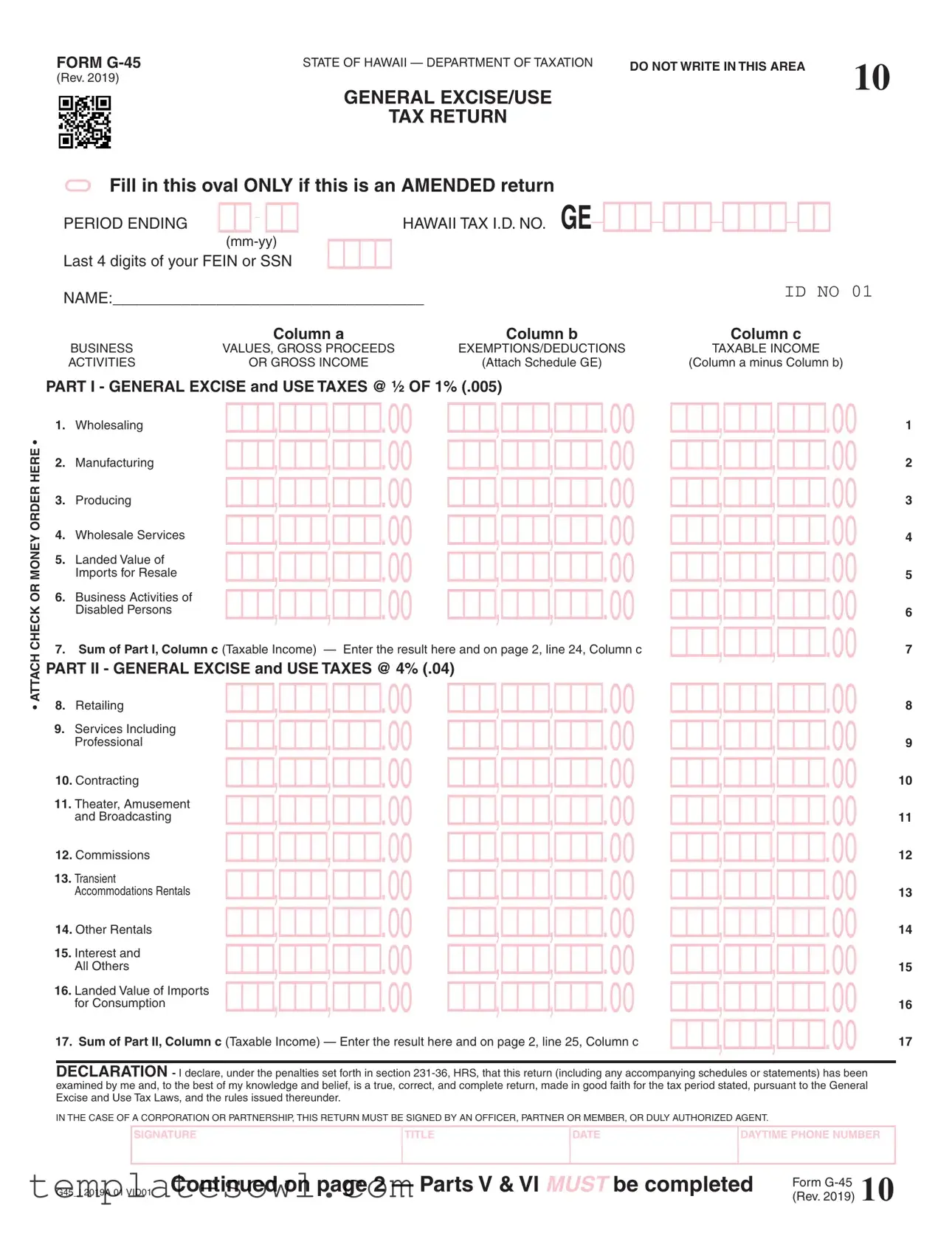

Fill Out Your G 45 Tax Form

The G-45 Tax Form is an essential document for businesses operating in Hawaii, specifically tailored for the General Excise and Use Tax. This form helps determine the tax obligations of various business activities, ranging from wholesaling and manufacturing to professional services and rental operations. It categorizes income into parts, each subject to different tax rates, and allows for exemptions and deductions that can minimize taxable income. Businesses must pay careful attention to sections such as insurance commissions, which have their own unique tax rate, and the county surcharge calculations that vary based on the location of conduct. It becomes incredibly important to accurately report all business values and ensure compliance, as failure to do so could result in penalties. Filing this form requires attention to detail, especially when it comes to the declaration at the end, affirming that the information provided is true and complete. Whether running a small service-based business or a larger manufacturing operation, staying on top of the G-45 is crucial for fulfilling tax responsibilities and avoiding unexpected liabilities.

G 45 Tax Example

FORM |

STATE OF HAWAII — DEPARTMENT OF TAXATION |

DO NOT WRITE IN THIS AREA |

10 |

|

(Rev. 2019) |

|

|

|

|

|

GENERAL EXCISE/USE |

|

|

|

|

TAX RETURN |

|

|

|

Fill in this oval ONLY if this is an AMENDED return |

|

|

||

PERIOD ENDING |

HAWAII TAX I.D. NO. GE |

|

|

|

|

|

|

|

|

Last 4 digits of your FEIN or SSN |

|

|

|

|

NAME:____________________________________ |

ID NO 01 |

|||

|

|

|||

|

Column a |

Column b |

Column c |

|

BUSINESS |

VALUES, GROSS PROCEEDS |

EXEMPTIONS/DEDUCTIONS |

TAXABLE INCOME |

|

ACTIVITIES |

OR GROSS INCOME |

(Attach Schedule GE) |

(Column a minus Column b) |

|

PART I - GENERAL EXCISE and USE TAXES @ ½ OF 1% (.005)

|

1. |

Wholesaling |

|

|

|

|

• |

|

|

|

|

|

|

HERE |

2. |

Manufacturing |

|

|

|

|

ORDER |

3. |

Producing |

|

|

|

|

|

|

|

|

|||

MONEY |

4. |

Wholesale Services |

|

|

|

|

|

|

Imports for Resale |

|

|

|

|

|

5. |

Landed Value of |

|

|

|

|

OR |

6. Business Activities of |

|

|

|

||

CHECK |

|

|

Disabled Persons |

|

|

|

7. |

Sum of Part I, Column c (Taxable Income) — |

Enter the result here and on page 2, line 24, Column c |

|

|||

ATTACH• |

|

|||||

8. |

Retailing |

|

|

|

||

|

PART II - GENERAL EXCISE and USE TAXES @ 4% (.04) |

|

|

|||

|

9. |

Services Including |

|

|

|

|

|

|

|

Professional |

|

|

|

|

10. Contracting |

|

|

|

||

|

11. Theater, Amusement |

|

|

|

||

|

|

|

and Broadcasting |

|

|

|

|

12. Commissions |

|

|

|

||

|

13. Transient |

|

|

|

||

|

|

|

Accommodations Rentals |

|

|

|

|

14. Other Rentals |

|

|

|

||

|

15. Interest and |

|

|

|

||

|

|

|

All Others |

|

|

|

|

16. Landed Value of Imports |

|

|

|

||

|

|

|

for Consumption |

|

|

|

|

17. Sum of Part II, Column c (Taxable Income) — Enter the result here and on page 2, line 25, Column c |

|

||||

|

|

|

||||

|

|

DECLARATION - I declare, under the penalties set forth in section |

||||

|

|

examined by me and, to the best of my knowledge and belief, is a true, correct, and complete return, made in good faith for the tax period stated, pursuant to the General |

||||

|

|

Excise and Use Tax Laws, and the rules issued thereunder. |

|

|

|

|

|

|

IN THE CASE OF A CORPORATION OR PARTNERSHIP, THIS RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT. |

||||

|

|

|

SIGNATURE |

TITLE |

DATE |

DAYTIME PHONE NUMBER |

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

G45_I 2019A 01 VID01 Continued on page 2 — Parts V & VI |

be completed |

(Rev. 2019) 10 |

|

|

Form |

FORM

Page 2 of 2 |

Name:___________________________________________________ |

|

|

|

Hawaii Tax I.D. No. GE |

|

ID NO 01 |

|

|

||

|

Last 4 digits of your FEIN or SSN |

|

PERIOD ENDING |

|

Column a |

Column b |

Column c |

BUSINESS |

VALUES, GROSS PROCEEDS |

EXEMPTIONS/DEDUCTIONS |

TAXABLE INCOME |

ACTIVITIES |

OR GROSS INCOME |

(Attach Schedule GE) |

(Column a minus Column b) |

PART III - INSURANCE COMMISSIONS @ .15% (.0015) |

|

Enter this amount on line 26, Column c |

|

18. Insurance |

|

|

|

Commissions |

|

|

18 |

PART IV - COUNTY SURCHARGE — Enter the amounts from Part II, line 17, Column c attributable to each county. Multiply Column c by the applicable county rate(s) and enter the total of the result(s) on Part VI, line 27, Column e.

19. Oahu (rate = .005) |

19 |

20. Maui |

20 |

21. Hawaii (rate = .005) |

21 |

22. Kauai (rate = .005) |

22 |

PART V — SCHEDULE OF ASSIGNMENT OF TAXES BY DISTRICT (ALL taxpayers MUST complete this Part and may be subject to a 10% penalty for noncompliance.)

DARKEN the oval of the taxation district in which you have conducted business. IF you did business in MORE THAN ONE district, darken the oval “MULTI” and attach Form

23. |

Oahu |

Maui |

Hawaii |

Kauai |

MULTI |

23 |

|

|

|

|

|

||

PART VI - TOTAL PERIODIC RETURN |

TAXABLE INCOME |

TAX RATE |

TOTAL TAX |

|

||

|

|

|

Column c |

Column d |

Column e = Column c X Column d |

|

24. |

Enter the amount from Part I, line 7 |

|

x .005 |

24. |

|

|

25. |

Enter the amount from Part II, line 17 |

|

x .04 |

25. |

|

|

26. |

Enter the amount from Part III line 18, Column c |

|

x .0015 |

26. |

|

|

27. |

COUNTY SURCHARGE TAX. See Instructions for Part IV. Multi district complete Form |

27. |

||

28. TOTAL TAXES DUE. Add column e of lines 24 through 27 and enter result here (but not less than zero). |

|

|||

|

If you did not have any activity for the period, enter “0.00” here |

28. |

||

29. |

Amounts Assessed During the Period,...................... PENALTY $ |

|

29. |

|

|

||||

|

(For Amended Return Only) |

INTEREST $ |

||

|

|

|

|

|

30. |

TOTAL AMOUNT. Add lines 28 and 29 |

|

30. |

|

31. |

TOTAL PAYMENTS MADE FOR THE PERIOD (For Amended Return ONLY) |

31. |

||

32. |

CREDIT TO BE REFUNDED. Line 31 minus line 30 (For Amended Return ONLY) |

32. |

||

33. |

ADDITIONAL TAXES DUE. Line 30 minus line 31 (For Amended Return ONLY) |

33. |

||

|

FOR LATE FILING ONLY |

PENALTY $ |

|

|

34. |

INTEREST $ |

34. |

||

|

|

|

|

|

35.TOTAL AMOUNT DUE AND PAYABLE (Original Returns, add lines 30 and 34;

Amended Returns, add lines 33 and 34) |

35. |

36.PLEASE ENTER THE AMOUNT OF YOUR PAYMENT. Attach a check or money order payable to “HAWAII STATE TAX COLLECTOR” in U.S. dollars to Form

I.D. No. on your check or money order. Mail to: HAWAII DEPARTMENT OF TAXATION, P. O. BOX 1425, HONOLULU, HI

If you are NOT submitting a payment with this return, please enter “0.00” here |

36. |

37.GRAND TOTAL OF EXEMPTIONS/DEDUCTIONS CLAIMED. (Attach Schedule

GE) If Schedule GE is not attached, exemptions/deductions claimed will be disallowed |

37. |

G45_I 2019A 02 VID01

Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The G-45 form is used to report and pay the General Excise and Use Taxes in Hawaii. |

| Amended Returns | This form allows taxpayers to indicate if they are filing an amended return by filling in a designated oval. |

| Filing Period | Taxpayers must indicate the period ending date in the format mm-yy on the form. |

| Tax Calculation | The general excise tax rate is 4%, while specific activities may be taxed at a reduced rate of ½%. |

| Insurance Commissions | Insurance commissions are taxed at a rate of 0.15% (0.0015) under Part III of the form. |

| County Surcharge | There's a county surcharge based on taxable income, which is dependent on the specific county's rate. |

| Declaration Requirements | Taxpayers must sign and declare that the return is true and complete under penalties set by law. |

| Submission Methods | The form can be filed electronically or mailed to the Hawaii Department of Taxation. |

| Governing Law | This form is governed by Hawaii’s General Excise and Use Tax Laws as outlined in section 231-36, HRS. |

Guidelines on Utilizing G 45 Tax

Filling out the G 45 Tax form requires attention to detail to ensure accurate reporting. Following these steps will help you complete the form correctly so that you can submit it. After you finish filling out the form, double-check all entries before sending it to the Hawaii Department of Taxation.

- Indicate if this is an amended return by filling in the appropriate oval.

- Enter the period ending date in the format mm-yy.

- Provide your Hawaii Tax I.D. Number and the last four digits of your FEIN or SSN.

- Fill in your name as it appears on official documents.

- For each business activity listed in Part I, write the gross proceeds in Column a.

- If you have any exemptions or deductions, list those amounts in Column b for the corresponding activities.

- Calculate the taxable income by subtracting Column b from Column a, and record the result in Column c.

- Complete Part II following the same steps for the different categories of activities pertaining to general excise and use taxes.

- Proceed to Part III and enter insurance commission amounts in Column a.

- In Part IV, report applicable amounts for Oahu, Maui, Hawaii, and Kauai counties based on your taxable income.

- In Part V, darken the oval for the taxation district where you conducted business or indicate "MULTI" if applicable.

- Calculate the total taxes due in Part VI by multiplying the taxable income by the respective tax rates and sum the results.

- If applicable, complete the sections for penalties and interest for amended returns in lines 29-34.

- Indicate your method of payment and attach the appropriate check or money order if necessary.

- Lastly, sign the form, including your title and date, and ensure the daytime phone number is provided.

What You Should Know About This Form

What is the G-45 Tax Form?

The G-45 Tax Form is the General Excise/Use Tax Return used in Hawaii. It is required for businesses that engage in activities subject to general excise tax. This form helps business owners report their gross income, exempt amounts, and calculate the tax owed to the state of Hawaii.

Who needs to file the G-45 Tax Form?

Any business operating in Hawaii that has taxable gross income must file the G-45. This includes companies involved in wholesaling, retailing, service provisions, and many other activities. If a business does not have any activities during a tax period, it must still file the form indicating zero activity.

How often do I need to file the G-45 Tax Form?

The filing frequency for the G-45 generally depends on the volume of business. Most businesses will file either monthly or quarterly. However, some smaller businesses may be allowed to file annually. Be sure to check the specific deadlines for your business type to avoid penalties.

What information is required to complete the G-45 Tax Form?

When completing the G-45, you will need to provide your Hawaii Tax I.D. number, the period ending date, business values, gross proceeds, exemptions, deductions, and taxable income related to your activities. Additionally, you must detail the business activities conducted during the period to calculate applicable taxes.

What are the tax rates associated with the G-45?

The G-45 contains different tax rates based on the specific business activities. For instance, general excise tax may range from ½ of 1% on wholesale activities to 4% for most other services. There is also a special rate for insurance commissions. Thus, it is crucial to understand which category your business activities fall into for accurate reporting.

What happens if I file my G-45 late?

If you file your G-45 after the deadline, you may incur penalties and interest on the amount of tax owed. It’s important to file on time to avoid these additional costs. If circumstances arise that prevent timely filing, you can request an extension or explain the delay, but this does not automatically waive penalties.

Can I amend my G-45 Tax Form?

Yes, if you discover errors in your originally filed G-45, you can submit an amended return. To indicate an amended return, you should fill in the oval specifically designated for this on the form. Ensure accurate corrections are made to avoid issues during reviews or audits.

Where do I send my completed G-45 Tax Form?

You should mail your completed G-45 Tax Form to the Hawaii Department of Taxation at the following address: P.O. Box 1425, Honolulu, HI 96806-1425. You can also choose to file electronically through the Hawaii State Tax Online Services portal for convenience.

What if I have questions while filling out the G-45?

If you encounter challenges while completing the G-45, don’t hesitate to reach out to the Hawaii Department of Taxation. They can provide guidance and clarify any concerns you may have regarding the form or the filing process. It’s always best to ask questions before submitting to ensure accuracy.

Can I claim exemptions on the G-45?

Yes, businesses can claim certain exemptions or deductions on the G-45. However, it’s essential to attach a Schedule GE when claiming these. Without this attachment, the exemptions claimed may be disallowed, resulting in a higher taxable income.

Common mistakes

One common mistake people make when filling out the G-45 Tax form is incorrect calculation of taxable income. Taxable income is derived from gross proceeds after subtracting exemptions and deductions. If someone mistakenly adds instead of subtracting, the entire calculation can be thrown off. This error may lead to either underreporting or overreporting taxes owed, which can complicate future dealings with tax authorities.

Another frequent mistake is neglecting to sign the form. The declaration at the end of the tax return requires a signature. Without it, the submission may be considered incomplete. This can result in delays, penalties, or even the need to refile. It is essential to ensure that the form is properly signed, especially when it involves a corporation or partnership, as it must be signed by an authorized individual.

People also often forget to include all necessary schedules and forms. For instance, the G-45 may require a Schedule GE attachment. If this schedule is not submitted alongside the G-45, the claimed exemptions and deductions might be disallowed. This simple oversight can lead to a higher tax bill than expected, thus causing frustration and additional work.

Lastly, misidentifying the taxation district is another common error. Each taxpayer needs to darken the correct oval that corresponds to their district. If a business has operated in multiple districts, the “MULTI” option must be selected, accompanied by Form G-75. A mistake here could result in incorrect tax calculations, leading to potential audits or additional penalties.

Documents used along the form

The G-45 Tax Form is essential for Hawaii businesses to report their General Excise and Use taxes. Alongside this form, several other documents may need to be completed to ensure proper compliance. Each plays a unique role in accurately reflecting the business's financial activities and tax obligations.

- Schedule GE: This attachment is required for listing exemptions and deductions related to gross income. It details how these deductions impact the total taxable income reported on the G-45.

- Form G-75: If a business operates in multiple taxation districts, this form must be completed. It assigns taxes by district and outlines the relevant amounts for each area of operation.

- Form G-46: Used to report additional information about specific income types, such as those from obsolescence or casual sales. This form ensures that all sources of income are captured accurately.

- Form G-49: This form provides a reconciliation of any estimated tax payments made. It helps businesses and tax authorities confirm that estimated payments align with their final tax liabilities.

- Form G-71: If there are any jurisdiction-specific regulations affecting tax rates or deductions, this form documents compliance with local laws. It provides valuable context for understanding local tax obligations.

- Tax Payment Receipt: Upon payment of the taxes due, businesses receive this receipt. It serves as proof of payment, which is crucial in case of audits or further inquiries by tax authorities.

- Declaration of Estimated Tax: If a business expects to owe a certain amount in taxes, this form aids in reporting estimated tax payments. Filing this can help avoid penalties for underpayment.

- Supporting Documentations: Records such as sales invoices, expense receipts, and financial statements. These documents are vital during audits to substantiate the amounts reported on the G-45 and other forms.

Filing the G-45 Tax Form is a multi-step process where accuracy is paramount. Utilizing the accompanying forms and documents not only aids in compliance but helps ensure proper reporting of tax liabilities and exemptions. Businesses must handle these obligations diligently to avoid potential issues with tax authorities.

Similar forms

The G-45 Tax form is a crucial document for businesses operating in Hawaii, specifically for reporting general excise and use taxes. It shares similarities with several other tax-related documents. Here are seven documents that are similar to the G-45 Tax form, along with explanations of those similarities:

- IRS Form 1065 - This form is used by partnerships to report their income and deductions to the IRS. Like the G-45, it requires detailed financial information, including income sources and exemptions, and must be signed by partners.

- IRS Form 1120 - Corporations use this form to report their income, gains, losses, and tax liability. Both forms demand accurate reporting of financial activity and adherence to deadlines set by tax agencies.

- IRS Form 1040 - This is an individual income tax return in the U.S. Like the G-45, it necessitates comprehensive detail on income, exemptions, and any taxes owed, making it essential for compliance with taxation laws.

- State Sales Tax Return - Many states require businesses to file this document, which captures sales and use tax collected. Similar to the G-45, it tracks taxable income and applicable rates based on various categories of sales.

- Form 941 - Employers use this quarterly return to report income taxes, social security, and Medicare taxes withheld from employee paychecks. Both the G-45 and Form 941 focus on accurate reporting and payments to state and federal entities.

- Form 940 - The employers' annual federal unemployment tax return requires companies to report their unemployment tax responsibilities. This form aligns with the G-45 in its goal of accurately reflecting a company's tax obligations.

- State Business License Application - While primarily a registration form rather than a tax return, it often collects similar financial information required to obtain a business license, like the G-45 does for tax purposes.

These documents not only share structural similarities but also reflect essential processes required for tax compliance in various contexts. Understanding these parallels can help streamline tax obligations for businesses operating across different states and at various levels of government.

Dos and Don'ts

When filling out the G-45 Tax form, several important guidelines should be followed to ensure accuracy and compliance. Below are four dos and don'ts to keep in mind.

- Do double-check all entries for accuracy before submission.

- Do ensure that all necessary schedules, such as Schedule GE, are attached as required.

- Don’t leave any sections of the form blank; every field should be filled out as applicable.

- Don’t submit payment without including a check or money order made out correctly to the Hawaii State Tax Collector.

Misconceptions

-

Misconception 1: The G-45 form is only for large businesses.

This is not true. The G-45 form applies to all businesses generating income in Hawaii, regardless of size. Whether you're a small sole proprietor or a multi-million-dollar corporation, if you conduct business in Hawaii, you need to file this form.

-

Misconception 2: If you didn’t have any sales, you don’t need to file.

Even if your business had no sales during the reporting period, you are still required to file the G-45 form. It’s vital to report a “0.00” income if that’s the case, ensuring compliance with tax regulations.

-

Misconception 3: The G-45 form is too complicated to complete without help.

While forms can seem daunting, the G-45 is relatively straightforward. With clear instructions available and the data usually based on sales information, many business owners find they can accurately complete the forms on their own.

-

Misconception 4: You can submit the G-45 form without attachments.

This is a significant misunderstanding. To support your deductions or exemptions, you're required to attach any necessary schedules. Failing to do so can lead to rejected claims and potential fines.

Key takeaways

Filling out the G-45 Tax form can seem daunting, but here are some key takeaways to simplify the process.

- Ensure you have your Hawaii Tax I.D. Number ready. It's essential for filing.

- Indicate if you're submitting an amended return by checking the appropriate box.

- Accurately report your business values and gross proceeds across the various categories listed.

- Keep track of any exemptions or deductions to calculate your taxable income correctly.

- Remember to sign the form; an officer or authorized agent must validate corporate or partnership returns.

- When calculating taxes, be sure to use the correct rates — for example, 0.5% for wholesaling and 4% for services.

- File and pay electronically for convenience, or mail your payment to the designated address.

By following these takeaways, you can navigate the G-45 Tax form more confidently and ensure compliance with Hawaii’s tax regulations.

Browse Other Templates

Printable Body Shop Quality Control Checklist - Routine inspections help identify potential environmental hazards in the shop.

Dd372 - This form should be seen as a step toward achieving eligibility for service members.

Will the Va Pay for Outside Prescriptions - The internal review process will determine the final decision on the claim based on the submitted form.