Fill Out Your Dtf 4 1 Form

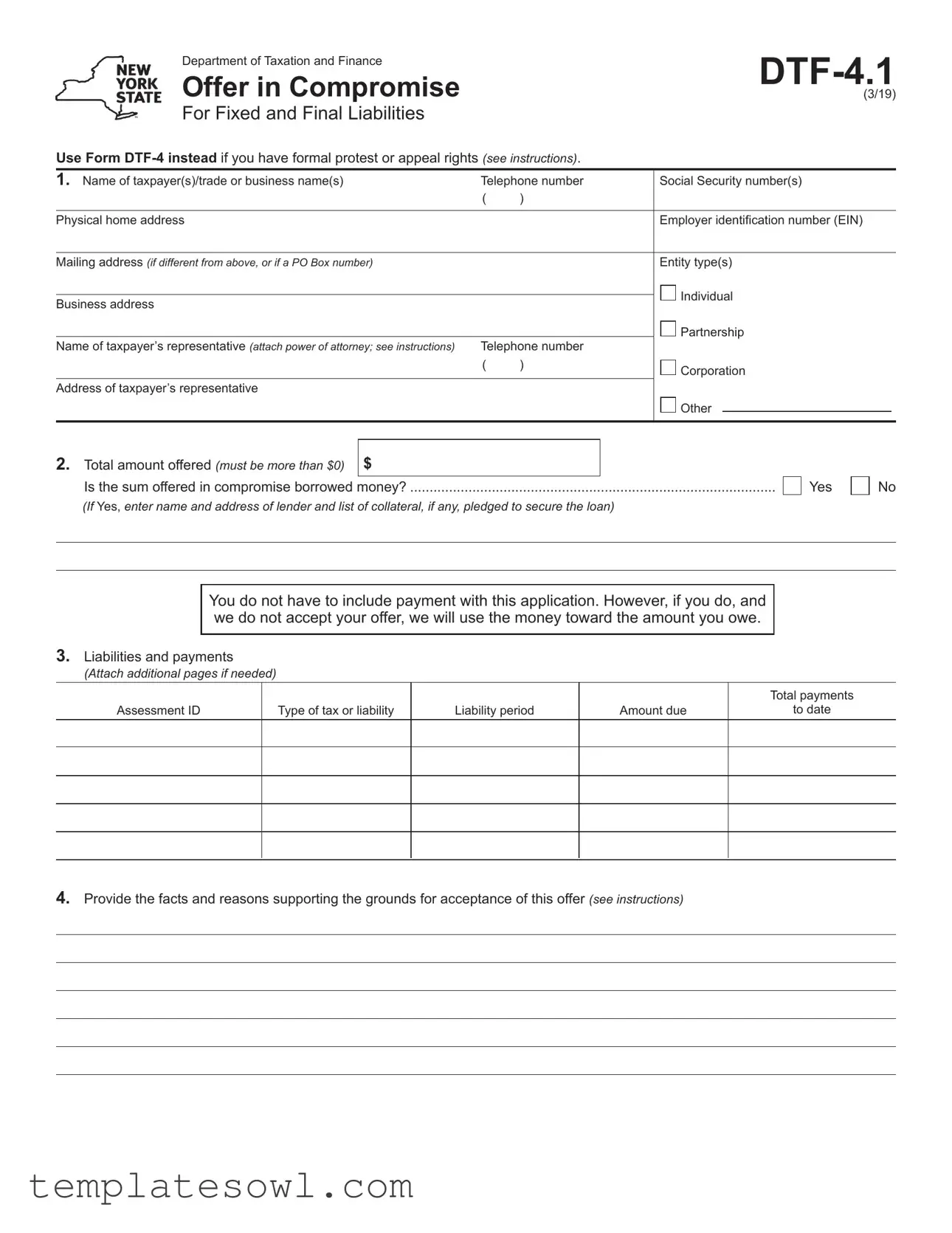

The DTF-4.1 form, also known as the Offer in Compromise for Fixed and Final Liabilities, serves a critical purpose for taxpayers in New York State facing financial distress. It allows individuals and businesses to propose a settlement for their tax liabilities that they may not be able to pay in full. This form is crucial for those who do not have rights to formal protest or appeal. The completion of the DTF-4.1 involves providing essential taxpayer information, including names, Social Security numbers, and contact details. It also requires taxpayers to specify the amount they wish to offer, which must be greater than zero, and disclose whether those funds come from borrowed money. Additionally, taxpayers must list their unpaid tax liabilities and provide supporting facts and reasons for their requests. Conditions tied to acceptance are determined by the Commissioner of Taxation and Finance and include agreements about how payments will be applied, the consequences of default, and potential waivers of certain rights over liabilities. The form emphasizes the importance of compliance with all tax obligations and potential collateral agreements. Overall, understanding and accurately filling out the DTF-4.1 can provide a lifeline to those struggling with overwhelming tax debts, offering a structured path toward financial relief.

Dtf 4 1 Example

Department of Taxation and Finance |

|

|

|

||

|

|

|

|

|

|

Offer in Compromise |

|

|

(3/19) |

||

For Fixed and Final Liabilities |

|

|

|

|

|

Use Form |

|

|

|

||

1. Name of taxpayer(s)/trade or business name(s) |

Telephone number |

Social Security number(s) |

|||

|

( |

) |

|

|

|

|

|

|

|

|

|

Physical home address |

|

|

Employer identification number (EIN) |

||

|

|

|

|

|

|

Mailing address (if different from above, or if a PO Box number) |

|

|

Entity type(s) |

||

|

|

|

Individual |

||

Business address |

|

|

|||

|

|

|

|

|

|

|

|

|

Partnership |

||

Name of taxpayer’s representative (attach power of attorney; see instructions) |

Telephone number |

|

|

|

|

|

( |

) |

Corporation |

||

|

|

|

|||

Address of taxpayer’s representative |

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

||

|

|

|

|

|

|

2. Total amount offered (must be more than $0) |

$ |

Is the sum offered in compromise borrowed money?...............................................................................................

(If Yes, enter name and address of lender and list of collateral, if any, pledged to secure the loan)

Yes

No

You do not have to include payment with this application. However, if you do, and we do not accept your offer, we will use the money toward the amount you owe.

3.Liabilities and payments

(Attach additional pages if needed)

Assessment ID

Type of tax or liability

Liability period

Amount due

Total payments

to date

4.Provide the facts and reasons supporting the grounds for acceptance of this offer (see instructions)

Page 2 of 4

5.Conditions (please read)

5A. It is agreed (a) that the Commissioner of Taxation and Finance (“the Commissioner”) shall keep all payments, sums collected, and other credits made to the liabilities asserted for the periods covered by this offer, and

(b)that the Commissioner shall keep any and all amounts to which taxpayers may be entitled under the Tax Law, due through overpayments of any tax or other liability, offsets, credits, or funds payable to the taxpayers that are available to New York State (for example, lottery offsets and unclaimed funds), for periods ending before, or within, or as of the end of the calendar year in which this offer is accepted (and which are not in excess

of the difference between the liability sought to be compromised and the amount offered).

5B. Any payments made under the terms of this offer shall be applied, unless otherwise agreed in writing, to the liabilities of the taxpayer(s) in the order determined upon by the Commissioner.

5C. It is further agreed and consented to by the taxpayer(s)

that upon notice of the acceptance of this offer, the taxpayer(s) shall have no right to contest in any court, or otherwise, at any time, the amount of the liability sought to be compromised. The Tax Department will not compromise any liability, nor satisfy any warrant, until all obligations of each taxpayer under the compromise agreement, or any collateral agreement, are completely performed and satisfied. In the event of a default by any taxpayer on the compromise agreement, or on any collateral agreement, or if this is a deferred payment offer and there is a default in payment of any installment of principal or interest due under its terms, or a default on any other term that the taxpayer(s) may have agreed upon with the Commissioner for acceptance of the deferred payments, New York State, at the option of the Commissioner or an official designated by him or her, may (a) proceed immediately by suit to collect the entire unpaid balance of the offer; or (b) proceed immediately by suit to collect as liquidated damages an amount equal to the liability sought to be compromised, minus any payments already received under the terms of the offer,

with interest on the unpaid balance at the annual rate(s) as established under the Tax Law and compounded from the date of default; or (c) disregard the amount of the offer and apply all amounts previously deposited under the offer against the amount of the liability sought to be compromised, immediately and without further notice file a warrant thereon and proceed to collect the balance of the original liability.

5D. It is understood that this offer will be considered and acted upon in due course and does not relieve the taxpayer(s) from the liability sought to be compromised, unless and until the offer is accepted in writing by the Commissioner, and there has been full compliance with the terms of the offer and any collateral agreements.

5E. Taxpayers waive the benefit of any statute of limitations applicable to the assessment and collection of liabilities sought to be compromised, and agree to the suspension of the running of the statutory period of limitations on assessment and collection for the period during which this offer is pending, and for one year thereafter. For these purposes, the offer shall be deemed pending from the date of acceptance of the waiver of the statutory period of limitations by an authorized Tax Department official, until the date on which the offer is formally accepted, rejected, withdrawn in writing, or, if necessary, approved by a justice of the Supreme Court.

5F. Taxpayers waive any statute of limitations defenses to the assessment and collection of the liability sought to be compromised, and further waive any statute of limitations defenses against the issuance of new assessment(s) for the compromised liability in the event any taxpayer fails to comply with the terms of the offer in compromise.

5G. Taxpayers also agree to forfeit any current capital loss or net operating loss credits taken on any future New York State return.

5H. Taxpayers agree that during the

6. Signatures

Under penalties of perjury, I declare that I have examined this application, including accompanying documents, and to the best of my knowledge it is true, correct, and complete. I also affirm that I have read, understand, and agree to the terms and conditions above.

I authorize the New York State Department of Taxation and Finance (DTF) to contact certain third parties, including but not limited to financial institutions and consumer credit reporting agencies, and to obtain my consumer credit report for the purpose of verifying the information I provided to DTF for determining my eligibility for the

Pursuant to Tax Law section 171, subdivision fifteenth, the undersigned submits this offer to the Commissioner to compromise any liabilities.

Date |

|

Signature of taxpayer(s) |

|

|

|

Date |

Signature of taxpayer(s) |

|

Corporations: See instructions on page 4, Section 6. |

|

|

Instructions

Use the correct form

•Use Form

You do not have these rights if you:

•owe tax, interest, or penalties due to: a math or clerical error on a return, a change the IRS made to your federal return, or your failure to pay on time the tax that you reported due on your return, or

•received a Statement of Proposed Audit Changes.

Your liabilities are fixed and final, and may be established by a valid warrant.

•Use Form

Considerations for using Form

You must be in compliance with all paying and filing requirements for periods not included in your offer. This includes estimated payments, tax deposits, and similar requirements.

Generally, we may consider offers in compromise from the following taxpayers:

•individuals and businesses discharged from bankruptcy

•individuals and businesses that are insolvent (liabilities, including tax liabilities, exceed the fair market value of assets)

•individuals (not businesses) for whom paying the debt in full would cause undue economic hardship

Submitting Form

Also, submitting Form

We may require a written collateral agreement or other security, to protect the Tax Department’s interest.

Generally, a taxpayer may make only one offer in compromise for a particular liability for a particular period.

Basis for compromise

To be eligible, you must show that you have been discharged in bankruptcy, you are insolvent, or (for individuals only) that collection in full would cause you undue economic hardship. You are considered insolvent if all your liabilities (including your tax debt) exceed the fair market value of your assets.

Undue economic hardship generally means that you are unable to pay reasonable basic living expenses, which are those providing for the health, welfare, and production of income for your family. We use IRS standards to help determine allowable living expenses.

We also consider other factors, including the taxpayer’s age, employment status, and employment history; any inability to earn income because of

All offers must include:

•a completed Form

•your last three federal income tax returns,

•a credit report less than 30 days old, and

•your last 12 months of statements from your bank or financial institution.

If we accept your offer

If the Tax Department accepts your offer, and you satisfy all the terms of the offer (for example, you paid in full the offer and complied with the terms of any collateral agreement), we will eliminate the remaining balance of your liabilities included in this offer, satisfying any warrants.

Taxpayer’s representative

If you have a representative, you must include a completed power of attorney. We recommend

Estates

When Form

Specific instructions

Section 1. Taxpayer information

Enter the full name and phone number of the taxpayer(s). If the taxpayer is a business, enter the name of the business or its trade name (or both). If this is a joint income tax liability, both spouses may submit one application and enter both names. However, for any other type of joint liability, such as a partnership, each must submit separate

Enter the taxpayer’s Social Security number, or, for a business, the EIN.

Enter the taxpayer’s physical home address, mailing address if different or a PO Box, and business address (if applicable).

Mark an X in a box to indicate entity type(s). If Other, fill in the blank.

If the taxpayer has a representative, enter the name, phone number, and address of the representative, and attach a completed power of attorney.

Section 2. Amount offered

Enter the total amount you intend to offer. You must offer more than $0, and you cannot include any amounts previously paid or collected against the liabilities.

Page 4 of 4

The amount must be a figure we realistically expect we could collect within a reasonable period of time. It is based on the total value of assets and the amount we could expect to collect from anticipated future income. Otherwise, the amount proposed must be justified by information you submit.

Mark an X in the Yes box if all or part of the money you are offering for the compromise is borrowed. If Yes, enter the name and address of the source of the borrowed money, and include a list of any collateral you have pledged to secure the loan.

Section 3. Liabilities and payments

List all unpaid liabilities administered by the Tax Department you wish to compromise. You may not submit an offer for a tax year or period that has not been assessed. You can view all your unpaid liabilities on your Online Services account. If you do not have an Online Services account, you can visit our website at www.tax.ny.gov and create one.

In the Type of tax or liability column, indicate whether the notice is for income, sales, withholding, or some other tax or liability.

If, for a particular liability, you are both personally liable and jointly liable with another individual or separate entity such as a corporation, you must submit your own Form

Section 4. Grounds for the offer

Provide all the facts and reasons supporting the grounds for acceptance of your offer. If needed, attach additional pages, and copies of appropriate documents, to fully and completely explain the details of your offer. For individuals only, if your offer is based on undue economic hardship, explain your situation and provide supporting documentation.

Section 5. Conditions

By submitting this application, you have read, understand, and agree to the terms and conditions in this section.

Section 6. Signatures

Sign and date. If you and your spouse seek to compromise a joint income tax liability, both must sign.

Corporations: Enter the corporate name. An authorized corporate signatory must sign. Print the signatory’s name and title immediately below the signature.

Mailing your Form

Along with your completed Form

Mail all documents to:

NYS TAX DEPARTMENT

CED OFFER IN COMPROMISE UNIT

W A HARRIMAN CAMPUS

ALBANY NY

Private delivery services – If not using U.S. Mail, see Publication 55, Designated Private Delivery Services.

More information

These instructions are intended only as a guide for preparing Form

For questions, call

Checklist

Is

If you have a representative, did you enter their name, address and phone number? Did you include a completed power of attorney?

Did you enter an offer of more than $0?

If your offer includes borrowed money, did you enter the lender’s name and address, and collateral, if any?

Did you include copies of all appropriate documents to support your offer? If you fail to submit all required statements and documents, we will not process your application.

Did you sign and date the bottom of page 2?

Did you include a completed Form

your last three federal income tax returns (if you are not required to file, include an explanation),

a credit report less than 30 days old, and

your last 12 months of statements from your bank or financial institution?

Are you compliant with all of your New York State tax filing requirements?

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used to submit an Offer in Compromise for fixed and final tax liabilities. |

| Use Case | Use DTF-4.1 if you lack formal protest or appeal rights related to your tax liabilities. |

| Borrowed Money | If the amount offered is borrowed, you must provide the lender's details and any collateral. |

| Required Information | Provide taxpayer identification such as Social Security numbers, physical address, and entity type. |

| Submission Requirements | Include a completed Form DTF-5 and relevant financial documentation when submitting DTF-4.1. |

| Acceptance Conditions | Acceptance of the offer must be in writing; liabilities remain until the terms are fully met. |

| Statute of Limitations | By submitting this offer, taxpayers waive certain statute of limitations defenses related to their liabilities. |

| Compliance Requirement | Taxpayers must comply with all New York State Tax Laws for five years after acceptance of the offer. |

Guidelines on Utilizing Dtf 4 1

Completing the DTF-4.1 form is essential for taxpayers looking to compromise their tax liabilities. Once you've gathered necessary information, follow the steps below to ensure accuracy and completeness when submitting your offer.

- Gather your personal and business information, including the names, Social Security numbers (or EIN for businesses), physical addresses, and telephone numbers of all taxpayers involved.

- Fill in the total amount you are offering to compromise, ensuring it is greater than $0.

- If any part of your offered amount is borrowed, check "Yes," and provide the lender's name, address, and details of any collateral.

- List all unpaid liabilities that you want to compromise, including the assessment ID, type of tax, liability period, and amount due.

- Provide a detailed explanation and reasons for your offer, attaching any additional pages or documents if necessary.

- Read the conditions carefully and indicate your agreement by signing and dating the form. If it's a joint liability, both parties must sign.

- Collect and attach all necessary supporting documents, including your completed Form DTF-5 and copies of your last three federal income tax returns, a credit report, and the last 12 months of bank statements.

- Verify your compliance with all New York State tax filing requirements before submission to avoid processing delays.

- Mail your completed form and attachments to the NYS Tax Department at the provided address. If using a private delivery service, check Publication 55 for guidance.

What You Should Know About This Form

1. What is the purpose of the DTF-4.1 form?

The DTF-4.1 form is used to submit an offer in compromise for fixed and final tax liabilities in New York State. Taxpayers can use this form when they do not have formal protest or appeal rights regarding the tax liabilities they owe. By filing this form, taxpayers are requesting the Tax Department to settle their debts for less than the full amount due.

2. When should I use the DTF-4 form instead of the DTF-4.1?

Use the DTF-4 form if you have formal protest or appeal rights for your liabilities. For instance, if your liabilities stem from a math error or a change made by the IRS to your federal return, the DTF-4 is the correct choice. If your liabilities are fixed and final without the opportunity for appeal, then the DTF-4.1 is appropriate.

3. Who is eligible to file for an offer in compromise using this form?

Eligibility for filing the DTF-4.1 includes individuals and businesses that have been discharged from bankruptcy, individuals and businesses that are insolvent (meaning their liabilities exceed the value of their assets), or individuals who would face undue economic hardship if required to pay their tax debt in full.

4. What information do I need to provide on the form?

The form requires details such as the taxpayer's name, social security number or employer identification number (EIN), physical address, and the total amount offered for compromise. Additionally, a comprehensive list of liabilities must be included, along with the reasons supporting your offer. If applicable, include documentation demonstrating your financial situation.

5. Do I need to submit any additional documents with my application?

Yes, you must attach a completed Form DTF-5, Statement of Financial Condition, along with copies of your last three federal income tax returns, a credit report dated within the last 30 days, and the last 12 months of bank statements. These documents help verify your financial status and support your request for compromise.

6. What happens if my offer is accepted?

If the Tax Department accepts your offer, the remaining balance of the liabilities included in the offer will be eliminated, provided you comply with all terms of the offer. This means you must fulfill any agreed payments and conditions to satisfy your debts officially. Acceptance does not happen until you receive written approval from the Tax Commissioner.

7. How is my offer amount evaluated?

The amount you offer must realistically reflect what the Tax Department believes they could collect within a reasonable time frame. Factors include the total value of your assets and anticipated future income. Make sure the proposed amount is justified based on your financial conditions.

8. Can I submit multiple offers in compromise for the same debt?

Generally, a taxpayer can only submit one offer in compromise for a specific liability and tax period. If your offer is accepted, it will forgive the debt only for the taxpayer whose offer has been approved. If other parties are involved in the liability, they will need to submit their own applications.

9. What if my financial circumstances change while my offer is pending?

While your offer is pending, it is critical to remain compliant with all filing and payment requirements for any tax periods not included in your offer. If your financial situation changes, you may need to inform the Tax Department, as this could affect your eligibility or the terms of the offer.

10. Where should I send my completed form and documents?

You must mail your completed DTF-4.1 form, along with Form DTF-5 and all supporting documents, to the New York State Tax Department at the address provided in the form instructions. Make sure to use a secure mailing method to ensure your documents arrive safely.

Common mistakes

Filling out the DTF-4.1 form can be daunting. Many people make simple mistakes that can delay the process or even lead to rejection of their offer. Here are some common pitfalls to avoid.

One frequent error is using the incorrect form. Applicants should ensure they are completing the DTF-4.1 form specifically for fixed and final liabilities. If you have formal protest or appeal rights, you should use the DTF-4 form instead. It’s essential to verify your situation before proceeding.

Another mistake involves entering personal information. Many individuals don’t provide complete or accurate details, like their Social Security number or telephone number. Double-check that all taxpayer information, including names and addresses, is filled out correctly. This minor oversight can cause major delays in processing.

People often overlook the requirement for the total amount offered. The offer must be more than $0, and it cannot include prior payments that have already been made towards the liabilities. Being clear about the amount you are willing to pay, while backing it up with supporting financial details, is critical.

Additionally, failing to disclose whether borrowed money makes up the offered settlement can be problematic. If the funds are borrowed, applicants need to provide the lender's name and address, along with details of any collateral pledged. Be transparent about the source of the funds to avoid complications later.

Not providing adequate grounds to support the offer also causes issues. Applicants should outline the facts and reasoning that justify the compromise offer. If your offer is based on economic hardship, thorough documentation is necessary to explain your situation clearly.

Furthermore, many fail to sign the form or forget to include a date. Signatures are crucial because they attest to the truthfulness of the information provided. Failing to sign could lead to outright rejection.

Lastly, neglecting to include necessary supporting documentation is a major error. Along with Form DTF-4.1, include completed Form DTF-5 and any required financial statements and tax returns. The more complete your submission is, the smoother the process will likely be.

By being mindful of these common mistakes, you can increase your chances of having your offer processed quickly and effectively. Take the time to review your form and ensure everything is accurate before submitting it.

Documents used along the form

The DTF-4.1 form is an essential part of the Offer in Compromise process, which allows taxpayers in New York to settle their tax liabilities for less than the amount owed. In order to ensure a smooth experience, several additional documents typically accompany the DTF-4.1 form. Below is a description of up to nine other forms and documents you may encounter in this process.

- Form DTF-4: This form is used for offers in compromise related to liabilities that are not fixed and final. If taxpayers have formal protest or appeal rights, they should use DTF-4 instead of DTF-4.1.

- Form DTF-5: This document is a Statement of Financial Condition. It details a taxpayer's financial status and is required with the DTF-4.1 submission, demonstrating eligibility for compromise.

- POA-1, Power of Attorney: When a representative is involved in the Offer in Compromise, this form delegates authority to that representative, allowing them to act on behalf of the taxpayer during the application process.

- Form ET-14: Used specifically for estates, this form is an Estate Tax Power of Attorney which allows an executor or administrator to submit offers on behalf of the deceased taxpayer.

- Tax Returns: Including copies of the last three federal income tax returns is mandatory. These documents enable the tax authorities to assess the taxpayer’s financial situation thoroughly.

- Credit Report: A copy of a credit report dated within the last 30 days is necessary for assessing the taxpayer’s current credit standing and financial obligations.

- Bank Statements: The last 12 months of bank statements must be submitted. This helps the Tax Department evaluate cash flow and overall financial health.

- Collateral Agreement: If the offer in compromise is financed through borrowed money, a detailed collateral agreement might be needed to protect the interests of the Tax Department.

- Supporting Documentation: Additional documentation that provides facts and evidence supporting the offer. This could include information regarding financial hardships or stability.

By preparing these documents thoroughly and accurately, taxpayers can streamline the process of submitting an Offer in Compromise. This diligence not only minimizes potential delays but helps set realistic expectations about the approach toward resolving tax liabilities. Understanding the role of each form is crucial for a successful application process.

Similar forms

The DTF-4.1 form serves a specific purpose in the realm of tax liabilities. There are several other documents with similar functions or characteristics. Here's a breakdown of six documents that relate closely to the DTF-4.1 form:

- Form DTF-4: This form is used for offers in compromise but is applicable to liabilities that are not fixed and final. While the DTF-4.1 targets fixed and finalized debts, DTF-4 permits taxpayers to address liabilities that still have room for appeal or protest.

- Form 656: Utilized in federal tax matters, Form 656 allows taxpayers to propose an offer in compromise to the IRS. Similar to the DTF-4.1, this form requires detailed financial information and justification for the offer, although it is specific to federal income taxes.

- Form 843: This document is filed when a taxpayer seeks a refund or abatement of taxes paid or proposed taxes. The process here doesn’t demand an offer in compromise; however, both forms address relief from tax burdens, albeit in different contexts.

- Form 1127: When a taxpayer is experiencing financial difficulty, Form 1127 can be filed to request an extension of time for payment of tax. Similar to DTF-4.1, this form requires evidence of financial hardship, offering taxpayers another avenue to address tax-related issues.

- Form 9465: Taxpayers who cannot pay their tax liabilities in full can use this form to create an Installment Agreement with the IRS. Like the DTF-4.1, it focuses on resolving tax problems, though it provides an extended payment plan rather than a settlement.

- Form ET-14: This form serves as a Power of Attorney for Estate Tax matters in New York. It allows a designated representative to act on behalf of the taxpayer, ensuring that, like the DTF-4.1, proper authorization is preserved when negotiating compromised liabilities.

These documents, much like the DTF-4.1 form, share the common goal of assisting taxpayers in managing and resolving their tax obligations.

Dos and Don'ts

Dos and Don'ts When Filling Out the DTF-4.1 Form

- Do make sure you are using the DTF-4.1 form specifically for fixed and final liabilities.

- Do provide accurate and complete personal and business information, including Social Security and Employer Identification Numbers.

- Do offer an amount greater than $0, and ensure that it is backed by realistic financial documentation.

- Do include all necessary supporting documents, such as your last three federal income tax returns and a recent credit report.

- Do sign and date the form, ensuring that all taxpayers involved provide their signatures if applicable.

- Don't attempt to submit the form without understanding the terms and conditions associated with your offer.

- Don't include any amounts already collected or previously paid against your liabilities in your offer.

- Don't forget to include the completed Form DTF-5 with your application, as it is a required component.

Misconceptions

Here are seven misconceptions regarding the DTF-4.1 form, which focuses on offers in compromise for fixed and final liabilities.

-

Misconception 1: The DTF-4.1 form is for anyone who owes back taxes.

In reality, it is only for taxpayers without formal protest or appeal rights. If you have rights due to errors or changes by the IRS, you must use a different form (DTF-4).

-

Misconception 2: Submitting the DTF-4.1 form automatically stops collection actions.

This is incorrect. Filing does not halt collections or the accrual of interest and penalties until the offer is accepted.

-

Misconception 3: All offers in compromise are guaranteed to be accepted.

This assumption is false. The offer must meet specific eligibility criteria, which are carefully reviewed by the Tax Department.

-

Misconception 4: You need to make a payment when submitting the DTF-4.1 form.

This is not true. You do not have to include a payment, although any funds submitted will be applied to your total liability if the offer isn't accepted.

-

Misconception 5: Any taxpayer can qualify for an offer based on hardship.

Only individuals may claim undue economic hardship, and specific conditions must be met to establish this status.

-

Misconception 6: Once the offer is submitted, it remains pending indefinitely.

This is misleading. The offer is considered pending for a specific time frame, after which it may be formally accepted or rejected.

-

Misconception 7: You can submit multiple offers for the same liability period.

This is incorrect. Generally, a taxpayer is allowed only one offer for a specific liability during a designated period.

Key takeaways

1. Form DTF-4.1 is specifically for taxpayers with fixed and final liabilities. If you have formal protest or appeal rights, you need to use Form DTF-4 instead.

2. The total amount offered must be greater than $0. You can include borrowed money, but you must disclose the lender's details and any collateral.

3. Payment is not required at the time of application; however, if submitted and the offer is not accepted, the payment will be applied to the outstanding liabilities.

4. Submit all unpaid liabilities you want to compromise. Ensure all liabilities included have been assessed and are documented properly.

5. Provide clear facts and reasons for your offer. Attach supporting documentation if necessary to strengthen your case for acceptance.

6. Taxpayers must comply with all New York State tax obligations after the acceptance of the offer. This includes filing tax returns and paying all required taxes for the next five years.

7. Missing documents or failing to complete the form accurately can lead to the application being rejected. Include the required Form DTF-5 along with your federal returns and financial statements.

Browse Other Templates

Maryland Handgun Registration - Verify the application details with care before submission to ensure compliance.

Hdo Officer Full Form - A signature from an authorized agent of the organization is required.

California Proposition 47 - The potential for lower recidivism rates lies in the improved support systems established by the initiative.