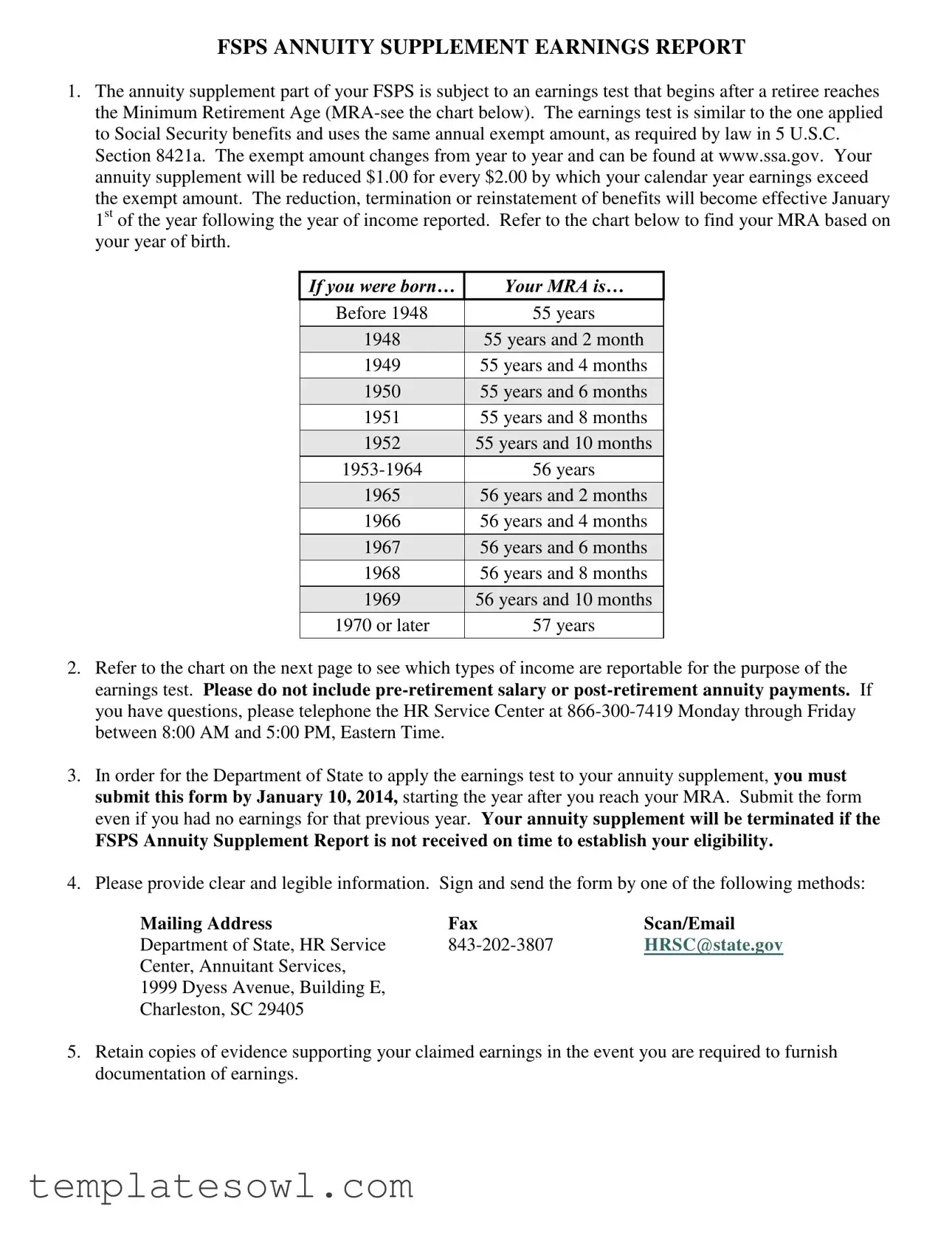

1.The annuity supplement part of your FSPS is subject to an earnings test that begins after a retiree reaches the Minimum Retirement Age

Section 8421a. The exempt amount changes from year to year and can be found at www.ssa.gov. Your annuity supplement will be reduced $1.00 for every $2.00 by which your calendar year earnings exceed

the exempt amount. The reduction, termination or reinstatement of benefits will become effective January 1st of the year following the year of income reported. Refer to the chart below to find your MRA based on your year of birth.

If you were born…

Your MRA is…

|

Before 1948 |

|

55 years |

||

|

|

||||

|

|

|

|

|

|

|

1948 |

|

|

55 years and 2 month |

|

1949 |

|

|

55 years and 4 months |

||

|

|

|

|

||

|

1950 |

|

|

55 years and 6 months |

|

1951 |

|

|

55 years and 8 months |

||

|

|

|

|

||

|

1952 |

|

|

55 years and 10 months |

|

|

|

56 years |

|||

|

|

|

|

||

|

1965 |

|

|

56 years and 2 months |

|

1966 |

|

|

56 years and 4 months |

||

|

|

|

|

||

|

1967 |

|

|

56 years and 6 months |

|

1968 |

|

|

56 years and 8 months |

||

|

|

|

|

||

|

1969 |

|

|

56 years and 10 months |

|

|

1970 or later |

|

57 years |

||

|

|

|

|

|

|

2.Refer to the chart on the next page to see which types of income are reportable for the purpose of the earnings test. Please do not include

3.In order for the Department of State to apply the earnings test to your annuity supplement, you must submit this form by January 10, 2014, starting the year after you reach your MRA. Submit the form even if you had no earnings for that previous year. Your annuity supplement will be terminated if the

FSPS Annuity Supplement Report is not received on time to establish your eligibility.

4.Please provide clear and legible information. Sign and send the form by one of the following methods:

Mailing Address |

Fax |

Scan/Email |

Department of State, HR Service |

HRSC@state.gov |

|

Center, Annuitant Services, |

|

|

1999 Dyess Avenue, Building E, |

|

|

Charleston, SC 29405 |

|

|

5.Retain copies of evidence supporting your claimed earnings in the event you are required to furnish documentation of earnings.

How To Determine Which Income to Report

Include as earnings:

-All wages from employment covered by Social Security.

-Net Income from

-All cash pay for agricultural work, domestic

work in a private home, service not in the course of your employer’s trade of business.

-All pay, cash or

-All pay for work not covered by Social Security, if the work is done in the United States, including pay for:

•Family employment

•Work as a student, student nurse, intern, newspaper and magazine vendor,

•Work for States or foreign governments or instrumentalities, and

•Work covered by the Railroad Retirement Act.

Regardless of what income is called, if it is actually wages for services you performed or net earnings from

Do not include as earnings:

-Pensions or annuities paid as retirement income, including your FSPS benefit or any benefits received as a survivor.

-Salary earned before retirement and/or lump- sum payment for annual leave upon retirement. This includes any separation incentives.

-Distributions from our Thrift Savings Plan or Individual Retirement Accounts.

-Unemployment compensation.

-Gifts, insurance proceeds, inheritances, scholarships, alimony, capital gains, net business losses, prize winnings.

-

labor, for work not in the course of the employer’s trade or business, or the value of meals and lodging.

-Rentals from real estate that cannot be counted in earnings from

-Interest and dividends not resulting from trade or business.

-Pay for military training or for jury duty.

-Payments by an employer which are reimbursement specifically for your travel expenses and which are so identified by the employer at the time of payment and/or reimbursement or allowance for moving expenses, if they are not counted as wages for Social Security purposes.

FSPS Annuity Supplement Report

Print Name Clearly

Year of Income

Employee ID or last four digits of SSN

Date Received by HRSC (completed by HRSC)

1.Is your annuity supplement currently reduced or terminated because you reported excess earnings last year? (Darken only one oval.)

OYes (Please skip directly to question 3.)

ONo (Please continue to question 2.)

2.Did you have any earnings after retirement and in the year entered above? (Darken only one oval.)

OYes (Please continue to question 3.)

ONo (Please sign and return document.)

3. What were your earnings for the year entered above?

DollarsCents

Warning: Your earnings are subject to verification with the Social Security Administration’s earnings file. Any intentional false statement or willful misrepresentation is punishable by fine, imprisonment, or both (18 U.S.C. 1001).

Complete and return this form even if you had no earnings for the year indicated in the box above.

Failure to return this form may result in the termination of your annuity supplement.

Please do not include your salary before your date of retirement or any annuity payments.

Signature

Daytime Phone Number

Date: (mm/dd/yyyy)

|

Privacy Act Statement |

AUTHORITY |

The information is sought pursuant to the Foreign Service Act (22 U.S.C. § 3901 et seq. and |

|

22 U.S.C. § 4071) and E.O. 9397, as amended. 31 U.S.C. § 7701 requires any person doing |

|

business with the Federal government furnish a Social Security Number or tax identification |

|

number. |

PURPOSE |

The information solicited on this form will be used to determine your eligibility to continue |

|

receiving the annuity supplement and the amount of the supplement. |

USES |

The information may be shared with national, state or local government, or the Social |

|

Security Administration in order to determine benefits and issue benefits under their |

|

programs, to obtain information necessary for determination or continuation of benefits |

|

under this program or to report income for tax purposes. It may also be shared and verified, |

|

as noted above with law enforcement agencies when they are investigating a violation or |

|

potential violation of civil or criminal law. More information on the Routine Uses for the |

|

system can found in the System of Records Notice, |

DISCLOSURE |

The collection of this information is voluntary, however, failure to provide may result in |

|

benefits being denied. |

Form Characteristics

| Fact Name | Description |

|---|---|

| Earnings Test | The FSPS Annuity Supplement is subject to an earnings test after the retiree reaches their Minimum Retirement Age (MRA). The reduction occurs at a rate of $1.00 for every $2.00 earned above the exempt amount, as set forth in 5 U.S.C. Section 8421a. |

| Submission Requirement | Retirees must submit the DS 5026 form by January 10 of the year following their MRA. Failure to submit on time may terminate the annuity supplement. |

| Reportable Income | Income types that must be reported include wages, net self-employment income, and certain cash payments. Excluded categories feature pensions, unemployment benefits, and gifts. |

| Privacy and Authority | The information collected under the authority of the Foreign Service Act and E.O. 9397 is voluntary. However, withholding information may result in denial of benefits. |

Guidelines on Utilizing Ds 5026

Completing the DS-5026 form is essential for the proper evaluation of earnings related to the FSPS Annuity Supplement. Ensure that the information you provide is accurate, as it will influence your annuity benefits. Follow these steps to fill out the form correctly.

- Print your name clearly at the top of the form.

- Enter the year of income you are reporting.

- Provide your Employee ID or the last four digits of your Social Security Number.

- Wait for the Human Resources Service Center (HRSC) to fill in the "Date Received by HRSC" section.

- Indicate whether your annuity supplement is currently reduced or terminated because you reported excess earnings last year. Darken only one oval: "Yes" or "No."

- If you answered "No" in the previous step, answer question 2 by indicating if you had any earnings after retirement for the reported year. Darken only one oval: "Yes" or "No."

- If you answered "Yes" to question 2, state your earnings for the reported year in dollars and cents. If you answered "No," proceed to sign and return the document.

- Sign the form and provide your daytime phone number and email address.

- Write the date using the format mm/dd/yyyy.

- Submit the completed form by mail, fax, or email as instructed in the guide.

Retain a copy of the completed form and any supporting documents. This will help in case you need to verify your earnings later. Remember to submit your form by January 10 of the year following your MRA for your annuity supplement to remain uninterrupted.

What You Should Know About This Form

What is the purpose of the DS-5026 form?

The DS-5026 form is used to report earnings that may affect your annuity supplement from the Foreign Service Pension System (FSPS). This report is essential because it allows the Department of State to determine your eligibility for continuing the annuity supplement and to accurately calculate its amount. If you exceed the yearly earnings threshold set by law, your annuity supplement may be reduced. Complete this form even if you had no earnings, as failing to do so may result in the termination of your benefits.

How is the earnings test applied to my annuity supplement?

The earnings test begins once you reach your Minimum Retirement Age (MRA). If your earnings exceed the exempt amount, your annuity supplement will be reduced by $1.00 for every $2.00 earned over that limit. The exempt amount is updated yearly, so it's important to check the latest figures at the Social Security Administration's website. The adjustment to your supplement will take effect on January 1st of the year following the income reported on your form.

What types of income must I report on this form?

When filling out the DS-5026, be sure to report all wages from employment that Social Security covers, net income from self-employment, and other specified types of earnings such as cash pay for agricultural and domestic work. However, you do not include your retirement salary, annuity payments, or other specified incomes, such as pensions or unemployment compensation. Listing only the relevant income is crucial to accurately assess your annuity supplement status.

What happens if I do not submit the DS-5026 form on time?

If you do not submit the form by the deadline, which is January 10 of the year following when you reached your MRA, your annuity supplement could be terminated. This strict deadline is vital because it ensures the Department of State can review your earnings and determine your eligibility for the supplement accurately. Always retain a copy of your submitted form and any supporting documents, as you may need them later to verify your reported earnings.

Common mistakes

Filling out the DS 5026 form can be tricky. Many people make mistakes that can lead to delays or issues with their annuity supplement. One common error is not submitting the form on time. It’s crucial to remember that this form needs to be submitted by January 10 of the year following when you reach your Minimum Retirement Age (MRA). Delaying submission can result in termination of your benefits.

Another mistake occurs when individuals fail to report all relevant earnings. It’s easy to overlook certain types of income that must be included in the earnings test. Wages from employment and net income from self-employment are just a few examples. On the other hand, people often mistakenly include pensions or retirement annuities, which should not be reported. Understanding what to include and exclude is vital.

Legibility is also an important factor. Many forms are rejected simply because the information is hard to read. When filling out the DS 5026, ensure that all information is clear and legible. Take time to write neatly and double-check your entries to avoid unnecessary complications. In addition, make sure to provide your signature where required. Omitting your signature can lead to the form being considered incomplete.

Some people forget to keep copies of their submissions. It’s a good practice to retain copies of the completed form and any supporting documentation that verifies claimed earnings. This can be invaluable if questions arise later. If you don’t have evidence to support your reported earnings, it may lead to issues with your benefits.

Lastly, many make the mistake of not using the correct submission method. You may choose to mail, fax, or email the form, but be sure to choose a method that you can verify was successful. If you send it via email, ensure you receive confirmation of receipt. Failure to do so could result in the Department of State not having your information, which may affect your annuity supplement eligibility.

Documents used along the form

The DS 5026 form is an important document that individuals must submit to the Department of State to report earnings relevant to their annuity supplement under the Foreign Service Pension System. In addition to the DS 5026 form, there are several other documents that may be required during the process of receiving and managing benefits. Below is a list of commonly used forms and documents that accompany the DS 5026 form.

- FSPS Annuity Application Form: This form enables individuals to apply for the Foreign Service Pension System annuity. It collects personal information, including service history and beneficiary details, to initiate the pension process.

- DS 5050: FSPS Retirement Benefits Election: This document allows retirees to elect specific benefits under the FSPS. Retirees must complete this form to clarify their choices regarding benefits, such as survivor coverage or different payment options.

- Social Security Benefit Application (Form SSA-1): Applicants use this form to apply for Social Security benefits. It provides essential information necessary for determining eligibility and is particularly relevant for individuals with earnings exceeding the exempt amount.

- IRS Form 1040: This annual income tax return form must be completed by all taxpayers. The reported income can impact the earnings test applied to annuity supplements, making accurate tax reporting crucial.

- Supporting Earnings Documentation: This may include pay stubs, tax returns, or other proof of income. It is essential to retain this documentation in case verification of reported earnings is required by the Department of State or the Social Security Administration.

Understanding and completing the necessary documentation is crucial for maintaining eligibility for benefits. Each document plays a distinct role in the process and ensures that retirees receive the support they are entitled to. It is recommended to keep thorough and accurate records for a seamless experience.

Similar forms

- Social Security Earnings Report - Like the Ds 5026 form, the Social Security Earnings Report requires individuals to disclose their annual earnings for the purpose of determining eligibility for benefits. Both documents assess income against a specific threshold, which impacts the level of supplement or benefits provided.

- W-2 Form - This document reports wages paid to employees and any taxes withheld. Similar to the Ds 5026, it provides necessary income information that can affect retirement benefits. Individuals must ensure proper reporting of earnings to both the IRS and agencies assessing retirement benefits.

- 1099-MISC Form - Used for reporting miscellaneous income, this form is essential for self-employed individuals. Like the Ds 5026, it highlights various forms of compensation, impacting calculations around income thresholds necessary for retirement benefits.

- Tax Return Form 1040 - The annual income tax return summarizes total earnings and is used by the IRS to assess tax obligations. Similar to the Ds 5026, this document's information can be used to determine eligibility for other benefits based on income levels.

- Retirement Benefit Application - When individuals apply for retirement benefits, they must report their income as part of the process. This document parallels the Ds 5026 in that both require adequate reporting of earnings for the assessment of benefits.

- Employer Verification Letter - Employers often provide letters confirming employee earnings. This document shares a similar purpose with the Ds 5026 form, as both serve to validate earnings for benefit assessment.

- Disability Income Certification - This form requires individuals to report income while applying for disability benefits. Similar to the Ds 5026, it helps determine if income exceeds eligibility thresholds for receiving support.

- Pension Benefit Statement - This document outlines the amount of pension income individuals receive. Much like the Ds 5026, it helps evaluate an individual's total income sources in relation to benefit continuance.

Dos and Don'ts

When filling out the DS 5026 form, it is important to follow specific guidelines to ensure the process runs smoothly. Here are eight key points to keep in mind.

- Do submit the form by January 10 of the year after you reach your Minimum Retirement Age (MRA).

- Do provide clear and legible information throughout the form.

- Do include all reportable earnings such as wages from employment covered by Social Security.

- Do retain copies of documents supporting your claimed earnings for future reference.

- Do not include pre-retirement salary or any annuity payments on the form.

- Do not report gifts, inheritances, or other non-earning incomes as part of your earnings.

- Do not write in the section reserved for HR Service Center verification.

- Do not forget to sign the form before submitting.

These guidelines will help ensure that your submission is complete and may prevent delays in your annuity supplement processing.

Misconceptions

Misconceptions about the DS 5026 form can lead to confusion. Here are five common misunderstandings along with clarifications:

- Misconception 1: The DS 5026 form is only for retirees with high earnings.

- Misconception 2: You can submit the form at any time during the year.

- Misconception 3: Only salary from a job counts as earnings.

- Misconception 4: You do not need to keep records of your income.

- Misconception 5: The annuity supplement is automatically adjusted if earnings exceed the exempt amount.

This form is required for all retirees who reach their Minimum Retirement Age (MRA), regardless of their earnings. Even if you had no income in the previous year, it's essential to submit the form to maintain your benefits.

The form must be submitted by January 10th of the year following the year you reached your MRA. Missing this deadline could result in the termination of your annuity supplement.

Many types of income are considered earnings, including self-employment income and cash payments for agricultural or domestic work. However, certain payments, like pensions or unemployment benefits, are excluded.

It's crucial to retain copies of documentation supporting your claimed earnings. You may be required to provide this information to verify your income if needed.

The adjustment is not automatic. If your earnings exceed the exempt amount, you must report this through the DS 5026 form, which then leads to potential adjustments in your benefits.

Key takeaways

The DS 5026 form is required to report earnings after reaching your Minimum Retirement Age (MRA).

The earnings test is similar to the one used for Social Security benefits. Your annuity supplement can be reduced if your earnings exceed a set exempt amount.

Submit the form by January 10 of the year after you reach your MRA. Even if you had no earnings, you must still send the form.

Clear and legible information is crucial. Always include your full name, Employee ID, and year of income.

Keep copies of any documents that prove your reported earnings. These can be useful if you ever need to verify your income.

Reportable income includes all wages covered by Social Security or earned from self-employment, among other things.

Do not report pensions, retirement benefits, or any other forms of income specified by the guidelines.

If your income exceeds the exempt amount, know that your annuity supplement will be reduced by $1.00 for every $2.00 over that limit.

Failure to submit the form on time can result in the loss of your annuity supplement benefits.

Browse Other Templates

Ched-unifast Online Scholarship Application Portal - Transitioning students must comply with guidelines specific to their educational level.

Aws Meaning Welding - Provides documentation for regulatory compliance audits.