Fill Out Your Fl 150 Form

The FL 150 form, formally recognized as the Income and Expense Declaration, serves a critical role in family law proceedings in California. Specifically designed for individuals navigating issues such as child support, spousal support, or general financial disclosures within family court, this form facilitates an accurate assessment of a party's financial situation. The document requires detailed information regarding one’s employment, income sources, and significant expenses, making it an essential tool for the courts to determine fair support obligations. You'll find sections dedicated to employment history, educational background, and current income, alongside an area to disclose deductions and total expenses. It's crucial to include accurate financial details, as this declaration can influence the court's decisions. With the necessity of additional documentation—like pay stubs and tax returns—it's essential for individuals to prepare thoroughly. Completing the FL 150 form accurately not only promotes transparency but also contributes to a fair outcome in family law cases.

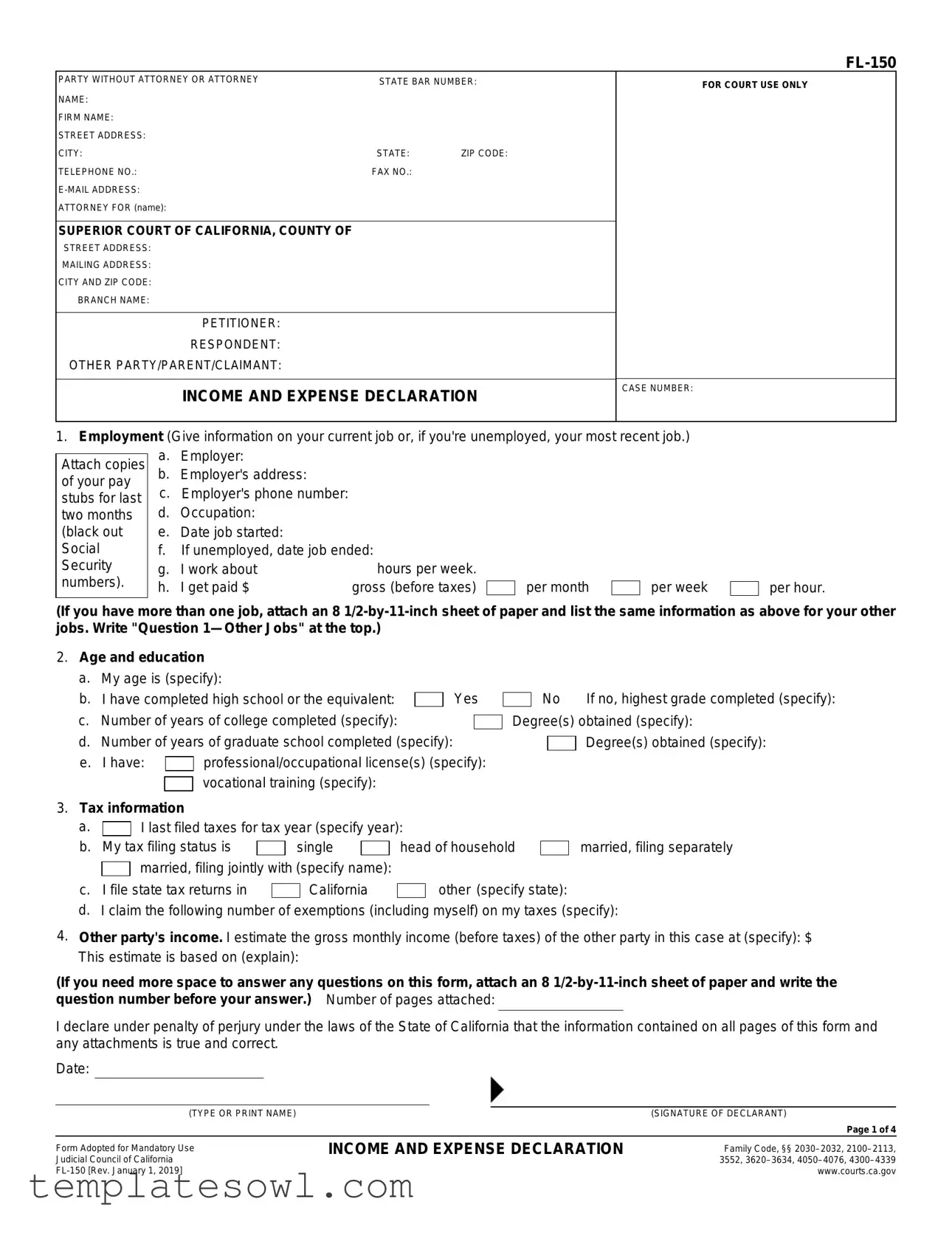

Fl 150 Example

PARTY WITHOUT ATTORNEY OR ATTORNEY |

STATE BAR NUMBER: |

|

NAME: |

|

|

FIRM NAME: |

|

|

STREET ADDRESS: |

|

|

CITY: |

STATE: |

ZIP CODE: |

TELEPHONE NO.: |

FAX NO.: |

|

|

|

|

ATTORNEY FOR (name): |

|

|

SUPERIOR COURT OF CALIFORNIA, COUNTY OF

STREET ADDRESS:

MAILING ADDRESS:

CITY AND ZIP CODE:

BRANCH NAME:

PETITIONER:

RESPONDENT:

OTHER PARTY/PARENT/CLAIMANT:

INCOME AND EXPENSE DECLARATION

FOR COURT USE ONLY

CASE NUMBER:

1.Employment (Give information on your current job or, if you're unemployed, your most recent job.)

Attach copies of your pay stubs for last two months (black out Social Security numbers).

a.Employer:

b. Employer's address:

c.Employer's phone number: d. Occupation:

e. Date job started:

f. If unemployed, date job ended:

g. |

I work about |

hours per week. |

h. |

I get paid $ |

gross (before taxes) |

per month

per week

per hour.

(If you have more than one job, attach an 8

2.Age and education

a.My age is (specify):

b. |

I have completed high school or the equivalent: |

|

|

Yes |

|||

|

|

||||||

c. Number of years of college completed (specify): |

|

|

|||||

|

|

||||||

d. Number of years of graduate school completed (specify): |

|

|

|||||

e. |

I have: |

|

professional/occupational license(s) (specify): |

||||

|

|||||||

|

|

|

vocational training (specify): |

|

|

||

|

|

|

|

|

|||

No If no, highest grade completed (specify): Degree(s) obtained (specify):

No If no, highest grade completed (specify): Degree(s) obtained (specify):

Degree(s) obtained (specify):

3.Tax information

a. |

|

I last filed taxes for tax year (specify year): |

|

|||||||||

|

|

|||||||||||

b. |

My tax filing status is |

|

|

single |

|

|

head of household |

|

married, filing separately |

|||

|

|

|

|

|||||||||

|

|

married, filing jointly with (specify name): |

|

|

|

|

||||||

|

|

|

|

|

|

|||||||

c. |

I file state tax returns in |

|

|

|

California |

|

other (specify state): |

|

||||

|

|

|

|

|

||||||||

d. I claim the following number of exemptions (including myself) on my taxes (specify):

4.Other party's income. I estimate the gross monthly income (before taxes) of the other party in this case at (specify): $ This estimate is based on (explain):

(If you need more space to answer any questions on this form, attach an 8

I declare under penalty of perjury under the laws of the State of California that the information contained on all pages of this form and any attachments is true and correct.

Date:

(TYPE OR PRINT NAME) |

|

(SIGNATURE OF DECLARANT) |

Page 1 of 4

Form Adopted for Mandatory Use Judicial Council of California

INCOME AND EXPENSE DECLARATION

Family Code, §§

PETITIONER:

RESPONDENT:

OTHER PARTY/PARENT/CLAIMANT:

CASE NUMBER:

Attach copies of your pay stubs for the last two months and proof of any other income. Take a copy of your latest federal tax return to the court hearing. (Black out your Social Security number on the pay stub and tax return.)

5. Income (For average monthly, add up all the income you received in each category in the last 12 months |

|

|

Average |

|||||||||||||||||||

and divide the total by 12.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Last month monthly |

||||||||||

a. Salary or wages (gross, before taxes) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

||||||||

................................................................................................................b. Overtime (gross, before taxes) |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|||||||

c. |

.........................................................................................................................Commissions or bonuses |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

||||||

d. |

Public assistance (for example: TANF, SSI, GA/GR) |

|

|

currently receiving |

|

$ |

|

|

|

|||||||||||||

|

|

|||||||||||||||||||||

e. |

Spousal support |

|

|

from this marriage |

|

|

|

from a different marriage |

|

federally taxable* |

$ |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||

f. |

Partner support |

|

|

from this domestic partnership |

|

|

from a different domestic partnership |

$ |

|

|

|

|||||||||||

|

|

|

|

|||||||||||||||||||

g. |

Pension/retirement fund payments |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

||||||

.........................................................................................................h. Social Security retirement (not SSI) |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|||||||

i. |

Disability: |

|

|

Social Security (not SSI) |

|

|

|

|

State disability (SDI) |

|

Private insurance |

$ |

|

|

|

|||||||

|

|

|

|

|

|

|||||||||||||||||

j. |

Unemployment compensation |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

||||||

k. |

............................................................................................................................Workers' compensation |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

||||||

l. |

Other (military allowances, royalty payments) (specify): |

|

|

|

|

|

$ |

|

|

|

||||||||||||

6.Investment income (Attach a schedule showing gross receipts less cash expenses for each piece of property.)

a. |

Dividends/interest |

$ |

b. |

Rental property income |

$ |

c. |

Trust income |

$ |

d. |

Other (specify): |

$ |

7. Income from |

$ |

||||||

I am the |

|

owner/sole proprietor |

|

business partner |

|

other (specify): |

|

|

|

|

|

||||

Number of years in this business (specify):

Name of business (specify):

Type of business (specify):

Attach a profit and loss statement for the last two years or a Schedule C from your last federal tax return. Black out your Social Security number. If you have more than one business, provide the information above for each of your businesses.

8. Additional income. I received

Additional income. I received

9. Change in income. My financial situation has changed significantly over the last 12 months because (specify):

Change in income. My financial situation has changed significantly over the last 12 months because (specify):

10.Deductions

a. |

Required union dues |

$ |

|||

b. Required retirement payments (not Social Security, FICA, 401(k), or IRA) |

.................................................................. |

$ |

|||

c. Medical, hospital, dental, and other health insurance premiums (total monthly amount) |

$ |

||||

d. Child support that I pay for children from other relationships |

$ |

||||

e. |

Spousal support that I pay by court order from a different marriage |

|

|

federally tax deductible* |

$ |

|

|||||

f. Partner support that I pay by court order from a different domestic partnership |

$ |

||||

g. |

Necessary |

$ |

|||

11.Assets

a. |

Cash and checking accounts, savings, credit union, money market, and other deposit accounts |

$ |

||||

b. Stocks, bonds, and other assets I could easily sell |

$ |

|||||

c. |

All other property, |

|

real and |

|

personal (estimate fair market value minus the debts you owe) |

$ |

|

|

|||||

Last month

Total

*Check the box if the spousal support order or judgment was executed by the parties and the court before January 1, 2019, or if a

INCOME AND EXPENSE DECLARATION |

Page 2 of 4 |

PETITIONER:

RESPONDENT: OTHER PARTY/PARENT/CLAIMANT:

CASE NUMBER:

12.The following people live with me:

Name |

Age |

How the person is |

That person's gross |

Pays some of the |

|

|||

related to me (ex: son) |

monthly income |

household expenses? |

||||||

a. |

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|||

b. |

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|||

c. |

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|||

d. |

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|||

e. |

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

13.Average monthly expenses

a. Home:

(1)

Rent or

Rent or

If mortgage:

(a)average principal:

(b)average interest:

Estimated expenses

mortgage.......... $

$

$

|

Actual expenses |

|

Proposed needs |

|

|

|

|

|

|||

|

h. |

Laundry and cleaning |

$ |

||

|

i. |

Clothes |

$ |

||

|

j. |

Education |

$ |

||

|

k. |

Entertainment, gifts, and vacation |

$ |

||

|

l. |

Auto expenses and transportation |

|

||

|

(2) |

Real property taxes |

$ |

|

(3) |

Homeowner's or renter's insurance |

$ |

|

|

(if not included above) |

|

|

(4) |

Maintenance and repair |

$ |

b. |

$ |

||

c. |

Child care |

$ |

|

d. Groceries and household supplies |

$ |

||

e. |

Eating out |

$ |

|

f. Utilities (gas, electric, water, trash) |

$ |

||

g. |

Telephone, cell phone, and |

$ |

|

14.Installment payments and debts not listed above

|

(insurance, gas, repairs, bus, etc.) |

$ |

m. Insurance (life, accident, etc.; do not include |

$ |

|

|

auto, home, or health insurance) |

|

n. |

Savings and investments |

$ |

o. |

Charitable contributions |

$ |

p. Monthly payments listed in item 14 |

$ |

|

|

(itemize below in 14 and insert total here) |

|

q. |

Other (specify): |

$ |

r.TOTAL EXPENSES

the amounts in a(1)(a) and (b)) |

$ |

|

|

|

|

s. Amount of expenses paid by others |

$ |

|

Paid to |

For |

Amount |

Balance |

Date of last payment |

|

|

$ |

$ |

|

|

|

$ |

$ |

|

|

|

$ |

$ |

|

|

|

$ |

$ |

|

|

|

$ |

$ |

|

|

|

$ |

$ |

|

15.Attorney fees (This information is required if either party is requesting attorney fees):

a.To date, I have paid my attorney this amount for fees and costs (specify): $

b.The source of this money was (specify):

c.I still owe the following fees and costs to my attorney (specify total owed): $

d.My attorney's hourly rate is (specify):

I confirm this fee arrangement.

Date:

|

(TYPE OR PRINT NAME) |

|

|

(SIGNATURE OF DECLARANT) |

|

|

|

|

|

INCOME AND EXPENSE DECLARATION |

Page 3 of 4 |

|||

PETITIONER:

RESPONDENT:

OTHER PARTY/PARENT/CLAIMANT:

CASE NUMBER:

CHILD SUPPORT INFORMATION

(NOTE: Fill out this page only if your case involves child support.)

16.Number of children

a. |

I have (specify number): |

children under the age of 18 with the other parent in this case. |

|

b. |

The children spend |

percent of their time with me and |

percent of their time with the other parent. |

|

(If you're not sure about percentage or it has not been agreed on, please describe your parenting schedule here.) |

||

17.Children's

a. |

|

I do |

|

I do not |

have health insurance available to me for the children through my job. |

|

|

b.Name of insurance company:

c.Address of insurance company:

d.The monthly cost for the children's health insurance is or would be (specify): $ (Do not include the amount your employer pays.)

18. Additional expense for the children in this....................................................................case |

Amount per month |

||||

a. Childcare so I can work or get job training |

$ |

|

|

|

|

b. Children's health care not covered by insurance |

$ |

|

|

|

|

c. Travel expenses for visitation |

$ |

|

|

|

|

d. Children's educational or other special needs (specify below): |

$ |

|

|

|

|

19. Special hardships. I ask the court to consider the following special financial circumstances |

|||||

(attach documentation of any item listed here, including court orders): |

$ |

Amount per month For how many months? |

|||

a. Extraordinary health expenses not included in 18b |

|

|

|

|

|

b. Major losses not covered by insurance (examples: fire, theft, other |

$ |

|

insured loss) |

||

|

||

c. (1) Expenses for my minor children who are from other relationships and |

$ |

|

are living with me |

||

|

||

(2) Names and ages of those children (specify): |

|

(3) Child support I receive for those children............................................... $

The expenses listed in a, b, and c create an extreme financial hardship because (explain):

20.Other information I want the court to know concerning support in my case (specify):

INCOME AND EXPENSE DECLARATION |

|||||

|

|

|

|

|

|

For your protection and privacy, please press the Clear |

|

Print this form |

|

Save this form |

|

This Form button after you have printed the form. |

|

|

|||

|

|

|

|

|

|

Page 4 of 4

Clear this form

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The FL-150 form is used to declare your income and expenses in California family law cases. |

| Governing Law | This form is governed by California Family Code sections 2030–2032, 2100–2113, and others. |

| Mandatory Use | The form is adopted for mandatory use by the Judicial Council of California. |

| Filing Requirement | You must file the FL-150 form with the court to support requests for spousal or child support. |

| Income Information | The form asks for detailed income information, including salary, bonuses, and other sources. |

| Expense Declaration | Monthly expenses must be listed, including necessities like housing, utilities, and childcare. |

| Signature Required | A signature on the form confirms that the information provided is true under penalty of perjury. |

| Attachments Needed | You may need to attach pay stubs, tax returns, and proof of other income as supporting documents. |

| Children's Information | Section for child support includes details about children, healthcare expenses, and financial hardships. |

| Updates on Information | Form requires updates if your financial situation changes before the court hearing. |

Guidelines on Utilizing Fl 150

Completing the FL-150 form is an important step in presenting your financial situation to the court. Ensuring that all sections are properly filled out will facilitate a clearer understanding of your income, expenses, and overall financial status. The following steps will guide you through the process of filling out this essential form.

- At the top of the form, provide your name, address, and contact information. If you have an attorney, include their details as well.

- Fill in the case number and the names of the involved parties, including yourself (Petitioner) and the other party (Respondent or other parent/claimant).

- In Section 1, provide information about your current or most recent job, including employer details, job title, and income specifics.

- Complete Section 2 by stating your age, education, and any professional or occupational licenses you hold.

- For Section 3, list tax-related information, including the last year you filed taxes and your filing status.

- In Section 4, estimate the gross monthly income of the other party involved in the case, along with the basis of your estimate.

- Document all sources of income in Section 5, including wages, public assistance, spousal support, and any other income received. Be sure to provide monthly averages.

- In Section 6, report any investment income, including dividends and rental property income.

- Section 7 requires information on self-employment income. Specify your role, business name, and submit any necessary financial statements.

- Note any additional income in Section 8 and changes in your financial situation in Section 9.

- Detail your monthly deductions in Section 10, such as union dues and medical expenses.

- In Section 11, list your assets, including cash, stocks, and property, providing estimates of their value.

- Section 12 allows you to document the living situation of others residing with you, including their relationship to you and their income contributions.

- Provide a detailed account of your average monthly expenses in Section 13, covering all necessary costs for living.

- If applicable, fill out Section 15 for attorney fees by indicating the amount paid and owed.

- Complete Section 16 if your case involves child support, specifying the number of children and their time spent with you versus the other parent.

- In Section 17, include information on children's health care expenses and any additional related expenses in Section 18.

- Document any special financial hardships in Section 19 and provide any relevant supporting information in Section 20.

- Finally, review your form and sign it, declaring under penalty of perjury that the information provided is true and correct.

After completing the FL-150 form, it is recommended to attach necessary documents, such as pay stubs and tax returns. These may need to be submitted to the court along with the form itself during your hearing. Ensure your documents are well-organized and that your personal information is protected by blacking out sensitive details where necessary.

What You Should Know About This Form

What is the FL-150 form used for?

The FL-150 form, also known as the Income and Expense Declaration, is a crucial document utilized in California family law cases. It provides the court with a comprehensive overview of a party’s financial situation. This includes details about income, deductions, expenses, and any assets. The information provided can impact decisions regarding spousal support, child support, and attorney fees, making it essential for parties involved in such matters to complete this form accurately and thoroughly.

Who needs to fill out the FL-150 form?

Typically, any individual involved in a family law proceeding—whether as a petitioner or respondent—who is seeking or contesting spousal or child support is required to complete the FL-150 form. Additionally, even if one party is not directly seeking support, they may be asked to provide this information if it is relevant to the case. The form helps ensure that both parties and the court have a clear understanding of each individual's financial capabilities.

What information must be included on the FL-150 form?

The FL-150 form requires detailed information pertaining to various aspects of your financial life. This includes employment details, income from all sources, tax filing information, living expenses, and information about any dependencies, such as children. You must provide estimates of your gross monthly income and enumerate your expenses. Additional documentation, like pay stubs and tax returns, might also be necessary to accompany the form in support of your declarations.

What happens if I fail to submit the FL-150 form?

Neglecting to file the FL-150 form may significantly affect your case. The court could view failure to provide required financial information as an unwillingness to cooperate, which may lead to unfavorable rulings or delays in your case. In some situations, the court may impose sanctions or restrictions on your ability to present evidence or request support. It is crucial to meet all deadlines and requirements for the proper administration of justice.

Common mistakes

Filling out the FL-150 form can seem overwhelming, but it's crucial to get it right. Many people make common mistakes that can jeopardize their case or lead to delays. Here are nine mistakes to avoid while completing this important document.

Firstly, one mistake often noticed is the failure to include accurate information about employment. Whether you're currently employed or recently unemployed, providing precise details helps your case. Omitting even minor details about your job title or employer’s address can confuse the court.

Another oversight involves tax information. Forgetting to specify your last tax year filed or inaccurately stating your tax filing status can complicate matters significantly. The court relies heavily on tax information to assess income, so getting these details right is essential.

The income section can be tricky. Many individuals fail to list all sources of income, including bonuses or additional jobs. If you've been paid separately in the past year, or if you're receiving public assistance, ensure these are documented clearly. Incomplete income reports can give a misleading picture of financial status.

A crucial mistake lies in not providing documentation. Attach copies of your pay stubs and tax returns as required. Many forget or think it’s not necessary, but these documents substantiate the claims made in the FL-150 form.

Incorrectly estimating the other party’s income is another frequent error. It’s important to provide a reasonable estimate based on your knowledge or evidence, even if you aren't sure of the exact figure. An unrealistic estimate raises red flags for the court.

Furthermore, some people skip sections of the form or fail to attach additional pages when needed. If there isn't enough space to provide complete answers, do not hesitate to include an 8 1/2-by-11-inch sheet to elaborate. Neglecting this could result in a lack of clarity in the information you are presenting.

Moreover, the declaration at the end is often overlooked. While it may seem like a formality, failing to sign or date the form can render it invalid. It's essential to ensure this final step is completed.

People sometimes miscalculate their expenses. Making sure your monthly expenses are clear and accurately summed is essential to support your claims effectively. If something seems too low or too high, the court may question your credibility.

Lastly, misunderstanding the importance of providing details about others living with you can create issues. The court needs to understand how these individuals may impact your finances. Always ensure to elaborate clearly on their relationship to you and their respective contributions.

By avoiding these common pitfalls, you can strengthen your FL-150 submission and minimize potential complications in your case. Always take your time, double-check your answers, and, if necessary, seek assistance to ensure accuracy.

Documents used along the form

The FL-150 form, or Income and Expense Declaration, is a crucial document often used in family law cases in California. While it provides detailed information about an individual’s income and expenses, several other forms may accompany it during legal proceedings. Each of these forms typically serves a specific function in supporting the case. Below is a list of commonly used forms alongside the FL-150.

- FL-170: Responsive Declaration to Request for Orders - This form is used to respond to a party's request for orders related to support or custody. It allows the responding party to present their side of the situation, including any objections or additional information regarding the request.

- FL-155: Income and Expense Declaration Attachment - This document is attached when additional space is needed to provide detailed information about an individual's income and expenses beyond what is included on the FL-150 form. It is particularly useful for those with complex financial situations.

- FL-140: Declaration Under Uniform Child Custody Jurisdiction and Enforcement Act - This declaration is necessary when a case involves child custody issues, particularly if multiple jurisdictions are involved. It outlines the child's residency and the relevant custody decisions made in other jurisdictions.

- FL-180: Judgment - This form is used to summarize the court's orders in family law matters, including the final decisions regarding custody, support, and divisions of property. It provides official documentation of the court's ruling.

- FL-300: Request for Order - Parties use this form to formally request a hearing on various issues, including support and custody arrangements. It outlines the requests being made and provides a basis for the court to consider these issues at a hearing.

- FL-247: Proof of Service - This document verifies that relevant papers have been properly delivered to other parties involved in a case. Completing a Proof of Service is essential for ensuring that all parties are informed and that the legal process continues smoothly.

Each of these forms plays a significant role in family law proceedings, ensuring that all necessary information is presented to the court, which can influence the outcome of a case. Understanding how these documents interrelate alongside the FL-150 is critical for individuals navigating the complexities of family law in California.

Similar forms

- FL-155: Income and Expense Declaration (Attach Only) - This form serves a similar function as FL-150, specifically allowing a party to provide a more detailed financial overview without filling out the entire form again. It includes income details and expense declarations, making it easier to update information as needed.

- FL-150-INFO: Information Sheet for Income and Expense Declaration - This document explains the purpose and usage of the FL-150 form. It provides guidelines on how to accurately declare income and expenses, ensuring that parties understand their responsibilities when filling out financial disclosures.

- FL-310: Child Support Case Registry Form - This form is closely related to FL-150, particularly in cases involving child support. It collects basic information about the parents and the children, cascading into the financial details that the FL-150 covers.

- FL-190: Judgment - When final judgments are made regarding support or spousal maintenance, this form is used. It summarizes the financial findings and obligations agreed upon in the income and expense context, linking to the information declared in the FL-150.

- FL-342: Child Support Modification - This document is relevant when a change in circumstances necessitates a modification of child support. It requires updated income and expense declarations similar to those found in FL-150, ensuring that all financial factors are considered in adjustments.

- FL-150-UC: Income and Expense Declaration for Unemployed Persons - Specifically tailored for those who are currently unemployed, this form collects income and expense information akin to that found in FL-150 but focuses on the financial situations of jobless individuals.

- FL-158: Financial Disclosure Declaration - Used chiefly in cases where financial transparency is paramount, this form compiles similar data to FL-150 but can be a more streamlined approach for quick declarations of financial status.

- FL-320: Spousal Support Declaration - This form outlines spousal support obligations and uses financial information often derived from the FL-150. It is a specific application of the income and expense reporting found in FL-150 that focuses on spousal maintenance.

- FL-399: Request for Order - In cases where one party is asking for a court order concerning finances, this form requires detailed income and expense documentation that mirrors the information presented in the FL-150 to support claims.

Dos and Don'ts

When completing the FL-150 form, you should adhere to specific guidelines to ensure accuracy and compliance. Here’s a straightforward list of what to do and what to avoid:

- Do gather all necessary documentation, including pay stubs and tax returns.

- Do provide accurate and honest information to avoid potential legal issues.

- Do double-check your calculations for income and expenses before submitting.

- Do sign and date the form in the appropriate sections.

- Do keep copies of the form and all attachments for your records.

- Don't leave any sections blank; if a question doesn't apply to you, write "N/A."

- Don't forget to black out your Social Security number on any documents attached.

- Don't submit estimates; provide documented figures whenever possible.

- Don't use jargon or unclear language when describing your financial situation.

- Don't be late. Ensure you submit the form within any required deadlines.

Misconceptions

When dealing with the FL-150 form, there are several misconceptions that can lead to confusion. Here are six common misunderstandings clarified:

- The FL-150 is only for divorce cases. Many people think this form is exclusively related to divorce proceedings. In reality, it can be used in various family law matters, including child custody and support cases.

- The FL-150 does not require accurate income reporting. Some believe they can provide estimates or omit certain income sources. It is crucial to report all income accurately, as this declaration can significantly impact court decisions regarding support and expenses.

- Only one combined FL-150 for both parties is necessary. Many assume a single form will suffice if they agree on finances. However, each party involved in a case must submit their own respective FL-150 to ensure clarity and transparency.

- Supporting documents are optional. There's a misconception that you can fill out the FL-150 without any additional proof. In fact, the court requires various documents, such as pay stubs and tax returns, to validate the financial information provided.

- Filing the FL-150 is a one-time event. Some individuals believe that submitting this form is a singular task. However, if your financial situation changes or if there are updates in the case, you may need to file an amended FL-150.

- It's fine to leave sections blank if they're not applicable. It’s often thought that skipping unnecessary sections is acceptable. However, it's best to provide complete responses and clearly indicate "not applicable" where relevant to avoid confusion or delays in processing.

Understanding these misconceptions can help individuals navigate the complexities of family law more effectively. Providing accurate, comprehensive information on the FL-150 form will foster a smoother process in legal proceedings.

Key takeaways

Filling out the FL-150 form, also known as the Income and Expense Declaration, is an important step in any court proceeding involving financial matters, particularly in family law cases. Here are some key takeaways to help you navigate this process with confidence:

- Be Thorough and Accurate: It’s crucial to provide detailed information about your income and expenses. This form will significantly impact determinations related to child support, spousal support, and other financial obligations. Ensure that you attach necessary documents, like pay stubs and tax returns, to support your claims.

- Know What to Include: Report all sources of income. This means not only salary or wages but also things like bonuses, unemployment benefits, and investment income. The more categories you cover, the clearer the picture of your financial situation will be for the court.

- Update Changes: If you’ve experienced any changes in your financial situation over the past year, such as a job loss or a significant increase in expenses, be sure to outline these changes. This can be crucial for the court's considerations in your case.

- Focus on Deductions: List any deductions you incur regularly. These can include union dues, child support payments, or medical costs. Knowing your deductions helps provide a clearer picture of your financial needs and capabilities.

- Don't Rush the Process: Completing the FL-150 requires time and attention. Take breaks if you feel overwhelmed. A rushed form could lead to inaccuracies, which can complicate your case further.

By following these tips, you can feel more prepared and empowered when filling out the FL-150 form, ensuring your financial situation is presented accurately to the court.

Browse Other Templates

Mv426b - Applications for street rods and collectible vehicles include specific requirements tailored to those vehicle types.

Va Form 26-1880 - Geographical location is important for routing the application to the correct center.