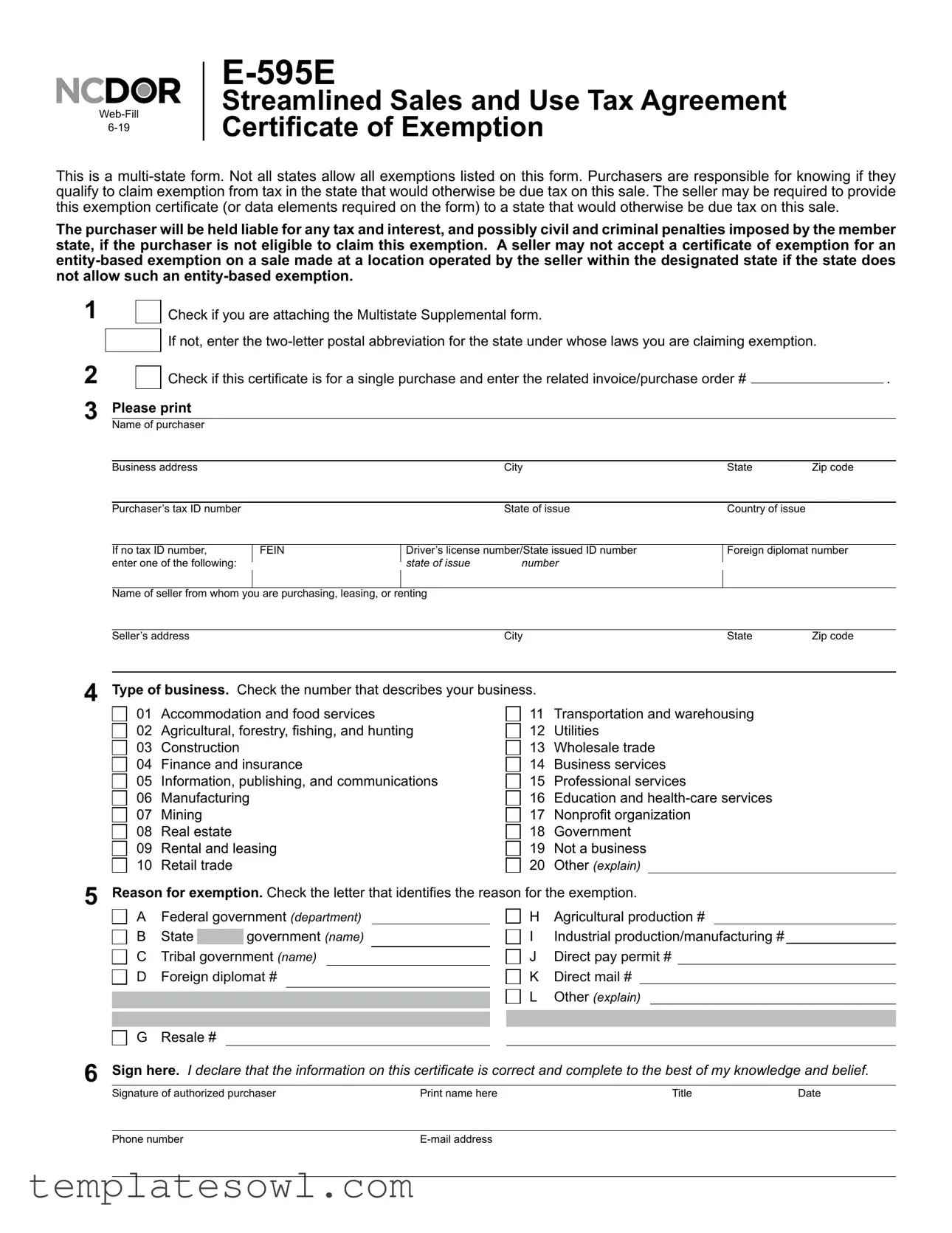

Fill Out Your E 595 E Form

The E 595 E form, known formally as the Streamlined Sales and Use Tax Agreement Certificate of Exemption, serves a critical purpose for businesses operating across state lines in the United States. This form, designed for multi-state use, allows purchasers to claim exemptions from sales tax on otherwise taxable items. However, it is essential for purchasers to understand that not all states allow the exemptions listed on this form. Responsibility lies with the purchaser to accurately determine their qualification for the exemption in the state where the transaction takes place. If improper claims are made, the purchaser may face repayment of taxes, interest charges, or, in severe instances, penalties that could be civil or even criminal in nature. For sellers, the form acts as a safeguard, provided that they maintain proper records of exempt transactions. Specific sections on the form require information such as the purchaser's tax identification number and type of business, as well as the seller's details. Moreover, the certificate's format accommodates both single purchase transactions and blanket exemptions for recurring purchases. Understanding the nuances of the E 595 E form is vital for efficient tax compliance and for avoiding legal challenges related to sales tax liabilities.

E 595 E Example

Streamlined Sales and Use Tax Agreement

Certificate of Exemption

This is a

this exemption certificate (or data elements required on the form) to a state that would otherwise be due tax on this sale.

The purchaser will be held liable for any tax and interest, and possibly civil and criminal penalties imposed by the member state, if the purchaser is not eligible to claim this exemption. A seller may not accept a certificate of exemption for an

1

2

3

Check if you are attaching the Multistate Supplemental form.

If not, enter the

|

|

Check if this certificate is for a single purchase and enter the related invoice/purchase order # |

|

|

. |

||

|

|

||||||

Please print |

|

|

|

|

|

||

Name of purchaser |

|

|

|

|

|

||

|

|

|

|

||||

Business address |

City |

State |

Zip code |

||||

Purchaser’s tax ID number |

|

|

State of issue |

Country of issue |

|

|

|

|

|

||

If no tax ID number, |

FEIN |

Driver’s license number/State issued ID number |

Foreign diplomat number |

||

enter one of the following: |

|

state of issue |

number |

|

|

|

|

|

|

||

Name of seller from whom you are purchasing, leasing, or renting |

|

|

|

||

|

|

|

|

|

|

Seller’s address |

|

|

City |

State |

Zip code |

4

Type of business. Check the number that describes your business.

01 Accommodation and food services

02Agricultural, forestry, fishing, and hunting

03Construction

04Finance and insurance

05Information, publishing, and communications

06Manufacturing

07Mining

08Real estate

09Rental and leasing

10Retail trade

11 Transportation and warehousing

12 Utilities

13 Wholesale trade

14 Business services

15 Professional services

16 Education and

17 Nonprofit organization

18 Government

19 Not a business

20 Other (explain)

5

6

Reason for exemption. Check the letter that identifies the reason for the exemption.

A |

Federal government (department) |

|

|

H |

Agricultural production # |

|

|||||||||

|

State |

|

|

government (name) |

|

I |

Industrial production/manufacturing # |

|

|||||||

B |

or local |

||||||||||||||

|

|

|

|

|

|

|

J |

Direct pay permit # |

|

||||||

C |

Tribal government (name) |

|

|

||||||||||||

D |

Foreign diplomat # |

|

K |

Direct mail # |

|

||||||||||

|

|

|

|

|

|

|

|

|

L |

Other (explain) |

|||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

G |

Resale # |

|

|

|

|

|

|

|

|

|

|||||

Sign here. I declare that the information on this certificate is correct and complete to the best of my knowledge and belief.

Signature of authorized purchaser |

Print name here |

Title |

Date |

Phone number |

|

|

|

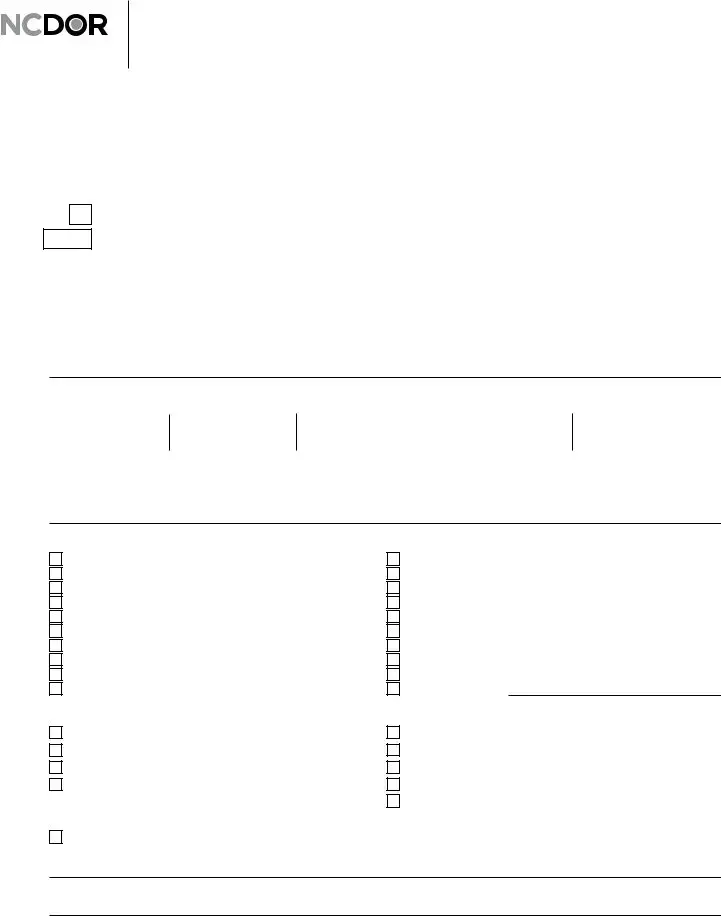

Page 2

Streamlined Sales and Use Tax Agreement

Certificate of Exemption: Multistate Supplemental

Name of purchaser

State |

Reason for exemption |

Identification number (if required) |

AR

GA

IA

IN

KS

KY

MI

MN

NC

ND

NE

NJ

NV

OH

OK

RI

SD

TN*

UT

VT

WA

WI

WV

WY

*SSUTA Direct Mail provisions are not in effect for Tennessee.

2

Page 3

Streamlined Sales and Use Tax Agreement

Certificate of Exemption Instructions

Use this form to claim exemption from sales tax on purchases of otherwise taxable items. The purchaser must complete all fields on the exemption certificate and provide the fully completed certificate to the seller in order to claim exemption.

Warning to purchaser: You are responsible for ensuring that you are eligible for the exemption you are claiming. You will be held liable for any tax and interest, and possibly penalties imposed by the member state to which the tax is due on your purchase, if the purchase is not legally exempt.

Purchaser instructions for completing the exemption certificate

1.Some purchasers may wish to complete a single certificate for multiple states where they conduct business and,

regularly, make exempt purchases from the same seller. If you do, check the box on the front of the SSUTA

Certificate of Exemption to indicate that you are attaching the Multistate Supplemental form on page 2.

CAUTION: Certificates completed with a multistate supplement may include

and purchasers MUST BE AWARE that these additional

If you are not attaching the Multistate Supplemental form, enter the

boxes provided if you are claiming an exemption from sales and use tax imposed by the State of North Carolina. If you are claiming an exemption from more than one member state, complete the SSUTA Certificate of Exemption: Multistate Supplemental form.

2.Single purchase exemption certificate: Check this box if this exemption certificate is being used for a single purchase. Include the invoice or purchase order number for the transaction.

If this boxed is not checked, this certificate will be treated as a blanket certificate. A blanket certificate continues in force so long as the purchaser is making recurring purchases (at least one purchase within a period of twelve consecutive months) or until otherwise cancelled by the purchaser.

3.Purchaser information: Complete the purchaser and seller information section, as requested. An identification number for you or your business must be included. Include your North Carolina sales and use tax account ID

number or North Carolina sales and use tax exemption number, as appropriate. If a transaction does not require the use of a registration or exemption number, enter the Federal Employer Identification Number (FEIN) issued to

your business, or if no FEIN is required, enter your personal driver’s license number and the state from which it is issued. Foreign diplomats and consular personnel must enter the individual tax identification number shown on the sales tax exemption card issued to you by the United States Department of State’s Office of Foreign Missions.

Multistate Purchasers: The purchaser should enter its headquarters address as its business address.

4.Type of business: Check the number that best describes your business or organization. If none of the categories apply, check number 20 and provide a brief description.

5.Reason for exemption: Check the letter that applies to your business and enter the additional information requested for that exemption. If the member state that is due tax on your purchase does not require the additional information requested for the exemption reason code checked, enter “NA” for not applicable on the appropriate line. If an exemption that is not listed applies, check “L Other” and enter an explanation. The explanation for “L Other” must include a clear and concise explanation of the reason for the exemption claimed.

6.Sign here: Sign and date the certificate of exemption. Print your name along with your title, phone number, and

3

Page 4

Streamlined Sales and Use Tax Agreement

Certificate of Exemption Instructions - Continued

Multistate Purchasers: Attach the SSUTA Certificate of Exemption: Multistate Supplemental form and indicate the applicable reason for exemption and identification number (if required) for each of the additional

states in which the purchaser wishes to claim exemption from tax.

CAUTION: The exemptions listed are general exemptions most commonly allowed by member states. However, each state’s laws governing exemptions are different. Not all of the reasons listed may be valid exemptions in the state in which you are claiming exemption. In addition, each state has other exemptions that are not listed on this form. To determine what sales and use tax exemptions are allowed in a particular state refer to the state’s web site or other information available relating to their exemptions.

For information on exemption certificate procedures and exemption number requirements in North Carolina, see

Sales and Use Tax Bulletins which can be found on the Department’s website at www.ncdor.gov, or you may contact the Taxpayer Assistance and Collection Center at

Seller: You are required to maintain proper records of exempt transactions and provide those records to Member states of the SST Governing Board, Inc., when requested. These certificates may be provided in paper or electronic format. If a paper exemption certificate is not forwarded by the purchaser, but instead the data elements required

on the form are otherwise captured by the seller, the seller must maintain such data and make it available to Member states in the form in which it is maintained by the seller.

You are relieved of the responsibility for collecting and remitting sales tax on the sale or sales for which the purchaser provided you with this exemption certificate, even if it is ultimately determined that the purchaser

improperly claimed an exemption, provided all of the following conditions are met:

1.All fields on the exemption certificate are completed by the purchaser or the required information is captured and maintained;

2.The fully completed exemption certificate (or the required information) is provided to you at the time of sale or as otherwise provided by Section 317 of the SSUTA;

3.If the purchaser is claiming an

4.You do not fraudulently fail to collect the tax due; or

5.You do not solicit customers to unlawfully claim an exemption.

4

Form Characteristics

| Fact Name | Description |

|---|---|

| Multi-State Applicability | The E 595 E form, known as the Streamlined Sales and Use Tax Agreement Certificate of Exemption, is designed for use across multiple states. However, it is crucial for purchasers to recognize that not all states accept the exemptions listed on the form. |

| Purchaser Responsibility | Purchasers hold the responsibility of determining their eligibility to claim an exemption. If a purchase is later deemed taxable, they will be liable for any tax owed, including interest and possible penalties. |

| Specific State Limitations | Certain states prohibit the acceptance of entity-based exemptions when sales occur at locations operated by the seller within that state. Each state has its own regulations, thus requiring due diligence by both purchasers and sellers. |

| Supplemental Requirements | If claiming exemptions for multiple states, businesses may need to complete the Multistate Supplemental form. This requirement adds a layer of complexity, necessitating knowledge of individual state laws regarding sales tax exemptions. |

Guidelines on Utilizing E 595 E

Completing the E 595 E form is essential for claiming a sales tax exemption. Once the form is filled out accurately, it must be provided to the seller to support the exemption claim. Follow the steps below to fill out the form correctly.

- Determine if you will attach the Multistate Supplemental form. If not, enter the two-letter postal abbreviation for the state related to your exemption.

- If using the exemption for a single purchase, check the box and include the corresponding invoice or purchase order number.

- Fill in your name and business address in the purchaser information section. Include city, state, zip code, and your tax ID number. If you do not have a tax ID, enter your FEIN or driver's license number.

- Provide the seller’s name and address, including city, state, and zip code.

- Choose the type of business by checking the number that applies. If none fit, select “20 Other” and briefly explain.

- Indicate the reason for exemption by checking the corresponding letter. Include any additional information if required.

- Sign the form and print your name, title, phone number, and email address in the designated areas.

What You Should Know About This Form

What is the E 595 E form?

The E 595 E form, also known as the Streamlined Sales and Use Tax Agreement Certificate of Exemption, is a multi-state document used by purchasers to claim exemption from sales tax on purchases of otherwise taxable items. It simplifies the process for individuals and organizations across participating states by allowing them to assert their tax-exempt status without needing to fill out multiple forms for various states.

Who is responsible for knowing if a claim for exemption is valid?

The purchaser bears the responsibility for ensuring that they qualify to claim exemption from sales tax. This includes understanding the specific exemptions recognized in the state where the purchase occurs. If a purchaser is not eligible for the exemption, they will be liable for any tax and interest, along with potential civil or criminal penalties imposed by the state.

Can a seller refuse to accept the E 595 E form?

Yes, a seller can refuse to accept the E 595 E form if it does not comply with their state’s exemption requirements. For instance, if a specific entity-based exemption is claimed, the seller must verify that the state where the sale takes place allows that exemption. Failing to do so may lead the seller to be held responsible for uncollected sales tax.

What information must be included in the E 595 E form?

The E 595 E form requires several pieces of information to be completed. This includes the name of the purchaser, their business address, and tax identification numbers. Additionally, it asks for seller information, the type of business, reason for exemption, and an authorized signature along with contact information. Completing all fields is crucial to ensure the form is valid.

What is a single purchase exemption certificate?

A single purchase exemption certificate allows purchasers to claim exemption from sales tax for a specific transaction. If this box is checked on the E 595 E form, the purchaser must also include the relevant invoice or purchase order number. If this box is not checked, the certificate acts as a blanket certificate, which remains valid for future transactions until canceled by the purchaser.

What should a purchaser do if they are making exempt purchases in multiple states?

If a purchaser is making exempt purchases in more than one state, they must attach the Multistate Supplemental form to the E 595 E certificate. This additional form allows them to claim exemption from taxes in multiple states, provided they specify the reason for exemption and include the required identification numbers for each state involved.

Common mistakes

When filling out the E 595 E form, one common mistake involves failing to provide the necessary identification number. Each purchaser must include a tax ID or, if not applicable, their driver's license number. Omitting this crucial information can lead to delays or rejections of the exemption claim. Always ensure that the identification number is correctly entered in the specified field.

Another frequent error is incorrectly indicating the type of business. There are specific numbers associated with different business categories, and checking the wrong box can cause complications. Select the number that accurately represents your business to avoid confusion or challenges during the exemption review.

Many individuals forget to check whether their exemption certificate is for a single purchase or a blanket exemption. If a single purchase is intended, the box must be checked. Not doing so treats the certificate as a blanket exemption, which could lead to issues if the purchaser is only intending to exempt a single transaction.

A further mistake arises when purchasers fail to specify the reason for exemption. The form requires checking the letter corresponding to the reason for the exemption. Without this information filled out correctly, there may be ambiguity in the exemption claim, which could trigger further scrutiny or rejection.

Additionally, purchasers sometimes neglect to sign or date the certificate. The form requires the authorized purchaser's signature to validate the information provided. Missing this step can invalidate the entire document and result in financial penalties.

People also often overlook the need to include an invoice or purchase order number for single purchase exemptions. This detail is critical, as absence of this information can complicate tracking for both the purchaser and seller. Always double-check to ensure all relevant details are present.

Another common oversight is failing to account for specific state requirements. Not all states recognize every exemption outlined on the E 595 E form. It’s important for purchasers to be aware of their individual state laws. Failing to understand these nuances can lead to unexpected tax liabilities.

Lastly, purchasers may neglect to consult the multistate supplemental form when claiming exemptions across different states. Those filling out the E 595 E form should ensure that all necessary attachments are included if applying for exemptions in multiple states. This careful scrutiny helps to ensure compliance and reduces the likelihood of errors.

Documents used along the form

When utilizing the E 595 E form for claiming a sales tax exemption, individuals and businesses often need additional documentation to ensure compliance with varying state regulations. Here’s a list of forms and documents that frequently accompany the E 595 E form, each serving a critical purpose in the exemption process.

- Multistate Supplemental Form: This form allows purchasers to claim exemption for multiple states simultaneously. It must be attached to the E 595 E form when claiming exemptions in several member states.

- Sales Tax Exemption Certificate: A specific state-issued document that proves a buyer is exempt from sales tax. States may have their own versions, and it's essential to use the right one for compliance.

- Direct Pay Permit: This permit allows businesses to pay sales tax directly to the state rather than to sellers. It's typically used by manufacturers or wholesalers to streamline tax payments on purchases.

- Federal Exemption Certificate: This certificate is crucial for entities claiming federal government exemption. It certifies that purchases made by federal agencies are exempt from sales tax.

- Resale Certificate: Retailers use this certificate to purchase goods intended for resale without paying sales tax upfront. It's particularly useful for resellers to facilitate their inventory acquisitions.

- Tax-Exempt Number Documentation: Many states issue tax-exempt numbers to qualifying organizations (like nonprofits). This documentation verifies an organization’s eligibility and is often required to substantiate sales tax exemptions.

- Compensating Use Tax Certificate: This form is utilized to report and pay use tax on items purchased out of state that get used within the purchaser's home state. It serves as a record of tax obligations.

- Foreign Diplomat Exemption Certificate: This specific certificate is used by foreign diplomats to claim tax exemptions on purchases made while living or working in the U.S. It verifies their eligibility for such exemptions.

- Farm Exemption Certificate: Farmers may use this certificate to exempt agricultural purchases from sales taxes. It confirms that the goods purchased are essential for farming operations.

- Nonprofit Organization Certificate: Nonprofits often use this form to certify their status and claim sales tax exemptions on purchases related to their charitable activities.

Understanding and managing these accompanying documents is essential for anyone seeking to navigate the complexities of tax exemptions efficiently. Properly completed forms and documentation help ensure compliance, protecting both purchasers and sellers from potential tax liabilities.

Similar forms

The E-595 E form serves as a streamlined sales and use tax agreement certificate of exemption. Similar to this form, several other documents also function to claim tax exemptions in different contexts. Below is a list of these similar documents:

- Form ST-5: This form is used in Massachusetts for sales tax exemption. Like the E-595 E, it requires information about the purchaser and the reason for exemption.

- Form ST-3: In New York, this form allows purchases to be made without sales tax for exempt entities. It too requires detailed information about the purchaser and the type of exemption claimed.

- Form ST-2: This Virginia form is used to certify exempt purchases. As with the E-595 E, it mandates disclosure of the purchaser's identity and the reason for exemption.

- Form ST-120: This New Jersey certificate of exemption is meant for businesses to claim sales tax exempt status. It is similar in that it necessitates complete details about the purchaser and the justification for the exemption.

- Form 13: In Connecticut, Form 13 certifies that certain purchases are exempt from state sales tax. Like the E-595 E form, it also insists on verifying the identity of the purchaser and the exemption reason.

- Form 150: The Texas Sales Tax Exemption Certificate allows a purchaser to make tax-exempt purchases and requires comparable details as the E-595 E, including purchaser's information and exemption type.

- Form ST-4: This is the Illinois Sales Tax Exemption Certificate form. It functions similarly by requiring identification details and an explanation for the claimed exemption from sales tax.

- Form 149: Used in Florida, this form certifies exempt purchases and is similar in structure to the E-595 E by demanding comprehensive information about the purchaser and exemption reason.

Dos and Don'ts

When filling out the E 595 E form, it's important to get it right. Here are four things to keep in mind that can help make the process smoother:

- Do make sure to complete all fields accurately. An incomplete form can lead to delays or issues in claiming your exemption.

- Don't assume all exemptions apply in every state. Each state has its own rules, so verify that the exemption you are claiming is valid in your state.

- Do double-check that you are entering the correct identification numbers. This includes your tax ID, FEIN, or driver's license number, if applicable.

- Don't forget to sign and date the form. Without your signature, the exemption certificate may not be considered valid.

Misconceptions

Misconceptions about the E 595 E Form

- Misconception 1: The form can be used in any state for any exemption.

- Misconception 2: Once the form is submitted, the exemption is guaranteed.

- Misconception 3: A blanket certificate covers all future purchases without limits.

- Misconception 4: Only businesses can use this exemption form.

- Misconception 5: You can ignore the multistate supplemental form if making purchases in multiple states.

- Misconception 6: Sellers have no responsibilities when an exemption certificate is provided.

Not all states accept the exemptions listed on the E 595 E form. Each state has its own rules regarding sales tax exemptions. It’s important to check whether the exemption applies in the specific state you are dealing with.

Filing the form does not guarantee the exemption. The purchaser is still responsible for determining eligibility. If not eligible, the purchaser may face tax liabilities and penalties.

A blanket certificate is only good as long as the purchaser continues to make regular purchases from the seller. If no purchase is made within a twelve-month period, the exemption may no longer apply.

Individuals can also claim exemptions using this form. The key is to provide the correct information and demonstrate eligibility for the exemption claimed.

If you plan to claim exemptions in multiple states, you must complete the multistate supplemental form. This is essential for ensuring compliance with each state's specific exemption rules.

Sellers are required to keep proper records of exempt transactions. They must also ensure the information on the exemption certificate is correctly filled out before relying on it.

Key takeaways

The E 595 E form is a valuable tool for claiming sales tax exemptions across multiple states. Here are essential takeaways to ensure proper completion and usage of this form:

- Verification of Eligibility: It is the responsibility of the purchaser to verify if they qualify for the exemption claimed.

- Multi-State Consideration: This form is designed for use across various states, but not all states honor every exemption included.

- Document Requirements: Sellers may need to provide this exemption certificate to the respective state to validate the exemption.

- Liability for Incorrect Claims: Purchasers can incur penalties, including tax and interest liabilities, if they incorrectly claim an exemption.

- Single Purchase vs. Blanket Certificate: Check the appropriate box if claiming a single purchase exemption to avoid automatic classification as a blanket certificate.

- Completion of All Fields: Each section of the form must be filled out correctly; omissions can lead to complications in claiming an exemption.

- Business Type Indication: It is crucial to choose the correct business type from the provided options to ensure transparency and accuracy.

- Accuracy in Reason for Exemption: Carefully select and provide details for the exemption reason code that applies to your situation.

- Signature and Contact Information: The form must be signed and dated, and contact details should be provided for follow-up questions by tax authorities.

Utilizing the E 595 E form correctly can simplify your purchasing process significantly, but thorough care and attention are paramount.

Browse Other Templates

Long and Foster Rental Application - Be aware of the necessary documents required for previous residences.

Tax Exempt Office Depot - Don't forget to follow instructions carefully to ensure a smooth application process.