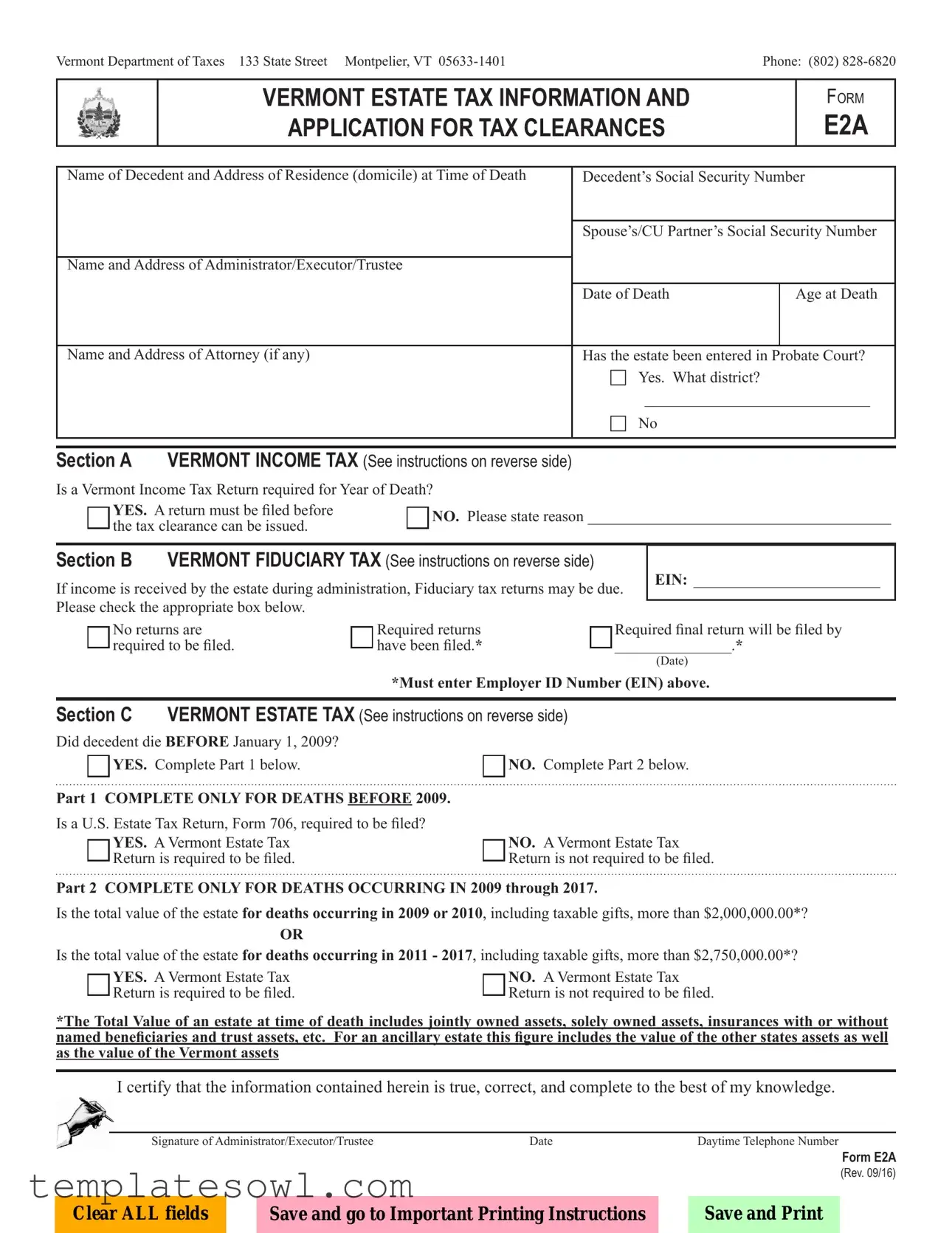

Fill Out Your E2A Form

The E2A form serves as a critical document for the administration of estate taxes in Vermont, detailing essential information necessary for tax clearance following a decedent’s passing. This form is designed to collect various vital data, including the names and social security numbers of both the decedent and their spouse or civil union partner. Additionally, it requires information about the decedent's address at the time of death, as well as identifying details of the estate’s administrator, executor, trustee, and any legal representation involved. Notably, the E2A includes specific sections addressing Vermont income tax requirements, fiduciary tax obligations, and the thresholds for estate taxes based on the year of death. Whether the estate has entered probate court and the subsequent necessary filings for tax returns are significant factors outlined in this form. By addressing these elements, the E2A form ultimately facilitates the process of resolving tax responsibilities, ensuring that the estate is compliant with state regulations posthumously.

E2A Example

Vermont Department of Taxes 133 State Street Montpelier, VT

|

VERMONT ESTATE TAX INFORMATION AND |

Form |

||||

|

APPLICATION FOR TAX CLEARANCES |

E2A |

||||

|

|

|

|

|

|

|

Name of Decedent and Address of Residence (domicile) at Time of Death |

Decedent’s Social Security Number |

|||||

|

|

|

|

|

|

|

|

|

|

Spouse’s/CU Partner’s Social Security Number |

|||

|

|

|

|

|

|

|

Name and Address of Administrator/Executor/Trustee |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Date of Death |

|

Age at Death |

|

|

|

|

|

|

|

|

Name and Address of Attorney (if any) |

|

Has the estate been entered in Probate Court? |

||||

|

|

|

Yes. What district? |

|

||

|

|

|

_ _____________________________ |

|||

|

|

|

No |

|

||

|

|

|

|

|

||

|

|

|

|

|

||

Section A VERMONT INCOME TAX (See instructions on reverse side) |

|

|

|

|||

Is a Vermont Income Tax Return required for Year of Death? |

|

|

|

|||

YES. A return must be filed before |

NO. Please state reason________________________________________ |

|||||

the tax clearance can be issued. |

||||||

|

|

|

|

|||

Section B VERMONT FIDUCIARY TAX (See instructions on reverse side)

If income is received by the estate during administration, Fiduciary tax returns may be due. Please check the appropriate box below.

EIN:_ ________________________

No returns are required to be filed.

Required returns have been filed.*

Required final return will be filed by

_______________.*

(Date)

*Must enter Employer ID Number (EIN) above.

Section C VERMONT ESTATE TAX (See instructions on reverse side)

Did decedent die BEFORE January 1, 2009?

YES. Complete Part 1 below.

YES. Complete Part 1 below.

Part 1 COMPLETE ONLY FOR DEATHS BEFORE 2009.

Is a U.S. Estate Tax Return, Form 706, required to be filed? YES. A Vermont Estate Tax

Return is required to be filed.

NO. Complete Part 2 below.

NO. Complete Part 2 below.

NO. A Vermont Estate Tax Return is not required to be filed.

Part 2 COMPLETE ONLY FOR DEATHS OCCURRING IN 2009 through 2017.

Is the total value of the estate for deaths occurring in 2009 or 2010, including taxable gifts, more than $2,000,000.00*?

OR

Is the total value of the estate for deaths occurring in 2011 - 2017, including taxable gifts, more than $2,750,000.00*?

YES. A Vermont Estate Tax |

|

NO. A Vermont Estate Tax |

|

||

Return is required to be filed. |

|

Return is not required to be filed. |

|

*The Total Value of an estate at time of death includes jointly owned assets, solely owned assets, insurances with or without named beneficiaries and trust assets, etc. For an ancillary estate this figure includes the value of the other states assets as well as the value of the Vermont assets

I certify that the information contained herein is true, correct, and complete to the best of my knowledge.

Signature of Administrator/Executor/Trustee |

Date |

Daytime Telephone Number |

Form E2A

(Rev. 09/16)

Clear ALL fields |

|

Save and go to Important Printing Instructions |

|

Save and Print |

|

|

|

|

|

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The E2A form is used to apply for tax clearances related to the estate of a deceased individual in Vermont. |

| Governing Law | This form is governed by the Vermont Department of Taxes regulations, specifically related to estate and fiduciary tax obligations. |

| Residence Information | Applicants must provide the name and address of the decedent's residence at the time of death. |

| Social Security Numbers | The form requires the decedent's and, if applicable, the spouse's or civil union partner's Social Security numbers. |

| Probate Status | Applicants must indicate whether the estate has been entered into Probate Court, and specify the district if applicable. |

| Income Tax Requirement | A Vermont Income Tax Return must be filed for the year of death before tax clearance can be issued, if required. |

| Estate Value Thresholds | For estates of decedents who died from 2009-2017, the total estate value must exceed specific thresholds to require a Vermont Estate Tax Return. |

| Certification | The form concludes with a certification section, where the administrator, executor, or trustee attests to the truthfulness of the information provided. |

Guidelines on Utilizing E2A

When you're ready to fill out the E2A form, gather all necessary information about the decedent and the estate. Make sure you have all pertinent details at hand. Once you complete the form, it can be submitted to the Vermont Department of Taxes for tax clearance. Follow the steps below to ensure that everything is filled out correctly.

- Provide the name of the decedent and their address at the time of death.

- Enter the decedent’s Social Security Number.

- Input the Social Security Number of the spouse or civil union partner.

- Fill in the name and address of the administrator, executor, or trustee.

- Record the date of death.

- Note the age at death.

- If there is an attorney involved, enter their name and address.

- Indicate whether the estate has been entered in probate court by checking "Yes" or "No." If "Yes," specify the district.

- In Section A, answer if a Vermont Income Tax Return is required for the year of death by checking "Yes" or "No." Provide a reason if "No."

- Section B pertains to fiduciary tax. Indicate if returns are required by checking the appropriate box. Fill in the Employer ID Number (EIN), if applicable, and complete the relevant information.

- Move to Section C regarding Vermont Estate Tax. If the decedent died before January 1, 2009, check "Yes" and complete Part 1.

- If the death occurred between 2009 and 2017, fill out Part 2 by indicating whether the total value of the estate exceeds the given amounts based on the year of death.

- Confirm the total value of the estate includes all relevant assets.

- At the end of the form, certify the information by signing where indicated and providing the date and daytime telephone number.

What You Should Know About This Form

What is the purpose of the E2A form?

The E2A form is used to apply for tax clearances related to an estate in Vermont. It serves as a declaration of the decedent’s estate tax obligations, and it helps the state ensure that all necessary tax returns have been filed and taxes paid before the estate can be settled. Tax clearances can be crucial for administering the estate and avoiding future liabilities.

Who should complete the E2A form?

The form should be completed by the administrator, executor, or trustee of the decedent's estate. This individual is responsible for managing the estate’s affairs, which includes addressing any tax matters. If there is an attorney involved, their information should also be provided on the form.

What information is required on the E2A form?

Essential information includes the name and address of the decedent, their Social Security number, and the date of death. You will also need to provide details about the administrator or executor, including their contact information. Additionally, the form asks about any probate court involvement and whether income tax or fiduciary tax returns have been filed or are required.

Is a Vermont Income Tax Return always required when completing the E2A form?

No, a Vermont Income Tax Return is only required if the decedent’s estate needs one for the year of death. If applicable, the return must be filed before the tax clearance can be issued. If no return is needed, you must provide a reason on the form.

What are the estate tax filing requirements under the E2A form?

The estate tax requirements depend on the date of the decedent's death and the total value of the estate. If the decedent died before January 1, 2009, a U.S. Estate Tax Return (Form 706) is typically necessary. For deaths between 2009 and 2017, you need to assess the total estate value. If it surpasses certain thresholds, a Vermont Estate Tax Return must be filed.

What does it mean if the estate is not required to file a Vermont Estate Tax Return?

If the total value of the estate falls below the required thresholds, a Vermont Estate Tax Return is not needed. However, all assets, including jointly owned property and certain trust assets, must be included in the valuation to determine if filing is necessary.

How can I submit the E2A form?

The completed E2A form should be submitted to the Vermont Department of Taxes at the address provided on the form. It is advisable to keep a copy for your records. If you have questions or need further assistance, you can contact the department directly at the provided phone number.

Common mistakes

Filling out the E2A form can be straightforward, but many people make common mistakes that can delay the process. One significant error is omitting the decedent’s Social Security number. This number is crucial for processing the estate tax clearance. Without it, the state may face difficulties verifying the decedent's identity.

Another frequent mistake is failing to provide the full address of the decedent’s residence at the time of death. Incomplete or incorrect addresses can lead to confusion or delays. Accurate information helps ensure that all correspondence is routed properly and efficiently.

Many applicants overlook the requirement for a Vermont Income Tax Return for the year of death. If a return is due, it must be submitted before a tax clearance can be issued. Ignoring this requirement may result in automatic disqualification from receiving the necessary clearance.

Additionally, incorrect answers regarding whether the estate has been entered in Probate Court commonly occur. Applicants sometimes select "No" without realizing that Probate may be required for their situation. This oversight can complicate the procedure or prevent clearance from being granted.

When completing Section C concerning Vermont Estate Tax, applicants sometimes fail to check if a U.S. Estate Tax Return, Form 706, is necessary. Not addressing this question properly can lead to confusion and potential penalties if required forms aren’t filed.

Lastly, using incorrect or outdated information can hinder the process. Individuals may forget to verify certain figures, such as the total value of the estate, which should include all assets, insurance policies, and gifts. Accurate calculations are essential to determine tax responsibilities correctly.

Documents used along the form

The E2A form, which is essential for obtaining tax clearances for estates in Vermont, is often accompanied by several other important forms and documents. Each of these plays a crucial role in the estate administration and tax clearance process. Below is a list of common documents that may be required alongside the E2A form.

- U.S. Estate Tax Return (Form 706): This federal form may be necessary for estates that exceed certain value thresholds. It details the value of the deceased's estate and calculates the potential estate tax due. Completing this form is essential to ensure compliance with federal tax obligations.

- Vermont Estate Tax Return: This state-specific return is required if the estate’s value exceeds the Vermont estate tax exemption threshold. The return provides information about the estate’s assets and must be filed before tax clearances can be issued.

- Fiduciary Income Tax Return (Form 1041): If the estate generates income during the administration period, this form must be filed to report the income received. It helps determine the fiduciary tax obligations of the estate.

- Probate Petition: When an estate enters probate court, a probate petition is filed to initiate the legal process. This document informs the court about the deceased's assets and requests that the court validate the will and appoint the executor or administrator.

- Will or Trust Document: The last will and testament or trust document is fundamental in guiding how the deceased's assets should be distributed. This document provides vital information that the executor or trustee must follow during the estate administration process.

Submitting the E2A form along with these associated documents ensures the estate is compliant with Vermont's tax laws. This diligence helps expedite the clearance process, allowing the estate to settle in a timely manner and facilitating the distribution of assets to beneficiaries.

Similar forms

-

Form 706: This is the U.S. Estate Tax Return needed for estates that exceed certain value thresholds at the time of death. Similar to the E2A, it requires detailed information about the decedent’s assets and liabilities to calculate any tax due.

-

Form 1041: This is the U.S. Income Tax Return for Estates and Trusts. Much like the E2A, it addresses the tax obligations of the estate during its administration, including income generated by the estate.

-

Vermont Non-Resident Income Tax Return (Form IT-1040NR): Estates often have to file this form if they have income sourced from Vermont. Similar to the E2A, this form assesses tax responsibilities based on location and residency.

-

Form DE-9: The Vermont Death Certificate must be submitted in probate matters and contains essential information about the decedent. Like the E2A, the DE-9 is vital for establishing the legal status of the estate.

-

Application for Gift Tax Clearance: Just like the E2A, this application pertains to tax obligations surrounding gifts made by the decedent prior to their death. It confirms if any gift taxes are owed.

-

Form R-1: This is the Vermont Estate Tax Return. It functions similarly to the E2A, requiring detailed reporting of the estate's value and assessment of potential estate tax obligations.

Dos and Don'ts

When filling out the E2A form, it’s crucial to get it right. Here’s a straightforward list of things you should and shouldn’t do:

- Do review the instructions on the reverse side thoroughly before you begin.

- Do double-check all of your entries for accuracy. Mistakes could delay the process.

- Do include all necessary documentation. This may include tax returns or death certificates.

- Do ensure that the signature of the Administrator, Executor, or Trustee is clear and signed in the appropriate section.

- Do keep a copy of the completed form for your records.

- Don’t rush through the form. Take your time to fill it out carefully.

- Don’t leave any required fields blank. Incomplete forms can be returned.

- Don’t forget to include your daytime telephone number for any follow-up questions.

- Don’t ignore mailing instructions; ensure that your form goes to the correct address.

- Don’t assume you know the requirements. If you’re unsure, seek help.

Being careful and attentive will help ensure that your E2A form is processed smoothly. Good luck!

Misconceptions

Understanding the E2A form can be challenging. Here are eight misconceptions that may mislead individuals navigating this important document:

- Filing the E2A form is optional for all estates. In reality, if an estate meets certain criteria, filing the E2A form is a necessary step to obtain tax clearance.

- Only large estates need to file the E2A form. Many individuals believe this, but even smaller estates may be subject to requirements depending on income and assets.

- All estates require a Vermont Income Tax return for the year of death. This is incorrect. If the estate does not have any income, a return may not be necessary.

- The E2A form can be filed at any time after the decedent's death. However, timeliness is crucial. Delays can hinder tax clearance and the administration of the estate.

- Only the executor can file the E2A form. Although the executor typically handles this task, other authorized representatives can also assist in the process.

- Submitting the E2A form guarantees tax clearance. This isn’t assured. Clearances rely on meeting all tax obligations, including any required tax returns.

- Once the E2A form is submitted, no further action is necessary. Individuals should remain attentive to additional requests from tax authorities or updates regarding tax obligations.

- Only the estate's value at the time of death is considered for tax purposes. This is misleading. Both jointly owned and trust assets also factor into the total estate value.

Being informed about these misconceptions can help individuals navigate the complexities of the E2A form with greater confidence.

Key takeaways

Completing the E2A form requires careful attention to detail. Below are key takeaways to ensure accuracy and compliance.

- Include the Name and Address of the decedent as it was at the time of death. This information is essential for proper identification.

- Provide the decedent’s and spouse’s/social partner’s Social Security Numbers accurately. Double-check for any errors to avoid delays.

- Identify the Administrator, Executor, or Trustee with their contact information. This person will be responsible for handling the estate.

- Indicate if the estate has been entered into Probate Court. Specify the district if applicable, as this affects the processing.

- Determine if a Vermont Income Tax Return is necessary for the year of death. This must be filed before a tax clearance can be issued.

- If the estate generates income during administration, fiduciary tax returns may be required. Ensure to check the right boxes on the form.

- For deaths before January 1, 2009, complete Part 1 of the E2A form. You must determine if a U.S. Estate Tax Return, Form 706, is needed.

- For deaths from 2009 to 2017, check if the estate’s total value exceeds the specified amounts to ascertain the requirement for a Vermont Estate Tax Return.

- Accurately calculate the Total Value of the Estate at the time of death, which includes all relevant assets, to avoid misunderstandings.

- Finally, ensure all signatures are completed and that the information provided is true and accurate to the best of your knowledge.

Take prompt action in gathering this information, as delays can impact tax clearance and estate settlement processes.

Browse Other Templates

How Long Does It Take to Get Unemployment in Pa - The consent granted in the UC-1208 form is extensive regarding management of unemployment benefits communication.

Animal Health Certificate for Travel - It must be signed by a licensed veterinarian no more than ten days before your travel date.