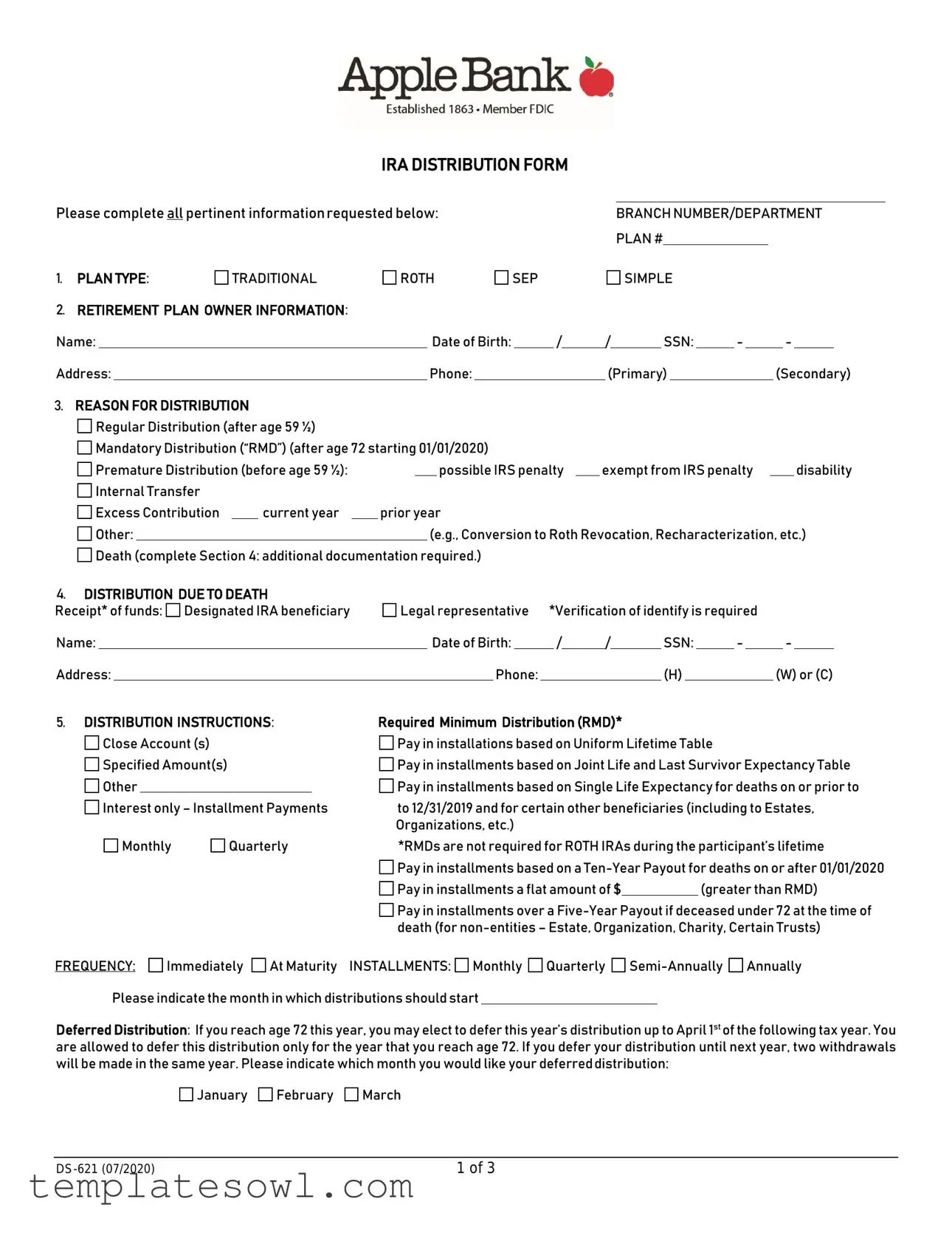

Fill Out Your Ds 621 Form

The DS-621 form serves as a crucial tool for individuals seeking to manage their Individual Retirement Accounts (IRAs) effectively. This form allows account holders to initiate distributions from various types of retirement plans, including Traditional, Roth, SEP, and SIMPLE accounts. Understanding the specifics of the DS-621 form is essential, as it requires users to provide detailed information about their accounts, including branch numbers, plan types, and personal identification details such as Social Security numbers and contact information. Moreover, the form facilitates selections regarding the reason for distribution; whether it's a regular withdrawal, a required minimum distribution (RMD), or an early withdrawal under specific conditions. A section is dedicated to beneficiaries in the unfortunate event of the account holder’s death, requiring additional documentation to protect the interests of those entitled to the benefits. Furthermore, the form stipulates options for how the distribution can be executed, including payment methods and frequencies. Acknowledging the tax implications of each withdrawal type, users must also indicate their preferences for federal income tax withholding. By providing clear instructions and authorizations, the DS-621 form underscores the importance of compliance with Internal Revenue Code requirements while helping account holders navigate their retirement planning more effectively.

Ds 621 Example

IRA DISTRIBUTION FORM

Please complete all pertinent informationrequested below: |

|

BRANCH NUMBER/DEPARTMENT |

||||

|

|

|

|

PLAN # |

|

|

1. PLAN TYPE: |

TRADITIONAL |

ROTH |

SEP |

SIMPLE |

||

2.RETIREMENT PLAN OWNER INFORMATION:

Name: |

|

Date of Birth: |

|

/ |

/ |

SSN: |

- |

- |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address: |

|

Phone: |

|

|

|

|

(Primary) |

|

|

|

|

(Secondary) |

||||||

3. REASON FOR DISTRIBUTION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Regular Distribution (after age 59 ½) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Mandatory Distribution (“RMD”) (after age 72 starting 01/01/2020)

Mandatory Distribution (“RMD”) (after age 72 starting 01/01/2020)

Premature Distribution (before age 59 ½): |

|

|

|

|

possible IRS penalty |

|

exempt from IRS penalty |

|

disability |

|||

Internal Transfer |

|

|

|

|

|

|

|

|

|

|

|

|

Excess Contribution |

|

current year |

|

prior year |

|

|

|

|

||||

Other: |

|

|

|

|

|

|

(e.g., Conversion to Roth Revocation, Recharacterization, etc.) |

|||||

Death (complete Section 4: additional documentation required.)

Death (complete Section 4: additional documentation required.)

4.DISTRIBUTION DUE TO DEATH

Receipt* of funds: |

|

Designated IRA beneficiary |

Legal representative |

*Verification of identify is required |

|||||||||||||||||||||||

Name: |

|

|

|

|

|

|

Date of Birth: |

|

|

/ |

/ |

|

|

SSN: |

- |

- |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

Phone: |

|

|

|

|

|

|

|

(H) |

|

|

|

(W) or (C) |

|||||||

5. DISTRIBUTION INSTRUCTIONS: |

Required Minimum Distribution (RMD)* |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Close Account (s) |

|

|

Pay in installations based on Uniform Lifetime Table |

|

|

|

|

|

|

|||||||||||||||||

|

Specified Amount(s) |

|

|

Pay in installments based on Joint Life and Last Survivor Expectancy Table |

|||||||||||||||||||||||

|

Other |

|

|

|

|

|

Pay in installments based on Single Life Expectancy for deaths on or prior to |

||||||||||||||||||||

|

Interest only – Installment Payments |

to 12/31/2019 and for certain other beneficiaries (including to Estates, |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

Organizations, etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Monthly |

Quarterly |

*RMDs are not required for ROTH IRAs during the participant’s lifetime |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

Pay in installments based on a |

|||||||||||||||||||

|

|

|

|

|

|

|

|

Pay in installments a flat amount of $ |

|

|

|

|

(greater than RMD) |

||||||||||||||

|

|

|

|

|

|

|

|

Pay in installments over a |

|||||||||||||||||||

|

|

|

|

|

|

|

|

death (for |

|||||||||||||||||||

FREQUENCY: |

Immediately |

At Maturity INSTALLMENTS: Monthly |

Quarterly |

|

Annually |

||||||||||||||||||||||

Please indicate the month in which distributions should start

Deferred Distribution: If you reach age 72 this year, you may elect to defer this year’s distribution up to April 1st of the following tax year. You are allowed to defer this distribution only for the year that you reach age 72. If you defer your distribution until next year, two withdrawals will be made in the same year. Please indicate which month you would like your deferreddistribution:

January

January  February

February

March

March

1 of 3 |

Federal Income Tax Withholding Election: You must select one, withholding options as noted below. If you do not we are required to automatically withhold from your taxable payments as required by Federal Law.

|

Do not withhold federal income tax from payments |

I elect to have the amount of $ |

|

withheld from my distribution |

|||||||

|

|

|

|

payment(s) (not available for automatic distribution) |

|||||||

|

Withhold federal income tax from payments (10% - normal) |

|

other percentage |

% |

|

||||||

Method of Payment |

|

|

|

|

|

|

|

|

|||

|

Automated Clearing House (“ACH”) Entry |

|

|

|

|

|

|

|

|

||

|

Check mailed to the recipient’s address |

|

Check mailed to recipient of funds in Section 4 |

||||||||

|

EFT deposit to IRA owner’s Apple Bank Account: |

|

|

|

|

|

|

|

|

||

|

Savings: Checking: NOW: or Money Market Account No. |

|

|

|

|

|

|

|

|

|

|

Specify Dollar ($) Amount(s): |

Specify affected retirement account(s): list numbers below |

||||||||||

# |

|

|

|

$ |

|

|

|

|

|

|

|

# |

|

|

|

$ |

|

|

|

|

|

|

|

# |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please note that early withdrawals from time deposit accounts may result in interest penalties. See your accountdisclosures.

IF YOU HAVE SELECTED ACH ENTRY as your method of paymenti:

(A)Your Financial Institution must be an ACH Participant (acting as the RDFI); and

(B)A VOIDED check or

Additionally, please provide the following Third Party Financial Institution information:

FINANCIAL INSTITUTION NAME:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(“RDFI”) Address: |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Routing Transit/ABA Number: |

|

|

|

|

|

|

|

|

|

Account Number: |

|

|||||||||||

- |

|

|

|

- |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of Account: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking Account |

Savings Account |

6.AUTHORIZATION

By signing this authorization, below:

•You authorize us, as Trustee, to make a withdrawal(s) from the IRA account(s) identified above in the manner and for the reason(s) indicated. You affirm that the withdrawal(s) are permitted under the terms and conditions of the applicable Traditional, Roth, SEP or SIMPLE IRA Adoption Agreements that you have signed and meet all legal requirements of the Internal Revenue Code (“IRC”). Apple Bank may rely on your statements herein and shall not be held liable for any tax, penalty or other consequence incurred in connection with any withdrawal hereby authorized.

•You represent and warrant that the referenced Third Party Financial Institution (“Third Party FI”) account(s) to which you have directed your distribution(s) is/are held in your name.

•You acknowledge that withdrawals from a

2 of 3 |

•You recognize that withdrawals made from any SIMPLE IRA prior to age 59½ and within the first two years of participating in an employer’s SIMPLE IRA plan may be subject to a 25% early withdrawal penalty.

•You shall Indemnify Apple Bank from any liability in the event that you fail to meet any applicable IRS requirements.

•You certify under penalties of perjury that you are a U.S. citizen or other U.S. person (including a resident alien individual) and that the tax identification number shown (TIN) on this form is your correct TIN.

Customers selecting ACH Entries:

•Authorize and request Apple Bank to make direct transfer EFT distributions from the Apple Bank IRA listed in this form by initiating debit entries to such Apple BankIRA.

•Authorize us, upon receiving instructions from you or as otherwise authorized by you, to make payments from you and to you, by credit entries to the designated account at the Third Party Financial Institution identified above (the “Third Party FI”). You authorize the Third Party FI to process such entries and to credit the designated account(s) for such entries. You ratify such instructions and agree that neither we nor any mutual fund will be liable for any loss, liability, cost, or expense for acting upon all such instructions believed to be genuine if we employ reasonable procedures to prevent unauthorized transactions. You agree that this authorization may only be revoked by written notice to us in such time and manner as to afford us and the Bank a reasonable opportunity to act uponit.

•Warrant and represent that (i) the third party’s account identified in Section 3 is owned by a natural person, (ii) that person has authorized his/her account to be credited in accordance with your instructions, and (iii) the account has been established for personal, family, or household use, and not for commercial purposes.

Name of individual receiving funds (please print) |

Signature |

Date |

7.Approved by APPLE BANK FOR SAVINGS

Authorized Signature |

|

Date |

|

|

|

|

|

Print Name |

Teller Number |

||

iIf your ACH or EFT deposit cannot be originated or processed for any reason a check will be mailed to the record address until such time a new designation is presented.

3 of 3 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The DS-621 form facilitates distributions from Individual Retirement Accounts (IRAs), including Traditional, Roth, SEP, and SIMPLE plans. |

| Governing Tax Laws | The form is governed by sections of the Internal Revenue Code (IRC), particularly those dealing with retirement accounts and distributions. |

| Distribution Reasons | Individuals can indicate various reasons for distribution, such as regular distribution, mandatory distribution due to age, or in the event of a beneficiary's death. |

| Withholding Requirements | Federal income tax withholding options are provided in the form. If no selection is made, withholding will be applied automatically according to federal law. |

| Frequency of Payment | Distributions can be scheduled on various frequencies, including monthly, quarterly, semi-annually, or annually, based on the individual’s preferences. |

Guidelines on Utilizing Ds 621

Completing the DS-621 form requires careful attention to detail. This will ensure that all necessary information about your IRA distribution is accurately conveyed. Upon finalization of this process, the form will facilitate the distribution according to your selected options.

- Plan Type: Select your plan type from the options: Traditional, Roth, SEP, or SIMPLE.

- Owner Information: Fill in your name, date of birth, Social Security Number, address, and phone numbers (both primary and secondary).

- Reason for Distribution: Choose the appropriate reason for your distribution, such as Regular Distribution or Mandatory Distribution. If the reason is due to death, ensure to complete Section 4.

- Distribution Due to Death: If applicable, provide the name, date of birth, Social Security Number, address, and phone numbers for the designated beneficiary or legal representative.

- Distribution Instructions: Indicate how you want the distribution to be executed. Choose required minimum distribution, close accounts, or specify installment amounts, either immediately or deferred.

- Federal Income Tax Withholding: Select your withholding option. If you choose to withhold a specific amount, indicate that amount.

- Method of Payment: Choose your payment method, such as Automated Clearing House (ACH) entry or check. If you choose ACH, attach a voided check.

- Third Party Financial Institution Information: Fill in the details of your financial institution, including the name, address, routing number, and account number.

- Authorization: Read the authorization section carefully. Sign, print your name, and provide the date.

- Approval: Leave space for the authorized signature from Apple Bank and the date, along with the teller number.

What You Should Know About This Form

What is the purpose of the DS 621 form?

The DS 621 form is primarily used for withdrawing funds from individual retirement accounts (IRAs). This form allows account holders to specify the type of distribution they are requesting, such as a regular distribution, mandatory distribution, or an early distribution. By completing this form, you ensure that your withdrawal complies with IRS regulations and reflects your intended distribution plan.

Who should fill out the DS 621 form?

The form should be filled out by the owner of the IRA account from which funds are being withdrawn. If the account owner is deceased, a designated beneficiary or legal representative may complete the form. It's critical that the person filling out the form provides accurate information to avoid processing delays.

What information is needed to complete the DS 621 form?

You must provide several key pieces of information, including your name, date of birth, Social Security number, and contact information. Additionally, you'll need to specify the type of IRA account, the reason for the distribution, and how you want to receive the payment. Ensure all details are correct to facilitate timely processing.

What are the possible methods of payment available on the DS 621 form?

The form allows for multiple methods of payment. You can choose to receive your distribution via Automated Clearing House (ACH) transfer, a mailed check, or direct deposit into your Apple Bank account. Selecting a method of payment that suits your needs is essential for efficient processing.

Are there any tax implications when withdrawing funds using the DS 621 form?

Yes, there are tax implications. Withdrawals from non-Roth IRAs are generally taxed as ordinary income. If you withdraw funds before reaching age 59½, you may incur a 10% early withdrawal penalty unless you qualify for an exemption. Make sure you understand these implications to avoid unexpected tax consequences.

Common mistakes

Filling out the DS-621 form can be a straightforward process, but mistakes can lead to unnecessary delays and complications. Here are ten common errors to be aware of:

First, failing to provide complete information is a frequent oversight. Each section of the form requires specific details. Leaving any part blank, such as the Branch Number or Plan Type, can cause processing delays. Double-check that every section is filled out completely.

Second, using incorrect codes or details can lead to confusion. Ensure that the type of retirement plan chosen matches the account you are accessing. Mistakes in choosing Traditional, Roth, SEP, or SIMPLE can hinder your distribution and cause administrative headaches.

Third, many individuals forget to include their Social Security Number. This crucial piece of information is often overlooked but is necessary to verify identity and compliance. Always double-check that it is included and correct.

Fourth, it is common for people to misuse the distribution reasons. Selecting “Premature Distribution” when it is not applicable, or not understanding the criteria for each reason, can cause issues. Read the options carefully and ensure the reason you select accurately reflects your situation.

Fifth, individuals often neglect to specify the method of payment. Whether choosing between a check or ACH transfer, be clear on your preferred method. Leaving this blank can result in the default payment being processed, which might not be ideal for your needs.

Sixth, not selecting federal income tax withholding options is another mistake. Understanding the implications of withholding taxes can help avoid surprises during tax season. If you do not choose, the form requires automatic withholding at a default rate.

Seventh, when dealing with distributions due to death, it’s crucial to provide accurate beneficiary information, including name, date of birth, and Social Security Number. Incomplete information here can result in beneficiaries facing delays in receipt of funds.

Eighth, many forget to check their distribution frequency options. Whether you prefer annual, quarterly, or monthly distributions, selecting a frequency ensures funds are distributed as planned. Without it, distributions may occur in a manner that may not be convenient or beneficial for you.

Ninth, failing to provide proper identification documentation in certain cases can halt the process. When distributions are due to death, additional paperwork is often necessary. Ensure you include all required documents to avoid any delays.

Lastly, individuals sometimes sign the form without reading all terms carefully. It’s essential to understand what you are agreeing to, especially concerning penalties for early withdrawal and the tax implications. Taking a moment to read can save complications later.

By avoiding these common errors, individuals can help ensure a smoother experience with the DS-621 form. Careful attention to detail is key in successfully completing your distribution request.

Documents used along the form

The DS-621 form is essential for managing IRA distributions. However, several other forms and documents are typically needed in conjunction with the DS-621. Each of these documents serves a specific purpose, helping to ensure compliance with regulations and protect the rights of all parties involved. Below is a list of these important forms.

- Form W-4P: This form allows individuals to request federal income tax withholding on their pension or IRA payouts. It helps specify how much tax should be withheld from distributions.

- Individual Retirement Account (IRA) Custodial Agreement: This document outlines the rules of the IRA and the responsibilities of the account custodian. It provides critical information on how the account is managed.

- Beneficiary Designation Form: This form is used to name beneficiaries who will receive the account assets upon the account owner’s death. It ensures that the correct individuals receive the funds.

- Form 5329: This IRS form is filed to report additional taxes on IRAs. It is used when an individual takes an early distribution or fails to take the required minimum distribution.

- Distribution Request Form: A separate form may be required to detail the specifics of the distribution request. This form clarifies the amount and type of distribution being requested.

- Withdrawal Authorization Form: This document grants permission for the IRA custodian to process the withdrawal from the retirement account. It outlines the reason for the withdrawal and ensures that it is authorized.

- Form 1099-R: Upon distribution, this IRS form is issued to report the distribution of income from an IRA or retirement plan. It is essential for reporting taxable income during tax season.

- Trust Account Documentation: If an IRA is held in trust, the associated trust documents are required. They specify the terms under which the IRA can be managed and distributed.

- Power of Attorney (POA): If someone is acting on behalf of the account owner, a POA document may be necessary. It grants legal authority to another person to make decisions regarding the IRA.

These associated documents, alongside the DS-621 form, help ensure a smooth process for IRA distributions while addressing various legal and tax implications. Being well-prepared with these forms helps account holders navigate their financial futures more effectively.

Similar forms

-

Form 1099-R: This document reports distributions from retirement accounts. Like the Ds 621, it includes important information about the amount withdrawn, tax implications, and reasons for distribution.

-

Form W-4P: Used for withholding tax from pension or annuity payments, it allows individuals to designate tax withholding preferences similar to what the Ds 621 outlines for IRA distributions.

-

Form 8606: This form is used to report Non-deductible IRAs. It shares similarities with the Ds 621 in terms of tracking contributions and distributions from retirement accounts.

-

Form 5329: This form addresses additional taxes on IRAs and other qualified plans. It provides important information regarding penalties for early withdrawals, mirroring the rules stated in the Ds 621.

-

Form 1040: Used for reporting individual income tax, it may include information on IRA distributions. The Ds 621 pertains specifically to planning these distributions for tax purposes.

-

Form 5498: This is a contribution information form for IRAs. It complements the Ds 621 by helping individuals track contributions over time while distributions show the withdrawals.

-

Form 8822: This form allows for a change of address. If an account holder moves, both the Ds 621 and Form 8822 are necessary to keep beneficiary information updated for distributions.

-

Form 403(b): This defines the retirement plan, similar to IRA forms. The concepts are alike in managing distributions and qualifiers for withdrawals.

-

Beneficiary Designation Forms: These forms specify who will inherit the retirement accounts. Just like the Ds 621 addresses death distributions, beneficiary forms ensure clarity on fund allocation.

-

Withdrawal Authorization Forms: These are often used to request funds from various accounts. The principle is similar to the Ds 621, as both require authorization for fund disbursement.

Dos and Don'ts

- Do complete all sections of the form accurately, providing clear and complete information.

- Do double-check your Social Security Number (SSN) for accuracy to avoid processing delays.

- Do indicate the correct reason for distribution, as this impacts your tax obligations.

- Do ensure that any supporting documentation is included, especially when claiming death benefits.

- Do consult with a tax advisor if you have questions regarding how distributions may affect your taxes.

- Don't leave any sections blank; incomplete forms can lead to rejection or further complications.

- Don't forget to sign the authorization section, as missing signatures can invalidate the form.

- Don't overlook the importance of specifying your preferred payment method accurately.

- Don't assume that your financial institution will accept your form without checking their requirements first.

Misconceptions

Misconceptions about the DS-621 Form:

- It only applies to Traditional IRAs. The DS-621 form is for various types of retirement accounts, including Roth, SEP, and SIMPLE IRAs.

- All distributions from IRAs are taxed. While traditional IRAs typically incur taxes upon distribution, Roth IRAs do not have required minimum distributions during the participant's lifetime.

- You must withdraw funds as soon as you reach age 59½. While you can take distributions without penalty after this age, it is not mandatory.

- Only owners can request a distribution. A designated beneficiary or legal representative can also initiate a distribution process in specific circumstances.

- There are no penalties for early withdrawal from a SIMPLE IRA. Withdrawals made before age 59½ within the first two years of participating may incur a hefty 25% penalty.

- IRS penalties do not apply to all types of distributions. Certain distributions such as those for disability or death can be exempt from penalties but still may be taxable.

- Simply withdrawing more than the RMD is always allowed. Withdrawals exceeding the required minimum distribution may lead to unexpected tax implications based on your tax bracket.

- You can change the withdrawal pattern anytime. While frequency can be modified, certain established agreements must be respected once signed.

- The form is irrelevant if my retirement account is with a different bank. The DS-621 form is specific to Apple Bank. However, similar forms will be required by other institutions.

- Completing the form is straightforward and requires no additional documentation. Certain cases, especially those involving death, require additional documents for verification.

Key takeaways

Filling out and using the DS-621 form correctly is essential for managing IRA distributions. Here are key takeaways to consider:

- The form is used for various retirement plans, including Traditional, Roth, SEP, and SIMPLE IRAs.

- Complete all sections accurately, including personal information and social security number.

- Indicate the reason for the distribution clearly, as this may affect whether penalties apply.

- Choose from different options for receiving distributions, such as monthly or quarterly payments.

- Note that federal income tax withholding must be chosen. If not selected, automatic withholding will occur.

- Consider the implications of early withdrawals; distributions taken before age 59½ may incur penalties.

- For withdrawals due to death, additional documentation may be required to confirm beneficiary status.

- Signature and date are needed for authorization, affirming compliance with IRS requirements.

By keeping these points in mind, individuals can navigate the DS-621 form with greater ease and ensure their IRA distributions comply with all necessary regulations.