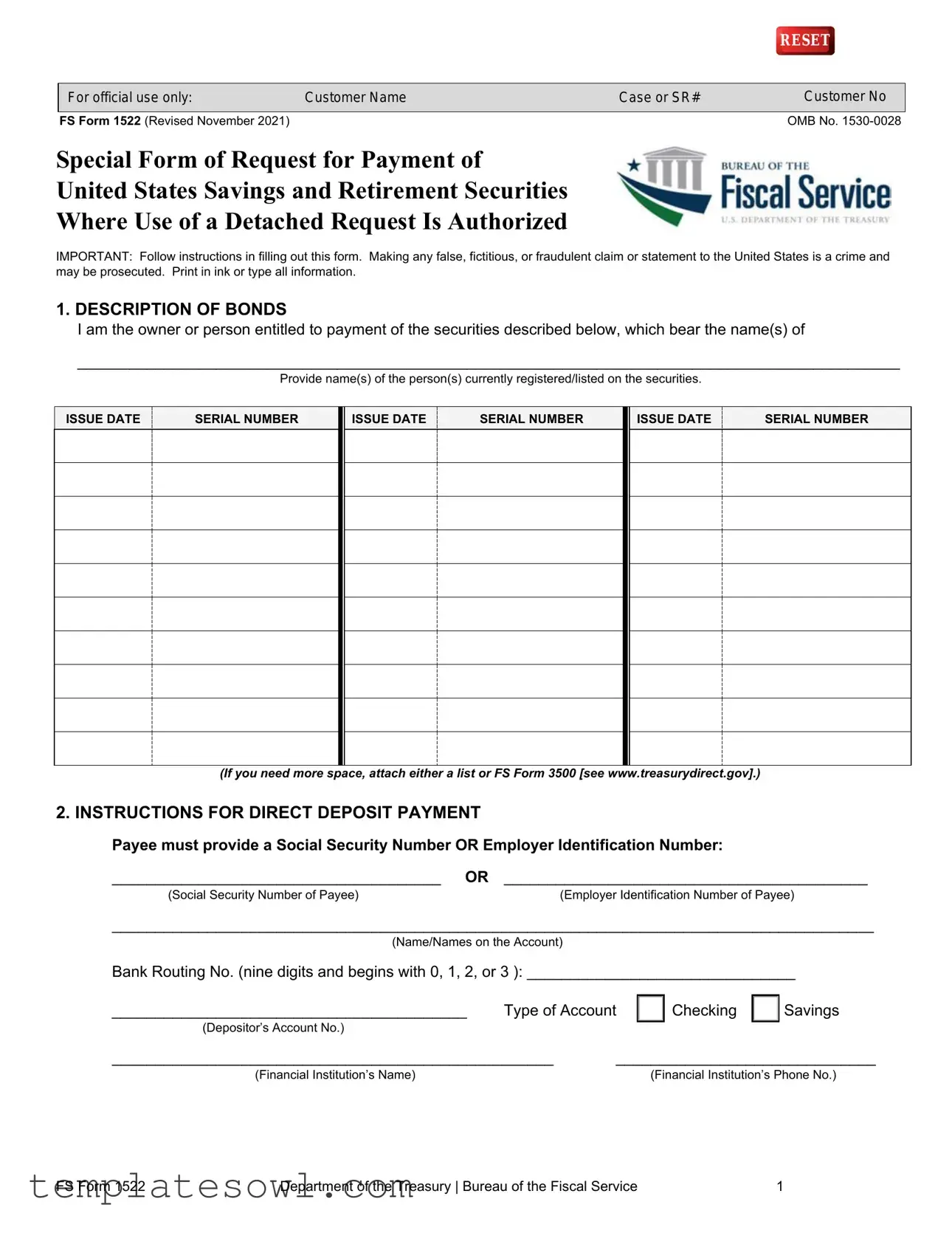

Fill Out Your Fs1522 Form

The FS Form 1522 is an essential document for those looking to redeem United States savings and retirement securities. This form serves as a formal request for payment associated with various types of securities, including savings bonds and individual retirement bonds. It is designed for use by the owner, co-owner, or any authorized representative, ensuring that the rightful parties can access the funds tied to these securities. Proper completion is crucial, as individuals must provide specific information regarding the securities, such as issue dates and serial numbers. Important details, including the payee's tax identification information, must also be submitted for the direct deposit option, streamlining the payment process. Furthermore, the form entails a section for signatures and certifications, confirming the identity of the claimants. Those requesting amounts over $1,000 are required to sign in the presence of a notary or authorized certifying officer to ensure the legitimacy of the request. Thus, the FS Form 1522 plays a vital role in the secure and efficient transfer of funds for U.S. savings bonds and similar securities, operating under strict guidelines to prevent fraud and ensure accurate processing.

Fs1522 Example

|

|

|

RESET |

|

|

|

|

For official use only: |

Customer Name |

Case or SR# |

Customer No |

|

|

|

|

FS Form 1522 (Revised November 2021) |

|

|

OMB No. |

Special Form of Request for Payment of

United States Savings and Retirement Securities

Where Use of a Detached Request Is Authorized

IMPORTANT: Follow instructions in filling out this form. Making any false, fictitious, or fraudulent claim or statement to the United States is a crime and may be prosecuted. Print in ink or type all information.

1. DESCRIPTION OF BONDS

I am the owner or person entitled to payment of the securities described below, which bear the name(s) of

_______________________________________________________________________________________________

Provide name(s) of the person(s) currently registered/listed on the securities.

ISSUE DATE |

SERIAL NUMBER |

ISSUE DATE |

SERIAL NUMBER |

|

|

|

|

ISSUE DATE |

SERIAL NUMBER |

(If you need more space, attach either a list or FS Form 3500 [see www.treasurydirect.gov].)

2. INSTRUCTIONS FOR DIRECT DEPOSIT PAYMENT

Payee must provide a Social Security Number OR Employer Identification Number:

______________________________________ |

OR __________________________________________ |

(Social Security Number of Payee) |

(Employer Identification Number of Payee) |

________________________________________________________________________________________

(Name/Names on the Account)

Bank Routing No. (nine digits and begins with 0, 1, 2, or 3 ): _______________________________

_________________________________________ |

Type of Account |

(Depositor’s Account No.)

Checking

Savings

___________________________________________________ |

______________________________ |

(Financial Institution’s Name) |

(Financial Institution’s Phone No.) |

FS Form 1522 |

Department of the Treasury | Bureau of the Fiscal Service |

1 |

3. SIGNATURE

Under penalties of perjury, I certify that:

1.The number shown on this form is my correct Taxpayer Identification Number (or I am waiting for a number to be issued to me); and

2.I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and

3.I am a U.S. person (including a U.S. resident alien).

NOTE: You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return.

Certification. If the current redemption value (see Instructions) of your bonds totals $1,000 or less, your signature need not be certified; you may simply sign the form and enclose a current copy of your driver’s license, passport, state ID, or military ID. If the current redemption value of your bonds totals more than $1,000, sign this form in the presence of a notary or certifying officer.

Complete in ink. If required (see “Certification” above), sign in the presence of a notary or certifying officer.

Sign

Here: __________________________________________________________________________________________________

(Signature)

_____________________________________________________ |

______________________________________________ |

||

(Print Name) |

|

|

(Social Security Number) |

Home Address ________________________________________ |

______________________________________________ |

||

(Number and Street or Rural Route) |

|

(Daytime Telephone Number) |

|

_____________________________________________________ |

______________________________________________ |

||

(City) |

(State) |

(ZIP Code) |

(Email Address) |

Sign

Here: __________________________________________________________________________________________________

(Signature)

_____________________________________________________ |

______________________________________________ |

||

(Print Name) |

|

|

(Social Security Number) |

Home Address ________________________________________ |

______________________________________________ |

||

(Number and Street or Rural Route) |

|

(Daytime Telephone Number) |

|

_____________________________________________________ |

______________________________________________ |

||

(City) |

(State) |

(ZIP Code) |

(Email Address) |

You may leave this blank if your bonds are worth $1,000 or less and you enclose an ID named above in “Certification.”

Instructions to Notary or Certifying Officer: 1. Name(s) of the person(s) who appeared and date of appearance MUST be completed. 2. If a Medallion stamp is used, an original signature is required. 3. Person(s) must sign in your presence.

I CERTIFY that ________________________________________________________________________ , whose identity(ies)

(Names of Persons Who Appeared)

is/are known or proven to me, personally appeared before me this _______________ day of _______________ |

__________ |

(Month) |

(Year) |

at ___________________________________________________ and signed this form. |

|

(City, State) |

|

________________________________________________________ |

|

(Signature and Title of Notary or Certifying Officer) |

|

________________________________________________________ |

|

(Name of Financial Institution) |

|

________________________________________________________ |

|

(Address) |

|

________________________________________________________ |

|

(City, State, ZIP code) |

|

FS Form 1522 |

Department of the Treasury | Bureau of the Fiscal Service |

2 |

You may leave this blank if your bonds are worth $1,000 or less and you enclose an ID named above in “Certification.”

Instructions to Notary or Certifying Officer: 1. Name(s) of the person(s) who appeared and date of appearance MUST be completed. 2. If a Medallion stamp is used, an original signature is required. 3. Person(s) must sign in your presence.

I CERTIFY that ________________________________________________________________________ , whose identity(ies)

(Names of Persons Who Appeared)

is/are known or proven to me, personally appeared before me this _______________ day of _______________ |

__________ |

(Month) |

(Year) |

at ___________________________________________________ and signed this form. |

|

(City, State) |

|

________________________________________________________ |

|

(Signature and Title of Notary or Certifying Officer) |

|

________________________________________________________ |

|

(Name of Financial Institution) |

|

________________________________________________________ |

|

(Address) |

|

________________________________________________________ |

|

(City, State, ZIP code) |

|

INSTRUCTIONS

USE OF FORM – Use this form to request payment of United States Savings Bonds, Savings Notes, Retirement Plan Bonds, and Individual Retirement Bonds.

WHO MAY COMPLETE – This form may be completed by the owner, coowner, surviving beneficiary, or legal representative of the estate of a deceased or incompetent owner, persons entitled to the estate of a deceased registrant, or such other persons who may be entitled to payment under the regulations governing United States Savings Bonds. A minor may sign this form if, in the opinion of the notary or certifying officer, he or she is of sufficient competency to understand the nature of the transaction. An incompetent person may not sign this form.

COMPLETION OF FORM – Print clearly in ink or type all information requested.

ITEM 1.DESCRIPTION OF BONDS – Provide the name(s) of the person(s) shown in the inscription of the bonds for which payment is requested. Describe the bonds by issue date and serial number.

ITEM 2.INSTRUCTIONS FOR DIRECT DEPOSIT PAYMENT

The payee's Taxpayer Identification Number must be provided. Furnish the Social Security Number if the payee is an individual. If an estate, trust, or other entity is involved and IRS has assigned an Employer Identification Number, provide that number. Furnish the name(s) on the account, the account number, the type of account, and the financial institution's name, the routing/transit number which identifies the institution, and the institution's phone number. You may need to contact the financial institution to obtain the routing number.

Please verify account information for accuracy and legibility to avoid a delay in deposit.

ITEM 3. SIGNATURE

The person(s) requesting payment of the bonds must sign the form in ink, print his or her name, and provide his or her address, daytime telephone number, and if applicable,

FS Form 1522 |

Department of the Treasury | Bureau of the Fiscal Service |

3 |

CERTIFICATION – To find the current redemption value of savings bonds of Series EE, Series E, or Series I, or of savings notes, use the Savings Bond Calculator at TreasuryDirect.gov.

If the current redemption value of your bonds totals $1,000 or less, your signature need not be certified. Rather, when you sign the form, you may verify your identity by enclosing a current copy of your driver’s license, passport, state ID, or military ID.

If the current redemption value of your bonds totals more than $1,000, each person whose signature is required must appear before and establish identification to the satisfaction of a notary or authorized certifying officer. The signatures to the form must be signed in the presence of the notary or officer. The notary or certifying officer must affix the seal or stamp which is used when certifying requests for payment. Authorized certifying officers are available at financial institutions, including credit unions, in the United States. Examples of acceptable seals and stamps:

•The seal or stamp of a notary

•A financial institution’s official seal or stamp, including: Signature Guaranteed seal or stamp; Endorsement Guaranteed seal or stamp; Corporate seal or stamp (a corporate resolution isn’t required); or Issuing or paying agent seal or stamp (including name, location, and

•The seal or stamp of

WHERE TO SEND – Unless otherwise instructed, send this form and the bonds, as well as any other appropriate forms, evidence, or identification records, to the address below. Legal evidence or documentation you submit cannot be returned.

Treasury Retail Securities Services, P.O. Box 9150, Minneapolis, MN

(Phone:

NOTICE UNDER THE PRIVACY AND PAPERWORK REDUCTION ACTS

The collection of the information you are requested to provide on this form is authorized by 31 U.S.C. CH. 31 relating to the public debt of the United States. The furnishing of a Social Security Number, if requested, is also required by Section 6109 of the Internal Revenue Code (26 U.S.C. 6109).

The purpose of requesting the information is to enable the Bureau of the Fiscal Service and its agents to issue securities, process transactions, make payments, identify owners and their accounts, and provide reports to the Internal Revenue Service. Furnishing the information is voluntary; however, without the information, the Fiscal Service may be unable to process transactions.

Information concerning securities holdings and transactions is considered confidential under Treasury regulations (31 CFR, Part 323) and the Privacy Act. This information may be disclosed to a law enforcement agency for investigation purposes; courts and counsel for litigation purposes; others entitled to distribution or payment; agents and contractors to administer the public debt; agencies or entities for debt collection or to obtain current addresses for payment; agencies through approved computer matches; Congressional offices in response to an inquiry by the individual to whom the record pertains; as otherwise authorized by law or regulation.

We estimate it will take you about 15 minutes to complete this form. However, you are not required to provide information requested unless a valid OMB control number is displayed on the form. Any comments or suggestions regarding this form should be sent to the Bureau of the Fiscal Service, Forms Management Officer, Parkersburg, WV

address; send to the address shown in "WHERE TO SEND" above.

FS Form 1522 |

Department of the Treasury | Bureau of the Fiscal Service |

4 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | FS Form 1522 is used to request payment for United States Savings and Retirement Securities. |

| Owner Eligibility | The form can be completed by the owner, co-owner, surviving beneficiary, or legal representative of the deceased owner's estate. |

| Certification Requirement | If the bond's redemption value exceeds $1,000, signatures must be certified by a notary or a certifying officer. |

| Submission Instructions | Completed forms should be sent to the Treasury Retail Securities Services in Minneapolis, MN. |

| Privacy Notice | Information collected on this form is confidential and may be disclosed under certain legal conditions, as specified by Treasury regulations. |

| OMB Control Number | The form has an OMB No. 1530-0028, which must be displayed for the validity of the information collection. |

Guidelines on Utilizing Fs1522

Once you have gathered your necessary personal information and details regarding the savings bonds, you are ready to fill out Form FS1522. This form will require specific details about the bonds you wish to redeem, payment method instructions for direct deposit, and certification of your identity and taxpayer status. To ensure smooth processing, follow the steps outlined below carefully.

- Start with Section 1 – Description of Bonds: In the first section, write the name(s) of the person(s) whose names are listed on the bonds. Include each issue date and serial number of the bonds you are redeeming. If additional space is needed, attach a separate list or FS Form 3500.

- Move on to Section 2 – Instructions for Direct Deposit Payment: Here, provide the Social Security Number or Employer Identification Number of the payee. Next, fill in the names listed on the bank account and its account number. Indicate whether it is a checking or savings account. Include the bank’s name, its routing number (which is nine digits starting with 0, 1, 2, or 3), and the bank's phone number. It’s wise to double-check all account information for accuracy.

- Complete Section 3 – Signature: Under penalties of perjury, sign the form both in ink and print your name. Ensure you include your complete address, daytime phone number, and email address, if applicable. If your name differs from that on the bonds due to marriage or legal reasons, include both names and explain how the change occurred, for example, "Miss Mary T. Jones now by marriage Mrs. Mary T. Smith."

- Certification Requirements: Determine the current redemption value of your bonds. If it is $1,000 or less, you can simply sign the form and attach a copy of an identification document such as a driver’s license or passport. If the value exceeds $1,000, you must sign the form in front of a notary or authorized certifying officer. The notary will then need to complete the certification section. Make sure all required signatures are present before proceeding.

- Final Steps: Once all sections are completed and signed, package the completed Form FS1522 along with the relevant bonds. Send everything to the appropriate address: Treasury Retail Securities Services, P.O. Box 9150, Minneapolis, MN 55480-9150. Keep in mind that any documentation submitted will not be returned to you.

What You Should Know About This Form

What is the FS Form 1522 used for?

The FS Form 1522 is a request form used to obtain payment for United States Savings Bonds, Savings Notes, Retirement Plan Bonds, and Individual Retirement Bonds. Individuals who are owners, co-owners, surviving beneficiaries, or legal representatives of an estate can complete this form to request payment for these securities.

Who is eligible to fill out the FS Form 1522?

Eligible individuals include the owner of the bonds, co-owners, surviving beneficiaries, or legal representatives of an estate in cases where the owner is deceased or incompetent. It can also be signed by a minor if deemed competent by a notary or certifying officer. However, an incompetent person cannot sign the form.

What information is required in the Description of Bonds section?

In this section, you need to provide the names of those registered on the bonds, along with details such as the issue date and serial number for each bond. If you have more bonds than can fit on the form, you may attach a separate list or use FS Form 3500 to provide the necessary information.

What details do I need to provide for direct deposit payment?

For direct deposit, you must provide the payee's Taxpayer Identification Number, which can be a Social Security Number for individuals or an Employer Identification Number for entities. Additionally, you need to include the name on the account, the bank routing number, account type (checking or savings), and the financial institution's name and phone number. Verify all information to ensure deposit accuracy.

When is notary certification required?

If the current redemption value of your bonds exceeds $1,000, signatures must be certified in the presence of a notary or certifying officer. In cases where the bonds’ value is $1,000 or less, you can simply sign the form and include a copy of your ID to verify your identity.

What should I do if I have changed my name?

If your name has changed due to marriage or other legal reasons, you should indicate both your former name and your current name on the form. For example, you may state, “Miss Mary T. Jones now by marriage Mrs. Mary T. Smith,” to ensure clarity.

Where do I send the completed FS Form 1522?

Once you have completed the form and gathered any required documentation, send it to the Treasury Retail Securities Services at P.O. Box 9150, Minneapolis, MN 55480-9150. Keep in mind that any legal evidence or documentation submitted cannot be returned.

What happens if I don’t provide the required information?

Failing to provide the necessary information may delay your request for payment. It’s important to complete the form accurately and fully, as this ensures that the Bureau of the Fiscal Service can process the transaction effectively.

Common mistakes

Filling out the FS Form 1522 can seem straightforward, but some common mistakes can complicate the process. One frequent error is failing to provide complete details about the securities. Applicants must list the names of those currently registered on the bonds, along with their respective issue dates and serial numbers. Omitting this information can lead to unnecessary delays. Always ensure that these details are filled out accurately and completely.

An additional mistake often made involves the Taxpayer Identification Number. People sometimes assume that including either a Social Security Number or an Employer Identification Number is optional, but it is, in fact, a requirement. The payee must provide the correct number to facilitate a smooth payment process, so be sure to double-check this crucial information before submitting the form.

Furthermore, many applicants neglect to sign the form properly. The signature must be made in ink, and the person requesting payment needs to print their name clearly underneath. Failure to adhere to this requirement can result in the rejection of the request. If a name change has occurred, it is essential to reflect both names and explain the change properly in the signature area; otherwise, this may lead to complications.

It is also common for individuals to disregard the notarization requirements for signatures. If the total current redemption value of the bonds exceeds $1,000, the signature must be certified by a notary or certifying officer. Bypassing this step can lead to delays or problems in processing the request. Always make sure to comply with the necessary certification requirements.

Another frequent oversight is related to the information about the financial institution. People sometimes provide incorrect bank routing numbers or forget to include the financial institution's phone number. This slip-up can cause errors in direct deposit and can delay or even prevent the receipt of funds. Always verify this information with your bank prior to submission.

Finally, applicants often overlook checking the entire form for clarity and completeness before submission. Mistakes like unclear handwriting or missing signatures can cause significant delays. Taking the time to review each section for accuracy and clarity will ensure a smoother process and avoid unnecessary complications.

Documents used along the form

When submitting the FS Form 1522 for the payment of United States Savings and Retirement Securities, individuals often need to accompany it with additional documents. Each of these documents serves a specific purpose and ensures that the process is smooth and compliant with regulations.

- FS Form 3500: This form allows applicants to provide additional information if there isn't enough space on Form 1522 for listing bonds. It's essential for keeping records organized and complete.

- Notarized Identification: If the current redemption value of the bonds exceeds $1,000, a notarized copy of an ID is required. This serves to confirm the identity of the individual requesting payment.

- Proof of Ownership Documents: Documentation that establishes ownership of the bonds may be necessary. This could include previous statements or certificates proving that the requester is entitled to the securities.

- Direct Deposit Authorization: If a direct deposit payment is requested, this document collects the bank's information and account details, ensuring that funds are transferred accurately.

- Taxpayer Identification Number (TIN) Documentation: Individuals must provide their Social Security Number or Employer Identification Number. This is vital for tax purposes and to confirm eligibility for payment.

- Beneficiary Declaration: In cases where the owner is deceased, a declaration naming the beneficiaries must be included to ascertain who is entitled to the payment.

Having these documents ready when submitting FS Form 1522 can expedite the processing of requests and help avoid delays. This proactive approach ensures that all necessary information is in order, leading to a more efficient experience.

Similar forms

FS Form 3500: This form is used when submitting a request for a payment of a U.S. Savings Bond, especially when more space is needed to list multiple securities. Like FS Form 1522, it requires identification details and payment instructions for receiving funds.

FS Form 1820: This form serves to request payment for lost, stolen, or destroyed savings bonds. It shares FS Form 1522’s purpose of securing payment while necessitating the verification of identity and entitlement to the securities.

FS Form 1520: Similar to FS Form 1522, this form is used to claim payment on U.S. savings bonds for beneficiaries. Both forms underline the need for rightful claimants to prove identity and establish ownership before receiving funds.

IRS Form W-9: This form is utilized to provide a Taxpayer Identification Number (TIN) for tax reporting purposes. Just as FS Form 1522 requires a TIN, so too does the W-9 support tax compliance by ensuring accurate information is on file with the IRS.

IRS Form 8832: This form allows a business entity to choose how it will be classified for federal tax purposes. Its commonality with FS Form 1522 lies in the requirement of clear, correct identification and instructions for ensuring payments are processed correctly.

Form SSA-11: Also known as the “Application for Spouse's or Child's Benefits,” this form is similar in that it helps individuals claim benefits, requiring information about personal identification and relationships to the claim, much like FS Form 1522 addresses ownership of securities.

Form 1040: This is the standard individual income tax return form. Though its primary function differs, both Form 1040 and FS Form 1522 require accurate personal data and financial details to ensure compliance with governmental processes and accurate payment of claims.

Dos and Don'ts

Things to Do When Filling Out the FS Form 1522:

- Print clearly in ink or type all requested information.

- Provide accurate and complete names of the securities' registered owners.

- Include a Social Security Number or Employer Identification Number for direct deposit.

- Attach additional documentation if the redemption value exceeds $1,000.

Things to Avoid When Filling Out the FS Form 1522:

- Do not leave any required fields blank.

- Avoid making false or misleading statements, as this is a serious offense.

- Do not forget to sign the form in front of a notary if required.

- Refrain from using pencil or unclear handwriting.

Misconceptions

- Only One Person Can Use FS Form 1522: This form can actually be completed by various individuals including co-owners, surviving beneficiaries, or legal representatives of an estate. It is not limited to just one person.

- Certification is Always Required: Certification is only necessary if the current redemption value of the bonds exceeds $1,000. For lesser amounts, attaching a copy of an ID is sufficient.

- Once Submitted, The Form Cannot Be Corrected: While it’s crucial to fill the form out carefully, if an error is made, it can often be corrected by submitting a new form with accurate details.

- The Form Can Be Mailed Anywhere: There is a specific address for submitting the form and the bonds. It's essential to send them to the correct location to ensure proper processing.

- Anyone Can Notarize the Signature: Not all notaries or certifying officers are accepted to notarize this form. Only authorized certifying officers at financial institutions can do this.

- Direct Deposit is Optional: If you want to receive funds via direct deposit, providing bank information is necessary. Without it, payments will be issued by check.

Key takeaways

Key Takeaways on Filling Out and Using the FS Form 1522:

- The FS Form 1522 is specifically designed for requesting payment of various United States savings bonds and securities.

- Accurate completion is crucial; print clearly in ink or type all the required information.

- Include the name(s) of the person(s) currently listed on the securities; provide issue dates and serial numbers.

- The payee must provide either a Social Security Number or an Employer Identification Number.

- Direct deposit details must include the bank routing number and the type of account (checking or savings).

- If bonds total more than $1,000 in redemption value, a notary or certifying officer must witness the signature.

- Identity verification is needed only if the bond value is over $1,000; a government-issued ID suffices for lesser amounts.

- Retain a copy of the completed form and related documents for your records; originals cannot be returned.

- Submit the completed form and any necessary documentation to the Treasury Retail Securities Services to avoid delays.

Browse Other Templates

5914 - Historical comparisons can be made with previous versions for analysis.

How to Pair Blueparrott B250-xt - This rebate helps you enjoy high-quality communication without added costs.