Fill Out Your Hud 92800 5B Form

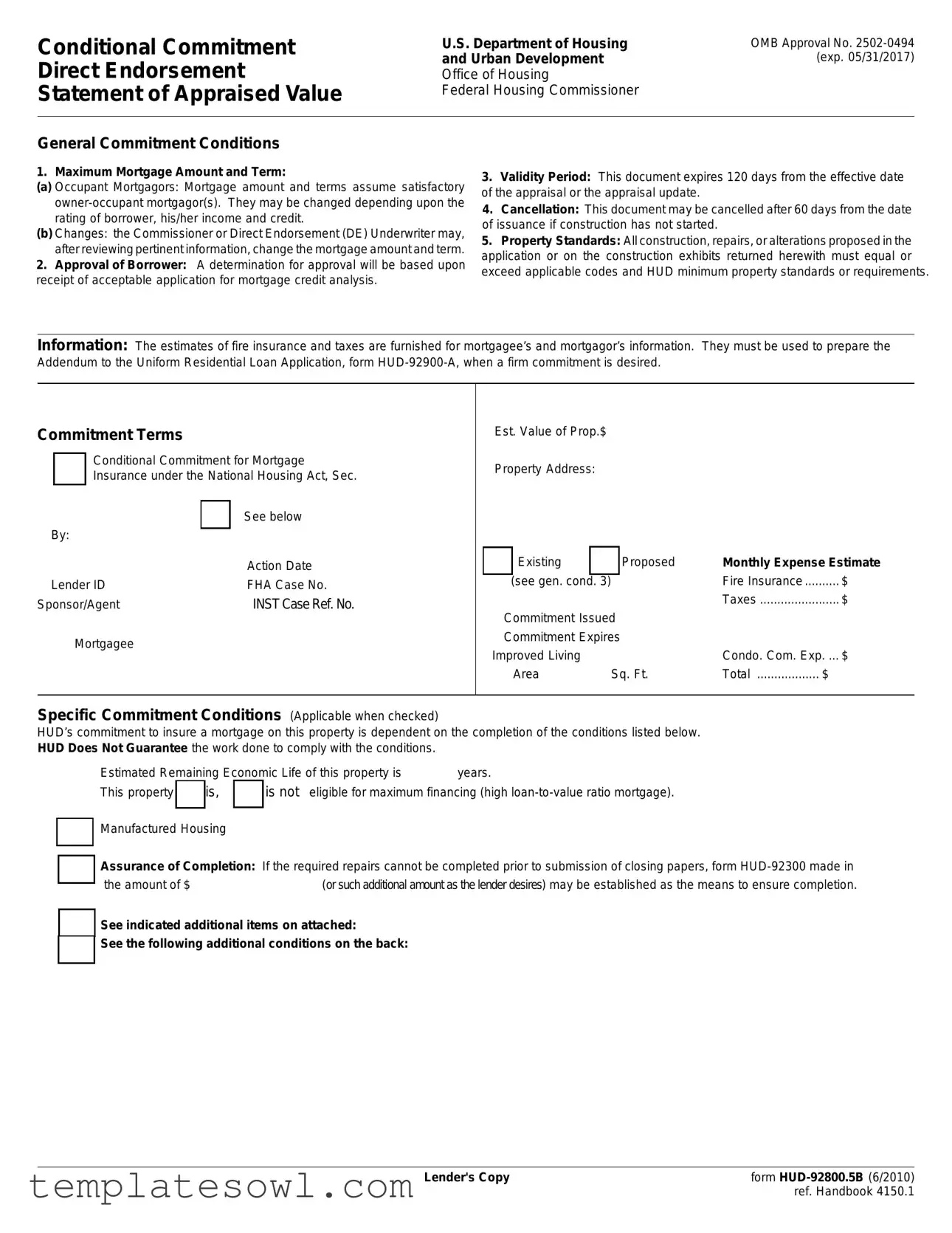

The HUD 92800.5B form, formally known as the Conditional Commitment Direct Endorsement Statement of Appraised Value, is a crucial document in the landscape of mortgage insurance within the United States. This form serves as an application for both proposed and existing construction properties, helping to establish the conditions under which the U.S. Department of Housing and Urban Development (HUD) will commit to insuring a mortgage for a particular property. Among its key features, the form outlines essential conditions that must be met for mortgage insurance under the National Housing Act, including the valid approval period and the maximum mortgage amounts allowed based on borrower details. The form also includes stipulations regarding property standards, ensuring that any proposed constructions adhere to the minimum standards set by HUD. Moreover, it specifies the process for borrower approval, which relies on an acceptable mortgage credit analysis. In addition, the form indicates the necessary conditions related to specific scenarios, such as health authority approvals and flood insurance mandates for properties located in special flood hazard areas. The document is designed to ensure transparency and compliance, necessitating that both lenders and borrowers adhere to its detailed provisions to facilitate the mortgage process successfully.

Hud 92800 5B Example

Conditional Commitment

Direct Endorsement

Statement of Appraised Value

U.S. Department of Housing |

OMB Approval No. |

and Urban Development |

(exp. 05/31/2017) |

Office of Housing |

|

Federal Housing Commissioner |

|

General Commitment Conditions

1. Maximum Mortgage Amount and Term:

(a)Occupant Mortgagors: Mortgage amount and terms assume satisfactory

(b)Changes: the Commissioner or Direct Endorsement (DE) Underwriter may, after reviewing pertinent information, change the mortgage amount and term.

2.Approval of Borrower: A determination for approval will be based upon receipt of acceptable application for mortgage credit analysis.

3.Validity Period: This document expires 120 days from the effective date of the appraisal or the appraisal update.

4.Cancellation: This document may be cancelled after 60 days from the date of issuance if construction has not started.

5.Property Standards: All construction, repairs, or alterations proposed in the application or on the construction exhibits returned herewith must equal or exceed applicable codes and HUD minimum property standards or requirements.

Information: The estimates of fire insurance and taxes are furnished for mortgagee’s and mortgagor’s information. They must be used to prepare the Addendum to the Uniform Residential Loan Application, form

Commitment Terms

Conditional Commitment for Mortgage Insurance under the National Housing Act, Sec.

|

|

See below |

By: |

|

Action Date |

|

||

|

|

|

Lender ID |

FHA Case No. |

|

Sponsor/Agent |

INSTCase Ref. No. |

|

Mortgagee |

|

|

Est. Value of Prop.$

Property Address:

|

Existing |

|

|

Proposed |

Monthly Expense Estimate |

|

|

(see gen. cond. 3) |

|

|

Fire Insurance |

$ |

|

|

|

|

|

|

Taxes |

$ |

Commitment Issued |

|

|

||||

Commitment Expires |

|

|

||||

Improved Living |

|

|

Condo. Com. Exp. |

... $ |

||

|

Area |

Sq. Ft. |

Total |

$ |

||

Specific Commitment Conditions (Applicable when checked)

HUD’s commitment to insure a mortgage on this property is dependent on the completion of the conditions listed below. HUD Does Not Guarantee the work done to comply with the conditions.

Estimated Remaining Economic Life of this property is |

years. |

||||

This property |

|

is, |

|

is not eligible for maximum financing (high |

|

|

|

||||

|

|

|

|

|

|

Manufactured Housing

Manufactured Housing

Assurance of Completion: If the required repairs cannot be completed prior to submission of closing papers, form

the amount of $(or such additional amount as the lender desires) may be established as the means to ensure completion.

See indicated additional items on attached:

See the following additional conditions on the back:

See the following additional conditions on the back:

Lender's Copy |

form |

|

ref. Handbook 4150.1 |

Public reporting burden for this collection of information is estimated to average seven minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and main- taining the data needed, and completing and reviewing the collection of information. This information is required to obtain benefits. HUD may not collect this information, and you are not required to complete this form, unless it displays a currently valid OMB control number.

Section 203 of the National Housing Act authorizes the Secretary of the Department of Housing and Urban

Development to insure mortgages on appraisal and commitment/direct endorsement statement of appraised value on a designated property.

This form serves as the application for individual “proposed construction” and “existing construc- tion” properties.

The Conditional Commitment / Direct Endorse- ment Statement of Appraised Value (Form HUD- 92800.5B) sets forththe terms upon which the commitment/direct endorsement statement of appraised value is made and the specific conditions that must be met before HUD can endorse a Firm Commitment for Mortgage Insurance.

Responses to the collection of information are required to obtain mortgage insurance. Informa- tion contained in these collections will be used only for the purpose of determining the eligibility of a property for mortgage insurance. The informa- tion is considered confidential. While no assur- ances of confidentiality are pledged to respon- dents, HUD generally discloses this data only in response to a Freedom of Information request.

Specific Commitment Conditions (Applicable when indicated on the front of this form)

B.Proposed Construction: The builder or mortgagee must notify the assigned Fee Inspector as appropriate (see items 11, 12, and 13 below).

C.Warranty: Form

D.Section 223: This commitment is issued pursuant to Section 223(e).

E.Health Authority Approval: Submit local health authority approval (on a form or letter) indicating the individual water supply and/or sewage disposal system is acceptable.

F.Reserved.

G.Prefabricator’s Certificate: The Lender shall provide a prefabrication certificate as required by the related engineering bulletin.

H.Termite Control: (Proposed Construction) If soil poisioning is used, the builder shall complete form

I.Flood Insurance Requirement: This property is located in a special flood hazard area and must be covered by flood insuranceinaccordancewithHUD regulation 24 CFR 203.16a.

J.Carpet Identification: (as listed in Certified Products Direc- tory) Manufacturer recommended maintenance program must be provided to the homebuyer.

K.Termite Control (Existing Construction): A recognized ter- mite control operator shall furnish certification using form

structures within the legal boundaries of the property indicate no evidence of active termite infestation.

L.CodeEnforcement: The lender shall submit a statement from the public authority that the property meets local code require- ments. If the mortgage on the property is to be insured under Section 221(d)(2), a code compliance inspection is required.

M.Repairs: The lender shall notify the original appraiser upon completion of required repairs, unless otherwise instructed.

N.Lender's Certificate of Completion: The lender shall furnish a certificate that required repairs have been examined and were satisfactorily completed.

O.Manufacturers Warranties must be provided to the homebuyer covering heating/cooling systems, hot water heat- ers, ranges, etc.

P.Initial Inspection (2 working days) is requested before the “beginning of construction” with forms in place.

Q.Frame Inspection (1 working day) is requested when the building is enclosed and framing, plumbing, heating, electrical, and insulation is complete and visible.

R.FinalInspectionis requested when construction is completed and the property ready for occupancy.

S.Insulation Certificate must be posted in a conspicuous location in the dwelling.

T.The Insured Protection Plan Warranty Agreement shall be executed between the builder and the homebuyer.

U.The lender shall furnish a certificate of occupancy or letter of acceptance from the local building authority.

Conditional Commitment

Direct Endorsement

Statement of Appraised Value

U.S. Department of Housing |

OMB Approval No. |

and Urban Development |

|

Office of Housing |

|

Federal Housing Commissioner |

|

General Commitment Conditions

1. Maximum Mortgage Amount and Term:

(a)Occupant Mortgagors: Mortgage amount and terms assume satisfactory

(b)Changes: the Commissioner or Direct Endorsement (DE) Underwriter may, after reviewing pertinent information, change the mortgage amount and term.

2.Approval of Borrower: A determination for approval will be based upon receipt of acceptable application for mortgage credit analysis.

3.Validity Period: This document expires 120 days from the effective date of the appraisal or the appraisal date.

4.Cancellation: This document may be cancelled after 60 days from the date of issuance if construction has not started.

5.Property Standards: All construction, repairs, or alterations proposed in the application or on the construction exhibits returned herewith must equal or exceed applicable codes and HUD minimum property standards or requirements.

Information: The estimates of fire insurance and taxes are furnished for mortgagee’s and mortgagor’s information. They must be used to prepare the Addendum to the Uniform Residential Loan Application, form

Commitment Terms

Conditional Commitment for Mortgage Insurance under the National Housing Act, Sec.

|

|

See below |

By: |

|

Action Date |

|

||

|

|

|

Lender ID |

FHA Case No. |

|

Sponsor/Agent |

INSTCase Ref. No. |

|

Mortgagee |

|

|

Est. Value of Prop.$

Property Address:

|

Existing |

|

|

Proposed |

Monthly Expense Estimate |

|

|

(see gen. cond. 3) |

|

|

Fire Insurance |

$ |

|

|

|

|

|

|

Taxes |

$ |

Commitment Issued |

|

|

||||

Commitment Expires |

|

|

||||

Improved Living |

|

|

Condo. Com. Exp. |

... $ |

||

|

Area |

Sq. Ft. |

Total |

$ |

||

Specific Commitment Conditions (Applicable when checked)

HUD’s commitment to insure a mortgage on this property is dependent on the completion of the conditions listed below. HUD Does Not Guarantee the work done to comply with the conditions.

Estimated Remaining Economic Life of this property is |

years. |

||||

This property |

|

is, |

|

is not eligible for maximum financing (high |

|

|

|

||||

|

|

|

|

|

|

Manufactured Housing

Manufactured Housing

Assurance of Completion: If the required repairs cannot be completed prior to submission of closing papers, form

the amount of $(or such additional amount as the lender desires) may be established as the means to ensure completion.

See indicated additional items on attached:

See the following additional conditions on the back:

See the following additional conditions on the back:

Case Binder Copy |

form |

|

ref. Handbook 4150.1 |

Public reporting burden for this collection of information is estimated to average seven minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and main- taining the data needed, and completing and reviewing the collection of information. This information is required to obtain benefits. HUD may not collect this information, and you are not required to complete this form, unless it displays a currently valid OMB control number.

Section 203 of the National Housing Act authorizes the Secretary of the Department of Housing and Urban

Development to insure mortgages on appraisal and commitment/direct endorsement statement of appraised value on a designated property. This form serves as the application for individual “proposed construction” and “existing construc- tion” properties.

The Conditional Commitment / Direct Endorse- ment Statement of Appraised Value (Form HUD- 92800.5B) sets forththe terms upon which the commitment/direct endorsement statement of appraised value is made and the specific conditions that must be met before HUD can endorse a Firm Commitment for Mortgage Insurance.

Responses to the collection of information are required to obtain mortgage insurance. Information contained in these collections will be used only for the purpose of determining the eligibility of a property for mortgage insurance. The information is considered confidential. While no assurances of confidentiality are pledged to respondents, HUD generally discloses this data only in response to a Freedom of Information request.

Specific Commitment Conditions (Applicable when indicated on the front of this form)

B.Proposed Construction: When utilizing a FHA Compliance Inspector, the builder or mortgagee must notify the assigned Fee Inspector as appropriate (see items 11, 12, and 13 below).

C.Warranty: Form

D.Section 223: This commitment is issued pursuant to Section 223(e).

E.Health Authority Approval: Submit local health authority approval (on a form or letter) indicating the individual water supply and/or sewage disposal system is acceptable.

F.Reserved.

G.Prefabricator’s Certificate: The Lender shall provide a prefabrication certificate as required by the related engineering bulletin.

H.Termite Control: (Proposed Construction) If soil poisioning is used, the builder shall complete form

I.Flood Insurance Requirement: This property is located in a special flood hazard area and must be covered by flood insuranceinaccordancewithHUD regulation 24 CFR 203.16a.

J.Carpet Identification: (as listed in Certified Products Direc- tory) Manufacturer recommended maintenance program must be provided to the homebuyer.

K.Termite Control (Existing Construction): A recognized ter- mite control operator shall furnish certification using form

structures within the legal boundaries of the property indicate no evidence of active termite infestation.

L.CodeEnforcement: The lender shall submit a statement from the public authority that the property meets local code require- ments. If the mortgage on the property is to be insured under Section 221(d)(2), a code compliance inspection is required.

M.Repairs: The lender shall notify the original appraiser upon completion of required repairs, unless otherwise instructed.

N.Lender's Certificate of Completion: The lender shall furnish a certificate that required repairs have been examined and were satisfactorily completed.

O.Manufacturers Warranties must be provided to the homebuyer covering heating/cooling systems, hot water heat- ers, ranges, etc.

P.Initial Inspection (2 working days) is requested before the “beginning of construction” with forms in place.

Q.Frame Inspection (1 working day) is requested when the building is enclosed and framing, plumbing, heating, electrical, and insulation is complete and visible.

R.FinalInspectionis requested when construction is completed and the property ready for occupancy.

S.Insulation Certificate must be posted in a conspicuous location in the dwelling.

T.The Insured Protection Plan Warranty Agreement shall be executed between the builder and the homebuyer.

U.The lender shall furnish a certificate of occupancy or letter of acceptance from the local building authority.

Conditional Commitment

Direct Endorsement

Statement of Appraised Value

U.S. Department of Housing |

OMB Approval No. |

and Urban Development |

|

Office of Housing |

|

Federal Housing Commissioner |

|

Attention Homebuyers This property is not FHA Approved and FHA does not warrant the condition or the value of the property. However, FHA will insure a mortgage on the property if certain conditions are met.

For Existing Houses: If you are buying a house which has been lived in before, be sure the house is in acceptable condition before signing a purchase contract. An appraisal is made only to estimate the value of the property. This appraisal does not guarantee that the house is free from defects. HUD cannot give you money for repairs so you must protect yourself before you buy. You should inspect the property carefully and you are encouraged to hire a private home inspection service. Look in the telephone book or the internet for such services.

FHA does not perform home inspections.

For New Homes: If you are buying a new home, HUD requires the builder to provide a

Fair Housing & Equal Opportunity Hotline: (800)

The law requires that borrowers using

Grace Period: If this application is rejected, the lender may request reconsid- eration within 60 days of the last rejection date. Where a sales contract is signed prior to the expiration of the Conditional Commitment/Direct Endorse- ment Statement of Appraised Value, a lender has 30 days to process or submit an application to the Field Office for a Firm Commitment. A Firm Commitment with a term of 90 days may be issued.

Estimated Value of Property : The amount HUD considers the property to be worth.

Monthly Expense Estimates:The estimated amounts you will pay for hazard/fire insurance and real estate taxes. If you are buying within a condominium or planned unit development, this also includes the condominium or homeowners association fees that you must pay.

Commitment Terms

Conditional Commitment for Mortgage Insurance under the National Housing Act, Sec.

|

|

See below |

By: |

|

Action Date |

|

||

|

|

|

Lender ID |

FHA Case No. |

|

Sponsor/Agent |

INSTCase Ref. No. |

|

Mortgagee |

|

|

Est. Value of Prop.$

Property Address:

|

Existing |

|

|

Proposed |

Monthly Expense Estimate |

|

|

(see gen. cond. 3) |

|

|

Fire Insurance |

$ |

|

|

|

|

|

|

Taxes |

$ |

Commitment Issued |

|

|

||||

Commitment Expires |

|

|

||||

Improved Living |

|

|

Condo. Com. Exp. |

... $ |

||

|

Area |

Sq. Ft. |

Total |

$ |

||

Specific Commitment Conditions (Applicable when checked)

HUD’s commitment to insure a mortgage on this property is dependent on the completion of the conditions listed below. HUD Does Not Guarantee the work done to comply with the conditions.

Estimated Remaining Economic Life of this property is |

years. |

||||

This property |

|

is, |

|

is not eligible for maximum financing (high |

|

|

|

||||

|

|

|

|

|

|

Manufactured Housing

Manufactured Housing

Assurance of Completion: If the required repairs cannot be completed prior to submission of closing papers, form

the amount of $(or such additional amount as the lender desires) may be established as the means to ensure completion.

See indicated additional items on attached:

See the following additional conditions on the back:

See the following additional conditions on the back:

This form must be delivered to the borrower promptly, but no later than at the time of the borrower’s signing of the Uniform Residential Loan Application (URLA) and Addendum (form

Homebuyer's Copy |

form |

|

ref. Handbook 4150.1 |

Specific Commitment Conditions (Applicable when indicated on the front |

|

mandated form, that the house and other structures within the legal |

|

||||||||||||||||||||||

of this form) |

|

|

|

|

|

|

|

|

|

boundaries of the property indicate no evidence of active termite |

|||||||||||||||

B. Proposed Construction: |

|

The builder or mortgagee must notify the |

|

infestation. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

L. |

Code Enforcement: |

The lender shall submit a statement from the |

||||||||||||||||||||||

|

assigned Fee Inspector as appropriate (see items 11, 12, and 13 |

||||||||||||||||||||||||

|

below). |

|

|

|

|

|

|

|

|

|

public authority that the property meets local code requirements. |

||||||||||||||

C. |

Warranty: Form |

M. Repairs: The lender shall notify the original appraiser upon completion |

|||||||||||||||||||||||

|

shall be executed between the builder and the purchaser. |

|

|

|

of required repairs, unless otherwise instructed. |

|

|

|

|||||||||||||||||

D. |

Section 223: This commitment is issued pursuant to Section 223(e). |

N. Lender's Certificate of Completion: |

The lender |

shall furnish a |

|||||||||||||||||||||

E. |

Health Authority Approval: Submit local health authority approval |

|

certificate that required repairs have been examined and were satisfac- |

||||||||||||||||||||||

|

torily completed. |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

(on a form or letter) indicating the individual water supply and/or |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

O. Manufacturers Warranties |

must |

be |

provided to |

the homebuyer |

||||||||||||||||||||

|

sewage disposal system is acceptable. |

|

|

|

|

||||||||||||||||||||

F. |

Reserved. |

|

|

|

|

|

|

|

|

covering heating/cooling systems, hot water heaters, ranges, etc. |

|||||||||||||||

|

|

|

|

|

|

|

P. |

Initial Inspection (2 working days) is requested before the “beginning |

|||||||||||||||||

G. |

Prefabricator’s Certificate: The Lender shall provide a prefabrication |

||||||||||||||||||||||||

|

of construction” with forms in place. |

|

|

|

|

||||||||||||||||||||

|

certificate as required by the related engineering bulletin. |

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

Q. Frame Inspection (1 working day) is requested when the building is |

||||||||||||||||||||||

H. |

Termite Control (Proposed Construction): If soil poisioning is used, |

||||||||||||||||||||||||

|

enclosed and framing, plumbing, heating, electrical, and insulation is |

||||||||||||||||||||||||

|

the builder shall complete form |

|

|||||||||||||||||||||||

|

|

complete and visible. |

|

|

|

|

|

|

|

|

|||||||||||||||

|

ment Guarantee, and transmit a copy to HUD or the Direct Endorse- |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

R. Final Inspection is requested when construction is completed and the |

||||||||||||||||||||||||

|

ment Underwriter. The Mortgagee will deliver the original and a copy |

||||||||||||||||||||||||

|

to the mortgagor at closing. |

|

|

|

|

|

property ready for occupancy. |

|

|

|

|

|

|||||||||||||

I. |

Flood Insurance Requirement: This property is located in a special |

S. Insulation Certificate must be posted in a conspicuous location in the |

|||||||||||||||||||||||

|

flood hazard area and must be covered by flood insurance in accor- |

|

dwelling. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

dance with HUD regulation 24 CFR 203.16a. |

|

|

|

T. The Insured Protection Plan Warranty Agreementshall be executed |

||||||||||||||||||||

J. |

Carpet Identification: |

(as listed in Certified |

Products |

Directory) |

|

between the builder and the homebuyer. |

|

|

|

||||||||||||||||

U. The lender shall furnish a certificate of occupancy or letter of accep- |

|||||||||||||||||||||||||

|

Manufacturer recommended maintenance program must be provided |

||||||||||||||||||||||||

|

|

tance from the local building authority. |

|

|

|

|

|||||||||||||||||||

|

to the homebuyer. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

K. |

Termite Control: (Existing Construction) A recognized termite control |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

operator shall furnish certification using form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

||||||||||||||||||||

AdvicetoHomebuyers If your application was processed by a Direct |

Estimated Monthly Expenses: |

These are costs associated |

with |

homeowner- |

|||||||||||||||||||||

Endorsement (DE) lender, you should first contact them for assistance before |

ship which HUD believes the |

||||||||||||||||||||||||

calling HUD. |

|

|

|

|

|

|

|

property. |

Two examples of “estimated monthly expenses” are fire insurance and |

||||||||||||||||

Prepaid Items: |

These are charges that normally will be paid at closing and are |

taxes, which are |

paid |

to |

your |

lender each |

month as part of |

your |

mortgage |

||||||||||||||||

payment. |

These |

are |

put |

into |

your |

escrow |

account. |

|

|

|

|||||||||||||||

recurring in |

nature. They include |

such items as |

funds for |

real estate |

taxes |

and |

|

|

|

||||||||||||||||

OtherCostsofHomeownership: |

Utilities |

are usually |

paid |

monthly to |

|||||||||||||||||||||

hazard |

insurance. |

The amount |

of these items |

will vary |

depending |

upon |

the |

||||||||||||||||||

whomever provides the service. Also, you should save a certain amount |

|||||||||||||||||||||||||

closing |

date. |

No |

estimate is provided with this |

statement. |

|

|

|||||||||||||||||||

|

|

each month to cover repair and maintenance costs which will come up while |

|||||||||||||||||||||||

Escrow Account: This is a special account that your lender will keep on |

|||||||||||||||||||||||||

you own your home. |

|

|

|

|

|

|

|

|

|

||||||||||||||||

your behalf to save the necessary funds to pay certain future bills. Your |

|

|

|

|

|

|

|

|

|

||||||||||||||||

Late Payments: If you do not pay your mortgage payment within 15 days |

|||||||||||||||||||||||||

mortgage payment will include, in addition to an amount for interest and |

|||||||||||||||||||||||||

from the 1st day of the month, you can be charged a penalty. This may be |

|||||||||||||||||||||||||

principal, amounts to cover such items as property taxes, hazard insur- |

|||||||||||||||||||||||||

4 cents for each dollar of your payment. |

|

|

|

|

|||||||||||||||||||||

ance, and, for certain FHA programs, the mortgage insurance premium. |

|

|

|

|

|||||||||||||||||||||

New Construction: After |

specifications |

are |

accepted by |

HUD |

or a direct |

||||||||||||||||||||

These charges are collected in advance so that your lender will have |

|||||||||||||||||||||||||

endorsement lender, the builder is required to warrant that the house substan- |

|||||||||||||||||||||||||

enough money in the account to apply the charge when it comes due. |

|||||||||||||||||||||||||

tially conforms to approved plans and specifications. This warranty is for 1 year |

|||||||||||||||||||||||||

Generally, 1/12 of the next year’s estimated charges will be the amount |

|||||||||||||||||||||||||

following the date on which title is transferred to the original buyer or the date on |

|||||||||||||||||||||||||

collected with each of your monthly mortgage payments. Bear in mind that |

|||||||||||||||||||||||||

which the house was first lived in, which ever happens first. If, during the |

|||||||||||||||||||||||||

in most communities taxes and other operating costs are increasing. The |

|||||||||||||||||||||||||

warranty |

period, |

you notice |

defects for |

which you believe the builder is |

|||||||||||||||||||||

estimates should give some idea of what you can expect the costs to be at |

|||||||||||||||||||||||||

responsible, ask him in writing to fix them. If he does not fix them, write your |

|||||||||||||||||||||||||

the beginning. |

In some areas the estimate of taxes may also include |

||||||||||||||||||||||||

lender or HUD. Include your FHA case number. If inspection shows the builder |

|||||||||||||||||||||||||

charges such as sewer charges, garbage collection fee, water rates, etc. |

|||||||||||||||||||||||||

to be at fault, your lender or HUD will try to persuade him to fix the defect. If |

|||||||||||||||||||||||||

Mortgage Insurance Premium: |

The amount for insuring your mortgage. |

||||||||||||||||||||||||

he does not, you may be able to obtain legal relief under the builder’s warranty. |

|||||||||||||||||||||||||

The premium may be in the form of an upfront charge and/or a monthly |

|||||||||||||||||||||||||

charge depending upon the section of the Housing Act under which your |

Where a structural defect is involved, HUD can provide money for corrections |

|

under certain conditions. You cannot expect the builder to fix damage caused |

||

mortgage is insured. Your lender can provide you with specific information |

||

by ordinary wear and tear or by by poor maintenance. Keeping the house in |

||

about your transaction. |

||

good condition is your responsibility. |

||

|

Weatherization. Contact your local utility company or other qualified person or firm for home energy audit. If

Sales Contract: It is expressly agreed that notwithstanding any other provisions of this contract, the purchaser shall not be obligated to complete the purchase of the property described herein or to incur any penalty by forfeiture of earnest money deposits or otherwise unless the purchaser has been given in accor- dance with HUD/FHA or VA requirements a written statement by the Federal Housing Commissioner, Veterans Administration, or a Direct Endorsement lender setting forth the appraised value of the property of not less than

$. The purchaser shall have the privilege and

option of proceeding with consummation of the contract without regard to the amount of the appraised valuation. The appraised valuation is arrived at to determine the maximum mortgage the Department of Housing and Urban Development will insure. HUD does not warrant the value nor the condition of the property. The purchaser should satisfy himself/herself that the price and condition of the property are acceptable.

Amount to be Borrowed When you borrow to buy a home, you pay interest and other charges which add to your cost. A larger downpayment will result in a smaller mortgage. Borrow as little as you need and repay in the shortest time.

Homebuyer's Copy |

form |

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Purpose | The HUD 92800.5B form is used for Conditional Commitment and Direct Endorsement for mortgage insurance under the National Housing Act. |

| Validity Period | This document is valid for 120 days from the effective date of the appraisal or appraisal update. |

| Cancellation Policy | The form can be canceled after 60 days from the date of issuance if construction has not commenced. |

| Approval Process | Approval of the borrower is contingent upon receiving an acceptable application for mortgage credit analysis. |

| Maximum Financing | The property can either qualify or not qualify for maximum financing, which reflects its loan-to-value ratio. |

| Property Standards | All proposed construction must meet or exceed applicable codes and HUD minimum property standards. |

| Estimated Property Value | The form includes an estimate of the property's value, which influences the mortgage amount approved. |

| HUD’s Commitment | HUD's commitment to insure the mortgage is contingent upon the completion of specific conditions listed in the form. |

Guidelines on Utilizing Hud 92800 5B

Filling out the HUD 92800.5B form is an essential step in securing mortgage insurance for a property, whether it’s newly constructed or an existing home. This process involves providing specific information regarding the property and the borrower’s financial qualifications. Completing the form accurately can help ensure a smoother transaction down the line.

- Begin by entering the Estimated Value of Property in the designated area.

- Fill in the Property Address with accurate details about the property's location.

- Indicate the Type of Property as “Existing” or “Proposed” in the appropriate section.

- List the Monthly Expense Estimates for hazard/fire insurance and real estate taxes.

- Provide the Lender ID and FHA Case Number on the form.

- Specify the Commitment Issued Date and the Commitment Expires Date.

- Detail any Specific Commitment Conditions that apply by checking the appropriate boxes.

- Provide information regarding the Remaining Economic Life of the property.

- If applicable, indicate whether the property is eligible for maximum financing.

- Ensure all required signatures and dates are included before submitting the form to the lender.

What You Should Know About This Form

What is the HUD 92800.5B form and its purpose?

The HUD 92800.5B form, known as the Conditional Commitment Direct Endorsement Statement of Appraised Value, is a critical document used in the mortgage insurance process under the National Housing Act. This form serves as an assurance from the U.S. Department of Housing and Urban Development (HUD) that the specific property meets required standards for insurance coverage. More specifically, it outlines the terms on which HUD may commit to insure a mortgage, as well as the conditions necessary for that insurance to be granted. Essentially, this form is fundamental in gauging property eligibility for HUD-insured financing.

How long is the HUD 92800.5B form valid, and what happens if it expires?

This form has a validity period of 120 days from the effective date of the appraisal. If the conditions outlined in the form are not met within this timeframe, the document will expire and the borrower may need to start the application process over again. Furthermore, if construction has not commenced within 60 days of issuance, the document can be cancelled. This introduces additional urgency for borrowers and lenders, as they must ensure compliance with all conditions before the expiration date or face potential delays in funding.

What specific conditions may affect the commitment outlined in the form?

The form lists numerous specific conditions that must be met before HUD will endorse a firm commitment for mortgage insurance. These include requirements related to property standards, approval of the borrower, and any particular repairs or construction mandates. For example, the property must meet local building codes and HUD's minimum standards, and the lender needs to provide documentation regarding insurance and property taxes. It also specifies that a warranty is required for new constructions. Non-compliance with any of these conditions could jeopardize the mortgage insurance commitment.

How does the HUD 92800.5B form relate to mortgage approval for potential homeowners?

This form is integral to the mortgage approval process for those seeking financing under FHA guidance. When a potential homeowner applies for a mortgage, they must present this form as part of their application to confirm that the property is eligible for insurance. It establishes a pathway for the borrower to secure favorable financing terms, facilitating home ownership. Consequently, not only is the HUD 92800.5B crucial for lenders in assessing risk, but it also serves as an essential reference point for borrowers throughout the purchasing process.

Common mistakes

Filling out the HUD 92800.5B form can be tricky. Many people make mistakes that can delay the mortgage process. One common mistake is not providing accurate property information. It's essential to include the correct property address and estimated value. A minor error in this area can lead to significant issues down the line, so double-check these details before submitting.

Another frequent error is miscalculating monthly expenses. When estimating costs for fire insurance and taxes, individuals often approximate without verifying the correct amounts. These figures should reflect realistic expenses, as they play a crucial role in determining mortgage eligibility and approval. Ensuring accuracy here can prevent unnecessary delays.

Many also overlook the importance of adhering to property standards. The form requires the proposed construction or renovations to meet specific codes and HUD minimum property standards. Failing to acknowledge these requirements may result in a rejected application. Always ensure that outlined conditions are complete and compliant before submission.

A lack of understanding of the validity period is another mistake. The document expires 120 days from the appraisal date. If the mortgage application is not submitted within this timeframe, the entire process may need to restart. Staying aware of these time constraints can save both time and stress.

Moreover, individuals sometimes neglect to include necessary signatures. Each section of the form must be correctly signed by the appropriate parties. Missing a signature can lead to complications. Therefore, take a moment to review the form thoroughly and confirm that everything is signed as needed.

Some applicants fail to promptly submit required documentation. Additional conditions, such as local health authority approvals or termite inspections, might be necessary. These documents should accompany the application. Delays in gathering this information can significantly hinder the approval process.

A common misstep is misunderstanding the term “firm commitment.” A firm commitment does not guarantee approval but indicates a willingness to insure the mortgage under specified conditions. Misinterpreting this aspect can lead to confusion later in the process. It is essential to clarify what this commitment entails to maintain realistic expectations.

Another area where mistakes occur is the completion of specific commitment conditions. If some boxes require checking or specific conditions are applicable, be sure to indicate those clearly on the form. Incomplete information can lead to misunderstandings that could delay approval.

Lastly, many people do not seek help when needed. If there are uncertainties about any part of the form, consulting with a lending professional can clarify things. It is better to ask questions upfront than to deal with complications later. Taking these steps can help ensure that the HUD 92800.5B form is completed correctly, making the mortgage application process smoother.

Documents used along the form

The HUD 92800 5B form is an important document used in the home mortgage process, specifically for obtaining mortgage insurance under the Federal Housing Administration (FHA). Along with this form, several other documents may also be required to ensure a smooth transaction. Here's a brief overview of five common documents often used in conjunction with the HUD 92800 5B form.

- HUD-92900-A: This addendum to the Uniform Residential Loan Application provides additional information required for the FHA mortgage application. It helps lenders assess the applicant's financial situation further and outlines any unique loan requirements.

- HUD-92300: Known as the Assurance of Completion form, this document ensures that all required repairs or construction tasks will be completed before the mortgage closing. It's essential for properties that need renovations to meet FHA standards.

- HUD-92544: This form serves as a warranty for new construction properties. It outlines the responsibilities of contractors and builders regarding any defects or issues that might arise within a specified period after purchase.

- HUD-92052: The Termite Soil Treatment Guarantee is required if soil treatment is used in the construction of a new home. This document certifies that the property has been treated for termite prevention, ensuring safety and compliance with FHA rules.

- NCPA-1: This certification form indicates that the existing property has been inspected for termite infestation. It is crucial for older homes to ensure they are free from active pest problems before being secured by an FHA loan.

Overall, these documents play a significant role in the home buying and financing process. Each serves a purpose, ensuring compliance with federal regulations, protecting both lenders and borrowers, and facilitating a smooth transaction. Proper attention to these forms can help avoid delays and complications during the mortgage application process.

Similar forms

HUD-92900-A: The Addendum to the Uniform Residential Loan Application (HUD-92900-A) complements the HUD-92800.5B by providing additional details on the borrower's mortgage application. Both forms facilitate the lender's assessment of the borrower's eligibility.

HUD-92300: This form serves as an Assurance of Completion for required repairs not finished before closing. Similar to the HUD-92800.5B, it ensures that specific conditions for mortgage approval must be met for the loan to proceed.

HUD-92544: The Warranty of Completion of Construction (HUD-92544) is required for new builds. It shares the objective of the HUD-92800.5B in confirming that specific requirements are satisfied before finalizing the mortgage.

NCPA-1: This form certifies that no active termite infestation exists in the property. Like the HUD-92800.5B, it addresses compliance with property standards important for mortgage insurance eligibility.

Dos and Don'ts

When filling out the HUD 92800.5B form, follow these guidelines to avoid mistakes:

- Double-check all personal information for accuracy, including names, addresses, and identification numbers.

- Ensure that you have all necessary documentation ready before starting the form.

- Read all instructions thoroughly before filling out the form.

- Use black or blue ink to fill out the form, as other colors may not scan properly.

- Keep a copy of the completed form for your records once submitted.

Here are some things to avoid when completing the form:

- Do not leave any required fields blank; this could delay your application.

- Avoid submitting the form without reviewing it first to catch any errors.

- Do not accept unverified information from others; always check your sources.

- Do not rush; take your time to ensure clarity and precision in your responses.

- Don't forget to meet the submission deadline to remain eligible for mortgage insurance.

Misconceptions

- Misconception 1: The HUD 92800.5B form guarantees mortgage approval.

- Misconception 2: The validity of this document can be extended indefinitely.

- Misconception 3: HUD guarantees the quality of the property.

- Misconception 4: Flood insurance is optional for properties in hazard areas.

- Misconception 5: The HUD 92800.5B form is the only document needed for a mortgage.

Many believe that completing this form ensures they will receive a mortgage. In reality, the form outlines conditions and is part of the process for obtaining mortgage insurance, but it does not guarantee approval.

Some assume that the validity period of the form can be stretched. However, it expires 120 days from the effective date of the appraisal or update, and this timeframe cannot be altered.

There is a common belief that HUD certifies the condition or value of a property. This is not the case; the agency only provides insurance for mortgages that meet certain criteria. Buyers must conduct their own inspections to ensure property quality.

Some individuals think flood insurance is not required if a property is located in a flood hazard area. The truth is, HUD mandates flood insurance in these situations to protect homeowners and lenders from financial loss.

Many people mistakenly believe that this form alone is sufficient to secure a mortgage. In fact, it is one part of a larger application process, which includes several other forms and compliance with various regulations.

Key takeaways

Filling out and using the HUD 92800.5B form, also known as the Conditional Commitment Direct Endorsement Statement of Appraised Value, is a key step in obtaining mortgage insurance from the Federal Housing Administration (FHA). Below are five important takeaways regarding this process:

- Understand the Purpose: This form acts as the application for individual properties, whether they are proposed new constructions or existing homes. Its primary goal is to establish the conditions under which HUD will insure a mortgage.

- Approval and Changes: The approval of the borrower hinges on the receipt of an acceptable application for mortgage credit analysis. Keep in mind that the Commissioner or Direct Endorsement Underwriter can modify the mortgage amount and terms based on borrower qualifications.

- Time Sensitivity: The validity period of this document is 120 days from the effective date of the appraisal. If construction has not started within 60 days from issuance, the document may be cancelled.

- Property Standards Compliance: All proposed construction, repairs, or alterations must meet or exceed applicable building codes and HUD's minimum property standards. This ensures the safety and livability of the property.

- Insurance and Maintenance Costs: Elevating the financial picture, the form requires estimates for fire insurance and real estate taxes. This information must be accurately included in the Addendum to the Uniform Residential Loan Application (HUD-92900-A) when seeking a firm mortgage commitment.

Browse Other Templates

How to Get My Llc in Nc - It must be submitted to the North Carolina Secretary of State’s office.

Homeless Court - Caseworker contact details must be included in the application.

Can I Get a Vehicle Moving Permit Online - The form aims to prevent unfit vehicles from being used on public highways.