Fill Out Your Dtf 803 Form

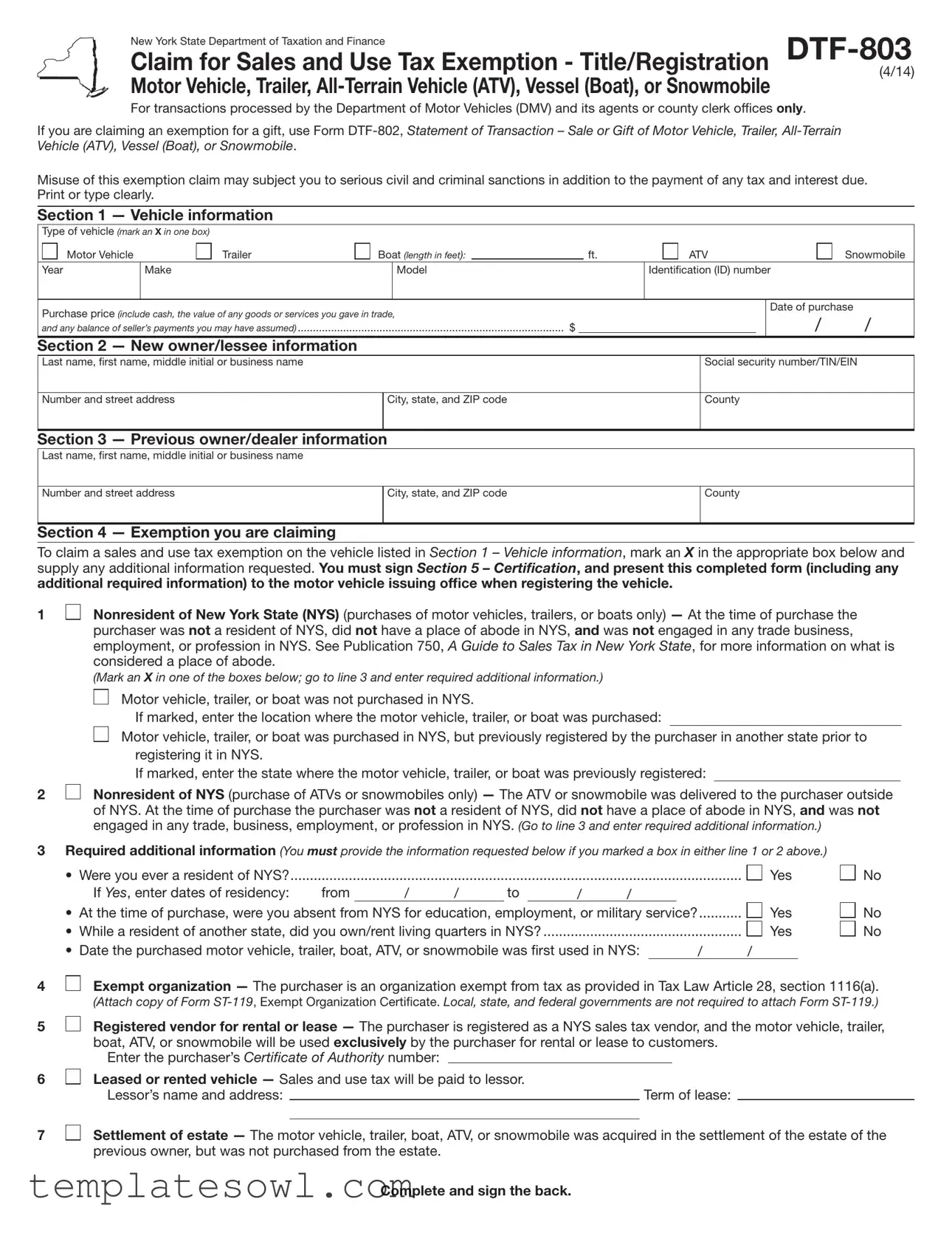

The DTF 803 form, officially known as the Claim for Sales and Use Tax Exemption, serves an essential purpose for individuals and organizations looking to exempt themselves from sales and use tax when acquiring specific types of vehicles in New York State. This form applies to a variety of vehicles, including motor vehicles, trailers, all-terrain vehicles (ATVs), vessels (boats), and snowmobiles. Designed for transactions managed by the Department of Motor Vehicles (DMV) and its designated agents, the form facilitates exemptions based on various criteria, such as the purchaser's residency status at the time of purchase or the intended use of the vehicle. Notably, this form cannot be used for gift transactions; for such exemptions, applicants must utilize the Form DTF 802. When filling out the DTF 803 form, clear and accurate information is crucial. Sections require details on the vehicle type, ownership, and the specific exemption being claimed, along with signatures and certifications. Failing to adhere to the proper guidelines might result in significant penalties and interest charges. The form emphasizes the obligation to provide truthful information, reinforcing that misuse could lead to civil and criminal sanctions. Through structured sections and specific instructions, the DTF 803 ensures that the process for claiming tax exemptions is straightforward while also underpinning the importance of compliance with New York tax laws.

Dtf 803 Example

New York State Department of Taxation and Finance |

|

Claim for Sales and Use Tax Exemption - Title/Registration |

|

|

(4/14) |

Motor Vehicle, Trailer,

For transactions processed by the Department of Motor Vehicles (DMV) and its agents or county clerk ofices only.

If you are claiming an exemption for a gift, use Form

Misuse of this exemption claim may subject you to serious civil and criminal sanctions in addition to the payment of any tax and interest due. Print or type clearly.

Section 1 — Vehicle information

Type of vehicle (mark an X in one box) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Motor Vehicle |

Trailer |

Boat (length in feet): |

|

|

|

ft. |

ATV |

Snowmobile |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

Make |

|

|

|

Model |

|

|

|

Identiication (ID) number |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase price (include cash, the value of any goods or services you gave in trade, |

|

|

|

|

|

|

Date of purchase |

||||||||

|

|

|

|

|

|

/ |

/ |

||||||||

and any balance of seller’s payments you may have assumed) |

|

|

|

$ |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 2 |

— New owner/lessee information |

|

|

|

|

|

|

|

|

|

|

|

|

||

Last name, irst name, middle initial or business name |

|

|

|

|

|

|

|

|

Social security number/TIN/EIN |

||||||

|

|

|

|

|

|

|

|

|

|

||||||

Number and street address |

|

|

City, state, and ZIP code |

|

|

|

|

County |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

Section 3 |

— Previous owner/dealer information |

|

|

|

|

|

|

|

|

||||||

Last name, irst name, middle initial or business name |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||||

Number and street address |

|

|

City, state, and ZIP code |

|

|

|

|

County |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Section 4 |

— Exemption you are claiming |

|

|

|

|

|

|

|

|

|

|

|

|

||

To claim a sales and use tax exemption on the vehicle listed in Section 1 – Vehicle information, mark an X in the appropriate box below and supply any additional information requested. You must sign Section 5 – Certification, and present this completed form (including any additional required information) to the motor vehicle issuing office when registering the vehicle.

1

Nonresident of New York State (NYS) (purchases of motor vehicles, trailers, or boats only) — At the time of purchase the purchaser was not a resident of NYS, did not have a place of abode in NYS, and was not engaged in any trade business, employment, or profession in NYS. See Publication 750, A Guide to Sales Tax in New York State, for more information on what is considered a place of abode.

(Mark an X in one of the boxes below; go to line 3 and enter required additional information.)

2

Motor vehicle, trailer, or boat was not purchased in NYS.

If marked, enter the location where the motor vehicle, trailer, or boat was purchased:

Motor vehicle, trailer, or boat was purchased in NYS, but previously registered by the purchaser in another state prior to registering it in NYS.

If marked, enter the state where the motor vehicle, trailer, or boat was previously registered:

Nonresident of NYS (purchase of ATVs or snowmobiles only) — The ATV or snowmobile was delivered to the purchaser outside of NYS. At the time of purchase the purchaser was not a resident of NYS, did not have a place of abode in NYS, and was not engaged in any trade, business, employment, or profession in NYS. (Go to line 3 and enter required additional information.)

3Required additional information (You must provide the information requested below if you marked a box in either line 1 or 2 above.)

• Were you ever a resident of NYS? |

.................................................................................................................... |

|

|

|

|

|

|

|

|

||

|

If Yes, enter dates of residency: |

from |

/ |

/ |

to |

|

/ |

/ |

|

|

|

• At the time of purchase, were you absent from NYS for education, employment, or military service? |

........... |

|

|||||||||

• |

While a resident of another state, did you own/rent living quarters in NYS? |

................................................... |

|

|

|

||||||

• |

Date the purchased motor vehicle, trailer, boat, ATV, or snowmobile was irst used in NYS: |

/ |

/ |

||||||||

Yes

Yes Yes

No

No No

4

Exempt organization — The purchaser is an organization exempt from tax as provided in Tax Law Article 28, section 1116(a).

(Attach copy of Form

5

6

7

Registered vendor for rental or lease — The purchaser is registered as a NYS sales tax vendor, and the motor vehicle, trailer, boat, ATV, or snowmobile will be used exclusively by the purchaser for rental or lease to customers.

Enter the purchaser’s Certificate of Authority number:

Leased or rented vehicle — Sales and use tax will be paid to lessor. |

|

Lessor’s name and address: |

Term of lease: |

Settlement of estate — The motor vehicle, trailer, boat, ATV, or snowmobile was acquired in the settlement of the estate of the previous owner, but was not purchased from the estate.

Complete and sign the back.

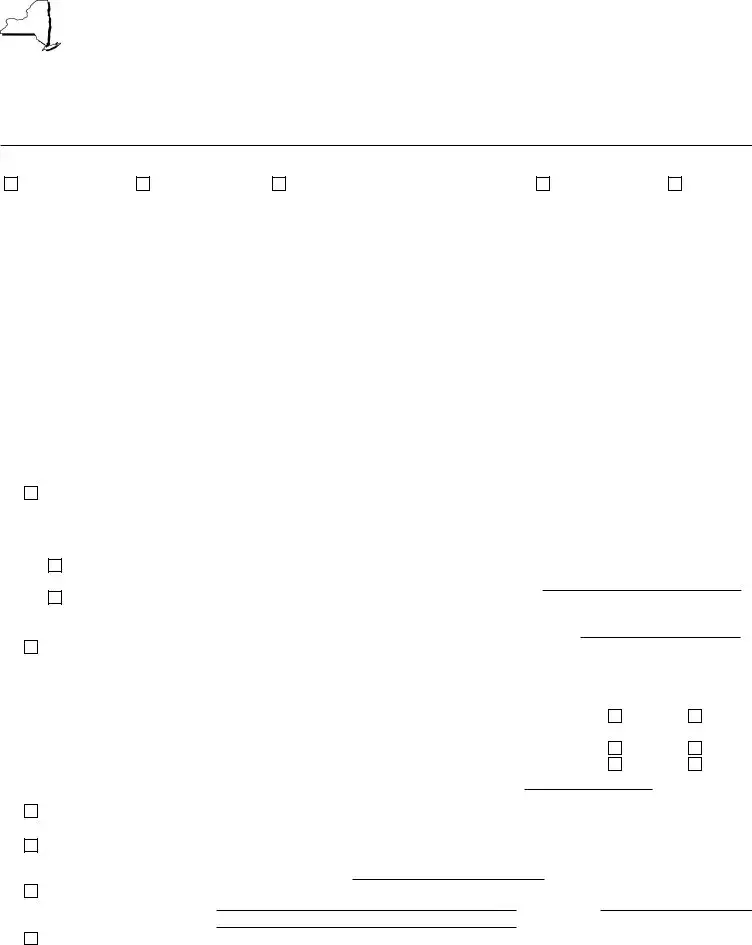

8

9

Tractor, trailer, or

Direct payment (DP) permit holder — The purchaser has a DP permit issued by the Tax Department.

Enter the DP permit number (attach copy): |

DP — |

10

New York sales and use tax paid to seller — The tax must be paid on the seller’s sales and use tax return. The buyer must attach a copy of the bill of sale indicating tax paid. Complete the following:

Seller: |

|

Purchase price: |

|

Tax paid: |

11

Individual Indian exemption — The purchaser must be an enrolled member of an exempt nation or tribe and must maintain a permanent residence on the reservation. The purchase must not be for resale. The motor vehicle, trailer, or boat must be registered to an address located on the reservation. If the purchase is an ATV or snowmobile, the vehicle must have been delivered to you on the reservation. Complete the following:

Name of exempt nation or tribe: Name of qualiied reservation:

12Military personnel (motor vehicles only) — NYS resident who purchased the vehicle outside NYS while in military service

a

b

13

14

Mark an X in the appropriate box.

NYS tax exempt (tax paid to another state) — No NYS or local sales or use tax is due if the seller or purchaser paid sales, use, excise, or highway use tax to another state in order to obtain the title. Complete the following:

Branch of military service: |

|

|

Dates of military service: from |

/ |

/ |

to |

|

/ |

/ |

|

||

State where vehicle was purchased: |

|

|

Tax paid: |

|

|

Paid by: |

|

purchaser |

seller |

|||

|

|

|

|

|

||||||||

Note: You must provide military ID or other documentation of military service and attach proof of tax paid to another state. NYS tax deferred — No NYS or local sales or use tax is due at this time if the purchaser:

•has been on active duty continuously since the vehicle was purchased outside NYS;

•is still on active duty and is still stationed outside NYS;

•has not been stationed in, nor had living quarters in, NYS from the time of purchase to the present; and

•will not use the vehicle in NYS except during authorized absence from duty.

Complete the following:

State or foreign country where vehicle was purchased (cannot be NYS): Present duty station:

Present living quarters:

Note: upon discharge, separation, or release from active duty, or upon being stationed or quartered within NYS, the purchaser must pay any sales and use tax due if the purchaser continues to use the motor vehicle in NYS.

Farm production and commercial horse boarding operation — The motor vehicle, trailer, boat, ATV, or snowmobile will be used predominantly either in farm production or in a commercial horse boarding operation, or in both. Mark an X in the appropriate box to indicate the type of plate registration.

Farming |

Commercial |

Registration not required (provide reason) |

||

Agriculture |

Passenger |

|

|

|

Other exemption (explain) |

|

|

|

|

|

|

|

|

|

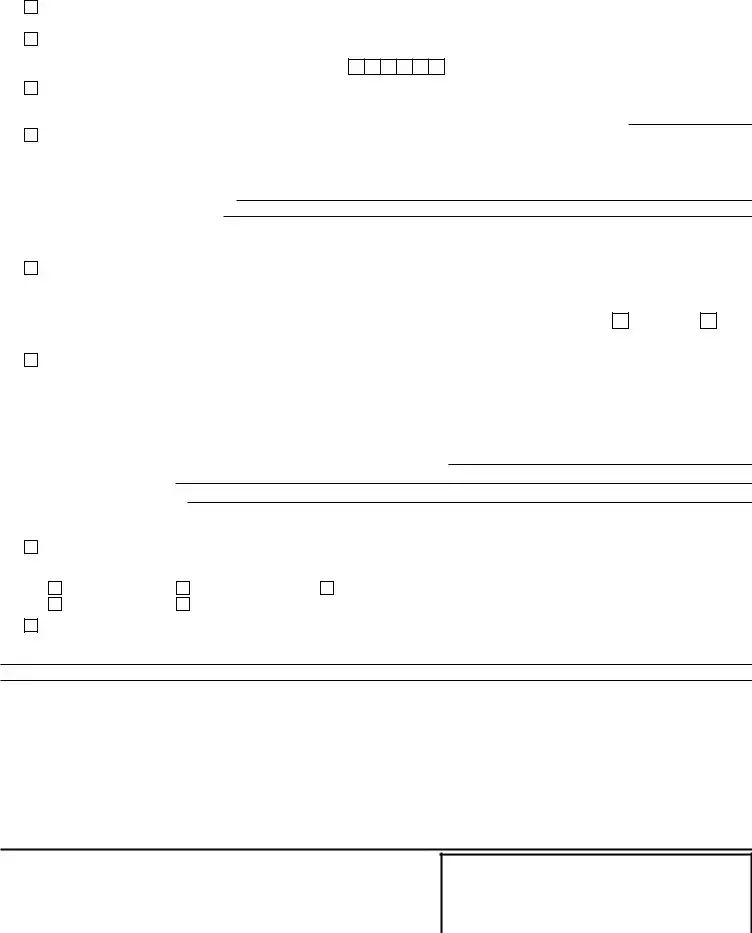

Section 5 — Certification

I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make these statements and issue this exemption certiicate with the knowledge that this document provides evidence that state and local sales or use taxes do not apply to a transaction or transactions for which I tendered this document and that willfully issuing this document with the intent to evade any such tax may constitute a felony or other crime under New York State Law, punishable by a substantial ine and a possible jail sentence. I understand that the Department of Motor Vehicles

or county clerk is agent for, and acts on behalf of, New York State and any locality with respect to any state or local sales or use tax the Department of Motor Vehicles or county clerk is required to collect from me; that as agent they are required to collect such taxes from me unless I properly furnish this certiicate; and that this certiicate will be made available to the Tax Department. I also understand that the Tax Department is authorized to investigate the

validity of tax exemptions claimed and the accuracy of any information entered on this document.

Signature of new owner |

|

|

|

|

Date |

|

|

|

(Sign name in full) |

||||

Print name of new owner |

|

Title (if business) |

|

|||

Privacy notification — The Commissioner of Taxation and Finance may collect and maintain personal information

pursuant to the New York State Tax Law, including but not limited to, sections

to 42 USC 405(c)(2)(C)(i). This information will be used to determine and administer tax liabilities and, when authorized by law, for certain tax offset and exchange of tax information programs as well as for any other lawful purpose. Information concerning quarterly wages paid to employees is provided to certain state agencies for purposes of fraud prevention, support enforcement, evaluation of the effectiveness of certain employment and training programs and other purposes authorized by law.

Failure to provide the required information may subject you to civil or criminal penalties, or both, under the

Tax Law. This information is maintained by the Manager of Document Management, NYS Tax Department, W A Harriman Campus, Albany NY 12227; telephone (518)

For office use only

Ofice |

|

Date |

||

|

|

|

|

|

Cashier’s initials |

Term no. |

Possible audit |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The DTF-803 form is used to claim an exemption from sales and use tax for specific vehicle registrations in New York State. |

| Applicable Transactions | This form is applicable only for transactions processed by the Department of Motor Vehicles (DMV) and related entities. |

| Exemption Types | The form allows exemptions for a variety of vehicles, including motor vehicles, trailers, ATVs, boats, and snowmobiles. |

| Filing Requirements | To successfully file, the completed form must be presented to the DMV during vehicle registration, along with any additional required documentation. |

| Legal Implications | Improper use of this exemption can lead to significant civil and criminal penalties under New York State law. |

| Governing Law | New York State Tax Law, specifically Article 28, Section 1116(a), governs the use of this form for tax exemptions. |

Guidelines on Utilizing Dtf 803

Filling out the DTF-803 form correctly is essential for those seeking a sales and use tax exemption in New York State. This formal process involves providing specific information related to the vehicle, owner, and the claimed exemption. After submitting the completed form, it should be presented to a motor vehicle issuing office when registering the vehicle.

- Obtain the DTF-803 form from the New York State Department of Taxation and Finance website or a DMV location.

- Print or type clearly on the form.

- In Section 1, fill out details about the vehicle:

- Mark one box indicating the type of vehicle (Motor Vehicle, Trailer, Boat, ATV, or Snowmobile).

- Enter the length of the boat in feet, if applicable.

- Provide the year, make, and model.

- Fill in the identification (ID) number.

- State the purchase price, including any goods or services given in trade.

- Provide the date of purchase (month, day, year).

- In Section 2, enter the new owner/lessee information:

- Include the last name, first name, middle initial, or business name.

- Provide the social security number, TIN, or EIN.

- Fill in the street address, city, state, and ZIP code.

- Specify the county.

- In Section 3, enter details about the previous owner/dealer:

- Provide the last name, first name, middle initial, or business name.

- Include the number and street address, city, state, and ZIP code.

- Specify the county.

- Move to Section 4, where you will indicate the exemption you are claiming:

- Mark the box corresponding to the exemption type.

- If necessary, fill in any required additional information related to your specific exemption claim.

- Sign and date Section 5, the certification section, ensuring that all information provided is accurate and complete.

- Attach any required documentation, such as a copy of Form ST-119 if claiming an exemption as an organization.

- Submit the completed form along with any required attachments to the motor vehicle issuing office.

What You Should Know About This Form

What is the purpose of the DTF-803 form?

The DTF-803 form, titled "Claim for Sales and Use Tax Exemption," is utilized primarily in New York for claiming exemption from sales and use tax for various vehicle transactions. This applies to motor vehicles, trailers, all-terrain vehicles (ATVs), vessels (boats), and snowmobiles. It is specifically designed for transactions processed by the Department of Motor Vehicles (DMV) and its designated agents or county clerk offices.

Who needs to submit the DTF-803 form?

Individuals or organizations seeking to claim an exemption from sales and use tax in New York must submit the DTF-803 form. The form is appropriate for new vehicle owners, including those purchasing vehicles registered in other states or those entitled to exemptions based on residency status, membership in exempt organizations, or military service.

What types of exemptions can be claimed using this form?

Several types of exemptions can be claimed on the DTF-803 form. These include, but are not limited to: non-residents of New York, vehicles purchased outside New York, exempt organizations, registered vendors, vehicles used in farming or commercial boarding, and military personnel. Each category has specific requirements that need to be met and documented.

How do I fill out the DTF-803 form?

To fill out the DTF-803 form, start by providing detailed information about the vehicle you are claiming an exemption for, including its make, model, and identification number. Then, fill out your personal details as the new owner or lessee. Next, you must indicate the exemption type you are claiming by marking the appropriate boxes and supplying any additional requested information. Finally, the form must be signed in the certification section, confirming the validity of the statements made.

What happens if I misuse the DTF-803 form?

Using the DTF-803 form improperly can lead to serious consequences. Misuse of the exemption claim may expose you to civil or criminal penalties, including hefty fines or jail time, in addition to any tax obligations and interest due. Therefore, it is crucial to ensure that all information provided is accurate and that the exemption claimed is valid under New York State law.

Where do I submit the completed DTF-803 form?

Once you have completed the DTF-803 form, you need to present it at the motor vehicle issuing office as part of the registration process. This includes providing any additional documents required to support your claim. Make sure you have all relevant documentation to avoid delays in processing your application.

What documentation is required to support my exemption claim?

Depending on the exemption you are claiming, you may need to provide various supporting documents. For example, if you are claiming an exemption for a motor vehicle purchased outside of New York, you must include a copy of the bill of sale showing the tax paid if applicable. Other exemptions might require additional forms, like Form ST-119 for exempt organizations. Be sure to review the requirements for your specific exemption type to ensure all necessary documentation is included.

Common mistakes

When filling out the DTF-803 form, many people make mistakes that can lead to delays or denials. One common error is not marking the right box in Section 4, which outlines the specific exemptions being claimed. It’s crucial to read each option carefully and choose the one that accurately applies to your situation. An improper selection could result in your claim being rejected.

Another frequent mistake is failing to provide complete vehicle information in Section 1. Ensure that you fill in details such as the identification number, purchase price, and date of purchase clearly. Missing or inaccurate information can cause significant issues when your exemption is reviewed.

People often neglect to sign Section 5, the certification section. A signature is mandatory to validate your claim. Without it, your application may not be considered, which can lead to frustration when trying to resolve the matter later.

In addition, many forget to double-check their personal information in Section 2. Errors in the name, social security number, or address can lead to complications, especially if they don’t match other documentation. Make sure everything aligns appropriately to prevent needless confusion.

Some individuals also make the mistake of not attaching the required documentation that supports their exemption claim. Whether it’s proof of residency or a copy of Form ST-119, failure to include these documents may lead to a denial. Always verify that you have all necessary paperwork before submitting the form.

Another oversight is failing to complete the back side of the form when needed. Some exemption claims, especially those involving specific types of vehicles or special circumstances, require additional information provided on the backside. Ensure you read through all instructions completely.

Finally, a common mistake occurs when people assume that the DTF-803 form can be submitted without a clear understanding of the requirements specific to their case. Reading the instructions and understanding the necessary conditions for your exemption is critical. Take the time to familiarize yourself with the guidelines provided by the New York State Department of Taxation and Finance.

Documents used along the form

The DTF-803 form is an important document used in New York State for claiming sales and use tax exemptions related to vehicles, boats, and similar items. Alongside the DTF-803, several other forms may be used to provide additional information or to specify the nature of the transaction. Below is a list of commonly associated documents that can be relevant in these scenarios.

- DTF-802 Form: This form is used to report a sale or gift of a motor vehicle, trailer, ATV, vessel, or snowmobile. It provides the necessary details to the New York State Department of Taxation and Finance when an exemption is claimed on the basis of a gift.

- Form ST-119: The Exempt Organization Certificate form, ST-119, is required when the purchaser is an organization that is exempt from sales tax. A copy of this form must be attached to verify the exemption status of the organization making the claim.

- Bill of Sale: A bill of sale serves as proof of the transaction between the buyer and the seller. It should include details about the purchase price and specify if sales and use tax was paid at the time of sale, which can also support claims made in the DTF-803.

- Certificate of Authority: This document is necessary for businesses that are registered vendors for rental or lease transactions. It indicates that the business is authorized to collect sales tax and is pivotal in establishing exemption claims related to commercial vehicle usage.

- DP Permit: A Direct Payment Permit allows certain purchasers to bypass sales tax at the point of sale. Those holding a DP permit must attach a copy of it, along with their claim for exemption on the DTF-803.

- Military Documentation: Military personnel must provide documentation, such as a military ID, to verify their status when claiming sales tax exemptions. This is particularly relevant for vehicles purchased outside of New York state while in active service.

Using these forms and documents accurately ensures compliance with New York State tax laws while facilitating the exemption process. Understanding the purpose and requirements of each form can greatly aid individuals and organizations in making valid claims.

Similar forms

- Form DTF-802: Similar to the DTF-803, this form is used to claim a sales tax exemption for gifts or sales of motor vehicles, trailers, ATVs, boats, or snowmobiles. It also requires detailed buyer and seller information.

- Form ST-119: This is an exempt organization certificate. It's needed for non-profit organizations claiming tax exemptions. Like the DTF-803, it serves as proof of tax-free purchases.

- Form ST-120: This certificate is issued to vendors to allow the purchase of items without paying sales tax. It supports tax exemption claims similar to the DTF-803.

- Form ST-121: Used for resale, this form allows businesses to make tax-exempt purchases of inventory. It is similar to the DTF-803 in that it facilitates tax-free transactions.

- Form DTF-806: This application is for a refund of overpaid sales tax. It relates to the DTF-803 as both deal with sales tax exemptions and refunds.

- Form DTF-804: This form allows manufacturers to claim exemptions on purchases of certain equipment. Its function of claiming exemptions aligns with the purpose of the DTF-803.

- Form 8862: This is used to claim the Earned Income Tax Credit (EITC) after denial. It requires documentation similar to the DTF-803, focusing on the legitimacy of claims.

- Form IT-203: This is for non-resident income tax returns. It shares similarities with the DTF-803 by requiring information on residency status and tax liabilities.

Dos and Don'ts

When filling out the Dtf-803 form, follow these guidelines for a smooth process:

- Print or type clearly. Ensure that all information is legible to avoid processing delays.

- Provide accurate vehicle information. Double-check details like the year, make, model, and identification number.

- Mark only one exemption box that applies to your situation.

- Include any supporting documents as required, such as Form ST-119 for exempt organizations.

- Sign Section 5 to certify the accuracy of your information.

- Attach proof of any tax paid if claiming a tax exemption based on prior payment.

- Keep a copy of the completed form for your records.

Equally important, avoid these common mistakes:

- Do not leave any fields blank unless specified.

- Avoid using white-out or erasing any mistakes on the form.

- Do not claim exemptions for vehicles not eligible under New York State law.

- Refrain from submitting the form without the required signatures.

- Do not send the form directly to the Tax Department; it must be presented to the DMV or county clerk.

- Do not assume that completing the form guarantees tax exemption without satisfying all conditions.

- Do not forget to verify that the tax exemption applies to your specific purchase circumstances.

Misconceptions

There are several common misconceptions regarding the DTF-803 form, which is used for claiming a sales and use tax exemption for specific vehicles in New York. Below is a list that clarifies these misconceptions.

- Misconception 1: Anyone can use the DTF-803 form for any type of vehicle transaction.

- Misconception 2: The exemption is automatically granted upon submission of the form.

- Misconception 3: All New York residents qualify for the sales tax exemption.

- Misconception 4: Providing false information on the DTF-803 form carries no significant consequences.

- Misconception 5: There is no requirement to prove previous residency status.

The DTF-803 form is specifically intended for motor vehicles, trailers, boats, all-terrain vehicles (ATVs), and snowmobiles purchased in certain circumstances. For gifts, a different form (DTF-802) must be used.

The form must be correctly completed and submitted to the appropriate motor vehicle issuing office. There is no guarantee that the claim will be accepted; the authorities may require additional documentation or verification.

Only specific scenarios qualify for an exemption. This includes non-residents of New York at the time of purchase or purchases made for exempt organizations. Not all New York residents will meet these criteria.

Misrepresentation on the form can lead to serious civil and criminal penalties. This includes fines and potential jail time under New York State law.

If claiming that the purchaser was a non-resident at the time of purchase, additional information must be provided, including dates of any prior residency and verification of absence from New York State for various reasons.

Key takeaways

Filling out the DTF-803 form is essential for claiming a sales and use tax exemption in New York State. Here are some key takeaways to keep in mind:

- The DTF-803 form is specifically for motor vehicles, trailers, all-terrain vehicles (ATVs), vessels (boats), or snowmobiles. It applies to transactions handled by the Department of Motor Vehicles (DMV).

- This form should only be used if you qualify for an exemption. If you're claiming a gift exemption, use Form DTF-802 instead.

- Misusing this exemption may lead to both civil and criminal penalties, including paying any taxes plus interest owed.

- All sections of the form must be filled out clearly, using either print or typed text.

- Provide detailed vehicle information in Section 1, including type, year, make, model, and purchase price.

- Section 4 requires you to specify the type of exemption you are claiming. Various boxes are provided for different exemption types, such as nonresident purchases or exempt organizations.

- In the certification section, your signature confirms that all information provided is accurate. Falsifying information could lead to serious consequences.

- Submit the completed form, along with any required attachments, to the motor vehicle issuing office at the time of registration.

Browse Other Templates

LLC Statutory Agent Withdrawal Form,Statutory Agent Resignation Notice,LLC Agent Departure Document,Arizona Statutory Agent Termination Form,Agent Resignation Filing,LLC Agent Notice of Resignation,Statutory Agent Exit Form,Arizona LLC Statutory Agen - The form requires you to input the Arizona Corporation Commission (A.C.C.) file number associated with the LLC.

Form 1007 - It is important to maintain records of rental agreements and expenses.

Dwc Form-83 - This declaration helps mitigate misunderstandings related to workers' compensation coverage and who is responsible.