Fill Out Your Hud 92544 Form

The HUD 92544 form, known as the Warranty of Completion of Construction, plays a crucial role in the process of obtaining a HUD-insured single-family mortgage. This form, issued by the U.S. Department of Housing and Urban Development, requires information about the lender, the property, and the purchasers or owners involved. Its main purpose is to establish that the construction of the property meets the necessary standards and conforms to the approved plans. The form includes a warranty from the builder that guarantees the home is free from defects in workmanship and materials for one year from the date of the property's sale or completion. Additionally, it addresses various situations regarding nonconformity and outlines the responsibilities of the builder to remedy any issues that may arise. It's essential for those involved in a HUD-insured mortgage to understand the significance of this warranty, as it plays a part in safeguarding buyers against potential construction flaws while helping lenders assess the insurability of a mortgage.

Hud 92544 Example

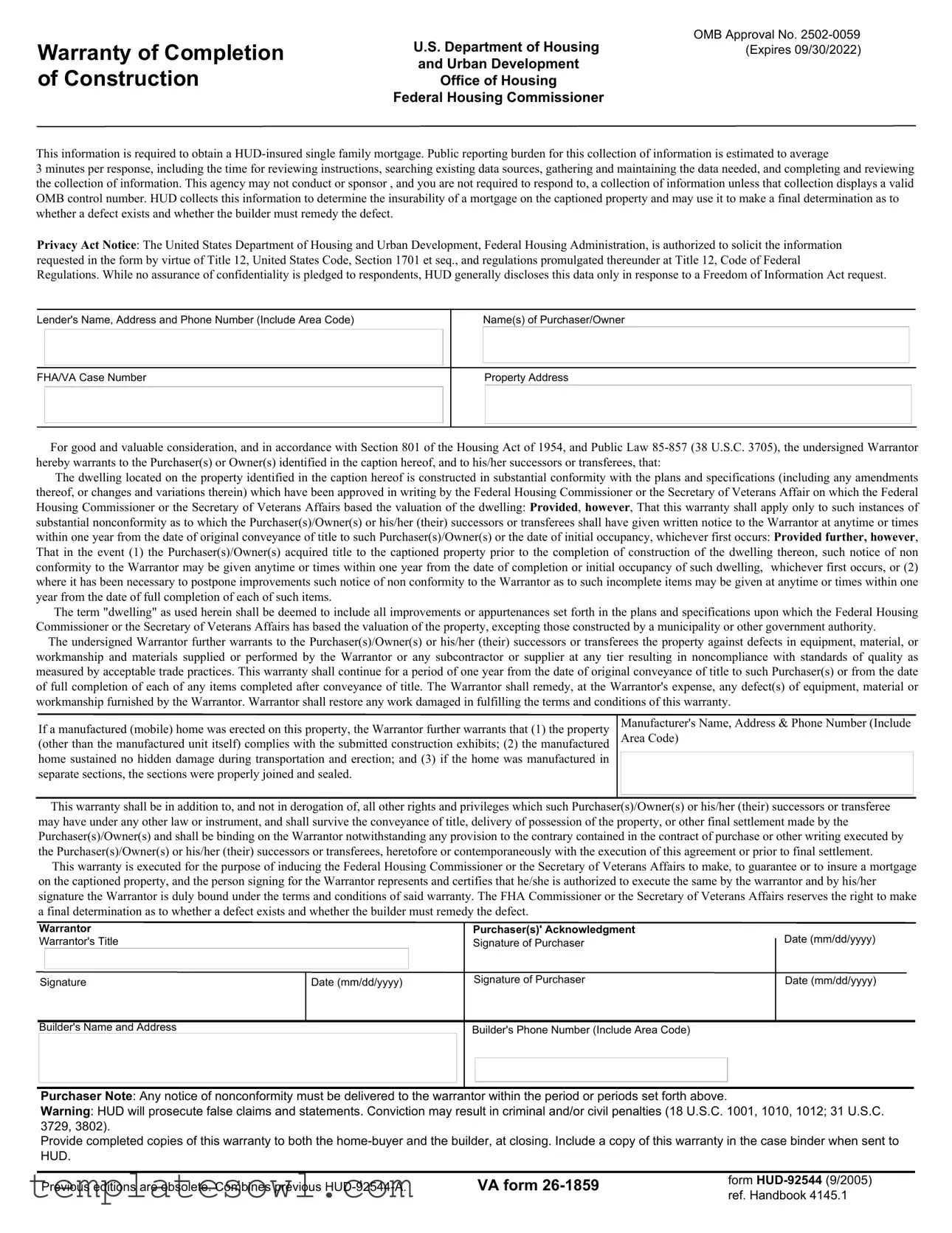

Warranty of Completion of Construction

OMB Approval No.

U.S. Department of Housing(Expires 09/30/2022)

and Urban Development

Office of Housing

Federal Housing Commissioner

This information is required to obtain a

3 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. This agency may not conduct or sponsor , and you are not required to respond to, a collection of information unless that collection displays a valid OMB control number. HUD collects this information to determine the insurability of a mortgage on the captioned property and may use it to make a final determination as to whether a defect exists and whether the builder must remedy the defect.

Privacy Act Notice: The United States Department of Housing and Urban Development, Federal Housing Administration, is authorized to solicit the information requested in the form by virtue of Title 12, United States Code, Section 1701 et seq., and regulations promulgated thereunder at Title 12, Code of Federal Regulations. While no assurance of confidentiality is pledged to respondents, HUD generally discloses this data only in response to a Freedom of Information Act request.

Lender's Name, Address and Phone Number (Include Area Code)

Name(s) of Purchaser/Owner

FHA/VA Case Number

Property Address

For good and valuable consideration, and in accordance with Section 801 of the Housing Act of 1954, and Public Law

The dwelling located on the property identified in the caption hereof is constructed in substantial conformity with the plans and specifications (including any amendments thereof, or changes and variations therein) which have been approved in writing by the Federal Housing Commissioner or the Secretary of Veterans Affair on which the Federal Housing Commissioner or the Secretary of Veterans Affairs based the valuation of the dwelling: Provided, however, That this warranty shall apply only to such instances of substantial nonconformity as to which the Purchaser(s)/Owner(s) or his/her (their) successors or transferees shall have given written notice to the Warrantor at anytime or times within one year from the date of original conveyance of title to such Purchaser(s)/Owner(s) or the date of initial occupancy, whichever first occurs: Provided further, however, That in the event (1) the Purchaser(s)/Owner(s) acquired title to the captioned property prior to the completion of construction of the dwelling thereon, such notice of non conformity to the Warrantor may be given anytime or times within one year from the date of completion or initial occupancy of such dwelling, whichever first occurs, or (2) where it has been necessary to postpone improvements such notice of non conformity to the Warrantor as to such incomplete items may be given at anytime or times within one year from the date of full completion of each of such items.

The term "dwelling" as used herein shall be deemed to include all improvements or appurtenances set forth in the plans and specifications upon which the Federal Housing Commissioner or the Secretary of Veterans Affairs has based the valuation of the property, excepting those constructed by a municipality or other government authority.

The undersigned Warrantor further warrants to the Purchaser(s)/Owner(s) or his/her (their) successors or transferees the property against defects in equipment, material, or workmanship and materials supplied or performed by the Warrantor or any subcontractor or supplier at any tier resulting in noncompliance with standards of quality as measured by acceptable trade practices. This warranty shall continue for a period of one year from the date of original conveyance of title to such Purchaser(s) or from the date of full completion of each of any items completed after conveyance of title. The Warrantor shall remedy, at the Warrantor's expense, any defect(s) of equipment, material or workmanship furnished by the Warrantor. Warrantor shall restore any work damaged in fulfilling the terms and conditions of this warranty.

If a manufactured (mobile) home was erected on this property, the Warrantor further warrants that (1) the property (other than the manufactured unit itself) complies with the submitted construction exhibits; (2) the manufactured home sustained no hidden damage during transportation and erection; and (3) if the home was manufactured in separate sections, the sections were properly joined and sealed.

Manufacturer's Name, Address & Phone Number (Include Area Code)

This warranty shall be in addition to, and not in derogation of, all other rights and privileges which such Purchaser(s)/Owner(s) or his/her (their) successors or transferee may have under any other law or instrument, and shall survive the conveyance of title, delivery of possession of the property, or other final settlement made by the Purchaser(s)/Owner(s) and shall be binding on the Warrantor notwithstanding any provision to the contrary contained in the contract of purchase or other writing executed by the Purchaser(s)/Owner(s) or his/her (their) successors or transferees, heretofore or contemporaneously with the execution of this agreement or prior to final settlement.

This warranty is executed for the purpose of inducing the Federal Housing Commissioner or the Secretary of Veterans Affairs to make, to guarantee or to insure a mortgage on the captioned property, and the person signing for the Warrantor represents and certifies that he/she is authorized to execute the same by the warrantor and by his/her signature the Warrantor is duly bound under the terms and conditions of said warranty. The FHA Commissioner or the Secretary of Veterans Affairs reserves the right to make a final determination as to whether a defect exists and whether the builder must remedy the defect.

Warrantor

Warrantor's Title

Signature

Date (mm/dd/yyyy)

Purchaser(s)' Acknowledgment

Signature of Purchaser

Signature of Purchaser

Date (mm/dd/yyyy)

Date (mm/dd/yyyy)

Builder's Name and Address

Builder's Phone Number (Include Area Code)

Purchaser Note: Any notice of nonconformity must be delivered to the warrantor within the period or periods set forth above.

Warning: HUD will prosecute false claims and statements. Conviction may result in criminal and/or civil penalties (18 U.S.C. 1001, 1010, 1012; 31 U.S.C. 3729, 3802).

Provide completed copies of this warranty to both the

Previous editions are obsolete. Combines previous |

VA form |

form

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The HUD 92544 form is used to provide a warranty of completion of construction for HUD-insured single-family mortgages. |

| OMB Approval | It has been approved by the Office of Management and Budget under No. 2502-0059. |

| Information Collection | Completing the form typically takes about 3 minutes, including reviewing instructions and gathering information. |

| Privacy Notice | The U.S. Department of Housing and Urban Development is authorized to collect information according to Title 12 of the U.S. Code. |

| Warranty Duration | The warranty lasts for one year from the date of title conveyance or completion of construction. |

| Defect Coverage | The warranty covers defects in equipment, material, or workmanship provided by the Warrantor or subcontractors. |

| Compliance with Plans | The form ensures the construction complies with the approved plans and specifications set by the Federal Housing Commissioner. |

| Previous Editions | This version combines previous HUD-92544-A and VA Form 26-1859. Older editions are now obsolete. |

Guidelines on Utilizing Hud 92544

After obtaining the HUD 92544 form, careful attention to detail is essential while filling it out. Completing this form accurately helps ensure that all pertinent information is documented properly for future reference and verification.

- Locate the top section of the form to fill in the Lender's Name, Address, and Phone Number. Ensure the area code is included.

- Provide the Name(s) of Purchaser/Owner. This section requires the legal names of all individuals involved.

- Insert the FHA/VA Case Number in the designated box. This number is crucial for identifying the mortgage associated with the property.

- Complete the Property Address field. Make sure to include the street address, city, state, and ZIP code accurately.

- In the warranty section, enter the name, title, and date for the Warrantor. This refers to the individual or entity providing the warranty.

- Sign and date the form in the Signature and Date fields, using mm/dd/yyyy format.

- Have the Purchaser(s) acknowledge their understanding by signing and dating the form. List both purchasers if applicable.

- Next, fill in the details for the Builder's Name and Address, along with the Builder's Phone Number, including the area code.

- Check all information for accuracy before submitting the form. Errors can cause delays in processing.

Once the form is completed, ensure to provide copies to both the home buyer and the builder at closing. Additionally, retain a copy for the case binder when sent to HUD. Adhering to these steps will help facilitate the process associated with the mortgage on the property.

What You Should Know About This Form

What is the HUD 92544 form?

The HUD 92544 form is known as the Warranty of Completion of Construction. It is required to obtain a HUD-insured single-family mortgage. This form ensures that the dwelling has been constructed according to approved plans and specifications, and it provides a warranty against defects in workmanship and materials.

Who needs to fill out the HUD 92544 form?

The form needs to be completed by the Warrantor, usually the builder or contractor, who is offering the warranty. Additionally, both the purchaser/owner and the builder must sign the form to acknowledge and agree to the warranty terms.

What information is included on the HUD 92544 form?

This form collects details such as the lender's name and contact information, the names of the purchasers or owners, the property address, and the FHA/VA case number. It also requires the warranty terms and signatures from all involved parties.

How long is the warranty valid?

The warranty provided by the HUD 92544 form lasts for one year from the date of original title conveyance or from the date of full completion of any items completed after conveyance. It ensures that any defects reported within this period will be remedied by the Warrantor.

What should I do if I find a defect?

If you discover a defect, you must give written notice to the Warrantor within one year of title conveyance or completion. This notice allows the Warrantor to address any nonconformity issues under the warranty terms.

What does the term "dwelling" encompass in the warranty?

The term "dwelling" includes the main structure as well as any improvements or appurtenances specified in the construction plans. However, it does not cover those constructed by a municipality or other government authority.

What happens if the builder fails to remedy defects?

If the builder does not address the reported defects, the FHA Commissioner or the Secretary of Veterans Affairs may make a final determination regarding the defect's existence and any required remediation by the builder.

Are there any legal implications for false claims?

Yes, filing false claims or statements on the HUD 92544 form may lead to criminal or civil penalties. It is important to provide accurate and truthful information to avoid serious legal consequences.

Can the warranty be transferred to future owners?

Yes, the warranty does transfer to the successors or transferees of the original purchasers. This provides ongoing protection for future owners regarding defects that may arise within the warranty period.

How can I ensure I am completing the form correctly?

Carefully review the instructions provided with the HUD 92544 form. It is advisable to double-check all information entered and to have all parties involved sign the form to ensure validity.

Common mistakes

When completing the HUD 92544 form, individuals often encounter pitfalls that can lead to delays or complications in their mortgage applications. One common mistake lies in the accuracy of the names and contact details. All parties, including the lender, purchaser, and builder, must be precisely identified with the correct information. Errors in spelling or missing contact numbers can result in frustration and unnecessary back-and-forth communication.

Another frequent error occurs with the FHA/VA case number. Some applicants may mistakenly omit this crucial identifier or enter incorrect information, which is critical for processing the mortgage insurance. A missing or invalid case number can lead to significant verification delays, ultimately affecting the timeline for acquiring financing.

Completion of the property address is also a major area where errors are made. Applicants sometimes fail to include all relevant details, such as apartment numbers or zip codes. Incomplete addresses can create confusion and potentially delay the title transfer process or issuance of insurance.

In relation to the warranties provided within the form, many people misinterpret the terms or conditions, leading to incomplete acknowledgment of these assurances. Failing to understand the scope of warranty coverage can result in misunderstanding the rights and obligations of both the purchaser and the warrantor. Such misconceptions can hinder a client's ability to act upon defects discovered post-occupancy.

Signatures on the form may also pose a challenge. Each required individual must sign in the appropriate sections, but applicants often neglect to sign or date the document. This oversight can render the warranty invalid. Jurisdictional issues could arise from improper signing authority; thus, all parties need to ensure that the signatures correctly reflect their respective roles as stated in the form.

Finally, individuals frequently overlook the instructions related to the submission of completed forms. Providing copies to both the home-buyer and the builder is essential, as is including a copy in the case binder sent to HUD. Ignoring these submission guidelines can create hurdles later in the mortgage approval process and lead to unnecessary complications.

Documents used along the form

The HUD 92544 form, known as the Warranty of Completion of Construction, serves as an important part of the mortgage process for homes insured by HUD. Alongside this document, there are several other forms that are commonly used. Each serves a specific purpose that contributes to the completeness and legality of the real estate transaction. Below is a list of forms and documents frequently associated with the HUD 92544.

- FHA Case Number Assignment Document: This document assigns a unique FHA case number to the property, which is essential for tracking the insurance process and file management.

- VA Form 26-1859: Used in conjunction with VA home loans, this form verifies the veteran's eligibility for benefits and is often needed alongside the HUD 92544.

- Appraisal Report: This report provides an independent valuation of the home, assessing its market value to ensure it meets HUD standards for insurance.

- Mortgage Application (FHA Loan Application 92900-A): The standardized application collects vital information regarding the borrowers and property, necessary for loan approval.

- Certificate of Occupancy: Issued by the local authority, this document confirms that the home meets safety and building codes, allowing the home to be inhabited.

- Builder's Certification: This attestation from the builder confirms that the construction has adhered to acceptable standards and complies with FHA guidelines.

- Sales Contract: A legally binding agreement between the buyer and seller that outlines the terms of the sale, including price and conditions.

- Title Insurance Policy: This document protects against any defects in the title of the property, ensuring the buyer's ownership rights are secured.

- Property Disclosures: Required by law, these disclosures inform buyers of any known issues or defects with the property that could affect its value or habitation.

- Final Closing Statement: This document summarizes the financial details of the transaction, including costs, fees, and funds being transferred at the closing of the sale.

Understanding the importance of each document in the context of the housing transaction is crucial. These forms collectively ensure that all legal and procedural requirements are met, providing peace of mind for all parties involved in the process. As such, attention to detail in completing these documents is paramount.

Similar forms

HUD-92541: Borrower's Acknowledgment - This form confirms that the borrower understands their responsibilities in relation to any guarantees made by the builder. Both documents serve to ensure the homeowner is aware of their rights and obligations regarding property warranties and repairs.

VA Form 26-1859: Certificate of Completion - This document certifies that a property meets all required specifications for the Veterans Administration loan. Like the HUD-92544, it ensures that the property constructed is compliant with the approved plans, providing a layer of assurance to potential homeowners.

FHA 203(k) Supplemental Action Worksheet - This document is essential for properties undergoing rehabilitation. It parallels the HUD-92544 in offering a warranty that the improvements made meet FHA standards, protecting both the lender and the borrower from future defects.

Builder's Warranty - This is a separate document provided by the builder that outlines additional guarantees regarding the construction quality and materials. Similar to the HUD-92544, it provides a timeline and conditions under which the builder must address noncompliance or defects found after completion.

Dos and Don'ts

When filling out the HUD 92544 form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Here are five important do's and don'ts to keep in mind:

- Do read all instructions carefully before starting the form. This helps to understand each section and its requirements.

- Do provide accurate information. Double-check names, addresses, and other critical details to avoid delays.

- Do keep a copy of the completed form for your records. Documentation is key for future reference and accountability.

- Do submit the form on time. Meeting deadlines is essential to the processing of your application.

- Do ensure that all required signatures are included. Missing signatures could lead to complications and delays.

- Don’t leave any sections blank. Every part of the form must be completed to prevent processing issues.

- Don’t misrepresent information. Providing false statements may result in serious legal consequences.

- Don’t forget to include all necessary documentation. Supporting documents may be needed to validate the information provided.

- Don’t ignore deadlines. Late submissions can result in disqualification from the program.

- Don’t discard previous editions. Ensure you are using the most current version of the form to avoid errors.

Careful attention to these tips will facilitate a smoother process and help ensure that the HUD 92544 form is correctly filled out and submitted.

Misconceptions

The HUD 92544 form, also known as the Warranty of Completion of Construction, is an essential document when it comes to obtaining a HUD-insured mortgage. However, many misconceptions surround this form that can lead to confusion. Here are eight common misunderstandings:

- The HUD 92544 is optional. Some homebuyers believe that submitting this form is optional. In reality, this form is a requirement for obtaining a HUD-insured mortgage, as it provides essential warranty information.

- This form only benefits the builder. Many assume that the form is primarily designed to protect builders. In fact, it serves to protect homebuyers by ensuring that construction meets specific standards, thereby securing their investment.

- Homebuyers must provide their own legal representations. There is a misconception that homebuyers need to have legal counsel to understand the implications of this form. While legal advice can be beneficial, the form is intentionally designed to be comprehendible to the average consumer.

- It addresses only major defects. Some believe the warranty provided by the form covers only significant construction issues. In truth, the warranty can address a range of nonconformities, from minor defects to serious construction failures.

- The warranty is indefinite. There's a belief that the warranty lasts forever. However, the warranty is valid for one year from the original conveyance of title or from the date of full completion of any additional items.

- This form guarantees a perfect home. Homebuyers may mistakenly think that signing this form ensures their home will be free from any issues. It simply guarantees that any defects reported within the warranty period will be addressed.

- The warranty claim process is overly complicated. Some homebuyers feel intimidated by the process of filing a warranty claim. Though there are steps to follow, the process is straightforward and intended to be accessible.

- The HUD 92544 replaces other warranties. People often think that this form supersedes other warranties provided during a home purchase. Instead, it is an additional layer of protection that complements existing warranties, not a replacement for them.

Understanding these common misconceptions can empower homebuyers, ensuring they are well-informed as they navigate their homebuying journey.

Key takeaways

Filling out the HUD 92544 form is crucial for obtaining a HUD-insured single-family mortgage. Here are some key takeaways to consider:

- This form provides a warranty that confirms the home was built according to approved plans and specifications. It protects the buyer from future defects.

- Notice requirements are important. Buyers must notify the Warrantor of any substantial nonconformity within one year of title conveyance or initial occupancy.

- The warranty covers not only the structure but also equipment and materials supplied by the builder or subcontractors.

- This warranty lasts for one year from the date the title is conveyed or from the date specific items are completed after conveyance.

- Buyers must receive a copy of the completed warranty at closing. This ensures that all parties have documentation of the warranty terms.

- The Warrantor is responsible for remedying any defects at their own expense, ensuring accountability for the construction quality.

- Privacy is limited. While personal data on the form may not be kept confidential, it is generally only released under the Freedom of Information Act.

- False claims are taken seriously. HUD warns that criminal and civil penalties may follow any misrepresentations on this form.

Understanding these key points can lead to a smoother experience when dealing with the HUD 92544 form, particularly for potential homeowners and builders.

Browse Other Templates

Registration Suspended but I Have Insurance Pa - Completing the MV 221 helps avoid unnecessary fines related to vehicle registration.

Broker Partnership Application,Mortgage Broker Network Enrollment,UWM Affiliate Registration,Wholesale Mortgage Broker Signup,UWM Collaboration Form,Broker Integration Application,Wholesale Lending Partnership Form,Mortgage Broker Support Document,UW - Ensure your W-9 is complete for tax identification.

Workers Comp Form 5020 - All injuries occurring during work hours should be reported without exception.