Fill Out Your H1049 Medicaid Form

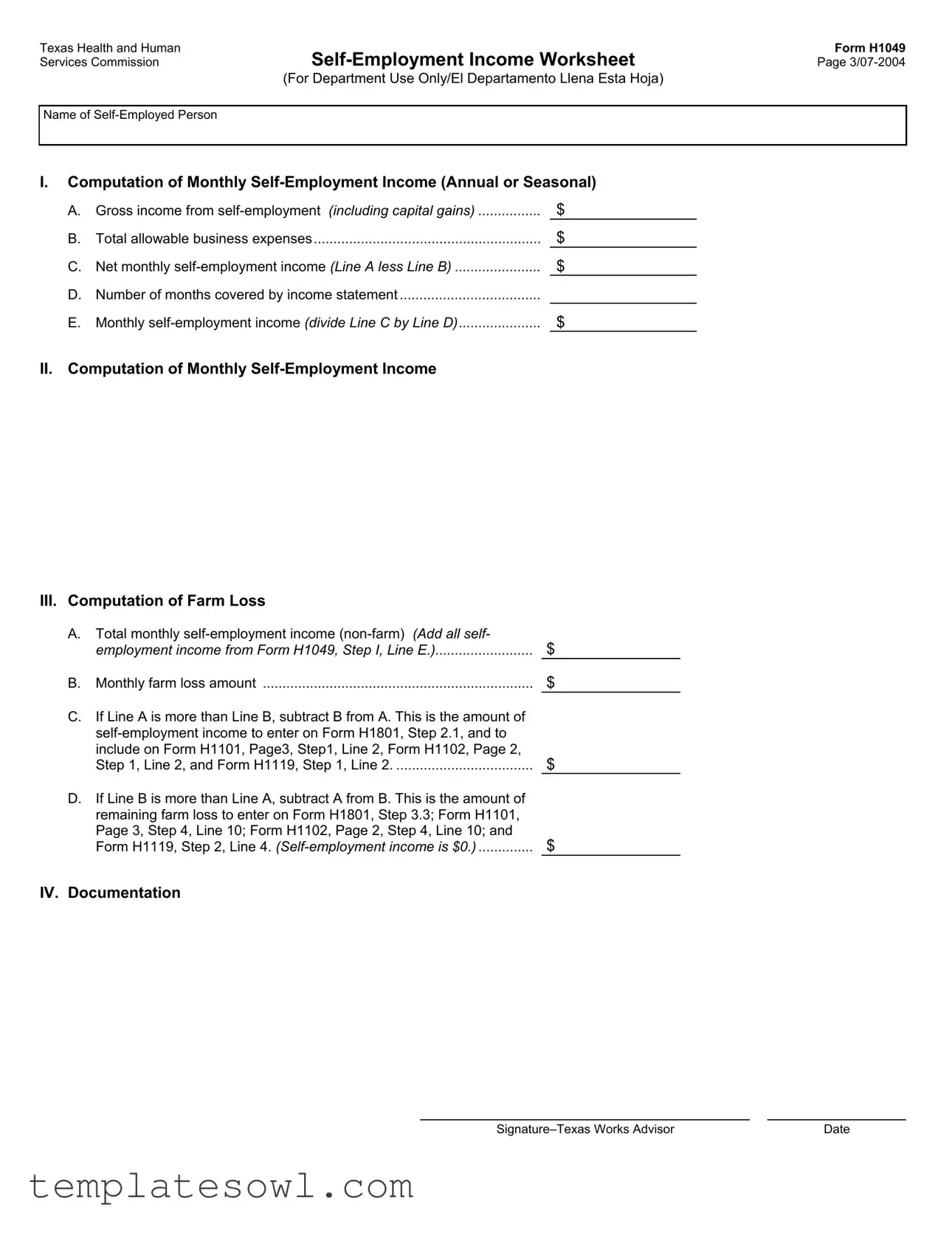

The H1049 Medicaid form plays a crucial role in the assessment of self-employment income for individuals seeking assistance through Texas's Medicaid program. This form allows applicants to document their self-employment income by calculating both gross income and allowable business expenses, ultimately determining the net monthly self-employment income. It's structured in a way that guides users through a series of computations, making it easier to understand how various elements contribute to their overall income picture. Additionally, it includes a section to account for farm losses, a vital consideration for those whose livelihood may involve agricultural activities. The form culminates in a numeric output that influences how applicants report their income on other related forms. Furthermore, the form is designed for ease of use, ensuring that applicants can provide the necessary information with clarity and precision. By understanding the major aspects of the H1049 form, individuals can enhance their chances of a successful application by accurately representing their financial situation.

H1049 Medicaid Example

Texas Health and Human |

Form H1049 |

|

Services Commission |

Page |

|

|

(For Department Use Only/El Departamento Llena Esta Hoja) |

|

|

|

|

Name of |

|

|

|

|

|

I.Computation of Monthly

A. |

Gross income from |

$ |

B. |

Total allowable business expenses |

$ |

C. |

Net monthly |

$ |

D. |

Number of months covered by income statement |

|

E. |

Monthly |

$ |

II. Computation of Monthly

III.Computation of Farm Loss

A.Total monthly

B.Monthly farm loss amount .....................................................................

C.If Line A is more than Line B, subtract B from A. This is the amount of

D.If Line B is more than Line A, subtract A from B. This is the amount of remaining farm loss to enter on Form H1801, Step 3.3; Form H1101, Page 3, Step 4, Line 10; Form H1102, Page 2, Step 4, Line 10; and Form H1119, Step 2, Line 4.

$

$

$

$

IV. Documentation

Date |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Identifier | Form H1049 is a worksheet used for calculating self-employment income to determine eligibility for Medicaid in Texas. |

| Governing Law | This form is governed under the Texas Health and Human Services Commission rules regarding Medicaid eligibility. |

| Purpose | The primary purpose of H1049 is to document and compute gross income and allowable business expenses for self-employed individuals. |

| Sections | The form includes sections for computation of monthly self-employment income and documentation of farm losses if applicable. |

| Submission Requirement | Form H1049 must be completed and submitted to the Texas Works Advisor to assess eligibility for benefits. |

Guidelines on Utilizing H1049 Medicaid

After correctly filling out the H1049 form, you will submit it along with any required documentation to the relevant authorities. Completing this process accurately ensures that your self-employment income is considered when determining your eligibility for Medicaid.

- Obtain the H1049 form. You can download it from the Texas Health and Human Services website or request a physical copy from your local office.

- Provide your name. At the top of the form, enter the name of the self-employed person.

- Complete Section I. For each line:

- A. Enter your total gross income from self-employment, including any capital gains.

- B. List all allowable business expenses.

- C. Calculate your net monthly self-employment income by subtracting Line B from Line A.

- D. Indicate the number of months that are covered by your income statement.

- E. Divide Line C by Line D to determine your monthly self-employment income.

- Complete Section II. Use the same method as Section I if applicable.

- Complete Section III. For this section, follow these steps:

- A. Add up all your self-employment income from Form H1049, Step I, Line E.

- B. Enter your monthly farm loss amount.

- C. If your total monthly self-employment income is greater than your farm loss amount, subtract B from A. This is the income to enter on other required forms.

- D. If your farm loss amount is greater than your total monthly self-employment income, subtract A from B. This represents the remaining farm loss to be documented on other forms.

- Provide supporting documentation. Attach any required documents showing your income and expenses as proof.

- Sign and date the form. The Texas Works Advisor must also sign the form and provide the date of completion.

What You Should Know About This Form

What is the H1049 Medicaid form used for?

The H1049 Medicaid form, also known as the Self-Employment Income Worksheet, is utilized to determine the self-employment income of individuals applying for Medicaid in Texas. This information is crucial for assessing eligibility and calculating benefits.

Who needs to complete the H1049 form?

Any individual who is self-employed and applying for Medicaid in Texas needs to complete the H1049 form. This applies to both annual and seasonal income from self-employment, including farming activities.

How is net monthly self-employment income calculated?

To calculate net monthly self-employment income, you will subtract total allowable business expenses from gross income. This result provides the net self-employment income, which is then divided by the number of months covered by the income statement.

What information is required to complete the H1049 form?

You will need to provide your gross income from self-employment, total business expenses, and the time period your income statement covers. Additional details regarding any farm income or losses should also be included if applicable.

What happens if I have both self-employment income and farm losses?

If your net self-employment income from non-farm activities exceeds your farm loss, you will enter that amount on the required forms. Conversely, if your farm losses exceed your self-employment income, you will need to report the remaining farm loss on the designated forms as indicated.

Is there a specific format for reporting allowable business expenses?

While there is no strict format, ensure that all expenses are documented and clearly listed. Common allowable business expenses may include supplies, equipment, rent, and utilities directly related to your self-employment activities.

How often should I submit the H1049 form?

The H1049 form should be submitted whenever you apply for Medicaid or if there is a significant change in your income. Make sure to stay updated with Texas Medicaid requirements, as they may change.

Do I need to attach supporting documents with the H1049 form?

Who should I contact if I have questions about the H1049 form?

If you have questions about completing the H1049 form, you can reach out to your Texas Works Advisor. They can provide guidance and clarification based on your specific situation.

Where can I find the H1049 form?

The H1049 form is available on the Texas Health and Human Services Commission website. You can download it directly from their website or obtain a copy at your local Medicaid office.

Common mistakes

Completing the H1049 Medicaid form can be challenging, and many individuals make common mistakes that can lead to delays or denials of their applications. One frequent error is failing to accurately report gross income from self-employment. Some may underestimate their earnings or exclude certain income sources, like capital gains. This oversight can alter the final calculations and affect eligibility.

Another mistake often seen is improperly calculating allowable business expenses. Applicants may not be aware of what qualifies as a deductible expense or may include personal expenses instead. This can inflate the reported net income, which may disadvantage the applicant by suggesting higher earnings than reality.

Many individuals also struggle with the computation of net monthly self-employment income. This figure is crucial because it impacts future calculations for monthly income. Misplacing figures or miscalculating the net amount can lead to incorrect conclusions about one's financial status.

Failing to specify the number of months covered by the income statement is another mistake. This detail is necessary to calculate the monthly self-employment income accurately. Inaccuracies here can lead to a misrepresentation of income that can influence the overall determination of benefits.

Some applicants forget to divide their net income by the number of months specified. This step determines the monthly self-employment income. Skipping it or miscalculating can significantly impact the perceived financial situation of the applicant.

Moreover, it's not uncommon for individuals to overlook the farm loss computations stated in the form. Self-employed individuals with farming income must accurately calculate the farm loss, which could alter their self-employment income dramatically. Ignoring these calculations can unintentionally misrepresent their financial status.

Finally, ensuring that all sections of the form are filled out completely is essential. Incomplete submissions can lead to processing delays. This includes neglecting the signature section at the bottom, which is vital for validating the document. All applicants should take the time to review each section to avoid these common pitfalls.

Documents used along the form

The H1049 Medicaid form is an essential document for self-employed individuals applying for Medicaid in Texas. Along with this form, several other documents may be required to ensure a comprehensive assessment of income and financial standing. Each of these forms serves a specific purpose in the Medicaid application process.

- Form H1801: This form is used to report income and resources for individuals applying for Medicaid. It details both earned and unearned income, aiding in the determination of eligibility.

- Form H1101: This is a resource assessment form that evaluates household resources. Information about assets such as bank accounts and property is collected to assess overall financial eligibility.

- Form H1102: Similar to the H1101, this form specifically focuses on income deductions and expenses to ensure applicants receive fair consideration based on their financial situation.

- Form H1119: Used for documenting additional income sources, this form helps outline special circumstances that might affect income calculations, ensuring an accurate reevaluation of Medicaid eligibility.

- Tax Returns: Recent tax returns provide an official record of income, supporting the figures reported on forms related to self-employment income and overall financial status.

- Profit and Loss Statements: These statements give a summary of income and expenses for a self-employed individual, demonstrating the profitability of the business and any losses incurred.

- Bank Statements: Current bank statements verify monthly income and expenses. They serve as an additional layer of financial evidence required by Medicaid authorities.

- Business Licenses: A copy of any current business licenses can be necessary to confirm the legitimacy of the self-employment status. This documentation is crucial for establishing eligibility.

Collectively, these forms and documents will streamline the Medicaid application process for self-employed individuals. Having the necessary paperwork at hand can help ensure a more efficient review and a better chance of successful application outcomes.

Similar forms

Form H1801: Similar to the H1049, this form is used to assess income eligibility for Medicaid and requires detailed information on self-employment income. Both forms focus on accurately reporting income for financial assessments.

Form H1101: This document is utilized for reporting income and expenses related to self-employment. It shares a common goal with the H1049 in determining net income from self-employment for Medicaid eligibility.

Form H1102: Like the H1049, the H1102 assesses total income for Medicaid applications. Both forms demand precise calculations of income and allowable deductions, ensuring consistency in reporting.

Form H1119: This form also addresses self-employment income reporting for Medicaid eligibility. It complements the H1049 by detailing various income sources and deductions, similar in functioning and purpose.

Form H1020: The H1020 formulates a similar purpose, dealing with income verification. It seeks to establish total income and ensure that applicants meet Medicaid standards through exhaustive financial disclosure.

Form H1018: This document is used to assess resource eligibility and income from self-employment. The structure and focus on net income reflect those of the H1049, highlighting similar reporting requirements.

Form H1006: The H1006 emphasizes monthly income evaluation for Medicaid applicants. It includes nuances similar to the H1049, focusing on comprehensive income assessments for self-employed individuals.

Form H3940: This form is intended for reporting self-employment income in relation to other benefits. The approach aligns with the H1049, as it also requires detailed breakdowns of income and operating expenses.

Dos and Don'ts

Filling out the H1049 Medicaid form is an important step in ensuring you receive the support you need for your self-employment income. However, certain common mistakes can hinder your application process. Here is a guide outlining what you should and shouldn’t do when completing this form.

- Do ensure that all income figures are accurate and reflect your gross income before any expenses.

- Do clearly document your allowable business expenses. Include only those that are necessary for your business operations.

- Do calculate your net monthly self-employment income carefully. Divide your total self-employment income by the appropriate number of months.

- Do review the form for completeness. Ensure that your name and signature are included with the date.

- Don’t omit any sources of income. All forms of self-employment income must be reported.

- Don’t include personal expenses that are not related to your business when calculating allowable expenses.

- Don’t rush through the calculations. Errors can lead to delays or rejections of your application.

- Don’t forget to keep copies of the completed form and any documentation you provide for your records.

By following these guidelines, you can navigate the application process more smoothly and improve your chances of a successful outcome. Remember, accurate information is crucial for a fair evaluation of your circumstances.

Misconceptions

Understanding the H1049 Medicaid form is essential for those navigating self-employment income reporting. However, several misconceptions surround this important document. Below are nine common misunderstandings, clarifying what people often get wrong.

- The H1049 form is only for individuals with farm income. This form is applicable to any self-employed person, regardless of whether their income derives from farming. It encompasses all types of self-employment, including non-farm activities.

- Only profits must be reported on the H1049 form. It is vital to report both gross income and allowable business expenses. The calculation of net income requires subtracting these expenses from the gross income.

- The form requires monthly income statements exclusively. While monthly income is key, the form can accommodate various reporting periods. Users must correctly indicate the number of months covered by their income statement.

- Self-employment income is not considered for Medicaid eligibility. Self-employment income significantly impacts Medicaid eligibility. Understanding how to calculate and report it accurately is crucial.

- Documentation is unnecessary after filling out the H1049 form. It is important to maintain thorough documentation. Records verifying income and expenses must be available for review if requested by Medicaid officials.

- Losses from self-employment cannot offset other income. The H1049 form allows for the reporting of both self-employment income and business losses. Adjustments can be made to calculate the overall financial picture.

- The computations on the H1049 are straightforward and require little attention. Attention to detail is essential. Accurate calculations significantly affect financial assessments and eligibility determinations.

- Submission of the H1049 form guarantees Medicaid approval. Completing this form is just one step in the Medicaid application process. Approval depends on a variety of factors, including overall financial eligibility.

- The H1049 form is static and unchanging. Medicaid regulations and forms can evolve. It is prudent to check for updates or changes to the form periodically to ensure compliance with current requirements.

Addressing these misconceptions helps individuals better navigate self-employment income reporting and its implications for Medicaid eligibility.

Key takeaways

When filling out the H1049 Medicaid form, keep the following key takeaways in mind:

- Understand the purpose: This form is primarily used to calculate monthly self-employment income, which impacts Medicaid eligibility.

- Gather necessary information: Before you start, collect income statements and records of business expenses to ensure accurate reporting.

- Calculate gross income: Line A requires you to report your total gross income from self-employment, including any capital gains.

- Deduct expenses: On Line B, list all allowable business expenses. This will help determine your net income.

- Find net income: Subtract total business expenses from gross income to get your net monthly self-employment income for Line C.

- Account for reporting period: Indicate how many months the income statement covers in Line D to accurately calculate average monthly income.

- Calculate monthly income: Divide the net monthly income (Line C) by the number of months (Line D) to find your monthly income for Line E.

- Include farm income and losses: If you have both self-employment and farm income, carry out the computations in Section III to determine overall income or losses.

- Review the instructions: Carefully read all instructions on the form to ensure you’re filling it out as required.

- Sign and date: Don’t forget to sign and date the form at the end; incomplete forms may delay processing.

Filling out the H1049 form accurately is crucial for accessing Medicaid services. Take your time and ensure all information is complete and precise.

Browse Other Templates

Texas Workers Compensation - Understanding the purpose of the RME can help alleviate concerns for injured employees.

Va 26-8937 - The VA 26-8937 requires a veteran's personal details including name, address, and date of birth.

Kmart Donations - Detailing other supporters of the event can strengthen your application.