Fill Out Your Hardship Withdrawal Request Form

The Hardship Withdrawal Request Form is essential for individuals in the Plumbers Local Union No. 1 Employee 401(k) Savings Plan seeking relief from financial difficulties. Each section of the form must be completed carefully. It requires a personal signature on the certification page, affirming the financial hardship and authorizing the withdrawal. Assembling adequate documentation to support your request is critical. A lack of required paperwork can lead to delays or outright denial of the withdrawal. Be mindful that the documents needed are specified in the Required Documentation Instructions attached at the end of the form. Additionally, updating your Notification Preference will ensure you receive updates about your request in a timely manner. After gathering all materials, you can mail, express mail, or fax your request to Prudential Retirement. Upon receiving the application, Prudential will assess the documents to determine eligibility based on Internal Revenue Code regulations and Plan provisions. If approved, your hardship withdrawal amount will depend on the verified financial need, and all distributions will be reported to the IRS. Keep in mind that the responsibility of meeting tax obligations falls on you, and it’s advisable to consult a tax or legal professional for guidance. Customer service representatives are available to assist you further, ensuring you navigate the process smoothly.

Hardship Withdrawal Request Example

|

|

72 |

|

|

Hardship Withdrawal Request Form |

|

|

Plumbers Local Union No. 1 Employee 401(k) Savings Plan |

|

|

|

|

1. |

Complete all sections in this form. |

|

||

Instructions 2. |

Sign the page titled "Certification of Financial Hardship and Authorization." |

|

3. |

Obtain and submit all required documentation that pertains to the reason for your request. |

|

Note: The documents you need to attach to your Request for Hardship Withdrawal Request Form to substantiate the nature of your hardship request are detailed on the Hardship Withdrawal Request Required Documentation Instructions (located at the end of this document).

Important: Requests received with documentation that is incomplete or does not meet the requirements described will not be processed until they are in good order, which could cause a substantial delay in receiving your funds.

It is your responsibility to obtain and verify the documents you submit meet the stated requirements.

4.Please be sure to update your 'Notification Preference' to be notified of the status of your request (if applicable).

5.Mail all forms and documentation to:

Regular Mail to: |

OR |

Express Mail to: |

OR |

Fax to: |

Prudential Retirement |

|

Prudential Retirement |

|

|

PO Box 5410 |

|

30 Scranton Office Park |

|

|

Scranton, PA |

|

Scranton, PA |

|

|

|

|

Upon receipt of your hardship request, all documents will be reviewed by Prudential. |

|

|

|

Approval/ |

• If your paperwork is not in good order, the hardship distribution request will be denied. We will notify |

|

Denial of |

you of our findings. Please note that the documents submitted will not be returned to you, therefore, |

|

Hardship |

please make copies for your records. |

|

|

||

Request |

• If it is determined that you qualify for a hardship based on current Internal Revenue Code regulations |

|

|

|

and Plan provisions, Prudential will process your request. |

•All hardship distributions are reported to the Internal Revenue Service on Form

•In the event of an audit you must retain documentation to support your claim of financial hardship and to demonstrate compliance. Tax or legal counsel should be consulted regarding the permissibility of any distribution.

To understand your withdrawal process, refer to the page titled "Important Notice to Participants Taking a Hardship Withdrawal". In taking this withdrawal it is extremely important that you review this in order to complete this form appropriately and expedite your request.

Customer Service representatives are available to help you complete the forms, or answer general questions you may have about your distribution or about your Plan. Call

Personal assistance with a Customer Service representative is available Monday through Friday, 8 a.m. to 9 p.m. Eastern Time, except on holidays.

Our representatives look forward to providing you with information in English, Spanish, or many other languages through an interpreter service.

Account information is available for the hearing impaired by calling us at

Ed. 11/12/2019

Plan number: 920010

Page 1 of 27

72

Hardship Withdrawal Request Form

Plumbers Local Union No. 1 Employee 401(k) Savings Plan

|

|

|

Plan number |

|

|

|

|

|

|

|

|

|

||||||||

About You |

|

|

|

2 |

|

0 |

|

0 |

|

1 |

|

0 |

|

|

|

|||||

|

9 |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|||||||||||||||

Social Security number |

||||||||||||||||||||

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

- |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Sub Plan number

0 0 0 0 0 1

Plumbers 1

First name |

MI |

|

|

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

City |

|

|

|

|

|

|

|

|

State |

|

|

ZIP code |

|||||||||||||||||||||||||||||||||||||||||||

-

Date of birth |

|

|

|

|

|

|

|

|

|

Gender |

|

|

|

|

Fax Number |

|||||||||||

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

M |

|

|

|

F |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

month |

|

day |

|

year |

|

|

|

|

|

|

|

area code |

||||||||||||||

Preferred Email address (how Prudential will contact you, if needed)

-

Daytime telephone number

- |

|

|

|

|

|

- |

|

|

area code

Mobile telephone number

- |

|

|

|

|

|

- |

|

|

area code

Notification Preference (how you prefer Prudential to contact you for this request, choose one): ___ Email ___SMS Text

Please note: If neither email or text are selected (or both), we will default to email if provided.

Please review all the enclosed information before proceeding.

Reason for Hardship Withdrawal

(Check all that apply)

I hereby request a Hardship Withdrawal for the following reason(s). I agree to provide the applicable documentation as described in the Hardship Withdrawal Request Required Documentation Instructions.

**Please refer to Important Notice to Participants Taking a Hardship Withdrawal for a definition of dependent in IRC Section 152

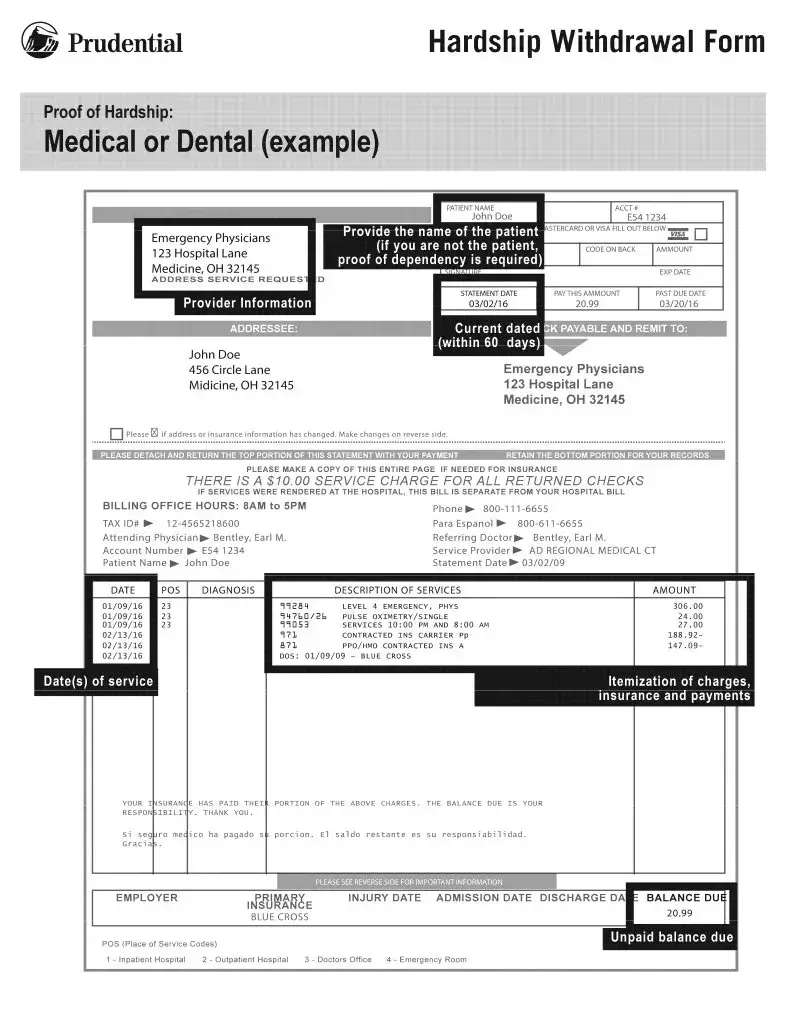

Medical/Dental expenses incurred by me, my spouse, or any of my dependents, or primary beneficiary.

Purchase (excluding mortgage payments) of my principal residence.

Payment of tuition for the next 12 months of

Payments needed to prevent eviction or imminent mortgage foreclosure from my principal residence.

Payment of burial or funeral expenses for my deceased parent, spouse, child, dependent, or primary beneficiary.

Expenses for the repair of damage to my principal residence that qualifies for a casualty deduction.

Important: Documentation requirements for your Hardship withdrawal are located in the Hardship

Withdrawal Request Required Documentation Instructions at the end of this document. The documents

listed must be included with your request.

Ed. 11/12/2019

Plan number: 920010

Page 2 of 27

Withdrawal

Request

Amount

(You will only be approved for up to the documented financial need)

The disbursement amount will be taken from your account according to the hierarchy determined by your Plan/Program. If the amount requested exceeds your maximum hardship withdrawal amount, you will be paid the maximum amount available.

Amount: $________________ A SPECIFIC AMOUNT IS REQUIRED

If you would like your hardship withdrawal to include additional amounts necessary to pay anticipated taxes, penalties and applicable fees (this is called a

I would like to

By checking this box, I would like to increase the withdrawal amount to cover any federal and state income taxes, penalties & applicable fees that may be reasonably anticipated as a result of this withdrawal.

•Your election for Federal & State Income Tax in the following tax sections will be used as the amount of reasonably anticipated taxes in the

•If applicable, the 10% penalty amount will be added to your withdrawal

•The total maximum allowed to

•

•Withhold the Federal & State Income Tax amount(s) you elect in the following tax sections (even if greater than 35%)

I certify that I have obtained all funds currently available to me from this and any other plan of the Employer. If I have not taken all available

•The

•The

•The

•The Qualified Joint Survivor Annuity Notice/Spoual Waiver provided applies to both the

Ed. 11/12/2019

Plan number: 920010

Election for Withholding of Federal Income Tax

Federal tax laws require us to withhold income taxes from the taxable portion of a qualified retirement plan distribution. Some states also require withholding from the taxable portion of your distribution if federal income tax is withheld. Hardship disbursements are subject to 10% federal income tax withholding, unless you elect otherwise. You can elect to have no federal income taxes withheld by checking the box below. If you elect out of withholding, you are still responsible for payment of any taxes due, and you may incur penalties if your withholding and/or estimated tax payments are not sufficient. If you do not check one of the options below, 10% federal income tax withholding will be automatically deducted from your payment.

1. |

I elect to have federal income tax withheld at 10% from the taxable amount of my distribution. |

||||

2. |

I elect not to have federal income tax withheld from my distribution. |

|

|

||

3. |

I elect to have federal income tax withheld from the taxable amount of my distribution at either the |

||||

|

following percentage or dollar amount. The federal withholding calculated from your election |

||||

|

below must be at least 10% of the taxable amount of my distribution amount. |

||||

|

______________________ % or |

$ |

|

.00 |

|

It is our understanding a hardship disbursement is not eligible to be rolled over. All or part of the taxable portion of your hardship disbursement may be subject to an additional 10% federal income tax penalty on early distributions, unless you qualify for an exception. Since neither Prudential nor any of its employees, agents or representatives can give legal or tax advice, or financial advice on behalf of your Plan, you are urged to consult your own personal legal, tax and/or financial advisor with any questions on allowances, deductions, or tax credits that may apply to your particular situation before you take any action.

Ed. 11/12/2019

Plan number: 920010

Page 4 of 27

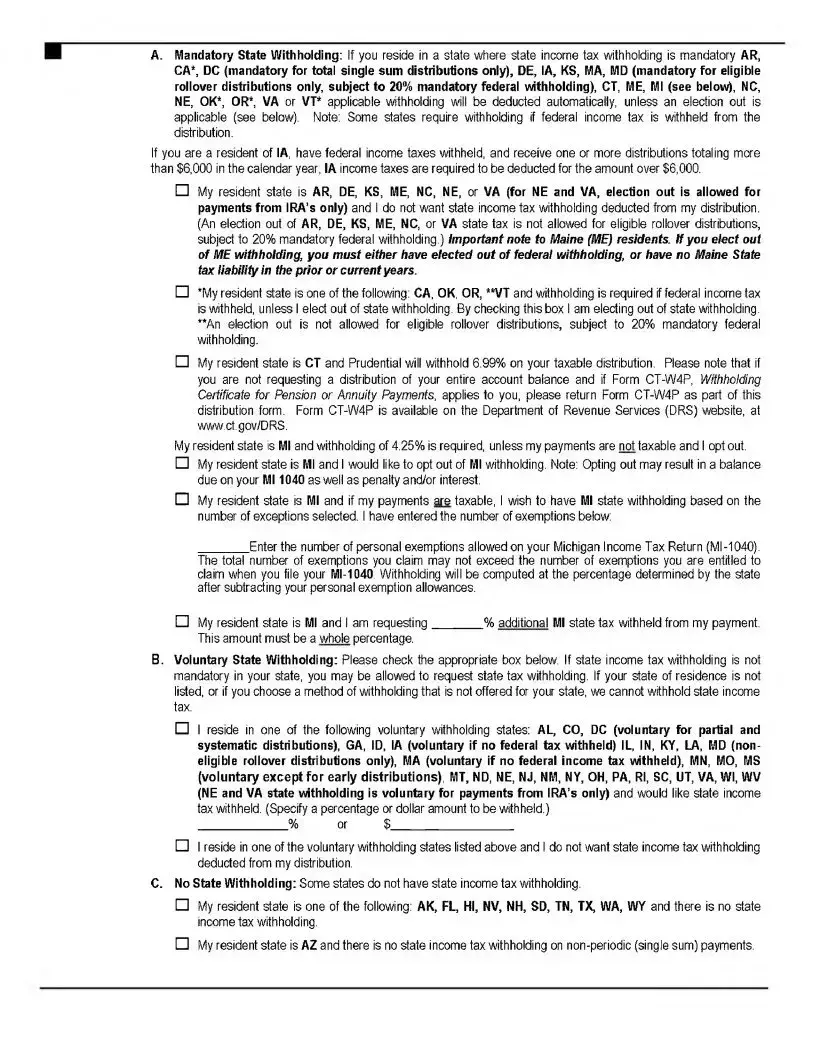

Election for Withholding of State Income Taxes

(For Single Sum Payments and

Rollovers of

Ed. 11/12/2019

A.Mandatory State Withholding: If you reside in a state where state income tax withholding is mandatory AR, CA*, DC (mandatory for total single sum distributions only), DE, IA, KS, MA, MD (mandatory for eligible rollover distributions only, subject to 20% mandatory federal withholding), CT, ME, Ml (see below), NC, NE, OK*, OR*, VA or VT* applicable withholding will be deducted automatically, unless an election out is applicable (see below). Note: Some states require withholding if federal income tax is withheld from the distribution.

If you are a resident of IA, have federal income taxes withheld, and receive one or more distributions totaling more than $6,000 in the calendar year, IA income taxes are required to be deducted for the amount over $6,000.

□My resident state is AR, DE, KS, ME, NC, NE, or VA (for NE and VA, election out is allowed for payments from IRA’s only) and I do not want state income tax withholding deducted from my distribution. (An election out of AR, DE, KS, ME, NC, or VA state tax is not allowed for eligible rollover distributions, subject to 20% mandatory federal withholding ) Important note to Maine (ME) residents. If you elect out of ME withholding, you must either have elected out of federal withholding, or have no Maine State tax liability in the prior or current years.

□*My resident state is one of the following: CA, OK, OR, **VT and withholding is required if federal income tax is withheld, unless I elect out of state withholding. By checking this box I am electing out of state withholding. **An election out is not allowed for eligible rollover distributions, subject to 20% mandatory federal withholding.

□My resident state is CT and Prudential will withhold 6.99% on your taxable distribution. Please note that if you are not requesting a distribution of your entire account balance and if Form

My resident state is Ml and withholding of 4.25% is required, unless my payments are not taxable and I opt out.

□My resident state is Ml and I would like to opt out of Ml withholding. Note: Opting out may result in a balance due on your Ml 1040 as well as penalty and/or interest.

□My resident state is Ml and if my payments are taxable, I wish to have Ml state withholding based on the number of exceptions selected. I have entered the number of exemptions below:

________ Enter the number of personal exemptions allowed on your Michigan Income Tax Return

□My resident state is Ml and I am requesting________ % additional Ml state tax withheld from my payment. This amount must be a whole percentage.

B.Voluntary State Withholding: Please check the appropriate box below. If state income tax withholding is not mandatory in your state, you may be allowed to request state tax withholding. If your state of residence is not listed, or if you choose a method of withholding that is not offered for your state, we cannot withhold state income tax.

□I reside in one of the following voluntary withholding states: AL, CO, DC (voluntary for partial and systematic distributions), GA, ID, IA (voluntary if no federal tax withheld) IL, IN, KY, LA, MD (non- eligible rollover distributions only), MA (voluntary if no federal income tax withheld), MN, MO, MS (voluntary except for early distributions), MT, ND, NE, NJ, NM, NY, OH, PA, Rl, SC, UT, VA, Wl, WV (NE and VA state withholding is voluntary for payments from IRA’s only) and would like state income tax withheld. (Specify a percentage or dollar amount to be withheld.)

______________ % or $___________________

□I reside in one of the voluntary withholding states listed above and I do not want state income tax withholding deducted from my distribution.

C.No State Withholding: Some states do not have state income tax withholding.

□My resident state is one of the following: AK, FL, HI, NV, NH, SD, TN, TX, WA, WY and there is no state income tax withholding.

□My resident state is AZ and there is no state income tax withholding on

Plan number: 920010

Page 5 of 27

Payment Options

Please select a payment option below. If no selection is made, a check will be sent via regular mail.

Express Mail (The cost is $25 per check. Prudential will deduct $25 from your account prior to the distribution.)

Please Note: Express mail is not available for delivery to post office boxes.

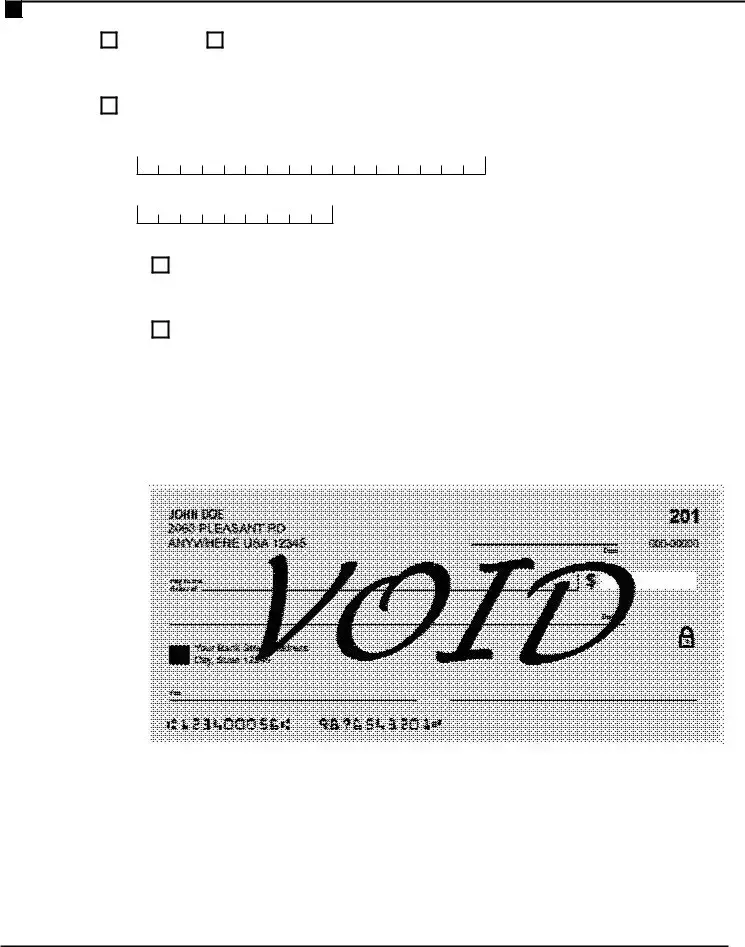

Electronic Funds Transfer (EFT).

If you would like your disbursement sent to you via EFT, please provide the information below.

Account Number

Financial Institution Routing/Transit/ABA Number

Type of Account (please choose one):

Checking

(Must attach a voided check below, or include a letter from your financial institution signed by an authorized representative, with your name, checking account number, and ABA routing number.)

Savings

(Must include a letter from your financial institution signed by an authorized representative, with your name, savings account number, and ABA routing number.)

IMPORTANT: Your EFT payment may result in a check payable to you if:

•Your voided check or financial institution letter is not included

•All of the necessary information is not provided

•This section does not apply to your disbursement request

Please Tape Voided Check Here (we are not able to accept starter or

I have carefully read this form and I hereby authorize Prudential to make this Plan payment(s) to the financial institution listed above in the form of Electronic Fund Transfer (EFT). I understand Prudential is not responsible for any losses associated with incorrect information provided (e.g. wrong banking instructions).The credit will typically be applied to your account within 2 business days of being processed.

In the event that an overpayment is credited to the financial institution account listed above, I hereby authorize and direct the financial institution designated above to debit my account and refund any overpayment to Prudential. This authorization will remain in effect until Prudential receives a written notice from me stating otherwise and until Prudential has had a reasonable chance to act upon it.

Ed. 11/12/2019

Plan number: 920010

Page 6 of 27

Certification

of Financial

Hardship and

Authorization

I certify that the information provided on this form and on any attached forms is true, correct, and complete to the best of my knowledge. I authorize representatives of my plan to verify any or all of the information submitted. I acknowledge and agree that any false or misleading information submitted on this form or any attached form may subject me to personal liability. Furthermore, my employer may exercise its rights against me if damaged by false or misleading information I submit, i.e. termination or suspension. I also certify that I am eligible for distribution of funds from the Plan. I am aware this distribution will increase my taxable income for the year. I further certify that this withdrawal is necessary to satisfy the hardship described, that the amount requested is not in excess of the amount necessary to relieve the financial need, and that I have insufficient cash or other liquid assets to satisfy the need. I have read the entire Hardship Withdrawal form and application.

As a Participant of the

I have obtained all currently available distribution amounts under this and any other plan of the Employer, including all

I have reviewed all the information contained in the Attachment to the Hardship Withdrawal Request and believe, in good faith, that I qualify for this hardship withdrawal;

I have included in this submission the requested documentation that evidences my financial need.

I understand that my request for a hardship withdrawal from the Plan may generally not be revoked once processed.

Generally, forms expire after 90 days. I understand that I may be required to complete a new form if all required information and documentation is not received before the expiration date.

Privacy Act Notice:

If your employer engages the services of Prudential Retirement to qualify hardships on their behalf, this information is to be used by Prudential Retirement in determining whether you qualify for a financial hardship under your retirement Plan. It will not be disclosed outside Prudential Retirement except as required by your Plan and permitted by law for regulatory audits. You do not have to provide this information, but if you do not, your application for a hardship may be delayed or rejected.

Consent:

By signing below, I consent to allow Prudential Retirement to request and obtain information for the purposes of verifying my eligibility for a financial hardship under this Plan.

If there are investment options available through your retirement account that are subject to the fund’s market timing policies, you may be subject to restrictions or incur fees if you engage in excessive trading activity in those investments. You may wish to review the fund prospectus or your retirement account’s market timing policy prior to submitting this transaction request. If a fee applies to the transaction, you will be able to view the details after the transaction is processed by logging on to the retirement internet site at www.prudential.com/online/retirement.

X |

|

Date |

Participant's signature |

(REQUIRED) |

|

Ed. 11/12/2019

Plan number: 920010

Page 7 of 27

Important Notice to Participants Taking a Hardship Withdrawal

Hardship Withdrawals and other Plan Withdrawal Options

If your plan allows for other

Brokerage Accounts

If you have any of your account balance invested in brokerage accounts, then you are responsible for transferring the proceeds of funds from your brokerage account to your Prudential participant account before you request a distribution. Prudential Retirement will not automatically perform the transfer.

Federal and State Tax Withholding

The withdrawals you receive from your Plan are subject to Federal Income Tax withholding unless you elect not to have withholding apply. Withholding will only apply to the portion of your distribution or withdrawal that is included in your income subject to Federal Income Tax. If you elect not to have withholding apply to your withdrawal, or if you do not have enough Federal Income Tax withheld from your withdrawal, you may be responsible for payment of estimated tax. You may incur penalties under the estimated tax rule if your withholding and estimated tax payments are not sufficient.

Note that a voluntary withholding election cannot be made involving accounts for which a name and/or taxpayer identification number (TIN) is incorrect or missing. See IRS Publication 1586 for information about mandatory withholding when a participant’s (or beneficiary’s) TIN is missing or incorrect.

For specific state tax withholding information, refer to the section of the form titled "Election for Withholding of State Income Taxes."

Ed. 11/12/2019

Plan number: 920010

Page 8 of 27

Important Notice to Participants Taking a Hardship Withdrawal

(Continued)

Dependent

The definition of "dependent" is important in the application of the "deemed hardship" withdrawal standards that pertain to plans/programs. Unless a specific exception applies, a dependent must either be a "qualifying child" or a "qualifying relative". These terms are defined as follows:

Qualifying Child

A qualifying child is a child or descendant of a child of the taxpayer. A child is a son, daughter, stepson, stepdaughter, adopted child or eligible foster child of the taxpayer. A qualifying child also includes a brother, sister, stepbrother or stepsister of the taxpayer or a descendant of any such relative. In addition, the individual must have the same primary place of abode as the participant for more than half of the taxable year, the individual must not have provided over half of his own support for the calendar year, and the individual must not have attained age 19 by the end of the calendar year. An individual who has attained age 19 but is a student who will not be 24 as of the end of the calendar year and otherwise meets the requirements above is also considered a qualifying child. Special rules apply to situations such as divorced parents, disabled individuals, citizens or nationals of other countries, etc. Please see your tax advisor for further details regarding special situations.

Qualifying Relative

A qualifying relative is an individual who is not the participant's "qualifying child", but is the participant's: child, descendant of a child, brother, sister, stepbrother, stepsister, father, mother, ancestor of the father or mother, stepfather, stepmother, niece, nephew, aunt, uncle,

Primary Beneficiary

A “primary beneficiary under the plan” is a named beneficiary under the plan with a certain unconditional right to all or a portion of the participant’s account balance upon the death of the participant.

Ed. 11/12/2019

Plan number: 920010

Page 9 of 27

Page 12 of 27

Form Characteristics

| Fact Name | Description |

|---|---|

| Complete All Sections | Every section of the Hardship Withdrawal Request form must be filled out completely for the request to be processed efficiently. |

| Documentation Requirement | Applicants must submit all necessary documentation that supports the reason for their hardship withdrawal. Incomplete submissions will result in delays. |

| Notification Preference | Participants should select how they prefer to be contacted regarding their request status, choosing either email or SMS text messaging for notifications. |

| Mailing Instructions | All forms and documentation need to be sent to Prudential through regular mail, express mail, or fax. Detailed addresses are provided in the form. |

| Tax Implications | Hardship withdrawals may be subject to federal and state taxation. Consult a tax advisor to understand potential penalties and tax obligations. |

Guidelines on Utilizing Hardship Withdrawal Request

After filling out the Hardship Withdrawal Request form, you will submit it along with all required documentation to Prudential Retirement. Ensuring that all information is accurate and complete is vital. Incomplete submissions may lead to delays in processing your request.

- Gather all required personal information, including your Social Security number, address, and contact details.

- Complete all sections of the Hardship Withdrawal Request form accurately.

- Sign the "Certification of Financial Hardship and Authorization" page.

- Attach all necessary documentation that supports your reason for requesting the hardship withdrawal. Refer to the Hardship Withdrawal Request Required Documentation Instructions for specific documents needed.

- Choose your notification preference for updates regarding your request, selecting either email or SMS text.

- Determine the amount you wish to withdraw and write it clearly in the specified box. Include any additional amounts necessary to cover taxes, if applicable.

- Fill out the election sections for withholding federal and state income taxes, as required. Ensure you check the correct boxes based on your preferences.

- Review the entire form and attached documents for accuracy before mailing.

- Submit your completed form and documentation by regular mail, express mail, or fax to the designated Prudential Retirement addresses provided on the form.

What You Should Know About This Form

1. What is a Hardship Withdrawal Request?

A Hardship Withdrawal Request allows you to access funds from your 401(k) savings plan when you are facing an immediate and pressing financial need. This withdrawal can only be requested under specific circumstances outlined by the Internal Revenue Code, such as medical expenses, tuition payments, or to prevent eviction or foreclosure. It's crucial to provide proof of your hardship through the required documentation.

2. How do I submit a Hardship Withdrawal Request?

To submit your request, you must complete all sections of the Hardship Withdrawal Request form accurately. Ensure that you sign the Certification of Financial Hardship and Authorization page. Afterward, attach all necessary documentation supporting your claim, and mail everything to the appropriate Prudential address. If you prefer, you can also send it via express mail or fax. Don't forget to keep copies of your submitted documents for your records.

3. What happens if my documentation is incomplete?

If you submit your request with incomplete documentation, your request will not be processed until everything is in order. This can significantly delay the approval and distribution of your funds. Therefore, it’s your responsibility to review the Hardship Withdrawal Request Required Documentation Instructions carefully to ensure all required documents are included.

4. How long does it take to process a Hardship Withdrawal Request?

The processing time for a Hardship Withdrawal Request can vary based on several factors, including the completeness of your documentation and Prudential’s review process. Once your request is received, Prudential will review all documents. If everything is in order, they will process the distribution as quickly as possible. Delays can occur if additional information is needed.

5. Are there taxes or penalties associated with a Hardship Withdrawal?

Yes, proceeds from a Hardship Withdrawal may be subject to federal income tax withholding at a minimum of 10%. Additionally, early distributions from your retirement account may incur a 10% additional tax penalty unless you qualify for an exception. It is wise to consult your tax advisor for guidance on how to minimize your tax implications.

6. Can I withdraw my entire account balance?

No, you can only withdraw the amount necessary to meet your documented financial need. The withdrawal amount is limited to the available funds in your plan, and Prudential will pay the maximum amount allowed based on your situation.

7. What types of documentation do I need to provide?

The documentation required will depend on the reason for your hardship withdrawal. Common documents may include medical bills, eviction notices, or proof of tuition payments. The specific documentation needs are detailed in the Hardship Withdrawal Request Required Documentation Instructions, which must be followed closely to ensure compliance.

8. Will my withdrawal be reported to the IRS?

Yes, all hardship distributions must be reported to the IRS. Prudential will issue you a Form 1099-R to document the distribution for tax purposes. It’s important to keep this form and other supporting documents in case of an audit or if you need to substantiate your withdrawal with tax authorities.

9. What if I have more questions about my withdrawal?

If you have questions about your Hardship Withdrawal Request or the process, you can reach out to Prudential’s customer service representatives. They are available Monday through Friday during business hours and can provide assistance in multiple languages. Remember, it’s always beneficial to seek professional legal or tax advice when navigating the implications of a hardship withdrawal.

Common mistakes

Completing the Hardship Withdrawal Request form can be a challenging process, and common mistakes can lead to delays or denials of assistance. One frequent error is failing to complete all sections of the form. This form requires detailed and accurate information. If any section is left blank, the request may be sent back for completion, which can slow down the entire process.

Another mistake involves not signing the certification page. This signature is crucial because it verifies that the information provided is accurate and that the applicant understands the withdrawal conditions. Without this signature, the request cannot be processed.

Submitting incomplete documentation is another common issue. The form specifies that documentation supporting the hardship must be included. If required documents are missing or do not meet the specified criteria, the request will not be considered complete. This can lead to significant delays as the applicant scrambles to gather the necessary paperwork.

Additionally, some individuals forget to update their notification preferences, which can result in missed updates on the status of their applications. Choosing how to receive updates—whether via email, text, or another method—is important for staying informed throughout the process.

Incorrectly calculating the withdrawal amount can also be a problem. The form requires a specific dollar amount based on documented financial need. If the amount requested exceeds the documented need, the applicant will only receive the maximum available amount. This misunderstanding may lead to expectations not being met.

Finally, many people overlook the importance of consulting tax or legal advice concerning their withdrawal. The withdrawal may have tax implications and could be subject to penalties if not handled correctly. Engaging a professional can help clarify these issues and ensure the request is made appropriately.

Documents used along the form

When submitting a Hardship Withdrawal Request form, there are several additional documents that may also be required to support your application. These documents help verify the validity of your hardship claim and ensure that your request can be processed efficiently. Below is a list of commonly required forms and documents that accompany a Hardship Withdrawal Request.

- Hardship Withdrawal Request Required Documentation Instructions: This document outlines the specific documentation needed for different types of hardship claims. It serves as a guide to ensure that all necessary materials are included with your request.

- Proof of Hardship Documentation: Depending on the reason for your withdrawal (e.g., medical expenses, eviction), submit relevant documents like medical bills or eviction notices to substantiate your claim.

- Identification Documents: This may include a government-issued ID or Social Security card. These documents confirm your identity and help to prevent fraud.

- Income Statements: Depending on your hardship, you may need to provide evidence of your income, such as recent pay stubs or tax returns, to demonstrate financial need.

- Letters from Professionals: In some cases, letters from healthcare providers or social services can help substantiate your claim. These letters should explain your situation and the necessity of the withdrawal.

- Tax Forms (if applicable): If your hardship is related to tax issues or other financial obligations, attach relevant tax documents. These could include tax returns or notices from tax authorities.

- Proof of Residency: Documents like utility bills or lease agreements might be needed to verify your current address and support your claims about your primary residence or impending eviction.

- Authorization Forms: If you are submitting on behalf of someone else, ensure that you have any necessary authorization forms signed, allowing you to manage their withdrawal request.

Carefully compiling these documents along with your Hardship Withdrawal Request form is critical. Missing or incomplete information can lead to delays. By ensuring you have everything in order, you improve your chances of a smooth and timely withdrawal process. Always remember to keep copies of all submitted documents for your records.

Similar forms

- Withdrawal Application Form: Like the Hardship Withdrawal Request form, this document requests essential information for processing a withdrawal from retirement savings. Applicants must complete the form and provide documentation to substantiate the reason for the withdrawal. Successful submission hinges on meeting specific documentation requirements to avoid delays.

- Loan Request Form: This form is used when an employee wishes to take a loan against their retirement account. Similar to the Hardship Withdrawal Request, it requires personal identification and the completion of various sections. Documentation to verify the financial need for the loan is often necessary.

- Distribution Request Form: When an individual seeks a distribution from their retirement account, this form must be filled out. It is akin to the Hardship Withdrawal Request in that both forms necessitate detailed information regarding the account holder and the reason for the withdrawal. Supporting documents are also vital for processing this request.

- Beneficiary Change Form: This document allows individuals to update their designated beneficiaries. Although not directly related to financial hardship, it shares the commonality of requiring precise information and documentation to ensure compliance with specific plan provisions.

- Retirement Account Rollover Form: Like the Hardship Withdrawal Request, this form facilitates the transfer of retirement savings from one plan to another. It involves completing all required sections and often submitting supporting documentation to verify the eligibility of the rollover.

- Financial Hardship Verification Form: Specifically designed to provide proof of hardship, this form is similar in purpose to the Hardship Withdrawal Request. It typically details the nature of the hardship and necessitates thorough documentation to ensure that the request aligns with industry regulations.

Dos and Don'ts

When filling out the Hardship Withdrawal Request form, keep in mind both the dos and don’ts to ensure your request is processed efficiently.

- Do complete all sections of the form thoroughly.

- Do sign the "Certification of Financial Hardship and Authorization" page.

- Do gather and submit all required documentation related to your hardship.

- Do check your 'Notification Preference' to receive updates on your request.

- Don’t omit important documents, as this will delay processing.

- Don’t forget to make copies of your submitted documents for your records.

Misconceptions

- My withdrawal will be processed immediately. Many individuals mistakenly believe that once they submit their Hardship Withdrawal Request form, the process will be quick. In reality, if documentation is incomplete or not in good order, processing times can be significantly delayed.

- Any reason qualifies for a hardship withdrawal. It's a common misconception that any financial difficulty justifies a hardship withdrawal. The withdrawal must meet specific criteria established by the Internal Revenue Code and Plan provisions, which include medical expenses, housing payments, and certain educational costs.

- I can withdraw as much as I want. This is incorrect. Hardship withdrawals are limited to the documented financial need. If the requested amount exceeds the allowable limit, only the maximum permitted amount will be disbursed.

- I don’t need to provide documentation. Many individuals assume that they can simply request a hardship withdrawal without supplying supporting documents. However, it is essential to include all required documentation detailing the nature of the financial hardship for the request to be considered.

- My documents will be returned after processing. This belief can lead to significant issues. Once submitted, any documents related to the hardship request will not be returned, making it vital to keep copies for personal records.

- Consulting a representative exempts me from understanding the process. While customer service representatives can provide assistance, relying solely on them can result in mistakes. It is essential that applicants read the guidelines carefully to ensure they understand the requirements for a successful hardship withdrawal.

- I can roll over my hardship withdrawal. This is untrue. Hardship withdrawals are generally not eligible to be rolled over into another retirement plan or account, which can cause tax implications.

- Once I apply, I will not be contacted until the request is approved or denied. In reality, applicants need to monitor their 'Notification Preference' settings. Failure to do so may result in missing important updates about their request status.

- A hardship withdrawal will not affect my taxes. This is a dangerous misconception. Hardship withdrawals may incur federal income tax and penalties, leading to unexpected financial consequences if not properly accounted for.

Key takeaways

Here are some key takeaways regarding the Hardship Withdrawal Request form:

- Complete all sections of the form thoroughly. Incomplete submissions will delay processing.

- Document your financial hardship clearly and provide all necessary supporting documents.

- Remember to sign the certification page, indicating your authorization for the request.

- Stay informed about the status of your application by updating your notification preferences.

- Mail all forms and documentation to the designated address to ensure timely processing.

- Consult a tax or legal advisor to understand potential tax implications or penalties associated with your withdrawal.

- Keep copies of all documents submitted. They will not be returned to you after processing.

Browse Other Templates

Commercial Rent Tax Submission,NYC First Quarter Rent Tax Form,NYC Commercial Tax Filing,Quarterly Commercial Rent Return,NYC Rent Tax Report,Commercial Rent Tax Declaration,Q1 Commercial Rent Tax Document,Commercial Rent Tax Assessment Form,2020/21 - Timely submission of this form contributes to maintaining good standing with tax authorities.

Optum Rx Fax Form - Your health care information is sensitive and should be treated as confidential.

M11q Form 2023 - The M11Q form is a medical request for home care services.