Fill Out Your Eb 12 Form

The EB-12 form plays a critical role in the unemployment insurance process in Wisconsin, facilitating the necessary documentation for individuals actively seeking work. This Weekly Work Search Log is designed to help claimants record their job search activities as part of the requirements to maintain eligibility for benefits. Claimants are instructed to report their weekly work contacts, detailing essential information such as the date of contact, method of outreach—whether by phone, in-person, or online—and the results of each interaction with potential employers. The form requires specific details for each contact, including the employer's name, address, and any additional pertinent information that may assist in verifying job search efforts. It emphasizes the importance of completeness; omitting any requested information may lead to delays or denials in receiving unemployment benefits. Claimants are advised to submit their weekly claims online for quicker processing, but for those lacking internet access, the EB-12 form remains a viable alternative. Acknowledging the procedural guidelines set forth, it is crucial that individuals understand the importance of accuracy and thoroughness in completing the log to ensure a smooth claims process.

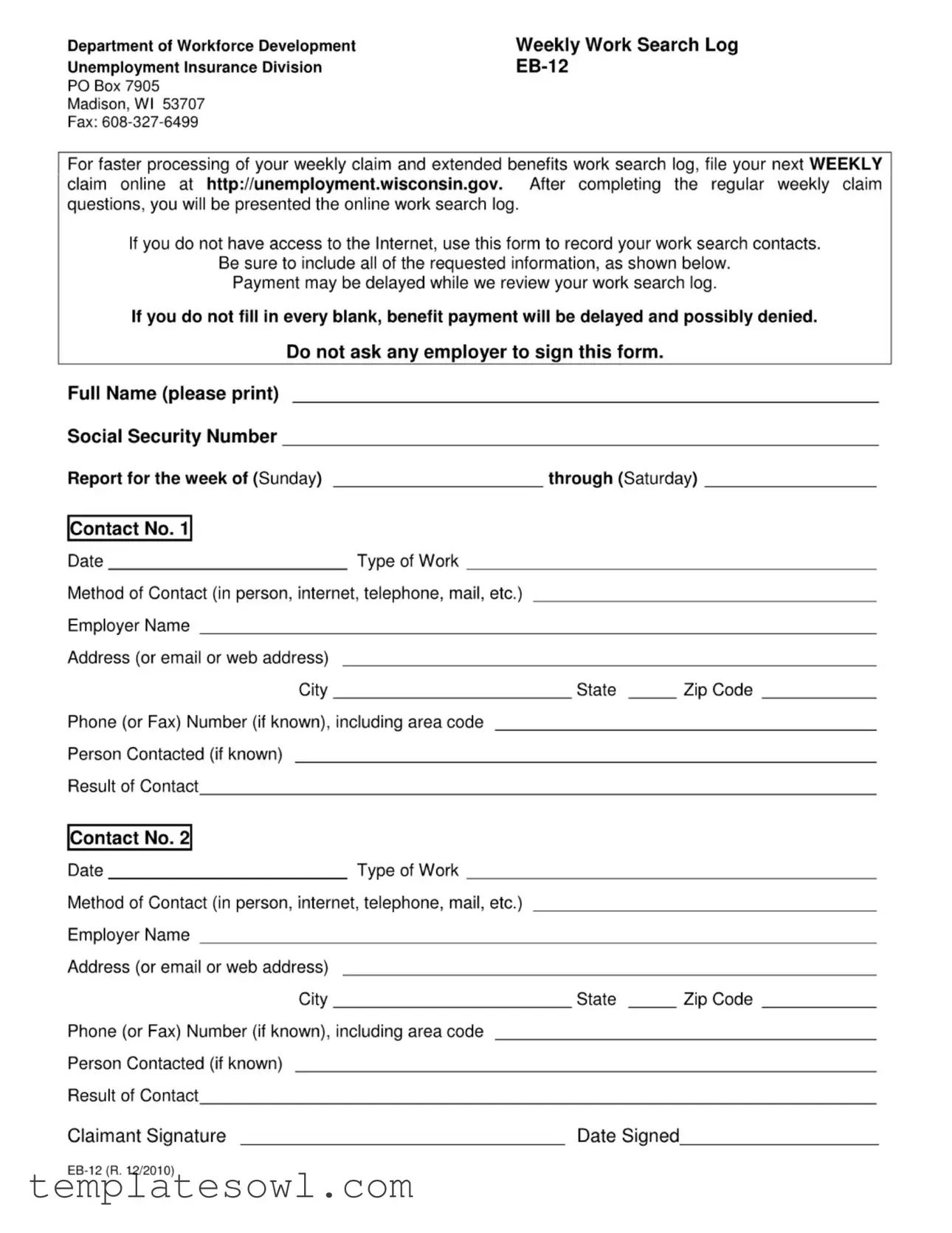

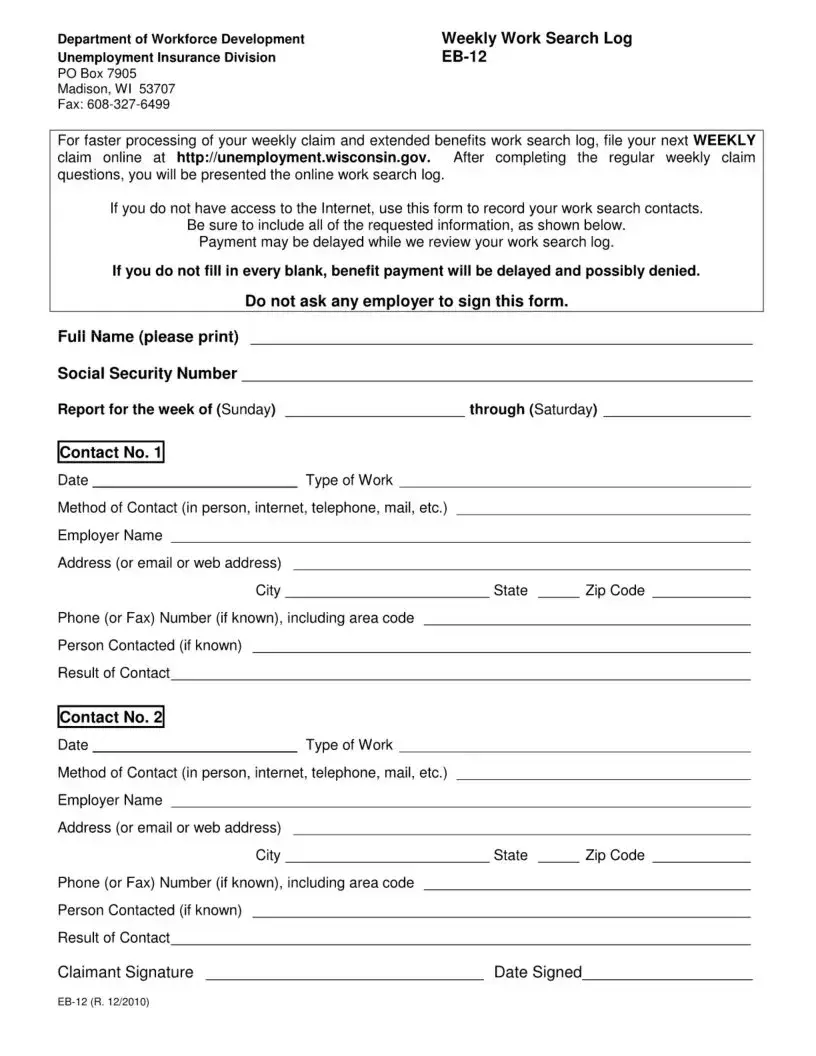

Eb 12 Example

Department of Workforce Development |

Weekly Work Search Log |

Unemployment Insurance Division |

PO Box 7905

Madison, Wl 53707

Fax:

For faster processing of your weekly claim and extended benefits work search log, file your next WEEKLY

claim online at http://unemployment.wisconsin.gov. After completing the regular weekly claim

questions, you will be presented the online work search log.

If you do not have access to the Internet, use this form to record your work search contacts.

Be sure to include all of the requested information, as shown below. Payment may be delayed while we review your work search log.

If you do not fill in every blank, benefit payment will be delayed and possibly denied.

Do not ask any employer to sign this form.

Full Name (please print)

Social Security Number

Report for the week of (Sunday)through (Saturday)

Contact No. 1

Date |

Type of Work |

Method of Contact (in person, internet, telephone, mail, etc.)

Employer Name

Address (or email or web address)

City |

State |

Zip Code |

Phone (or Fax) Number (if known), including area code

Person Contacted (if known)

Result of Contact

Contact No. 2

Date |

Type of Work |

Method of Contact (in person, internet, telephone, mail, etc.)

Employer Name

Address (or email or web address)

City |

State |

Zip Code |

Phone (or Fax) Number (if known), including area code

Person Contacted (if known)

Result of Contact

Claimant Signature |

Date Signed |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The EB-12 form serves as a weekly work search log for individuals claiming unemployment benefits in Wisconsin. |

| Governing Law | The form is governed by Wisconsin's unemployment insurance laws, specifically found under Wis. Stat. § 108. |

| Submission Method | Claimants can submit the EB-12 form online for faster processing. If the Internet is unavailable, they can fill it out by hand. |

| Required Information | Filling out the entire form is crucial. Missing information may lead to delays or denials of benefit payments. |

| Contact Method | The form allows various contact methods, including in-person, phone, and email, for documenting job searches. |

| Claimant Signature | A signature from the claimant is required on the form to validate the information provided. |

| Processing Time | Reviewing the work search log may delay payment. Timely submission helps avoid this issue. |

| Weekly Reporting Period | The form covers a specific reporting period, from Sunday to Saturday, for recording job search activities. |

| Prohibited Actions | Claimants should not ask employers to sign the EB-12 form, as this is explicitly discouraged. |

Guidelines on Utilizing Eb 12

After obtaining the EB-12 form, you’ll need to record your work search activities for the week. Completing the form accurately is essential to ensure timely processing of your unemployment benefits. Failure to provide complete information may delay or even result in denial of your claim. Here are the steps to fill out the form:

- Write your full name in the designated space at the top of the form. Make sure it is printed clearly.

- Enter your Social Security Number in the next box.

- Indicate the week you are reporting by filling in the dates—starting Sunday through Saturday.

- For each work contact, fill out the following details:

- Date of contact.

- Type of Work you are seeking.

- Method of Contact used, such as in-person, internet, telephone, or mail.

- Employer Name of the company you contacted.

- Address, including email or web address if applicable.

- City, State, and Zip Code where the employer is located.

- Phone Number or fax number, if you have this information.

- Person Contacted, if known.

- Result of Contact, such as whether you were offered an interview or if the employer was hiring.

- Repeat the above details for the second work contact in the same format.

- Sign the form at the bottom, indicating that the information provided is true and accurate.

- Put the date you signed the form next to your signature.

Ensure that you keep a copy of the completed EB-12 form for your records. Once finished, you can submit the form to the address specified on the document for processing.

What You Should Know About This Form

What is the EB-12 form used for?

The EB-12 form is used to record your work search activities while claiming unemployment benefits in Wisconsin. Completing this form helps document your efforts to find work and is necessary for obtaining continued benefits.

How do I submit the EB-12 form?

You can submit the form by mailing it to the address provided on the form: Department of Workforce Development, Weekly Work Search Log, Unemployment Insurance Division, EB-12, PO Box 7905, Madison, WI 53707. Alternatively, if you are filing your weekly claim online, you can enter your work search log directly into the online system.

What information do I need to include on the EB-12 form?

On the EB-12 form, you must include your full name, Social Security number, the week you are reporting for, and details of each job contact you made. This includes the date of contact, type of work, method of contact (e.g., in person, via internet), the employer's name and address, and the result of each contact.

Can I use the EB-12 form if I don't have internet access?

Yes, if you do not have internet access, you can use the EB-12 form to record your work search contacts. Be sure to fill it out completely to avoid delays in your benefit payments.

What happens if I do not fill out the EB-12 form correctly?

If the EB-12 form is not filled out correctly or completely, it can lead to delays in payment or even denial of benefits. It’s important that you provide all requested information and double-check your entries for accuracy.

Why shouldn't I ask an employer to sign the EB-12 form?

Employers should not be asked to sign the EB-12 form. This is to protect both the claimant and the employer from misunderstandings regarding the work search activities and to maintain the integrity of the unemployment benefit process.

When do I need to submit the EB-12 form?

You need to submit the EB-12 form each week you claim unemployment benefits. This log documents your job search efforts for that particular week, and timely submission is crucial for receiving your benefits without interruption.

What can I do if I forget to submit the EB-12 form?

If you forget to submit the EB-12 form, you should do so as soon as you remember. Be aware that failure to submit on time can lead to delayed payments. Always keep track of deadlines to ensure your benefits remain uninterrupted.

What are the consequences of false information on the EB-12 form?

Providing false information on the EB-12 form can lead to serious repercussions, including penalties or legal action. It is essential to record only accurate and truthful details regarding your job search efforts.

How can I ensure faster processing of my claim?

The fastest way to process your claim is by filing it online at http://unemployment.wisconsin.gov. This method allows you to input your weekly work search log directly, which speeds up the review process.

Common mistakes

Completing the EB-12 form can be straightforward, but several common mistakes might hinder the processing of unemployment claims. One frequent error is leaving out contact information for work search attempts. Each contact requires specific details including the employer's name, address, and method of contact. Incomplete entries can lead to delays or denials of benefits.

Another common mistake is not providing a full name or Social Security number correctly. Accuracy is crucial because any discrepancies can complicate identification processes. Missing or incorrect information will prompt the administrative body to seek clarification, which can further delay the receipt of benefits.

Many people also fail to record all work search activities on the form. Some assume that only a few contacts are necessary, but including every attempt at securing employment can show diligence in job searching. Neglecting to document these efforts fully can raise questions about the claimant's commitment to finding work, resulting in possible payment delays.

Additionally, claimants often err by not specifying the dates for each work search. Each entry should cover the requested week clearly, indicating the date of each contact made. This chronological clarity helps streamline the review process and supports the legitimacy of the work search claims.

Claimants sometimes misunderstand the requirements concerning employer signatures. It is clearly stated that no employer should sign the form. Attempting to obtain a signature can cause confusion and may lead to unnecessary complications in processing the claim.

Last but not least, neglecting to sign and date the form is a significant oversight. It may seem minor, but without a signature, the form cannot be processed. This simple yet critical step ensures that all the information provided is verified and authentic, making it essential for timely processing of benefits.

Documents used along the form

The EB-12 form is an important document for individuals claiming unemployment benefits in Wisconsin. Alongside the EB-12, several other forms and documents may be necessary for a complete application. Each plays a specific role in the process, ensuring that all required information is submitted accurately for a timely review. Below is a list of other common forms that may be utilized in conjunction with the EB-12 form.

- UI Benefit Claim Form: This is the primary form used to apply for unemployment insurance benefits. It gathers essential information about the claimant's employment history and eligibility.

- Work Search Requirements Notice: This document outlines the obligations of unemployment claimants regarding job searches. It includes guidelines on how many job contacts are required per week.

- Identity Verification Form: Claimants may need to submit this form to confirm their identity and protect against fraudulent claims. It often requires personal information and documentation.

- Employment Documentation: This includes pay stubs, W-2s, or tax returns needed to verify previous employment. Accurate records help establish eligibility for benefits.

- Employer Separation Notice: Often completed by the employer, this form provides details on the circumstances of the claimant's separation from the job. It is crucial in determining eligibility for benefits.

- Continued Claim Form (UC-150): This form may be used to report ongoing eligibility for benefits after the initial claim. It often includes questions about job search activities.

- Appeal Forms: If a claimant's initial application is denied, they can use specific appeal forms to challenge the decision. These forms require a statement and relevant documentation supporting the appeal.

- Training Approval Form: If a claimant participates in approved training programs while receiving benefits, this form may be necessary to confirm participation and retain eligibility for benefits.

- Tax Forms (1099 or W-2): Claimants may be required to submit tax documents that reflect any income received while collecting unemployment benefits, ensuring compliance with tax reporting requirements.

Altogether, the EB-12 form and these additional documents create a framework to support claimants as they navigate the unemployment benefits process. Completing each accurately is essential for receiving timely assistance and ensuring proper compliance with state regulations.

Similar forms

The EB-12 form serves as a critical tool in the unemployment benefits process in Wisconsin, specifically for documenting job searches. Several other forms share similarities with the EB-12, each serving distinct yet related purposes. Here’s a list of ten documents that are akin to the EB-12 form:

- Unemployment Insurance Weekly Claim Form: Like the EB-12, this form is used to report weekly unemployment benefits and usually requires similar details about job search activities.

- Job Search Referral Form: This document tracks referrals made by job placement agencies, capturing information about employers and methods of contact similar to what is required in the EB-12.

- Work Search Verification Form: As with the EB-12, this form verifies job search efforts for claimants seeking unemployment benefits, gathering details about contacts and results.

- Weekly Work Activity Log: This form serves to document day-to-day job search activities, akin to the weekly tracking required by the EB-12.

- Employer Contact Record: Similar in purpose, this record captures specific employer interactions and outcomes, echoing the contact details found in the EB-12.

- Employment History Report: This report includes a claimant’s work history, providing context for their job search efforts, much like the job-related information requested in the EB-12.

- Resume Submission Form: This form documents the submission of resumes to different employers, paralleling the job search documentation found in the EB-12.

- Job Application Log: Documenting applications sent out, this log shares the goal of tracking efforts to secure employment, similar to the EB-12’s focus on work search.

- Skills Assessment Form: While primarily focused on evaluating job seekers' skills, it also relates to the job search process, appealing to the same audience as the EB-12.

- Re-Employment Services Participation Form: This document records participation in job training or re-employment services, tying in with the broader theme of job search documentation, like the EB-12.

Each of these forms plays a role in helping individuals document their job search efforts, ensuring compliance with unemployment benefits requirements and improving the effectiveness of their job search strategies.

Dos and Don'ts

When filling out the EB-12 form, there are important dos and don'ts to keep in mind for accuracy and compliance.

- Do complete all sections of the form to avoid payment delays.

- Do provide your full name and Social Security number clearly.

- Do list all work search contacts for the reporting week.

- Do indicate the date, type of work, and method of contact for each entry.

- Do use ink and print legibly.

- Do submit the form on time to ensure benefits are processed promptly.

- Do sign and date the form before submission.

- Don’t leave any blanks on the form; incomplete information can lead to denial of benefits.

- Don’t ask any employer to sign or authenticate the form.

- Don’t use shorthand or abbreviations that might be unclear.

- Don’t provide inaccurate or misleading information regarding contacts.

- Don’t submit the form late; doing so can impact payment.

- Don’t forget to keep a copy of the completed form for your records.

- Don’t bypass the online filing if you have internet access, as it may expedite the process.

Misconceptions

Misconceptions about the EB-12 form can lead to confusion. Here are nine common myths explained:

- Myth 1: You don’t need to submit the EB-12 form if you find a job.

- Myth 2: The EB-12 form is optional.

- Myth 3: Employers must sign the EB-12 form.

- Myth 4: You can skip fields if you can't find information.

- Myth 5: You can submit the EB-12 form any time you want.

- Myth 6: The method of contact does not matter.

- Myth 7: You only need to record in-person job contacts.

- Myth 8: Payments are automatic once you file the EB-12 form.

- Myth 9: There's no specific format for documenting job searches.

Fact: If you are still filing for unemployment benefits, you must submit the EB-12 form to document your job search efforts, regardless of job status.

Fact: Completing the EB-12 form is required. Failure to do so may delay or result in denial of your benefits.

Fact: Do not ask employers to sign the form. It is not necessary, and doing so can complicate your claim process.

Fact: All requested information must be filled out completely. Leaving blanks can lead to processing delays.

Fact: The EB-12 form must be submitted during the week that you are claiming benefits, and it should reflect contacts made during that week.

Fact: You must specify the method of contact used. This helps verify your job search activities.

Fact: All types of contacts, including online, phone, and mail, should be recorded on the form.

Fact: Payments will be reviewed after your form is submitted. They are not guaranteed and can be delayed if there are issues.

Fact: The EB-12 form has required fields. It must be completed in the format outlined in the instructions to be accepted.

Key takeaways

Filling out the EB-12 form correctly is essential for a smooth unemployment benefits process. Here are some key takeaways to ensure you do it right:

- Purpose of the Form: The EB-12 form is designed to document your work search efforts while applying for unemployment benefits.

- Timeliness: Submit your work search log promptly to avoid delays in receiving benefits.

- Filing Online: Consider filing your weekly claim online for quicker processing. This may simplify the completion of your work search log.

- Accuracy is Key: Enter all required information accurately. Incomplete forms can lead to delayed or denied payments.

- No Employer Signatures: Do not seek employer signatures on this form. It is not necessary and may complicate the process.

- Contact Details: Ensure all contact information is clear and complete, including the employer's name, address, and phone number.

- Method of Contact: Clearly indicate the method of contact for each employer. Specify whether it was in person, through the internet, or by phone.

- Weekly Reporting: The form requires reporting for specific weeks. Ensure you fill out the dates accurately to reflect the correct reporting period.

- Sign and Date: Don’t forget to sign and date the form. This confirms that the information you've provided is true and complete.

- Keep a Copy: After submitting the form, retain a copy for your records. Keeping a record of your work search activities can be beneficial.

Following these guidelines will help you navigate the unemployment benefits application process with confidence.

Browse Other Templates

REM Iowa Service Request,REM Iowa Support Application,REM Iowa Care Services Form,REM Iowa Client Intake Form,REM Iowa Accessibility Application,REM Iowa Assistance Request,REM Iowa Service Enrollment Form,REM Iowa Community Access Application,REM Io - This form is designed for individuals seeking REM Iowa community and developmental services.

Ss89 Form - Your consent via the SSA-89 is crucial for institutions needing to verify your Social Security Number.