Fill Out Your Ic 4010 Form

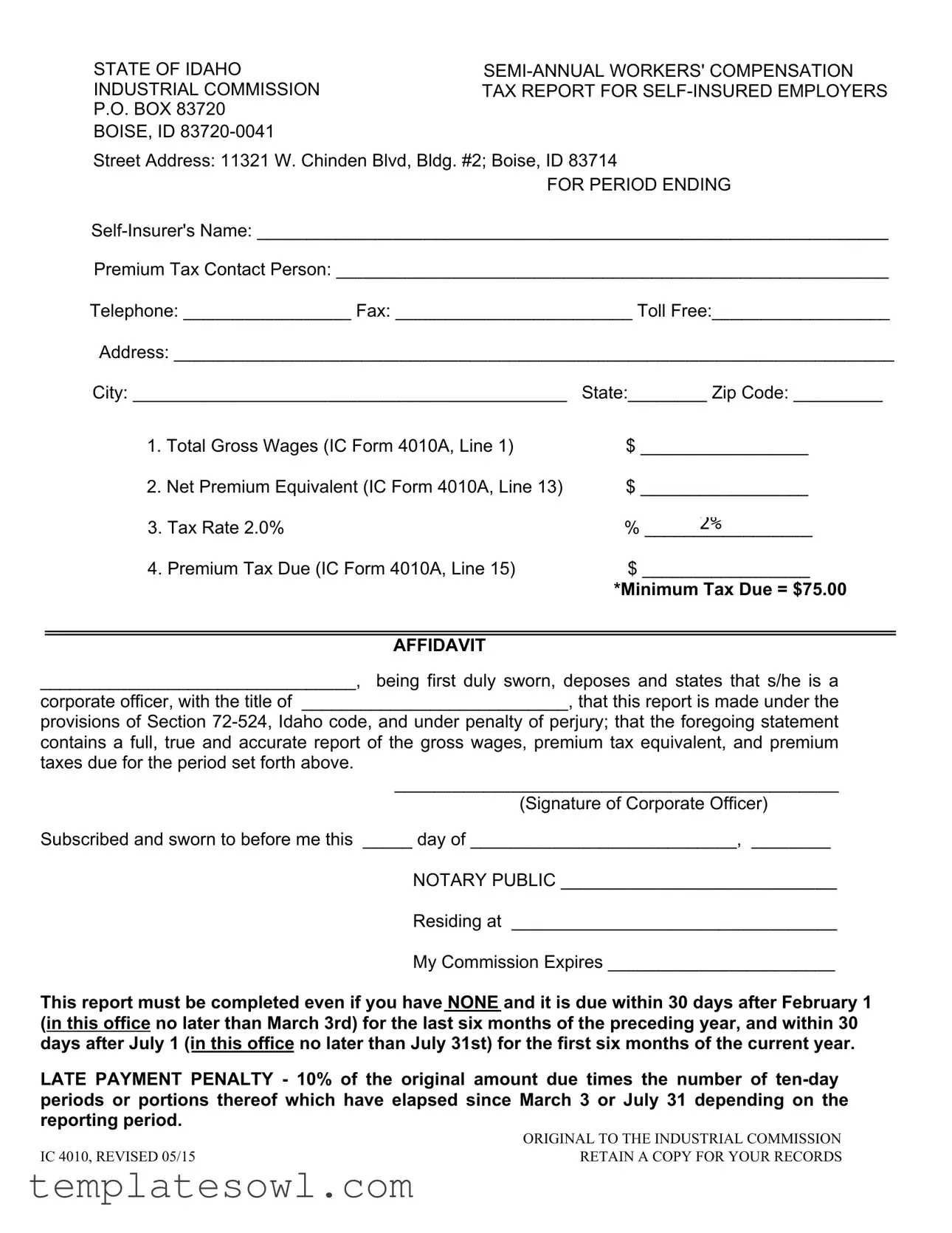

The IC 4010 form is an essential document for self-insured employers in Idaho, serving as the semi-annual workers' compensation industrial commission tax report. It requires organizations to report various financial details, including total gross wages and net premium equivalents for the specified reporting period. Employers complete this form to ensure compliance with Idaho’s regulations concerning workers’ compensation tax obligations. One key aspect of the form is the tax calculation, which is based on a fixed rate of 2% applied to the company's net premium equivalent. It's important to note that a minimum tax amount of $75 is stipulated, regardless of the calculated figure. Furthermore, the form includes an affidavit section requiring a corporate officer to affirm the accuracy of the reported data under penalty of perjury. This report must be submitted within strict timelines: it is due within 30 days following the close of both the first and second half of the year, ensuring timely regulatory compliance. Failing to submit the form on time can lead to penalties, including late fees calculated as a percentage of the amount owed. Overall, the IC 4010 form plays a crucial role in tracking the financial health of self-insured businesses and their adherence to labor laws in Idaho.

Ic 4010 Example

STATE OF IDAHO |

|

INDUSTRIAL COMMISSION |

TAX REPORT FOR |

P.O. BOX 83720 |

|

BOISE, ID

Street Address: 11321 W. Chinden Blvd, Bldg. #2; Boise, ID 83714

FOR PERIOD ENDING

Premium Tax Contact Person: ________________________________________________________

Telephone: _________________ Fax: ________________________ Toll Free:__________________

Address: _________________________________________________________________________

City: ____________________________________________ |

State:________ Zip Code: _________ |

||

1. |

Total Gross Wages (IC Form 4010A, Line 1) |

$ _________________ |

|

2. |

Net Premium Equivalent (IC Form 4010A, Line 13) |

$ _________________ |

|

3. Tax Rate 2.0% |

% |

2% |

|

4. Premium Tax Due (IC Form 4010A, Line 15) |

$ _________________ |

||

|

|

*Minimum Tax Due = $75.00 |

|

AFFIDAVIT

________________________________, being first duly sworn, deposes and states that s/he is a

corporate officer, with the title of ___________________________, that this report is made under the

provisions of Section

_____________________________________________

(Signature of Corporate Officer)

Subscribed and sworn to before me this _____ day of ___________________________, ________

NOTARY PUBLIC ____________________________

Residing at _________________________________

My Commission Expires _______________________

This report must be completed even if you have NONE and it is due within 30 days after February 1 (in this office no later than March 3rd) for the last six months of the preceding year, and within 30 days after July 1 (in this office no later than July 31st) for the first six months of the current year.

LATE PAYMENT PENALTY - 10% of the original amount due times the number of

|

ORIGINAL TO THE INDUSTRIAL COMMISSION |

IC 4010, REVISED 05/15 |

RETAIN A COPY FOR YOUR RECORDS |

Form Characteristics

| Fact Name | Description |

|---|---|

| State Governing | The IC 4010 form is specifically for self-insured employers in Idaho. |

| Reporting Period | Reports are due twice a year: within 30 days after February 1 and July 1. |

| Address | Submissions should be sent to P.O. Box 83720, Boise, ID 83720-0041. |

| Minimum Tax Due | No matter the amount calculated, the minimum tax due is $75.00. |

| Tax Rate | The applicable tax rate for the premium tax is 2.0%. |

| Late Payment Penalty | A 10% penalty applies for late payments after the deadline. |

| Affidavit Requirement | The form requires an affidavit signed by a corporate officer. |

| Contact Information | Employers must provide contact information for the Premium Tax Contact Person. |

| Retain a Copy | Employers are advised to keep a copy of the completed form for their records. |

| Governing Law | The IC 4010 is governed by Section 72-524 of the Idaho Code. |

Guidelines on Utilizing Ic 4010

After gathering the necessary information and documentation, accurately filling out the IC 4010 form is the next step for self-insured employers in Idaho to ensure compliance with state reporting requirements. Following these steps will help streamline the process.

- Begin by entering the Self-Insurer's Name at the top of the form.

- Fill in the Premium Tax Contact Person and provide their phone number, fax number, and toll-free number.

- Complete the address section, including City, State, and Zip Code for your organization.

- On the next lines, enter the Total Gross Wages as reported on IC Form 4010A, Line 1.

- Next, provide the Net Premium Equivalent from IC Form 4010A, Line 13.

- Indicate the Tax Rate as 2%.

- Calculate the Premium Tax Due based on IC Form 4010A, Line 15.

- Remember that the minimum tax due is $75.00.

- In the affidavit section, sign and print your name, affirming that you are a corporate officer and providing your title.

- Date the form in the designated area.

- Find a Notary Public to subscribe and notarize your signature, filling out their information as required.

- Submit the original form to the Industrial Commission at the provided address.

- Make sure to retain a copy of the completed form for your records.

What You Should Know About This Form

What is the purpose of the IC 4010 form?

The IC 4010 form serves as a semi-annual tax report specifically designed for self-insured employers in Idaho. It collects information regarding gross wages and the net premium equivalent, enabling employers to report their premium tax obligations to the Idaho Industrial Commission. Accurate completion of this form ensures compliance with Idaho law and assists in the funding of the state's workers' compensation program.

When is the IC 4010 form due?

The IC 4010 form must be submitted within 30 days after February 1 for the reporting period that covers the last six months of the preceding year. This means it must be received by the Idaho Industrial Commission no later than March 3. For the first six months of the current year, the form is due within 30 days after July 1, with a deadline of July 31 for submission. Late submissions can incur penalties.

What happens if the IC 4010 form is filed late?

If the IC 4010 form is filed after the deadline, a penalty will be imposed. This fine amounts to 10% of the original premium tax due for each ten-day period or any portion thereof that has passed since either March 3 or July 31, depending on the report's applicable period. Therefore, timely submission is crucial to avoid additional costs.

Is it necessary to file the IC 4010 form even if there are no wages to report?

Yes, it is mandatory for employers to complete and submit the IC 4010 form regardless of whether they have any wages to report during the specified period. This ensures that the Idaho Industrial Commission maintains an accurate record of employers' compliance and their various statuses with workers' compensation reporting.

What information is required on the IC 4010 form?

The IC 4010 form requires several key pieces of information. Employers must provide their name, contact details, total gross wages, and the net premium equivalent. Additionally, they must calculate and report the premium tax due, which is based on a tax rate of 2%. Finally, the form requires a notarized affidavit from a corporate officer affirming the accuracy of the provided information.

Common mistakes

Filling out the IC 4010 form can be complex, and many self-insured employers make mistakes that could delay processing or result in penalties. One common error is forgetting to report a total gross wages amount. This figure is essential for determining accurate tax and must be completed carefully. Skipping this line can lead to rejection of the entire form.

Another frequent mistake involves miscalculating the net premium equivalent. This amount is derived from previous calculations and directly affects the final tax due. An incorrect entry here can not only misrepresent your liability but also trigger audits.

People sometimes overlook the tax rate section. The form specifies a tax rate of 2.0%. Entering a different percentage can lead to significant discrepancies in your tax calculations. Ensure this is correctly filled in to avoid complications.

Failure to include the premium tax due amount is also a common pitfall. This line is crucial for determining what you owe. Neglecting to fill it out can cause unnecessary delays and potential penalties for late payments.

Many individuals do not remember that the form must be completed even if there are no taxes owed. This “zero return” is still required by law and must be submitted on time. Missing this obligation could result in fines.

Additionally, incorrect or missing contact information can hinder communication with the Industrial Commission. Ensure the contact person’s name, phone number, and address are accurate so that any questions regarding the form can be addressed swiftly.

Another mistake involves not signing the affidavit correctly. The form requires the signature of a corporate officer, along with an indication of their title. Failing to provide this can render the form invalid.

It’s also important not to forget about the notary public section. This requirement is critical for the affidavit's validity. If this section is incomplete or incorrect, the form’s authenticity could be questioned, leading to delays.

Finally, many people underestimate the importance of tracking submission deadlines. The form has specific due dates after February 1 and July 1. Missing these deadlines can result in automatic late penalties, which only add to the overall tax burden.

Documents used along the form

The IC 4010 form is essential for self-insured employers in Idaho, serving as a report for their semi-annual workers' compensation tax obligations. Alongside the IC 4010, there are several other documents that may be necessary for compliance and record-keeping. Below are commonly used forms and documents that might accompany the IC 4010.

- IC Form 4010A: This is the supporting document that provides specific details about gross wages and premium equivalents needed for accurate reporting on the IC 4010 form.

- IC Form 4011: Self-insured employers may need this form to report any changes in their workforce or operational status that could impact their workers' compensation obligations.

- Annual Payroll Report: Often required in conjunction with the IC 4010, this report lists the total payroll expenses for the year, which can directly influence the calculation of premium taxes.

- Claims Reports: Detailed documentation of any workers’ compensation claims filed during the reporting period is sometimes necessary to provide a comprehensive view of liabilities.

- Tax Payment Receipts: Documentation of past tax payments can be essential for referencing any discrepancies and verifying timely payments.

- Experience Modification Rate (EMR) Worksheet: This worksheet is used to calculate the EMR, which can affect the premiums and taxes owed by self-insured employers.

- Safety Programs Documentation: Evidence of workplace safety initiatives may need to be presented, especially if reviewing claims and loss history is on the agenda.

- Audits or Financial Statements: In some cases, organizations may have to provide recent financial statements to assess their ability to cover potential liabilities adequately.

- Notarized Affidavits: An affidavit signed by a corporate officer may be required to validate the information submitted on the IC 4010 form.

- Electronic Filing Confirmation: If the IC 4010 is submitted electronically, a confirmation receipt should be retained for record-keeping purposes.

Keeping these documents organized and readily available can help ensure that the reporting process goes smoothly and that compliance with state obligations is maintained. This careful attention to detail can help avoid penalties and contribute to better workforce management.

Similar forms

- Form 941: This form is used by employers to report income taxes, social security tax, and Medicare tax withheld from employee’s paychecks. Like the IC 4010, it tracks tax liabilities and is submitted quarterly.

- Form W-2: Employers use Form W-2 to report wages and taxes withheld for each employee. Similar to the IC 4010, it provides a summary of earnings and deductions, but on an annual basis.

- Form 1099-MISC: This form is for reporting payments made to independent contractors. It shares similarities with the IC 4010 in capturing income information but is used for non-employees.

- Form 990: Nonprofits use this form to report their financial activities, including revenue and expenses. Like the IC 4010, it is a comprehensive financial report, but it focuses on tax-exempt organizations.

- Form 1065: Partnerships file this form to report income, gains, losses, and deductions. Both this form and the IC 4010 provide a breakdown of financial information, though for different business structures.

- Form 1120: Corporations use this form to report income tax information. Similar to the IC 4010, it summarizes earnings and tax obligations, but it is specific to corporations.

- Schedule C: Sole proprietors file this form to report income and expenses from their business. Like the IC 4010, it details financial performance, but it's tailored for self-employed individuals.

- Form 8862: This form is used primarily to claim the Earned Income Tax Credit after prior disallowance. While it serves a different purpose, both forms require thorough reporting of tax-related information.

Dos and Don'ts

When filling out the IC 4010 form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do: Make sure to complete all required fields, including the contact person's information and total gross wages.

- Do: Double-check your calculations for the Net Premium Equivalent before submitting.

- Do: Submit the form by the deadline to avoid late payment penalties.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank; every section needs to be filled out.

- Don't: Ignore the penalty for late submissions, as this will increase the amount due significantly.

Misconceptions

There are several misconceptions about the IC 4010 form that can create confusion for self-insured employers in Idaho. Here are six common misunderstandings:

- It’s optional to file the IC 4010 form. Many believe that if they have no wages or taxes due, they don't need to file. However, this form must be completed regardless of whether there are any figures to report.

- Late payments incur a flat fee. Some think that penalties are charged at a fixed rate. In reality, late payments are subject to a penalty of 10% of the original amount due for each ten-day period, or portion thereof, that has passed.

- The tax rate is negotiable. Certain individuals assume they can negotiate the tax rates applied to their premiums. The tax rate is set at 2% and is not subject to negotiation.

- Only large companies need to file. There’s a misconception that only self-insured employers with substantial operations need to submit the IC 4010. In truth, every self-insured employer, regardless of size, must file.

- Filing deadlines can be ignored. Some believe they can submit the form whenever it's convenient. The deadlines are firm, with reports deemed due within 30 days after February 1 and July 1 each year.

- A notary is optional for the affidavit section. Many think that notarization isn’t necessary for the affidavit. However, a signature must be notarized to ensure the authenticity of the document.

Understanding these facts about the IC 4010 form can help ensure compliance and avoid unnecessary penalties.

Key takeaways

When completing and using the IC 4010 form for Idaho's semi-annual workers' compensation tax report, it is essential to keep the following key takeaways in mind:

- Timely Submission: Ensure the form is submitted within 30 days after the reporting periods end. This means submitting by March 3 for the period ending January 31 and by July 31 for the period ending July 1.

- Accurate Reporting: Fill out all required fields, including total gross wages and net premium equivalent. These details are crucial for determining the tax owed accurately.

- Minimum Tax Due: Be aware that regardless of the calculated premium tax, a minimum tax of $75.00 is always due.

- Penalties for Late Payment: A late filing incurs a penalty of 10% of the total amount due for each ten-day period (or portion thereof) after the due date.

Completing the IC 4010 form accurately and on time can help avoid unnecessary penalties and complications. Always keep a copy of the submitted form for your records.

Browse Other Templates

Bathroom Sign in and Out Sheet - Monitor restroom supplies to avoid shortages for users.

Church Balance Sheet - Encourage accurate record-keeping through detailed submissions.

Csa Insurance Meaning - The form helps both guests and property management handle damage issues efficiently.