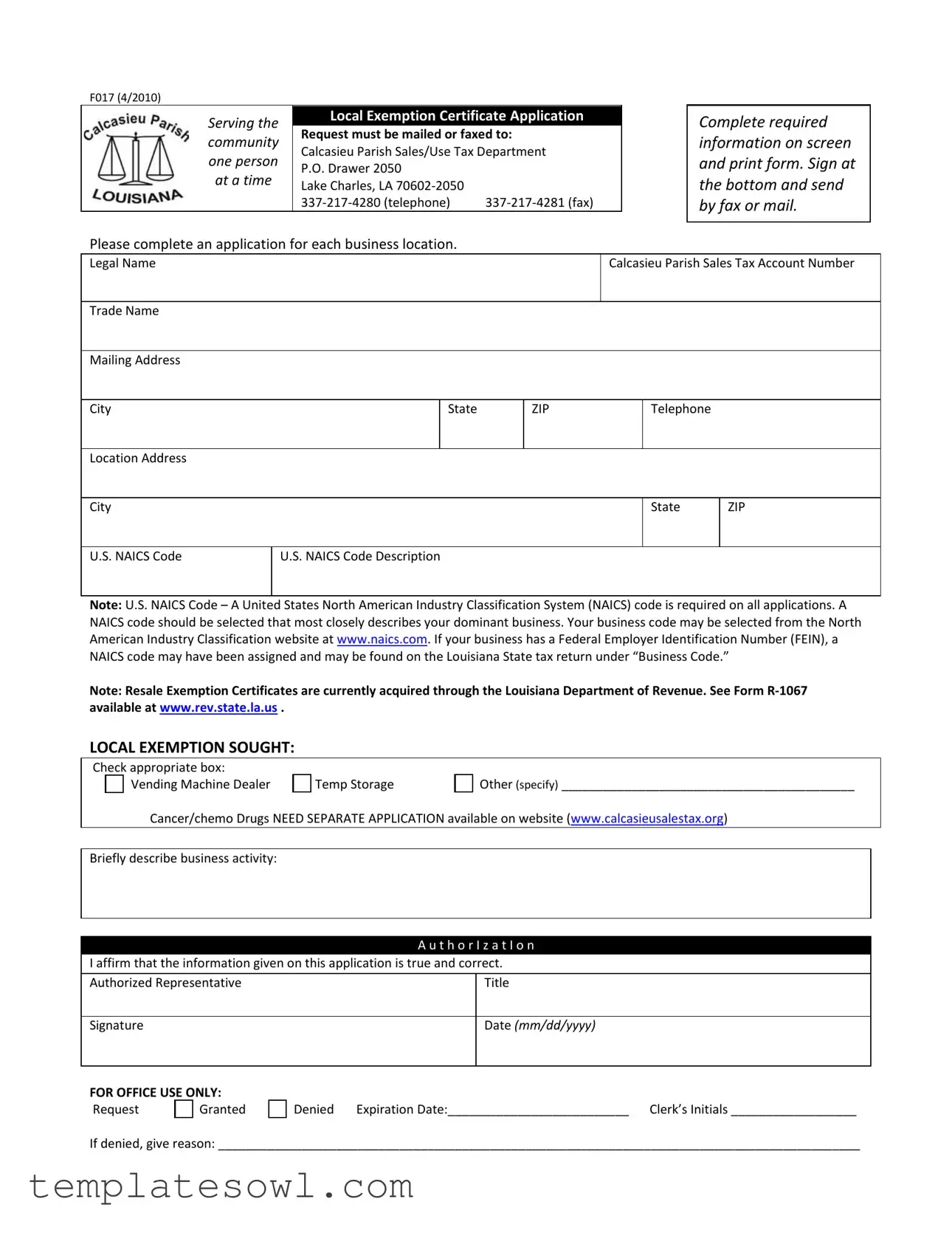

Fill Out Your F017 Form

The F017 form serves as an essential tool for businesses seeking a Local Exemption Certificate in Calcasieu Parish, Louisiana. Designed to streamline the application process, it must be submitted either by mail or fax to the local Sales/Use Tax Department. As applicants fill out this form, they will need to provide key details such as their legal name, trade name, mailing and location addresses, as well as contact information. One crucial aspect of the form is the requirement of a U.S. NAICS code, which classifies the business within the North American Industry Classification System. This code not only reflects the type of business but may also be found on relevant state tax documents, like the Louisiana State tax return. It is important to complete a separate application for each business location to ensure proper processing. The form includes checkboxes to indicate the type of exemption sought—such as for vending machine dealers or temporary storage—and highlights the need for a separate application for cancer or chemotherapy drugs. Upon completion, the authorized representative must affirm the accuracy of the provided information by signing and dating the form. This guarantees that the application meets local requirements while facilitating the exemption process.

F017 Example

F017 (4/2010)

Serving the |

Local Exemption Certificate Application |

||

Request must be mailed or faxed to: |

|||

community |

|||

Calcasieu Parish Sales/Use Tax Department |

|||

one person |

|||

P.O. Drawer 2050 |

|

||

at a time |

|

||

Lake Charles, LA |

|

||

|

|

||

|

|||

Complete required information on screen and print form. Sign at the bottom and send by fax or mail.

Please complete an application for each business location.

Legal Name |

|

|

|

Calcasieu Parish Sales Tax Account Number |

||

|

|

|

|

|

|

|

Trade Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

ZIP |

|

Telephone |

|

|

|

|

|

|

|

|

Location Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

ZIP |

|

|

|

|

|

|

|

U.S. NAICS Code |

U.S. NAICS Code Description |

|

|

|

|

|

|

|

|

|

|

|

|

Note: U.S. NAICS Code – A United States North American Industry Classification System (NAICS) code is required on all applications. A NAICS code should be selected that most closely describes your dominant business. Your business code may be selected from the North American Industry Classification website at www.naics.com. If your business has a Federal Employer Identification Number (FEIN), a NAICS code may have been assigned and may be found on the Louisiana State tax return under “Business Code.”

Note: Resale Exemption Certificates are currently acquired through the Louisiana Department of Revenue. See Form

available at www.rev.state.la.us .

LOCAL EXEMPTION SOUGHT:

Check appropriate box: Vending Machine Dealer

Temp Storage

Other (specify) __________________________________________

Cancer/chemo Drugs NEED SEPARATE APPLICATION available on website (www.calcasieusalestax.org)

Briefly describe business activity:

|

|

A u t h o r I z a t I o n |

|

|

|

|

I affirm that the information given on this application is true and correct. |

|

|

|

|

|

Authorized Representative |

Title |

Signature

Date (mm/dd/yyyy)

FOR OFFICE USE ONLY:

Request |

|

Granted |

Denied |

Expiration Date:__________________________ Clerk’s Initials __________________ |

If denied, give reason: ____________________________________________________________________________________________

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The F017 form is used to request a Local Exemption Certificate in Calcasieu Parish. |

| Submission Method | The form must be mailed or faxed to the Calcasieu Parish Sales/Use Tax Department. |

| Contact Information | The department can be reached by telephone at 337-217-4280 or by fax at 337-217-4281. |

| NAICS Code Requirement | A U.S. NAICS Code is required and should be selected based on the dominant business activity. |

| Governing Law | The form is governed by Louisiana state tax laws regarding sales and use tax exemptions. |

Guidelines on Utilizing F017

After completing the F017 form, it should be mailed or faxed to the Calcasieu Parish Sales/Use Tax Department. Each business location requires a separate application. Ensure all necessary information is filled out accurately before submission.

- Obtain the form: Download the F017 form from the appropriate website.

- Complete the required fields: Fill in your Legal Name, Calcasieu Parish Sales Tax Account Number, Trade Name, Mailing Address, City, State, ZIP, Telephone, Location Address, City, State, ZIP.

- Input U.S. NAICS Code: Identify and enter the U.S. NAICS Code that best describes your dominant business. You can find this code on the NAICS website or your Louisiana State tax return.

- Select Local Exemption Sought: Check the box for Vending Machine Dealer, Temp Storage, Other, or Cancer/chemo Drugs as applicable.

- Describe business activity: Provide a brief description of what your business does.

- Authorization: Affirm the correctness of the information by signing the form. Include your title and the date of signing.

- Submit the form: Fax or mail the completed form to:

P.O. Drawer 2050

Lake Charles, LA 70602-2050

Fax: 337-217-4281

What You Should Know About This Form

What is the F017 form?

The F017 form is an application for a Local Exemption Certificate in Calcasieu Parish, Louisiana. This form is necessary for businesses seeking a sales tax exemption for specific activities such as vending machine operations or temporary storage. It must be completed and submitted to the Calcasieu Parish Sales/Use Tax Department.

How do I submit the F017 form?

The completed F017 form must be mailed or faxed to the Calcasieu Parish Sales/Use Tax Department. The mailing address is P.O. Drawer 2050, Lake Charles, LA 70602-2050. Alternatively, you may fax the completed form to 337-217-4281. Always ensure that the information is accurately filled out before submission for efficiency.

What information is required on the F017 form?

Applicants must provide various details including the legal name of the business, the Calcasieu Parish Sales Tax Account Number, the trade name, mailing address, location address, telephone number, and U.S. NAICS code with its description. Each business location requires a separate application.

What is a NAICS code and where can I find it?

A United States North American Industry Classification System (NAICS) code is a six-digit number used to classify businesses based on their economic activity. It is required on all applications. You can find the appropriate NAICS code by visiting the North American Industry Classification website at www.naics.com or referring to your Louisiana State tax return under “Business Code” if you possess a Federal Employer Identification Number (FEIN).

Are there specific exemptions listed in the F017 form?

Yes, the F017 form allows applicants to check applicable categories for the local exemption sought. These include “Vending Machine Dealer,” “Temp Storage,” and other specified uses. Careful consideration of your business activities is necessary when selecting the appropriate exemption box.

Is a separate application needed for cancer/chemo drugs?

Yes, a separate application is required for cancer and chemotherapy drugs. This specific application can be found on the Calcasieu Parish Sales Tax Department's website at www.calcasieusalestax.org. It is essential to follow the designated procedures for these types of exemptions.

What should I do after submitting the F017 form?

After submission, the Calcasieu Parish Sales/Use Tax Department will review the application. Applicants should expect notification regarding whether the request has been granted or denied. In the event of denial, the applicant will receive a reason for the denouncement, helping to address any issues for future applications.

What happens if my application is denied?

If your application is denied, the Department will provide a reason for the denial. It is advised to carefully address these issues before resubmitting an application. Understanding the reasons can significantly improve the chances of approval for future requests.

Common mistakes

People often encounter various challenges when completing the F017 form for the Local Exemption Certificate Application. One common mistake is failing to provide the complete and accurate legal name of the business. This field is crucial, as it must align with the business's official records. Any discrepancies between the name on the form and the registered name could lead to delays or even rejection of the application.

Another frequent error involves the U.S. NAICS Code. Applicants frequently overlook the necessity of including this code, which classifies the type of business activities. A suitable code should be selected from the North American Industry Classification System. In some cases, applicants may enter an outdated or incorrect code, which can impede the processing of the application.

Additionally, individuals filling out the form may neglect to send a separate application for each business location. Each location requires its unique application, as stated in the guidelines. Not adhering to this requirement could result in incomplete processing and potential denial of exemption for certain locations.

Finally, not signing and dating the form can be an easy mistake to overlook. The section for the authorized representative’s signature is essential for validity. If this part is missing, the application will lack the necessary authorization, further complicating the request process. Ensuring all steps are thoroughly completed helps streamline the experience of obtaining the Local Exemption Certificate.

Documents used along the form

The F017 form is essential for businesses seeking local exemption certificate applications in Calcasieu Parish, Louisiana. To ensure compliance and smooth processing, several other documents are often used in conjunction with this form. Here are four key documents that could be relevant.

- Form R-1067: This is the Louisiana Department of Revenue's Resale Exemption Certificate application. Businesses use this form to obtain exemption certificates for the resale of items. It helps businesses avoid paying sales tax on inventory that they plan to resell.

- Federal Employer Identification Number (FEIN): This document serves as a unique identifier for businesses. It's necessary when applying for various permits and licenses and is often required on tax returns. Having a FEIN is crucial for businesses operating in multiple states or with employees.

- Business License Application: Many localities require businesses to obtain a license to operate legally. This application commonly requests information about the nature of the business, its ownership, and location. It's essential for ensuring that the business complies with local regulations.

- NAICS Code Documentation: This documentation includes a reference to the North American Industry Classification System (NAICS) codes. Businesses must identify and provide the correct NAICS code that describes their primary business activity. This ensures accurate reporting and compliance with categorization standards.

Understanding these documents alongside the F017 form can help streamline the application process for many businesses. Each plays a vital role in demonstrating compliance with local tax regulations and business operations.

Similar forms

- Form R-1067: This form is also related to tax exemption requests specifically for Resale Exemption Certificates in Louisiana. It functions similarly by requiring the applicant's business information and a detailed description of activities.

- Sales Tax Exemption Certificate: This certificate serves to exempt certain purchases from sales tax. Like the F017, it necessitates basic business information and detailing the specific items or services for which the exemption is sought.

- Business License Application: A business license application gathers essential details about the business, including the owner’s name, address, and nature of the business. The F017 shares a similar purpose in collecting relevant business information for regulatory purposes.

- Tax Registration Form: This form registers a business for tax purposes and includes similar essential details as the F017, such as the business name, address, and tax classifications.

- Vendor Registration Form: This document is used to register vendors for tax purposes. Like the F017, it collects critical information about the vendor and the sales activities they intend to undertake.

- Exempt Use Certificate: This certificate allows businesses to make exempt purchases. It requires the buyer to provide their business information and the nature of the purchased items, aligning closely with the F017’s requirements for detailed business input and exemption request.

Dos and Don'ts

When filling out the F017 form for the Local Exemption Certificate Application Request, keep the following dos and don’ts in mind:

- Do complete the required information on the screen before printing.

- Do ensure you sign the bottom of the form.

- Do submit a separate application for each business location.

- Do accurately select your U.S. NAICS Code from the provided resources.

- Don't forget to indicate the local exemption being sought.

- Don't leave any required fields blank.

- Don't send the form without confirming that all information is true and correct.

Following these guidelines will help ensure a smoother application process.

Misconceptions

The F017 form, used for applying for a Local Exemption Certificate in Calcasieu Parish, is often surrounded by misconceptions. Understanding the correct information is essential for a smooth application process. Here are nine common misconceptions:

- Only one application is needed for multiple locations. Each business location requires a separate application to ensure proper handling and records.

- The NAICS code is optional. The U.S. NAICS Code is required. It helps categorize businesses accurately, so applicants should choose the code that most closely describes their primary business activity.

- The F017 form can be submitted without a signature. Each application must include an authorized representative's signature at the bottom to be valid.

- Faxing the application is the only submission method. Applicants can either mail or fax the completed form. Choose the method that works best for you.

- Anyone can complete the application. Only an authorized representative of the business should fill out and sign the application, ensuring that all information is accurate and truthful.

- All businesses qualify for a Local Exemption Certificate. Not every business will meet the requirements. It is essential to check eligibility based on specific business activities.

- The form does not require a detailed description of the business. Providing a brief but clear description of business activities is crucial. It helps justify the exemption request.

- Applying for this exemption is a lengthy process. While processing times can vary, many applications are handled efficiently. Ensuring all required information is complete will speed up this process.

- Denying an application does not require feedback. If an application is denied, the reasons must be documented. Applicants may inquire about the specifics to improve future attempts.

By correcting these misconceptions, applicants can better navigate the F017 form process and fulfill their business needs more effectively.

Key takeaways

Here are the key takeaways for filling out and using the F017 form:

- Complete all required sections, including Legal Name, Trade Name, and Mailing Address.

- Make sure to provide a valid U.S. NAICS Code that accurately reflects the primary activity of your business.

- Each business location requires a separate application, so avoid submitting multiple locations on one form.

- Sign the form at the bottom before sending it via fax or mail to ensure your application is valid.

- If your request is denied, you will receive information on why it was not approved, allowing you to correct any issues.

- For resale exemption certificates, refer to the Louisiana Department of Revenue's Form R-1067 instead of this local exemption form.

Make sure to verify all your information before submission to facilitate a smooth process.

Browse Other Templates

1099 for Independent Contractor - Understand the absence of unemployment benefits at the end of a contract period.

Cdl Driving Record - Failure to comply with the outlined regulations may lead to legal penalties.