Fill Out Your Dwc 83 Form

The Dwc 83 form is a critical document for both Hiring Contractors and Independent Contractors in Texas, particularly in the construction industry. This form serves as a declaration of the independent relationship between the two parties under the Texas Workers' Compensation Act. It outlines essential qualifications that an Independent Contractor must meet to be classified as such, emphasizing payment structures, the ability to hire helpers, and the freedom to work for multiple contractors. By signing this agreement, both the Hiring Contractor and the Independent Contractor signify their mutual understanding that the Contractor's workers’ compensation insurance will not extend to the Independent Contractor or their employees. This is crucial in avoiding unexpected liabilities. The form also stipulates that should a new hiring agreement be made that does not align with the initial terms, both parties are obligated to inform the Texas Department of Insurance within ten days. Furthermore, the agreement incorporates an option for the Hiring Contractor to provide workers' compensation coverage if desired, marking a shift in the employment relationship solely for the purpose of coverage under Texas law. With these elements clearly stated, the Dwc 83 form establishes a framework that safeguards both parties' interests in compliance with state regulations.

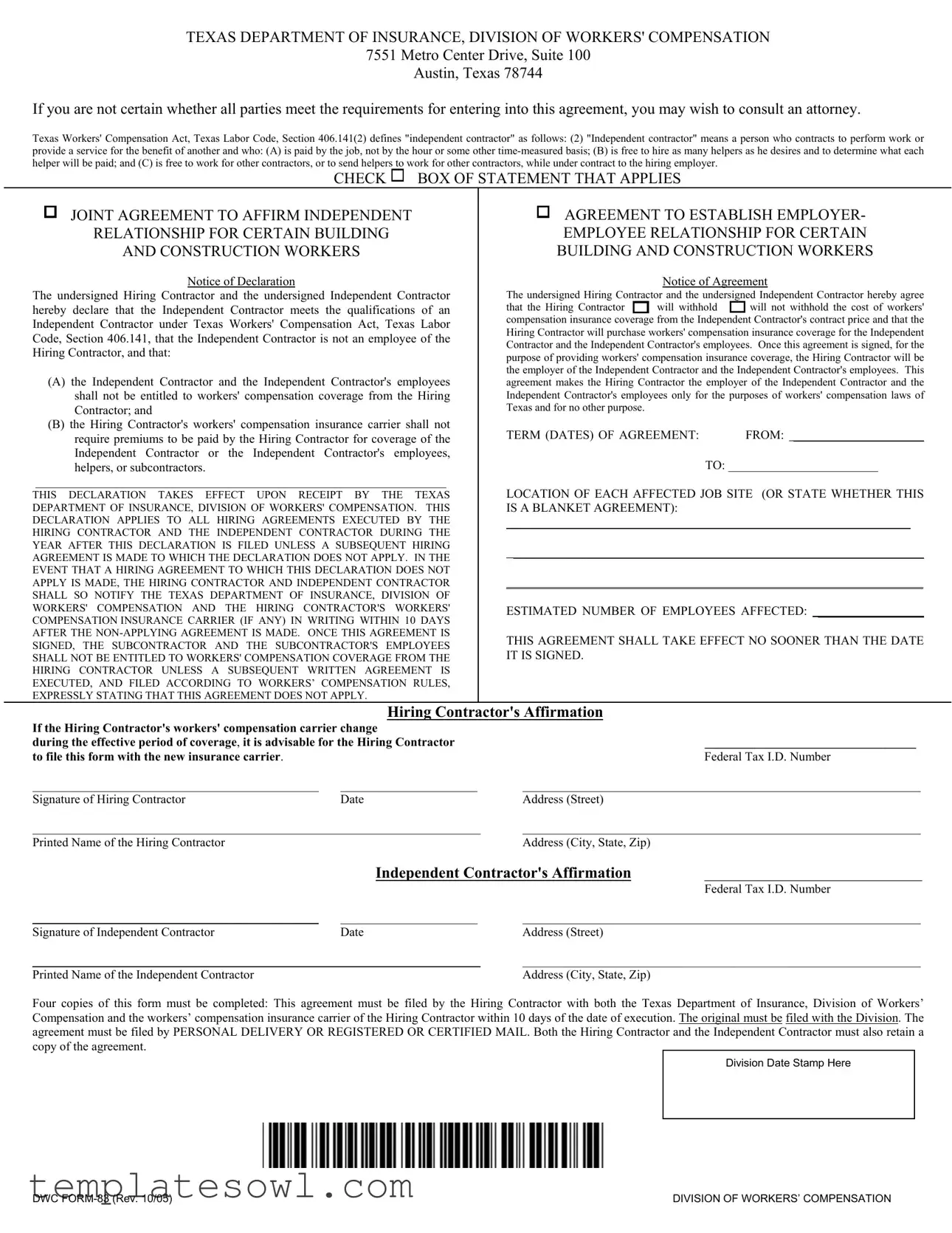

Dwc 83 Example

TEXAS DEPARTMENT OF INSURANCE, DIVISION OF WORKERS' COMPENSATION

7551 Metro Center Drive, Suite 100

Austin, Texas 78744

If you are not certain whether all parties meet the requirements for entering into this agreement, you may wish to consult an attorney.

Texas Workers' Compensation Act, Texas Labor Code, Section 406.141(2) defines "independent contractor" as follows: (2) "Independent contractor" means a person who contracts to perform work or

provide a service for the benefit of another and who: (A) is paid by the job, not by the hour or some other

CHECK

BOX OF STATEMENT THAT APPLIES

BOX OF STATEMENT THAT APPLIES

JOINT AGREEMENT TO AFFIRM INDEPENDENT

RELATIONSHIP FOR CERTAIN BUILDING

AND CONSTRUCTION WORKERS

Notice of Declaration

The undersigned Hiring Contractor and the undersigned Independent Contractor hereby declare that the Independent Contractor meets the qualifications of an Independent Contractor under Texas Workers' Compensation Act, Texas Labor Code, Section 406.141, that the Independent Contractor is not an employee of the Hiring Contractor, and that:

(A)the Independent Contractor and the Independent Contractor's employees shall not be entitled to workers' compensation coverage from the Hiring Contractor; and

(B)the Hiring Contractor's workers' compensation insurance carrier shall not require premiums to be paid by the Hiring Contractor for coverage of the Independent Contractor or the Independent Contractor's employees,

helpers, or subcontractors.

__________________________________________________________________

THIS DECLARATION TAKES EFFECT UPON RECEIPT BY THE TEXAS DEPARTMENT OF INSURANCE, DIVISION OF WORKERS' COMPENSATION. THIS DECLARATION APPLIES TO ALL HIRING AGREEMENTS EXECUTED BY THE HIRING CONTRACTOR AND THE INDEPENDENT CONTRACTOR DURING THE YEAR AFTER THIS DECLARATION IS FILED UNLESS A SUBSEQUENT HIRING AGREEMENT IS MADE TO WHICH THE DECLARATION DOES NOT APPLY. IN THE EVENT THAT A HIRING AGREEMENT TO WHICH THIS DECLARATION DOES NOT APPLY IS MADE, THE HIRING CONTRACTOR AND INDEPENDENT CONTRACTOR SHALL SO NOTIFY THE TEXAS DEPARTMENT OF INSURANCE, DIVISION OF WORKERS' COMPENSATION AND THE HIRING CONTRACTOR'S WORKERS' COMPENSATION INSURANCE CARRIER (IF ANY) IN WRITING WITHIN 10 DAYS AFTER THE

AGREEMENT TO ESTABLISH EMPLOYER- EMPLOYEE RELATIONSHIP FOR CERTAIN BUILDING AND CONSTRUCTION WORKERS

AGREEMENT TO ESTABLISH EMPLOYER- EMPLOYEE RELATIONSHIP FOR CERTAIN BUILDING AND CONSTRUCTION WORKERS

Notice of Agreement

The undersigned Hiring Contractor and the undersigned Independent Contractor hereby agree

that the Hiring Contractor

will withhold

will withhold

will not withhold the cost of workers' compensation insurance coverage from the Independent Contractor's contract price and that the Hiring Contractor will purchase workers' compensation insurance coverage for the Independent Contractor and the Independent Contractor's employees. Once this agreement is signed, for the purpose of providing workers' compensation insurance coverage, the Hiring Contractor will be the employer of the Independent Contractor and the Independent Contractor's employees. This agreement makes the Hiring Contractor the employer of the Independent Contractor and the Independent Contractor's employees only for the purposes of workers' compensation laws of Texas and for no other purpose.

will not withhold the cost of workers' compensation insurance coverage from the Independent Contractor's contract price and that the Hiring Contractor will purchase workers' compensation insurance coverage for the Independent Contractor and the Independent Contractor's employees. Once this agreement is signed, for the purpose of providing workers' compensation insurance coverage, the Hiring Contractor will be the employer of the Independent Contractor and the Independent Contractor's employees. This agreement makes the Hiring Contractor the employer of the Independent Contractor and the Independent Contractor's employees only for the purposes of workers' compensation laws of Texas and for no other purpose.

TERM (DATES) OF AGREEMENT: |

FROM: _____________________ |

|

TO: ________________________ |

LOCATION OF EACH AFFECTED JOB SITE (OR STATE WHETHER THIS IS A BLANKET AGREEMENT):

_________________________________________________________________

__________________________________________________________________

___________________________________________________________________

ESTIMATED NUMBER OF EMPLOYEES AFFECTED: _________________

THIS AGREEMENT SHALL TAKE EFFECT NO SOONER THAN THE DATE IT IS SIGNED.

Hiring Contractor's Affirmation

If the Hiring Contractor's workers' compensation carrier change |

|

|

during the effective period of coverage, it is advisable for the Hiring Contractor |

__________________________________ |

|

to file this form with the new insurance carrier. |

|

Federal Tax I.D. Number |

______________________________________________ |

______________________ |

________________________________________________________________ |

Signature of Hiring Contractor |

Date |

Address (Street) |

________________________________________________________________________ |

________________________________________________________________ |

|

Printed Name of the Hiring Contractor |

|

Address (City, State, Zip) |

|

Independent Contractor's Affirmation |

____________________________ |

|

|

|

|

Federal Tax I.D. Number |

______________________________________________ |

______________________ |

________________________________________________________________ |

|

Signature of Independent Contractor |

Date |

Address (Street) |

|

________________________________________________________________________ |

________________________________________________________________ |

||

Printed Name of the Independent Contractor |

|

Address (City, State, Zip) |

|

Four copies of this form must be completed: This agreement must be filed by the Hiring Contractor with both the Texas Department of Insurance, Division of Workers’ Compensation and the workers’ compensation insurance carrier of the Hiring Contractor within 10 days of the date of execution. The original must be filed with the Division. The agreement must be filed by PERSONAL DELIVERY OR REGISTERED OR CERTIFIED MAIL. Both the Hiring Contractor and the Independent Contractor must also retain a copy of the agreement.

Division Date Stamp Here

DWC |

DIVISION OF WORKERS’ COMPENSATION |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Governing Law | The DWC Form 83 is governed by the Texas Workers' Compensation Act, specifically Texas Labor Code, Section 406.141. |

| Purpose | This form establishes the independent relationship between the Hiring Contractor and the Independent Contractor. |

| Independent Contractor Definition | An independent contractor is defined as someone who performs work, is paid by the job, and can hire helpers and work for multiple clients. |

| Workers' Compensation Implications | By signing the form, the Independent Contractor acknowledges that they and their employees do not receive workers' compensation coverage through the Hiring Contractor. |

| Validity Duration | The declaration applies to all hiring agreements executed during the year after filing unless a new agreement states otherwise. |

| Notification Requirement | If a hiring agreement outside the scope of the declaration is made, notification must be sent to the Texas Department of Insurance within 10 days. |

| Filing Process | The completed form must be filed personally or by registered/certified mail with both the Texas Department of Insurance and the Hiring Contractor's insurance carrier within 10 days of execution. |

Guidelines on Utilizing Dwc 83

After obtaining the DWC 83 form, the next step involves accurately completing it to establish an independent contractor relationship under Texas workers' compensation laws. This declaration is crucial in clarifying the roles and responsibilities between the Hiring Contractor and the Independent Contractor.

- Start by entering the date on the top left corner of the form.

- Fill in the Hiring Contractor’s information, including the name and address.

- Provide the Federal Tax I.D. Number for the Hiring Contractor.

- Check the box for the statement that applies: either the Joint Agreement or the Agreement to Establish Employer-Employee Relationship.

- Clearly write the term (dates) of the agreement in the designated area (FROM and TO).

- Indicate the location of each affected job site or state if this is a blanket agreement in the provided space.

- Estimate and enter the number of employees affected by this agreement.

- Obtain signatures from both the Hiring Contractor and the Independent Contractor, along with the date of signing.

- Include their printed names and addresses after the signatures.

- Make four copies of the completed form for distribution.

- File

What You Should Know About This Form

What is the purpose of the DWC 83 form?

The DWC 83 form is used in Texas to establish the independent contractor status of workers in the building and construction industry. This form serves two primary purposes: to declare that the contractor is not an employee of the hiring contractor and to define the responsibilities regarding workers' compensation coverage. By signing this agreement, both the hiring contractor and the independent contractor affirm their understanding of their relationship under Texas law.

Who qualifies as an independent contractor under this form?

According to the Texas Workers' Compensation Act, an independent contractor meets specific criteria. These criteria include being paid by the job, having the freedom to hire helpers and set their wages, and the ability to work for other contractors without restrictions. The DWC 83 form requires both parties to certify that the independent contractor fulfills these qualifications in order to avoid being classified as an employee for workers' compensation purposes.

What happens if a hiring agreement is made that does not apply to the DWC 83 declaration?

If a new hiring agreement is executed that does not align with the DWC 83 declaration, both the hiring contractor and the independent contractor must notify the Texas Department of Insurance, Division of Workers' Compensation, and the hiring contractor's workers' compensation insurance carrier within ten days. This notification is essential to clearly delineate the terms of the new agreement and ensure compliance with the state regulations surrounding workers' compensation coverage.

How should the DWC 83 form be filed?

The DWC 83 form must be filed within ten days of its execution. The hiring contractor is responsible for submitting the form to both the Texas Department of Insurance and the insurance carrier. This can be done through personal delivery or by registered or certified mail. It is also advisable that the hiring contractor retains a copy of the agreement for their records, ensuring that both parties have documentation of their agreement regarding independent contractor status.

Common mistakes

Filling out the DWC 83 form can seem daunting, and many people stumble on certain aspects during the process. One common mistake is neglecting to clearly identify the job sites. Without specifying where the work will occur, it leaves the arrangement vague and may lead to complications if any disputes arise later. Clearly stating the location of each affected job site adds clarity and helps avoid confusion.

Another frequent error is failing to estimate the number of employees affected. This step is crucial as it not only impacts insurance calculations but also signals the scope of work to the Texas Department of Insurance. Ignoring this detail can delay approval or even lead to denials of essential coverage.

Some individuals also misinterpret the independent contractor status. The DWC 83 requires clear affirmation that the contracting individual meets the criteria set forth in Texas law. If the status is misrepresented—intentionally or not—both the Hiring Contractor and the Independent Contractor risk legal repercussions, including financial liabilities for withholding taxes or failing to provide workers’ compensation coverage.

Additionally, it’s easy to make mistakes in the dates section of the agreement. Specifying incorrect start and end dates can lead to confusion regarding the duration of the contract. Such errors could inadvertently void the agreement if they conflict with your stated intentions or the timing required for effective coverage.

Another mistake involves the signatures. Missing signatures or mismatched names between the printed and signed forms can complicate matters significantly. Each party must ensure their signature aligns with their printed name and corresponding titles to validate the agreement properly.

Lastly, many overlook the necessity of filing the original document promptly. Submitting the agreement by personal delivery or registered mail is essential, as delays or misplacement can result in loss of coverage. It's crucial to understand that this form must be filed within ten days, ensuring that all parties involved remain protected under the state’s workers’ compensation laws.

Documents used along the form

The DWC 83 form is a key document used in Texas for establishing the independent contractor relationship in the construction industry. There are several other forms and documents that are often used alongside it, which help clarify the responsibilities and relationships between contractors and independent workers. Below are some of those documents, each described briefly.

- Form DWC 81: This form is used to report a work-related injury or occupational disease to the Texas Division of Workers' Compensation. Employers must complete and submit this form to ensure the injured employee receives workers' compensation benefits.

- Form DWC 3: This document is the "Employer's Notice of Injury" and is submitted when an employee has sustained a work-related injury. It informs the insurance carrier of the circumstances surrounding the injury.

- Form DWC 4: Known as the "Employee's Claim for Compensation," this form is filled out by an employee to formally claim benefits after a workplace injury. It provides information about the injury and accounts for lost wages.

- Form DWC 7: This is the "Notice of Insurance Coverage" form, which confirms that a business has valid workers' compensation insurance. It must be filed with the Texas Division of Workers' Compensation to inform them of coverage details.

- Form DWC 42: This form is used to file a report of an employer's liability for a workplace injury. It helps clarify any disputes regarding the benefits owed to an injured worker.

- Certificate of Coverage: This document certifies that an employer has an active workers' compensation insurance policy. It may be requested by other parties, such as subcontractors, to verify coverage.

- Subcontract Agreement: This is an agreement between a general contractor and a subcontractor outlining the terms of work, payment, and responsibilities. It can help define the independent contractor relationship further.

Using these additional forms and documents can help clarify roles and responsibilities in a contractual arrangement. They are important to ensure compliance with Texas labor laws and to protect the rights of all parties involved.

Similar forms

-

Form DWC-84: Similar to the DWC-83 form, this form also addresses the relationship between a hiring contractor and an independent contractor but is specifically designed for the notice of an employer/employee relationship. It clarifies the responsibilities for workers' compensation coverage.

-

Form 1099-MISC: This form is commonly used to report payments made to independent contractors. While it serves a different purpose, it underscores the independent contractor's status and compensation structure outside of traditional employment.

-

Form DWC-70: This form is utilized to report non-submission of a required workers' compensation policy for certain subcontractors. Like the DWC-83, it functions to clarify coverage status and obligations between parties.

-

Form W-2: This form reports wages paid to employees. While it is focused on employees rather than independent contractors, it helps to delineate the differences in treatment for tax purposes, highlighting the implications of independent contractor status.

-

Independent Contractor Agreement: This contract outlines the terms of the working relationship, similar to the DWC-83 in establishing the independent contractor's status. It provides a framework for expectations, payment, and responsibilities.

-

Form DWC-4: This form is used to report work-related injuries and serves to further establish clarity regarding coverage, obligations, and rights within the relationship, similar to the DWC-83.

-

Form 990: Nonprofit organizations use this form to report their financial information, including payments to independent contractors. It provides transparency regarding compensation and highlights distinctions between employee and contractor treatment.

-

Memorandum of Understanding (MOU): This document establishes a mutual agreement between parties, similar to the DWC-83's declaration. It outlines roles, responsibilities, and expectations in a collaborative framework.

-

Form DWC-7: This is utilized for applications for workers' compensation benefits. Like the DWC-83, it conveys essential information about worker status and coverage entitlement, although from an injured worker's perspective.

Dos and Don'ts

When filling out the DWC 83 form, careful attention to details is crucial. Here are seven important things to keep in mind:

- Do ensure all required signatures are present. Missing signatures can delay the processing of the form.

- Do provide accurate information. Double-check the names, signatures, and addresses. Inaccurate information could lead to complications.

- Do check the applicable box that reflects the nature of your agreement. Clarity in categorization helps prevent misunderstandings.

- Don’t forget to file within the stipulated time frame. Submit the completed form within 10 days of execution to avoid penalties.

- Don’t use incorrect or outdated forms. Always ensure you have the latest version of the DWC 83 form.

- Don’t leave any sections blank. Every section must be completed to ensure the document is valid.

- Don’t neglect to keep copies for your records. Both the Hiring Contractor and Independent Contractor should retain copies of the agreement.

By adhering to these dos and don’ts, you enhance the likelihood of a smooth filing process. This can help safeguard your rights and interests as you navigate the requirements involved in the DWC 83 form.

Misconceptions

Understanding the DWC 83 form is crucial for both Hiring Contractors and Independent Contractors in Texas. However, there are several misconceptions surrounding this form that can create confusion. The following list outlines seven common misunderstandings about the DWC 83 form and provides clarifications to help clear things up.

- Misconception 1: Signing the DWC 83 form automatically grants workers' compensation coverage.

- Misconception 2: The DWC 83 form can be used retroactively.

- Misconception 3: Only one DWC 83 form is needed per project.

- Misconception 4: The DWC 83 form serves as a definitive classification of employment status.

- Misconception 5: Filing the DWC 83 form guarantees that disputes over worker status will be resolved in favor of the Independent Contractor.

- Misconception 6: Once filed, the DWC 83 form is permanent and cannot be changed.

- Misconception 7: Both parties must always agree to use the DWC 83 form for every project.

This is not true. The DWC 83 form is a declaration of the independent contractor status. It specifically states that the Independent Contractor and their employees are not entitled to workers' compensation coverage from the Hiring Contractor unless a separate written agreement is established.

The DWC 83 form cannot be applied retroactively. It takes effect only upon receipt by the Texas Department of Insurance, Division of Workers’ Compensation. Therefore, any agreements made before its filing are not covered by this declaration.

In fact, a separate DWC 83 form must be filed for each hiring agreement. If multiple agreements exist within a year, each one requires its own form. This ensures appropriate coverage and compliance with Texas laws.

This is misleading. The DWC 83 form merely acknowledges a declaration made by both the Hiring Contractor and Independent Contractor regarding their relationship. Other factors beyond this form may influence employment classification under the law.

Filing the form does not guarantee outcomes in any legal disputes. While it provides a documented agreement, courts and other agencies may still consider a variety of factors when determining the actual employment relationship.

This is incorrect. The Hiring Contractor and Independent Contractor can establish new hiring agreements that may override previous declarations. However, these changes must be documented and filed according to the applicable rules.

While both parties may prefer to use the DWC 83 form, it is not obligatory in every situation. Depending on the nature of the work and their agreement, they may opt for different arrangements.

Clarifying these misconceptions can help ensure that both Hiring Contractors and Independent Contractors understand their rights and responsibilities under Texas law when using the DWC 83 form.

Key takeaways

When completing and utilizing the DWC 83 form in Texas, there are several important points to keep in mind:

- The form is used to affirm the independent contractor status of individuals in certain building and construction roles.

- Both the Hiring Contractor and the Independent Contractor must agree that the Independent Contractor meets the qualifications set forth in the Texas Workers' Compensation Act.

- Once signed, the agreement states that the Independent Contractor and their employees will not be provided with workers' compensation coverage from the Hiring Contractor.

- It is essential to submit the completed form to the Texas Department of Insurance, Division of Workers’ Compensation, along with the Hiring Contractor's workers’ compensation insurance carrier.

- Four copies of the completed form are required; each party should keep one for their records.

- The agreement takes effect once it is signed and must be filed within 10 days of execution, either by personal delivery or registered/certified mail.

Understanding these key points can help ensure compliance with Texas labor laws and clarify the responsibilities of both parties involved in the agreement.

Browse Other Templates

Land Contract Template Michigan - All commitments stated are to be observed in good faith throughout the contract period.

Ngb Form 22 - The NGB 22 form is maintained by the Military Personnel Office for state record keeping.

How to Make an Insurance Claim - It is beneficial to keep track of all consultations related to your claim.