Fill Out Your Exemption Tax St3 Form

The Exemption Tax ST3 form plays a crucial role in the sales tax process in Minnesota, particularly for those entities that qualify for specific exemptions. This form essentially acts as a certification that allows purchasers to claim an exemption from sales tax on eligible purchases. Designed for use by both purchasers and sellers, the ST3 form helps establish clear documentation of exemption statuses. A purchaser must complete the form and present it to the seller, who then has the obligation to keep this certificate as part of their records. Importantly, an incomplete form means the seller must charge sales tax. The ST3 is classified as a blanket certificate, remaining valid for ongoing purchases unless canceled by the purchaser or specified for a single transaction. The document requires specific details, including the purchaser’s identification, address, type of business, and reason for claiming the exemption. Exemptions can apply to a variety of entities, including government bodies, non-profit organizations, and educational institutions, among others. It is also essential for all parties involved to understand the various categories, as misuse of the certificate can lead to penalties. By clarifying who qualifies for exemptions and under what circumstances, the ST3 form serves both to facilitate commerce and ensure compliance with tax regulations.

Exemption Tax St3 Example

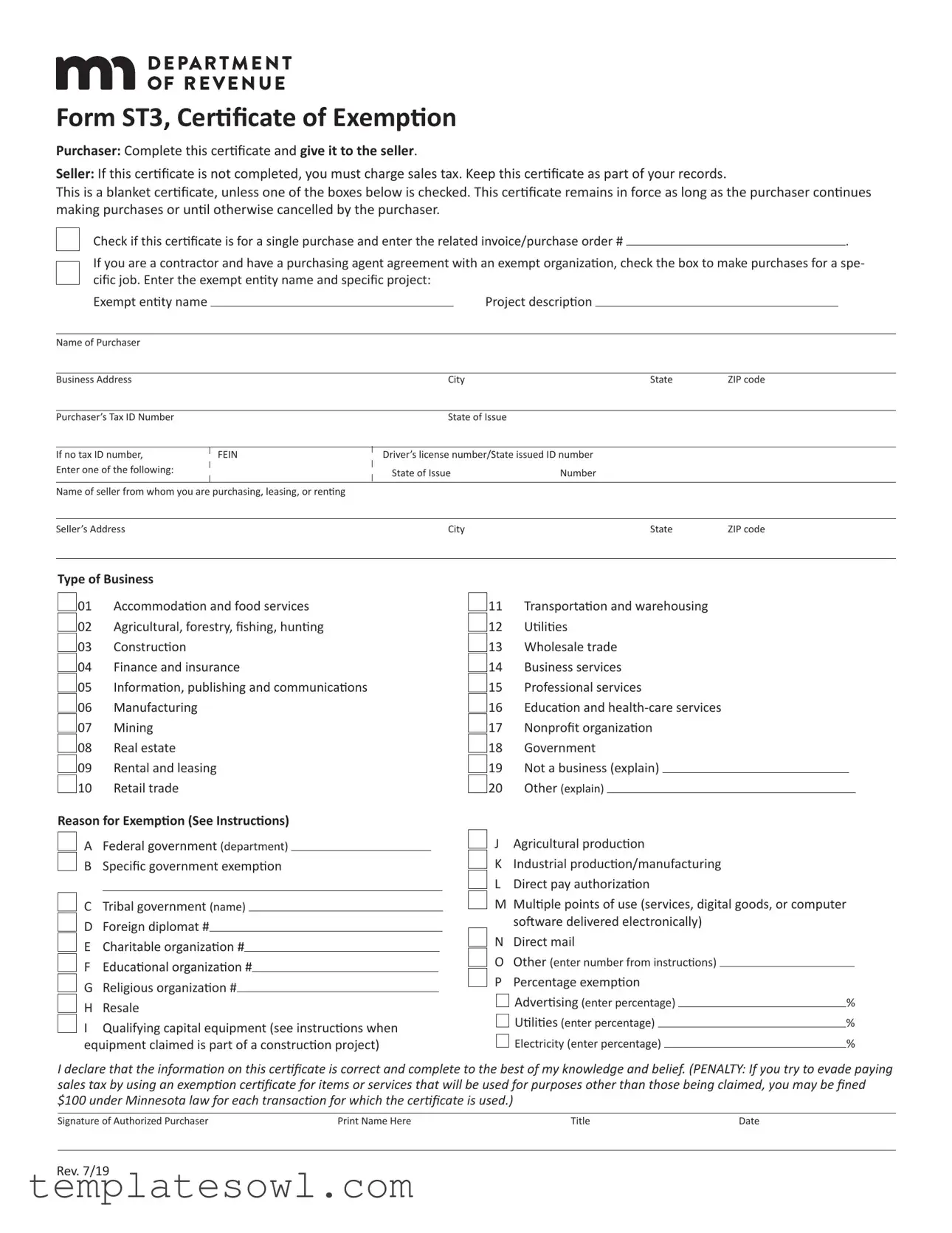

Form ST3, Certificate of Exemption

Purchaser: Complete this certificate and give it to the seller.

Seller: If this certificate is not completed, you must charge sales tax. Keep this certificate as part of your records.

This is a blanket certificate, unless one of the boxes below is checked. This certificate remains in force as long as the purchaser continues making purchases or until otherwise cancelled by the purchaser.

Check if this certificate is for a single purchase and enter the related invoice/purchase order # |

|

. |

If you are a contractor and have a purchasing agent agreement with an exempt organization, check the box to make purchases for a spe- cific job. Enter the exempt entity name and specific project:

Exempt entity name |

|

|

Project description |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Name of Purchaser |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Address |

|

City |

|

State |

ZIP code |

||

|

|

|

|

|

|

|

|

Purchaser’s Tax ID Number |

|

State of Issue |

|

|

|

|

|

|

|

|

|

|

|

|

|

If no tax ID number, |

FEIN |

Driver’s license number/State issued ID number |

|

|

|||

Enter one of the following: |

|

State of Issue |

Number |

|

|

||

|

|

|

|

|

|

|

|

Name of seller from whom you are purchasing, leasing, or renting |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Seller’s Address |

|

City |

|

State |

ZIP code |

||

Type of Business

01 Accommodation and food services

01 Accommodation and food services

02 Agricultural, forestry, fishing, hunting

02 Agricultural, forestry, fishing, hunting

03 Construction

03 Construction

04 Finance and insurance

04 Finance and insurance

05 Information, publishing and communications

05 Information, publishing and communications

06 Manufacturing

06 Manufacturing

07 Mining

07 Mining

08 Real estate

08 Real estate

09 Rental and leasing

09 Rental and leasing

10 Retail trade

10 Retail trade

Reason for Exemption (See Instructions)

A Federal government (department)

B Specific government exemption

C Tribal government (name)

D Foreign diplomat #

E Charitable organization # F Educational organization # G Religious organization # H Resale

I Qualifying capital equipment (see instructions when equipment claimed is part of a construction project)

|

11 |

Transportation and warehousing |

|

|

|

|

||||||

|

|

Utilities |

|

|

|

|

||||||

|

12 |

|

|

|

|

|||||||

|

|

Wholesale trade |

|

|

|

|

||||||

|

13 |

|

|

|

|

|||||||

|

|

Business services |

|

|

|

|

||||||

|

14 |

|

|

|

|

|||||||

|

|

Professional services |

|

|

|

|

||||||

|

15 |

|

|

|

|

|||||||

|

|

Education and |

|

|

|

|

||||||

|

16 |

|

|

|

|

|||||||

|

|

Nonprofit organization |

|

|

|

|

||||||

|

17 |

|

|

|

|

|||||||

|

|

Government |

|

|

|

|

||||||

|

18 |

|

|

|

|

|||||||

|

|

Not a business (explain) |

|

|

|

|

|

|

|

|

||

|

19 |

|

|

|

|

|

|

|

|

|||

|

|

Other (explain) |

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

J |

Agricultural production |

|

|

|

|

||||||

|

|

|

|

|

||||||||

|

K |

Industrial production/manufacturing |

|

|

|

|

||||||

|

|

|

|

|

||||||||

|

L |

Direct pay authorization |

|

|

|

|

||||||

|

|

|

|

|

||||||||

|

M |

Multiple points of use (services, digital goods, or computer |

||||||||||

|

||||||||||||

|

|

software delivered electronically) |

|

|

|

|

||||||

|

N |

Direct mail |

|

|

|

|

||||||

|

O |

Other (enter number from instructions) |

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||||

|

P |

Percentage exemption |

|

|

|

|

||||||

|

|

|

|

|

||||||||

|

|

Advertising (enter percentage) |

|

|

|

|

% |

|||||

|

|

Utilities (enter percentage) |

|

|

% |

|||||||

|

|

Electricity (enter percentage) |

|

|

% |

|||||||

I declare that the information on this certificate is correct and complete to the best of my knowledge and belief. (PENALTY: If you try to evade paying sales tax by using an exemption certificate for items or services that will be used for purposes other than those being claimed, you may be fined $100 under Minnesota law for each transaction for which the certificate is used.)

Signature of Authorized Purchaser |

Print Name Here |

Title |

Date |

Rev. 7/19

Form ST3 Instructions

Fact sheets and industry guides are available on our website at www.revenue.state.mn.us.

Purchasers

Complete this certificate and give it to the seller. Include your Minnesota tax identification number if you have one. Do not send it to the Min- nesota Department of Revenue.

Note: You are responsible for knowing if you qualify to claim exemption from tax and will be held liable for any use tax, interest and pos- sible penalties due if the items you purchased are not eligible for exemption.

Sellers

Keep this certificate as part of your records. Accepting a completed exemption certificate relieves you from collecting the tax. If this certifi- cate is not completed, you must charge sales tax. You may be required to provide this exemption certificate (or the data elements required on the form) to the state to verify this exemption.

Exemption Descriptions

Use these descriptions to complete the Reason for Exemption section.

A. Federal government — Enter the name of the department. The seller must obtain a purchase order, payment voucher, work order, a completed Form ST3 or similar documentation to show the purchase was from the federal government. See the Government - Federal Government Industry Guide.

B.Specific government exemptions — Enter the specific exemption from the list below.

•Ambulance services

•Biosolids processing equipment

•

•Chore/homemaking services

•Correctional facility meals or drinks

•Emergency rescue vehicle repair and replacement parts

•Emergency vehicle accessory items

•Firefighter equipment

•Hospitals

•Libraries

•Local Governments

•Metropolitan Council

•Nursing homes

•Petroleum products used by government

•Regionwide public safety radio communication system

•Solid waste disposal facility

•State or local government agency from another state

•Transit program vehicles

•Water used directly in providing fire protection

See Fact Sheet 142, Sales to Governments, Fact Sheet 135, Fire Fighting, Police and Emergency Equipment, Government - Local Gov- ernments Industry Guide, and Fact Sheet 139, Libraries.

C.Tribal government — All sales to tribal governments are exempt. Enter the name of the tribe. See Fact Sheet 160, Tribal Governments and Members.

D.Foreign diplomat — Sales tax exemption cards are issued to some foreign diplomats and consular officials stationed in this country. Enter the number issued to the foreign diplomat. See the Government - Federal Government Industry Guide.

E.Charitable organizations — Must be operated exclusively for charitable purposes. You must apply for and receive exempt status autho- rization from the department. Some nonprofit organizations do not qualify for sales tax exemption. This exemption may not be used for the purchase of lodging or prepared food. See the Nonprofit Organizations Industry Guide.

F.Educational organizations — Educational organizations operated exclusively for educational purposes must use Form ST3 on qualifying purchases. Organizations such as nonprofit professional and trade schools, scouts, youth groups, youth athletic and recreational pro- grams, etc., operated exclusively for educational purposes must apply for exempt status authorization from the department and use Form ST3 on qualifying purchases. This exemption may not be used for the purchase of lodging or prepared food. See the Nonprofit Organiza-

tions Industry Guide. |

Continued |

1 |

|

Form ST3 instructions (continued)

G.Religious organizations — Churches and other religious organizations operated exclusively for religious purposes can use Form ST3 without exempt status authorization or may apply for exempt status authorization from the department. This exemption may not be used for the purchase of lodging or prepared food. See the Nonprofit Organizations Industry Guide.

H.Resale — Items or services must be purchased for resale in the normal course of business. You may not use this exemption if the vendor is restricted by federal or state law from selling certain products for resale. Liquor retailers cannot sell alcoholic beverages exempt for resale. M.S.340A.505

I.Qualifying Capital Equipment — Machinery and equipment purchased or leased primarily for manufacturing, fabricating, mining, or refining tangible personal property to be sold ultimately at retail if the machinery and equipment are essential to the integrated production process.

Additional information needs to be provided when the CE exemption is claimed for a construction project that would normally be consid- ered an improvement to real property. The purchaser must provide documentation to the contractor to identify the exempt portion of the project.

See Fact Sheet 103, Capital Equipment and Fact Sheet 128, Contractors.

J.Agricultural production — Materials and supplies used or consumed in agricultural production of items intended to be sold ultimately at retail. Does not cover furniture, fixtures, machinery, tools (except qualifying detachable tools and special tooling) or accessories used to produce a product. See the Agricultural and Farming Industry Guide.

K.Industrial production — Materials and supplies used or consumed in industrial production of items intended to be sold ultimately at retail. Does not cover furniture, fixtures, machinery, tools (except qualifying detachable tools and special tooling) or accessories used to produce a product. See Fact Sheet 145, Industrial Production.

L.Direct pay — Allows the buyer to pay sales tax on certain items directly to the state instead of to the seller. Applicants must be registered to collect sales tax in order to qualify and must apply for and receive direct pay authorization from the department. The State of Minne- sota (all state agencies) has direct pay authorization. This means state agencies pay sales tax directly to the department, rather than to the seller. Direct pay authorization may not be used for meals and drinks; lodging or related lodging services; admissions to places of amuse- ment or athletic events, or use of amusement devices; motor vehicles; certain services; or memberships to sports and athletic facilities. If you sell any of the excluded items, you should charge sales tax.

M.Multiple points of use — Taxable services, digital goods, or electronically delivered computer software that is concurrently available for use in more than one taxing jurisdiction at the time of purchase. Purchaser is responsible for apportioning and remitting the tax due to each taxing jurisdiction.

N.Direct mail

•It is delivered or distributed by U.S. Mail or other delivery service.

•It is sent to a mass audience or to addresses on a mailing list provided by the purchaser or at the direction of the purchaser.

•The cost of the items is not billed directly to recipients.

O.Other exemptions —

1.Aggregate delivered by a third party hauler to be used in road construction. Charges for delivery of aggregate materials by third party haulers are exempt if the aggregate will be used in road construction.

2.Airflight equipment. The aircraft must be operated under Federal Aviation Regulations, parts 91 and 135. See the Aircraft Industry Guide.

3.Ambulance services — privately owned (leases of vehicles used as an ambulance or equipped and intended for emergency re- sponse). Must be used by an ambulance service licensed by the EMS Regulatory Board under section 144E.10. See Fact Sheet 135, Fire Fighting, Police, and Emergency Equipment.

4.Aquaculture production equipment. Qualifying aquaculture production equipment, and repair or replacement parts used to main- tain and repair it. See the Agricultural and Farming Industry Guide.

5.Automatic

6.

7.Construction exemption for special projects under M.S. 297A.71. Certain purchases for the construction of a specific project or facility are exempt under M.S. 297A.71, such as waste recovery facilities. This exemption does not apply to projects for which you must pay sales or use tax on qualifying purchases and then apply for a refund.

8.Exempt publications. Materials and supplies used or consumed in the production of newspapers and publications issued at average intervals of three months or less. Includes publications issued on

Continued 2

Form ST3 Instructions (continued)

9.Farm machinery. Qualifying farm machinery, and repair or replacement parts (except tires) used to maintain and repair it. See the

Agricultural and Farming Industry Guide.

10.Handicapped accessible (residential building materials). Building materials and equipment purchased by nonprofit organizations if the materials are used in an existing residential structure to make it handicapped accessible, and the homeowner would have qualified for a refund of tax paid on the materials under M.S. 297A.71, subd. 11 or subd. 22. Nonprofit organizations include those entities organized and operated exclusively for charitable, religious, educational or civic purposes; and veteran groups exempt from federal taxation under IRC 501(c)(19).

11.Handicapped accessible (vehicle costs). Conversion costs to make vehicles handicapped accessible. Covers parts, accessories and labor.

12.Herbicides for use on invasive aquatic plants. Starting July 1, 2019, herbicides used under an invasive aquatic plant management permit are exempt from sales tax. The exemption only applies to herbicides labeled for use in water and registered with the Depart- ment of Agriculture for use on invasive aquatic plants. The herbicides must be purchased by lakeshore property owners, a lakeshore property association, or a contractor hired to provide invasive aquatic plant management.

13.Horse materials. Covers consumable items such as feed, medications, bandages and antiseptics purchased for horses. Does not cover machinery, tools, appliances, furniture and fixtures. See the Veterinary Practice Industry Guide.

14.Hospitals and outpatient surgical centers. Sales to a hospital and outpatient surgical center are exempt if the items purchased are used in providing hospital or outpatient surgical services. (M.S. 297A.70, subd. 7)

15.Instructional materials required for study courses by college or private career school students (M.S. 297A.67, subd. 13a)

16.Logging equipment. Qualifying logging equipment, and repair or replacement parts (except tires) used to maintain and repair it. See

Fact Sheet 108, Logging Equipment.

17.Materials used for business outside Minnesota in a state where no sales tax applies to such items; or for use as part of a mainte- nance contract. This exemption applies only if the items would not be taxable if purchased in the other state (e.g., a state that does not have sales tax).

18.Materials used to provide certain taxable services. Materials must be used or consumed directly in providing services taxable under M.S. 297A.61, subd. 3(g)(6).

19.Medical supplies for a

20.Motor carrier direct pay (MCDP). Allows motor carriers to pay tax directly to the state when they lease mobile transportation equipment or buy certain parts and accessories. Applicants must be registered for sales tax in order to apply. You must apply for and receive MCDP authorization from the Department of Revenue. See the Motor Vehicle Industry Guide.

21.Nonprofit snowmobile clubs. Certain machinery and equipment is exempt when used primarily to groom state (or

22.Nursing homes and bonding care homes. Sales to nursing homes and boarding care homes are exempt. Nursing homes must be licensed by the state. Boarding care homes must be certified as a nursing facility.

23.Packing materials. Packing materials used to pack and ship household goods to destinations outside of Minnesota.

24.Poultry feed. The poultry must be for human consumption.

25.Preexisting construction bids and contracts. Tangible personal property or services purchased in relation to a preexisting construc- tion bid or contract are exempt from a new local tax or a tax rate increase for six months from the effective date of the new local tax or rate increase. This exemption is only for the change in tax on items or services purchased during the transitional period. The preexisting bid must be submitted and accepted before the effective date of the tax change and the building materials or services must be used pursuant to an obligation of the bid. A construction contract must have documentation of a bona fide written

26.Prizes. Items given to players as prizes in games of skill or chance at events such as community festivals, fairs and carnivals lasting fewer than six days.

27.Purchasing agent. Allows a business who has been appointed as a purchasing agent by an exempt organization to make purchases exempt from sales tax. All documentation pertaining to the purchasing agent agreement is kept by the purchasing agent to verify exemption.

28.Repair or replacement parts used in another state or country as part of a maintenance contract. This does not apply to equipment or tools used in a repair business.

29.Resource recovery facilities. Applies to equipment used for processing solid or hazardous waste (after collection and before dis-

posal) at a resource recovery facility. You must apply for and receive approval from the department. |

Continued |

3 |

Form ST3 Instructions (continued)

30.

31.Senior citizen groups. Groups must limit membership to senior citizens age 55 or older, or under 55 but physically disabled. They must apply for and receive exempt status authorization from the department.

32.Ship repair or replacement parts and lubricants. Repair or replacement parts and lubricants for ships and vessels engaged princi- pally in interstate or foreign commerce. See the Transportation Service Providers Industry Guide.

33.Ski areas. Items used or consumed primarily and directly for tramways at ski areas, or in snowmaking and

34.Solar energy system means a set of devices whose primary purpose is to collect solar energy and convert and store it for useful purposes including heating and cooling buildings or other energy using processes, or to produce generated power by means of any combination of collecting, transferring, or converting

35.Taconite production items. Mill liners, grinding rods and grinding balls used in taconite production if purchased by a company taxed under the

36.Telecommunications, cable television and direct satellite equipment used directly by a service provider primarily to provide those services for sale at retail. See Fact Sheet 119, Telecommunications, Pay Television, and Related Services. This exemption was not in effect from July 1, 2013 through March 31, 2014.

37.Textbooks required for study to students who are regularly enrolled.

38.Tribal government construction contract. Materials purchased on or off the reservation by tribal government or

41.TV commercials. Covers TV commercials and tangible personal property primarily used or consumed in preproduction, production or

42.Veteran organizations. Limited exemption applies to purchases by veteran organizations and their auxiliaries if they are organized in Minnesota and exempt from federal income tax under IRC Section 501(c)(19); and the items are for charitable, civic, educational or nonprofit use (e.g. flags, equipment for youth sports teams, materials to make poppies given for donations).

43.

44.Wind energy systems. Wind energy conversion systems and materials used to construct, install, repair or replace them.

P. Percentage Exemptions —

• Advertising materials: Percentage exemptions may be claimed for advertising materials for use outside of Minnesota or local taxing area. Purchaser must enter exempt percentage on Form ST3. See Fact Sheet 133, Advertising.

• Utilities: Exemption applies to percent of utilities used in agricultural or industrial production. General space heating and lighting is not included in the exemption. Purchaser must enter exempt percentage on Form ST3. See the Agricultural and Farming Industry Guide and Fact Sheet 129, Utilities Used in Production.

• Electricity: Exemption applies to percent of electricity used to operate enterprise information technology equipment, or used in office and meeting spaces, and other support facilities in support of enterprise information technology equipment. Purchaser must enter exempt percentage on Form ST3. See Revenue Notice

Forms and Information

Website: www.revenue.state.mn.us.

Email: SalesUse.Tax@state.mn.us

Phone:

4

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form ST3 | Form ST3 is used to certify that a purchaser is exempt from sales tax when buying goods or services. |

| Seller Responsibilities | If the seller does not receive a completed ST3 form, they must charge sales tax on the transaction. |

| Validity Duration | This certificate remains valid as long as the purchaser continues to make exempt purchases or until canceled by them. |

| Single Purchase Option | The form allows for a single purchase exemption if the corresponding invoice number is provided. |

| Types of Exempt Organizations | Exemptions apply to various entities, including federal and tribal governments, charities, and educational institutions. |

| Contractor Agreements | Contractors may use this form if they have agreements with exempt organizations for specific jobs. |

| State-Specific Laws | This form is governed by Minnesota Statutes Section 297A, which outlines the conditions for sales tax exemptions. |

| Purchaser's Responsibility | Purchasers are responsible for knowing if they qualify for exemptions and may face consequences if misused. |

Guidelines on Utilizing Exemption Tax St3

Completing the Exemption Tax ST3 form accurately is essential for ensuring compliance while benefiting from tax exemptions. Follow these straightforward steps to fill out the form correctly.

- Obtain the Exemption Tax ST3 form from the official website or your local revenue office.

- Fill in the Name of Purchaser field with your full name or the name of your business.

- Provide the Business Address, including the city, state, and ZIP code.

- Enter your Purchaser’s Tax ID Number. If you don’t have one, write your FEIN or driver’s license number.

- Next, enter the Name of Seller who you are purchasing from and their Address, along with city, state, and ZIP code.

- Select the Type of Business from the provided options by entering the corresponding number.

- Check the criteria for Reason for Exemption and fill in any necessary details based on your chosen reason.

- If applicable, check the box for a single purchase and provide the related invoice or purchase order number.

- If you are a contractor making purchases for a specific job under an exempt organization, check the appropriate box and provide the necessary information.

- Sign the form in the designated area, and print your name, title, and the date.

After completing the form, deliver it to the seller. Ensure that you keep a copy for your records. The seller will retain the certificate, and it will protect them from having to charge sales tax on your purchase.

What You Should Know About This Form

1. What is the purpose of the Exemption Tax ST3 form?

The Exemption Tax ST3 form serves as a certificate for purchasers to claim exemption from sales tax for certain transactions. By completing this form, buyers can provide evidence to sellers that they qualify for a sales tax exemption, which must be documented to avoid charging sales tax on the transaction. This is particularly important as sellers are obliged to collect tax unless they receive a properly filled exemption form.

2. Who is responsible for completing the ST3 form, and what information is required?

The purchaser is responsible for completing the ST3 form and submitting it to the seller. Essential details include the purchaser’s name, business address, tax identification number, and the reason for claiming the exemption. Furthermore, the form requires information about the seller, including their name and address. This documentation ensures that both parties are aware of the sales tax exemption status for the transaction.

3. How does the type of exemption affect the use of the ST3 form?

The type of exemption directly influences the completion of the ST3 form. Different exemptions apply to various categories such as federal government purchases, charitable organizations, and resale items. Depending on the box checked for the reason for exemption, additional documentation may be required. For instance, if a charitable organization is claiming an exemption, proof of its exempt status must be presented, while government departments may need to provide purchase orders. Understanding the underlying basis for the exemption is critical to ensure compliance.

4. What happens if the ST3 form is not completed correctly?

If the ST3 form is not filled out correctly, the seller must charge sales tax on the transaction. Sellers rely on the accuracy of the information provided in the form to determine whether an exemption applies. If incorrect details are submitted, or if a required box is left unchecked, the exemption will be invalidated. This could potentially lead to additional financial liabilities for the purchaser if state authorities later determine that tax was due for the items purchased.

5. Are there any penalties for misuse of the ST3 exemption?

Yes, there are penalties for the misuse of the ST3 exemption certificate. If a buyer attempts to evade paying sales tax by using the form inappropriately—such as for items not eligible for exemption—they may face fines. Under Minnesota law, the penalty can be as much as $100 for each instance of misuse. Consequently, it is essential for purchasers to understand and assert their eligibility for the exemption genuinely, to avoid both legal repercussions and financial loss.

Common mistakes

Filling out the Exemption Tax ST3 form incorrectly can lead to unnecessary complications. One common error is failing to complete all required sections. This form requires specific information about the purchaser, the seller, and the reason for the exemption. Omitting details like tax identification numbers or selecting incorrect exemption codes can result in non-acceptance of the certificate.

Another mistake is misunderstanding the reason for exemption. The form offers various options, and selecting the wrong category can lead to issues. For instance, if a charitable organization selects a government exemption, it could face penalties when the audit occurs. It is crucial to carefully read and understand each reason for exemption provided and choose accurately based on the purchase's nature.

People also often neglect to sign and date the certificate. An unsigned form invalidates the exemption, obligating the seller to charge sales tax. This can lead to unexpected costs down the line for the purchaser. It's essential to remember that all fields must be completed properly—this includes the significant step of providing a signature and the date.

Lastly, many individuals assume that simply having a blanket exemption certificate is sufficient without additional documentation. However, depending on the type of exemption claimed, some transactions may necessitate additional proof. For example, contractors working for specific exempt organizations need to ensure that they have the correct documentation indicating that the purchases apply specifically to an exempt project. Without such documentation, the exemption could be contested during audits.

Documents used along the form

The Exemption Tax ST3 form is a crucial document in the realm of tax exemption transactions, particularly in sales tax scenarios. In addition to this form, several other documents and forms are necessary to ensure clarity, compliance, and accurate record-keeping. Here is a list of commonly associated documents that work in tandem with the ST3 form:

- Sales Tax Exemption Certification: This document serves as a formal declaration by the purchaser claiming a specific exemption from sales tax for the purchase made. It specifies the basis for the exemption, linking it to the ST3 form as supporting evidence.

- Purchase Order: Often required to be presented alongside the ST3 form, a purchase order provides details about the item or service being acquired, including the quantity, price, and vendor information. This helps to substantiate the claim when an exemption is applied.

- Vendor's Tax ID Certificate: This document confirms that the seller is a registered vendor in compliance with state tax laws. It ensures that the seller can legally engage in tax-exempt transactions with the purchaser.

- Federal Tax Exemption Letter: In some cases, organizations such as charities or educational institutions must present a federal tax exemption letter, which verifies their status as tax-exempt entities. This letter strengthens the argument for exemption on purchases made with the ST3 form.

- Tax Exempt Status Application: Organizations seeking sales tax exemption need to fill out an application with their respective state revenue department. This application is essential to prove eligibility before utilizing the ST3 form for future purchases.

- Transactional Records: Maintaining records of sales transactions and any exemption forms utilized is necessary for both the seller and purchaser to validate that exemptions were properly applied. These records include invoices, receipts, and any correspondence related to the exemption.

- Affidavit of Exempt Status: Some entities might require an affidavit, which is a written statement made under oath, declaring their exempt status. This document can reinforce the credibility of the exemption claimed on the ST3 form.

Understanding these associated documents and their roles can greatly facilitate smoother transactions when applying form ST3 for sales tax exemptions. By having this documentation in order, both purchasers and sellers can navigate the complexities of tax laws while ensuring compliance with relevant regulations.

Similar forms

- Form ST3, Certificate of Exemption: This document allows a purchaser to claim an exemption from sales tax by providing certification to the seller. Similar to the ST3, it requires the purchaser to provide specific information related to their claim for exemption.

- Form ST3C, Certificate of Exemption for Contractors: This form is used by contractors when purchasing materials for specific jobs. Like the ST3, it certifies exemptions but focuses more on project-specific purchases.

- Form ST-4, Certificate of Exempt Use: This form certifies the use of purchased items exempt from sales tax. Similar to the ST3, it includes details about the purchaser and the intended use of purchased items.

- Form ST-5, Sales Tax Exemption Certificate: This document grants exemptions to certain purchases related to resale. It aligns closely with the ST3 in terms of confirming the eligibility and purpose of the transaction.

- Form ST-6, Exemption Certificate for Nonprofit Organizations: This form is issued for nonprofit entities to claim tax exemptions. It is similar to the ST3 in that it requires specific information about the organization and its exemption status.

- Form ST-7, Certificate for Government Purchases: Government entities use this form to confirm tax-exempt purchases, similar to how a purchaser utilizes the ST3 to certify their exemption status for certain purchases.

- Form ST-8, Exemption Certificate for Educational Purchases: Educational institutions utilize this form to qualify for tax exemptions on eligible purchases. It mirrors elements of the ST3 by focusing on the exempt status of the organization.

- Form ST-9, Exemption Certificate for Medical Purchases: This form is used by healthcare providers to certify exemptions for certain medical equipment and supplies. It has similar informative characteristics to the ST3 with a focus on health-related transactions.

- Form ST-10, Exemption Certificate for Food Sales: This document allows retailers to sell food items without collecting tax under specific circumstances. Its process of certification parallels the ST3 in the necessity of detailed information.

- Form ST-11, Exemption Certificate for Agricultural Purchases: Agricultural entities use this form to claim exemptions on qualifying purchases, similar to the ST3, as both require the establishment of the exempt purpose for the transaction.

Dos and Don'ts

When filling out the Exemption Tax ST3 form, there are specific dos and don’ts to keep in mind. Following these guidelines will help ensure that your form is completed correctly and that you meet the necessary requirements for tax exemption.

- Do carefully read the instructions provided with the form.

- Do make sure to include your tax identification number if you have one.

- Do provide accurate details about the exempt entity and the reason for exemption.

- Do double-check all entered information for accuracy before submitting.

- Don't assume that all purchases qualify for exemption without verifying eligibility.

- Don't forget to keep a copy of the completed form for your records.

- Don't submit the form to the Department of Revenue; give it directly to the seller.

Misconceptions

Understanding the nuances of the Exemption Tax ST3 form is essential for both purchasers and sellers. However, various misconceptions can cloud the clarity around its use. Below is a list of ten common misconceptions, along with explanations to clarify each point.

- The ST3 form can be submitted to the Minnesota Department of Revenue. Many people believe they should send the completed form to the state. In reality, the form is not submitted to the Department of Revenue; purchasers should give it directly to the seller.

- All sales to nonprofit organizations are automatically exempt from tax. This is incorrect. Nonprofit organizations must obtain exempt status authorization from the Department of Revenue to qualify for tax exemption on purchases.

- You can use the ST3 form for any purchase, regardless of its purpose. The exemption certificate is only valid for specific purchases as outlined. Using it for items not intended for the exempt purpose may lead to penalties.

- The form is valid indefinitely once completed. While the ST3 form remains in effect as long as the purchaser continues making qualifying purchases, it may be canceled at any time by the purchaser, which is often overlooked.

- All government-related purchases are exempt without additional verification. Although government entities are typically exempt, specific documentation such as a purchase order may be necessary to establish the exemption.

- Any contractor can use the ST3 form for tax exemption. Not every contractor qualifies. They must have a purchasing agent agreement with an exempt organization and follow the specific guidelines associated with their project.

- Purchasers do not need to provide any identification when using the ST3 form. On the contrary, it is important for purchasers to provide their tax identification number or an alternate ID (like a driver’s license number) to verify their exemption eligibility.

- Once the exemption is claimed, no further responsibilities exist. This is a misconception. Purchasers are responsible for knowing whether they qualify for exemptions and will face penalties if they misuse the ST3 form.

- Exemptions apply to all types of businesses equally. The ST3 form has different criteria depending on the type of business or organization. Not all businesses will automatically qualify for tax exemption.

- The ST3 form does not require seller retention. This is misleading. Sellers must keep the completed ST3 form as part of their records as it protects them from having to collect sales tax on exempt sales.

Clarifying these misconceptions can aid both buyers and sellers in ensuring compliance with tax regulations while maximizing the benefits of their exemptions under the law.

Key takeaways

Filling out and using the Exemption Tax St3 form requires attention to detail and understanding of its implications.

- Purchasers must complete the form accurately and provide it to the seller to claim an exemption from sales tax.

- Failure to complete the form mandates that the seller charge sales tax on the transaction.

- This exemption certificate remains valid as long as the purchaser continues to make qualifying purchases or until revoked.

- Each exemption reason has specific criteria that must be clearly understood and accurately checked on the form.

Browse Other Templates

Adverse Action Fcra - Chex Systems provides various templates to assist institutions in fulfilling compliance obligations efficiently.

Dap Notes Template - The "P" section outlines the client's response and plans for future sessions.