Fill Out Your Dshs 14 417 Form

The DSHS 14 417 form plays a vital role in securing child care subsidies in Washington State, specifically through the Child Care Subsidy Programs (CCSP). Designed for parents and guardians seeking financial assistance, the form outlines the essential information needed to process an application. At the heart of the application process is eligibility, which hinges upon detailed income verification and household information. Applicants must provide proof of income from various sources, including pay stubs or a statement from an employer for newly hired individuals. Additionally, the form requires documentation regarding child support payments, when applicable, and specific details about child care providers. For those utilizing care from family, friends, or neighbors, further verification must be provided to ensure compliance with state regulations. The DSHS 14 417 also explores requirements based on the type of care, offering guidance on income limits, proof of residency, and necessary background checks for providers. By filling out this form accurately and completely, applicants can help streamline the process, ensuring timely access to the much-needed financial support for child care services.

Dshs 14 417 Example

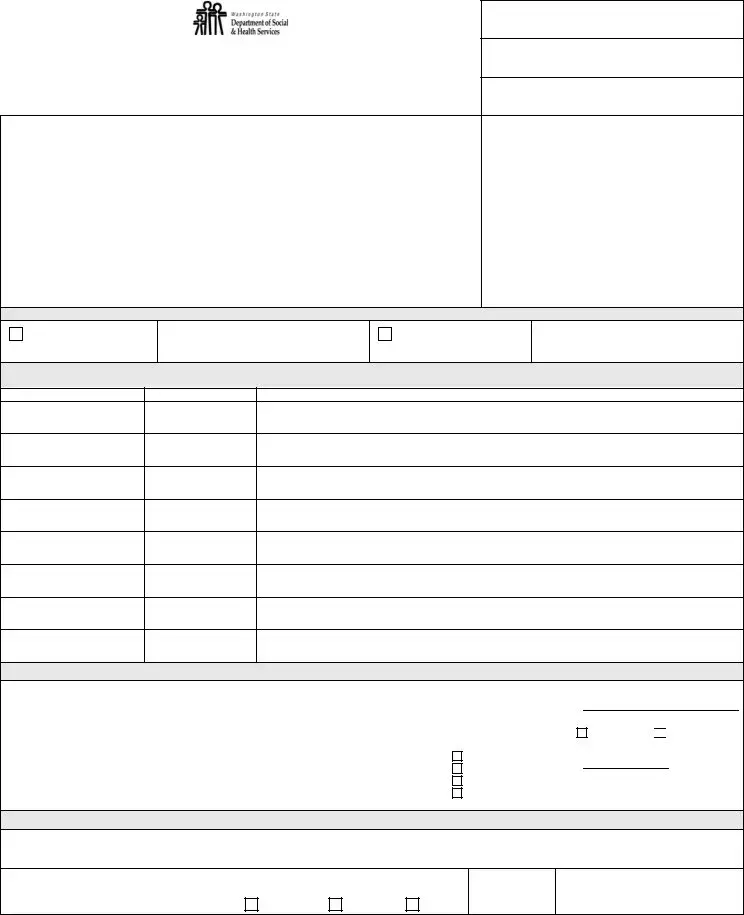

STATE OF WASHINGTON

DEPARTMENT OF SOCIAL AND HEALTH SERVICES

CHILD CARE SUBSIDY PROGRAMS (CCSP)

CCSP Application

Date:

PARENT/GUARDIAN

CASE NUMBER

_____

FOLD

Dear Applicant:

We are sending this application because you requested Child Care Subsidies.

We will process your application and determine eligibility once you provide the following information.

CCSP application / provider information (you must complete this even if you are in a WorkFirst activity);

Provide proof of the last three months of household income (such as copies of pay stubs, child support, Social Security Income, Supplemental Security Income (SSI), and any other income received by someone in your family). Include your employment schedule. You don’t need to provide proof of income from cash assistance from the state (TANF).

If you are newly employed and have no pay stubs, we will accept a statement from your employer with a hire date, how much you are making (per hour, salary, etc.), and what your schedule will be. You must provide us a copy of your wage stubs within 30 days WAC

Proof of court or administrative ordered child support payments (if applicable) and verification of payments made.

Working Connections Child Care Only: If care is provided by a Family / Friends / Neighbors provider, the provider must meet the qualifications listed on the Application Part 2B and you must submit:

Legible copy of the provider’s picture identification, such as a driver’s license, state identification card, passport, or military identification;

Legible copy of the provider’s valid Social Security card;

Proof that the provider is legally able to work in the U.S., such as a Green Card, Resident Alien Card, or Employment Authorization Document (EAD);

Background Authorization form, DSHS

No payment will be made for care provided prior to the date all background check results are received.

Please call the number below if you have questions.

Call Center Telephone Number: |

|

Fax Number: |

CCSP APPLICATION

DSHS

Seasonal Child Care

Applicants must:

Live in Adams, Benton, Chelan, Douglas, Franklin, Grant,

|

CHILD CARE SUBSIDY PROGRAMS (CCSP) |

|

|

|

|

|

Kittitas, Okanogan, Skagit, Walla Walla, Whatcom or Yakima |

||||||||||||||||||||||

|

CCSP Application |

|

|

|

|

|

|

|

|

Counties; |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

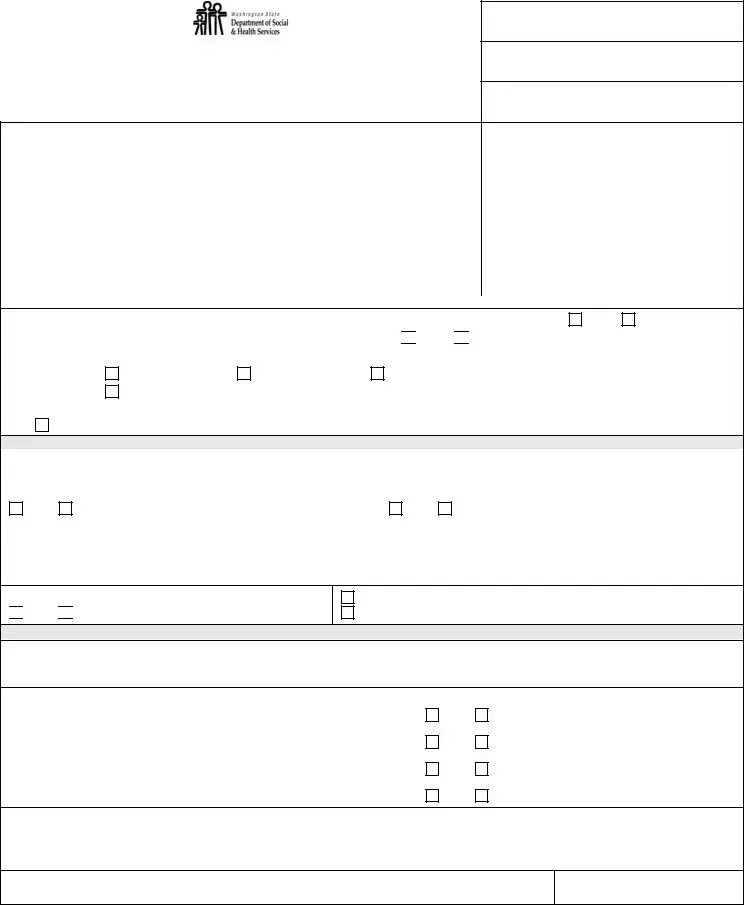

Part 1. Application Information |

|

|

|

Work in a |

||||||||||||||||||||||||

|

|

|

|

|

|

production, harvesting or processing of fruit trees or crops. |

|||||||||||||||||||||||

|

Incomplete information may delay approval for |

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||||||||||||

|

Services and payment. Type or print clearly. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APPLICANT’S NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CLIENT ID NUMBER |

|

|

|

BIRTHDATE |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

APPLICANT’S ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN (OPTIONAL) |

|

|

|

TELEPHONE NUMBER |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

CITY |

|

|

|

STATE |

ZIP CODE |

|

|

|

|

|

APPLICANT’S ETHNICITY RACE |

|

|

APPLICANT’S GENDER |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Male |

Female |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

CHILDREN FOR WHOM YOU ARE RESPONSIBLE LIVING IN THE HOUSEHOLD |

|

|

|

|

|

|

|

|||||||||||||||||

|

NAME (LAST, FIRST, |

|

|

|

BIRTHDATE |

|

|

MALE/ |

|

|

ETHNICITY |

|

SSN (OPTIONAL) |

U.S. CITIZEN OR |

RELATIONSHIP TO |

||||||||||||||

|

MIDDLE INITIAL) |

|

|

|

|

FEMALE |

|

|

|

LEGAL RESIDENT |

APPLICANT |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

SPOUSE OR THE CHILD’S OTHER PARENT/GUARDIAN LIVING IN THE HOUSEHOLD (REQUIRED) |

|

|

|

|||||||||||||||||||||||||

|

Are you married? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

NAME |

|

|

|

BIRTHDATE |

|

|

|

|

|

SSN (OPTIONAL) |

|

RELATIONSHIP TO |

|

|

RELATIONSHIP TO |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

APPLICANT |

|

|

ABOVE CHILDREN |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

APPLICANT |

|

|

|

|

|

|

|

|

|

|

|

|

|

SPOUSE OR SECOND PARENT/GUARDIAN |

|

|

||||||||||

|

NAME OF EMPLOYER, WORKFIRST ACTIVITY, OR SCHOOL |

|

|

|

|

NAME OF EMPLOYER, WORKFIRST ACTIVITY, OR SCHOOL |

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

ADDRESS (EMPLOYMENT, WORKFIRST ACTIVITY,OR SCHOOL) |

|

|

|

ADDRESS (EMPLOYMENT, WORKFIRST ACTIVITY,OR SCHOOL) |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

TELEPHONE NUMBER |

|

|

|

DATE STARTED |

|

|

|

|

|

|

TELEPHONE NUMBER |

|

DATE STARTED |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

IF YOU ARE EMPLOYED, HOW OFTEN ARE YOU PAID AND YOUR |

|

|

|

IF YOU ARE EMPLOYED, HOW OFTEN ARE YOU PAID AND YOUR |

||||||||||||||||||||||||

|

WAGE PER PAY PERIOD? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WAGE PER PAY PERIOD? |

|

|

|

|

|

|

|

|

|||||

|

Weekly |

|

Every two weeks |

|

|

|

|

|

|

|

|

|

Weekly |

|

|

Every two weeks |

|

|

|

||||||||||

|

Twice a month |

|

Monthly |

|

$ |

|

|

|

|

|

|

|

|

Twice a month |

Monthly |

|

|

|

|

$ |

|

|

|||||||

|

Do you pay court ordered child support? |

|

|

|

|

|

|

Yes |

|

No |

Monthly amount: $ |

|

|

|

|||||||||||||||

|

Do you have a court order to receive child support? |

|

Yes |

|

No |

Monthly amount: $ |

|

|

|

||||||||||||||||||||

|

|

|

MONTHLY SOURCES OF EARNED/UNEARNED INCOME FOR ALL FAMILY MEMBERS |

|

|

|

|||||||||||||||||||||||

Include COPIES (for the last three months): |

|

NAME |

|

|

|

|

|

NAME |

|

|

NAME |

|

|

|

|

NAME |

|

|

|||||||||||

|

|

|

SELF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Employment (gross, before taxes, include tips) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Temporary Aid to Needy Families (TANF) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Child support received |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Social Security (SSI, SSA) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

VA, Disability, L&I, or Unemployment benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (specify): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CCSP APPLICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DSHS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

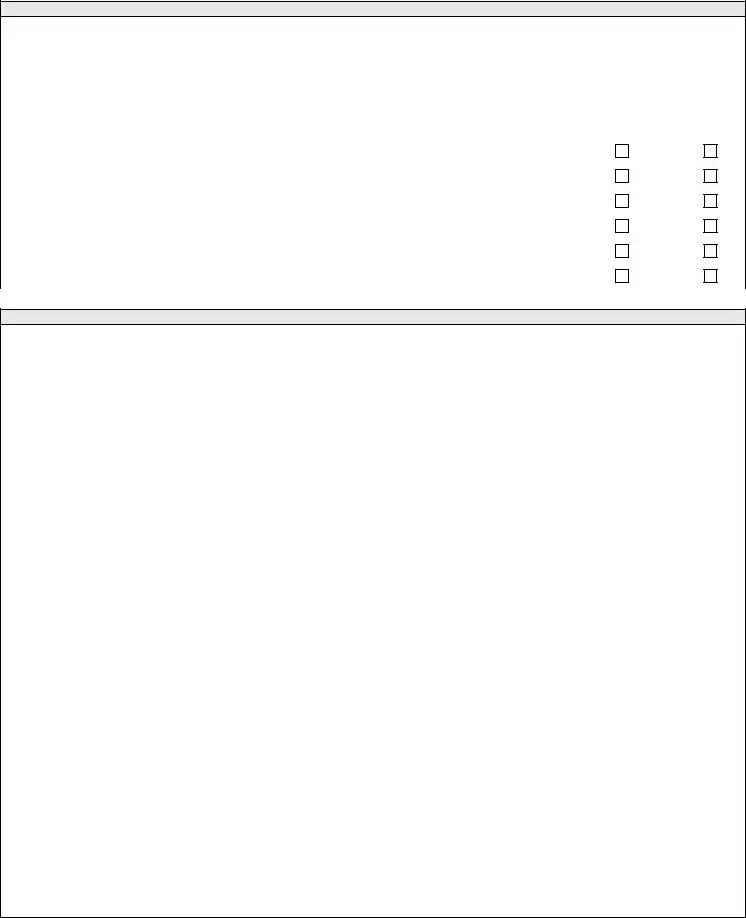

PARENT/GUARDIAN’S ACTIVITY SCHEDULE

|

APPLICANT |

SPOUSE OR SECOND PARENT/GUARDIAN |

ACTIVITY (EMPLOYMENT, SCHOOL, WORFIRST ACTIVITY) INDICATE |

ACTIVITY (EMPLOYMENT, SCHOOL, WORFIRST ACTIVITY) INDICATE |

|

TIME WITH A.M./P.M. |

TIME WITH A.M./P.M. |

|

|

|

|

|

WHAT IS YOUR SCHEDULE FOR EMPLOYMENT, |

WHAT IS YOUR SCHEDULE FOR EMPLOYMENT, |

|

SCHOOL, WORKFIRST ACTIVITY? |

SCHOOL, WORKFIRST ACTIVITY? |

Monday |

|

|

|

|

|

Tuesday |

|

|

|

|

|

Wednesday |

|

|

|

|

|

Thursday |

|

|

|

|

|

Friday |

|

|

|

|

|

Saturday |

|

|

|

|

|

Sunday |

|

|

|

|

|

What date will child care begin:

Applicant: One way, how long does it take you to travel from the childcare to your activity (work, school, etc.)?

Other parent/guardian: One way, how long does it take you to travel from the childcare to your activity (work, school, etc.)?

CHILDREN’S ACTIVITY SCHEDULE. FOR ADDITIONAL CHIDREN, ATTACH A SEPARATE PIECE OF PAPER WITH THEIR INFORMATION.

CHILDREN’S |

SCHOOL SCHEDULE |

CHILD CARE SCHEDULE |

NAMES |

(EXACT DAYS AND TIMES) |

(EXACT DAYS AND TIMES) |

|

|

|

|

|

|

|

|

|

|

|

|

Do you have a child with Special Needs? |

Yes |

No |

If yes, please contact the Authorizing Worker for |

|

information about special needs payment rates. |

||||

|

|

|

||

|

|

|

||

|

|

HEARING RIGHTS |

||

If you disagree with this decision, you may request a hearing by contacting this office or write to Office of Administrative Hearings, P O Box 42489, Olympia, WA

On or before the effective date of this action or no more than 10 days after we send you notice of this action, IF you receive benefits now and you want them to continue, or

Within 90 days of the date you receive this letter.

At the hearing, you have the right to represent yourself, be represented by an attorney or by any other person you choose. You may be able to get free legal advice or representation by contacting an office of legal services.

I declare under penalty of perjury that the information given by me in this declaration is true, correct and complete to the best of my knowledge and realize that willful falsification of this information by me may subject me to penalties as provided in Washington State Law. (RCW 74.08.055)

FIRST PARENT/LEGAL GUARDIAN’S SIGNATURE |

DATE |

SECOND PARENT/LEGAL GUARDIAN’S SIGNATURE |

DATE |

|

|

|

|

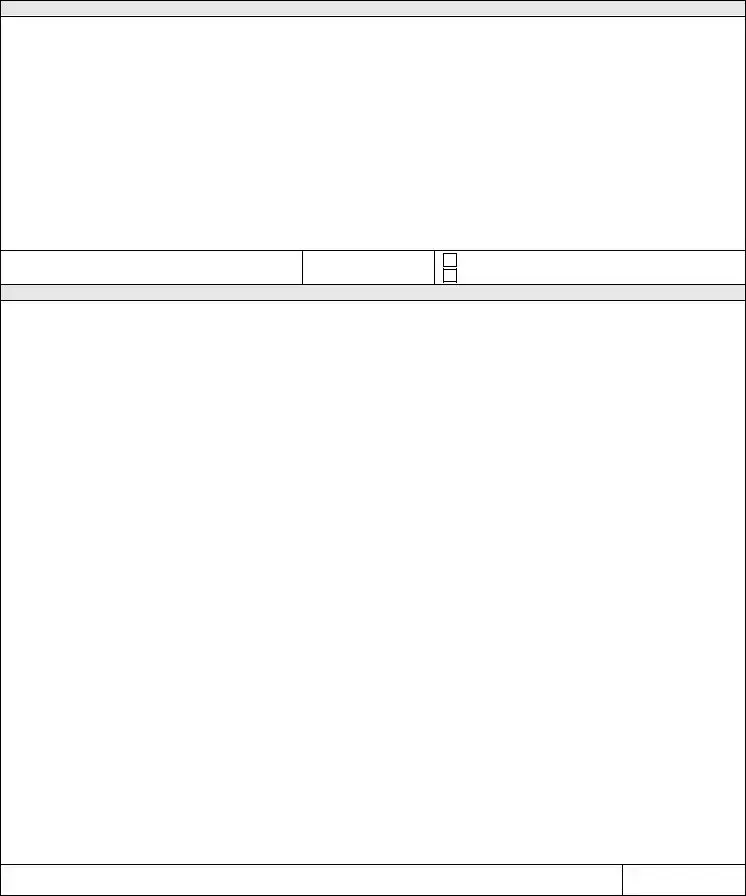

CCSP APPLICATION

DSHS

CHILD CARE SUBSIDY PROGRAMS (CCSP)

CCSP Application

Part 2A. Licensed Provider Information

(TO BE COMPLETED BY PARENT/GUARDIAN AND PROVIDER)

Type or print clearly. Incomplete information may delay approval for payment.

DATE

CALL CENTER TELEPHONE NUMBER

FAX NUMBER

1. PROVIDER’S NAME AND ADDRESS |

CLIENT IDENTIFICATION NUMBER |

The provider’s name and address given to us is public information and can |

|

||

be given to anyone who requests it. |

|

|

|

|

|

PARENT/GUARDIAN’S NAME |

|

|

|

|

|

PROVIDER’S NAME |

|

|

PROVIDER NUMBER |

|

|

|

|

PROVIDER’S ADDRESS |

|

|

PROVIDER TELEPHONE NUMBER |

|

|

|

|

CITY |

STATE |

ZIP CODE |

EXPECTED START DATE FOR CARE |

2. TYPE OF CARE: CHECK THE CORRECT BOX IDENTIFYING THE TYPE OF CARE YOU PROVIDE. PROVIDER COMPLETE SECTIONS 3 AND 4.

Licensed Child Care Center

PROVIDER’S SSN OR FEDERAL TAX IDENTIFICATION NUMBER

Licensed Family Home Child Care

PROVIDER’S SSN OR FEDERAL TAX IDENTIFICATION NUMBER

3.ENTER THE DAYS AND TIMES YOU WILL PROVIDE CARE FOR THE FOLLOWING CHILDREN (PLEASE USE SECTION FIVE FOR ADDITIONAL CHILDREN YOU CARE FOR)

NAMES

BIRTHDATE

DAYS AND TIMES CARE WILL BE PROVIDED, SPECIFY BEFORE AND AFTER SCHOOL TIMES

4. LICENSED PROVIDER: ENTER YOUR DAILY RATES

What are the usual rates you charge to parents / guardians?

This information must be provided before payment is authorized.

INFANT (ZERO |

ENHANCED |

TODDLER (18 – 29 |

|

– 11 MONTHS) |

TODDLER (12 |

MONTHS) |

|

$ |

– 17 MONTHS) |

$ |

|

|

$ |

|

|

PRESCHOOL |

SCHOOL AGE |

REGISTRATION FEE |

|

(30 MONTHS – |

(FIVE – 12 |

NONE |

|

FIVE YEARS |

YEARS) |

||

NOT IN |

$ |

||

YEARLY |

|||

SCHOOL) |

|

FIELD TRIP FEE |

|

$ |

|

||

|

|

IF YES, AMOUNT:

$

PER CHILD

PER FAMILY

PER FAMILY

$PER MONTH

RATE

Contact the Call Center for payment rates for children with special needs.

I understand completing this form does not guarantee payment. If child care is authorized, I agree to child care payment at my usual rate or the DEL rate, whichever is less.

PROVIDER’S SIGNATURE

Director

Owner

Other

DATE

TELEPHONE AND FAX NUMBER (INCLUDE AREA CODE)

CCSP APPLICATION

DSHS

WORKING CONNECTIONS CHILD CARE (WCCC)

WCCC Only Application

Part 2B. Family / Friends / Neighbors Provider Information

(TO BE COMPLETED BY PARENT/GUARDIAN AND PROVIDER)

Type or print clearly. Incomplete information may delay approval for payment.

DATE

CALL CENTER TELEPHONE NUMBER

FAX NUMBER

SECTION 1. PROVIDER’S NAME AND ADDRESS |

CLIENT IDENTIFICATION NUMBER |

The provider’s name and address given to us is public information and can be |

|

|||

given to anyone who requests it. |

|

PARENT/GUARDIAN’S NAME |

||

|

|

|

|

|

|

PROVIDER’S NAME |

|

|

PROVIDER NUMBER |

|

|

|

|

|

|

PROVIDER’S ADDRESS |

|

|

PROVIDER TELEPHONE NUMBER |

|

|

|

|

|

|

CITY |

STATE |

ZIP CODE |

EXPECTED START DATE FOR CARE |

|

|

|

||

|

|

SECTION 2. TO BE COMPLETED BY PARENT APPLYING FOR CHILD CARE |

||

1. Is the provider your child (natural, step, adopted, or foster) aged 18 through 20 years old.

2. Is the provider your parent (natural, step, adopted, or foster).

Yes

Yes

No If yes to #2, please check the box below that applies to you.

No If yes to #2, please check the box below that applies to you.

Yes

No

Are you :

Widowed. |

Divorced. |

Married, separated, or never married. |

Living with my disabled spouse who is unable to care for my child for at least four continuous weeks in a calendar quarter.

3.

Neither 1 or 2 apply.

SECTION 3. TO BE COMPLETED BY FAMILY / FRIENDS / NEIGHBORS PROVIDER

PROVIDER’S SSN |

RELATIONSHIP TO CHILD |

PROVIDER’S EMAIL ADDRESS |

||

|

|

|

||

PROVIDER OVER 18? |

BIRTH DATE |

US CITIZEN OR A RESIDENT LEGALLY ABLE TO WORK IN THE U.S.? |

||

Yes |

No |

|

Yes |

No |

|

|

|

|

|

You must:

Provide care only in the children’s home. Care may be in the provider’s home if he/she is one of the following relatives to the children: aunt, uncle, grandparent, sibling living outside of the home, great aunt, great uncle, or great grandparent.

Do you live with the child you are providing care for?

Yes

Yes

No

No

Care will be done in the children’s home. Go to Section 5. Care will be done in the provider’s home. Complete Section 4.

SECTION 4. PROVIDER COMPLETES IF THE CHILD CARE OCCURS IN YOUR HOME AND THE CHILD DOES NOT LIVE THERE

When care occurs in your home and the child does not live there, provide the department with the names, birth dates, and sex offender status of all persons, 16 years of age or older, who live with you:

NAME |

BIRTH DATE |

REGISTERED SEX OFFENDER |

|

1. |

|

Yes |

No |

|

|

||

|

|

|

|

2. |

|

Yes |

No |

|

|

||

|

|

|

|

3. |

|

Yes |

No |

|

|

||

|

|

|

|

4. |

|

Yes |

No |

|

|

||

|

|

|

|

Failure to report a sex offender in the provider’s home where care is provided will result in permanent disqualification of the provider.

WAC

I certify the persons listed above are the only individuals, 16 years of age or older, who reside with me. I understand these individuals will be subject to the same background inquiry process as me. I also understand if another person, 16 years of age or older, moves into my home while I am an authorized provider for WCCC, I must immediately notify the parent.

PROVIDER’S SIGNATURE

DATE

CCSP APPLICATION

DSHS

SECTION 5. TO BE COMPLETED BY FAMILY / FRIENDS / NEIGHBORS PROVIDER

Family / Friends / Neighbors providers can bill the state for no more than six (6) children at the same time.

ENTER DAYS, TIMES, AND AT WHAT RATES YOU WILL PROVIDE CARE FOR THE CHILD(REN).

|

|

|

THE USUAL |

CHOOSE ONE OF THE |

||

|

|

|

HOURLY |

TWO BOXES BELOW FOR |

||

CHILD’S FIRST AND LAST |

|

DAYS AND TIMES CARE WILL BE |

RATE I |

EACH CHILD. |

||

BIRTHDATE |

PROVIDED, SPECIFY BEFORE AND AFTER |

CHARGE TO |

MY RATE IS MORE |

I WANT MY |

||

NAME |

||||||

|

SCHOOL TIMES |

CARE FOR |

THAN THE STATE |

LESSER |

||

|

|

RATE FOR THIS CHILD. |

HOURLY |

|||

|

|

|

THE CHILD |

|||

|

|

|

I WANT THE MAXIMUM |

RATE FOR |

||

|

|

|

IS: |

STATE RATE. |

THIS CHILD. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT THE CALL CENTER FOR PAYMENT RATES FOR CHILDREN WITH SPECIAL NEEDS.

SECTION 6. TO BE READ AND SIGNED BY THE PROVIDER

Provider Responsibilities:

Complete a background check authorization. If you care for a child in your own home, also submit a completed background authorization for anyone 16 years of age or older who lives with you or moves into your home.

Report to DSHS within 24 hours any criminal convictions or pending charges against you or anyone 16 years or older in hour home if care is provided in your home.

Report to DSHS within 10 days if you change your legal name, address, or telephone number.

Provider Eligibility:

Be 18 years of age or older and a citizen or legal resident of the United States.

Provide care only in the children's home. Care may be provided in the provider's home only if he/she is one of the following relatives to the children; aunt, uncle, grandparent, sibling living outside the home, or a great aunt, great uncle or great grandparent.

Not have a disqualifying criminal background under WAC

Be physically and mentally healthy enough to meet all the needs of the child in care. If staff ask for it, the parent(s) must provide written proof you are physically and mentally healthy enough to be a safe child care provider.

Be able to care for the child without using physical punishment or mental abuse.

Provide care to the child in a safe home.

Be informed about basic health practices, prevention and control of infectious disease, and immunizations.

Provide constant care, supervision, and activities based on the developmental needs of the child.

Immediately report, to the parent, any notice of criminal convictions or pending charges against yourself or of anyone in the household, 16 years of age or older, when care occurs outside the child’s home.

Not be the child's biological, step or adoptive parent, legal guardian, adult acting in loco parentis, or the spouse of any of these individuals.

Attendance Records:

Records must:

O Show both days and times you cared for each child

O Have the parent/guardian sign and date the attendance records at least weekly O Be kept for five (5) years

O Be provided within 14 days if DSHS or DEL asks to see them

Billing:

You will not be paid for child care provided prior to the date all background check results are cleared by DSHS. If you provide care before your background check clears, the family is responsible for paying you.

You may bill DSHS for no more than six (6) children during the same hours of care.

Review daily attendance records in order to determine the number of units to bill based on a child’s attendance and authorization.

CCSP APPLICATION

DSHS

SECTION 6. CONTINUED

Service Employees International Union Local 925 (SEIU 925)

SEIU 925 represents Family/Friends/Neighbor providers. The Collective Bargaining Agreement outlines the provisions and benefits for SEIU 925 members. Members pay dues of 2 percent of the child services paid by the state. Dues are capped at a maximum of $50 per month.

Additional information is available in: A Guide for Family, Friends and Neighbors Child Care Providers located at: http://www.del.wa.gov/requirements/info/subsidy.aspx

I understand completing this form does not guarantee payment. If child care is authorized, I agree to child care payment at my usual rate or the State rate, whichever is less. I understand that payment cannot occur prior to the date the department receives all background check results. I have read and understand Section 6 of this form.

I declare under penalty of perjury the information given by me in this declaration is true, correct and complete to the best of my knowledge and realize willful falsification of this information by me may subject me to penalties as provided in Washington State Law. (RCW 74.08.055)

PROVIDER’S SIGNATURE

DATE

SECTION 7. TO BE READ AND SIGNED BY THE PARENT

I, as the parent/guardian, certify my Family / Friends / Neighbors provider meets the requirements listed above. I understand:

If I cannot make these assurances, payment will not be authorized.

Certain background information may disqualify my provider. It is my provider's responsibility to immediately tell me if they, or any person, 16 years of age or older living with the provider, when care occurs outside of the child's home are charged or convicted of any crime. I am then responsible to immediately tell my WCCC authorizing worker.

No payment will be made for care provided prior to the date all background check results are received.

I must notify CCSP staff, within five days, if this provider stops child care.

My provider will not be paid for the care of more than six children at the same time (same hours and days).

I may not have more than three Family/Friends/Neighbors providers authorized for WCCC payment at the same time during my eligibility period. Only one of these three providers can be a

As the employer of your Family/Friends/Neighbors provider, it is your responsibility to have your provider complete the USCIS Employment Eligibility Verification Form

O All U.S. employers must complete and retain a Form

O This includes citizens and noncitizens.

O On the form, the employer must examine the employment eligibility and identity document(s) an employee presents to determine whether the document(s) reasonably appear to be genuine and relate to the individual and record the document information on the Form

O The list of acceptable documents can be found on the last page of the form. The form and instructions can be found at:

If the living situation changes between you and the provider please report this immediately (this type of change can impact what tax document will be sent to the providers for their service).

I declare under penalty of perjury the information given by me in this declaration is true, correct and complete to the best of my knowledge and realize willful falsification of this information by me may subject me to penalties as provided in Washington State Law. (RCW 74.08.055)

PARENT/GUARDIAN’S SIGNATURE

CCSP APPLICATION

DSHS

DATE

Form Characteristics

| Fact Name | Description |

|---|---|

| Program Name | The DSHS 14 417 form is part of the Washington State Child Care Subsidy Programs (CCSP). |

| Eligibility Requirements | Applicants must provide proof of household income from the last three months, excluding cash assistance from TANF. |

| Provider Compliance | For Family/Friends/Neighbors providers, they must meet specific qualifications outlined in the application. |

| Governing Laws | The regulations governing this form are found in the Washington Administrative Code (WAC) 170-290-0012 and WAC 170-290-0160. |

| Signature Requirement | The application must be signed by the first parent or legal guardian and, if applicable, the second parent or guardian. |

Guidelines on Utilizing Dshs 14 417

Successfully filling out the DSHS 14 417 form is essential for receiving Child Care Subsidies. Follow these detailed steps to ensure your application is complete and accurate to avoid any delays in processing.

- Begin by entering the CCSP Application Date and Parent/Guardian Case Number at the top of the form.

- Provide your Applicant’s Name, Client ID Number, Birthdate, Address, Phone Number, City, State, and ZIP Code.

- Fill out the Applicant’s Ethnicity, Race, and Gender sections.

- List all Children for Whom You Are Responsible, including names, birthdates, gender, ethnicity, SSN (optional), and their relationship to you.

- Complete the Spouse or the Child's Other Parent/Guardian section with required details, including their name, birthdate, and relationship information.

- Indicate your Employer, WorkFirst Activity, or School Name with the corresponding address and phone number, and the Date Started.

- Specify how often you are paid and your Wage Per Pay Period.

- List your Monthly Sources of Earned/Unearned Income for all family members, providing copies of relevant documentation for the last three months.

- Fill out your and your spouse's Activity Schedule, indicating times. Specify the expected start date for child care and travel time to your activity.

- Provide the Children’s Activity Schedule including school and child care times, and note if you have a child with special needs.

- Sign and date the form in the Hearing Rights section under the Parent/Guardian’s declaration statement.

- If applicable, complete sections related to the Licensed Provider Information or Family/Friends/Neighbors Provider Information as needed.

Once you have completed the form, ensure all required documentation is attached before submission to avoid any processing delays. If any questions arise during this process, consider reaching out to the designated contact number for assistance.

What You Should Know About This Form

What is the DSHS 14 417 form?

The DSHS 14 417 form is an application for Child Care Subsidy Programs (CCSP) provided by the Washington State Department of Social and Health Services. This form helps determine eligibility for child care subsidies, which may assist families in covering child care costs while they work, attend school, or participate in other approved activities.

Who needs to complete the DSHS 14 417 form?

Any parent or guardian who seeks child care subsidies through the CCSP must complete the DSHS 14 417 form. It is designed for families living in specified counties and requires details about household income and child care arrangements.

What information do I need to provide with the DSHS 14 417 form?

You must include proof of your household's income for the last three months. This can include pay stubs, child support documents, or Social Security Income records. If you have a newly started job, a statement from your employer can be submitted in place of pay stubs. Additional documents regarding child support and information about your child care provider are also necessary.

What types of child care providers are eligible?

Eligible providers can be licensed child care centers or family child care homes. Family, friends, or neighbors can also qualify if they meet specific criteria outlined in the form. Each provider must present valid identification and any necessary documentation that verifies their ability to work in the U.S.

How will I know if my application is approved?

The Department of Social and Health Services will process your application and notify you of your eligibility status. If there are any missing documents or information, they will reach out to you to resolve the issues before a decision is made.

What happens if my application is incomplete?

If you submit the DSHS 14 417 form without all necessary information, it may delay approval for services and payment. It's important to double-check that all required sections are filled out correctly before sending your application.

Can I appeal a denial of assistance?

Yes, if you disagree with a denial or any action taken regarding your application, you can request a hearing. You must do this within specific time frames, either before the effective date of the action or within 90 days of receiving notice.

What is the significance of the 'Working Connections Child Care' section?

This section pertains specifically to those applying for subsidies for child care that occurs outside of traditional child care facilities, such as care provided by family, friends, or neighbors. Here, detailed information about the caregiver and their qualifications must be provided.

Common mistakes

When filling out the DSHS 14 417 form, applicants often make several common mistakes that can lead to delays in processing their Child Care Subsidy application. One such mistake is providing incomplete information. The form requires detailed data about household income, employment, and child care arrangements. Leaving blank sections or failing to include required documentation can significantly slow down the application process.

Another frequent error involves inaccuracies in reporting household income. Many applicants may overlook the need to provide verification for all income sources, including child support, social security, and any other relevant payments. It is important to remember that even sporadic income sources must be documented; failure to do so can jeopardize eligibility for subsidies.

Omitting necessary documentation poses another challenge. The form explicitly requests proof of the last three months of household income. Submitting the form without these documents, such as pay stubs or tax returns, will lead to a request for additional information, stalling the approval process.

Inaccurate personal information can frustrate the application process as well. Errors made in detailing names, dates of birth, or social security numbers can result in mismatches in the system. Applicants must meticulously check the accuracy of this information before submission to prevent unnecessary complications.

Many people also neglect to sign the form, which automatically invalidates the application. This oversight can seem trivial, but a missing signature halts the processing completely. Each applicant should take a moment to ensure that all required signatures are on the document.

Timing is critical. Applicants often fail to provide a start date for child care, which is mandatory. Without this date, processing may be stalled until the necessary information is received. Providing a clear child care start date helps the caseworker to evaluate the timing of eligibility accurately.

Failure to include details about child care providers is another common mistake. If care is being provided by family, friends, or neighbors, the form requires additional documentation confirming the provider's eligibility. Skipping this step can result in delays or a denial of benefits.

Some applicants assume incorrect information about additional income that does not need to be declared. This misunderstanding can lead to disputes about eligibility later. It is important to clarify which income sources are relevant prior to submitting the application.

Finally, neglecting to keep copies of submitted documents can cause headaches down the road. If there are questions regarding what was submitted, having a copy can clarify matters quickly. Maintain organized records for all applications and submissions as a best practice.

Documents used along the form

The DSHS 14 417 form is essential for parents or guardians seeking financial assistance through the Child Care Subsidy Programs (CCSP). To successfully complete your application, there are various supplementary forms and documents that may be necessary. Each of these documents plays a role in verifying information or ensuring compliance with program requirements. Below is a list of forms and documents often required alongside the DSHS 14 417.

- WAC 170-290 Background Authorization (DSHS 09-653): This form is needed to conduct a background check for childcare providers to ensure they meet safety requirements.

- Proof of Income: This includes pay stubs, documentation of child support, or any other income verification, which may need to show the last three months of income.

- Child Support Verification: If applicable, parents must provide proof of court-ordered child support payments to determine financial eligibility.

- Employment Verification Form: This form documents current employment details, including start date and earning potential, especially necessary for new employees without pay stubs.

- Provider Identification: Providers must submit a copy of their government-issued photo ID and Social Security card to validate their identity.

- Proof of Legal Work Status: Documentation like a Green Card or Employment Authorization Document (EAD) is required to verify that providers can legally work in the U.S.

- Child Care Provider Application: This form gathers necessary information about the childcare provider, which helps in determining their suitability for the program.

- Children's Activity Schedule: A detailed schedule that outlines the days and times the children will be in care, helping to coordinate care with parental work or school.

- Child Care Provider Rate Schedule: Providers need to indicate their daily rates and any other applicable fees to establish the financial structure of childcare services.

- Child with Special Needs Documentation: If applicable, this provides specific information about any additional needs and may affect payment rates for care.

Each of these documents is important for demonstrating eligibility and ensuring compliance with childcare subsidy requirements. Having all the necessary forms ready can facilitate a smoother application process and help families receive the assistance they need.

Similar forms

- DSHS 14-001 Form: This form is used for applying for various state assistance programs. Similar to the DSHS 14 417, it requires detailed income and household information to assess eligibility for services.

- DSHS 14-400 Form: This document is related to food assistance programs. Both forms require proof of income and household details, ensuring that applicants qualify based on their economic situation.

- DSHS 14-005 Form: This application is designed for medical assistance programs. Like the DSHS 14 417, it also collects information about income and the number of household members in order to determine eligibility for healthcare services.

- DSHS 14-434 Form: This form is for housing assistance applications. It shares similarities with the DSHS 14 417 in requiring documentation of income and family structure to evaluate support needs.

- DSHS 14-021 Form: This form is utilized for applying for child support modifications. Both the DSHS 14 417 and this form necessitate details about household income and existing financial obligations to determine eligibility for adjustments.

- DSHS 14-020 Form: Similar to the DSHS 14 417, it focuses on applying for energy assistance through the state. It involves providing proof of income and household information to evaluate eligibility for utility bill support.

Dos and Don'ts

When filling out the DSHS 14 417 form, there are important guidelines to follow. Here is a simple list of what you should and shouldn't do.

- Do read all instructions carefully before starting the form.

- Do provide clear and legible information in every section.

- Do include proof of income from all household members for the last three months.

- Do ensure that background checks for child care providers are completed before any payments are made.

- Don’t leave any sections blank; incomplete information may delay your application.

- Don’t submit false information; it can lead to penalties.

- Don't forget to sign and date the application form before submission.

- Don’t include proof of income from cash assistance (TANF) as it is not required.

Misconceptions

- Misconception 1: The DSHS 14 417 form is only for parents with low income.

- Misconception 2: I need to provide proof of all my household income, regardless of its source.

- Misconception 3: The DSHS will automatically approve my application if I submit all documents.

- Misconception 4: All child care providers are eligible under the subsidy program.

- Misconception 5: I can submit the application without completing all sections fully.

- Misconception 6: It is acceptable to submit my application after the child care has started.

- Misconception 7: I can decide not to provide my social security number on the form.

- Misconception 8: The form is available only in a paper format.

- Misconception 9: All DSHS processes are slow and unresponsive.

This form is applicable to a variety of families seeking child care subsidies, not just for those with low income. Various eligibility criteria exist.

You do not need to report cash assistance from the state, such as TANF. Focus on non-cash sources and specific types of income only.

Submitting documents does not guarantee approval. A thorough review of your application will still take place to determine eligibility.

The child care provider must meet specific qualifications outlined in the application. Not all providers qualify for this program.

Submitting incomplete sections may result in delays. Ensure that all parts of the form are filled out accurately and completely.

While you can apply after care has begun, payment will only be authorized once all requirements, including background checks, are fulfilled.

While it's listed as optional, providing your SSN can help streamline the application process and resolve any discrepancies more easily.

Electronic versions of the DSHS 14 417 form may be accessible for easier submission. Check the DSHS website for details on digital forms.

While some wait times may occur, many applicants find the staff prompt and helpful. Don’t hesitate to reach out if you have questions.

Key takeaways

Filling out the DSHS 14 417 form is essential for families seeking assistance through the Child Care Subsidy Programs. Here are some key takeaways to ensure a smooth application process:

- Complete all required sections: Fill out the application completely, even if you are participating in a WorkFirst activity. Missing information can lead to delays in processing.

- Provide income verification: You need to submit proof of your household's income for the last three months. Acceptable documents include pay stubs, Social Security income statements, or a letter from your employer if you are newly hired.

- Document child support: If applicable, provide proof of child support payments made and any court-ordered agreements you may have.

- Verify provider qualifications: For Family/Friends/Neighbors care, ensure your provider meets all qualifications and submit the necessary documentation, including identification and proof of legal residency.

- Understand the appeal process: If you disagree with any decisions made regarding your application, you have the right to request a hearing. Pay attention to deadlines for filing your request.

- Timing matters: The exact start date for child care needs to be noted. It's important to communicate how long it takes to travel to your activities from the child care location.

Following these guidelines will help streamline your application process and increase the chances of successfully receiving the support you need for child care.

Browse Other Templates

Dl92 - Contact information for TDLR is provided on the form for further inquiries.

Free Printable Child Care Receipt Template - Parents can use this receipt for financial planning and tax purposes.

Ohio Real Estate Disclosure Form - The form serves as a critical communication document between buyers and sellers in Ohio residential real estate transactions.