Fill Out Your E3065 Form

The E3065 form is an essential tool for individuals seeking reimbursement for medical travel expenses related to workplace injuries in California. Designed specifically for injured workers, this form allows users to claim costs incurred while traveling for medical appointments. Claimants must provide specific details such as their name, claim number, and the mileage for each trip, which will be calculated at varying rates depending on the travel date. California law mandates the inclusion of a statement regarding the consequences of submitting fraudulent claims, underscoring the importance of honesty when filling out the form. Attachments like receipts for parking, bridge tolls, and public transportation costs play a crucial role in substantiating the claim, ensuring that all associated expenses are considered for reimbursement. Once completed, the form should be mailed to the assigned claims adjuster or one of the designated State Fund Claims Processing Centers. Remember to keep a copy for personal records as you move forward with your claim.

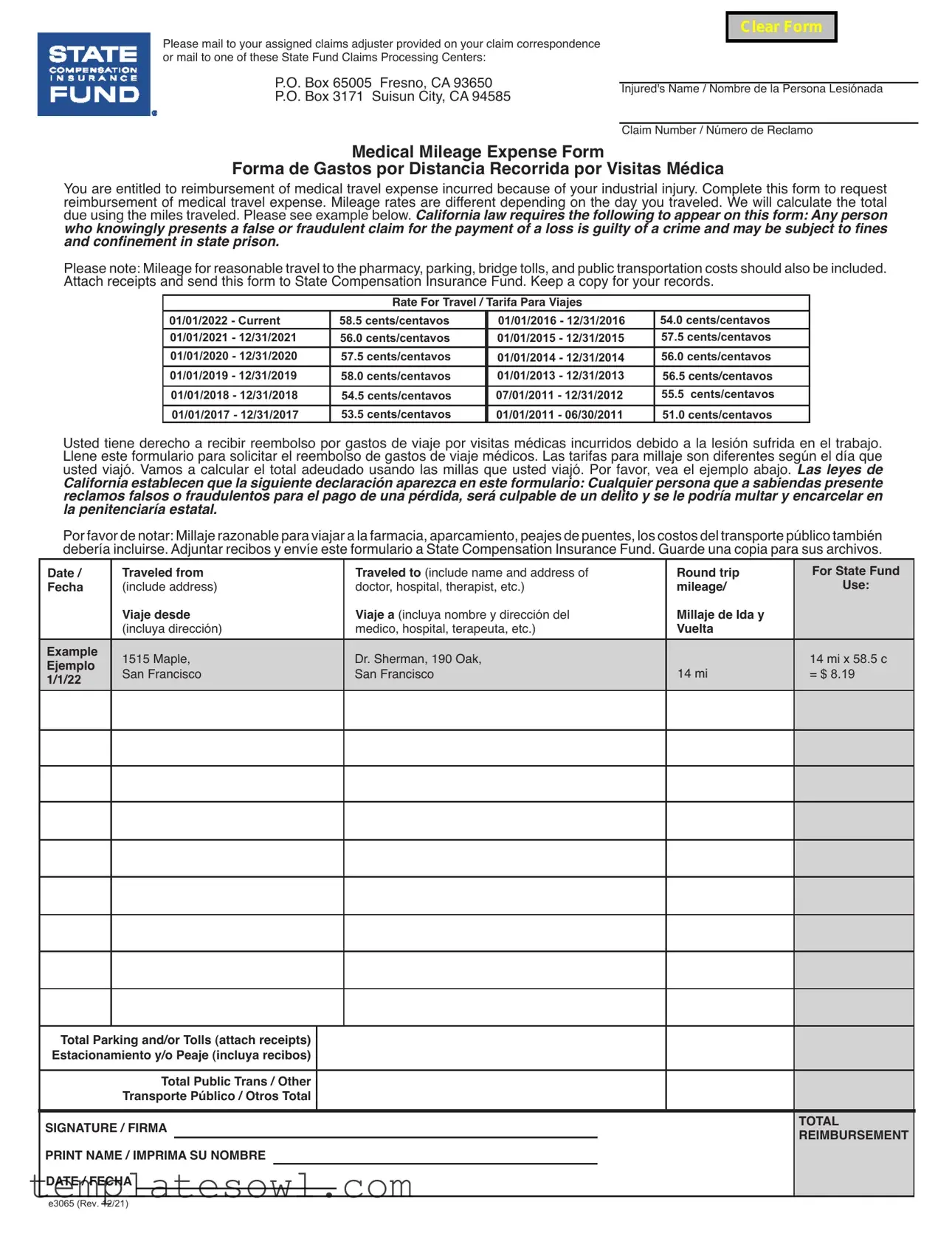

E3065 Example

Please mail to your assigned claims adjuster provided on your claim correspondence or mail to one of these State Fund Claims Processing Centers:

P.O. Box 65005 Fresno, CA 93650

P.O. Box 3171 Suisun City, CA 94585

Clear Form

Injured's Name / Nombre de la Persona Lesiónada

Claim Number / Número de Reclamo

Medical Mileage Expense Form

Forma de Gastos por Distancia Recorrida por Visitas Médica

You are entitled to reimbursement of medical travel expense incurred because of your industrial injury. Complete this form to request reimbursement of medical travel expense. Mileage rates are different depending on the day you traveled. We will calculate the total due using the miles traveled. Please see example below. California law requires the following to appear on this form: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Please note: Mileage for reasonable travel to the pharmacy, parking, bridge tolls, and public transportation costs should also be included. Attach receipts and send this form to State Compensation Insurance Fund. Keep a copy for your records.

Rate For Travel / Tarifa Para Viajes

01/01/2022 - Current |

58.5 cents/centavos |

01/01/2016 - 12/31/2016 |

54.0 cents/centavos |

01/01/2021 - 12/31/2021 |

56.0 cents/centavos |

01/01/2015 - 12/31/2015 |

57.5 cents/centavos |

01/01/2020 - 12/31/2020 |

57.5 cents/centavos |

01/01/2014 - 12/31/2014 |

56.0 cents/centavos |

01/01/2019 - 12/31/2019 |

58.0 cents/centavos |

01/01/2013 - 12/31/2013 |

56.5 cents/centavos |

01/01/2018 - 12/31/2018 |

54.5 cents/centavos |

07/01/2011 - 12/31/2012 |

55.5 cents/centavos |

01/01/2017 - 12/31/2017 |

53.5 cents/centavos |

01/01/2011 - 06/30/2011 |

51.0 cents/centavos |

Usted tiene derecho a recibir reembolso por gastos de viaje por visitas médicas incurridos debido a la lesión sufrida en el trabajo. Llene este formulario para solicitar el reembolso de gastos de viaje médicos. Las tarifas para millaje son diferentes según el día que usted viajó. Vamos a calcular el total adeudado usando las millas que usted viajó. Por favor, vea el ejemplo abajo. Las leyes de

California establecen que la siguiente declaración aparezca en este formulario: Cualquier persona que a sabiendas presente reclamos falsos o fraudulentos para el pago de una pérdida, será culpable de un delito y se le podría multar y encarcelar en la penitenciaría estatal.

Por favor de notar: Millaje razonable para viajar a la farmacia, aparcamiento, peajes de puentes, los costos del transporte público también debería incluirse. Adjuntar recibos y envíe este formulario a State Compensation Insurance Fund. Guarde una copia para sus archivos.

Date / |

Traveled from |

|

Traveled to (include name and address of |

|

Round trip |

For State Fund |

||||

Fecha |

(include address) |

|

doctor, hospital, therapist, etc.) |

|

mileage/ |

Use: |

||||

|

Viaje desde |

|

Viaje a (incluya nombre y dirección del |

|

Millaje de Ida y |

|

||||

|

(incluya dirección) |

|

medico, hospital, terapeuta, etc.) |

|

Vuelta |

|

||||

Example |

1515 Maple, |

|

Dr. Sherman, 190 Oak, |

|

|

14 mi x 58.5 c |

||||

Ejemplo |

|

|

14 mi |

|||||||

San Francisco |

|

San Francisco |

|

= $ 8.19 |

||||||

1/1/22 |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Parking and/or Tolls (attach receipts) |

|

|

|

|

|

|

||||

Estacionamiento y/o Peaje (incluya recibos) |

|

|

|

|

|

|

||||

|

|

Total Public Trans / Other |

|

|

|

|

|

|

||

|

Transporte Público / Otros Total |

|

|

|

|

|

|

|||

SIGNATURE / FIRMA |

|

|

|

|

|

TOTAL |

||||

|

|

|

|

REIMBURSEMENT |

||||||

PRINT NAME / IMPRIMA SU NOMBRE |

|

|

|

|

|

|||||

|

|

|

|

|

||||||

DATE / FECHA |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

e3065 (Rev. 12/21)

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The E3065 form is used to request reimbursement for medical mileage expenses incurred due to an industrial injury. |

| Application | This form applies specifically to California workers' compensation claims. |

| Reimbursement | Individuals can claim mileage for reasonable travel to medical appointments, pharmacies, and related services. |

| California Law | Under California law, presenting a false claim can lead to criminal charges, fines, and imprisonment. |

| Current Mileage Rate | As of January 1, 2022, the mileage reimbursement rate is set at 58.5 cents per mile. |

| Submission Process | The completed form should be mailed to the assigned claims adjuster or to one of the State Fund Claims Processing Centers listed on the form. |

| Record Keeping | It is essential to keep a copy of the completed E3065 form for personal records. |

Guidelines on Utilizing E3065

Completing the E3065 form allows you to request reimbursement for medical travel expenses related to your industrial injury. Once filled out, this form needs to be sent to either your assigned claims adjuster or a designated State Fund Claims Processing Center. It is essential to keep a copy for your records.

- Obtain the E3065 Form: Download the form from the relevant state compensation website or gather a physical copy.

- Fill in your personal information: Enter the injured person's name and claim number at the top of the form.

- Date of Travel: Record the date of travel in the designated section.

- Travel Details: Indicate where you traveled from and to, including the name and address of the doctor, hospital, or therapist.

- Mileage Calculation: Determine the round-trip mileage and enter this in the specified field.

- Calculate Reimbursement: Use the mileage rate applicable for your travel date to calculate your total mileage reimbursement.

- Include Additional Expenses: Add any parking fees or tolls incurred during your travels, ensuring you attach receipts for verification.

- Final Totals: Sum up your mileage reimbursement and any additional expenses to find the total reimbursement amount.

- Signature: Sign the form to validate your request for reimbursement.

- Print Your Name: Clearly print your name beneath your signature.

- Date: Indicate the date you are submitting the form.

Once you have completed all the above steps, review the form to ensure accuracy. Then, mail it to the designated address for processing, and remember to keep a copy for your records.

What You Should Know About This Form

What is the purpose of the E3065 form?

The E3065 form is used to request reimbursement for medical travel expenses incurred due to an industrial injury. If you have traveled for medical appointments related to a work-related injury, this form enables you to claim those travel expenses back from your employer's insurance provider.

How do I fill out the E3065 form?

To complete the form, you need to provide your name, claim number, and details of your travel, including where you traveled from and to, the distance of your trip, and any associated expenses like parking, tolls, and public transportation. Additionally, remember to attach any relevant receipts for these expenses.

Where do I send the completed E3065 form?

You should send your completed form to your assigned claims adjuster, which can be found in your claim correspondence. Alternatively, it can also be mailed to one of the following State Fund Claims Processing Centers: P.O. Box 65005, Fresno, CA 93650, or P.O. Box 3171, Suisun City, CA 94585.

What expenses can I include when using the E3065 form?

You may include mileage for travel to appointments, as well as expenses for parking, bridge tolls, and public transportation. It is crucial to keep all receipts as documentation to support your claim for reimbursement. Ensure all relevant costs are detailed in your submission.

What are the current mileage rates for travel reimbursement?

As of January 1, 2022, the mileage rate is set at 58.5 cents per mile. Rates differ depending on the year of travel, so it’s important to refer to the specified rates for the year in which the travel occurred when calculating your total reimbursement.

Is there any legal warning associated with the E3065 form?

Yes, California law mandates that any person who knowingly presents a false or fraudulent claim will be considered guilty of a crime. This could lead to fines and potential imprisonment. Accurate reporting is essential when filling out the form to avoid any legal repercussions.

How can I ensure I receive the correct reimbursement?

To facilitate accurate reimbursement, you should provide clear and complete information on the form, attach all necessary receipts, and keep a copy of everything for your records. Accurate calculations based on the current mileage rates are also crucial. Double-checking all information can help ensure that your claim is processed smoothly.

What should I do if I have questions about the E3065 form?

If you have questions or need assistance with the E3065 form, it is advisable to reach out directly to your claims adjuster. They can provide personalized guidance and address any concerns you may have regarding your claim.

Common mistakes

Filling out the E3065 form can appear straightforward, but many individuals inadvertently make mistakes that could delay their reimbursement. One common pitfall is neglecting to provide a complete and accurate claim number. This number is vital for your claims adjuster to process your request efficiently. Incomplete or incorrect claim numbers can lead to significant delays in receiving funds.

Another frequent error is failing to include necessary travel details. When documenting your trips, ensure you accurately specify the start and end locations, including both names and addresses. Omitting this information may result in reimbursement issues, as the claims processing centers require clear proof of where you traveled.

Additionally, many people overlook the importance of attaching receipts. To substantiate your expenses for parking, tolls, and public transportation, receipts are essential. Without these documents, your claim could be considered incomplete, potentially jeopardizing your reimbursement.

Another mistake is miscalculating the mileage. There are different reimbursement rates depending on the date of travel, so it’s essential to refer to the correct rate. Ensure you perform the multiplication correctly to avoid overestimating or underestimating your claim. A well-documented mileage log will serve you well.

Some individuals also fail to keep a copy of the completed form for their records. This oversight makes it difficult to track the status of your claim or provide proof if disputes arise. Retaining a copy is a simple yet crucial housekeeping task.

Submitting the form to the wrong address is another error that can cause significant delays. Ensure to send your request to the assigned claims adjuster as stated in your claim correspondence or to the appropriate State Fund Claims Processing Center. Double-check the address before mailing your form.

Inconsistent or unclear signatures can also create problems. Your signature signifies that you agree with the information provided. If your signature doesn’t match what is on file, it could raise concerns and prevent processing.

Some applicants forget to include all possible expenses. Besides mileage, remember to claim reasonable travel expenses to pharmacies and any other related costs required for your medical treatment. Every penny counts, and omitting these can result in loss of funds that you are entitled to.

Your printed name should be clear and legible. Illegible handwriting can lead to confusion and slow down the processing time of your claim. Ensuring clarity in your presentation helps the claims adjuster manage your request more effectively.

Lastly, not following up after submission can be a mistake that many make. Once you have sent your E3065 form, consider confirming receipt with your claims adjuster. This proactive approach ensures that any issues are resolved swiftly, keeping your reimbursement on track.

Documents used along the form

When submitting the E3065 form, there are several other important documents to consider. These forms help provide additional information and support the claims process. Properly completing and submitting them can ensure a smoother experience for those seeking reimbursement for medical travel expenses.

- Medical Mileage Expense Form: This form is specifically designed to calculate and request reimbursement for travel expenses related to medical appointments due to an industrial injury. It captures details about trips taken, including distances traveled and dates.

- Claim Initiation Form: This document is usually completed at the start of the claim process. It gathers essential information such as personal details, employment status, and initial incident specifics to establish the claim.

- Physician’s Report: A physician’s report outlines the medical condition and treatment that is relevant to the claim. It can have a significant impact on the determination of benefits and may be necessary to provide medical evidence supporting the injury.

- Appointment Records: Keeping records of all medical appointments is important. These documents show when medical services were provided and can help in substantiating the mileage claims submitted on the E3065 form.

- Transportation Receipts: Providing receipts for any public transport or parking expenses can support your claim. These receipts help document the additional travel costs incurred during medical visits.

- Claim Adjustment Request: If there are any disputes about the claim amount or if changes are necessary, this form can facilitate adjustments. It allows for the submission of additional information that might be needed to reassess the claim.

Each of these documents plays a key role in the overall claims process. Understanding their purpose can help individuals effectively navigate their claims and ensure all relevant information is properly submitted.

Similar forms

- Medical Expense Reimbursement Form: Similar to the E3065 form, this document is used to request reimbursement for medical costs incurred due to a workplace injury. It provides a breakdown of expenses and ensures that recipients receive compensation for expenses related to their recovery.

- Travel Expense Reimbursement Form: Like the E3065, this form is focused on recovering expenses related to travel. It details the amount spent on transportation for business purposes, offering a structure for individuals to document their travel and receive reimbursement.

- Workers' Compensation Claim Form: While this document initiates a claim for workplace injuries, it shares the goal of seeking financial support related to injury. Both forms are crucial in helping injured workers navigate the compensation process and recover their losses.

- Claim for Compensation for Lost Wages: This form is similar in that it addresses financial losses resulting from workplace injuries. It allows injured workers to detail missed work and income, enabling them to seek compensation for lost wages while focusing on recovery.

- Health Insurance Claim Form: This document is often completed to obtain coverage for medical procedures. Like the E3065, it emphasizes the need for accurate documentation of costs and services rendered to ensure reimbursement from insurance providers.

Dos and Don'ts

When filling out the E3065 form, it's essential to follow the right steps to ensure your reimbursement process goes smoothly. Below is a checklist of what you should and shouldn't do.

- Do include your full name and claim number at the top of the form.

- Do indicate the travel dates accurately to avoid discrepancies.

- Do ensure you attach all relevant receipts for parking and public transport costs.

- Do double-check the mileage rates that correspond to your travel dates.

- Do make sure your signature is present before mailing the form.

- Don't forget to keep a copy of the completed form for your records.

- Don't submit false information that could be considered fraudulent.

Misconceptions

The following list clarifies 10 common misconceptions regarding the E3065 form:

- Misconception 1: The E3065 form can only be used for mileage reimbursement.

- Misconception 2: Receipts are not necessary when submitting the form.

- Misconception 3: The form submission is optional.

- Misconception 4: All travel expenses are automatically reimbursed without review.

- Misconception 5: The mileage reimbursement rate remains the same each year.

- Misconception 6: The form can be sent to any address without consequence.

- Misconception 7: Personal vehicle maintenance costs are covered.

- Misconception 8: Travel to any location is reimbursable.

- Misconception 9: Your claim will not be affected by false claims.

- Misconception 10: Keeping a copy of the form is unnecessary after submission.

This form is designed to request reimbursement for various medical travel expenses, not solely mileage. This includes reasonable travel to pharmacies, parking, and tolls.

Receipts must be attached for all expenses, including parking and public transportation. These documents support the request for reimbursement.

Filing the E3065 form is essential for individuals seeking reimbursement for medical travel expenses incurred due to a workplace injury.

Reimbursement is calculated based on verified mileage and attached receipts. Claims may be denied if the form is filled out incorrectly or if receipts are not provided.

Reimbursement rates vary by year. It's crucial to apply the correct rate for the corresponding travel date as specified on the form.

The E3065 form must be sent to the assigned claims adjuster or one of the specified State Fund Claims Processing Centers to ensure proper handling.

The form does not reimburse personal vehicle maintenance costs, only direct travel expenses related to medical visits.

Only travel to medical appointments, including visits to doctors, hospitals, and therapists, qualifies for reimbursement.

Filing a false claim can result in serious consequences, including fines and imprisonment. It is critical to provide accurate information when filing.

It is advisable to keep a copy of the completed form for your records, as it serves as proof of submission and the details of your claim for future reference.

Key takeaways

Here are some key takeaways regarding the E3065 form, which is used to request reimbursement for medical mileage expenses related to industrial injuries:

- Eligibility for Reimbursement: You can be reimbursed for medical travel expenses incurred due to your work-related injury.

- Completing the Form: Fill out the form accurately. You need to include your name, claim number, and details about your travels.

- Travel Details: Indicate the dates of travel, destinations, and a round trip mileage calculation.

- Attach Receipts: It’s essential to include receipts for parking, bridge tolls, and public transportation costs.

- Current Mileage Rates: Be aware of the mileage reimbursement rates for different years. For instance, as of 01/01/2022, it's 58.5 cents per mile.

- Mailing Instructions: Send the completed form and attachments to your assigned claims adjuster or one of the State Fund Claims Processing Centers.

- Record Keeping: Keep a copy of the completed form and all attachments for your personal records.

- Fraud Alert: Be cautious. Submitting false claims is a crime and could lead to significant penalties.

Browse Other Templates

Da Form 3590 - The form is a standardized tool used across various Army departments.

Medicare Part D Notice - It outlines the rights of individuals regarding their existing prescription drug coverage.

Castrol Oil Rebate - Receive your rebate check by mail after processing.