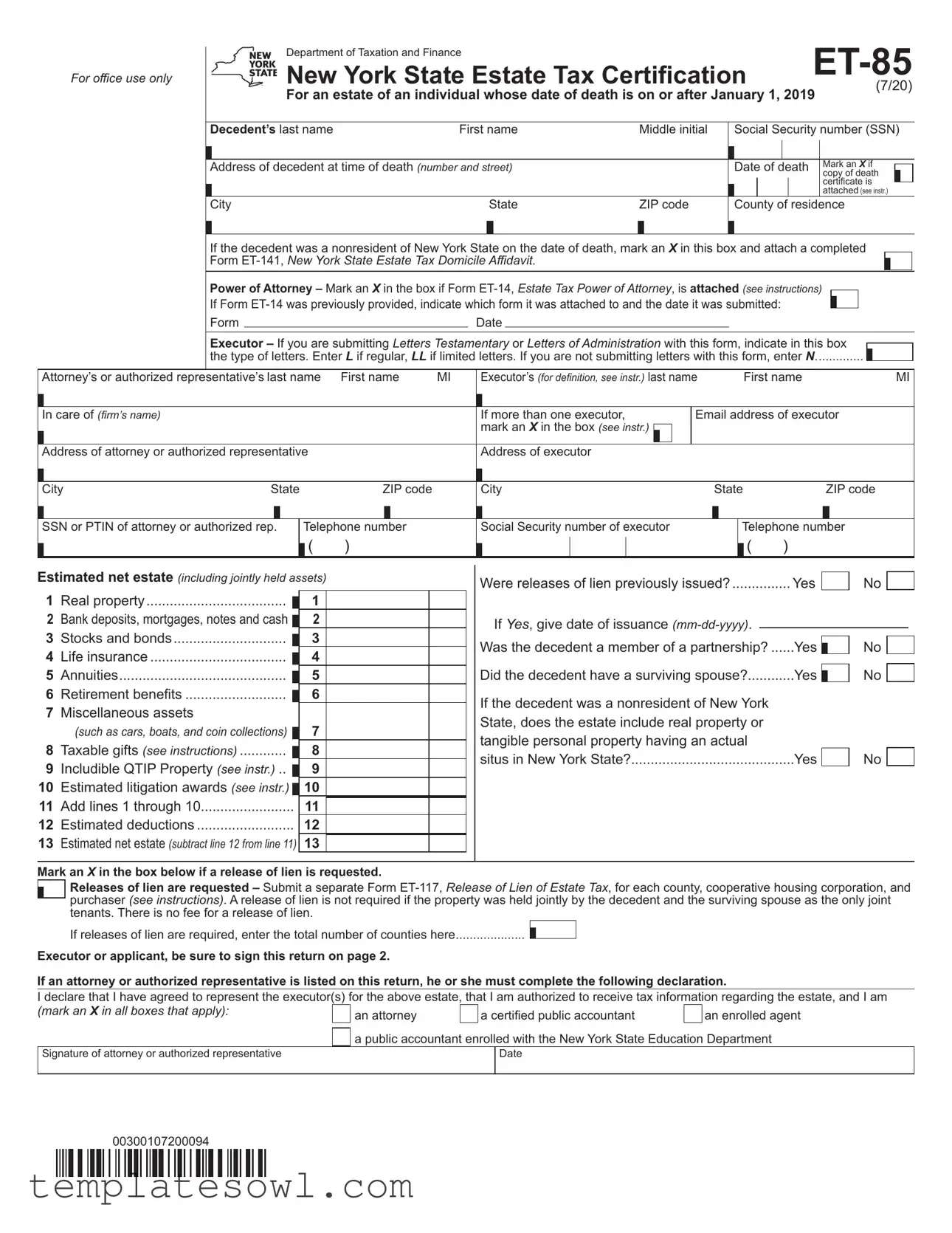

Fill Out Your Et 85 Form

The ET-85 form is an essential document for managing estate tax obligations in New York State, particularly for individuals whose date of death occurs on or after January 1, 2019. This form serves as a certification of the estate’s tax status and requires information such as the decedent’s full name, Social Security number, address at the time of death, and date of death. Executors must indicate their role in the estate and provide details about their legal representation. Additionally, the form addresses the estimated net estate, including various assets such as real property, bank deposits, and life insurance. Specific questions help determine the estate's tax implications, including the status of any lien releases and whether the decedent was a nonresident at the time of death. The form also requires a certification signature from the executor or the applicant, confirming the accuracy of the information provided. Overall, the ET-85 not only facilitates the estate tax process but also ensures that all relevant details are transparently shared with the New York State Department of Taxation and Finance.

Et 85 Example

|

|

|

|

|

|

Department of Taxation and Finance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(7/20) |

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

For office use only |

|

|

|

|

New York State Estate Tax Certification |

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

For an estate of an individual whose date of death is on or after January 1, 2019 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Decedent’s last name |

|

|

|

|

First name |

Middle initial |

|

|

Social Security number (SSN) |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Address of decedent at time of death (number and street) |

|

|

|

|

|

|

|

|

Date of death |

|

Mark an X if |

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

copy of death |

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

certificate is |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

attached (see instr.) |

||||||||

|

|

City |

|

|

|

|

|

|

|

|

|

State |

ZIP code |

|

|

County of residence |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

If the decedent was a nonresident of New York State on the date of death, mark an X in this box and attach a completed |

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

Form |

New York State Estate Tax Domicile Affidavit. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

Power of Attorney – Mark an X in the box if Form |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

If Form |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

Form |

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executor – If you are submitting Letters Testamentary or Letters of Administration with this form, indicate in this box |

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

the type of letters. Enter L if regular, LL if limited letters. If you are not submitting letters with this form, enter |

N |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attorney’s or authorized representative’s last name |

First name |

MI |

|

|

Executor’s (for definition, see instr.) last name |

|

|

|

First name |

|

|

|

|

|

|

|

|

MI |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

In care of (firm’s name) |

|

|

|

|

|

|

|

|

|

|

|

|

If more than one executor, |

|

|

|

|

|

Email address of executor |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mark an X in the box (see instr.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Address of attorney or authorized representative |

|

|

|

|

|

|

Address of executor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

City |

|

State |

ZIP code |

|

|

|

City |

|

|

|

|

|

|

State |

|

|

ZIP code |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

SSN or PTIN of attorney or authorized rep. |

|

|

|

Telephone number |

|

|

|

Social Security number of executor |

|

|

|

Telephone number |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( ) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Estimated net estate (including jointly held assets) |

||

1 |

Real property |

1 |

2 |

Bank deposits, mortgages, notes and cash |

2 |

3 |

Stocks and bonds |

3 |

4 |

Life insurance |

4 |

5 |

Annuities |

5 |

6 |

Retirement benefits |

6 |

7Miscellaneous assets

|

(such as cars, boats, and coin collections) |

7 |

8 |

Taxable gifts (see instructions) |

8 |

9 |

Includible QTIP Property (see instr.)... |

9 |

10 |

Estimated litigation awards (see instr.) |

10 |

11 |

Add lines 1 through 10 |

11 |

12 |

Estimated deductions |

12 |

13 |

Estimated net estate (subtract line 12 from line 11) 13 |

|

................Were releases of lien previously issued? |

|

No |

|

|

||||

If Yes, give date of issuance |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

Was the decedent a member of a partnership? |

Yes |

|

No |

|

|

|||

|

|

|||||||

|

|

|

|

|

|

|

||

Did the decedent have a surviving spouse? |

Yes |

|

No |

|

|

|||

|

|

|||||||

If the decedent was a nonresident of New York |

|

|

|

|

|

|||

State, does the estate include real property or |

|

|

|

|

|

|||

tangible personal property having an actual |

|

|

|

|

|

|||

situs in New York State? |

Yes |

|

No |

|

|

|||

|

|

|

|

|

|

|

|

|

Page 2 of 2

Certification: The undersigned states that he or she is the duly appointed executor or administrator, or a beneficiary or person having an interest in the above named estate for which no executor or administrator has been appointed and agrees to provide written evidence of such interest or authority upon request. The undersigned further states that he or she has a thorough knowledge of the decedent’s assets. This certification estimates the assets of the decedent’s estate, and the answers to the above questions are each and every one of them true in every particular. The certification is made to induce the Commissioner of Taxation and Finance to give a release of lien required by the Tax Law.

Signature of executor/applicant

State of |

|

, County of |

|

|

, |

||||

|

|

|

|||||||

Sworn to before me this |

|

|

|

|

day |

||||

|

|

|

|

||||||

of |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

||

Signature of Notary Public, Commissioner of Deeds, or authorized New York State Department of Taxation and Finance employee (affix stamp below)

Mark an X in the applicable box:

Attorney

Power of Attorney

Court appointed Executor

Other (specify role)

Mail to: NYS ESTATE TAX, PROCESSING CENTER, PO BOX 15167, ALBANY NY

00300207200094

Form Characteristics

| Fact Name | Detail |

|---|---|

| Governing Law | The ET-85 form is governed by New York State Tax Law. |

| Purpose | This form certifies the estate tax for individuals who passed away on or after January 1, 2019, facilitating the release of liens on their estates. |

| Executor's Role | The executor is responsible for completing the form and certifying the estate's estimated net worth, ensuring accurate representation of the deceased's assets. |

| Notary Requirement | The form must be sworn before a notary public or an authorized New York State employee, ensuring the authenticity of the certification. |

| Nonresident Considerations | If the decedent was a nonresident of New York at the time of death, additional documentation, such as Form ET-141, is required. |

| Attachments | Along with the ET-85, attachments such as a death certificate and potentially the Estate Tax Power of Attorney may be necessary for processing. |

Guidelines on Utilizing Et 85

Completing the ET-85 form is a crucial step for initiating the estate tax certification process in New York State. Ensuring accuracy and attention to detail while filling out this form can help streamline the certification process. Gather all required personal information and documents before you begin to avoid any delays.

- Begin by entering the decedent's last name, first name, and middle initial in the designated fields.

- Provide the decedent's Social Security number (SSN).

- Fill in the complete address of the decedent at the time of death, including street number, city, state, and ZIP code.

- Input the date of death in the format mm-dd-yyyy.

- Mark an X if a copy of the death certificate is attached.

- Indicate the county of residence at the time of death.

- If the decedent was a nonresident of New York State, mark the applicable box and attach Form ET-141.

- If using Power of Attorney, mark the appropriate box if Form ET-14 is attached.

- Indicate which form ET-14 was previously attached to and note the date of submission if applicable.

- For the executor section, denote the type of letters (L for regular, LL for limited, or N if not submitting letters).

- Provide the names of the attorney or authorized representative, along with the executor’s name, and include any firm’s name in the "in care of" section if required.

- Fill out the addresses for both the attorney and the executor, including city, state, and ZIP code.

- List the Social Security number or PTIN of the attorney or authorized representative, as well as the telephone numbers for both.

- Have the attorney or representative complete the declaration by marking the applicable boxes and signing with the date.

- Estimate the net estate including jointly held assets and provide the detailed asset information in the respective sections.

- If applicable, indicate whether releases of lien were previously issued, providing the issuance date if yes.

- Specify if the decedent was a partner in any partnership and whether they had a surviving spouse.

- Answer whether the estate includes real property in New York State and list any miscellaneous assets as necessary.

- Add lines 1 through 8 to get the total estimated assets.

- Deduct estimated deductions from total estimated assets to derive the estimated net estate.

- Mark the box if a release of lien is being requested and indicate the total number of counties if necessary.

- Complete the certification statement, signing it as the executor or applicant.

- Mail the completed form to the specified address: NYS ESTATE TAX, PROCESSING CENTER, PO BOX 15167, ALBANY NY 12212-5167.

- If applicable, complete the notary section by providing the required information and signature.

What You Should Know About This Form

What is the purpose of the ET-85 form?

The ET-85 form is used to certify estate tax matters in New York State. Specifically, it's for the estate of an individual who passed away on or after January 1, 2019. This form is necessary for releasing any estate tax lien on the decedent's assets, allowing for easier transfer or sale of property without the encumbrance of outstanding taxes.

Who needs to fill out the ET-85 form?

The executor or administrator of the estate, or a beneficiary with an interest in the estate needs to fill out the ET-85 form. If there is no appointed executor, anyone with standing to the estate can also complete the form. It’s essential that they have a thorough understanding of the decedent's assets and affairs to ensure the accuracy of the information provided.

What information must be included on the ET-85 form?

Key details required include the decedent’s full name, Social Security number, address at the time of death, date of death, and proof of a death certificate. The executor's contact details, including name, address, and any attorneys or representatives must also be provided. Furthermore, details about the assets of the estate and whether the decedent had a surviving spouse are necessary for the form’s completion.

What if the decedent was a nonresident of New York State?

If the decedent was not a resident of New York State at the time of their passing, the form requires marking the appropriate box. It is imperative to attach the completed Form ET-141, the New York State Estate Tax Domicile Affidavit, which determines the decedent’s domicile status. This step is crucial as it affects the estate tax obligations.

How does one request a release of lien using the ET-85 form?

To request a release of lien, the executor must mark the corresponding box on the ET-85 form. If a release is required, it is important to submit a separate Form ET-117 for each relevant county or property. A release is straightforward but essential to ensure that no pending estate tax liens affect the transfer of property.

Is there any cost associated with submitting the ET-85 form?

There is no fee for filing the ET-85 form itself. Additionally, if a release of lien is requested, there is also no charge for that process, which can significantly ease the burden during estate administration. This financial aspect allows executors to focus on fulfilling their responsibilities without incurring additional costs.

What happens if all required information is not included on the ET-85 form?

Failing to provide complete and accurate information may lead to delays in processing the form. Incomplete submissions can result in requests for additional information or even denials, which could prevent the release of liens. Ensuring thoroughness during the initial submission can save time and potential frustration.

Can the ET-85 form be submitted electronically?

No, the ET-85 form must be mailed to the New York State Estate Tax Processing Center. While some forms might allow for electronic submission, the ET-85 requires traditional mail to ensure all signatures and necessary documents accompany the submission. It's advisable to use a reliable mailing method to ensure timely delivery.

How long does it take to process the ET-85 form?

The time frame for processing the ET-85 form may vary based on the volume of submissions the New York State Department of Taxation and Finance receives. Generally, you can expect processing to take several weeks. Patience is key, but if there are concerns about status, contacting the department is encouraged to check on the progress.

Common mistakes

Filling out the ET-85 form can be a complex process, and there are several common mistakes that individuals often make. Understanding these pitfalls can save time and prevent unnecessary complications during estate tax processing.

One frequent error involves the omission of the decedent’s Social Security number. This number is essential for identifying the estate. Without it, the processing of the form can be delayed. Make sure to double-check that this crucial detail is filled in accurately.

Another common mistake is failing to attach supporting documentation. This includes the death certificate and, if applicable, the Form ET-141 for those who were nonresidents of New York State. Missing documents can lead to delays or even denials, so being thorough at the outset is critical.

Many people also misunderstand the requirements for identifying the executor or authorized representative. It’s essential to ensure that names, contact information, and signatures are complete and legible. Missing or unclear information can hinder communication and cause further delays.

Calculating the estimated net estate is another area where errors frequently occur. Individuals often miscalculate the totals from the asset lines or overlook including certain assets altogether. It's important to carefully review and add all applicable assets before moving on.

Moreover, some individuals forget to indicate whether they are requesting a release of lien. This step is crucial if it applies to your situation. Omitting this can complicate the tax process and could result in additional steps or fees later on.

Finally, the certification section is often overlooked or incorrectly filled out. The individual completing the form must ensure that they sign and date it, confirming their authority and knowledge of the estate. Neglecting this step can invalidate the form.

Taking the time to carefully review each section of the ET-85 form can help avoid these common mistakes. By ensuring accuracy and completeness, the process can be much smoother, minimizing the chance for delays or complications in estate tax matters.

Documents used along the form

The ET-85 form is crucial for those dealing with the estate tax in New York State. However, other forms and documents often accompany it to provide additional information or fulfill specific requirements. Below is a list of these forms, each serving a unique purpose in the estate tax process.

- ET-14: Estate Tax Power of Attorney - This form designates an attorney or authorized representative to handle matters related to the estate tax on behalf of the executor or administrator. It ensures that the representative has the authority to receive tax information.

- ET-141: New York State Estate Tax Domicile Affidavit - If the decedent was not a resident of New York at the time of death, this form clarifies the legal domicile status for tax purposes. It must be submitted to confirm the estate's taxation jurisdiction.

- ET-117: Release of Lien of Estate Tax - This document requests the removal of a lien against the estate for taxation purposes. It must be submitted separately for each county where the estate holds property.

- Letters Testamentary - These are official documents issued by a court to authorize an executor to manage the decedent’s estate. They signify the executor's legal right to act on behalf of the estate.

- Letters of Administration - Similar to Letters Testamentary, these documents are issued when a person dies without a will. They grant the administrator the authority to distribute the decedent's assets.

- Form IT-201: Resident Income Tax Return - If estate income is generated, this tax return may be necessary. It reports the estate's income and ensures compliance with income tax obligations.

- Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return - This federal form is filed for estates exceeding the federal estate tax exemption threshold, detailing the final value of the decedent's estate and any taxes owed.

- Form NYS-1: New York State Withholding Tax Form - If the estate makes payments to beneficiaries, this form helps ensure the proper amount of state withholding taxes is collected and remitted.

- Death Certificate - This official document serves as proof of the decedent’s death. It is often a required attachment when submitting the ET-85 form.

Understanding these forms can help streamline the estate administration process. They collectively ensure that all legal requirements are met and that the estate is handled according to both state and federal regulations.

Similar forms

- Form ET-141, New York State Estate Tax Domicile Affidavit: Similar to the ET-85, this form determines the domicile of the deceased in New York State for estate tax purposes, providing necessary information about the estate's tax liabilities.

- Form ET-14, Estate Tax Power of Attorney: This form allows the executor to designate someone to act on their behalf concerning estate tax matters, mirroring the approval process outlined in the ET-85.

- Form ET-117, Release of Lien of Estate Tax: Used to request the release of a tax lien on the estate, it serves a similar purpose by ensuring that certain tax claims are released, facilitating the resolution of estate matters.

- Form NYS-1, New York State Employer Registration: Although primarily for business purposes, it shares compliance aspects with the ET-85, requiring accurate reporting and tax obligations for entities operating in New York.

- Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return: This federal form is akin to the ET-85 in its function to report the value of an estate and any taxes owed, although it operates at the federal level rather than state.

- Form G-1, Taxpayer Identification Number Application: While mainly for obtaining a taxpayer ID, it is similar in ensuring proper identification and documentation that can influence the processing of estate tax certifications.

- Form W-9, Request for Taxpayer Identification Number: It is used to provide correct taxpayer identification to financial institutions, reflecting accuracy and accountability, similar to the certification aspect of the ET-85.

- Form 1040, U.S. Individual Income Tax Return: This document is essential for individual tax reporting and, like the ET-85, requires detailed financial information about the deceased to process tax obligations adequately.

Dos and Don'ts

Filling out the ET-85 form can be straightforward if you keep some essential do's and don’ts in mind. Here’s a guideline to help ensure that your experience is smooth and that your application is processed without delay.

- DO ensure that all required fields are completed before submission.

- DO verify that the decedent’s name and Social Security number are correct.

- DO attach the copy of the death certificate, if specified.

- DO indicate whether the decedent was a nonresident of New York State.

- DO seek assistance if you’re unsure about any aspect of the form.

- DON'T leave any questions unanswered or skip sections unnecessarily.

- DON'T forget to sign and date the form to validate your submission.

- DON'T assume that just because you filled it out this time, you won’t need to double-check the accuracy in the future.

- DON'T neglect to follow up after mailing your application to confirm receipt and processing status.

Misconceptions

Here are seven common misconceptions about the ET-85 form:

- You don’t need to submit the ET-85 form unless the estate tax is owed. Many people think this. However, the ET-85 form is necessary even if no estate tax is due. It serves to certify the estate's status with New York State.

- Only professional tax advisors can fill out the ET-85 form. While it can be helpful to have an attorney or tax advisor assist, any executor or authorized representative can complete the form. A good understanding of the estate’s assets is key.

- The ET-85 form is the same for residents and nonresidents. This isn’t true. Nonresidents must submit additional documents, such as the ET-141 form, along with the ET-85 to establish tax domicile properly.

- The ET-85 form is only about tax payments. In fact, this form also helps in requesting a release of lien. If property was owned jointly with a spouse, a release might not be necessary at all.

- Once filed, the information cannot be changed. This is a misconception. If you discover mistakes on the ET-85 form after submitting it, you can amend the form. Just be sure to follow the proper channels for corrections.

- You can delay submitting the ET-85 form. Many believe they can put it off until they have everything sorted. In reality, timely submission is crucial, especially if you need to secure a release of lien on estate property.

- All assets need to be listed in detail on the ET-85 form. While an accurate estimate is necessary, it’s not required to provide a line-by-line breakdown. A summary of the estimated net estate will usually suffice.

Key takeaways

Here are several key takeaways about the completion and use of the ET-85 form:

- Purpose of the ET-85 Form: The form is used to certify the estate tax status of an individual who passed away in New York State on or after January 1, 2019.

- Required Information: When filling out the form, personal details of the decedent, such as full name, social security number, and address at the time of death, must be accurately provided.

- Supporting Documentation: Attach a copy of the death certificate and any necessary forms, such as the ET-141 for nonresidents or ET-14 for Power of Attorney, if applicable.

- Executor Information: The executor must provide their name, contact details, and specify if they are submitting Letters Testamentary or Letters of Administration with the form.

- Net Estate Calculation: Complete the section calculating the estimated net estate by summing the value of various assets and subtracting estimated deductions.

- Certification Requirement: The person completing the form must certify their knowledge of the decedent’s assets and certainty regarding the accuracy of the information provided.

By following these key points, users can effectively navigate the process of filing the ET-85 form, ensuring compliance with New York State estate tax regulations.

Browse Other Templates

Visa to Spain - Bank statements covering the last six months must also be included with your application.

Ihsaa Physical Form 2023-24 - The form must be signed by a physician, nurse practitioner, or physician assistant after reviewing medical histories.