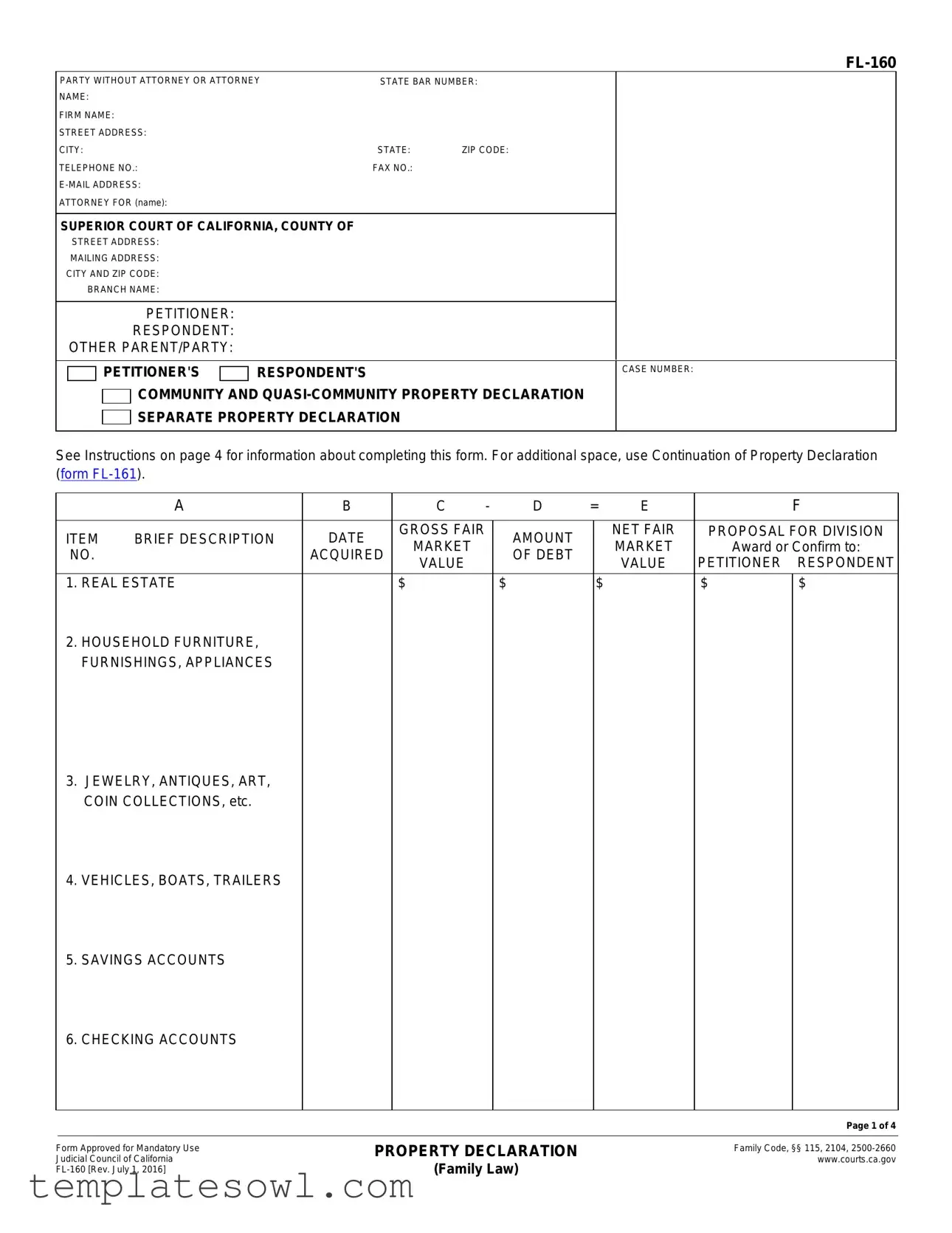

Fill Out Your Fl 160 Form

The FL-160 form, also known as the Property Declaration, plays a vital role in divorce and family law cases in California. This form is essential for individuals to disclose their assets and debts accurately during legal proceedings. It can be submitted as part of a Petition or Response, or may be required when filing a Request to Enter Default or a Judgment. The FL-160 separates information into two main categories: community property and separate property. Furthermore, it provides a structured chart to list various types of assets, such as real estate, vehicles, and bank accounts, along with their estimated values and any associated debts. Parties must detail the fair market value of their belongings and outline how they propose to divide these assets and liabilities. This declaration ensures transparency and fairness in the division of property, allowing both parties to understand their financial standings. Clear instructions accompany the form, guiding users through the completion process to help ensure that all necessary information is disclosed appropriately.

Fl 160 Example

PARTY WITHOUT ATTORNEY OR ATTORNEY |

STATE BAR NUMBER: |

|

NAME: |

|

|

FIRM NAME: |

|

|

STREET ADDRESS: |

|

|

CITY: |

STATE: |

ZIP CODE: |

TELEPHONE NO.: |

FAX NO.: |

|

|

|

|

ATTORNEY FOR (name): |

|

|

SUPERIOR COURT OF CALIFORNIA, COUNTY OF

STREET ADDRESS:

MAILING ADDRESS:

CITY AND ZIP CODE:

BRANCH NAME:

PETITIONER: |

|

|

RESPONDENT: |

|

|

OTHER PARENT/PARTY: |

|

|

PETITIONER'S |

RESPONDENT'S |

CASE NUMBER: |

|

COMMUNITY AND

COMMUNITY AND

SEPARATE PROPERTY DECLARATION

SEPARATE PROPERTY DECLARATION

See Instructions on page 4 for information about completing this form. For additional space, use Continuation of Property Declaration (form

|

A |

B |

|

C |

- |

D |

= |

E |

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

ITEM |

BRIEF DESCRIPTION |

DATE |

|

GROSS FAIR |

|

AMOUNT |

|

|

NET FAIR |

PROPOSAL FOR DIVISION |

|

|

MARKET |

|

|

|

MARKET |

Award or Confirm to: |

|||||

NO. |

|

ACQUIRED |

|

OF DEBT |

|

|

|||||

|

VALUE |

|

|

|

VALUE |

PETITIONER |

RESPONDENT |

||||

|

|

|

|

|

|

|

|

||||

1. REAL ESTATE |

|

|

$ |

|

$ |

|

$ |

|

$ |

$ |

|

2. HOUSEHOLD FURNITURE, |

|

|

|

|

|

|

|

|

|

|

|

FURNISHINGS, APPLIANCES |

|

|

|

|

|

|

|

|

|

|

|

3. JEWELRY, ANTIQUES, ART, |

|

|

|

|

|

|

|

|

|

|

|

COIN COLLECTIONS, etc. |

|

|

|

|

|

|

|

|

|

|

|

4. VEHICLES, BOATS, TRAILERS |

|

|

|

|

|

|

|

|

|

|

|

5. SAVINGS ACCOUNTS |

|

|

|

|

|

|

|

|

|

|

|

6. CHECKING ACCOUNTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 of 4 |

|

|

|

|

|

|

|

|

||||

Judicial Council of California |

|

PROPERTY DECLARATION |

|

|

|

|

www.courts.ca.gov |

||||

Form Approved for Mandatory Use |

|

|

|

|

|

|

|

|

Family Code, §§ 115, 2104, |

||

|

|

(Family Law) |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

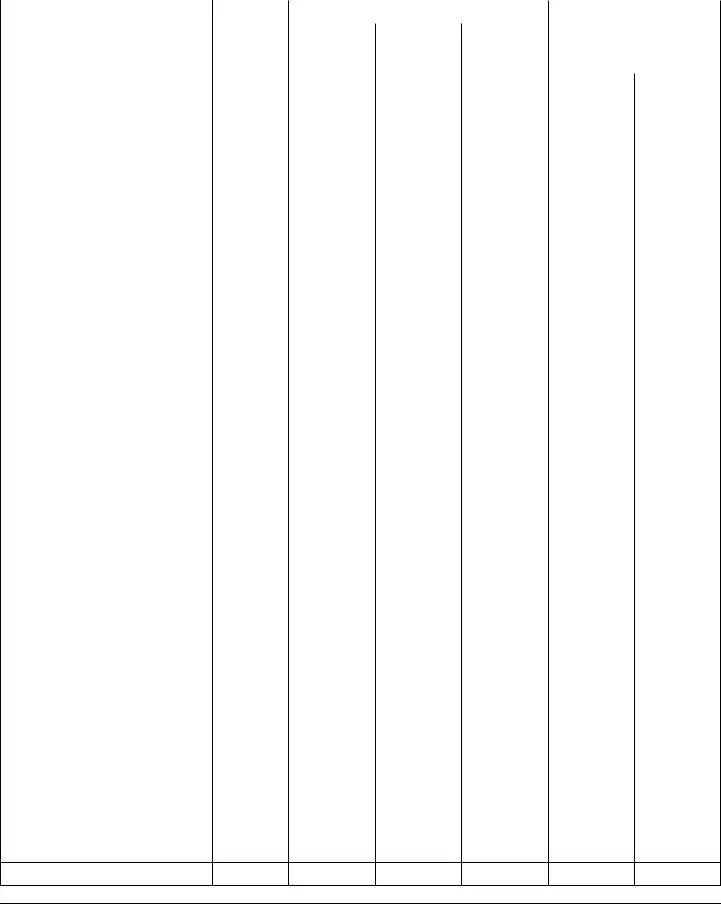

A |

B |

C |

- |

D |

= |

E |

|

F |

|

|

|

|

|

|

|

|

|

|

ITEM |

BRIEF DESCRIPTION |

DATE |

GROSS FAIR |

|

AMOUNT |

|

NET FAIR |

PROPOSAL FOR DIVISION |

|

MARKET |

|

|

MARKET |

Award or Confirm to: |

|||||

NO. |

|

ACQUIRED |

|

OF DEBT |

|

||||

|

VALUE |

|

|

VALUE |

PETITIONER |

RESPONDENT |

|||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

7. CREDIT UNION, OTHER |

|

$ |

$ |

|

|

$ |

$ |

$ |

|

DEPOSITORY ACCOUNTS |

|

|

|

|

|

|

|

|

|

8.CASH

9.TAX REFUND

10.LIFE INSURANCE WITH CASH SURRENDER OR LOAN VALUE

11.STOCKS, BONDS, SECURED NOTES, MUTUAL FUNDS

12.RETIREMENT AND PENSIONS

13.

14.ACCOUNTS RECEIVABLE, UNSECURED NOTES

15.PARTNERSHIP, OTHER BUSINESS INTERESTS

16.OTHER ASSETS

17.ASSETS FROM CONTINUATION SHEET

18.TOTAL ASSETS

PROPERTY DECLARATION |

|

|

Page 2 of 4

(Family Law)

|

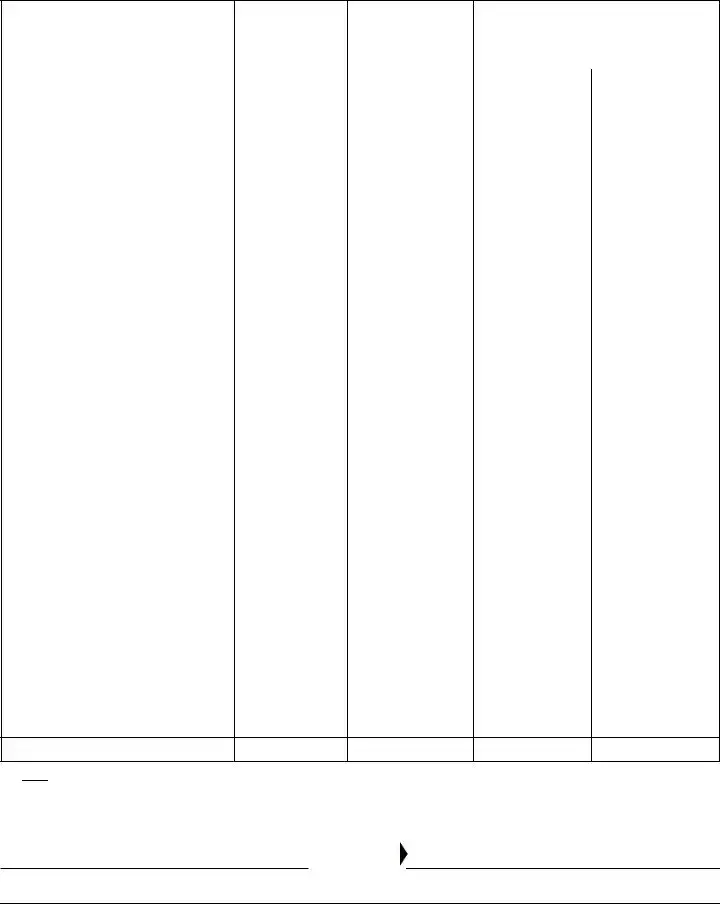

A |

B |

|

C |

D |

|

|

|

|

|

|

ITEM |

DEBTS— |

DATE INCURRED |

|

TOTAL OWING |

PROPOSAL FOR DIVISION |

|

Award or Confirm to: |

||||

NO. |

SHOW TO WHOM OWED |

|

|||

|

|

|

PETITIONER RESPONDENT |

||

|

|

|

|

|

|

19. STUDENT LOANS |

|

$ |

$ |

$ |

|

20.TAXES

21.SUPPORT ARREARAGES

22.

23.CREDIT CARDS

24.OTHER DEBTS

25.OTHER DEBTS FROM CONTINUATION SHEET

26.TOTAL DEBTS

A Continuation of Property Declaration (form

A Continuation of Property Declaration (form

I declare under penalty of perjury under the laws of the State of California that, to the best of my knowledge, the foregoing is a true and correct listing of assets and obligations and the amounts shown are correct.

Date:

(TYPE OR PRINT NAME) |

SIGNATURE |

PROPERTY DECLARATION |

|

|

Page 3 of 4

(Family Law)

INFORMATION AND INSTRUCTIONS FOR COMPLETING FORM

Property Declaration (form

When filing a Property Declaration with the court, do not include private financial documents listed below. Identify the type of declaration completed

1.Check "Community and

2.Do not combine a separate property declaration with a community and

Description of the Property Declaration chart

Pages 1 and 2

1.Column A is used to provide a brief description of each item of separate or community or

2.Column B is used to list the date the item was acquired.

3.Column C is used to list the item's gross fair market value (an estimate of the amount of money you could get if you sold the item to another person through an advertisement).

4.Column D is used to list the amount owed on the item.

5.Column E is used to indicate the net fair market value of each item. The net fair market value is calculated by subtracting the dollar amount in column D from the amount in column C ("C minus D").

6.Column F is used to show a proposal on how to divide (or confirm) the item described in column A.

Page 3

1.Column A is used to provide a brief description of each separate or community or

2.Column B is used to list the date the debt was acquired.

3.Column C is used to list the total amount of money owed on the debt.

4.Column D is used to show a proposal on how to divide (or confirm) the item of debt described in column A.

When using this form only as an attachment to a Petition or Response

1.Attach a Separate Property Declaration (form

2.Attach a Community or

When serving this form on the other party as an attachment to Declaration of Disclosure (form

1.Complete columns A through E on pages 1 and 2, and columns A through C on page 3.

2.Copies of the following documents must be attached and served on the other party:

(a)For real estate (item 1): deeds with legal descriptions and the latest lender's statement.

(b)For vehicles, boats, trailers (item 4): the title documents.

(c)For all bank accounts (item 5, 6, 7): the latest statement.

(d)For life insurance policies with cash surrender or loan value (item 10): the latest declaration page.

(e)For stocks, bonds, secured notes, mutual funds (item 11): the certificate or latest statement.

(f)For retirement and pensions (item 12): the latest summary plan document and latest benefit statement.

(g)For

(h)For each account receivable and unsecured note (item 14): documentation of the account receivable or note.

(i)For partnerships and other business interests (item 15): the most current

(j)For other assets (item 16): the most current statement, title document, or declaration.

(k)For support arrearages (item 21): orders and statements.

(l)For credit cards and other debts (items 23 and 24): the latest statement.

3.Do not file copies of the above private financial documents with the court.

When filing this form with the court as a attachment to Request to Enter Default

For more information about forms required to process and obtain a judgment in dissolution, legal separation, and nullity cases, see http://www.courts.ca.gov/8218.htm.

PROPERTY DECLARATION |

|||||

|

|

|

|

|

|

|

|

|

(Family Law) |

||

|

|

|

|

|

|

For your protection and privacy, please press the Clear |

|||||

This Form button after you have printed the form. |

|

|

Print this form |

|

Save this form |

|

|

|

|

|

|

Page 4 of 4

Clear this form

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The FL-160 form is utilized to declare community, quasi-community, and separate property during divorce or legal separation proceedings in California. |

| Governing Laws | The form is governed by Family Code sections 115, 2104, and 2500-2660, which outline requirements for property declarations in family law cases. |

| Attachment Requirement | This form may serve as an attachment to a Petition (FL-100), Response (FL-120), Request to Enter Default (FL-165), or Judgment (FL-180). |

| Documentation | When filing, necessary financial documents must be collected but should not be submitted to the court. They need to be disclosed to the other party. |

Guidelines on Utilizing Fl 160

After gathering your information, you'll need to fill out the FL-160 form. This form is important for listing your assets and debts in a clear and organized manner. Take your time, and ensure all details are accurate for smooth processing. Follow the steps below to complete the form correctly.

- At the top of the form, fill in your name and contact information. If you have an attorney, include their name, firm, and State Bar number.

- Provide the court details by entering the name of the Superior Court, the county, and the court’s street and mailing address.

- Identify the parties involved by entering the names of the Petitioner, Respondent, Other Parent/Party, and the case number in the specified fields.

- Decide if you are filing a "Community and Quasi-Community Property Declaration" or a "Separate Property Declaration." Check the appropriate box at the top of the form.

- Begin listing your assets in the asset declaration section. For each asset:

- In Column A, provide a brief description of the asset.

- In Column B, enter the date the asset was acquired.

- In Column C, provide the gross fair market value of the asset.

- In Column D, list the amount of debt owed on the asset.

- In Column E, calculate and enter the net fair market value by subtracting Column D from Column C.

- In Column F, propose how you want to divide or confirm the asset.

- Continue to list your debts in the debt declaration section, following a similar format:

- In Column A, provide a brief description of each debt.

- In Column B, enter the date the debt was incurred.

- In Column C, list the total amount owing on the debt.

- In Column D, indicate how you propose to divide or confirm responsibility for the debt.

- If you need additional space, attach the Continuation of Property Declaration (form FL-161).

- Complete the declaration by signing and dating the form. Make sure to print your name legibly below your signature.

Once the form is completed, review it for accuracy. It’s crucial to ensure everything is correct before submission. You can file it with the court or serve it to the other party as needed.

What You Should Know About This Form

What is the FL-160 form used for?

The FL-160 form, known as the Property Declaration, is used in family law cases in California. It helps parties clearly outline their community, quasi-community, and separate property as well as debts. This form allows both parties to disclose their assets and obligations to ensure fair division during divorce, legal separation, or annulment proceedings.

Who needs to complete the FL-160 form?

Any individual involved in a divorce or separation process in California may need to complete the FL-160 form. This includes both petitioners and respondents. The form may be attached to a petition, response, or different court documents to meet disclosure requirements.

What information is required on the FL-160 form?

The FL-160 requires a detailed listing of assets and debts. You will provide descriptions, acquisition dates, gross fair market values, amounts owed, and proposals for dividing each asset or debt. Ensure accuracy, as this information is important for the court's consideration.

How do I classify my property on the FL-160?

When completing the FL-160, it’s essential to check the correct box indicating whether you are listing community and quasi-community property or separate property. Community property is generally owned together by both spouses, while separate property is owned individually and not subject to division.

What should I do if I need more space to list assets or debts?

If you run out of space on the FL-160 form, you can use the Continuation of Property Declaration (form FL-161). This additional form can be attached and will become part of your property declaration. Make sure to reference it appropriately on the FL-160.

Are there any documents I must attach when filing the FL-160?

Yes, if you are filing the FL-160, you must attach key financial documents relevant to the listed assets and debts. For example, provide deeds for real estate, titles for vehicles, and bank statements for accounts. However, do not submit these private documents to the court; they should only be served to the other party.

What happens if I fail to properly complete the FL-160 form?

Failing to accurately complete the FL-160 can lead to delays in your case or complications during proceedings. Incomplete or incorrect disclosures may affect the division of property. It’s important to carefully fill out the form and seek guidance if needed to ensure compliance with court requirements.

Common mistakes

Filling out the FL-160 form accurately is crucial for any legal proceedings involving property declarations. However, many individuals make common mistakes when completing this form. Recognizing these errors can help avoid complications later in the process.

One frequent mistake is failing to check the correct declaration type on the first page. There are two options: the "Community and Quasi-Community Property Declaration," and the "Separate Property Declaration." Selecting the wrong option can lead to confusion about the nature of the property being reported.

Another error often encountered is inadequate descriptions of the assets or debts. Each item listed in Column A must have a clear and concise description. Vague terms like "stuff" or "valuables" do not provide sufficient information for proper assessment and division.

People frequently miscalculate the net fair market value in Column E. This value requires accurate subtraction of the amount owed from the gross fair market value. Errors in basic arithmetic can lead to incorrect financial representations.

Omitting information is a common oversight. Some individuals forget to fill out certain columns, particularly in the debt section. Each debt listed requires complete details, including the date incurred and total amount owed.

Another mistake involves providing outdated information, especially related to the market value of assets. Ensuring that this value reflects the current market conditions is essential. Relying on old appraisals or estimates can skew the results.

People may also misinterpret what constitutes separate versus community or quasi-community property. This confusion can result in a failure to categorize assets correctly, which is necessary for fair division according to the law.

Missing signatures are another frequent pitfall. The form requires a signature certifying that the information is true and correct. Failing to sign the declaration can lead to delays in processing.

Attaching required documents to support claims is essential. Some individuals neglect this step, forgetting to include necessary documentation for items like vehicles or properties, which can be a significant oversight.

Lastly, submitting copies of private financial documents along with the submitted form can create privacy issues. Individuals must remember that such documents should not be filed with the court; they only need to be served to the other party.

By paying attention to these common mistakes, individuals can improve their chances of successfully navigating the FL-160 form process.

Documents used along the form

The FL-160 form, known as the Property Declaration, plays a crucial role in family law proceedings, particularly during divorce or separation cases. Alongside this form, several other documents are often required to ensure a comprehensive disclosure of assets and debts. Below is a list of these key forms and documents.

- FL-140 - Declaration of Disclosure: This form provides an overview of the financial situation of both parties, ensuring that all relevant financial information is shared at the start of the divorce process.

- FL-142 - Schedule of Assets and Debts: This detailed form outlines all assets and debts of the parties involved, assisting in the equitable division of property.

- FL-161 - Continuation of Property Declaration: This supplementary form is used when there isn't enough space on the FL-160 to list all properties or debts, allowing for a continuation of the declaration.

- FL-165 - Request to Enter Default: This form is filed to request that the court proceed with the case if one party has not appeared or responded, often requiring a complete financial disclosure.

- FL-180 - Judgment: This form is used to finalize the divorce proceedings and includes the division of property as indicated in the FL-160 and other declarations.

- FL-150 - Income and Expense Declaration: This form provides the court with information regarding both parties' income, expenses, and financial needs, which can affect spousal or child support determinations.

- FL-395 - Notice of Change of Address: This document notifies the court and other parties of any address change, which is crucial during ongoing legal proceedings.

- Judgment Statement or Findings: This document outlines the court's decision regarding the division of assets, spousal support, and child custody arrangements after reviewing all submitted forms.

- Financial Statements or Bank Statements: While not a formal court document, these statements must be prepared and may need to be provided as supporting evidence during proceedings.

- Pension or Retirement Plan Documents: Required to disclose any interests or benefits earned during the marriage, which may affect the division of assets.

Completing and filing these forms accurately is essential for a fair and just resolution to property disputes in family law matters. Familiarity with these documents will help navigate the complexities of the legal process effectively.

Similar forms

-

FL-142: Schedule of Assets and Debts - This form is used to list both assets and debts in family law cases. Like FL-160, it aims to provide a detailed inventory for the court, ensuring transparency during the proceedings.

-

FL-161: Continuation of Property Declaration - This document is often used alongside FL-160 to provide additional space for detailing assets and debts. Both forms emphasize thoroughness in disclosing property and obligations.

-

FL-140: Declaration of Disclosure - This form requires parties to disclose financial information, including assets and debts. Similar to FL-160, it underscores the importance of clear financial disclosures in family law cases.

-

FL-165: Request to Enter Default - When filing for a default judgment, this form often accompanies FL-160. Both documents help ensure that the court has a complete understanding of the financial situation of the parties involved.

-

FL-180: Judgment - This form is used for formalizing a court's decision in a family law matter. When filed alongside FL-160, it provides a comprehensive view of the financial implications of the judgment.

-

FL-400: Petition for Dissolution of Marriage - This form initiates the divorce process. When paired with FL-160, it illustrates the assets and debts that will be addressed during the divorce proceedings.

-

FL-210: Response to Petition for Dissolution - This document allows the respondent to provide their side in a divorce case. Similar to FL-160, it can include a disclosure of assets and debts for clarity in the legal process.

Dos and Don'ts

When filling out the FL-160 form, it’s essential to approach the task with care. Here are seven important do's and don'ts to guide you:

- Do read the instructions thoroughly before beginning.

- Do provide accurate and complete information for each asset and debt listed.

- Do use the appropriate sections for community, quasi-community, and separate property.

- Do double-check calculations for gross and net fair market values.

- Don't combine separate property declarations with community property declarations.

- Don't include private financial documents when submitting to the court.

- Don't forget to sign and date the form at the end.

Following these guidelines will help ensure that the form is filled out correctly, minimizing potential errors or delays in the process.

Misconceptions

Understanding the FL-160 form can be crucial for anyone going through a family law case in California. However, several misconceptions can lead to confusion. Here are eight common misunderstandings about the FL-160 form:

- It is only for people with attorneys. The FL-160 form can be completed and filed by individuals without legal representation. It is designed for both parties, regardless of whether they have an attorney.

- Everyone needs to fill out every section. Not all sections require completion. Depending on the specific circumstances of the case, certain columns or items can be left blank or may not apply.

- The form is only for declaring community property. The FL-160 form also includes sections for declaring separate property and quasi-community property. Each type of property must be filled out correctly according to its category.

- Submitting the form is the same as completing property division. Completing the FL-160 is just the first step. The form does not finalize the division of property; that requires further agreements or court orders.

- All debts must be included in the property declaration. While the form does include a section for debts, not all debts must be declared. Only those that pertain to the property listed should be included.

- You cannot use continuation sheets. You are permitted to use continuation sheets (form FL-161) if needed. This allows for more detailed listings of assets or debts without crowding the main form.

- The FL-160 can be submitted without supporting documents. When filing, it is necessary to attach relevant supporting documents for many items. For instance, bank statements and real estate deeds provide important proof of the information declared.

- It's acceptable to file the form without checking for accuracy. Accuracy is critical when completing the FL-160. Any discrepancies can lead to complications later on in the process.

Clearing up these misconceptions can help individuals approach their family law matters with a better understanding of the FL-160 form.

Key takeaways

Filling out and utilizing the FL-160 form, or the Property Declaration form, is essential for individuals navigating family law matters. Here are some key takeaways to keep in mind:

- Purpose of the Form: The FL-160 serves to disclose assets and debts in family law cases, such as divorce or legal separation. It may be filed as part of a Petition or Response, or served as a separate disclosure document.

- Types of Property: Clearly differentiate between community, quasi-community, and separate properties. Community and quasi-community properties are listed together, while separate properties require a separate declaration.

- Accurate Valuation: When filling out the form, provide accurate descriptions, acquisition dates, and fair market valuations for each asset and debt. This ensures clarity and fairness during asset division.

- Documentation Requirements: Attach required documentation to support the values claimed. For example, include deeds for real estate or recent bank statements for financial accounts. However, do not file these documents with the court; they should only be served to the other party.

Browse Other Templates

Travel Card 101 - The DD 2883 must be signed in black ink, ensuring it is the original document submitted.

Hazmat Bol - Beginning January 1, 2013, compliance with the new format is mandatory for all shipments.

Eicr Stand for - Specific recommendations based on visual assessments point directly to areas needing attention.