Fill Out Your G121 Form

The G121 form, employed by Great Western Insurance Company, plays a crucial role in managing various aspects of life insurance policies. This form serves policyholders seeking to make changes, such as updating funeral home information or modifying beneficiary designations. Individuals can remove or alter existing beneficiaries or add new ones, ensuring that their wishes regarding policy proceeds are clearly articulated. The G121 form also provides a mechanism for transferring ownership rights and allows for irrevocable assignments of benefits directly to funeral homes, underscoring the importance of pre-planning. Moreover, policyholders have the option to request loans against their policies or surrender their policies altogether. Each of these elements requires careful consideration to avoid confusion and ensure proper documentation. By completing the G121 form, insured individuals contribute to a smoother transition of benefits at a difficult time, ultimately reinforcing their estate planning objectives.

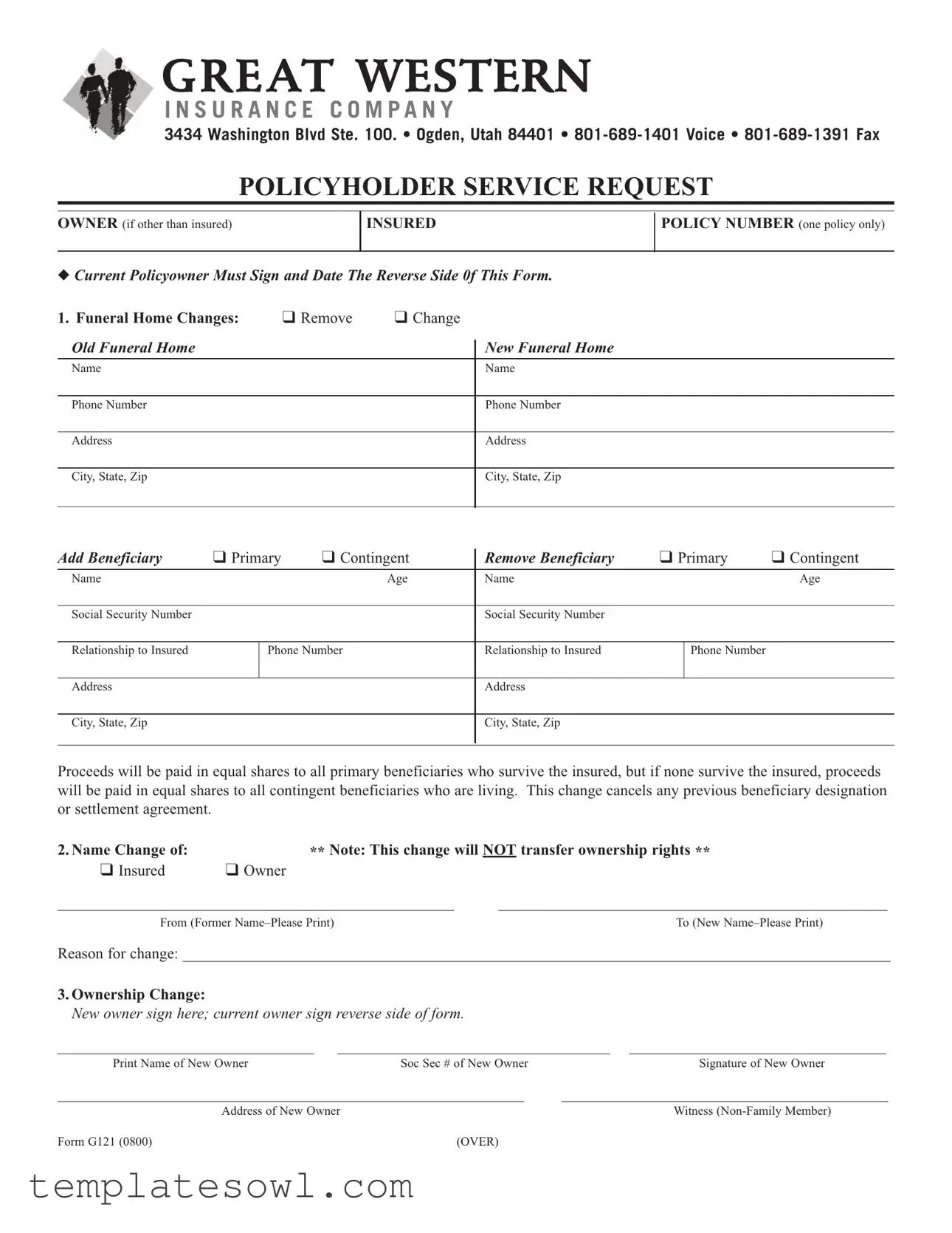

G121 Example

G R E AT WESTERN

I N S U R A N C E C O M P A N Y

3434 Washington Blvd Ste. 100. • Ogden, Utah 84401 •

POLICYHOLDERSERVICEREQUEST

OWNER (if other than insured)

INSURED

POLICYNUMBER (one policy only)

◆CurrentPolicyownerMustSignandDateTheReverseSide0fThisForm.

1. Funeral Home Changes: |

❑ Remove |

❑ Change |

OldFuneralHome

Name

NewFuneralHome

Name

Phone Number

Phone Number

Address

Address

City, State, Zip

City, State, Zip

AddBeneficiary |

❑ Primary |

❑ Contingent |

RemoveBeneficiary |

❑ Primary |

❑ Contingent |

||

|

|

|

|

|

|

|

|

Name |

|

|

Age |

Name |

|

|

Age |

|

|

|

|

|

|

|

|

Social Security Number |

|

|

|

Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

Relationship to Insured |

|

Phone Number |

Relationship to Insured |

|

Phone Number |

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

City, State, Zip |

|

|

|

City, State, Zip |

|

|

|

|

|

|

|

|

|

|

|

Proceeds will be paid in equal shares to all primary beneficiaries who survive the insured, but if none survive the insured, proceeds will be paid in equal shares to all contingent beneficiaries who are living. This changecancels any previous beneficiary designation or settlement agreement.

2.Name Change of: |

** Note:This change will NOT transferownershiprights ** |

|||

❑ Insured |

❑ Owner |

|

|

|

___________________________________________________ |

__________________________________________________ |

|||

From (Former |

|

|

To (New |

|

Reason for change: ___________________________________________________________________________________________ |

||||

3.OwnershipChange: |

|

|

|

|

Newownersignhere;currentownersignreversesideofform. |

|

|

||

_________________________________ |

___________________________________ _________________________________ |

|||

Print Name of New Owner |

Soc Sec # of New Owner |

Signature of New Owner |

||

____________________________________________________________ |

__________________________________________ |

|||

|

Address of New Owner |

|

||

FormG121(0800) |

|

(OVER) |

|

|

POLICYNUMBER _____________________

4.IrrevocableAssignment of Benefits

As the owner of the life insurance referred to above, I hereby irrevocably assign and transferall the policy benefits and proceeds of such policy to _________________________________________________________________________________________

Mortuary Name

I make this irrevocable assignment of benefits in connection with a

Designation of a beneficiary by me before or after the date of this assignment is subjectto this assignment and transfer.

Itismyintention,asownerofthepolicyreferredtoabove,tocontinuetopaythepremiumsandtoretainownershipofthepolicy.

5.Would you like to take a policy loan?

Issue check for ❑$ _______________

or ❑ maximum amount available.

❑Make check payable to policyowner

❑Make check payable to _______________________________________________________________________________

LoanAgreement InconsiderationoftheloanmadebyGreatWesternInsuranceCompany,Iassignthepolicytothecompanyassolesecurityfor therepaymentoftheloanwithinterestsubjecttotheprovisionsofthepolicy. IcertifythatnoBankruptcyProceedings,attach- ment,taxorotherlienorclaimisnowpendingagainstmeandthatthepolicyhasnotbeenpreviouslyassigned.

6.Do you need to surrenderyourpolicy? Please submit policy. If policy is lost, mark this box ❑

Thecashsurrendervalueisrequestedandwillbeacceptedinfullpaymentandreleaseofallclaimsunderthepolicy.Thesur- renderwillbeeffectivewhenthisrequestisreceivedbytheCompanyatitsOfficeinOgden,Utah.

❑MakecheckpayabletoPolicyowner

❑Makecheckpayableto __________________________________________________________________________________

Icertifythatnobankruptcyproceedings,attachment,taxorotherlienorclaimisnowpendingagainstme,andthatthepolicyhas

notbeenpreviouslyassigned.

7. Address/Telephone Numberchange forcurrent policyowner:

_________________________________________________________________________________________________________

8.Additional Request (Any OtherChanges Not ListedAbove)

________________________________________________________________________________________________________

SIGNATURES

I/weagreethatmy/oursignature(s)belowshallapplytoeachrequestwhichhasbeencompletedoneithersideofthisform

_____________________________________________ |

_______________ |

___________________________________________ |

Date |

CurrentPolicyowner(ifownedbyacompany,showtitle) |

|

_____________________________________________ |

|

___________________________________________ |

IrrevocableBeneficiary/AssigneeSignature |

|

Spouse’sSignaturerequiredinaCommunityPropertyState |

|

|

|

|

|

|

|

|

|

RECORDEDATTHEHOMEOFFICEON _____________________ |

BY________________________________________________________________________ |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The G121 form is used to request changes to a life insurance policy, including beneficiary adjustments and ownership changes. |

| Required Signatures | Current policyholders must sign and date the reverse side of the form, ensuring all requests are validated. |

| Beneficiary Distribution | Proceeds are paid in equal shares to all primary beneficiaries who survive the insured. If none survive, contingent beneficiaries will receive the proceeds. |

| Ownership Transfer Limitation | Changes in ownership do not transfer ownership rights, which may affect subsequent transactions. |

| Governing Law | This form operates under the laws of the State of Utah, including any relevant insurance regulations. |

Guidelines on Utilizing G121

After gathering all necessary information, it’s time to complete the G121 form. This document allows policyholders to request various changes related to their insurance policies. Follow these clear steps to ensure that the form is filled out correctly.

- Obtain the form: Start by downloading or printing the G121 form from the Great Western Insurance Company website.

- Fill in your details: Write your name under "Owner (if other than insured)" and "Insured". Also, include the policy number.

- Funeral Home Changes: Indicate if you want to remove or change a funeral home. Provide the old and new funeral home names along with the phone numbers and addresses if necessary.

- Add or Remove Beneficiary: Clearly specify if you are adding or removing a primary or contingent beneficiary. Fill in the requested information such as name, age, relationship to the insured, and phone number.

- Name Change: If applicable, indicate if the name change is for the insured or owner. Fill in the old name and the new name, along with the reason for the change.

- Ownership Change: The new owner should print their name, provide their Social Security number, and sign the form. Ensure the current owner signs the reverse side.

- Irrevocable Assignment of Benefits: Assign benefits to the specified mortuary. Fill in the mortuary's name and understand the implications of the assignment.

- Policy Loan Request: If requesting a loan, indicate the loan amount or state "maximum amount available." Specify who the check should be made payable to.

- Surrender Policy: If applicable, check the appropriate box to request cash surrender value. Make sure to submit the policy if possible.

- Address/Telephone Change: Write the new address and phone number for the current policy owner.

- Additional Requests: Note any other changes not covered above in the specified section.

- Sign the form: Both witnesses (non-family members) and the current policy owner must sign and date the form as required.

Once completed, review the form for accuracy before submission. Be sure to send it to Great Western Insurance Company at the address listed at the top of the form. This will ensure that your requests are processed without delay.

What You Should Know About This Form

What is the G121 form?

The G121 form is a document used by the Great Western Insurance Company to facilitate various changes related to life insurance policies. It allows policyholders to update beneficiaries, change insurance ownership, request loans, or initiate policy surrenders. It serves as an official means to communicate important updates to the insurance company.

How do I change the funeral home listed on my insurance policy using the G121 form?

To change the funeral home designation, fill out the specific section of the G121 form, selecting either "Remove" or "Change." Provide the old funeral home's name and contact information, as well as the new funeral home's name and contact details. This will ensure that your policy reflects your current preferences for funeral arrangements.

Can I add or remove beneficiaries using the G121 form?

Yes, the G121 form allows you to add or remove beneficiaries. Specify whether you are adding a primary or contingent beneficiary. Include their name, age, social security number, relationship to the insured, and contact information. Remember, this action will cancel any previous beneficiary designations you may have established.

What information do I need to provide if I want to change the name of the insured or owner?

If you're changing the name of the insured or the owner, print the former name and the new name clearly in the designated areas. You must also provide a brief reason for this change. Note that changing the name does not transfer ownership rights to the policy.

What should I do if I want to assign the benefits of my policy to a funeral home?

To assign benefits, fill out the section for irrevocable assignment of benefits on the G121 form. Provide the name of the mortuary to which you are assigning policy benefits. This type of assignment is linked to pre-paid funeral plans and remains effective, meaning future beneficiary designations will not override this assignment.

How can I take a loan against my policy using the G121 form?

You can request a policy loan by indicating the desired loan amount on the G121 form. You can choose either a specific dollar amount or the maximum available amount. Additionally, you must specify who the check should be made payable to, either the policy owner or another party specified by you.

What are the steps to surrender my insurance policy using the G121 form?

If you decide to surrender your policy, indicate this on the G121 form and submit the physical policy document. If the policy is lost, check the box for lost policy on the form. By surrendering, you will receive the cash surrender value, effectively releasing all claims under the policy once your request is processed by the company.

Can I change my address or phone number on the G121 form?

Absolutely. You can update your personal contact details by filling out the designated section of the G121 form. Provide your new address and phone number to ensure that all communication from the insurance company reaches you promptly.

What if I have additional requests that aren't specifically listed on the G121 form?

If you have other requests not covered in the G121 form, there’s a section for additional requests. Simply provide a clear description of the changes or actions you wish to undertake. This flexibility helps accommodate your unique needs beyond the standard options detailed in the form.

Do I need to sign the G121 form if I make or request changes?

Yes, signatures are required. The current policy owner must sign the form, and a witness, who should not be a family member, must also sign. This ensures that all changes are legally binding and acknowledged by the insurance company, providing additional protection against any misunderstandings.

Common mistakes

Filling out the G121 form correctly is vital to ensure your requests are processed efficiently. Unfortunately, many individuals make common mistakes that can lead to delays or complications. Recognizing these pitfalls can guide you towards completing the form accurately.

One frequent error is neglecting to provide complete information for the funeral home changes section. It is essential to include both the new and old funeral home names, along with their respective phone numbers and addresses. Incomplete entries can hinder the processing of any changes you wish to make.

Another common mistake occurs when individuals fail to sign and date the reverse side of the form. This signature is not just a formality; it is a crucial step that validates the information provided. Without it, the form may be considered incomplete and could result in unnecessary follow-up steps.

Many people also overlook the requirement to designate a beneficiary when making changes. This designation is critical because it dictates how proceeds will be distributed upon the insured's passing. Clearly marking whether you wish to add or remove a primary or contingent beneficiary, along with their complete details, is essential for clarity.

When indicating a name change, individuals often forget to include the reason for the change. While it may seem minor, this detail helps the insurance company understand the context behind the name alteration, preventing confusion or potential disputes later on.

The section regarding ownership changes is prone to errors as well. Many individuals assume that simply signing their name is sufficient. However, the current owner must also sign on the reverse side of the form, ensuring that the transition is fully acknowledged and documented.

Lastly, failing to provide accurate loan amount requests can complicate the borrowing process. Whether you wish to request the maximum amount or a specific sum, clearly stating this information is critical. Inaccurate or vague requests can lead to miscommunication and delays in receiving your funds.

By being aware of these common mistakes, you can enhance the chances of your G121 form being processed smoothly, thereby avoiding frustrating setbacks in managing your insurance policy.

Documents used along the form

The G121 form, used primarily for managing life insurance policies with Great Western Insurance Company, is often accompanied by various other documents that facilitate changes related to the policy. Below is a list of commonly used documents that may accompany the G121 form, along with a brief description of each.

- Policy Change Request Form: This document is used to formally request changes to the terms of an existing insurance policy, such as updates to coverage limits or adjustments to premiums.

- Beneficiary Designation Form: This form allows the policyholder to specify or alter the individuals or entities that will receive benefits upon the insured's death.

- Ownership Transfer Form: When transferring ownership of an insurance policy to another party, this document is essential. It provides the necessary details about the new owner and requires their signature.

- Loan Agreement Document: If the policyholder opts for a loan against the policy, this document outlines the terms of the loan, including interest rates and repayment obligations.

- Address Change Notification: To ensure that all correspondence reaches the correct individual, this simple form updates the insurance company with a new address for the policyholder.

- Health Declaration Form: This form may be requested when significant changes are made to a policy or when applying for new coverage, allowing the insurer to assess risk based on the insured’s health status.

- Funeral Home Assignment Form: In cases where funeral expenses are prepaid through life insurance, this document designates a specific funeral home and instructs the insurer on making payments directly to that establishment.

- Claim Form: Should a claim need to be filed, this form is essential for providing necessary information about the insured's passing and initiating the payment process to beneficiaries.

- Irrevocable Beneficiary Form: This document is used when a policyholder wants to name a beneficiary for whom they cannot change the designation without the beneficiary's consent. It provides additional security for the beneficiary.

These documents play a vital role in ensuring that the insurance policy functions smoothly and that all parties involved are clear about their rights and responsibilities. Having the correct paperwork in place helps avoid delays and misunderstandings, allowing for a more streamlined experience during often difficult times.

Similar forms

Life Insurance Beneficiary Change Form: This form allows policyholders to add or remove beneficiaries, similar to the G121 form's beneficiary section. Both require clear identification of the new beneficiaries and their relationships to the insured.

Ownership Transfer Form: Similar to the G121, this document is used to transfer ownership rights of an insurance policy. It requires signatures from both the current and new owners and emphasizes the legal implications of such a change.

Funeral Planning Authorization Form: This form gives consent to funeral homes to make arrangements, akin to the G121's funeral home change section. Both require detailed information about the funeral provider and preferences.

Change of Address Form: Like the address changes in the G121 form, this document is used to inform the insurance company about a policyholder's new contact information, ensuring that all communications are received.

Loan Request Form for Life Insurance: This document is similar because it allows policyholders to request loans against the cash value of their insurance policy. It includes acknowledgment of terms, much like the loan option indicated in the G121 form.

Policy Surrender Request Form: Similar to the surrender section in the G121 form, this document is used to officially request the cancellation and cash payout of a life insurance policy, requiring written consent from the policyholder.

Name Change Notification Form: Just like the name change section of the G121, this form is utilized to officially notify the insurance company of a policyholder’s name change, providing both old and new names.

Waiver of Premium Form: Similar in the context of premium payments, this document is submitted when a policyholder wishes to stop paying premiums due to specific circumstances, paralleling aspects of the G121 form for managing premiums and ownership.

Beneficiary Assignment Form: Like the G121’s irrevocable assignment section, this document assigns policy benefits to specific individuals or entities, confirming the relationship and understanding between parties involved.

Policy Review and Update Form: This document allows policyholders to assess and update various aspects of their insurance policy, closely resembling the comprehensive change requests included in the G121 form.

Dos and Don'ts

When filling out the G121 form, it’s essential to approach the task with diligence. Making the process seamless can ultimately save time and prevent potential issues down the road. Here are four key do's and don'ts to keep in mind:

- Do: Ensure all required fields are filled out completely. Missing information can delay processing.

- Do: Use clear and legible handwriting if the form is being filled out by hand. Clarity is crucial for accurate processing.

- Do: Verify that all signatures are included, especially from the current policyholder and any witnesses. Signatures validate the requests made in the form.

- Do: Keep copies of submitted forms for your records. This helps track requests in case of future inquiries.

- Don't: Skip the “reason for change” section if you are making a name change. Providing a reason clarifies the context of your request.

- Don't: Forget to check the appropriate boxes for changes you are requesting. Incorrect selections might lead to misunderstandings.

- Don't: Leave out the witness signature if applicable. In many cases, this can be a crucial part of the validation process.

- Don't: Submit the form without reviewing it thoroughly. Double-checking prevents errors and ensures that all instructions have been followed.

Following these simple guidelines can significantly enhance your experience with the G121 form, ensuring that your requests are processed without unnecessary complications.

Misconceptions

Misunderstandings about the G121 form can lead to confusion for policyholders. Below is a list of common misconceptions, each clarified for better understanding.

- Removing a Funeral Home is Simple: Many believe that changing or removing a funeral home is a straightforward process. However, the form requires clear documentation and may involve additional steps beyond merely filling out the G121.

- Beneficiaries Automatically Transfer Upon Change: It is often assumed that changing a beneficiary on the G121 automatically revokes previous designations. In fact, all changes must be explicitly stated to avoid legal complications.

- Only the Insured Can Fill Out the Form: Some policyholders think only the insured individual is allowed to fill out the G121. In reality, both the owner and the insured may complete parts of the form as necessary.

- Changes are Immediate: Many policyholders expect immediate processing of changes once the form is submitted. The reality is that changes are effective once the company processes the form, which may take time.

- Irrevocable Assignment is Easily Revoked: A common misconception is that irrevocable assignments can be changed at will. These assignments are binding and require consent from all parties involved.

- Cancellations are Non-Communicative: Some assume that submitting a surrender request means all relevant parties are notified. Notification is not automatic, and policyholders should confirm receipt and processing with the insurance company.

- Witnessing is Optional: Some individuals believe that having a witness is merely a formality. However, in certain states and situations, a witness might be legally required for the form to be valid.

- Policy Loans Are Always Available: It is a common belief that policyholders can always take a loan against their policy. Approval for loans can depend on the policy's value and the specific terms set by the insurer.

- All Address Changes Are Simple: Many think that updating an address on the G121 is a quick fix. However, additional verification may be necessary, especially when ownership is transferred.

- Submitting the Form Once is Sufficient: Lastly, some policyholders believe that submitting the G121 once will cover all future changes. In reality, updates need to be made each time a change occurs to maintain accurate records.

Understanding these misconceptions about the G121 form will help policyholders navigate their insurance needs more effectively.

Key takeaways

Filling out the G121 form is a straightforward process, but attention to detail is crucial. Here are some key takeaways to ensure you utilize this form effectively:

- Understand the purpose: The G121 form primarily facilitates changes related to funeral home selections, beneficiary designations, ownership transfers, and policy loans.

- Signature requirements: The current policyholder must sign and date the reverse side of the form for any changes to be valid.

- Beneficiary designations: You can add or remove beneficiaries, but know that any new designation will cancel previous ones. Be certain about the relationships and share allocations.

- Name changes: You can change the name of the insured or owner without transferring ownership rights. Ensure accurate details are filled out to avoid complications.

- Ownership transfers: To transfer the ownership of the policy, both the current and new owners must sign. This action must be carefully documented.

- Policy loans: If you wish to take a loan against your policy, indicate the amount and specify payee details. Keep in mind that the policy will act as security for the loan.

- Surrendering the policy: If you choose to surrender the policy, you need to submit the actual policy document. The cash surrender value will be processed when the request reaches the company.

- Keep your contact information updated: Changes to the address or phone number of the current policy owner impact communication; be sure to fill in these sections accurately.

- Consultation may be helpful: If you're unsure about the process or terms, consider seeking advice to guide you through the paperwork and ensure compliance with all necessary requirements.

By carefully considering each of these points, you can efficiently manage your insurance policy and related requests through the G121 form.

Browse Other Templates

Where Can I Get Hazmat Certified - The training certification must be signed by the trainer.

Palmetto Employee Remote Access Guide,Palmetto Health Networking Access Overview,MyAccess Remote Connection Manual,Palmetto Health Digital Gateway Instructions,Remote Work Access Overview for Palmetto Employees,Palmetto Health Telecommuting Access Gu - Administrative privileges are necessary to install the Citrix XenApp plugin.

Cac2 Form - For apprentices employed, details of the apprenticeship program are required.