Fill Out Your Gc 1565 Form

The GC 1565 form is a crucial document for anyone looking to manage their Health Savings Account (HSA) effectively, particularly when it comes to rolling over or transferring funds. This form provides account holders with the means to move money from an existing HSA or Medical Savings Account (MSA) from an institution to their new Chase HSA. By completing the GC 1565 form, individuals confirm that the funds in question qualify as eligible rollover contributions. It outlines two primary methods for transferring funds: a rollover, which involves requesting a distribution from the current HSA or MSA, and a direct trustee-to-trustee transfer, where the current financial institution is contacted to facilitate the transfer without the account holder needing to handle the funds directly. Clear instructions, such as how to properly fill out the account information and address where to send the request, accompany the form. Moreover, it's important that the completed form includes essential details, such as the account holder’s name, Social Security Number, and an authorization signature. For those with questions or needing assistance, Chase provides dedicated support through HSA Member Services, ensuring that account holders have the guidance they need throughout the process.

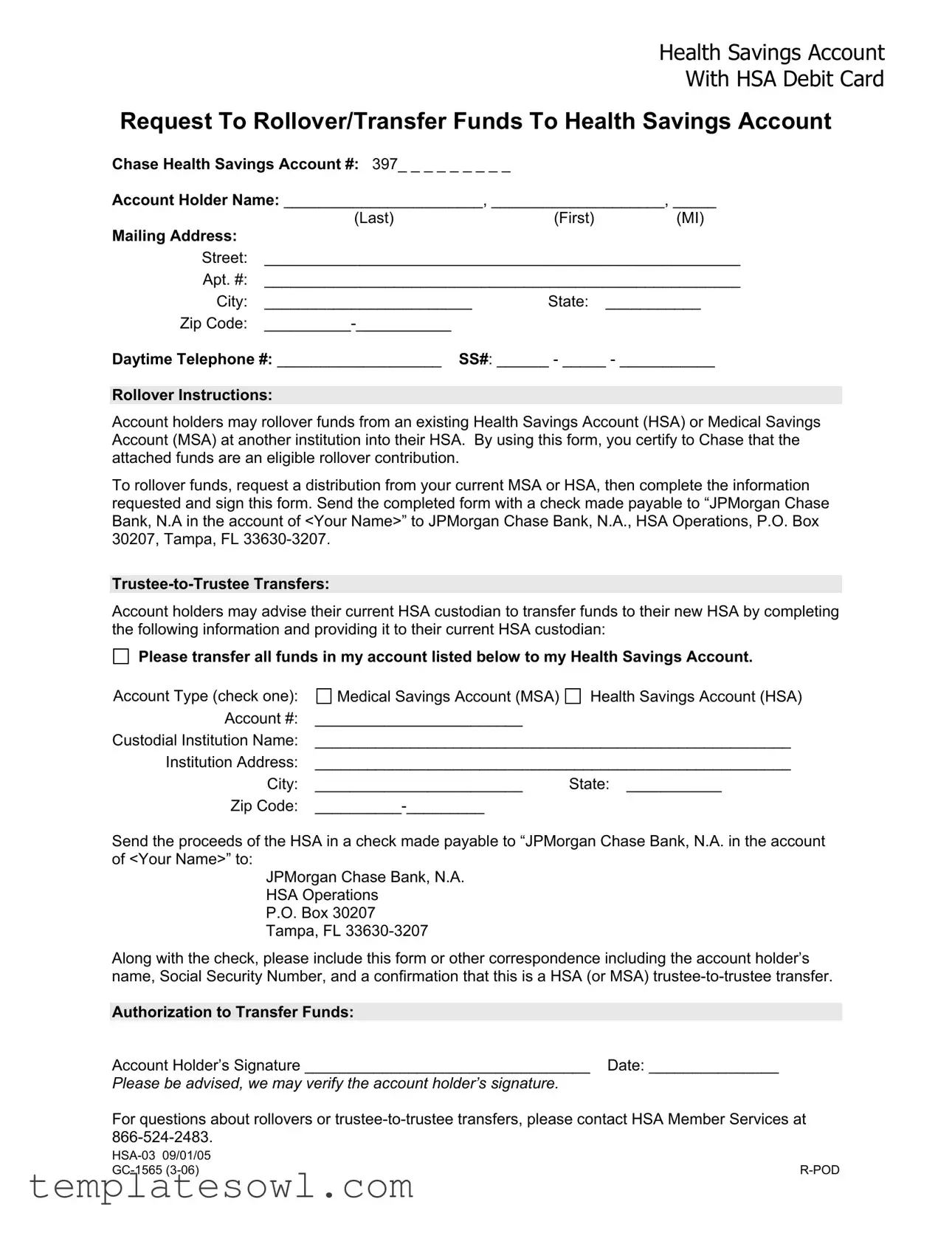

Gc 1565 Example

Health Savings Account

With HSA Debit Card

Request To Rollover/Transfer Funds To Health Savings Account

Chase Health Savings Account #: 397_ _ _ _ _ _ _ _ _

Account Holder Name: _______________________, ____________________, _____

|

(Last) |

(First) |

(MI) |

Mailing Address: |

|

|

|

Street: |

_______________________________________________________ |

||

Apt. #: |

_______________________________________________________ |

||

City: |

________________________ |

State: |

___________ |

Zip Code: |

|

|

|

Daytime Telephone #: ___________________ SS#: ______ - _____ - ___________

Rollover Instructions:

Account holders may rollover funds from an existing Health Savings Account (HSA) or Medical Savings Account (MSA) at another institution into their HSA. By using this form, you certify to Chase that the attached funds are an eligible rollover contribution.

To rollover funds, request a distribution from your current MSA or HSA, then complete the information requested and sign this form. Send the completed form with a check made payable to “JPMorgan Chase Bank, N.A in the account of <Your Name>” to JPMorgan Chase Bank, N.A., HSA Operations, P.O. Box 30207, Tampa, FL

Account holders may advise their current HSA custodian to transfer funds to their new HSA by completing the following information and providing it to their current HSA custodian:

Please transfer all funds in my account listed below to my Health Savings Account.

Account Type (check one): |

Medical Savings Account (MSA) |

Health Savings Account (HSA) |

Account #: |

________________________ |

|

Custodial Institution Name: |

_______________________________________________________ |

|

Institution Address: |

_______________________________________________________ |

|

City: |

________________________ |

State: ___________ |

Zip Code: |

|

|

Send the proceeds of the HSA in a check made payable to “JPMorgan Chase Bank, N.A. in the account of <Your Name>” to:

JPMorgan Chase Bank, N.A. HSA Operations

P.O. Box 30207 Tampa, FL

Along with the check, please include this form or other correspondence including the account holder’s name, Social Security Number, and a confirmation that this is a HSA (or MSA)

Authorization to Transfer Funds:

Account Holder’s Signature _________________________________ Date: _______________

Please be advised, we may verify the account holder’s signature.

For questions about rollovers or

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used to request the rollover or transfer of funds into a Chase Health Savings Account (HSA). |

| Eligible Contributions | Funds can be rolled over from an existing Health Savings Account (HSA) or a Medical Savings Account (MSA) at another institution. |

| Mailing Information | Completed forms should be sent to JPMorgan Chase Bank, N.A., HSA Operations, P.O. Box 30207, Tampa, FL 33630-3207. |

| Signature Requirement | The account holder must sign the form to authorize the transfer and certify that the funds are eligible for rollover. |

| Telephone Contacts | For questions regarding rollovers or transfers, users should contact HSA Member Services at 866-524-2483. |

| Trustee-to-Trustee Transfers | Account holders may request direct transfers by informing their current HSA custodian and providing the necessary details. |

Guidelines on Utilizing Gc 1565

Completing the GC 1565 form is straightforward, but it’s essential to follow each step carefully to ensure a smooth transfer of funds into your Health Savings Account (HSA). After you fill out the form, you will need to send it along with the required check or coordinate with your current HSA custodian for a direct transfer.

- Begin by entering your Chase Health Savings Account number in the designated space.

- Fill in your name in the format of Last, First, MI.

- Provide your mailing address, including street, apartment number (if applicable), city, state, and zip code.

- Enter your daytime telephone number and Social Security Number, formatted as XXX-XX-XXXX.

- Indicate the type of account you are rolling over funds from by checking either the Medical Savings Account (MSA) or Health Savings Account (HSA) box.

- Write your account number from which you are rolling over funds.

- List the name of your current custodial institution and its address, including city, state, and zip code.

- When ready, sign the form, and write the date of signature next to your name.

- Attach the check made payable to “JPMorgan Chase Bank, N.A. in the account of

.” - Submit the completed form and check to JPMorgan Chase Bank, N.A., HSA Operations, P.O. Box 30207, Tampa, FL 33630-3207.

Ensure you verify your information before sending. If you have questions, HSA Member Services is available for assistance.

What You Should Know About This Form

What is the purpose of the GC 1565 form?

The GC 1565 form is used to request a rollover or transfer of funds into a Health Savings Account (HSA) from an existing Health Savings Account or Medical Savings Account held at another institution. Completing this form allows account holders to certify that the funds being transferred are eligible rollover contributions, ensuring compliance with HSA regulations.

How do I complete the GC 1565 form?

To complete the GC 1565 form, first provide the required personal information, including your HSA account number, your full name, mailing address, daytime telephone number, and Social Security number. Depending on your situation, you will need to select either the rollover instruction or trustee-to-trustee transfer option. If you're rolling over funds, request a distribution from your current HSA or MSA before filling out the form. After completing the necessary sections, sign and date the form, and send it along with a check addressed to “JPMorgan Chase Bank, N.A. in the account of

What are the differences between a rollover and a trustee-to-trustee transfer?

A rollover involves withdrawing funds from your current HSA or MSA and then depositing them into your new HSA within a specified time frame, typically 60 days. This process requires you to handle the funds directly. In contrast, a trustee-to-trustee transfer allows the current HSA custodian to transfer the funds directly to your new HSA without you taking possession of the money. This method often simplifies the process and reduces the risk of missing the deadline for the rollover.

Who should I contact for assistance with the GC 1565 form?

If you have questions or require assistance while completing the GC 1565 form, you can reach out to HSA Member Services at 866-524-2483. They can provide guidance on rollovers, trustee-to-trustee transfers, and any other inquiries related to your Health Savings Account.

Common mistakes

Filling out the GC 1565 form can be a straightforward process, but there are common pitfalls that people often encounter. Recognizing these mistakes can save you time and potential issues with the transfer of your Health Savings Account (HSA) funds.

One frequent mistake is neglecting to provide all necessary personal information. Some individuals leave sections like the Account Holder Name or Mailing Address blank, which can delay processing. Always double-check that each box is filled out clearly and accurately.

Another issue arises when people misinterpret rollover instructions. It's crucial to remember that funds can only be rolled over from eligible accounts. Failing to certify that the funds are eligible can lead to complications, so take your time to read the instructions thoroughly.

Many people also forget to sign the form. The Account Holder’s Signature is not just a formality; it's a critical component of the submission. An unsigned form may be returned, requiring you to start again.

In addition, incorrect Social Security Numbers (SSNs) are a common error. An incorrect SSN not only delays the process but could also result in tax complications. It’s essential to verify that your SSN matches your official documents.

Some individuals overlook the payment details required for the HSA transfer. When you're sending a check, ensure that it is made out correctly: “JPMorgan Chase Bank, N.A. in the account of

Misunderstanding the type of account can also cause confusion. Be sure to check the correct box for Account Type—whether it’s a Medical Savings Account (MSA) or Health Savings Account (HSA). An incorrect selection may complicate the transfer.

When providing your current custodian's details, it's easy to overlook the full address. Incomplete address information may hinder the timely processing of your request. Provide a thorough address to avoid this issue.

People may not include additional correspondence when submitting their transfer request. This letter should contain your account holder name, SSN, and a confirmation that you are initiating a trustee-to-trustee transfer. If the form is missing this information, it can result in delays.

Lastly, some applicants fail to keep copies of the completed form and the check they send. Keeping a record can be incredibly helpful if there are questions or issues that arise after submission. A simple copy can make follow-ups much easier.

By avoiding these common mistakes, you can help ensure that your transfer process is as quick and efficient as possible. Take your time, double-check your work, and you’ll be on your way to a successful HSA transfer.

Documents used along the form

When dealing with a Health Savings Account (HSA), several forms and documents may accompany the GC 1565 form to ensure proper processing of funds and compliance with relevant regulations. Below is a brief overview of some commonly used documents in conjunction with the GC 1565 form.

- HSA Transfer Form: This document allows the account holder to request a transfer of funds directly from one HSA custodian to another. It provides essential details of both accounts to ensure a smooth transfer process.

- Distribution Request Form: Prior to initiating a rollover, a distribution request is necessary. This form notifies the current custodian of the account holder's intent to withdraw funds for rollover into another HSA.

- W-9 Form: Completion of the W-9 form is often required to provide taxpayer information. This ensures that the receiving institution has the correct information for reporting any distributions or contributions made to the HSA.

- Custodial Agreement: This is a document that outlines the terms and conditions under which the Health Savings Account operates. It is essential for understanding the rights and responsibilities of both the account holder and the custodian.

- Proof of Eligibility Document: Depending on the institution’s requirements, the account holder may need to provide proof that the funds being rolled over are from an eligible account, such as a previous HSA or MSA.

- Account Closing Form: If transferring from an existing HSA, the account holder may need to fill out this form to formally close their previous account after the transfer has been completed.

In conclusion, each of these documents plays an important role in facilitating the transfer or rollover process of funds into a Health Savings Account. It is crucial for account holders to familiarize themselves with these forms to ensure a seamless experience when managing their HSAs.

Similar forms

-

Form 8889: Health Savings Accounts (HSAs) - This form is used to report contributions to and distributions from HSAs. It shares similarities with GC 1565 in that both facilitate the management and access of HSA funds.

-

Form 1099-SA: HSA, Archer MSA, or Medicare Advantage MSA Distribution - This document reports distributions from an HSA, aligning with GC 1565's focus on fund transfers and rollovers involving HSAs.

-

Form 5500: Annual Return/Report of Employee Benefit Plan - Used for reporting information about employee benefit plans, it relates to managing HSAs and MSAs similar to the documentation required in GC 1565.

-

Form 5305-A: Health Savings Account Custodial Agreement - This agreement between account holders and custodians establishes the terms of an HSA, paralleling the procedural elements found in the GC 1565.

-

Form 1040: U.S. Individual Income Tax Return - While primarily a tax return form, it requires reporting of HSA contributions and distributions, connecting to the funds management outlined in GC 1565.

-

Form 5305: SIMPLE Health Savings Account Plan - This establishes requirements for a SIMPLE HSA plan and connects to the transferring processes of funds as seen in GC 1565.

-

Form 990: Return of Organization Exempt from Income Tax - Nonprofit organizations with HSAs must file this form. Its connection to financial oversight is similar to the fund transfer focus of GC 1565.

-

Form W-2: Wage and Tax Statement - Employers report contributions made to an employee's HSA, relating to the overall contribution and distribution reporting similar to GC 1565.

-

Form 1065: U.S. Return of Partnership Income - Partnerships that set up HSAs for employees will report this. Like GC 1565, it addresses aspects of HSA participation in business contexts.

-

Form 3508: Paycheck Protection Program Loan Forgiveness Application - This form relates to businesses managing their funds during fiscal distress, paralleling financial management discussed in GC 1565.

Dos and Don'ts

When filling out the GC 1565 form for a Health Savings Account (HSA) rollover or transfer, it's crucial to follow specific guidelines to ensure a smooth process. Here’s a list of seven do’s and don’ts to help you navigate this task effectively:

- Do: Provide accurate personal information, including your full name, mailing address, and Social Security Number.

- Do: Clearly indicate whether you are rolling funds from a Medical Savings Account (MSA) or an HSA.

- Do: Make sure to request a distribution from your current HSA or MSA before completing the form.

- Do: Use clear and legible handwriting or, if possible, fill out the form electronically to avoid any misinterpretation.

- Do: Ensure the check is made payable to “JPMorgan Chase Bank, N.A. in the account of

” as specified in the instructions. - Do: Keep a copy of the completed form and any correspondence for your records.

- Do: Contact HSA Member Services at 866-524-2483 if you have questions or need clarification on the process.

- Don't: Skip providing your daytime telephone number; it is essential for any follow-up or clarification.

- Don't: Forget to sign and date the form. An unsigned form will lead to delays.

- Don't: Use a non-specific or vague mailing address. Be precise to ensure proper handling.

- Don't: Include funds that are not eligible for rollover; verify eligibility before submitting.

- Don't: Fail to double-check that the account information provided matches your current accounts.

- Don't: Wait until the last minute to submit the form. Allow for processing time by sending it as early as possible.

- Don't: Assume that verbal instructions will suffice; always provide written confirmation with the required documentation.

Misconceptions

Many people have misconceptions about the Gc 1565 form, which is used for managing Health Savings Accounts (HSAs) and Medical Savings Accounts (MSAs). Understanding the truth behind these misconceptions can help ensure that individuals successfully complete their transactions. Here are seven common misconceptions:

- 1. The Gc 1565 form is only for new accounts. Some believe the form is exclusively for opening new HSAs. However, it is primarily designed for rolling over or transferring funds from an existing HSA or MSA.

- 2. The rollover process is automatic. Many assume that funds will automatically roll over without further action. In reality, account holders must formally request a distribution and complete the Gc 1565 form.

- 3. Only certain institutions can process the Gc 1565 form. Some people think that only specific financial institutions can handle this form. In fact, as long as the institution is qualified to manage HSAs or MSAs, they can utilize it.

- 4. There are no limits on rollover amounts. Some believe that any amount can be transferred without restrictions. However, there are annual limits on contributions to HSAs that may affect the total amount eligible for rollover.

- 5. A signature is not necessary. Some people overlook the need for their signature on the form. A signature is required to verify authorization for the transfer.

- 6. The form can be submitted electronically. Many assume that electronic submission is an option. Unfortunately, the Gc 1565 form must be mailed in with a check, rather than submitted online.

- 7. All funds must be transferred at once. It's commonly misunderstood that transfers can only happen in a single transaction. In fact, individuals may choose to roll over funds over multiple transactions, if they prefer.

Understanding these misconceptions can streamline the process of transferring funds between HSAs and help individuals better manage their healthcare savings.

Key takeaways

When preparing to fill out and utilize the GC 1565 form for Health Savings Account transactions, it’s essential to keep several key points in mind. These takeaways will help ensure a smoother process when managing your funds.

- Complete Accurate Information: Ensure that all sections of the form are filled out completely and accurately. Missing or incorrect details can lead to delays in processing.

- Identify Your Account: Clearly write down your Chase Health Savings Account number, as this is crucial for the correct processing of your funds.

- Understand Rollover Instructions: Familiarize yourself with the rollover process. To transfer funds from another account, request a distribution from that existing Account first before completing the form.

- Signature Verification: Be prepared for a signature verification process. The bank may need to verify your identity based on the signature provided on the form.

- Mailing Details: When sending the form, make sure to mail it along with your check, addressed correctly to the indicated location in Tampa, Florida.

- Trustee-to-Trustee Transfers: If you are choosing to perform a trustee-to-trustee transfer, ensure your current HSA custodian receives the proper instructions along with this completed form.

- Contact for Assistance: If any questions arise during the rollover or transfer process, reach out to HSA Member Services for guidance. Their contact number is 866-524-2483.

- Keep Copies: Always keep a copy of the completed form and any correspondence for your records. This can be helpful for future reference or if any issues come up.

By following these key takeaways, you can navigate the GC 1565 form process more effectively. This preparedness will not only ease your experience but can also facilitate quicker access to your Health Savings Account funds.

Browse Other Templates

Electrical Test Sheet - Qualified supervisors oversee the certification process to guarantee competency.

Dot Physical Form - Detailing chronic conditions ensures that necessary precautions are noted in the driver's file.

Species Development Form,Evolutionary Change Worksheet,New Species Inquiry Sheet,Geographic Isolation Analysis,Speciation Exploration Form,Adaptation Assessment Worksheet,Isolated Species Investigation,Evolutionary Theory Questionnaire,Galapagos Spec - Geographic barriers can lead to unique ecosystems and the emergence of new species.