Fill Out Your Inheritance Form

The Inheritance form plays a pivotal role in the process of transferring assets from a deceased individual to their heirs. This form is essential for those who seek an inheritance certificate, which legally recognizes the rights of the applicants to the estate. The form requires detailed information about the deceased, including their name, date and place of birth, and last residence. It also necessitates documentation, such as death and birth certificates, marriage certificates, and any existing wills. The applicant must provide personal information, including their relationship to the deceased and their own citizenship details. Additionally, the form delves into the testamentary dispositions, spotlighting whether a last will or contract of inheritance exists and who the appointed heirs are. Marital history is another crucial component, detailing the number of marriages the deceased had and any children from those unions. By meticulously filling out this form, individuals can navigate the often complex legal landscape following a loved one's passing, thereby ensuring that the inheritance process proceeds as smoothly as possible.

Inheritance Example

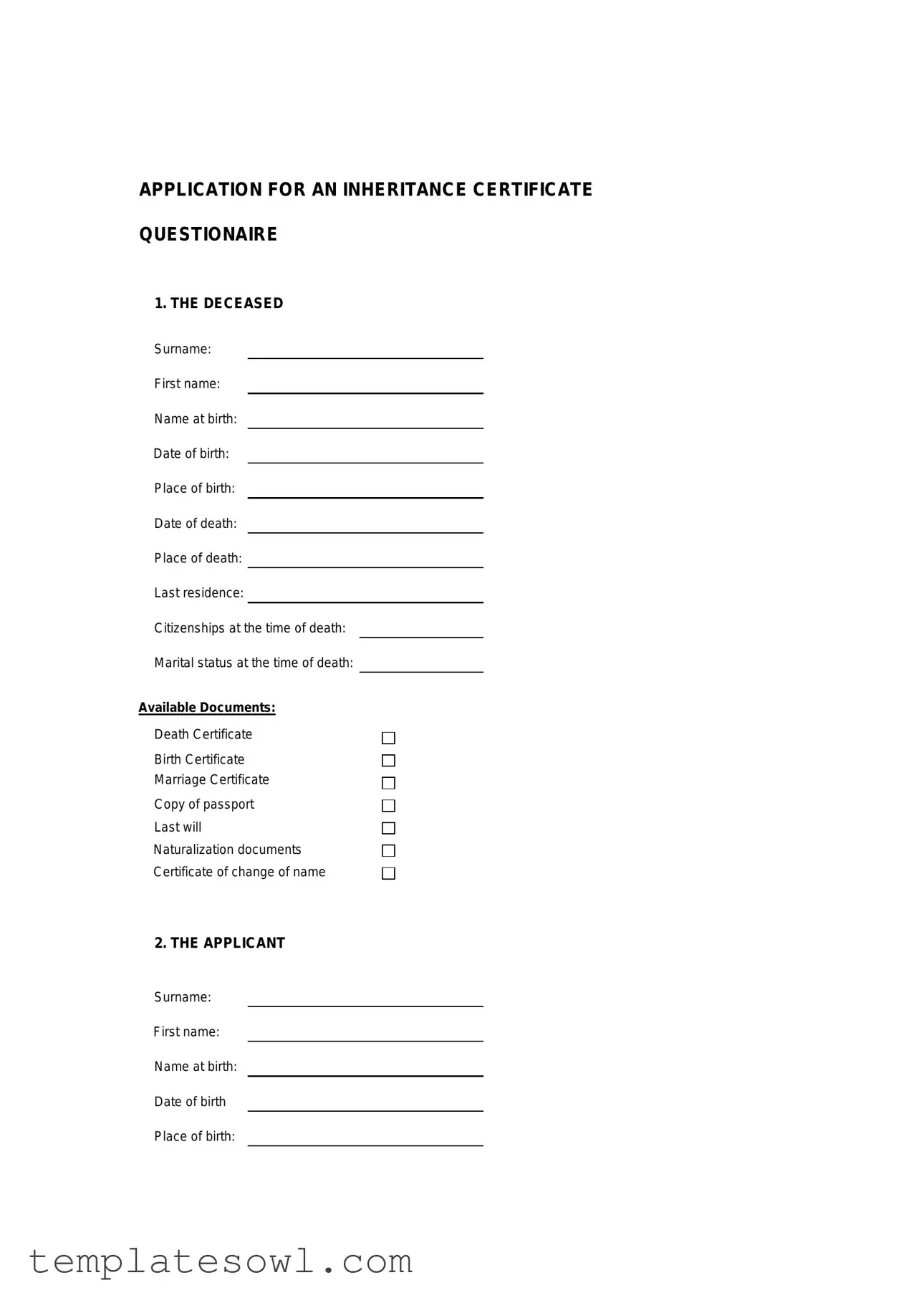

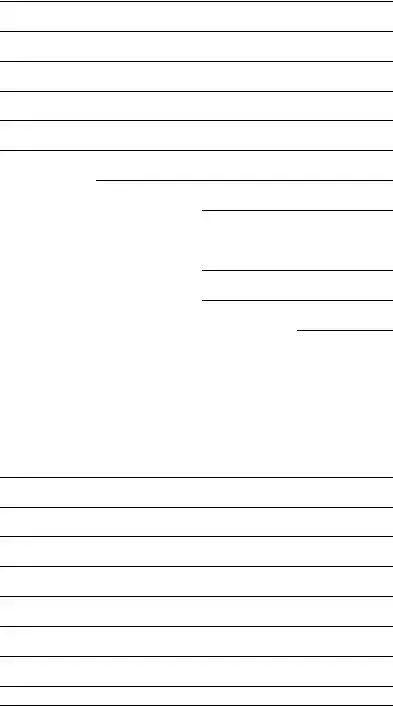

APPLICATION FOR AN INHERITANCE CERTIFICATE

QUESTIONAIRE

1. THE DECEASED

Surname:

First name:

Name at birth:

Date of birth:

Place of birth:

Date of death:

Place of death:

Last residence:

Citizenships at the time of death:

Marital status at the time of death:

Available Documents:

Death Certificate |

□ |

||

Birth Certificate |

|||

□ |

|||

Marriage Certificate |

|||

□ |

|||

Copy of passport |

|||

□ |

|||

Last will |

|||

□ |

|||

|

|||

Naturalization documents |

□ |

||

Certificate of change of name |

|||

□ |

|||

|

|||

2. THE APPLICANT |

|

||

Surname: |

|

|

|

First name: |

|

||

Name at birth: |

|

||

Date of birth |

|

|

|

Place of birth:

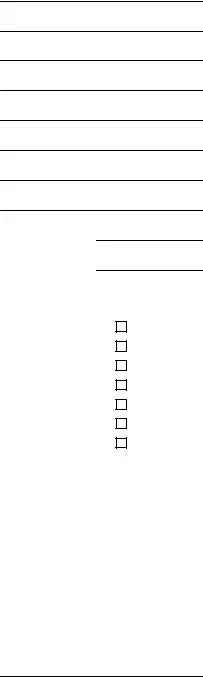

Current Address:

Telephone:

Citizenships:

Valid Passport / ID / Drivers´s license No.:

The deceased was my:

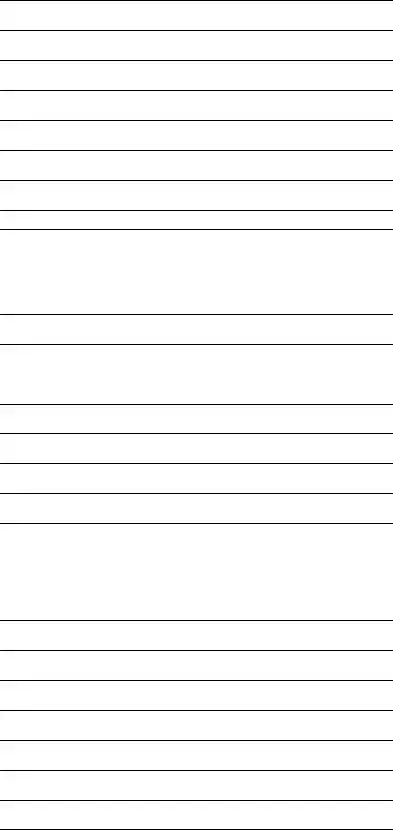

3. TESTAMENTARY DISPOSITIONS

Is there any last will/contract of Inheritnace or Trust?

Last will dated:

Probated by the court in: |

|

|

|

|

date: |

|

|

file number: |

|

I am appointed as only heir |

|

□ |

||

|

|

|

||

Apart from me the following heirs were appointed:

a)Surname:

First names:

Date of birth:

Place of birth:

Date of death:

Place of death:

Address:

Family relation to the deceased:

b)Surname:

First names:

Date of birth:

Place of birth:

Date of death:

Place of death:

Address:

Family relation to the deceased:

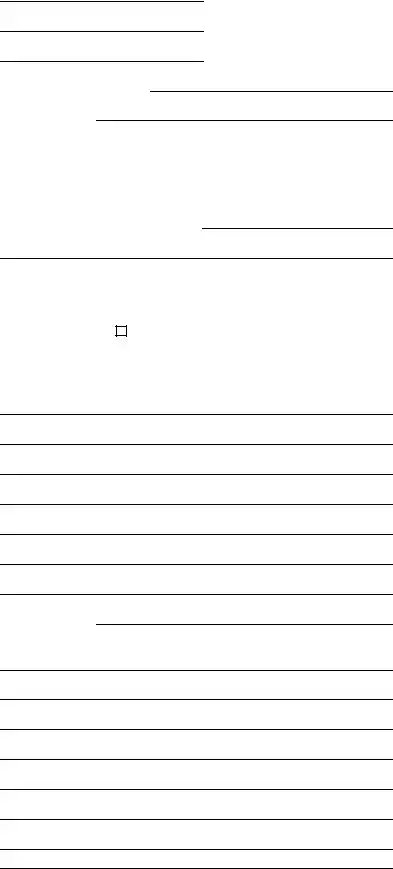

c)Surname:

First names:

Date of birth:

Place of birth:

Date of death:

Place of death:

Address:

Family relation to the deceased:

If more, please continue on a separate page.

4. MARRIAGES

The deceased was single. |

□ |

|

The deceased was married only once. □

The deceased was a widow/widower. □

The deceased was married ____ times.□

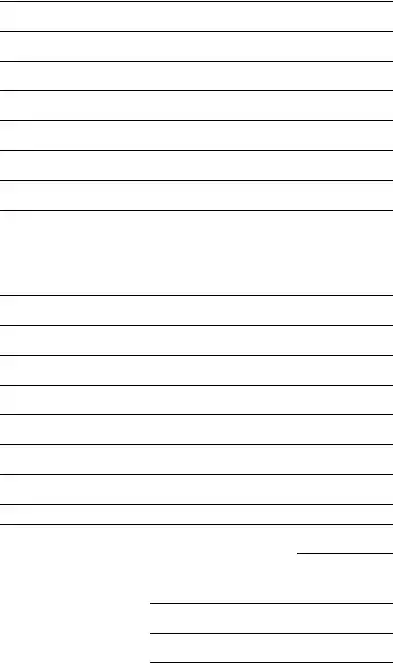

a)The first marriage with:

Surname:

First name:

Name at birth:

Date of birth:

Place of birth:

Last address

Date and place of wedding:

The first common residence after the marriage was in

The marriage was divorced by the decree of _________ (Court) in ____________ on the _______________

Citizenships of the deceased at the time of the first marriage:

Citizenships of the spouse at the time of the first marriage:

Did the deceased enter into a special agreement on his martial property regime?

b)The second marriage with:

Surname:

First name:

Name at birth:

Date of birth:

Place of birth:

Last address

Date and place of wedding:

The first common residence after the marriage was in

The marriage was divorced by the decree of __________ (Court) in ____________ on the ______________

Citizenships of the deceased at the time of the first marriage:

Citizenships of the spouse at the time of the first marriage:

Did the deceased enter into a special agreement on his martial property regime?

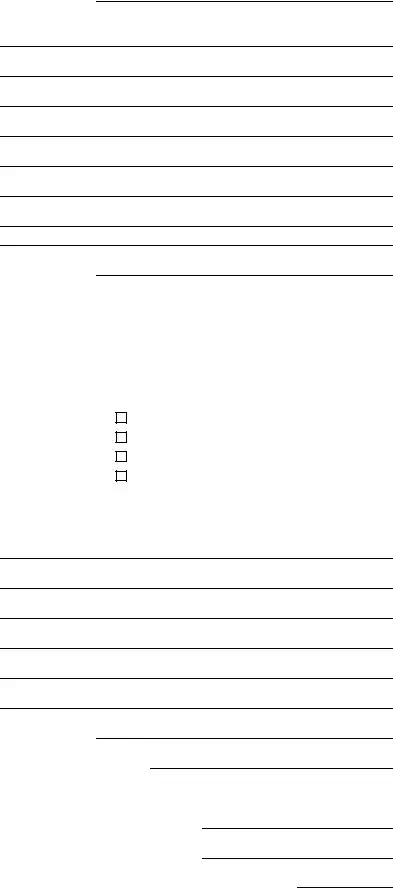

5.CHILDREN OF THE DECEASED

a)Child from the _____ marriage

Surname

First name:

Name at birth:

Date of birth:

Place of birth:

Date of death:

Place of death:

Address:

b) Child from the ____ marriage

Surname

First name:

Name at birth:

Date of birth:

Place of birth:

Date of death:

Place of death:

Address:

c)Child from the ____ marriage

Surname

First name:

Name at birth:

Date of birth:

Place of birth:

Date of death:

Place of death:

Address:

d)Child from the ____ marriage

Surname

First name:

Name at birth:

Date of birth:

Place of birth:

Date of death:

Place of death:

Address:

6.PARENTS OF THE DECEASED

a)Father of the deceased:

Surname

First name:

Name at birth:

Date of birth:

Place of birth:

Date of death:

Place of death:

Last Address:

b)Mother of the deceased

Surname

First name:

Name at birth:

Date of birth:

Place of birth:

Date of death:

Place of death:

Last Address:

Did the parents of the deceased had other children than the deceased? (If yes, please give details on a separate page)

Did the parents adopt any children?

Did the parents have children born out of wedlock?

Did one parent survived the deceased?

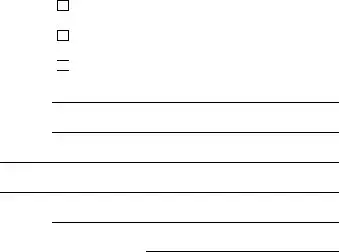

7. MISCELLANEOUS

My

of inheritance also on their behalf |

□ |

|

|

All the heirs a re willing to accept the inheritance |

□ |

|

A Lawsuit I pending in this matter about the right to inherit□

The value of the inheritance in Germany is approximately:

To whom shall the court send the inheritance certificate?

Does the inheritance include land in Germany?

Does the inheritance include bank account?

Does the inheritance includes a registered company?

Do you need the certificate of inheritance for restitution or pension matters?

Form Characteristics

| Fact Name | Description |

|---|---|

| Deceased Information | The application requires details such as the deceased's surname, first name, date of birth, and date of death. This information helps identify the individual in question. |

| Required Documents | Applicants must provide relevant documents like a death certificate, birth certificate, or last will. These documents validate the claims made in the application. |

| Applicant Details | Information about the applicant, including their relationship to the deceased, must be completed. This establishes the legitimacy of the request for an inheritance certificate. |

| Marital History | The form captures the deceased's marital status and details regarding any marriages. This includes information about prior marriages and agreements made concerning property distribution. |

Guidelines on Utilizing Inheritance

Preparing to fill out the Inheritance form can seem daunting, but breaking it down into manageable steps will ease the process. Gather all necessary documents and information about both the deceased and yourself. Now, let’s look at the specific steps required to complete the form.

- Begin by entering the details of the deceased. Fill in their surname, first name, name at birth, date of birth, place of birth, date of death, place of death, last residence, citizenships at the time of death, and marital status at the time of death.

- Check off the available documents you have: Death Certificate, Birth Certificate, Marriage Certificate, Copy of Passport, Last Will, Naturalization Documents, or Certificate of Change of Name.

- Next, provide your information in the applicant section. Include your surname, first name, name at birth, date of birth, place of birth, current address, telephone number, citizenships, and your valid identification number (Passport, ID, or Driver’s License).

- Clearly state your relationship to the deceased.

- In the testamentary dispositions section, indicate if there is a last will, contract of inheritance, or trust. If applicable, provide the date of the last will, where it was probated, the date of probate, and the file number.

- Next, indicate whether you are the only heir or list any additional heirs by providing their surname, first names, date of birth, place of birth, date of death, place of death, address, and family relation to the deceased.

- For marriages, check the appropriate box that describes the marital status of the deceased. Proceed to fill in details about each marriage, including the spouse's surname, first name, name at birth, date of birth, place of birth, last address, the date and place of the wedding, and related divorce information if applicable.

- Detail the citizens of the deceased and the spouse at the time of each marriage. Indicate whether a special agreement on marital property existed.

- Finally, list all children of the deceased. For each child, enter their surname, first name, name at birth, date of birth, place of birth, date of death, place of death, and address.

Review all the information before submitting the form. Accuracy is essential, as any discrepancies can delay the process. Once accurately filled, submit the form along with the necessary documents to the relevant authority.

What You Should Know About This Form

What is the purpose of the Inheritance form?

The Inheritance form is used to apply for an inheritance certificate. This document serves as proof of the legal right to inherit property, assets, or responsibilities from a deceased individual. By completing this form, applicants provide necessary information about both the deceased and themselves, which helps in establishing the rightful heirs.

What information do I need to provide about the deceased?

You will need to provide several key details about the deceased. This includes their full name, date and place of birth, date and place of death, and last known residence. Additionally, marital status at the time of death must be specified. You may also need to indicate which supporting documents you have, such as the death certificate or last will, to validate your claims.

Who can fill out the Inheritance form?

The form can be filled out by anyone who is considered an heir or has a personal interest in the estate of the deceased. This typically includes family members such as children, spouses, or siblings. It is essential for the applicant to provide their information and relationship to the deceased, as this establishes their right to inherit.

What should I do if the deceased had multiple marriages?

If the deceased had multiple marriages, you must provide details about each marriage on the form. This includes the names of spouses, marriage dates, and any divorce information if applicable. All children from these unions should also be listed along with any relevant details needed to clarify their relationship to the deceased. This helps determine the rightful heirs under probate law.

How do I submit the Inheritance form?

Common mistakes

Filling out an Inheritance form can seem straightforward, but many people make common mistakes that can delay the process or even lead to complications. One frequent error is failing to provide complete information about the deceased. Missing details such as the full name at birth, date of birth, or place of death can create difficulties for officials who need to verify identities. Always double-check that every required box has been filled out correctly.

Another common oversight is skipping the section on available documents. Applicants often do not check off all the boxes for necessary documents, like the death certificate or marriage certificate. Each of these items plays a critical role in validating the application. Missing one or more documents can result in a request for additional information, slowing down the process significantly.

When listing the heirs, applicants might unintentionally include incorrect or incomplete details. It’s crucial to ensure that each heir’s surname, first name, and relationship to the deceased are accurate. Mistakes in this area can lead to disputes or even legal challenges concerning the distribution of assets. Therefore, taking the time to verify each heir's information is essential.

The marital history section is another area where individuals frequently falter. Failure to accurately represent previous marriages can also create confusion. People sometimes forget to include critical details like the date and place of each marriage or misstate whether the deceased was single, married, or widowed. Each of these points affects the reality of inheritance and must be reported correctly.

Many people also struggle with the children’s section of the form. Listing children from various marriages incorrectly or omitting names entirely can lead to serious complications. Ensure all children are included and that the details provided, such as dates of birth and places of birth, are accurate.

One common mistake is the confusion over citizenships. The form requires that both the deceased and the spouse's citizenships at the time of marriage be clearly stated. Omitting this information or providing outdated details can result in a form being rejected.

Incomplete details regarding special agreements related to marital property can also lead to complications. Many people forget to check whether such agreements exist or fail to elaborate on them in the form, leaving out significant information that might impact inheritance rights.

Another issue arises when applicants fail to indicate their relationship to the deceased. Clearly stating this connection is critical. Misunderstanding your role as an heir can confuse the process. Make sure this information is accurately recorded; it is the foundation of your claim.

Inconsistent naming conventions can create additional confusion. Sometimes, people use nicknames or varying formats for names, which can lead to discrepancies. Consistency is key in legal documents; using full legal names helps to minimize misunderstandings.

Lastly, neglecting to proofread the entire application can be detrimental. Errors in spelling, grammar, or inattentiveness can result in miscommunication or lost information. Double-checking your application before submission ensures clarity and accuracy, thereby reducing the likelihood of unnecessary delays.

Documents used along the form

When navigating the process of inheritance and estate management, several forms and documents come into play. Each plays a crucial role in clarifying the rights and responsibilities of the deceased's estate and the heirs involved. Below is a list of common documents often associated with inheritance cases.

- Death Certificate: This official document confirms an individual's death, providing essential information such as the date and cause of death. It is often required for various legal and administrative purposes, including settling estates.

- Will: A will outlines an individual's wishes regarding the distribution of their assets after death. It designates beneficiaries and may include instructions for guardianship of minors.

- Trust Documents: If the deceased established a trust, these documents detail the terms and beneficiaries of that trust. Trusts can help avoid probate and may offer tax benefits.

- Marriage Certificate: This document verifies the marital status of the deceased at the time of death. It is significant in determining spousal rights to inheritance.

- Divorce Decree: This legal document formalizes the end of a marriage and outlines the division of assets. It is necessary to establish the deceased's marital history and potential entitlements of former spouses.

- Birth Certificates: These documents verify the identities and relationships of the deceased’s children. This is vital for establishing heirs and their claims to the estate.

- Naturalization Documents: For deceased individuals who were naturalized citizens, these documents confirm their citizenship status, which may affect inheritance rights.

Properly organizing and submitting these documents along with the inheritance form can significantly streamline the inheritance process. Being thorough and accurate in this step ensures that the wishes of the deceased are respected and that heirs receive their rightful entitlements.

Similar forms

-

Last Will and Testament: This document outlines how a deceased individual's assets should be distributed after their death. Like the Inheritance form, it identifies heirs and specifies the deceased's wishes concerning their estate.

-

Probate Application: This legal request seeks the court's approval of the deceased’s will. Much like the Inheritance form, it confirms the validity of the will and the designated heirs.

-

Death Certificate: This official document verifies the date, location, and cause of a person's death. It serves a similar purpose as the Inheritance form by providing necessary information for settling the deceased's affairs.

-

Trust Documentation: A trust document outlines how assets are to be managed and distributed. Similar to the Inheritance form, it details the roles of appointed trustees and beneficiaries.

-

Affidavit of Heirship: This sworn statement is often used when there is no will. It identifies the rightful heirs and is similar in intent to the Inheritance form, establishing who is entitled to the deceased's assets.

-

Memorandum of Intent: This document conveys the deceased’s preferences regarding asset distribution. Like the Inheritance form, it aids in clarifying the decedent's final wishes to those responsible for settling the estate.

-

Living Will: While primarily focused on healthcare decisions, a living will can also touch on end-of-life wishes. It parallels the Inheritance form by reflecting the individual's intentions and desires for their affairs.

-

Joint Tenancy Agreement: This document governs property co-ownership and specifies how assets are divided upon the death of a co-owner. Similar to the Inheritance form, it addresses ownership rights and distribution.

-

Power of Attorney: This document gives someone the authority to act on behalf of the deceased in financial or legal matters, often used prior to death. While the Inheritance form is concerned with post-death affairs, both documents emphasize the need for clear representation.

-

Family Health History Report: This document may include information on the deceased’s health condition and family genetics. Similarly, the Inheritance form gathers relational and genealogical information, supporting the identification of heirs.

Dos and Don'ts

When filling out the Inheritance form, it’s essential to approach the process with care and attention. Here are eight important dos and don’ts to consider.

- Do read the entire form thoroughly before starting to fill it out.

- Do provide complete and accurate information for both the deceased and yourself as the applicant.

- Do have supporting documents ready, such as the death certificate and birth certificate.

- Do make sure all names are spelled correctly, including middle names or any name changes.

- Don't leave any sections blank unless instructed otherwise.

- Don't provide outdated or incorrect contact information on the form.

- Don't forget to sign and date the application where indicated.

- Don't rush the process; take your time to ensure everything is filled out correctly.

Misconceptions

There are many misunderstandings regarding the Inheritance form. Here are four common misconceptions and their clarifications:

- It is only necessary for those with large estates. Many people believe that inheritance forms are needed only for substantial estates. In reality, these forms are essential for any estate that involves the transfer of property or assets after someone passes away, regardless of size.

- The process is automatic once a will is in place. Some assume that having a will means the inheritance process is automatic. However, a will must be validated through probate court, and completing the Inheritance form helps initiate this process.

- Only the primary heir needs to fill out the form. A misconception exists that only the primary heir should complete the form. In fact, all designated heirs must be listed, as their information is necessary for the court to determine the distribution of the deceased's assets.

- All assets are automatically transferred to the heirs. There is a belief that all assets transfer to heirs without complications. This is not the case. Certain assets may have to go through additional legal processes, and completing the form helps clarify how these assets should be handled.

Key takeaways

Filling out the Inheritance form may seem daunting at first, but careful attention to detail can significantly ease the process. Below are some key takeaways to keep in mind:

- Confirm Information on the Deceased: Gather all pertinent details about the deceased, including their full name, date of birth, and last residence. Accurate information is essential for processing the application smoothly.

- Focus on Available Documents: Ensure you have all necessary documents on hand. Common documents required may include the death certificate, birth certificate, marriage certificate, and any relevant wills or contracts of inheritance.

- Complete Applicant Information: Your section must include your full name, current address, and citizenship details. Your relationship to the deceased should be clearly stated for clarity.

- Discuss Testamentary Dispositions: It is crucial to establish if there is an existing will or trust. Make note of the probate information, as this may impact the distribution process.

- Detail Marriage History: The form requires a thorough account of the deceased's marriages. Include the names of spouses, marriage dates, and details regarding any divorces or separations.

- List of the Deceased’s Children: Provide detailed information about all children, including their names, dates of birth, and any relevant details such as date of death if applicable.

- Use Separate Pages if Necessary: If there are multiple heirs or additional children, continue providing that information on a separate page to ensure clarity.

- Review for Completeness: Before submission, review the entire form for completeness and accuracy. Ensuring that every section is filled out correctly can prevent delays in the processing of your application.

Completing this form with care and precision will facilitate a smoother process during a difficult time. Pay careful attention to each section, and don't hesitate to seek assistance if needed.

Browse Other Templates

Geico Forms - Provide details about the accident and your involvement accurately.

Wisley Card - You need to provide the ABA/routing number for your bank account.