Fill Out Your Hsa 02 Form

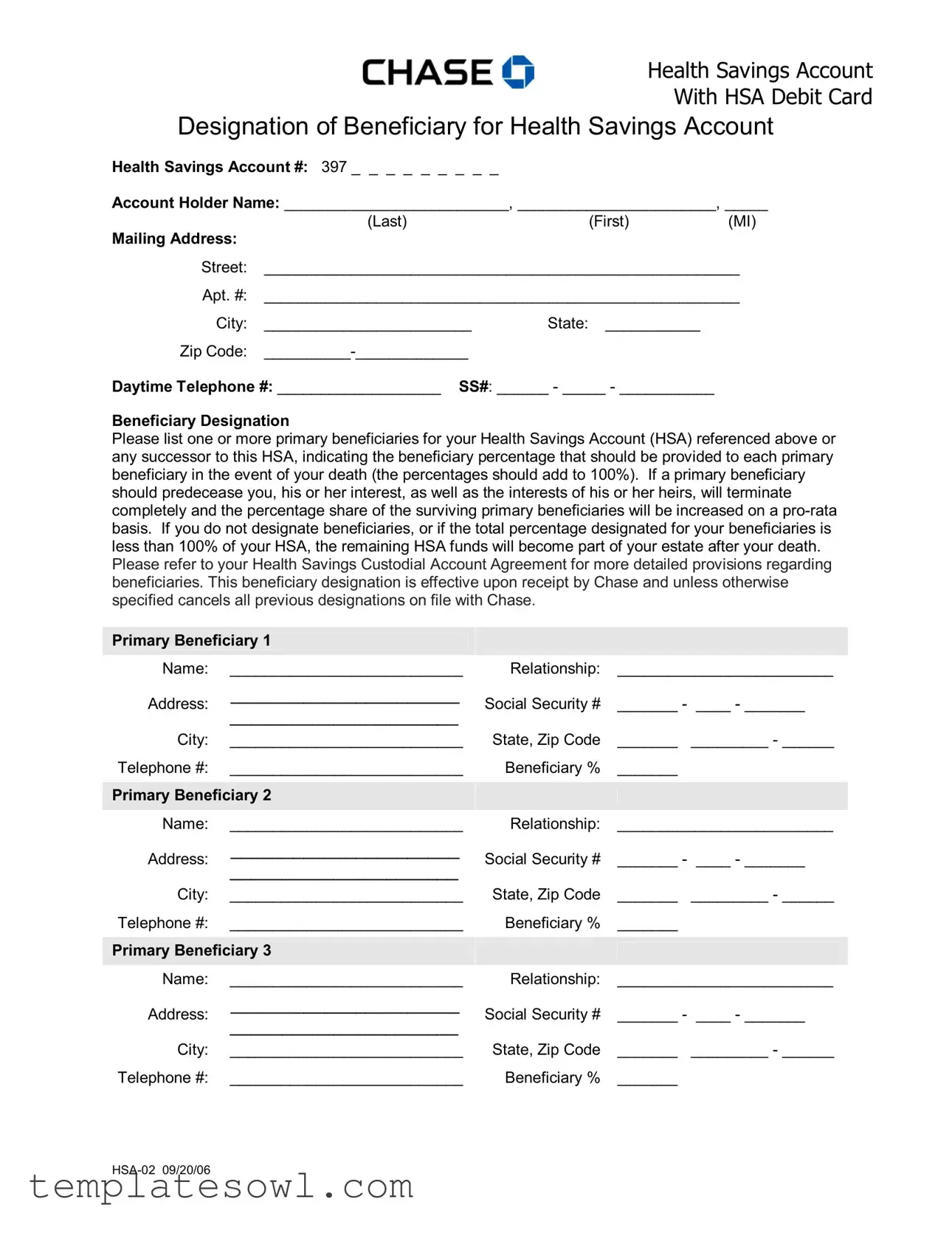

The HSA 02 form plays a crucial role in managing a Health Savings Account (HSA), particularly regarding the designation of beneficiaries. When individuals set up an HSA, they must complete this form to ensure that their funds are appropriately allocated after their passing. It not only allows account holders to name primary beneficiaries—who will inherit the account—but also offers a chance to designate contingent beneficiaries, set to receive assets if the primary beneficiaries are no longer alive. The form requires essential information, such as the account holder's details, including name, address, and Social Security number, as well as specific information about beneficiaries and their percentage shares. Proper completion of this form is vital; failure to designate beneficiaries or incorrectly totaling the designated percentages can lead to the remaining funds becoming part of the deceased's estate. The form also includes a spousal consent requirement for married individuals in certain states, ensuring that both partners are on the same page regarding beneficiary choices. Completing the HSA 02 is a straightforward process but one that carries significant importance for financial planning and peace of mind.

Hsa 02 Example

Health Savings Account

With HSA Debit Card

Designation of Beneficiary for Health Savings Account

Health Savings Account #: 397 _ _ _ _ _ _ _ _ _

Account Holder Name: __________________________, _______________________, _____

|

(Last) |

(First) |

(MI) |

Mailing Address: |

|

|

|

Street: |

_______________________________________________________ |

||

Apt. #: |

_______________________________________________________ |

||

City: |

________________________ |

State: ___________ |

|

Zip Code: |

|

|

|

Daytime Telephone #: ___________________ SS#: ______ - _____ - ___________

Beneficiary Designation

Please list one or more primary beneficiaries for your Health Savings Account (HSA) referenced above or any successor to this HSA, indicating the beneficiary percentage that should be provided to each primary beneficiary in the event of your death (the percentages should add to 100%). If a primary beneficiary should predecease you, his or her interest, as well as the interests of his or her heirs, will terminate completely and the percentage share of the surviving primary beneficiaries will be increased on a

Primary Beneficiary 1

Name: |

___________________________ |

Relationship: |

_________________________ |

|

Address: |

______________________ |

Social Security # |

_______ - |

____ - _______ |

|

______________________ |

|

|

|

City: |

___________________________ |

State, Zip Code |

_______ |

_________ - ______ |

Telephone #: |

___________________________ |

Beneficiary % |

_______ |

|

|

|

|

|

|

Primary Beneficiary 2 |

|

|

|

|

|

|

|

|

|

Name: |

___________________________ |

Relationship: |

_________________________ |

|

Address: |

______________________ |

Social Security # |

_______ - |

____ - _______ |

|

______________________ |

|

|

|

City: |

___________________________ |

State, Zip Code |

_______ |

_________ - ______ |

Telephone #: |

___________________________ |

Beneficiary % |

_______ |

|

|

|

|

|

|

Primary Beneficiary 3 |

|

|

|

|

|

|

|

|

|

Name: |

___________________________ |

Relationship: |

_________________________ |

|

Address: |

______________________ |

Social Security # |

_______ - |

____ - _______ |

|

______________________ |

|

|

|

City: |

___________________________ |

State, Zip Code |

_______ |

_________ - ______ |

Telephone #: |

___________________________ |

Beneficiary % |

_______ |

|

Health Savings Account

With HSA Debit Card

Designation of Beneficiary for Health Savings Account, continued

Contingent beneficiaries will receive your HSA assets in the event that all of your primary beneficiaries predecease you. Please list one or more contingent beneficiaries, together with the percentage of your HSA assets that each should receive (the percentages you list for all contingent beneficiaries should sum to 100%).

Contingent Beneficiary 1

Name: |

___________________________ |

Relationship: |

_________________________ |

|

Address: |

______________________ |

Social Security # |

_______ - |

____ - _______ |

|

______________________ |

|

|

|

City: |

___________________________ |

State, Zip Code |

_______ |

_________ - ______ |

Telephone #: |

___________________________ |

Beneficiary % |

_______ |

|

|

|

|

|

|

Contingent Beneficiary 2 |

|

|

|

|

|

|

|

|

|

Name: |

___________________________ |

Relationship: |

_________________________ |

|

Address: |

______________________ |

Social Security # |

_______ - |

____ - _______ |

|

______________________ |

|

|

|

City: |

___________________________ |

State, Zip Code |

_______ |

_________ - ______ |

Telephone #: |

___________________________ |

Beneficiary % |

_______ |

|

SPOUSAL CONSENT:

Your spouse’s signature is required below if you are married, have your legal residence in any community or marital property state (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington or Wisconsin) and you have designated someone other than, or in addition to, your spouse as beneficiary. If you do not obtain your spouse’s signature, you warrant none is required:

X__________________________________________________ |

_________________ |

Spouse’s Signature |

Date Signed |

____________________________________________________ |

|

Print Name |

|

Please forward this completed form to:

JPMorgan Chase Bank, N.A.

HSA Operations

P.O. Box 30207

Tampa, FL

For questions about account beneficiary matters, please contact HSA Member Services at

X |

_____ |

|

|

Signature of Account Holder |

|

|

Date Signed |

Form Characteristics

| Fact Name | Description |

|---|---|

| HSA Account Number | Each Health Savings Account has a unique account number, which is essential for identifying the account. |

| Beneficiary Designation | Account holders can designate primary and contingent beneficiaries to receive their HSA assets in the event of their death. |

| Percentage Allocation | The total percentage designated for beneficiaries must equal 100%. Otherwise, any leftover funds revert to the account holder's estate. |

| Spousal Consent Requirement | If the account holder is married and designates someone other than their spouse, spousal consent is required in certain states. |

| Impact of Predeceasing Beneficiaries | If a designated primary beneficiary dies before the account holder, their share is divided among the remaining primary beneficiaries on a pro-rata basis. |

| Effective Date of Designation | The beneficiary designation becomes effective upon receipt by the financial institution and cancels any previous designations on file. |

| Contact Information | For questions or concerns regarding beneficiary designations, account holders should contact HSA Member Services at 866-524-2483. |

Guidelines on Utilizing Hsa 02

Completing the HSA 02 form is an essential step in designating beneficiaries for your Health Savings Account (HSA). Once you fill out this form, it needs to be submitted to Chase for processing. Ensure that all required fields are completed accurately to avoid delays.

- Gather necessary information: Before you start filling out the form, collect all relevant details including your personal information, beneficiary names, relationships, addresses, and Social Security numbers.

- Enter your HSA account number: At the top of the form, locate the field for your Health Savings Account number and input it (format: 397 followed by eight digits).

- Fill in account holder details: Provide your name, mailing address, daytime phone number, and Social Security number in the designated fields.

- List primary beneficiaries: For each primary beneficiary, write their name, relationship to you, address, Social Security number, telephone number, and the percentage of your account they will receive.

- Include contingent beneficiaries: Using the same format, list any contingent beneficiaries—those who will inherit if all primary beneficiaries predecease you. Ensure these percentages also total 100%.

- Obtain spouse's consent: If you are married and have designated beneficiaries other than your spouse, have them sign the consent section. If this does not apply, you can proceed without this signature.

- Sign and date: As the account holder, sign and date the form at the bottom.

- Submit the form: Mail the completed form to the address provided: JPMorgan Chase Bank, N.A., HSA Operations, P.O. Box 30207, Tampa, FL 33630-3207.

If you have any questions as you complete the form, consider reaching out to HSA Member Services at 866-524-2483 for assistance.

What You Should Know About This Form

What is the purpose of the HSA 02 form?

The HSA 02 form is used to designate primary and contingent beneficiaries for a Health Savings Account (HSA). It ensures that the account holder's assets are distributed according to their wishes in the event of their death. Additionally, the form includes a section for spousal consent if applicable.

Who should fill out the HSA 02 form?

The account holder of the Health Savings Account should complete the HSA 02 form. This individual must provide relevant personal information, including their name, address, and Social Security number. They should also designate beneficiaries who will receive the account’s assets upon their death.

What happens if I do not designate any beneficiaries on the HSA 02 form?

If no beneficiaries are designated, or if the percentages assigned do not total 100%, the remaining HSA funds will become part of the account holder's estate after their death. This may lead to a longer probate process and potentially increase costs related to settling the estate.

Can I change my beneficiaries after submitting the HSA 02 form?

Yes, beneficiaries can be changed at any time by submitting a new HSA 02 form. The new designation will become effective upon receipt by Chase, and it will automatically cancel any previous beneficiary designations on file.

What is the importance of specifying percentages for beneficiaries?

Specifying percentages for primary and contingent beneficiaries ensures that the account holder's wishes are clearly defined and followed after their death. Each beneficiary must have their designated percentage add up to 100%. If a beneficiary predeceases the account holder, their share will be redistributed among the remaining beneficiaries on a pro-rata basis.

What is required if I am married and choose someone other than my spouse as a beneficiary?

If the account holder is married and selects a beneficiary other than or in addition to their spouse, a signature from the spouse is required on the HSA 02 form. This requirement is in place for residents of community or marital property states to protect both parties’ rights regarding the account's assets.

Who do I contact if I have questions about the HSA 02 form?

For inquiries about the HSA 02 form or beneficiary designations, individuals should contact HSA Member Services at 866-524-2483. Assistance is available to help clarify any concerns or questions regarding the form.

Where should the completed HSA 02 form be sent?

The completed HSA 02 form should be mailed to JPMorgan Chase Bank, N.A., HSA Operations, P.O. Box 30207, Tampa, FL 33630-3207. Ensure that the form is filled out accurately to prevent any delays in processing.

Common mistakes

Completing the HSA 02 form is a crucial step in ensuring that your Health Savings Account (HSA) assets are distributed according to your wishes. However, many individuals make common mistakes that can lead to complications later. Here are eight frequent pitfalls to avoid.

First, people often forget to designate a beneficiary altogether. Leaving this section blank can have significant consequences. Without a designated beneficiary, the funds in the HSA may become part of your estate, potentially leading to lengthy probate proceedings. Ensure to fill out this section completely to provide clarity regarding your wishes.

Another mistake is not completing the beneficiary percentage. The form explicitly states that the total percentage should equal 100%. Sometimes individuals mistakenly think they can leave certain percentages blank or divide by an arbitrary number. This can lead to complications and confusion for surviving beneficiaries.

Additionally, failing to update the form after major life changes is common. Events such as marriage, divorce, or the birth of a child may influence your choice of beneficiaries. Regularly reviewing and updating the HSA 02 form ensures that your designations reflect your current circumstances and intentions.

Incorrectly filling out the Social Security numbers is another frequent error. It is essential to provide accurate information for each beneficiary. A single mistake in the Social Security number can delay the processing of your requests or even result in the funds not being distributed correctly to the chosen beneficiaries.

Some individuals neglect to include contingent beneficiaries. By omitting contingent beneficiaries, you risk leaving your assets in limbo if all primary beneficiaries predecease you. This step is particularly important for those who might have a small circle of beneficiaries, as it provides a backup plan.

Many people also overlook obtaining spousal consent when required. If you are married and designate someone other than your spouse as a beneficiary, obtaining your spouse's signature is necessary in certain states. Failing to do so could invalidate your beneficiary designations.

Furthermore, the importance of clear communication cannot be understated. Some individuals make the mistake of assuming their beneficiaries understand their intentions without ever discussing it. Communicating your desires both verbally and in writing can help prevent any potential disputes or misunderstandings among family members.

Lastly, sending the form to the wrong address is a simple yet common error. Confirm that you are sending the completed form to the correct location, as specified in the instructions. If the form is overlooked or misplaced by the institution, it can impede the timely execution of your wishes.

By being mindful of these common mistakes, individuals can better navigate the process of completing the HSA 02 form, ensuring their wishes are clearly articulated and legally valid.

Documents used along the form

The HSA 02 form is an important document for managing your Health Savings Account (HSA) and establishing how your assets will be distributed after your passing. When working with this form, you may encounter several other documents that can further support your HSA account management and ensure that your intentions are properly documented.

- HSA Custodial Account Agreement: This document outlines the rules and features of your HSA. It includes information about contributions, distributions, and the responsibilities of both the account holder and the custodian, typically a bank or financial institution.

- IRS Form 8889: Used for reporting contributions and distributions from your HSA on your tax return, this form helps you keep track of your health-related expenses that can be tax-deductible.

- Form 5498-SA: This IRS form provides a record of your HSA contributions for the year. It is helpful for both you and the IRS to verify the amounts contributed.

- HSA Distribution Request Form: When you wish to withdraw funds from your HSA, this form is often required. It specifies how much you would like to withdraw and for what purpose—medical expenses or other qualifying reasons.

- Health Care Provider's Invoice: To support any HSA distributions for medical expenses, keep a copy of the invoice from your health care provider. This could be used for verification of the costs covered by your HSA.

- Spousal Consent Form: If you are married and choose beneficiaries other than your spouse, this form is necessary. It secures your spouse's consent about the beneficiary designations and ensures compliance with community property laws.

Understanding these forms and their purposes can significantly streamline the management of your HSA. They help ensure that your assets are handled according to your wishes, so it’s beneficial to be familiar with each document.

Similar forms

Beneficiary Designation Form: Similar to the HSA 02 form, this document allows individuals to designate beneficiaries for various types of accounts, ensuring that their assets are distributed according to their wishes upon death.

Last Will and Testament: A critical legal document that outlines how a person's assets will be allocated after their death. It may include specific beneficiary designations, akin to the HSA 02 form.

Life Insurance Beneficiary Form: This form serves to identify who will receive the proceeds of a life insurance policy, paralleling the beneficiary components of the HSA 02 form.

Retirement Account Beneficiary Designation: Similar to the HSA 02, this document specifies which beneficiaries will receive funds from retirement accounts like IRAs or 401(k) plans after the account holder's passing.

Payable on Death (POD) Account Agreement: This agreement designates a beneficiary for bank accounts, such as savings accounts. It functions in a way that is comparable to the beneficiary section of the HSA 02 form.

Transfer on Death (TOD) Registration: This allows individuals to name beneficiaries for their securities, much like how the HSA 02 form allows naming beneficiaries for health savings accounts.

Organ Donation Form: A document that allows individuals to express their wishes regarding organ donation. It serves a similar purpose of ensuring one's intentions are followed, akin to the beneficiary designations in the HSA 02 form.

Joint Tenancy Agreement: This agreement allows individuals to own property jointly, with automatic transfer of ownership to the surviving tenant upon death, similarly managing asset distribution like the HSA 02 form.

Trust Agreement: A legal document that places assets in a trust for the benefit of designated beneficiaries, echoing the role of the HSA 02 form in allocating assets after a person’s death.

Durable Power of Attorney for Health Care: While primarily addressing health care decisions, this document can also indicate who is empowered to make decisions on one’s behalf, akin to designating beneficiaries.

Dos and Don'ts

When completing the HSA 02 form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here’s a concise list of what to do and what to avoid:

- Do: Write clearly and legibly to avoid any misunderstandings.

- Do: Double-check that all beneficiary percentages add up to 100%.

- Do: Provide complete contact information for yourself and your beneficiaries.

- Do: Sign the form where indicated, ensuring that your signature matches your name as it appears on the account.

- Do: Use a black or blue ink pen for a professional appearance.

- Don’t: Leave any fields blank, as this could cause delays or rejections.

- Don’t: Forget to include your spouse’s signature if applicable; this is especially important for certain states.

- Don’t: Use nicknames or abbreviations; full legal names are required.

- Don’t: Assume your previous beneficiary designations carry over; they must be confirmed with each form submission.

- Don’t: Delay sending in the completed form; prompt submission ensures the proper implementation of your designations.

Following these guidelines will help ensure that the HSA 02 form is correctly filled out and submitted without issues.

Misconceptions

Understanding the HSA 02 form is crucial for those managing a Health Savings Account (HSA). However, various misconceptions can lead to confusion. Below are ten common misunderstandings regarding this important document.

- Anyone can submit the form. Only the account holder is authorized to complete and submit the HSA 02 form, as it pertains to their personal account and beneficiaries.

- Beneficiary designations are optional. While it's not legally required to name beneficiaries, failing to do so can result in the funds going to your estate, which may not be your intended wish.

- Designating a primary beneficiary supersedes all previous designations automatically. It’s true that the latest designation cancels prior ones, but it's important to ensure that the form is completed and submitted correctly for it to take effect.

- Contingent beneficiaries are not important. Misunderstandings often arise about the role of contingent beneficiaries. They are essential because they inherit the account only if all primary beneficiaries have passed away.

- The percentages for beneficiaries don’t need to add up to 100%. It is necessary for the total percentage designated for primary beneficiaries to equal 100%. Otherwise, remaining funds will go to your estate.

- Your spouse's signature is always required. This is only necessary if you live in a community property state and have designated someone other than your spouse as a beneficiary.

- The date of the form does not matter. The date is significant, as it indicates when the last changes to beneficiary designations were made. It can impact how the form is processed.

- All HSA providers are the same concerning beneficiary rules. Each institution may have slightly different policies or processes for managing beneficiaries. It is important to understand the specific rules that apply to your HSA provider.

- Updating beneficiaries is a one-time action. Life changes such as marriage, divorce, or the birth of a child may necessitate updates to your beneficiary designations. Regular reviews are important.

- The form can be submitted electronically. Many people believe they can submit the form online; however, it usually needs to be mailed or delivered to the institution directly.

Having clear and accurate information about the HSA 02 form is essential for ensuring that your assets are distributed according to your wishes. Addressing these misconceptions can help you make informed decisions regarding your Health Savings Account.

Key takeaways

1. Accurate Information is Crucial: Ensure that all fields, particularly the names, addresses, and Social Security numbers of beneficiaries, are filled out correctly. Incomplete or incorrect details can result in complications after your passing.

2. Beneficiary Percentages Must Total 100%: When designating beneficiaries, the total percentage allocated among all primary and contingent beneficiaries must equal 100%. Failing to do so can lead to the remaining funds becoming part of your estate.

3. Spousal Consent may be Required: If you are married and designate someone other than your spouse as a beneficiary, you will need your spouse's signature. This consent is particularly important in community property states to avoid legal issues later on.

4. Submit the Form Promptly: After completing the HSA 02 form, send it immediately to JPMorgan Chase Bank, N.A. for processing. Delays in submission could hinder the effective designation of your beneficiaries.

Browse Other Templates

When Should I Get Pre Qualified for a Mortgage - Borrowers are encouraged to note any outstanding debts, including alimony and child support, to assess financial obligations.

Flashcard Maker Free - Students can customize their flashcards to fit individual learning preferences and styles.