Fill Out Your Dws Ui 6 Form

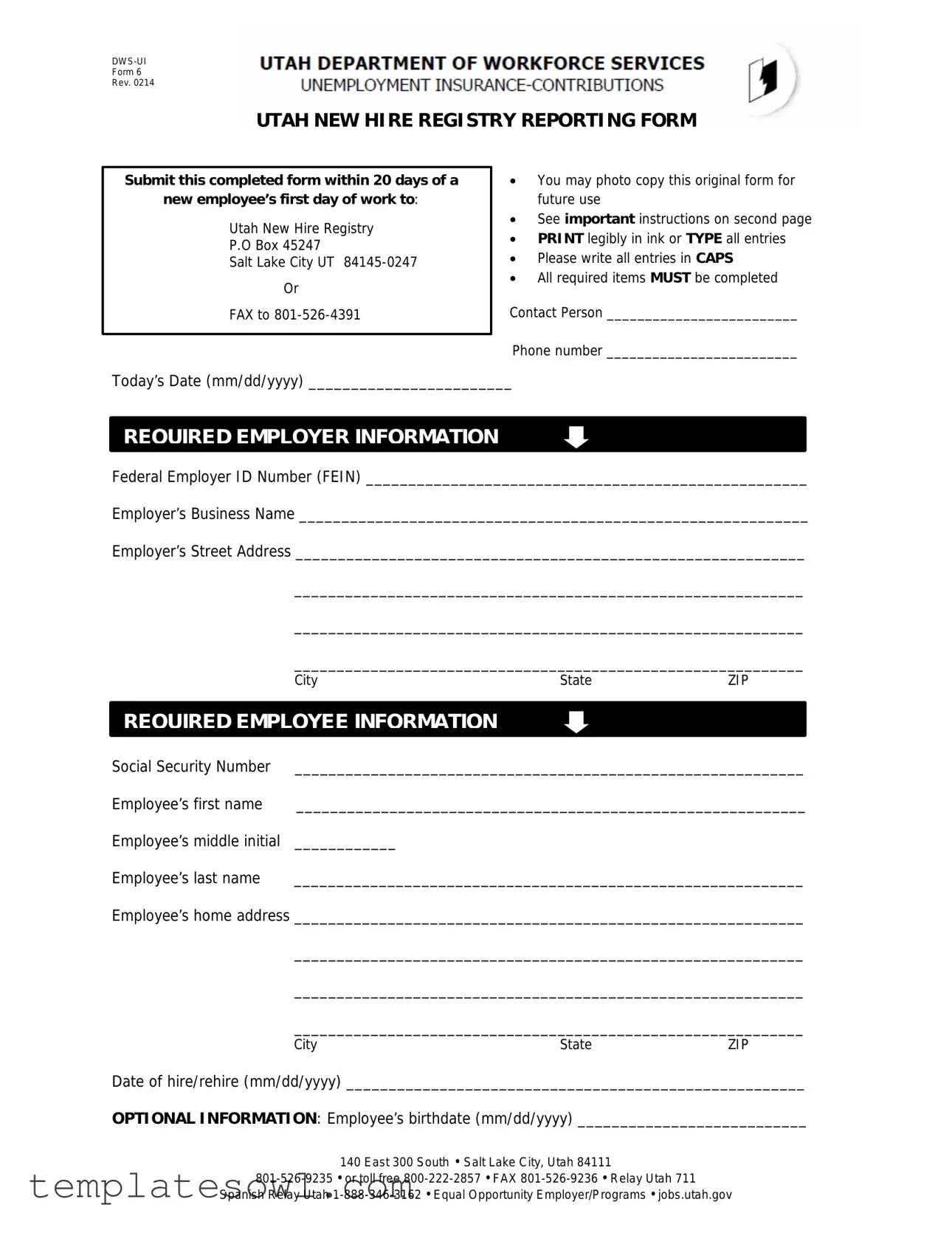

The DWS UI 6 form is an essential document for employers in Utah that must be submitted within a specific timeframe following the hiring of a new employee. This form initiates the process of reporting new hires to the Utah New Hire Registry, a critical requirement that helps streamline various state services, including child support enforcement. Within the confines of this document, one will find instructions for completion, as well as specific data fields that require meticulous attention. Vital information includes the employer's Federal Employer ID Number, the legal name of the business, and the employee's Social Security Number. It is imperative that all entries be filled out accurately and legibly, using capital letters to ensure clarity. Failure to submit the required information in a timely manner can lead to significant penalties, emphasizing the importance of understanding the form's requirements. The document also allows for optional details, such as the employee's birth date, thus enabling employers to keep comprehensive records. Different submission options are available, including mail, fax, and online reporting, catering to the needs of employers regardless of size. This proactive approach not only aids in compliance with state regulations but also facilitates various workforce management processes.

Dws Ui 6 Example

Form 6

Rev. 0214

UTAH NEW HIRE REGISTRY REPORTING FORM

Submit this completed form within 20 days of a

new employee’s first day of work to:

Utah New Hire Registry

P.O Box 45247

Salt Lake City UT

Or

FAX to

You may photo copy this original form for future use

See important instructions on second page

PRINT legibly in ink or TYPE all entries

Please write all entries in CAPS

All required items MUST be completed

Contact Person _________________________

Phone number _________________________

Today’s Date (mm/dd/yyyy) ________________________

REQUIRED EMPLOYER INFORMATION

Federal Employer ID Number (FEIN) ____________________________________________________

Employer’s Business Name ____________________________________________________________

Employer’s Street Address ____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

|

City |

State |

ZIP |

|

|

|

|

|

|

REQUIRED EMPLOYEE INFORMATION |

|

|

|

|

Social Security Number |

____________________________________________________________ |

|

||

Employee’s first name |

____________________________________________________________ |

|||

Employee’s middle initial |

____________ |

|

|

|

Employee’s last name |

____________________________________________________________ |

|

||

Employee’s home address ____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

CityStateZIP

Date of hire/rehire (mm/dd/yyyy) ______________________________________________________

OPTIONAL INFORMATION: Employee’s birthdate (mm/dd/yyyy) ___________________________

140 East 300 South • Salt Lake City, Utah 84111

Spanish Relay Utah

Form 6

Rev. 0214

INSTRUCTIONS

This form is used to report new hires by mail or fax. We strongly recommend entering new hire data on our web site at https://jobs.utah.gov/UI/Employer/EmployerHome.aspx. Larger employers may consider submitting new hire information by CD or by uploading a file on our website. For further information about electronic reporting, please refer to the New Hire Registry Handbook or visit our web site, https://jobs.utah.gov/UI/Employer/EmployerHome.aspx. You can contact us at

The Form: You may download, complete, and print this form in Acrobat Reader, but you cannot electronically save a completed form, or retain your work on a partially completed work. Alternately, you may print the form and use a typewriter with a dark simple print font with 10 or 12 pitch. If hand- printing, use black ink and print in CAPITAL LETTERS with clear character separation.

REQUIRED ITEMS must be completed. Forms submitted with missing data will be returned.

Federal Employer ID Number: The

Employer’s Name: List the employer’s legal name.

Employer’s Address: The address where child support payment orders are sent.

Employee’s Social Security Number: The

Date of Hire/Rehire: This is the date that labor or services for compensation are first performed by the employee. The date of rehire is the date labor or services for compensation are first performed by an employee who was previously employed by the employer, but has been separated from that employment for at least 60 consecutive days.

SUBMISSION OF NEW HIRE REPORTS

You may choose the filing method that is most convenient for you. You may also submit a copy of the employee’s

An employer who fails to timely report the hiring or rehiring of an employee as required by law is subject to a civil penalty of $25 to $500 for each such failure.

All required information must be provided within 20 calendar days of the employee’s first day of work.

Submit all data using the address, fax number or web site printed on the front of the form.

140 East 300 South • Salt Lake City, Utah 84111

Spanish Relay Utah

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The DWS UI 6 form is used to report new hires to the Utah New Hire Registry. |

| Submission Deadline | Employers must submit the form within 20 calendar days of the employee's first day of work. |

| Contact Information | For assistance, contact 801-526-9235 or toll-free at 800-222-2857. |

| Required Information | Key information includes the Federal Employer ID Number, employee's Social Security Number, and date of hire. |

| Acceptable Formats | The form can be completed and submitted by mail, fax, or through the website. |

| Penalties | Failure to report on time may result in civil penalties ranging from $25 to $500 per instance. |

| Handwriting Guidelines | Entries must be printed clearly in capital letters, preferably using black ink. |

| Electronic Submission | Larger employers may submit information via CD or upload files through the registry website. |

| Governing Laws | The form is governed by Utah State law related to employer responsibilities and new hire reporting. |

Guidelines on Utilizing Dws Ui 6

After completing the DWS UI 6 form, you'll need to submit it within a specific timeframe to ensure compliance with Utah's new hire reporting law. It's crucial to provide accurate and complete information to avoid any delays or penalties.

- Gather Necessary Information: Before you begin filling out the form, collect required details about both the employer and the employee. This includes names, addresses, and identification numbers.

- Complete Employer Information: Fill in the contact person's name, phone number, and today's date. Provide the Federal Employer Identification Number (FEIN), employer's business name, and full street address, ensuring all fields are filled out accurately.

- Fill Out Employee Information: Enter the employee's Social Security Number, full name (first, middle initial, last), and home address. Include the date of hire or rehire formatted as mm/dd/yyyy.

- Add Optional Information: If desired, include the employee's birthdate in mm/dd/yyyy format. This section is optional but can be beneficial for record-keeping.

- Check for Completeness: Review the form to ensure that all required fields are filled in and that the entries are written in capital letters and clear print.

- Submit the Form: Decide how you want to send the form. You can mail it to the address listed on the form or fax it to the provided number. Ensure it is sent within 20 days of the employee's start date.

What You Should Know About This Form

1. What is the purpose of the DWS UI 6 form?

The DWS UI 6 form is used to report new hires in the state of Utah. Employers must submit this form within 20 days of a new employee's first day of work. It helps the state maintain accurate records for child support enforcement and unemployment insurance programs.

2. How can I submit the DWS UI 6 form?

You can submit the completed form by mail or fax. Mail it to the Utah New Hire Registry at P.O. Box 45247, Salt Lake City, UT 84145-0247. Alternatively, you can fax the form to 801-526-4391. For convenience, you also have the option to report new hires online through the Utah Jobs website.

3. What information is required on the DWS UI 6 form?

Required information includes the federal employer identification number (FEIN), employer's business name and address, employee's social security number, employee's name, home address, and the date of hire. All required fields must be completed to ensure processing.

4. What happens if I do not submit the DWS UI 6 form on time?

If an employer fails to report a new hire or rehire within the required 20 days, they may incur a civil penalty ranging from $25 to $500 for each instance of late reporting. Timely submission is crucial to avoid these penalties.

5. Can I fill out the DWS UI 6 form electronically?

You may download the form and complete it using Acrobat Reader, but you cannot save the completed form electronically. It is recommended to print the form after filling it out. Handwritten submissions must use black ink and uppercase letters for clarity.

6. What should I do if I make an error on the form?

If you notice an error after submission, you should submit a corrected form as soon as possible. Ensure that all required information is accurate on the new submission to avoid delays or issues with processing.

7. Is there any optional information I can provide?

Yes, while completion of certain fields is mandatory, you may also provide optional information such as the employee’s birthdate. However, the omission of optional fields will not impact the processing of your report.

8. Are there other methods for submitting new hire information?

Larger employers may consider more efficient options, such as submitting new hire information via CD or uploading a file directly on the Utah Jobs website. Electronic reporting can simplify the process and improve accuracy.

9. What should I do if I need assistance with the form?

If you require assistance, you can contact the Utah New Hire Registry at 801-526-9235 or toll-free at 800-222-2857. They can provide guidance and answer any questions you may have regarding the form or submission process.

10. Why is it essential to report new hires?

Reporting new hires is essential for various reasons, including enforcing child support payments and determining eligibility for unemployment benefits. Accurate reporting helps ensure that these programs function effectively, benefiting the community as a whole.

Common mistakes

Filling out the DWS UI 6 form correctly is crucial for ensuring compliance with Utah's new hire reporting requirements. However, many people make common mistakes that can lead to delays or penalties. One frequent error is failing to complete all required items. Each section of the form requests specific information, and leaving any required field blank will result in the form being returned.

Another mistake people often make is not using the proper format for entries. The instructions specifically state that all entries must be written in CAPITAL LETTERS and that hyphens should not be used in numbers such as the Federal Employer ID Number and Social Security Number. Ignoring these guidelines can result in rejection of the form.

Some individuals forget to include the Date of Hire/Rehire. This date is critical, as it establishes the beginning of the employee's work period. Without it, the data cannot be processed accurately. Additionally, the date should adhere to the mm/dd/yyyy format to prevent further complications.

Many people also neglect to provide a valid Social Security Number. This 9-digit number is essential for proper identification and must be entered without hyphens. Submitting the form without this number renders it invalid.

Another common oversight is providing an incomplete Employer's Address. This address must be complete and accurate since it is where child support payment orders will be sent. Incomplete or incorrect addresses can lead to further administrative issues.

Individuals sometimes submit the form beyond the specified timeframe of 20 days post-hire. Timeliness is crucial to avoid potential civil penalties ranging from $25 to $500 for each failure to report on time. Remember, the form must be submitted promptly to prevent complications.

Relying on a poorly photocopied or illegible form can create significant problems, particularly if the printed details are difficult to read. If hand-printing, it is vital to use black ink and maintain clear character separation. Forms that are hard to decipher may be returned.

Many applicants overlook the option to utilize electronic submission methods. While the form can be submitted by mail or fax, choosing to report new hire data through the web portal is often faster and more efficient. This option is frequently underutilized.

Lastly, some people are not aware of the importance of double-checking all entries before submission. Simple mistakes can delay the processing of the new hire report and may result in administrative fines. A quick review can catch errors that may otherwise go unnoticed.

By being aware of these common mistakes, individuals can ensure that they fill out the DWS UI 6 form correctly, leading to smoother processing and adherence to state reporting requirements.

Documents used along the form

The DWS UI 6 form is an essential document for employers in Utah to report new hires to the Utah New Hire Registry. However, several other forms and documents often accompany this form to ensure compliance with hiring regulations and facilitate payroll processing. Below is a list of these documents with brief descriptions.

- W-4 Form: This form is used by employees to specify their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck.

- I-9 Form: The Employment Eligibility Verification Form verifies an employee's identity and legal authorization to work in the United States. This form must be completed within three days of the employee's start date.

- New Hire Reporting Notice: This document serves as a reminder to employers of their obligation to report new hires within a specific timeframe. Providing this notice helps streamline the reporting process.

- State Tax Withholding Forms: Depending on the state, these forms allow employees to elect additional state tax withholdings. The requirements vary by state, so employers should consult local regulations.

- Employee Handbook Acknowledgment: This form confirms that the employee has received and understands the company’s policies, procedures, and benefits outlined in the employee handbook.

- Direct Deposit Authorization Form: Employees may complete this form to authorize their employer to deposit their paychecks directly into their bank accounts, ensuring secure and timely payment.

- Emergency Contact Information Form: This document collects crucial contact information for employees in case of an emergency. Employers typically ask for this form to ensure they can reach family members if necessary.

Incorporating these forms alongside the DWS UI 6 enhances the hiring process and aids compliance with state and federal regulations. It’s essential to ensure that all necessary paperwork is completed thoroughly and accurately to avoid potential penalties.

Similar forms

W-4 Form: Similar to the DWS UI 6 form, the W-4 form collects essential employee information necessary for tax withholding. Both forms ensure accurate identification of the employee for tax purposes.

I-9 Form: Like the DWS UI 6 form, the I-9 verifies employee eligibility for employment in the U.S. It must also be completed within a specific timeframe following the employee’s start date.

State New Hire Reporting Form: This document serves the same purpose as the DWS UI 6 form at the state level, compiling new hire information for state taxation and child support enforcement.

Employee Information Form: This form gathers personal details similar to those on the DWS UI 6. It may include emergency contacts and essential personal data.

Payroll Setup Form: Both the Payroll Setup Form and the DWS UI 6 require a federal employer ID number and employee social security number to facilitate accurate payroll processing.

Direct Deposit Authorization Form: Like the DWS UI 6, this form collects necessary information to ensure that payments are made to the correct individual, facilitating employment and payment workflows.

Benefits Enrollment Form: This document parallels the DWS UI 6 by collecting personal and employment information needed to enroll employees in various benefit programs.

Occupational Safety and Health Administration (OSHA) Form: Like the DWS UI 6 form, OSHA forms include critical information about employees for compliance with safety and health regulations.

State Tax Withholding Form: This form is similar as it requires reporting of specific information related to state tax obligations, similar to the federal requirements on the DWS UI 6.

Resignation/Termination Form: Both forms serve the purpose of reporting and documenting employee status and information, marking important employment milestones.

Dos and Don'ts

When filling out the DWS UI 6 form, it's important to get it right to ensure compliance and avoid issues. Here are some essential tips on what to do and what to avoid:

- Do print legibly using black ink or type the entries.

- Do use capital letters for all entries to ensure clarity.

- Do complete all required fields to avoid delays in processing.

- Do submit the completed form within 20 days of the new employee’s first day of work.

- Don't place hyphens in Social Security Numbers or the Federal Employer ID Number.

- Don't forget to double-check your information for accuracy before submission.

Following these guidelines will help ensure smooth processing of the new hire reporting form.

Misconceptions

Many people have questions about the DWS UI 6 form, leading to a variety of misconceptions. Here are five common misunderstandings explained.

- The DWS UI 6 form is optional for employers. Many employers believe that completing this form is optional, but it's actually required by law to report new hires within 20 days of their start date.

- Only large companies need to submit the form. This is not true. All employers, regardless of size, must submit a DWS UI 6 form for every new hire or rehire. This requirement applies to every business operating in Utah.

- Paper submissions are the only way to file the form. While you can submit the form by mail or fax, online submission is highly encouraged. Employers can enter new hire data directly on the Utah Department of Workforce Services website.

- Only specific information is required to complete the form. Some think they can skip fields that seem less significant. However, all required items, such as the Social Security Number and the date of hire, must be filled out completely to avoid penalties.

- If the form is incomplete, nothing happens. This is a misleading belief. Forms that lack required information will be returned, which can lead to delays and potential fines. Employers may face civil penalties if they fail to report new hires on time.

Understanding these points can help ensure compliance and avoid unnecessary issues with new hire reporting in Utah.

Key takeaways

Here are some key takeaways regarding the completion and use of the DWS UI 6 form:

- Timely Submission is Essential: Employers must complete and submit the form within 20 days of a new employee's first day of work. Failure to do so may incur civil penalties ranging from $25 to $500.

- Accuracy Matters: Ensure all required fields are filled out completely. Incomplete forms will be returned. Pay special attention to the Federal Employer ID Number and the employee’s Social Security Number, as both must be reported without any hyphens.

- Legibility is Key: The form must be filled out legibly in ink or typed. When handwriting, use black ink and print all entries in capital letters to ensure clarity.

- Consider Electronic Options: For convenience, employers can submit new hire data electronically through the recommended website. This option may streamline the reporting process, especially for larger employers.

By following these guidelines, you can streamline the new hire reporting process and ensure compliance with state regulations.

Browse Other Templates

Which of the Following Vessels Must Be Registered to Operate Legally on Mississippi Public Waters? - Categorize the boat according to its defined type for proper registration.

Aoc-e-204 - Part II details every item received, including descriptions and values assigned.

Filing for Custody in Florida - Read all rules regarding service and filing carefully.